Weekly Editors' Picks Weekly Editors' Picks (0423-0429)

"Weekly Editor's Picks" is a "functional" column of Odaily.On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Now, come and read with us:

Now, come and read with us:

Investment and Entrepreneurship

Investment and Entrepreneurship

How to increase the probability of making money in the probability game of Crypto?

This article is for individual investors. If you want to switch to probabilistic thinking, you must first formulate strict rules; at the same time, pay attention to the size of the position (do not exceed the acceptable range), clarify your own advantages, admit your mistakes and stop in time, remain critical and patient during group discussions.

1confirmation partner: three counter-intuitive lessons in crypto VC investing

This article is very to organization. First, the construction of an investment portfolio is more important than picking the right target. Therefore, concentrated investment is better than prayerful diversification. Especially in the field of encryption, it is very difficult to surpass the performance of ETH in the long run. Second, before product-market fit, there is little correlation between the "hotness" of a round of financing and the final outcome. Valuation should be tightly controlled at the seed stage. More and more venture capital companies will enter the seed round of products with valuations of 60 million to 100 million US dollars. Third, it can be difficult to pick winners in the crowded space of popular narratives. Because capital is easy to attract founders who are mercenary, and investors sometimes know better than founders (this is dangerous), and the competition is fierce.

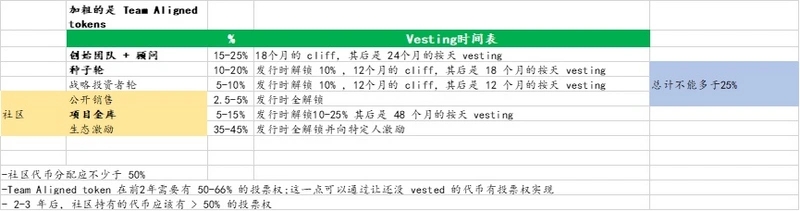

A brief analysis of token economics: how is good token economics designed?

DeFi

Messari: Disassemble the DeFi track and find the Alpha of the sub-track

NFT, GameFi and Metaverse

NFT, GameFi and Metaverse

This article explains in detail the underlying logic of the success of NFT projects and the way to break the situation for non-blue-chip NFT projects

For ordinary investors, the threshold for participating in blue-chip or popular NFT projects is getting higher and higher, and it is difficult to ambush and participate in blue-chip projects in advance; it is also difficult for non-blue-chip small and medium-sized project parties.

For new players, the purpose of learning is to expand your cognitive radius, and the result of learning is to narrow your action radius; mature cognitive system and decisive action ability are very important; in addition, protect the principal.

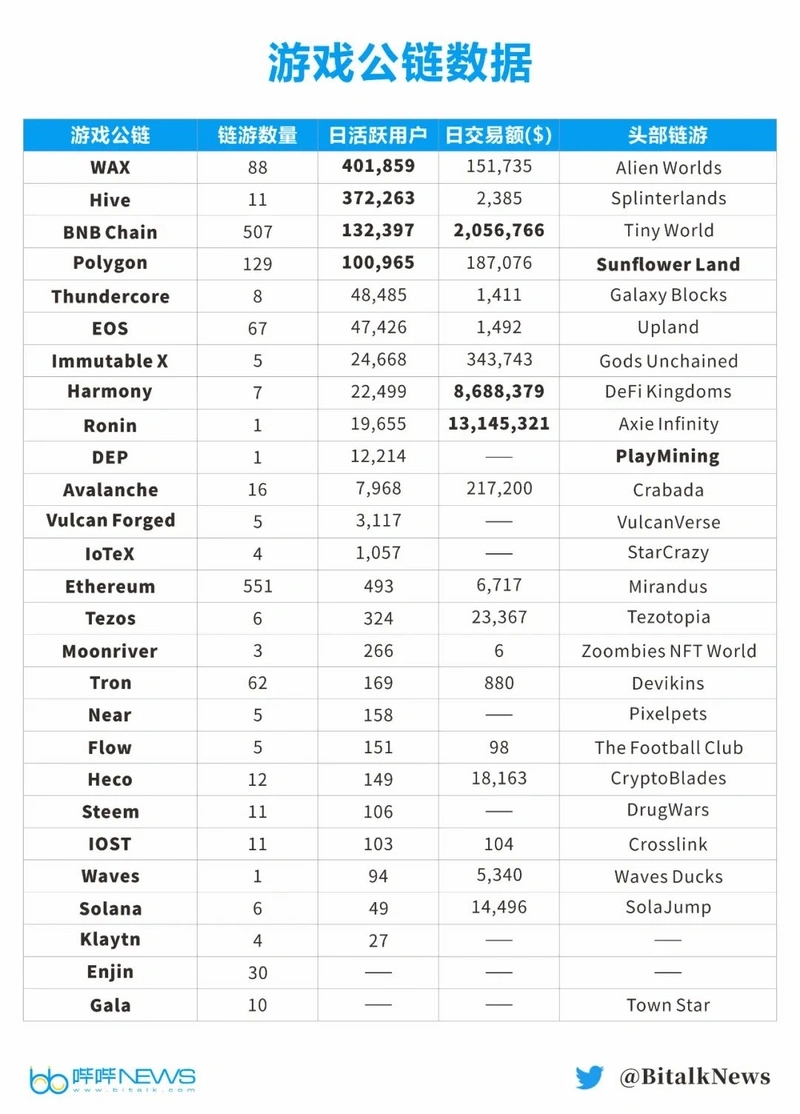

Games already “dominate” 52% of on-chain activity. The game DApp on the Polyon chain attracted 114,000 unique active wallets in the first quarter, and the game activity increased by 219% in the first quarter. Game activities on the Ronin and BNB Chain chains have decreased, and the total financing of Q1 games and virtual world projects reached 2.5 billion US dollars. The heat of the Metaverse began to drop.

Popular chain games such as DeFi Kingdoms, Splinterlands, Alien Worlds, Farmers World, Upland, Mobox, etc. come from multiple non-Ethereum public chains. Ronin, Flow, and Immutable X have opened up the paradigm of chain games making their own public chain/second layer. In the chain game ecology, Ethereum no longer occupies a dominant position. As of writing, the GameFi users of the 35 public chains are mainly divided by WAX, Hive, BSC, and Polygon. Among them, WAX and Hive accounted for 37% and 34% respectively. The three chains with the best daily transaction volume on GameFi are Ronin, Harmony, and BSC, and the transaction volume is contributed by Axie Infinity, DeFi Kingdoms, Tiny World, and Mobox.

Web 3.0

secondary title

X to Earn: The Official Challenge to the Death Spiral

When did Stepn reach its apogee and start its death spiral? The author suggests that everyone should not avoid talking about the death spiral, but should take the initiative to understand what the death spiral represents, challenge how to make the project last for a long time under the shadow of the death spiral, and what kind of operation and philosophy can survive under the shadow of the death spiral Let users, project parties and investors maximize long-term value at the same time.

The economic sources other than Ponzinomics in future stories are worth looking forward to, because there are more stories and space than the current P2E of chain games (such as the combination of Bike to Earn and carbon emissions).

In a narrow sense, the X in X to Earn refers to a certain user behavior, which emphasizes the user's time investment rather than capital investment. The commonality of the X to Earn project includes Earn and admission tickets (mostly NFT equipment).

Ethereum and scaling

Bankless: Ethereum 2022 Q1 Data Report and Ecological Highlights

New ecology and cross-chain

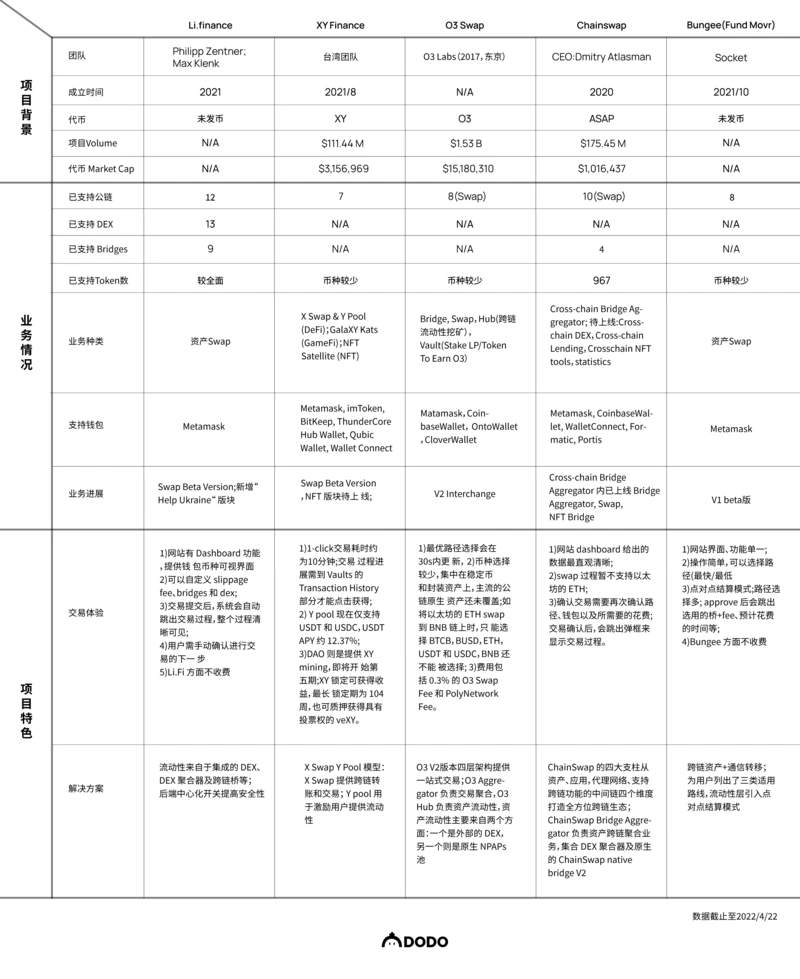

Cross-chain talk: Differentiated competition of cross-chain aggregatorsCross-chain talk: In-depth analysis of 16 cross-chain solution trade-offsThe book follows "

Cross-chain talk: In-depth analysis of 16 cross-chain solution trade-offs

Efficient liquidity makes the transaction costs of cross-chain aggregators cheaper, and the user experience of cross-chain aggregators is better. Cross-chain aggregators reduce development, decision-making and management costs. The business of cross-chain aggregators is not limited to asset cross-chain In the chain category, two-way transmission of assets and information, the cross-chain aggregator is an important component of the multi-chain universe; effectively preventing security vulnerability attacks is one of the problems that the cross-chain aggregator needs to solve urgently.

Ranked among the third largest blockchains? An article discussing Avalanche's fee model

Angles are interesting. The argument is that "on-chain data indicators are not that reliable". The argument is an example: Avalanche’s recent network fee consumption rate has tripled from the beginning of the year (at this rate, it consumes about 400 million US dollars a year), becoming the third largest blockchain after Ethereum and Binance Smart Chain.Paradigm investment partner Matt Mizbani found after research that the network block space consumed by the P2E game Crabada on Avalanche launched in November 2021 has steadily increased. Today, the game’s main contract consumes more than 50% of the network’s transaction fees. And more than 25% of users may be bots playing the game (users whose rest time is never less than 8 hours). They account for 55% of Crabada's total network fees. For reference: the top contracts on Ethereum that are calculated by fee consumption include: OpenSea, Uniswap, Gem, USDT, and USDC, and no contract consumes more than 15% of the fee.》《In addition, there are six good ecological project inventories this week, namely "》《Overview of Polygon's ecological landscape: there are more than a thousand ecological projects, and DeFi, NFT, and games dominate》《A Beginner's Guide to Optimism》《Ecological overview of Optimism: What other projects are worth participating in?》《Solana DeFi Cambrian Explosion? What other potential tracks and projects are worthy of attention in the future?》。

DAO

A quick overview of the basic situation of the new members of the Arbitrum ecosystem

secondary title

Whether or not DAOs should/has the right to "manually eliminate monopolies" is hotly debated (and divided). The Juno whale sanction incident exposed the defects of the POS mechanism and the governance problems on the DAO chain to the greatest extent: uneven distribution of governance weights, tedious governance procedures, legal risks, voter manipulation, and tyranny of the majority. In this regard, the optimization plan includes: increasing voting activity and participation rate, improving voting prudence and professionalism, code as law, and different rights for the same share.

Safety

Safety

hot spots of the week

hot spots of the week

In the past week,grayscaleIn the past week,grayscalePushing the SEC to approve its GBTC-to-Bitcoin ETF,US CongressmanBill reintroduced to allow CFTC to oversee cryptocurrency spot markets, Central African RepublicAdopting Bitcoin as Fiat Currency,, and startEstablishing a Digital Currency Regulator

CambodiaThe use and trading of cryptocurrencies is strictly prohibited;Musk will pay $44 billion in cashPayPal CEO, the transaction is expected to close in 2022,Goldman SachsSaid that it is necessary to double investment in digital wallets, and believes that this is the future of the industry,StripeGoldman SachsTelegramTokenization of physical assets is being explored,Announced that it will pilot crypto payments at Twitter using the Polygon network,Supports in-app purchases of Bitcoin and Toncoin,

PolygonChangpeng Zhao said BinancePotentially set up regulated entities in European G7 countries;Launched Web3 private network Supernets, will provide $100 million ecological fund, OptimismToken OP will be issued, the airdrop query page has been opened,

OpenSeaLaunched the governance system Optimism Collective, to promote ecological high-speed sustainable development;,Instagram suspected to be hacked,China Li NingFloor prices hit record highsChina Li NingLaunched BAYC#4102 peripheral clothing, and held offline pop-up activities,BendDAOGreenland GroupCobiePurchase BAYC #8302 and use it as the NFT image of the digital strategy,Become the largest holding address of MAYC and the fifth largest holding address of BAYC,Tucao ApeCoin's pledge proposal,RTFKT StudioOtherside cancels Dutch auction, Otherdeed NFT will be sold at a fixed price of 305 APE,With "Editor's Picks of the Week" series

With "Editor's Picks of the Week" seriesPortal。

See you next time~