Unveiling the two key figures behind ETH's recent surge: Tom Lee vs. Joseph Rubin

- 核心观点:ETH财库公司成价格主导力量。

- 关键要素:

- BitMine和Sharplink持仓超以太坊基金会。

- Tom Lee与Joseph Rubin成关键话事人。

- ETH财库战略提振市场信心。

- 市场影响:ETH价格受机构持仓显著影响。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

ETH has become the biggest focus in this round of market recovery, and ETH treasury reserve companies represented by BitMine (BMNR) and Sharplink Gaming (SBET) are undoubtedly the biggest driving force behind this round of ETH surge.

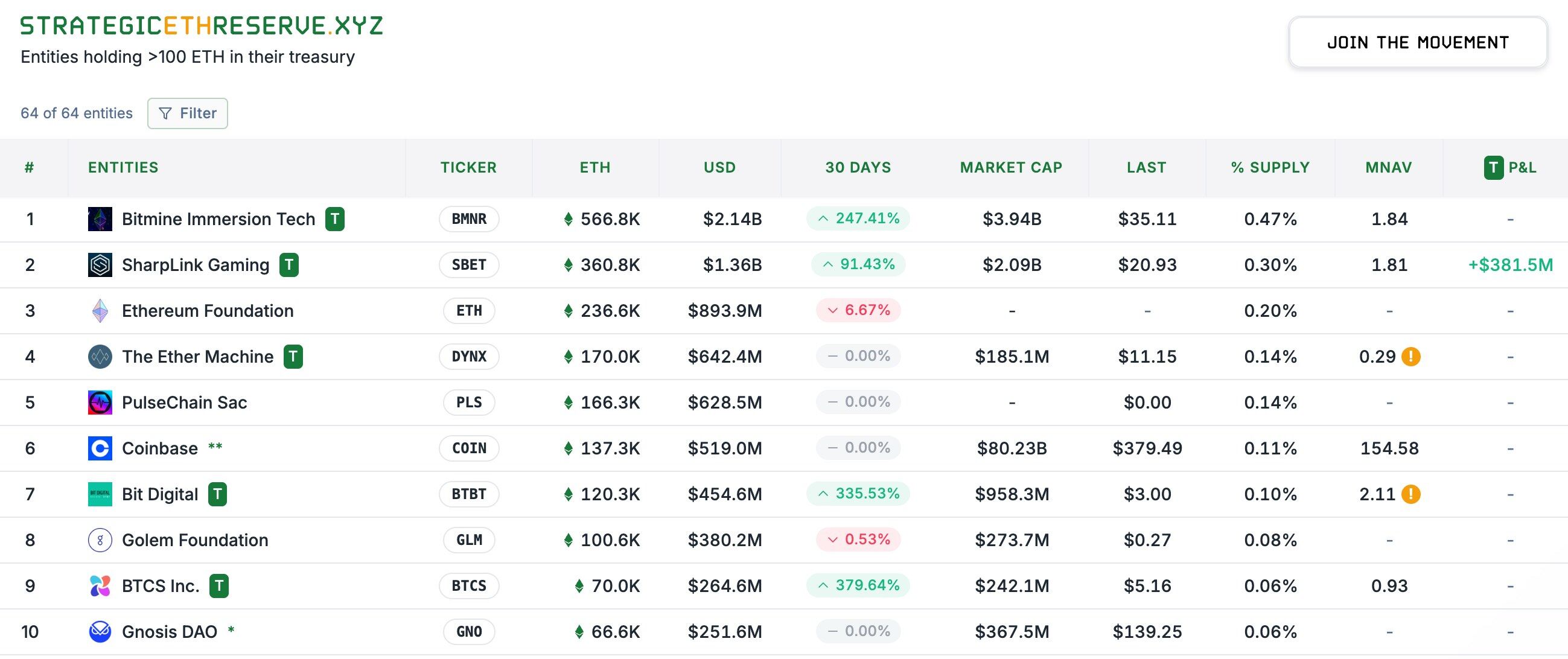

Data from the Strategic ETH Reserve shows that as of July 29th (Beijing time), BitMine and Sharplink Gaming held 566,800 and 368,000 ETH, respectively, valued at $2.14 billion and $1.36 billion, making them the only two entities with holdings exceeding that of the Ethereum Foundation. It's no exaggeration to say that BitMine and Sharplink Gaming now have a greater influence on ETH prices than the Ethereum Foundation, and their respective leaders, Tom Lee and Joseph Rubin, can be considered the true voices in the current ETH price trend.

Tom Lee: Former JPMorgan Chase Chief Equity Strategist, Cryptocurrency Bull

Tom Lee, whose full name is Thomas Jong Lee, was born in Westland, Michigan, to Korean immigrant parents. He is the third of four siblings. Tom Lee did not come from a financial family. His father is a retired psychiatrist, and his mother was a housewife who later opened a Subway.

Tom Lee graduated from the University of Pennsylvania with a bachelor's degree in economics, concentrating in finance and accounting, from the Wharton School. While at Penn, he joined the Delta Upsilon Fraternity, which Business Insider ranked as one of the top 17 alumni associations on Wall Street. He holds the CFA designation and is an active member of the CFA Society in New York and the Economic Club of New York.

Tom Lee began his Wall Street career in the early 1990s, initially working at Kidder, Peabody & Company before joining Salomon Smith Barney, a core investment bank under Citigroup. In 1999, Tom Lee joined JPMorgan Chase as chief equity strategist.

In 2002, Tom Lee gave a bearish view on the stock of the listed company Nextel, but was strongly counterattacked by the other party. The controversy attracted national attention and was also reported by the Wall Street Journal.

In 2014, Tom Lee left JPMorgan Chase and founded his own boutique research consulting firm, Fundstrat Global Advisors, where he served as head of research.

In 2017, Tom Lee began to focus on the cryptocurrency sector, and he has since frequently analyzed and predicted cryptocurrency market trends. However, unlike his previous work on the stock market, where he often offered both bullish and bearish views, Tom Lee's predictions for the cryptocurrency market are almost always bullish, and his price predictions are extremely aggressive. For example, at the market low in 2021, Tom Lee predicted that BTC would exceed $200,000 by 2022.

It is precisely because of this that many retail investors in Reddit's stock and cryptocurrency communities often speak of Tom Lee with some ridicule, believing that he is only "mindlessly bullish" and that reading his analysis "will not yield any new insights."

On June 30, 2025, Tom Lee's career took a turn. That same day, BitMine, a New York Stock Exchange-listed company, announced it would raise $250 million to launch its Ethereum treasury strategy . MOZAYYX led the round, with participation from Founders Fund, Pantera, FalconX, Republic Digital, Kraken, Galaxy Digital, DCG, Diametric Capital, Occam Crest Management, and Tom Lee. Tom Lee was also appointed Chairman of BitMine.

Afterwards, BitMine received investments from PayPal co-founder and Silicon Valley venture capitalist Peter Thiel and Ark Investment, owned by Cathie Wood, known as "Wood Sister" and "Female Buffett." The former acquired a 9.1% stake in Bitmine, while the latter subscribed to approximately 4.77 million shares of BitMine, which were worth US$182 million at the time.

At the same time, BitMine also started a crazy "buy, buy, buy" mode. In just one month, the company's ETH holdings had climbed to 566,776, surpassing the Ethereum Foundation and another ETH treasury company, Sharplink Gaming, which started earlier.

While BitMine topped the ETH holdings list, Tom Lee once again expressed his bullish confidence in ETH. In an interview with CoinDesk a few days ago, Tom Lee mentioned that if Circle’s current valuation level is used as a reference, then it would be completely reasonable for ETH to rise to $15,000.

Joseph Rubin: Co-founder of Ethereum, founder of Consensys, MetaMask, and Linea

Compared to Tom Lee, Joseph Rubin's story is probably more well-known in the industry. Joseph Rubin joined the Ethereum development team as early as the end of 2013 when Vitalik released the Ethereum white paper, and is widely regarded as one of the eight co-founders of Ethereum.

Joseph Rubin was born and raised in Toronto, Canada, to an intellectual family. He graduated from Princeton University in 1987, majoring in electrical engineering and computer science. Notably, while at Princeton, Rubin worked for Michael Novogratz, now the CEO of Galaxy Digital, another major cryptocurrency firm.

After graduating, Joseph Rubin worked in technology development at several software technology companies in Canada and the U.S. In the late 1990s, he joined Goldman Sachs, one of the world's largest investment banks, as Vice President of Technology in the Private Wealth Management Division, where he gained extensive experience in financial technology.

On the Ethereum founding team, Joseph Rubin played a role similar to that of a "strategic architect" - helping to shape the organizational structure, build relationships with partners, raise funds for the project, and coordinate early business activities.

In 2015, Joseph Rubin founded ConsenSys, an Ethereum infrastructure development company, to advance the application of Ethereum. Today, ConsenSys has spawned dozens of well-known sub-projects, including the well-known wallet application MetaMask and the Layer 2 network Linea.

On May 27, 2025, SharpLink Gaming, a US-listed company, announced it had signed a securities purchase agreement to raise $425 million in a private placement to purchase Ethereum (ETH) as its primary treasury reserve asset. Consensys led the financing, and Joseph Lubin will serve as Chairman of SharpLink Gaming's Board of Directors and as a strategic advisor to the company to develop its core business.

Since then, SharpLink Gaming has continued to increase its ETH holdings, and on July 14, it became the first entity to surpass the Ethereum Foundation in terms of holdings. Although the company's holdings were later overtaken by BitMine, it has also become a force that cannot be ignored in the Ethereum ecosystem.

As Ethereum’s tenth anniversary approaches, the discourse is shifting

Tomorrow (July 30), Ethereum will officially celebrate its tenth anniversary.

If we say that in the first ten years of Ethereum's birth, the right to speak of Ethereum was still firmly in the hands of the Ethereum Foundation represented by Vitalik, then after the first decade, with the deepening integration of ETH and traditional finance - especially under the trend of ETH treasury reserves, new forces represented by BitMine and Sharplink Gaming are gradually hoarding more ETH - the right to speak of Ethereum is also gradually shifting to the hands of these new forces with increasingly large holdings.

The continuous expansion of entities such as BitMine and Sharplink Gaming will certainly bring about certain centralization disputes, but in the medium and short term, when the price of ETH has been sluggish for a long time in the past few years due to narrative stagnation and intensified competition, community sentiment and coin holders' faith have become increasingly depressed, and ecological funds and talents have continued to flow out, it is the obvious buying brought by ETH treasury companies such as BitMine and Sharplink Gaming that has reversed the price decline and boosted community confidence. This has a very direct positive impact on the stability and development of the entire Ethereum ecosystem.

Cryptocurrency cannot forever remain an independent market, isolated from traditional finance. As bilateral integration progresses, different conflicts will naturally arise at different stages, ultimately forcing different solutions. Perhaps these ever-expanding entities will become an uncertain factor in Ethereum's future iterations. For Ethereum today, maintaining community confidence is paramount. If the only cost is a shift in discourse power, it may not be a bad thing.