Regulatory talks, license acquisitions, alliance formation: A look at recent moves by RWA leader Ondo

- 核心观点:Ondo获政策背书,推动代币化资产合规发展。

- 关键要素:

- 白宫报告认可代币化证券及稳定币价值。

- Ondo资产规模达13.4亿美元,市场领先。

- 战略收购与ETF申请加速合规布局。

- 市场影响:提升RWA赛道机构参与度。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

According to official news from Ondo Finance, the project has been included in the latest White House report from the President's Working Group on Digital Asset Markets. The report recognizes tokenized securities, stablecoins, and programmable settlement as key components of the future financial system. This policy endorsement not only provides authoritative support for Ondo's business model but also highlights the strategic value of tokenized assets in the global financial market.

In fact, as early as April 24th, Ondo demonstrated a proactive approach to compliance. It met with representatives from the renowned law firm Davis Polk & Wardwell LLP with the U.S. Securities and Exchange Commission (SEC) Crypto Working Group to discuss the compliance framework for tokenized U.S. securities. Key topics included asset structure models, registration requirements, market oversight, and financial crime compliance. Ondo proposed establishing a regulatory sandbox or seeking exemptions to create a more relaxed compliance environment for the issuance of tokenized assets. This dialogue provides important insights into the standardization of tokenized securities in the U.S. market and highlights Ondo's proactive approach to regulatory engagement.

Market Overview and Outlook: The Rise of Tokenized Assets

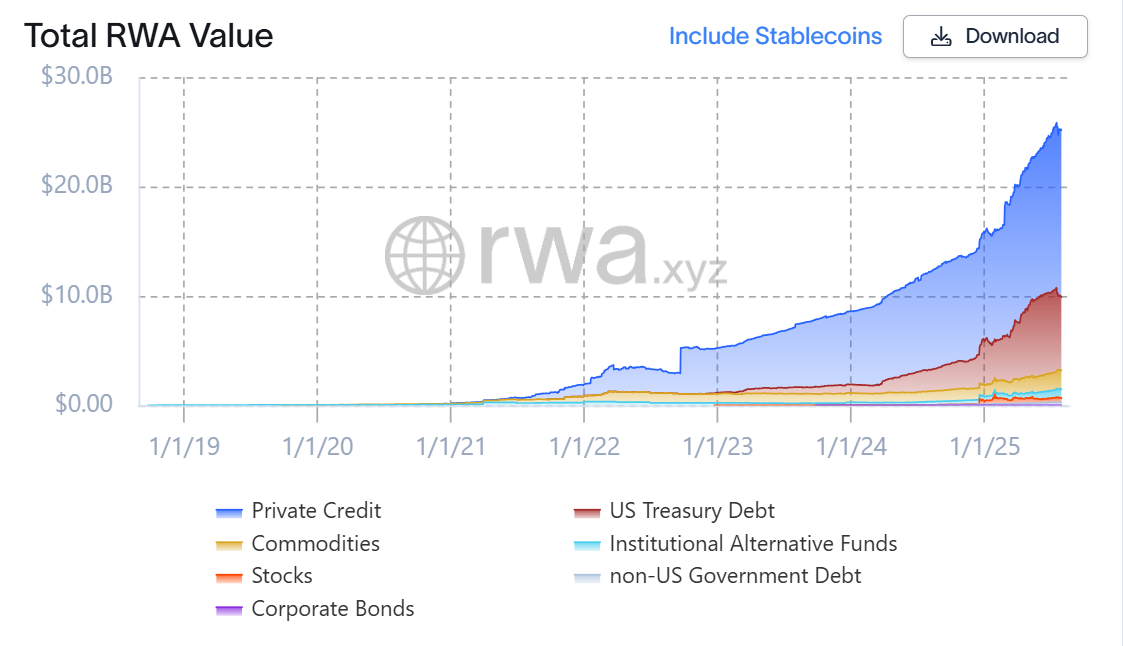

As a crypto-finance project focused on tokenizing real-world assets (RWAs), Ondo Finance has become a significant player in the sector since its mainnet launch in 2021. According to rwa.xyz , the global RWA market has surpassed $25 billion, with growth expected to accelerate significantly after 2024. As a bridge between traditional finance and blockchain technology, RWAs are becoming a core sector within the crypto economy.

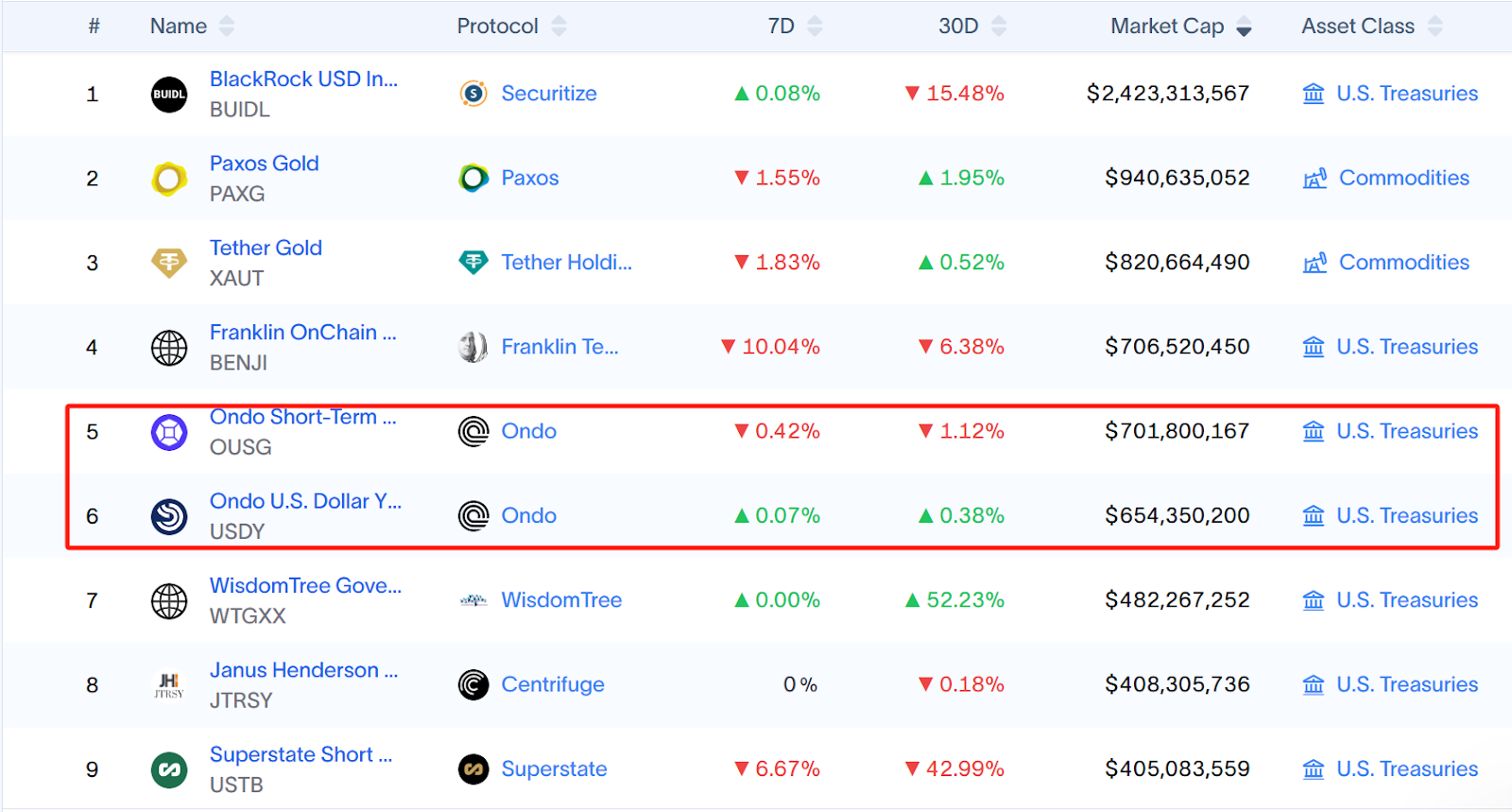

BlackRock's BUIDL fund maintains its industry leadership with $2.4 billion in tokenized assets, a success largely due to the support of Securitize's underlying protocol. However, Securitize has yet to launch a token. While Converge, the EVM-compatible blockchain it launched in partnership with Ethena, is focused on developing RWA products and, although originally scheduled for launch in Q2 2025, its mainnet launch has yet to materialize. In contrast, Ondo, with $1.34 billion in tokenized assets, has secured a firm position in the market and has been the first to issue a token, demonstrating its competitive edge.

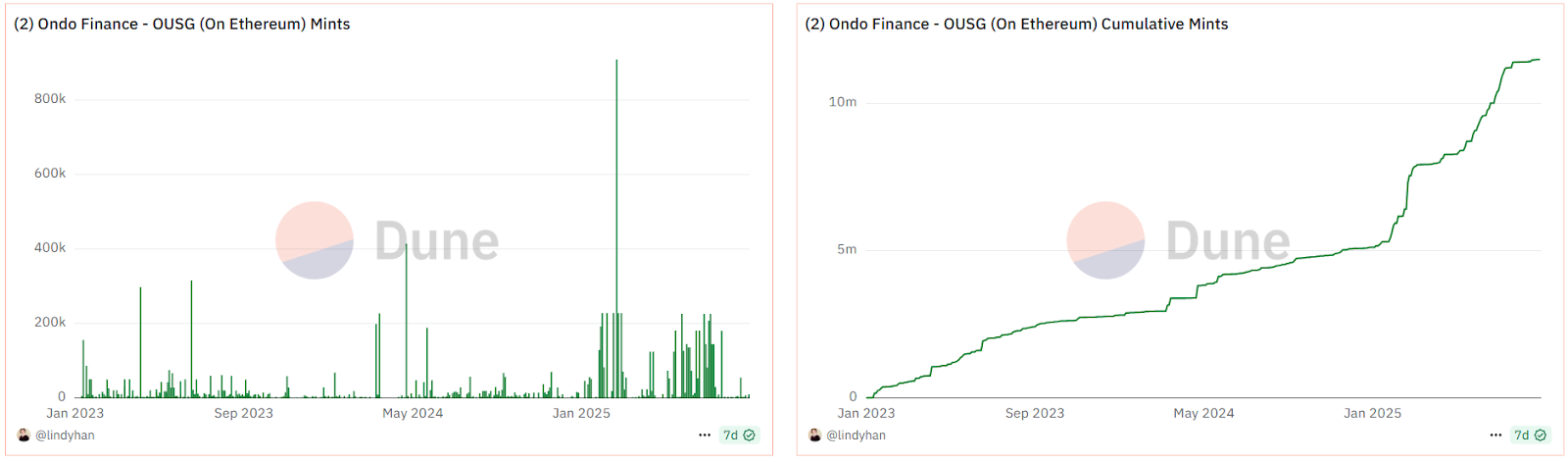

Since January 2025, the frequency of asset minting on Ondo Finance has become more intensive, helping to push the scale of OUSG on its chain to a new high.

Market competition: ETF application is on the agenda

The current market has entered a tokenization arms race, with exchanges accelerating their deployment of tokenized stocks and ETFs. On July 23rd, 21 Shares submitted its S-1 application for the ONDO ETF to the US SEC. If approved, the ONDO ETF will become a new target for institutional investors, significantly increasing the liquidity and market awareness of Ondo assets. This move also marks a key step for Ondo, moving from an on-chain protocol to the traditional financial market.

Strategic acquisitions: enhancing core competitiveness and technological upgrading

Ondo's strategic plan not only involves active communication with regulators but also involves further enhancing its core competitiveness through targeted acquisitions. On July 4, 2025, Ondo announced the acquisition of Oasis Pro, an SEC-regulated brokerage firm. The transaction is subject to regulatory approval. If the transaction is completed, Ondo will obtain licenses including broker-dealer, alternative trading system (ATS), and digital securities transfer agent, laying a solid foundation for its expansion into the US tokenized equity market. Additionally, on July 14, 2025, Ondo acquired blockchain development company Strangelove, further strengthening its capabilities in building on-chain infrastructure for RWAs. These strategic acquisitions not only enhance Ondo's technological and compliance advantages but also provide strong support for its in-depth expansion into on-chain finance.

Platform construction and technological innovation: breaking down traditional financial barriers

Ondo Finance's core mission is to seamlessly migrate traditional financial assets to the blockchain, and its flagship product, Ondo Global Markets, embodies this vision. On May 23, 2025, Ondo officially launched the platform, supporting the trading of public securities (including stocks) on the Solana blockchain. On July 2, 2025, Ondo further disclosed that the platform will launch this summer, initially listing over 100 US stocks, with plans to expand to thousands by the end of the year. These tokens are pegged 1:1 to the underlying stock or cash, support on-demand redemption, and offer continuous trading 24 hours a day, 5 days a week. The platform is deeply integrated with the Solana DeFi ecosystem, further enhancing the composability and flexibility of on-chain finance.

Furthermore, Ondo's technological capabilities have been widely recognized by traditional financial institutions. On May 14, 2025, JPMorgan Chase successfully settled a transaction on a public ledger, thanks to a collaboration between Ondo and Chainlink. Although the transaction took place on a private, "walled garden" network, this collaboration validated the reliability of Ondo's technology in institutional scenarios and provided significant support for its market expansion in traditional finance.

Industry collaboration: Promoting the globalization and standardization of tokenized securities

Ondo Finance understands that the long-term success of tokenized securities depends on industry collaboration and standardization. On June 17, 2025, Ondo launched the Global Markets Alliance to promote industry standards for tokenized securities. The Alliance brings together industry leaders including the Solana Foundation, Bitget Wallet, Jupiter, Trust Wallet, OKX Wallet, BitGo, Fireblocks, 1inch, and Alpaca. Through this cross-institutional collaboration, Ondo not only promotes the development of global standards for tokenized securities but also lays a solid foundation for its influence in the on-chain financial ecosystem.

In addition, Ondo Finance and Pantera Capital jointly established the $250 million Ondo Catalyst Fund, which aims to invest in RWA tokenization projects, including equity and tokens. Ondo's Chief Strategy Officer stated that the current market has entered a "tokenization arms race," with exchanges accelerating their deployment of tokenized stocks and ETFs. The fund is also promoting the development of on-chain financial infrastructure, with OKX Wallet joining its Global Market Alliance.

Conclusion

Amidst the clamor of narratives, Ondo Finance is quietly making its mark, proactively embracing compliance. From policy communication to technology implementation, from product design to industry collaboration, every step is centered around compliance and sustainability. Rather than opting for a quick, emotionally charged strategy, it is quietly building its own defenses through licensing, regulations, and infrastructure. The door to mainstream finance won't open to the loudest voices, but to those who truly understand the rules and weather the storm.