Who is Kyle Wool, the man who helped the Trump family earn $500 million?

- 核心观点:特朗普家族利用影响力炒作微型股获利。

- 关键要素:

- 小唐纳德入股无人机公司股价涨两倍。

- 埃里克比特币挖矿持股价值近5亿美元。

- Dominari半数IPO为中国高风险小公司。

- 市场影响:加剧微型股投机风险与监管压力。

- 时效性标注:中期影响

By Annie Massa and Zachary R. Mider, Bloomberg

Original translation: Luffy, Foresight News

One of the newest tenants in Trump Tower New York is a startup investment bank called Dominari Holdings Inc. It occupies two floors below the Trump Organization's headquarters, and Dominari President Kyle Wool considers this proximity a source of pride.

Wool has been actively cultivating his relationship with the Trump family for years. Since last year's election, he has become a financial advisor to the president's two sons and several Trump Organization executives, collaborating to facilitate a series of highly profitable transactions.

Dominari's offices, sleek and gleaming on the 22nd and 23rd floors, once housed the Tommy Hilfiger family offices. One July afternoon, a TV in the entrance was playing Fox Business Channel, and a nearby shelf displayed transparent trophies commemorating successful financings for corporate clients. Most of these clients aren't household names—Dominari specializes in financing micro-cap companies. These companies, while publicly traded, have smaller market capitalizations and volatile stock prices, driven more by market sentiment than earnings expectations. This explains why Wool's partnership with the Trump family has been so fruitful.

Trump's name: the engine of micro-cap stocks' popularity

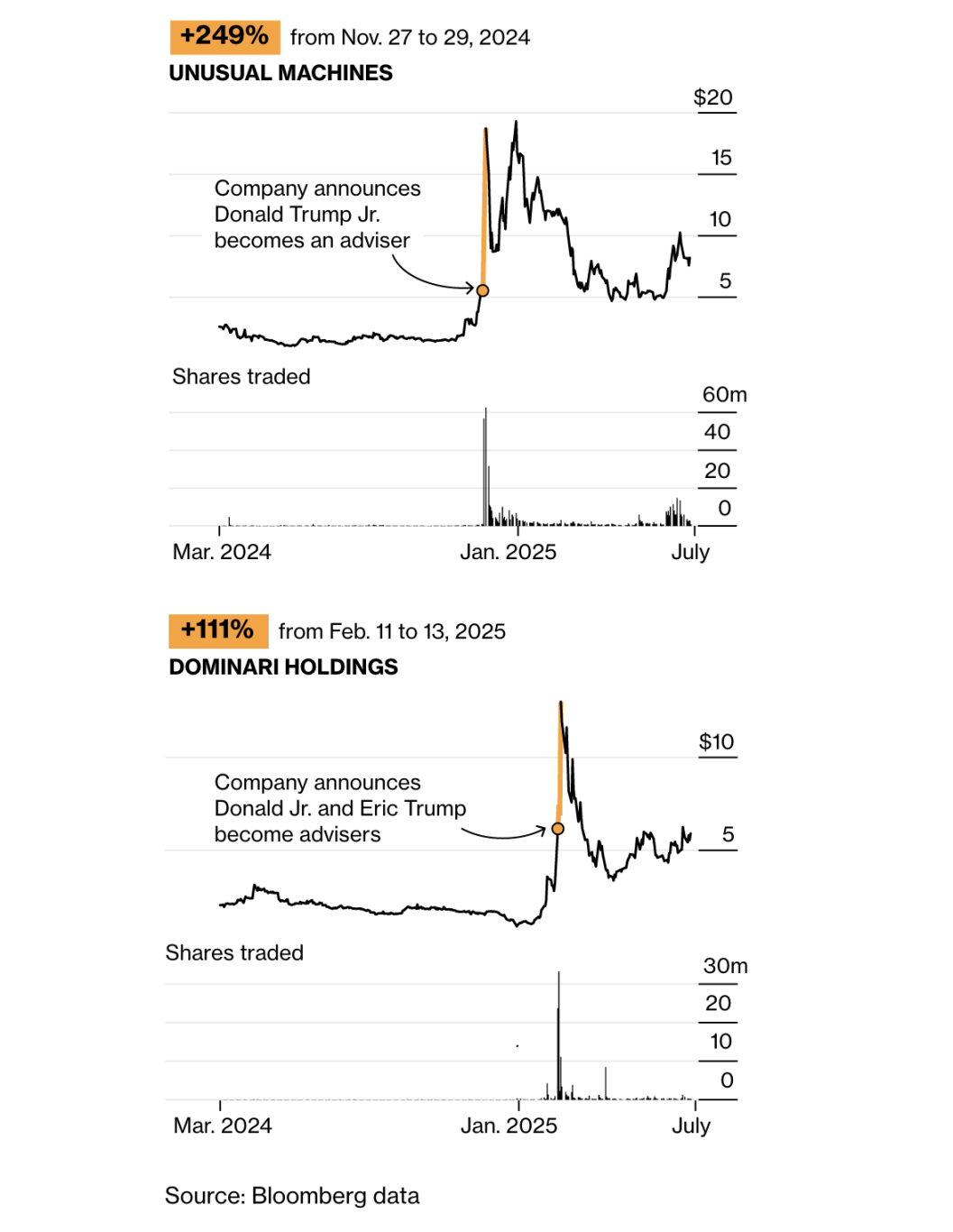

Trump's name just happens to generate the hype that stock market enthusiasts crave. Take, for example, Unusual Machines Inc., a loss-making drone company in Orlando. Three weeks after the 2024 election, news broke that Donald Trump Jr. would serve as a paid advisor and investor, a deal brokered by Wool. Securities filings show the company's stock price more than tripled in three days, generating a $4.4 million paper profit for the president's eldest son.

Since then, similar collaborations have continued to emerge: tying Trump family members to previously unknown stocks and then using the resulting exposure to drive up stock prices.

Unusual Machines, Dominari Holdings stocks surge as Trump's son becomes advisor

One such partnership involves Dominari itself. In February of this year, the company announced that Donald Trump Jr. and Eric Trump would serve as advisors and investors, holding a larger stake than any other outside investor. The announcement did not mention their father, President Trump, but stated only that the two would provide consulting services in the areas of artificial intelligence and data centers—despite their lack of apparent experience in those fields. Despite this, Dominari's stock price soared, enriching Wool and the Trump brothers by millions of dollars.

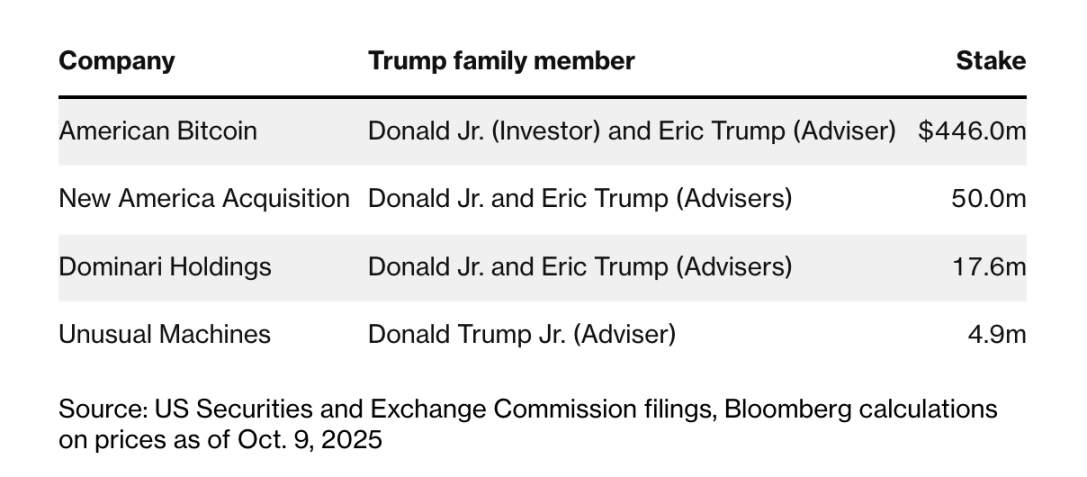

As of October 9, the Trump brothers' stake in Dominari was worth more than $17 million; Eric's stake in the Bitcoin mining company that Dominari helped establish was worth nearly $500 million, a huge windfall even by Trump family standards.

A spokesperson for the Trump Organization did not respond to requests for interviews with Eric and Donald Jr. In February, after the Trump brothers were appointed advisors to Dominari, Wool described them as exceptional businesspeople in an interview, but declined to comment for this article. Dominari, after receiving a summary of the Bloomberg Businessweek report, said it "contains inaccuracies and misinterpretations," but did not address specific issues or make executives available for interviews. The White House also did not respond to requests for comment.

Eric and Donald Jr. outside the Nasdaq Stock Exchange in New York in August

Dominari's partnership model represents a new twist on the Trump family's tradition of monetizing their reputation. The Trump Organization's real estate business has long since shifted from focusing solely on construction projects to selling the rights to the Trump brand. Its partnerships with Wool and micro-cap stocks, like its recent foray into cryptocurrency, are both attempts to trade prestige for wealth.

“The hallmark of micro-cap companies is that they’re always striving for attention,” said Stephen Kann, a banker who worked at Dominari for several months last year and author of “Micro-Cap Magic: Why the Biggest Returns Hidden in Stocks You’ve Never Heard of.” “Being associated with the Trump family puts a spotlight on them.”

For other presidential families, venturing into microcap stocks might be seen as a reputational risk, given their long track record of losing money for investors. As Warren Buffett once said, if American capitalism is a cathedral with a casino, then microcaps are like roulette wheels and slot machines.

About half of Dominari's IPOs are small companies headquartered in mainland China or Hong Kong, a sector particularly prone to price volatility and fraud. This ecosystem is fueled by a steady stream of small investors eager to make a quick buck, flocking to micro-cap stocks. Now, thanks to Wool's urging, the US First Family has joined their ranks.

Such collaborations also carry potential conflicts of interest. During Trump's first term, public scrutiny of conflicts of interest focused primarily on the family's real estate projects, where lobbyists and foreign government officials could indirectly enrich the president by hosting events and booking rooms at Trump hotels.

During this term, the Trump family's business ventures have become even more diverse, encompassing media, mobile phones, and cryptocurrency. Eric and Donald Jr. insist they are private businessmen, but their father's policies as president of the United States inevitably impact the companies they work with. Dominari has become the family's conduit for these new opportunities, significantly increasing the likelihood that official decisions will inflate the Trump family's wealth.

Kyle Wool: A network operator from rural New York

Wool grew up in Candor, a rural town of about 5,000 in upstate New York. After graduating from college, he entered the brokerage industry and soon found himself managing assets for wealthy individuals at institutions like Oppenheimer & Co. and Morgan Stanley. His clients included a Korean professional golfer, a timeshare tycoon (whose 90,000-square-foot mansion was featured in the 2012 film "The Queen of Versailles"), and even a company co-owned by Hunter Biden, son of then-Vice President Joe Biden.

The job itself wasn't particularly impressive, but Wool distinguished himself in other ways. He appeared in fashion magazines with friends, showcasing watches worth $165,000, and he socialized closely with the Serbian royal family, collaborating with them on humanitarian charities in the country.

In October 2018, Wool attended the Liedkrantz Foundation's annual charity luncheon with Crown Prince Alexander of Serbia.

In 2022, Wool became president of Revere Securities, a small New York brokerage firm specializing in financing microcap stocks (generally defined as companies with a market capitalization of less than $250 million, which regulators often warn investors are more risky and open to fraud). His clients included Anthony Hayes, a lawyer friend with whom he had appeared in fashion magazines.

At the time, Hayes was the CEO of a Nasdaq-listed company that had been undergoing a period of continuous transformation, from food sweeteners and pesticides to patent litigation and cancer drugs, accumulating tens of millions of dollars in losses. At Wool's suggestion, the company transitioned again to an investment bank and changed its name to Dominari—Latin for "control." A former colleague revealed that Wool was very fond of the term, "He would say over and over, 'I control, I control, I control.'" Soon after, Wool was appointed President of Dominari and head of its securities division.

At the same time, according to two people who worked with Wool, he began to fully cultivate his relationship with the Trump family. He moved his company's headquarters to Trump Tower and invested time and money in Trump properties—he became a member of the Trump Club in Jupiter, Florida (the initiation fee currently costs $500,000) and organized events at another Trump golf course. Soon after, he began conducting private fundraisers with Trump's sons and other Trump Organization executives.

“Dominari has brought us a lot of opportunities in the past, and many of them have been incredibly successful,” Eric said in an interview with cryptocurrency media Fintech.TV in April of this year. “Every time I see them, I’m very excited.”

The Trump brothers: From conflict-avoidance to freedom

As Executive Vice President of the Trump Organization, Eric oversees the day-to-day operations of the family business; Donald Jr. also serves as Executive Vice President, but is more active in MAGA (Make America Great Again) media campaigns. Both complained that during their father's first term, they attempted to avoid conflicts of interest by forgoing new overseas real estate projects, but still faced criticism. "In 2016, I tried to do everything right, but received almost no recognition," Eric told the Wall Street Journal last year. This time around, however, they face significantly fewer restrictions.

Like the Trump brothers, Wool frequently travels between New York and the MAGA enclaves of Florida, a fact evident in his often sun-kissed complexion during his frequent appearances on Fox Business. With his slicked-back hair, he evokes the image of a 1980s Wall Street elite who "ran the universe." On the show, he consistently delivers mainstream investment jargon (artificial intelligence stocks are hot, the market will rise) and heaps praise on President Trump.

Kann, a micro-cap specialist who previously worked at Dominari, described Wool as a "very gregarious guy" who enjoyed a drink and a joke, yet was also diligent and fully committed to the company's growth. Allan Evans, CEO of Unusual Machines, commented, "He was the quintessential New York banker who was willing to give his all to get the job done. He would do it on Saturdays and Sundays, even at 2 a.m., if there was work to be done."

Over the years, Wool has received five customer complaints from the Financial Industry Regulatory Authority (FinRA), alleging, among other things, that funds were invested in unsuitable investments and that Wool engaged in unauthorized trading. Two of these complaints were dismissed, two were settled, and one remains pending. Wool has denied any wrongdoing and, in a February interview, described these complaints as industry parlance: "After so many years in this industry, it's inevitable."

Evans at the Unusual Machines store in Orlando

The Trump Effect of Unusual Machines

Unusual Machines' offices are located in Room J of a warehouse in an industrial area of Orlando. When a reporter visited in late June, the company was in the midst of a hiring spree, with new desks and workstations filling the office, alongside boxes of equipment. At the time, the company had fewer than 20 employees, most of whom worked in the retail department, selling drone parts, primarily from China, to hobbyists. However, CEO Evans planned to more than double the workforce, open a factory to manufacture parts in-house, and secure new clients in the industrial and government contracting sectors.

Near the loading dock, an employee launched the company's smallest product—a buzzing, square white drone, barely larger than a slice of bread, that tumbled mid-air. Earlier this year, when Evans visited Mar-a-Lago, Donald Jr. had flown a similar drone in the ballroom to demonstrate its capabilities. "He flew it pretty well," Evans said.

Without Donald Jr., the company's prospects might be much bleaker. Unusual Machines started out as a forsaken business: Last year, its former owners decided to focus on military sales and divest their consumer business, and Wool helped take it public at $4 per share. But investors reacted poorly, sending the stock price plummeting to less than $2, and the company continued to burn through cash.

A worker assembles drone parts at Unusual Machines.

As Wool was scrambling to raise more capital, he recommended the stock to Donald Jr. Evans says the president's son was intrigued. Donald Jr., who holds a pilot's license and has experience using drones for deep-sea fishing, paid $100,000 for the stock and warrants and ultimately agreed to sign on as an advisor.

After Donald Jr.'s joining was announced last November, the company's stock price soared to over $20, increasing the value of his investment by 30 times. Because Donald Jr. is not an executive or director of Unusual Machines, he is not required to disclose the timing and amount of his stock purchases and sales. However, Evans stated that Donald Jr. continued to invest in subsequent financing rounds.

In the micro-cap space, it's not uncommon for "headline-grabbing announcements to drive the stock price up, followed by insider selling that sends the stock plummeting." But Evans says this isn't the case with their company: "If we were pump-and-dumping, we'd raise money when the stock hit $20, or I'd sell. But I've actually bought every time we've raised money and never sold. Our team believes in the future of the company."

Unusual Machines, venturing into domestic manufacturing, is one of dozens of American startups betting on demand from government and commercial buyers wary of China, the world's leading drone manufacturer. While some competitors have deep-pocketed backers or valuable patents, Unusual Machines has the advantage of Donald Trump Jr. But Evans says he hasn't lobbied the White House or curried favor with Defense Department officials: "Donald Jr. has a better sense of macro trends than I do. When you have lunch with Elon Musk on his private jet, you get a much better sense of where automation is going." (Evans made these remarks days before Musk's public falling-out with the White House.)

Evans believes Donald Jr.'s greatest contribution has been his public endorsement of the company. He says it's now easier to meet with potential business partners, and the company has raised over $80 million from investors this year. "Just that association gives us more credibility and helps us stand out. It's like Oprah joining the Weight Watchers board. What did Oprah have to do? Almost nothing."

American Bitcoin's $500 million fortune

Wool also helped the Trump family build a significant cryptocurrency fortune through American Bitcoin. During Trump's second term, his two sons became involved in various cryptocurrency projects, traveling the world to promote them at industry conferences and touting their father's pro-crypto stance.

Earlier this year, the Trump brothers partnered with Wool, Dominari, and others to acquire a 20% stake in an established Bitcoin mining company with mines in Texas, New York, and Alberta, Canada. The company subsequently went public through a merger with a micro-cap company and changed its name to American Bitcoin.

In May, the Trump brothers appeared at the largest Bitcoin industry conference in Las Vegas to promote the company's prospects and emphasize their alignment with their father's vision for supporting cryptocurrency. Eric said on stage, "We have a president who loves this industry and supports it 100 percent. I can tell you that our family is incredibly excited about this company and its future."

The deal generated significant gains for Wool: As of October 9, Dominari's stake was worth more than $150 million; Eric's was worth nearly $450 million.

“I’m incredibly proud of American Bitcoin,” Eric said in a text message. “It’s been an amazing success.” He didn’t respond to questions about other aspects of his relationship with Dominari, and American Bitcoin didn’t respond to a separate request for comment.

The value of the Trump brothers' holdings in Dominari-related transactions

Conflicts of interest are everywhere

As with drones, conflicts of interest are evident in the cryptocurrency sector. While there's no evidence that the Trump brothers' investments have influenced policy decisions, the value of these companies could rise or fall based on government action. In July, the White House recommended that the Internal Revenue Service (IRS) consider revising its long-standing tax guidelines for cryptocurrency mining, something the crypto industry has been calling for and would benefit companies like American Bitcoin.

Meanwhile, the company's mining computers are manufactured by a China-based manufacturer. Recently, a Republican lawmaker asked the U.S. Treasury Department to review such imports for national security reasons, a decision that rests with the Trump administration.

In the drone sector, the Trump administration is also promoting domestic production, continuing a bipartisan initiative from the Biden administration. In June, Trump signed an executive order accelerating the introduction of long-sought flight rules; in July, the Pentagon issued guidance aimed at accelerating U.S.-made drone procurement. Both initiatives have boosted the stock prices of U.S. drone companies this year.

Conflicts of interest haven't hindered Wool's collaboration with the Trump brothers. In August, they launched their latest venture: a blank-check company (or special purpose acquisition company) called New America Acquisition I Corp. This company will raise capital in the stock market and then acquire a local manufacturer, aligning with Trump's Made in America vision.

As part-time advisors, the Trump brothers will receive shares in the company that could be worth up to $50 million after the IPO. In a securities filing, New America Acquisition stated it would seek acquisition targets that could benefit from federal or state incentives, such as subsidies, tax credits, government contracts, or preferred purchasing programs. However, after the Associated Press inquired about the matter, the company removed this reference, with its lawyers attributing it to a "filing error." New America Acquisition did not respond to a request for comment.

Dominari's IPO controversy: success and disaster

Dominari executives expressed satisfaction with the company's rapid pace of dealmaking. In a June letter to shareholders, CEO Hayes declared himself "very proud of the company's achievements": revenue growth and a rising stock price, which he attributed in part to his advisory board, which at the time consisted entirely of Trump Organization executives, including Donald Jr., Eric, and relatively unknown company veterans Lawrence Glick, Alan Garten, and Ronald Lieberman.

Hayes also touted Dominari's 12 recent IPOs, including one for a company that operates two golf courses in Florida and one that builds roads in Hong Kong. He wrote, "Some media outlets have unfairly portrayed some of our recent IPOs, suggesting that the clients were of lower quality. We strongly dispute this characterization."

While some investments have certainly delivered significant returns for investors (like Unusual Machines), five of the 12 deals Hayes cited were disasters, with the companies' stock prices nearly halving after going public. While "the Trump family had nothing to do with most of the companies Dominari helped take public," under Wool's leadership, these IPOs have become a significant part of the firm's business.

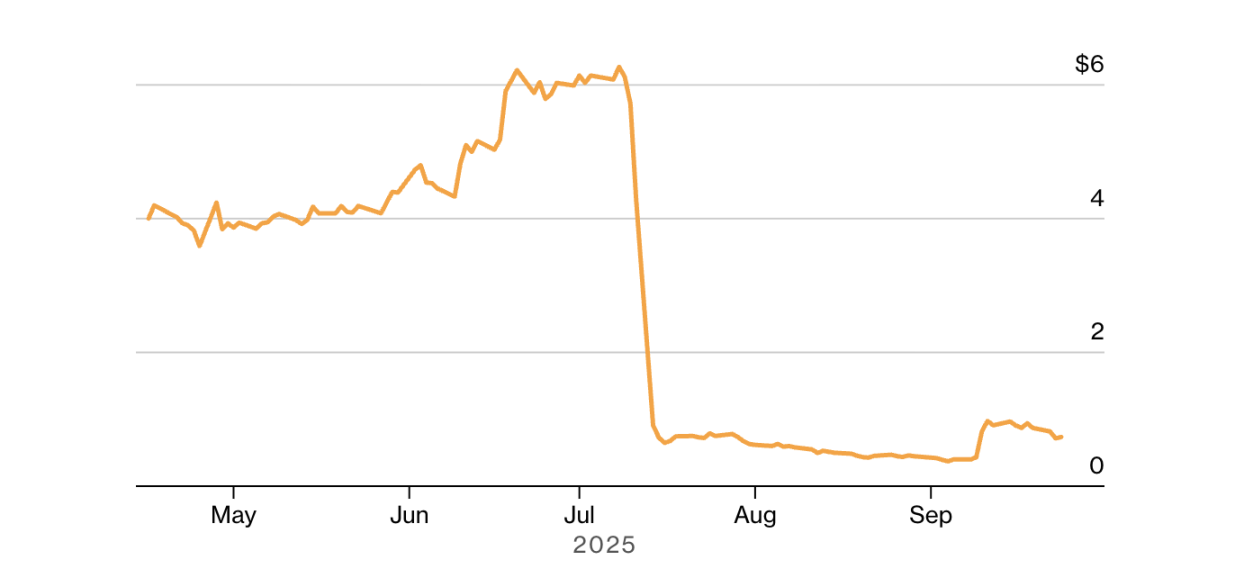

Among the 12 IPOs Hayes touted was Everbright Digital Holding Ltd., a Hong Kong marketing company with just seven employees that touted its deep involvement in the metaverse. Dominari helped Everbright take the company public on the Nasdaq in April, pricing its shares at $4, but investors reacted coldly. Trading volume suddenly surged in June, sending the stock price soaring to over $6.

The surge was driven by online stock-picking clubs. These increasingly popular clubs feature so-called "experts," often posing as American fund managers, encouraging American investors to buy stocks for quick profits on social media platforms. Artsyom Yefremenka, a 31-year-old auto mechanic in Fresno, California, said he once joined a stock-picking club on the instant messaging app Viber. The club's leader, a man named "Mr. James," had a history of making profitable stock recommendations. So, when Mr. James urged members to "buy a bunch of Everbright Digital Holding," Yefremenka invested about $20,000—nearly half a year's salary.

In mid-July, Everbright Digital Holding's stock price collapsed, falling to less than $1. During his lunch break, Yefremenka watched his investment vanish. "I thought, 'I can't be so stupid to have been ripped off so badly.' Greed ruined us all." Everbright Digital Holding did not respond to inquiries.

Everbright Digital Holding's stock price crashes

Microcap stocks have long been a hotbed of fraud and manipulation, and the recent hype surrounding microcap stocks through messaging apps is drawing attention from US regulators and law enforcement. Criminals sometimes "buy large quantities of a company's stock and then sell it at a high price through stock picking clubs." The FBI reported in July that complaints of pump-and-dump scams involving messaging apps had increased 300% compared to the previous year, with losses estimated to have reached billions of dollars for US investors.

Last month, the U.S. Securities and Exchange Commission (SEC) announced the creation of a task force to investigate "cross-border pump and dump scams," including scrutinizing underwriters who may have facilitated market manipulators' access to the U.S. listing system. Since Dominari's founding, 18 of its 38 IPOs have involved small companies headquartered in mainland China or Hong Kong. Some companies listed in the U.S. for unclear reasons: one operated three hot pot restaurants, while another was a luxury watch distributor with only seven employees. Several companies saw their share prices soar after being hyped by stock picking clubs, only to plummet. Examples include healthcare company Pheton Holdings Ltd., which lost over 80% of its market value after its IPO, and Skyline Builders Group Holding Ltd., which saw its share price plummet over 87% in a single day in July of this year.

There is no indication that Wool or Dominari are affiliated with stock-picking clubs or involved in stock price manipulation. The firm earns revenue from fees paid for helping companies go public, but typically withdraws from the company's affairs. There is no evidence that Dominari is under investigation by the SEC. It is just one of a dozen investment banks that facilitated the listing of small, speculative Chinese companies in the United States, a practice that effectively aided the fraudsters.

“These companies keep going public, and their stock prices keep going up like crazy, and then plummeting,” said Michael Goode, a micro-cap investor and blogger in Michigan. “It either means some investment banks are turning a blind eye to this, or these fraudsters are very good at hiding their tracks and covering up their activities.”

According to former colleagues, Wool has been telling people over the past few months that this period has been life-changing for him, and that Dominari's successful partnership with the Trump family has opened more doors for him. In June of this year, Wool helped a micro-cap toy manufacturer become a shareholder in a cryptocurrency created by billionaire Justin Sun. While the deal did not directly involve the Trump family, Wool told the Wall Street Journal that Eric Trump endorsed him, telling Sun that "Wool is a great guy."

Wool also told the Wall Street Journal that hedge funds and executives are suddenly contacting him, hoping to participate in deals: "Now you want to be my friend? I don't need it."

During a business trip to South Korea this year, Wool was treated like an unofficial ambassador. He shared his insights on the new US administration in a television interview and met with former South Korean lawmaker Yang Ki-dae. On Facebook, Yang described Wool as a "potential bridge between South Korea and President Trump" and mentioned that Wool had invited him to "visit Trump Tower on your next visit to the US."