Bankless:以太坊2022年Q1数据报告及生态亮点

原文作者:Bankless 分析师 Ben Giove

原文编译:DeFi 之道

这篇文章的最初灵感来自于 James Wang 的《以太坊公布 2021 年第一季度业绩》。此版本不是由以太坊或以太坊基金会发布的。

世界领先的智能合约平台以太坊公布了截至 2022 年 3 月 31 日的第一季度财务业绩。

关键结果

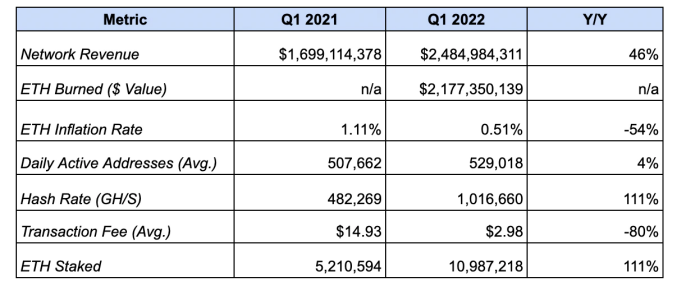

这些数据比较了 2021 年第一季度和 2022 年第一季度以太坊的表现。

以太坊协议

ETH 网络收入(总收入)和燃烧费用(协议收入)-- 来源:Token Terminal

网络收入从 16 亿美元增加到了 24 亿美元,增长了 46%。这衡量的是网络用户以 ETH 支付的交易费用价值。24.8 亿美元的收入(87%)通过 2021 年 8 月上线的 EIP-1559 实施的燃烧机制从流通的 ETH 供应中移除。

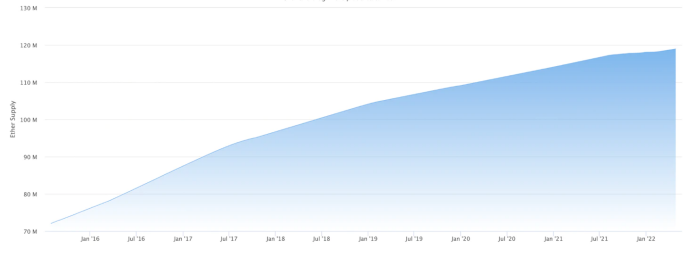

以太坊的供应增长 - 来源:Etherscan

第一季度,ETH 通胀率从 1.10% 下降到 0.51%,下降了 54%。这个指标跟踪了 ETH 供应的净变化。新的 ETH 是通过区块奖励发行的,区块奖励是作为确认网络交易的奖励支付给矿工的,并通过上述的 EIP-1559 燃烧。

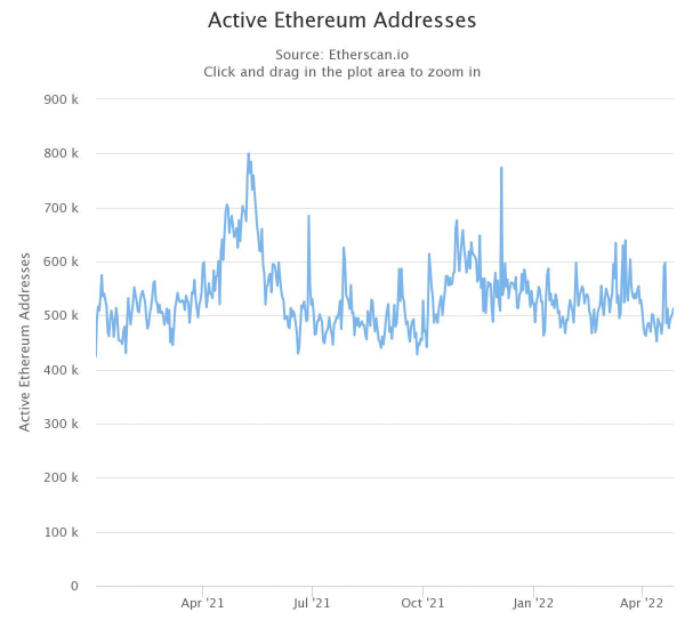

以太坊每日活跃地址 - 来源:Etherscan

每日平均活跃地址从 507,662 个上升到了 529,018 个,上升了 4%。这一数据跟踪了本季度内每天与网络互动的平均地址数。

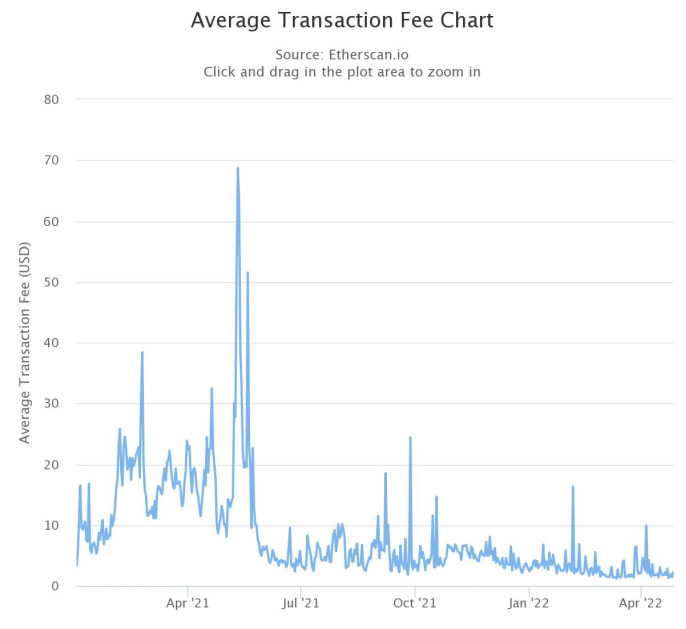

以太坊平均交易费用(美元)- 来源:Etherscan

平均交易费从 14.93 美元下降到 2.98 美元,下降了 80%。这衡量的是用户为确认其交易而为以太坊区块空间支付的平均费用。

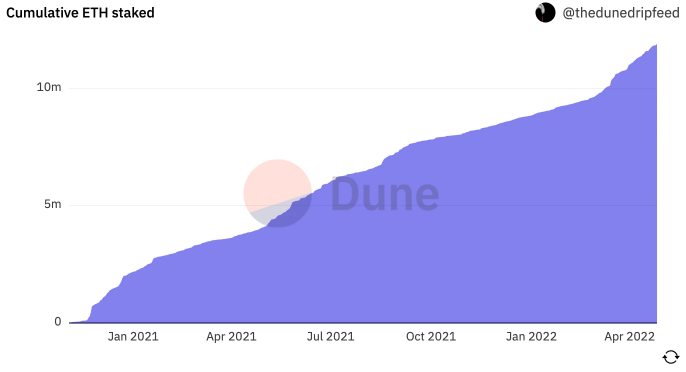

累积质押的 ETH 数量 - 来源:Dune Analytics

ETH 质押量从 520 万上升到了 1090 万,上升了 111%。这代表了在以太坊从使用工作量证明(PoW)共识机制过渡到权益证明(PoS)之前,在信标链上质押的 ETH 数量。大约 9.2% 的 ETH 总供应量是为了迎接“合并”而被质押的。

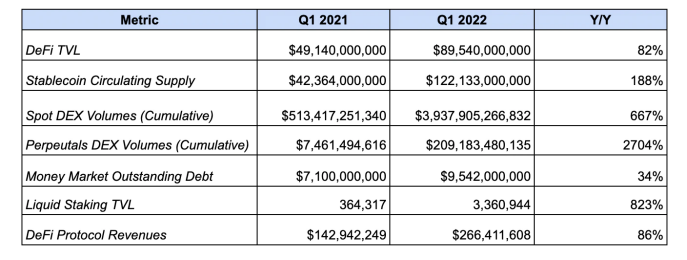

DeFi 生态

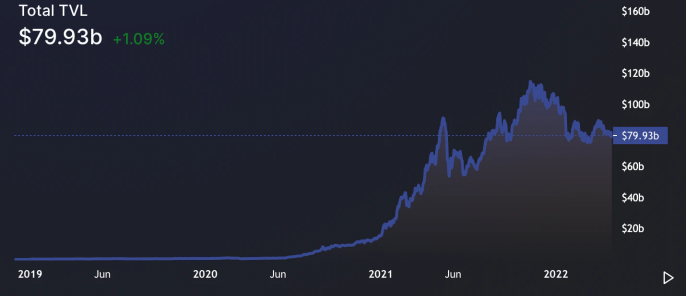

以太坊 DeFi TVL;来源:DeFi Llama

DeFi 总锁仓价值(TVL)从 491 亿美元增加到了 895 亿美元,增长了 82%。这衡量了存入基于以太坊的 DeFi 协议的资产价值,如去中心化交易所、货币市场和期权金库。

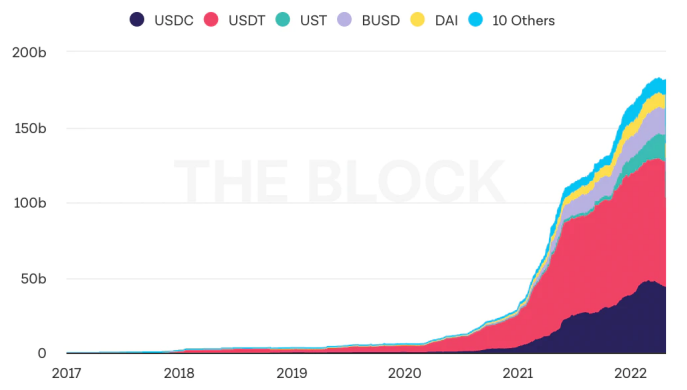

稳定币总供应量;来源:The Block

稳定币循环供应量从 423 亿美元上升到了 1221 亿美元,增长了 188%。这衡量了中心化和去中心化的稳定币价值,这些稳定币要么是本地发行的,要么是桥接到以太坊上的。计算在内的稳定币包括 USDC、USDT、DAI、FEI、FRAX、MIM、UST、LUSD、HUSD、PAX、TUSD、sUSD 和 BUSD。

注:上述图表包括所有链上的稳定币,而不仅仅是以太坊,因为这个指标的数据必须从众多来源中提取。然而,它仍然在很大程度上代表了以太坊的增长情况)。

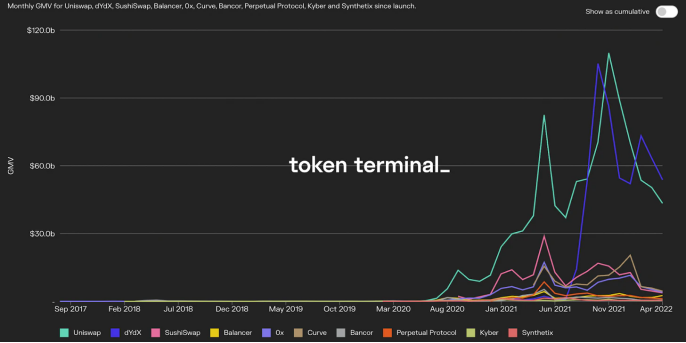

现货和永续 DEX 交易量;来源:Token Terminal

现货 DEX 交易量从 5134 亿美元增长到了 3.9 万亿美元,增长了 667%,永续 DEX 交易量从 74 亿美元暴增至 2091 亿美元,增长了 2704%。这些数据分别跟踪了在以太坊主网上运行的去中心化现货交易所和在以太坊 Layer-2 s 上运行的永续期货交易所的交易量。

注意:上面的图表不包括 GMX,它被包括在了 Perpetuals DEX 交易量的计算中。这方面的数据可以在这里找到。

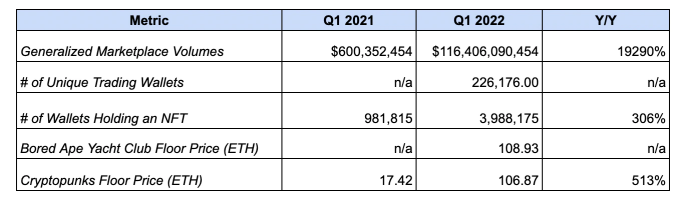

NFT 生态

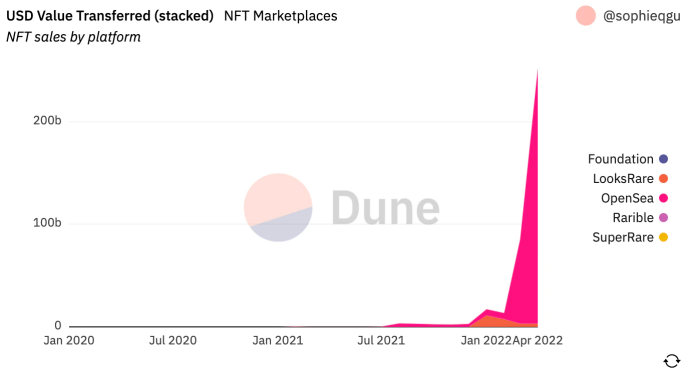

NFT 市场交易量;来源:Dune Analytics

NFT 市场交易量从 6.063 亿美元爆发到 1164 亿美元,增长了 19290%。这跟踪了两个最大的通用 NFT 市场的交易量,分别是 OpenSea 和 LooksRare。本季度有 226,176 个独立钱包购买或出售 NFT。

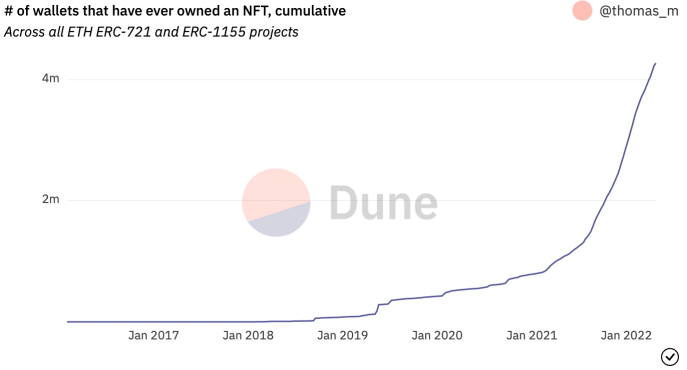

持有 NFT 的钱包累计总数 - 来源:Dune Analytics

持有 NFT 的独立钱包数量从 981,315 增加到 398 万,增长了 306%。这衡量了在某个时间点上持有 ERC-721 代币的钱包地址数量,该代币标准用于发行 NFT。

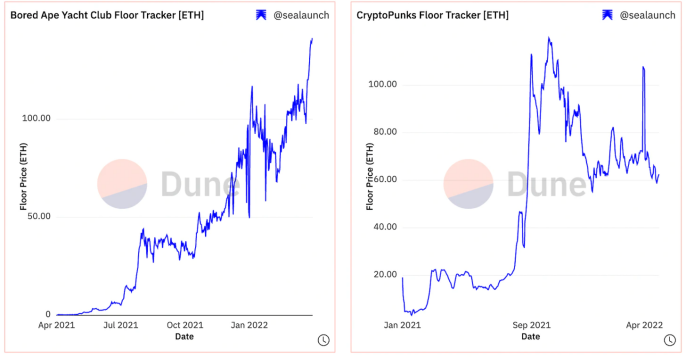

BAYC 和 CryptoPunks 的地板价;来源:Dune Analytics

CryptoPunks 的地板价从 17.42 ETH 上涨到 106.87 ETH,上涨了 513%。而 BAYC,虽然它在 2021 年第二季度才推出,但其地板价格,按这个标准来看,是最昂贵的 PFP NFT 系列,在本季度结束时为 108.93 ETH,根据当时的以太坊价格,价值约为 351,000 美元。

Layer 2 生态

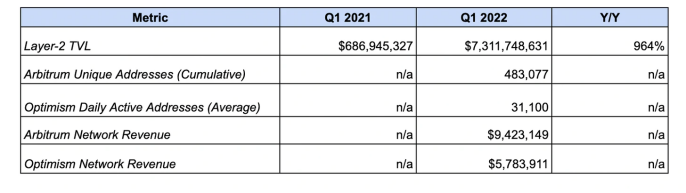

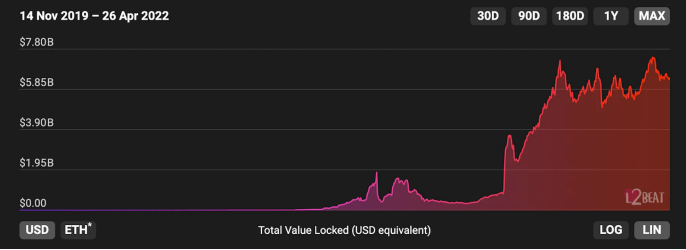

L2 总锁定价值;来源:L2 Beat

L2 总锁定价值从 6.869 亿美元增加到了 73 亿美元,增长了 964%。这衡量了锁定在以太坊 L2 扩展解决方案中的总价值,如 optimistic rollups,zkrollups,和 validiums。截至发稿,超过 230 亿美元的资产,包括 42 亿美元的 ETH,已经从以太坊桥接到了这些 L2 和其他 L1 上。

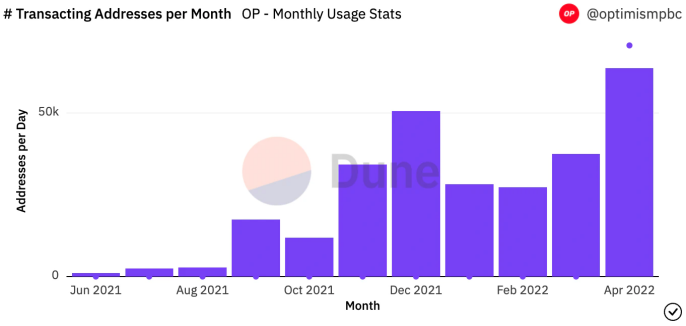

Optimism 月度活跃地址 - 来源:Dune Analytics

Optimism 的月平均活跃地址数为 31,100,而 Arbitrum 的累计独立地址数为 483,077。这衡量了本季度每月在 Optimism(一个 optimistic rollup)上进行交易的平均地址数,以及 Arbitrum(另一个 optimistic rollup)上的独立地址总数。鉴于这两个网络都是在 2021 年第三季度推出的,而且这两个网络的可用数据有限,我们无法进行同比比较。

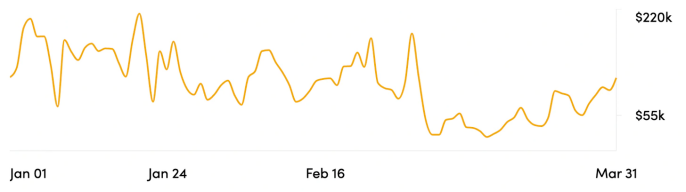

Arbitrum 每日网络收入;来源:Cryptofees.info

Arbitrum 网络收入为 940 万美元,而 Optimism 的网络收入为 570 万美元。这衡量的是用户分别在 Arbitrum 和 Optimism 这两个 optimistic rollups 上进行交易所支付的 ETH 费用。

生态亮点

稳定币、Curve 战争和贿赂

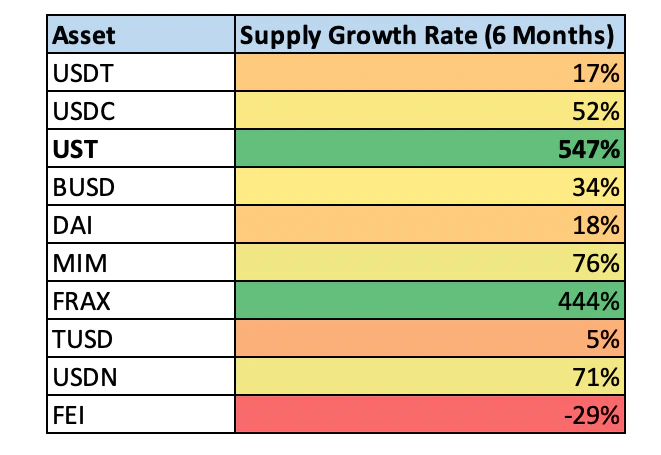

在第一季度,以太坊有许多令人兴奋的发展,其中最重要的可能是稳定币的持续上升。如上所述,稳定币在以太坊上的流通供应量按年增长超过 188%,达到 1220 亿美元以上。特别是,像 FRAX 和 UST 这样的算法稳定币,相对于它们的竞争对手,有超乎寻常的增长。这种增长表明,尽管市场疲软,资本可能没有大量逃离以太坊经济。

稳定币的 6 个月增长率;来源:Coingecko & Bankless

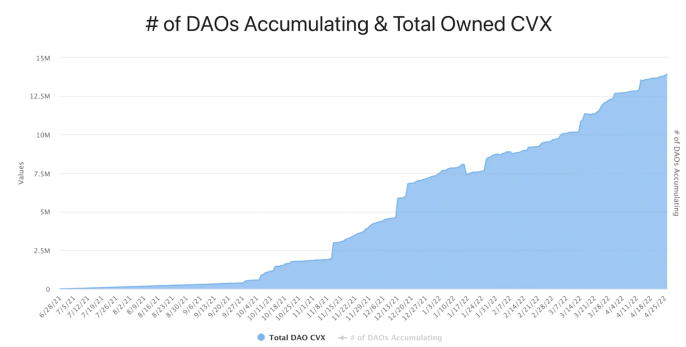

在稳定币领域的繁荣中,一个更值得注意的二阶效应是 "Curve 战争" 的持续发展。这是一场主要是稳定币 DAO 之间的战斗,以建立 Curve 的流动性,即 DeFi 最大 TVL 的去中心化交易所。第一季度,这一 "冲突" 成为中心舞台,DAO 们增加了它们对 CVX 的持有量,CVX 是 Convex Finance 的原生代币,该协议控制了 CRV(Curve 的治理代币)的多数供应量,超过了 73%。

DAO 持有的 CVX;来源:DAOCVX.com

为了配合他们的购买,DAO 向 CVX 持有人支付了超过 8920 万美元的贿赂(bribe),这些人锁定了他们的代币,以确保他们在指导 CRV 释放到交易所的不同池中的投票。随着这些 CVX 贿赂的年化收益率达到 40% 以上,第一季度巩固了这样一个概念,即这些付款可以成为具有战略意义的治理代币持有者的重要现金流来源。此外,第一季度有许多协议,如 Ribbon Finance、Balancer、Yearn 等,提出或实施切换到 ve 代币模式,希望复制 Curve 的成功。

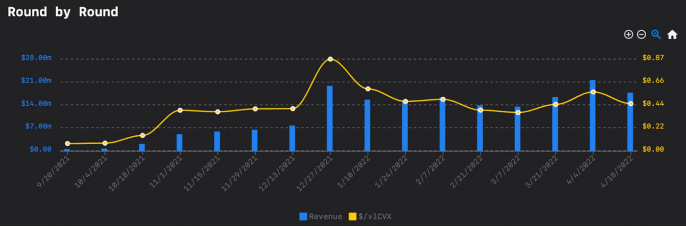

支付给 CVX 持有人的贿赂价值和每 CVX 的美元收益;来源:Llama Airforce

本季度还发布了几个令人兴奋的协议:

Alchemix V2,这是自偿贷款协议的第二次迭代,包括对大量新的抵押资产和收益生成策略的支持

Aave V3,多链货币市场的第三个版本,带有新的独立的贷款功能

Syndicate Protocol,允许创建链上投资俱乐部

NFT 似乎正在升温

借着前两个季度爆炸性增长的势头,以太坊的 NFT 生态在第一季度出现了几次重大的动荡。

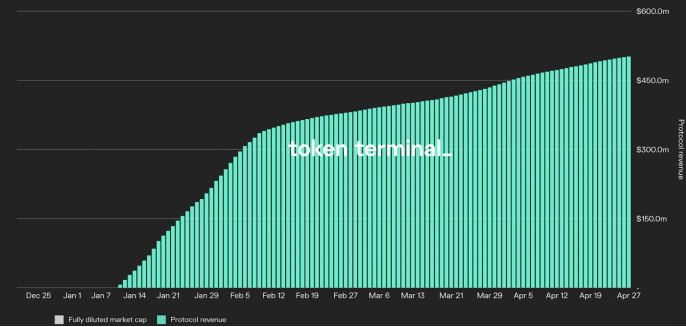

LooksRare 协议收入;来源:Token Terminal

其中之一是 1 月推出的 LooksRare,这是一个新的通用 NFT 市场,也是 OpenSea 的竞争对手,OpenSea 之前在该领域几乎拥有完全的主导地位。LooksRare 是在隐蔽状态下建立的,通过向 OpenSea 的用户空投原生治理代币 LOOKS,对其竞争对手进行了准吸血鬼式攻击。该市场还使 LOOKS 持有人能够将他们的代币进行质押,以获得平台产生的释放和基于 ETH 的费用收入。虽然这已经导致了关于洗钱交易的指控,以便获得这些奖励,但 LooksRare 在本季度促成了超过 221 亿美元的交易量,为持有者创造了超过 4.44 亿美元的收入。尽管 LOOKS 的估值目前比其历史最高点低 79%,但 LooksRare 似乎已经将 NFT 行业从单一垄断转为了双头垄断。

第一季度的另一个重大发展是 Yuga Labs 作为一个生态系统力量的建立。在 Bored Ape Yacht Club(BAYC)价值上升的推动下,它已经成为名人的最爱,按地板价计算,其是最有价值的 NFT 个人资料图片(PFP)藏品,Yuga 采取了若干重大举措,以加强其在以太坊经济这一新兴领域的地位。

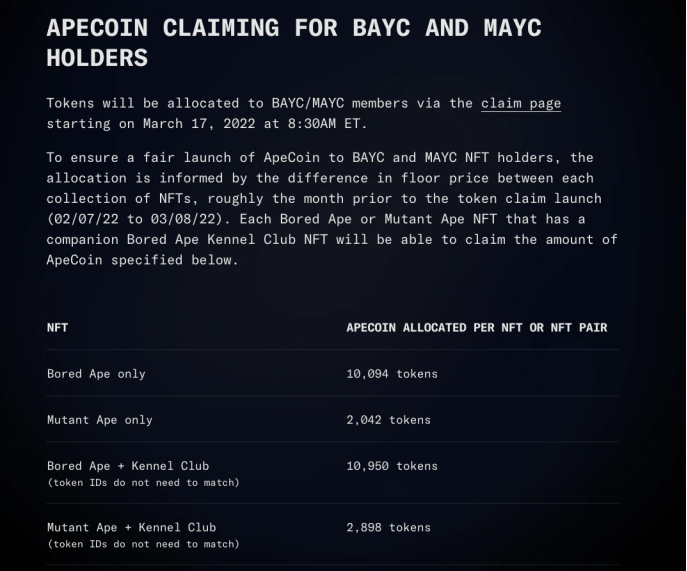

向 BAYC 和 MAYC 持有者空投 APE - 来源:Apecoin.com

首先,该公司收购了 Larva Labs NFT 系列的 IP,包括 Cryptopunks 和 Meebits。不久之后,Yuga 宣布发布 Apecoin(APE),其中该代币的部分供应被分配给了 BAYC 持有人,一些空投的数量超过六位数。

APE 的价格目前处于历史高位,完全稀释后的估值(FDV)超过 200 亿美元,它将作为该公司各种元宇宙生态系统项目中的治理和实用代币,例如最近预告的游戏 Otherside。这些发展使 Yuga 成为了广泛 NFT 生态系统中的一个蓝筹品牌和元宇宙媒体巨头。

L2 热度不减

以太坊新兴的 Layer-2 生态系统在第一季度继续增长。

如前所述,锁定在以太坊 L2 的 TVL 同比增长了 964%,到第一季度结束时超过 73 亿美元。综合来看,与其他 L1 网络一起,这批 L2 的 TVL 位居第五。Arbitrum 以超过 21 亿美元的 TVL,成为 L2 中锁定价值的领导者。

Arbitrum TVL:来源:DeFi Llama

许多 L2 原生应用已经看到了来自衍生品领域的最大牵引力。利用 L2 提供的更大的可扩展性,像 dYdX、Perpetual Protocol 和 GMX 这样的应用已经成为了五个最大去中心化永续交易所中的三个,并分别在 StarkEx、Optimism 和 Arbitrum 上线。

除了永续合约,另一类衍生品 -- 期权,已经开始在 L2 上看到有意义的牵引力,Dopex 和 Lyra 这两个去中心化期权交易所,分别在 Optimism 和 Arbitrum 上线。目前,这两个应用已经合计持有超过 1.19 亿美元的存款,且每个应用都在其网络中被列为使用最多的前五名。

Lyra TVL;来源:DeFi Llama

这些衍生品协议,以及其他 L2 原生项目,如 Tracer DAO、Jones DAO 和 Vesta Finance,似乎准备通过几个有利因素看到进一步的增长,例如在危险的市场条件下,DeFi 原生投资者对对冲和寻找替代收益来源的渴望增加,以及即将推出的各自 rollup 的代币(下文有更多介绍)。

前景展望

虽然市场面临着宏观逆风的漩涡,但以太坊的地平线上有几个催化剂,似乎有可能加强其基本面、竞争定位和代币经济。

合并,合并,合并

最重要的是即将到来的 PoW 到 PoS 的合并,而这个转换将带来许多重大的变化。以太坊是网络,ETH 是资产,对于前者来说,合并能够将区块链的能源消耗减少一个数量级,因为 PoS 的能源消耗远低于 PoW。这有助于减少以太坊对环境的影响,并增加其在传统机构投资者中的吸引力,这些投资者在做出分配决定时都会意识到 ESG(环境、社会和治理)。

预测合并后的ETH发行;来源:Ultrasound.money

合并也将对 ETH 的供应计划和价值主张产生重大影响。虽然 EIP-1559 导致其通胀率大幅下降,但过渡到 PoS 似乎有可能带来通缩的以太坊。根据目前 ETH 的质押量,以及 EIP-1559 激活以来的 Gas 消耗量,预计 ETH 将出现通缩,预计发行量为 - 2.1%。

虽然目前的质押供应量是不可转让的,但在合并后将逐步解锁并具有流动性,这种大规模的供应冲击可能会产生一个长期的比特币减半类型的影响,因为它极大地减少了 ETH 的卖压。此次合并还可能确立 ETH 的质押率,预计合并后将达到高达10%+的Web3无风险率,进一步增加以太坊作为现金流生产性资产和互联网原生债券的吸引力。

除了改变以太坊的 ESG 概况和 ETH 这一资产外,合并将有助于为未来的可扩展性升级铺平道路,如分片和 danksharding。这将使以太坊更好地满足在其经济中进行交易的永不满足的需求。

推出 Rollup 代币

以太坊增长的另一个主要催化剂是 L2 代币的推出。虽然 L2 在没有原生代币或全网激励计划的情况下成功获得了有意义的牵引力,但这些网络的治理代币的推出似乎准备推动其增长,并带来期待已久的 "L2 之夏"。

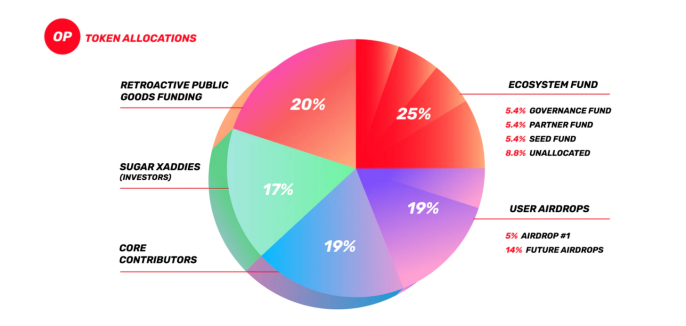

这方面的第一张多米诺骨牌在本周落下,4 月 26 日,Optimism 宣布推出 $OP,它将被用于网络治理,并且很可能被用来激励其新生但蓬勃发展的 DeFi 生态系统内的活动。

OP 代币分配;来源:Optimism Docs

正如那些利用激励计划的生态系统的爆炸性增长,如 Avalanche、Polygon 和 Fantom,这种策略在引导使用率、流动性和开发者活动方面非常有效。如果这一点被实施,Optimism 将经历类似的增长水平,而这也是合理的。

与 Optimism 一起,另外两个通用的 rollup,Arbitrum 和 ZK Sync 是通过推出代币,带来类似使用量增长的主要候选者。虽然 Arbitrum 还没有确认它将推出一个代币,但 ZK Sync 已经透露将推出一个代币用于去中心化他们的 rollups 定序器,这个实体将交易分批发布到 L1 上。

这些 rollup 代币和激励计划的推出应该成为一个重要的催化剂,帮助以太坊从其他 Layer-1 网络手中夺回市场份额(以太坊在 DeFi TVL 总量中的比例已经从 80% 下降到 51%),并提高日常用户参与去中心化经济的可及性。

附录

协议数据

DeFi 生态数据

NFT 生态数据

L2 生态数据