Aztec finally launches its token after seven years; even a lavish venture capital firm can't save it?

- 核心观点:Aztec启动AZTEC代币公开拍卖。

- 关键要素:

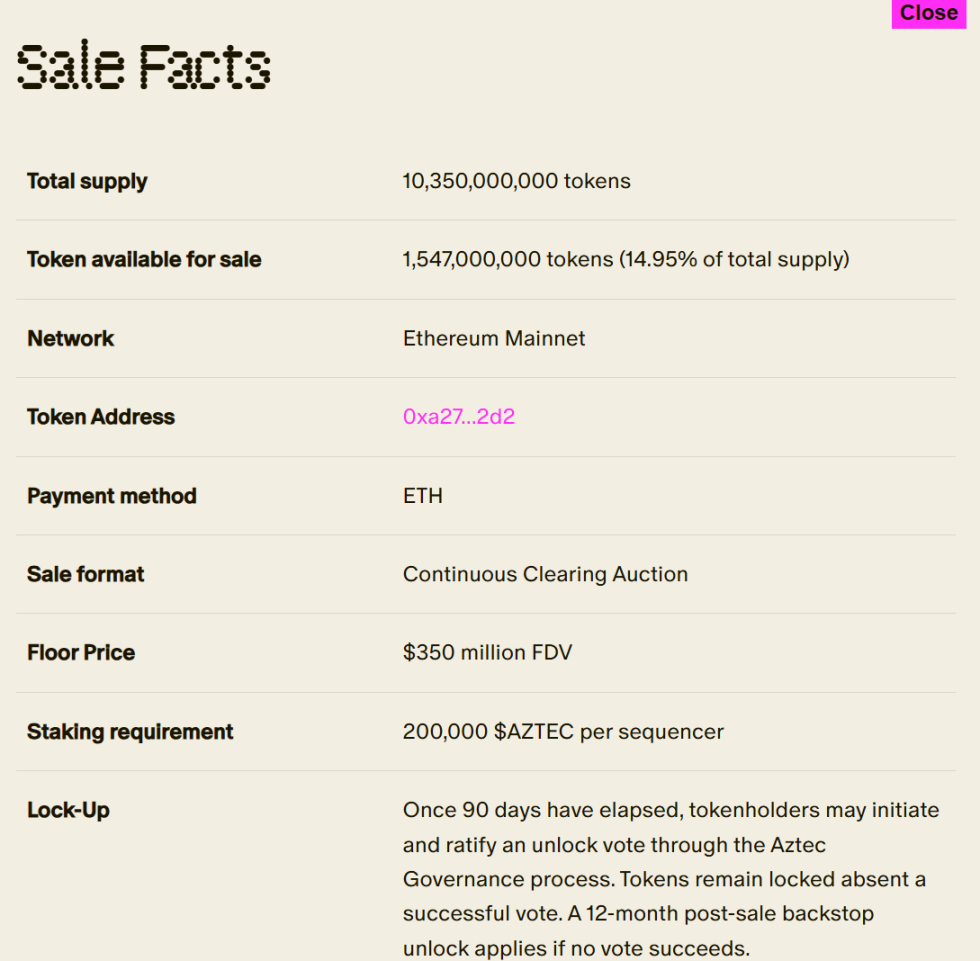

- 拍卖总额15.47亿枚,占供应14.95%。

- 起始估值3.5亿美元,低融资价75%。

- 采用连续清算拍卖协议定价。

- 市场影响:增加ZK赛道流动性,考验市场信心。

- 时效性标注:中期影响。

Original author: 1912212.eth, Foresight News

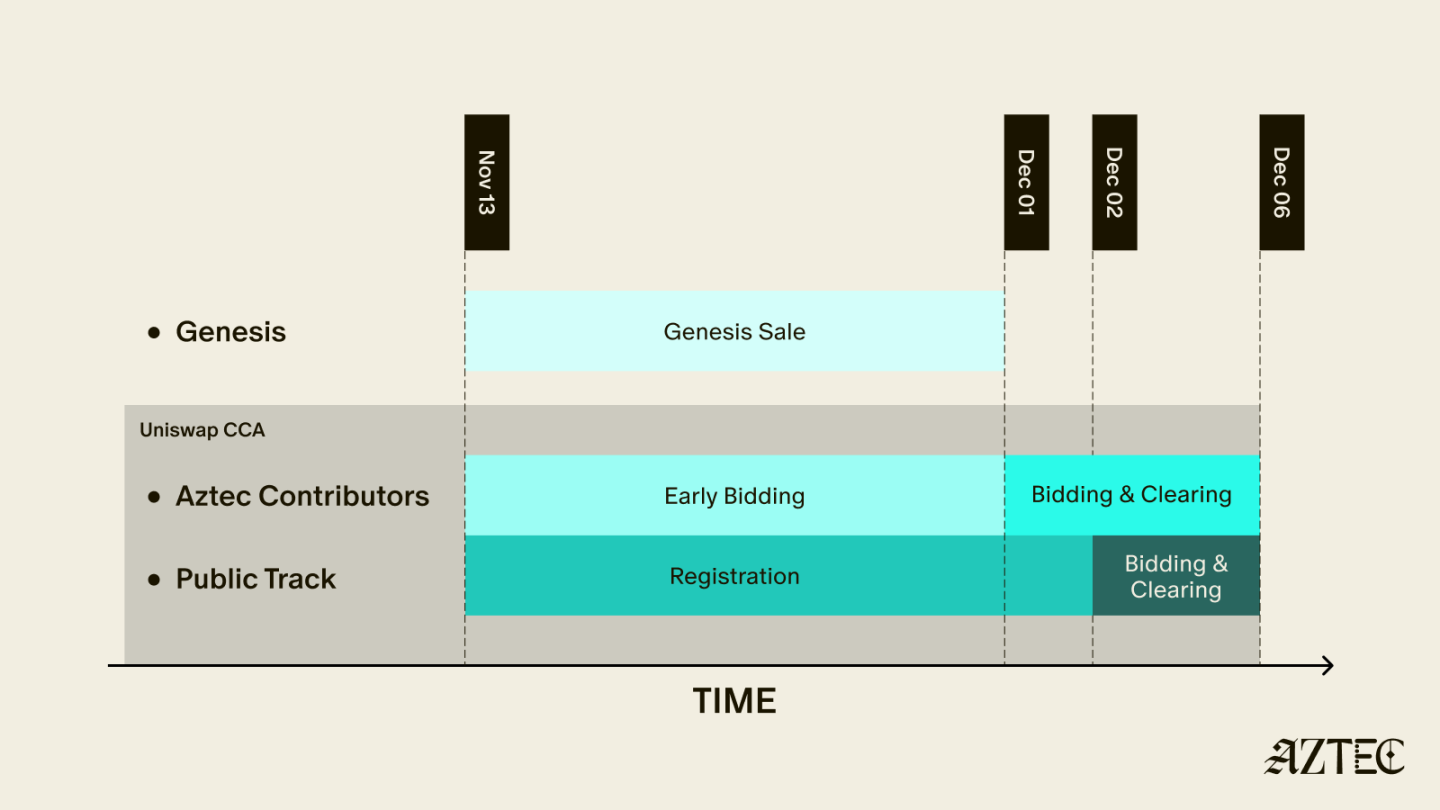

On November 13th, Aztec, a zero-knowledge privacy technology project, announced the launch of its AZTEC token sale. The sale will offer 1.547 billion tokens, representing 14.95% of the total supply, with payment made in ETH. Regarding the sale mechanism, the project stated that it will prioritize real-time price discovery and fair participation opportunities. The starting price is set at $350 million FDV, approximately 75% lower than the implied network valuation based on the latest equity financing. Participants can mint soul-bound NFTs to confirm their participation.

Registration and bidding for early participants will begin today (November 13th) at 3 PM (CET). Early participants will have a one-day exclusive early access period before the auction opens to the public. On December 1st, AZTEC will distribute the tokens to contributors and genesis bidders, and on December 2nd, all NFT holders can participate in the auction.

The public auction will be held from December 2 to December 6, 2025, during which time the tokens can be withdrawn and staked.

There was no airdrop or special allocation mechanism in this sale. Over 300,000 addresses were whitelisted and will be eligible to bid on the first day. The sale is open to users worldwide, including U.S. citizens.

Contributor Qualification Certification Rules

Participated in one or more of the following:

- Aztec Testnet Sequencer and Proofer

- ETH exclusive stakers include selected StakeCat ETH operators, Obol Silver, Rocketpool, LidoCSM, and Stakers Union.

- zk.money user

- Active community members

- Uniswap traders (3000 randomly selected from active traders in the past 30 days).

- Nansen's Ice, North, and Star levels.

In addition, the Genesis Sequencing Nodes are also included, and the top 200 high-quality node operators who have performed well on the Aztec testnet are also eligible to participate.

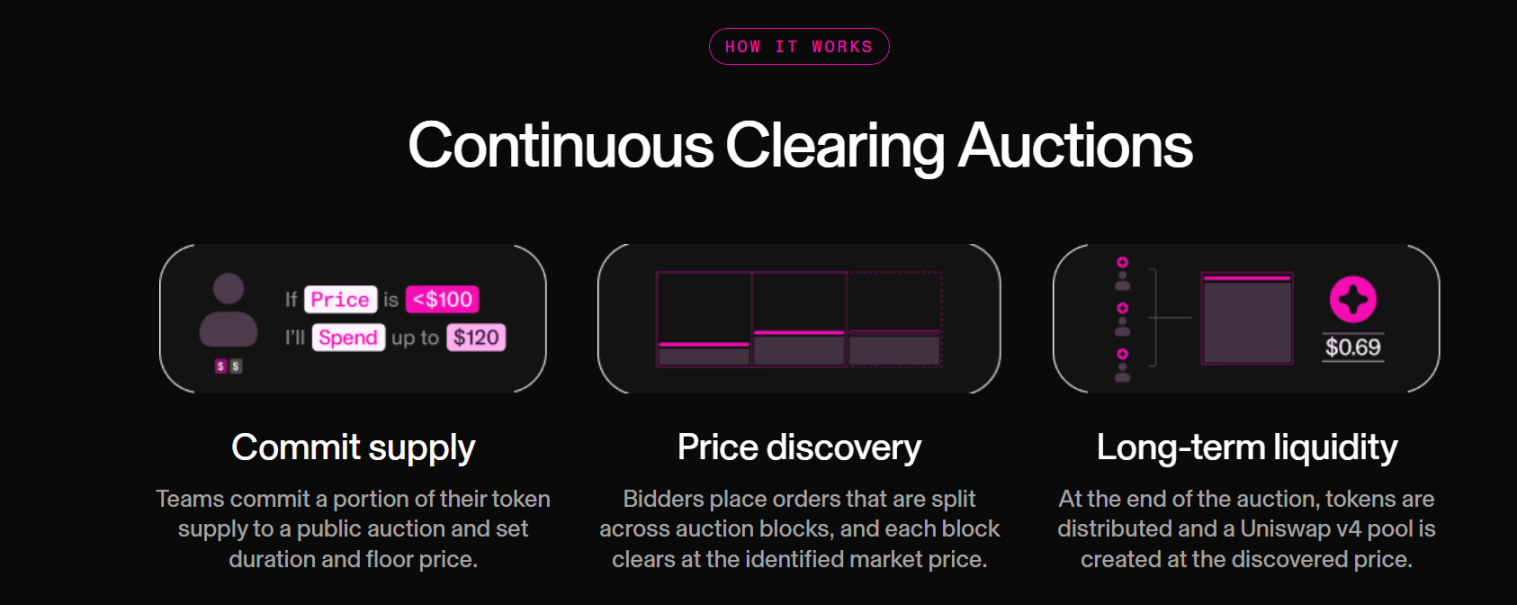

Auction Method: Continuous Liquidation Auction Agreement

Uniswap has announced the launch of the Continuous Clearing Auction Protocol (CCA), a customizable protocol for launching liquidity and issuing tokens on Uniswap v4. The protocol was designed in partnership with Aztec, who provided a ZK Passport module for private and verifiable participation.

The team commits a portion of the token supply to a public auction, setting a duration and a reserve price. Price discovery bidders place orders, which are then split within the auction block, with each split order liquidated at the predetermined market price.

When the long-term liquidity auction ends, tokens will be distributed and a Uniswap V4 liquidity pool will be created at the discovered price.

Token Economics

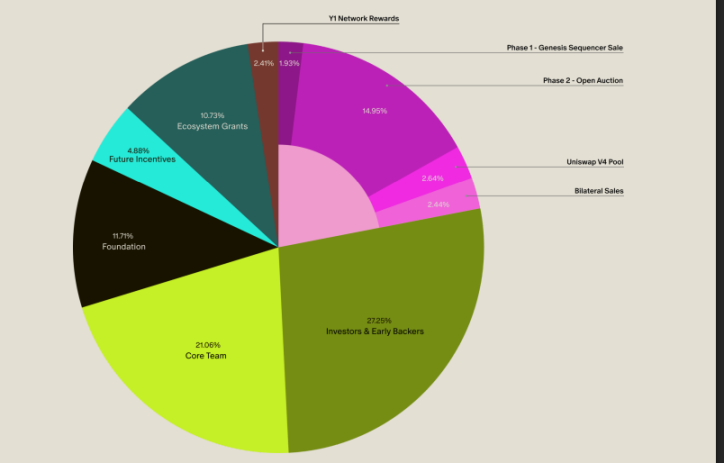

The Aztec white paper shows that the total supply of AZTEC Genesis tokens is 10,350,000,000, allocated as follows: 27.26% to investors and early backers, 21.06% to the core team, 11.71% to the Foundation, 10.73% to ecosystem grants, 14.95% to the Phase 2 public auction, 1.93% to the Phase 1 Genesis Sequential Sale, 2.44% to the Bilateral Sale, 2.64% to the Uniswap V4 liquidity pool, 4.89% to future incentives, and 2.41% to Y1 Network Rewards.

The token sale represents 21.96% of the total, corresponding to 2,272,500,000 tokens. These tokens will be owned by token holders and the foundation at launch.

Token features include

- Sequencer Staking: Tokens will be used to secure the network through staking by Aztec validators (the "Sequencers"), who are responsible for generating blocks on the Aztec network. Token holders who do not operate the Sequencers can choose to delegate their tokens to them.

- Governance: Token holders can participate in the governance of the Aztec network (“Aztec Governance”).

- Execution Environment: If the network is upgraded through Aztec governance in the future to support a smart contract execution environment, the tokens will be used to pay transaction fees on the Aztec network.

12 months after the token sale begins (November 13, 2025)

- Aztec governance allows for adjustments to the total token supply, including annual issuance at a capped percentage.

- If the execution environment is enabled, transaction fees may be regulated through a self-regulating mechanism similar to Ethereum EIP-1559.

Following the token sale, the Uniswap v4 liquidity pool may provide secondary market liquidity, with the foundation planning to inject 273 million tokens into the pool. The token sale contract will automatically inject tokens into the liquidity pool in proportion to the ETH paid by the buyers. The liquidity pool will be governed and controlled by Aztec and will be locked in an immutable smart contract for at least 90 days after launch, after which the lock can be released through governance voting. Furthermore, the tokens may be listed and traded on other decentralized trading protocols or centralized exchanges.

7 years of waiting

Aztec completed a $2.1 million seed round of funding at the end of 2018, followed by a new round of funding in September 2019. Then, in January 2020, Aztec Network launched its mainnet. Riding the wave of zero-knowledge mining and Level 2 computing, in December 2021, it completed a $17 million Series A funding round, led by Paradigm, with participation from prominent figures and institutions such as Vitalik Buterin. This was followed by a $100 million Series B funding round in December 2022, led by a16z.

However, the impressive lineup of venture capital firms did not translate into growth for the deal.

In March 2023, Aztec Network announced the phase-out of its DeFi privacy bridge project, Aztec Connect. This included disabling deposits from zk.money and other front-ends (such as zkpay.finance) into the Aztec Connect contract, and a complete abandonment of the Aztec Connect contract after one year, with all rollup functionality ceasing. Its representative responded that the decision was primarily driven by business considerations.

In May 2025, it launched its public testnet, which once attracted many airdrop users. However, the newly released token economics shows that Aztec did not receive any airdrop shares.

BTC has fallen below $100,000, and the market is showing signs of turning bearish. It remains to be seen how many players will actually pay the price. The real test for Aztec may have just begun.