"Weekly Editor's Picks" is a "functional" column of Odaily. On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Therefore, every Saturday, our editorial department will select some high-quality articles that are worth spending time reading and collecting from the content published in the past 7 days. You bring new inspiration.

Now, come and read with us:

Investment and Entrepreneurship

Therefore, every Saturday, our editorial department will select some high-quality articles that are worth spending time reading and collecting from the content published in the past 7 days. You bring new inspiration.

Now, come and read with us:

secondary title

Investment and Entrepreneurship

Researched 61 hundred times more projects, I found them with these characteristics

The old currency has a new narrative, and it is also a new growth point.

From the perspective of project establishment time, 76% of the 100-fold projects were established during the 18-20 year bear market cycle, and only 24% were established before 2017 (the last cycle).

The low/high point of BTC is basically in sync with the low/high point of BTC.

Continue Capital Horse: An exploratory analysis on top-tier public chains and their ecological valuation models

Suppose we define that the Public Chain Market Cap of other top public chains in the same period except ETH is PMC, define Ethereum Market Cap as EMC, and define PE=PMC/EMC.

The PE normalization range of the optimal non-ETH smart contract platform falls in the range of 6% -20%. The DP normalization range of conventional DEXs in their respective public chain ecology falls within the range of 1% -3%.

DeFi

A glance at the investment profile of 300 crypto VCs around the world: Who was the most active in the past 12 months?

San Francisco is the number one city in the world for cryptocurrency VC capital, representing 45.16% of the total capital of the top 50 global cryptocurrency VC firms, followed by New York, Hong Kong, Singapore, Austin, London and Shanghai.

The largest cryptocurrency-focused VC firms by fund size are: A16Z Crypto, Binance Labs, Multicoin, Pantera, and Paradigm. The top five cryptocurrency-focused VC firms by total cryptocurrency investment volume are: Coinbase Ventures, DCG, NGC, AU 21, and Animoca. The most active cryptocurrency VC firms right now are: Big Brain Holdings, Shima Capital, Infinity Ventures, GSR, and MH Ventures.

After the USDC crisis, what is the status of the stablecoin market?

The average market value of the 6 fiat currency stablecoins all rose, and the average market value of the 9 encrypted asset-based stablecoins all fell, which shows that the market’s confidence in the fiat currency stablecoins is still relatively strong, and the transmission of stablecoins based on encrypted assets is more negatively affected. big.

The market value of TUSD increased by more than 54%, the largest increase. The transactions between the three stablecoins USDC, USDT, and DAI constitute the main flow path of stablecoins in DeFi under the crisis. This change also shows user confidence in fiat stablecoins.

Foresight Ventures: Integration of LSD products and DeFi ecology

The ETH staking rate of return will become the benchmark rate of return on the chain, and there may be an interest rate difference between the chain and the off-chain.

The integration of LSD's interest-bearing attributes and DeFi includes the separation of principal and interest of LSD assets as collateral for lending agreements and interest rate products.

The stability of LSD price brought about by the Shanghai upgrade means that this asset has the opportunity to become a substitute for ETH on the chain, and its hard currency attribute will give LSD assets on the chain similar to Curve's 3 crv lp and Balancer's bb-a-USD same liquidity properties. The mechanism design of DeFi composability is essentially the flow of revenue between different protocols. At present, the main income sources of LSD assets include ETH staking income, the agreement's liquidity incentives for LSD assets, and the swap fee of LSD assets.

How Tokenized RWA Brings New Revenue Opportunities For DeFi?

Over the past few months, traditional funds and asset issuers have launched plans to tokenize other assets via public crypto networks. In order to attract new capital, DeFi protocols began to use RWA as collateral or a source of new investment opportunities, providing investors with higher returns. Tokenized RWA offers tangible benefits including lower investment minimums and increased access through fractional ownership, increased trading of previously illiquid assets, enhanced transparency and security.

The seven RWA private credit blockchain protocols combined have a combined historical loan value of $4.2 billion and ongoing loans of $456 million. These protocols use DeFi to provide private loans to businesses, including Maple, Centrifuge, Goldfinch, creditx, TrueFi, Clearpool, and Ribbon Lend. Their average annual interest rate is 12.63%.

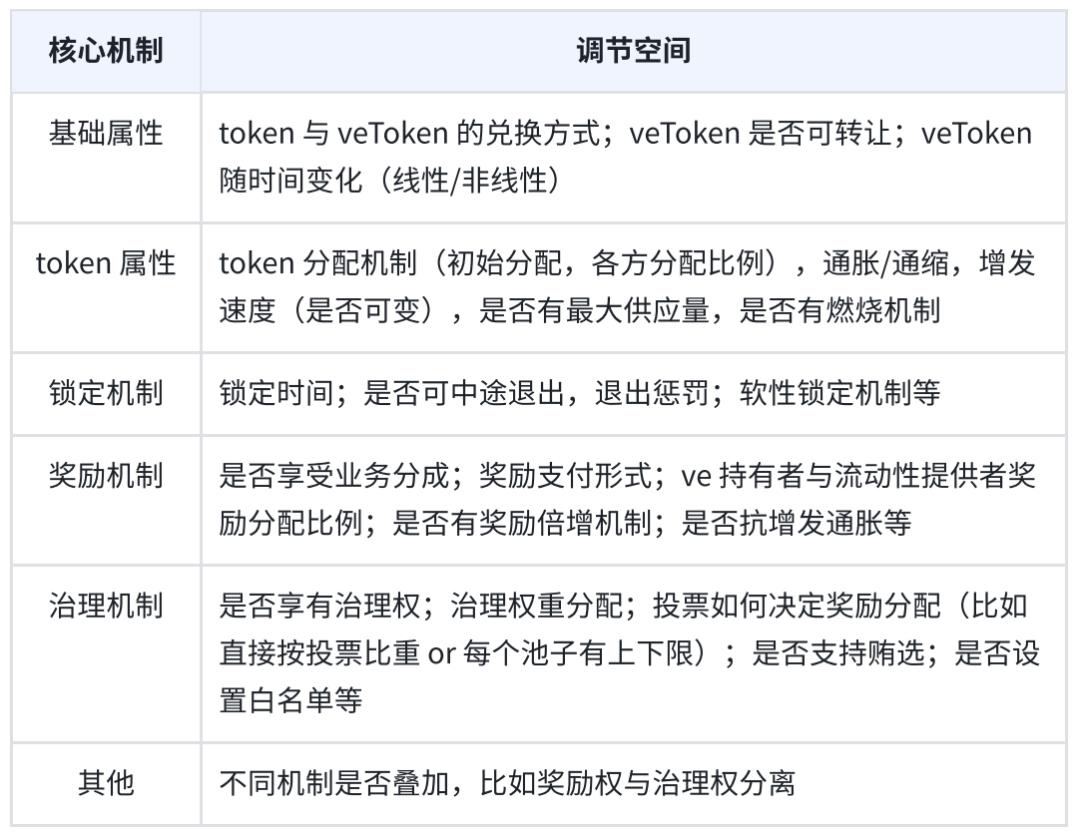

BuidlerDAO: A comprehensive interpretation of the mechanism and innovation of the veToken economic model

The emergence of ve (vote escrow, voting escrow) solves two problems: how to provide enough holding incentives for tokens; the interests of users and the agreement can be consistent for a relatively long period of time, so that they have the motivation to contribute to the long-term development of the agreement. contribute.

The advantages of ve are: after the lock-up, the liquidity is reduced, which reduces the selling pressure and contributes to the stability of the currency price; the possibility of better governance; the long-term interests of all parties are relatively coordinated. The disadvantages of ve are: the rigid "lock-in time" is not friendly to investors; the governance is centralized.

On the basis of Curve ve, different protocols have made different improvements, such as liquidity balance, ve token tokenization, ve token NFTization, soft lock*exit penalty. On the basis of ve, many protocols are also exploring new token rights distribution methods.

image description

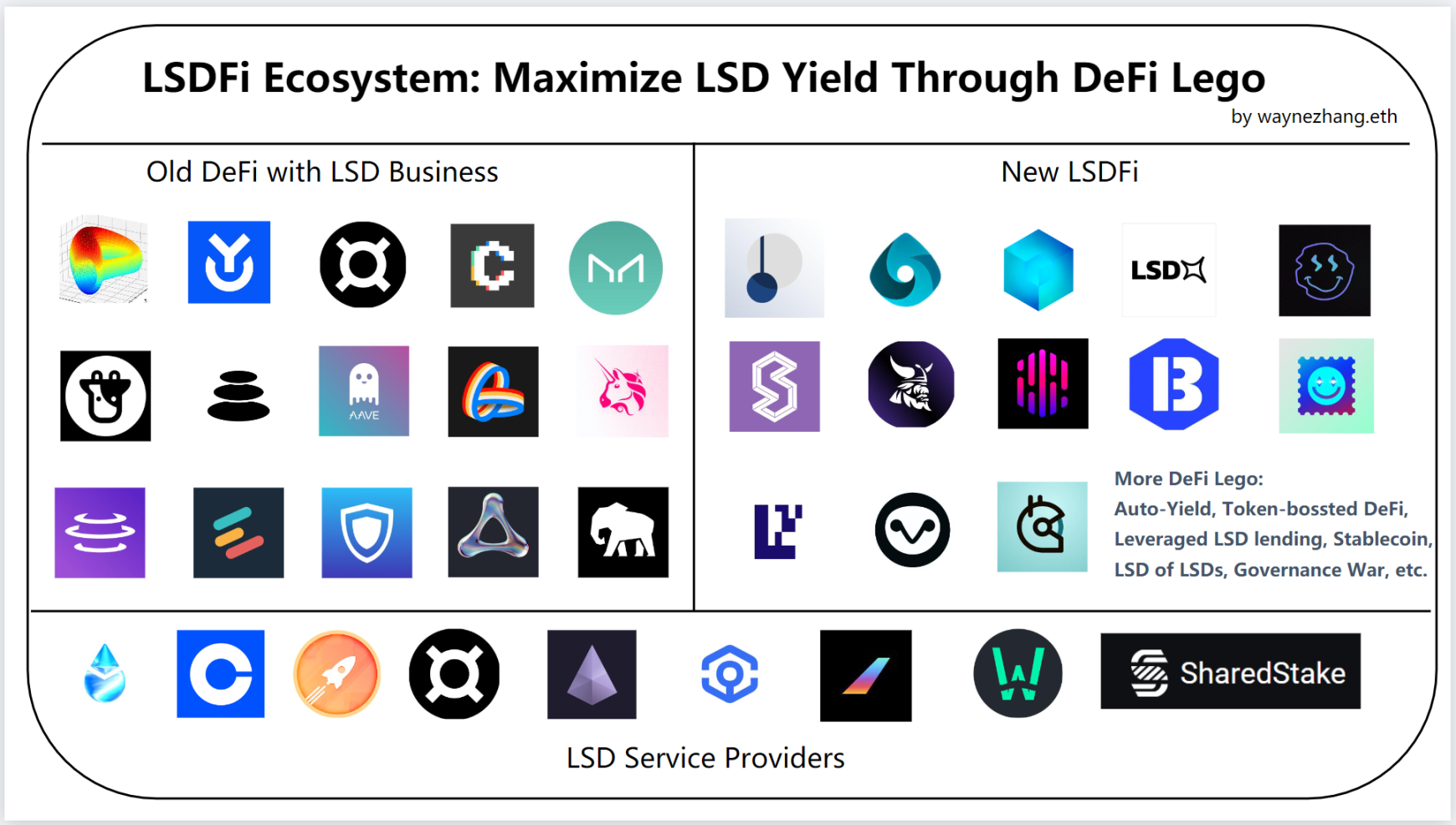

Multi-dimensional dismantling of the LSDFi ecosystem: Who can win the LSD War with DeFi Lego?

NFT, GameFi, and the Metaverse

Many projects of the incentive LSDFi type are vying for a right to speak: who can get more LSD, which will directly determine the number of their future cooperation projects and the DeFi Lego built on it.

LSDfi has little impact on validators.

There is a lot of room for collaboration between LSDFi projects. The LSD War has begun, and this war may continue until the pledge rate of Ethereum stabilizes at 25%+.

NFT, GameFi, and the Metaverse

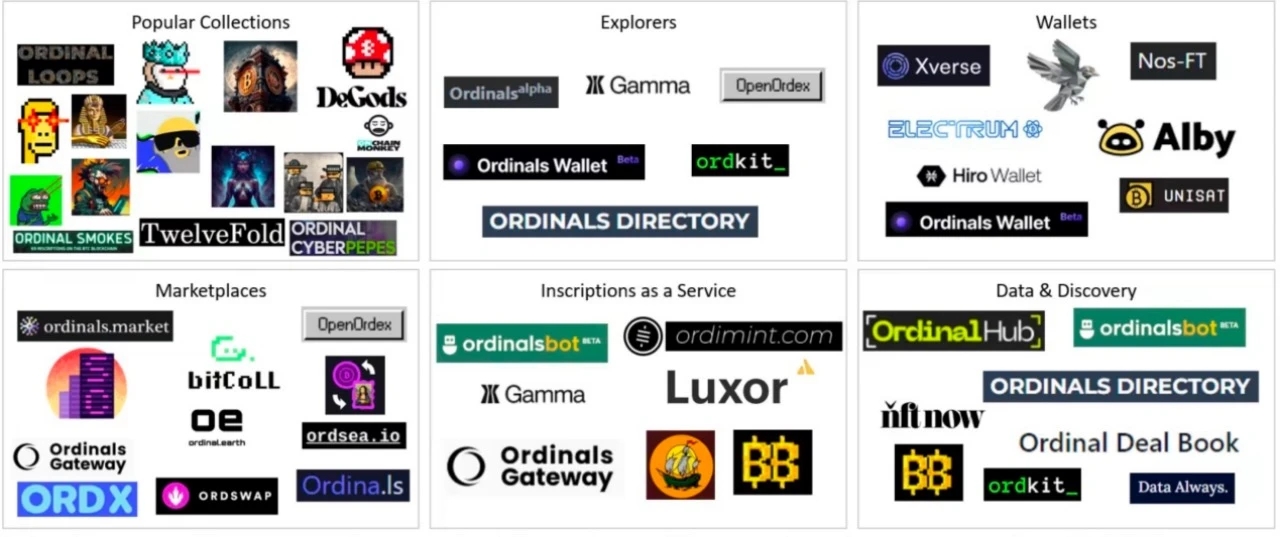

A comprehensive interpretation of Ordinals.

New ecology and cross-chain

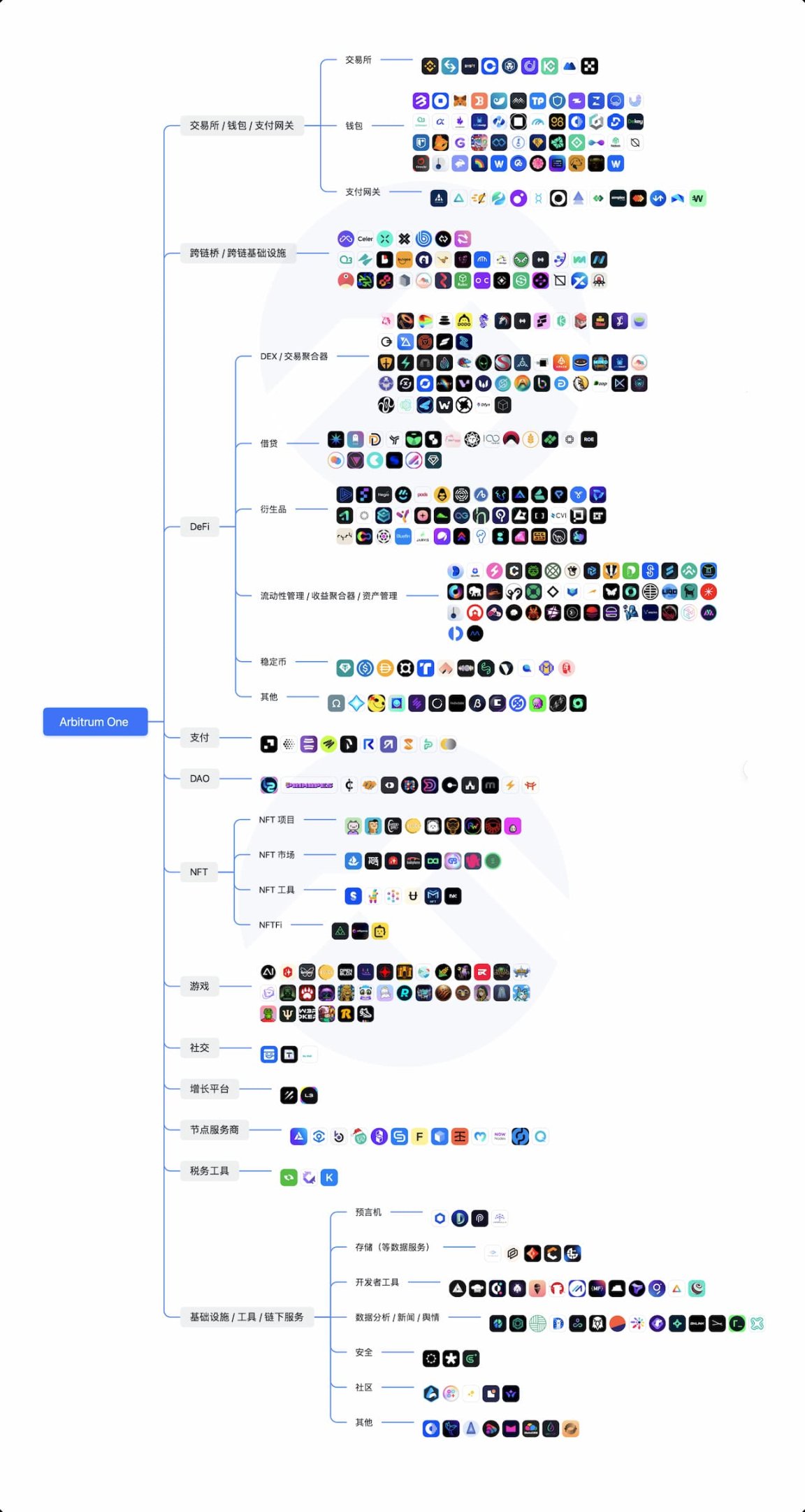

Arbitrum One

Arbitrum Nova

New ecology and cross-chain

Arbitrum Ecological Inventory: Exploring the Next Alpha

image description

image description

Which projects can use the Arbitrum airdrop "Dongfeng" to achieve leapfrog growth?

Radiant Capital, launched the V2 version on March 19;

hot spots of the week

In the past week,OpenAIGMX will launch synthetic assets.UBS buys Credit Suisse for CHF 3 billionsecondary titlehot spots of the week,In the past week,Add plugin support for ChatGPT, allowing networking, running computations, or using third-party services,UBS buys Credit Suisse for CHF 3 billion,, Switzerland considered,Full or partial nationalization of Credit Suisse186 banks found to be at risk similar to SVB, South Korean police confirmedDo Kwon arrested in MontenegroDo Kwon Launches Crypto Company in Serbia;

In addition, in terms of policies and macro markets,, prosecutors are investigating whether the company was used for money laundering,,Bankruptcy judge approves Celsius settlement, will return 72.5% of the cryptocurrency to personal escrow accounts that elect to settle,Ronin Hackers Tried to Send Euler Hackers a Phishing Scam to Steal Funds,In addition, in terms of policies and macro markets,The Fed announces to continue raising interest ratesSushiSwap and its CEO received a US SEC subpoena,, seeking 3 million USDT legal defense funds from Sushi DAO,,US SEC charges Justin Sun with allegedly illegally selling securities, defrauding and manipulating the market,Coinbase Receives SEC Wells Notice;

, Coinbase CEO responded:Coinbase has been approved by the SEC for listing and is willing to testify in courtUS Congress: Will Support Bitcoin MiningSEC Charges Celebrities With Endorsing Cryptocurrencies,Coinbase:Multiple entertainers have paid damages and SEC settlementsIn terms of opinions and voices, Paradigm:, former CTO of Coinbase:;

Institutions, large companies and top projects,Bitcoin will hit $1 million in 90 days,ChatGPT quickly assesses smart contract risks, but falls short of accuracy standards,, Star Xu:,OKB Chain is positioned as Ethereum Layer 2Institutions, large companies and top projects,Ark Invest sells about $13.5 million in Coinbase stock,Coinbase CEO and executives sold over $7.4 million in company stock in the past 30 daysAlibaba Cloud will launch Web3 security tools for developers and enterprises in AprilTelegram supports users to send USDT in chat, The Wall Street Journal:Binance Reinstates Bitcoin Transaction FeesUniswap V3 deployed to AvalancheProposal vote passed, deployment scheduled for 5 weeks,,MakerDAO Founder Publishes “Endgame” Governance Reform Proposal,, containing three major improvements,ImmutableX Announces 2 IMX Utility Upgrades: 20% of the platform fee must be paid in IMX; it will be used as the core Gas currency of Immutable zkEVM,Sui mainnet will be launched in Q2 this year

NFT and GameFi fields,The Sui Foundation is designing a community access plan for the SUI token,, there is no airdrop plan,,Jay Chou Launches Limited Edition Music Metaverse on Conflux...well, another week of ups and downs.

With "Editor's Picks of the Week" seriesPortal。

See you next time~