Weekly Editors' Picks Weekly Editors' Picks (0402-0408)

"Weekly Editor's Picks" is a "functional" column of Odaily.On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Now, come and read with us:

Now, come and read with us:

invest

invest

Token Economic Analysis Framework: How to study Token in the encrypted world?can be used with ""Take it.

Investing Essentials: How to Evaluate a Project’s Token Supply?

"Take it.

The encryption layout of Tiger Global: a "barbarian" who voted for 358 projects in one year

A great organization Portfolio combing + interpretation.

In 2021, Tiger Global participated in investing in 358 projects and captured a total of 188 unicorn companies, far surpassing well-known VCs such as a16z, Sequoia, and Lightspeed. In Q1 of this year, Tiger Global participated in 19 investment transactions, a quarter-on-quarter increase of 90%.

DeFi

Tiger Global's investment features are adapting to the macro environment, making quick moves, investing more, making quick decisions (outsourcing due diligence to Bain Consulting, establishing connections with various sub-funds), accepting low returns, lowering thresholds, and fighting price wars (for projects High valuation to grab the case). At the same time, Tiger Global hopes to allocate as much capital as possible under a reasonable IRR. Its current practice is to invest in the top 10% of projects in the technology field.

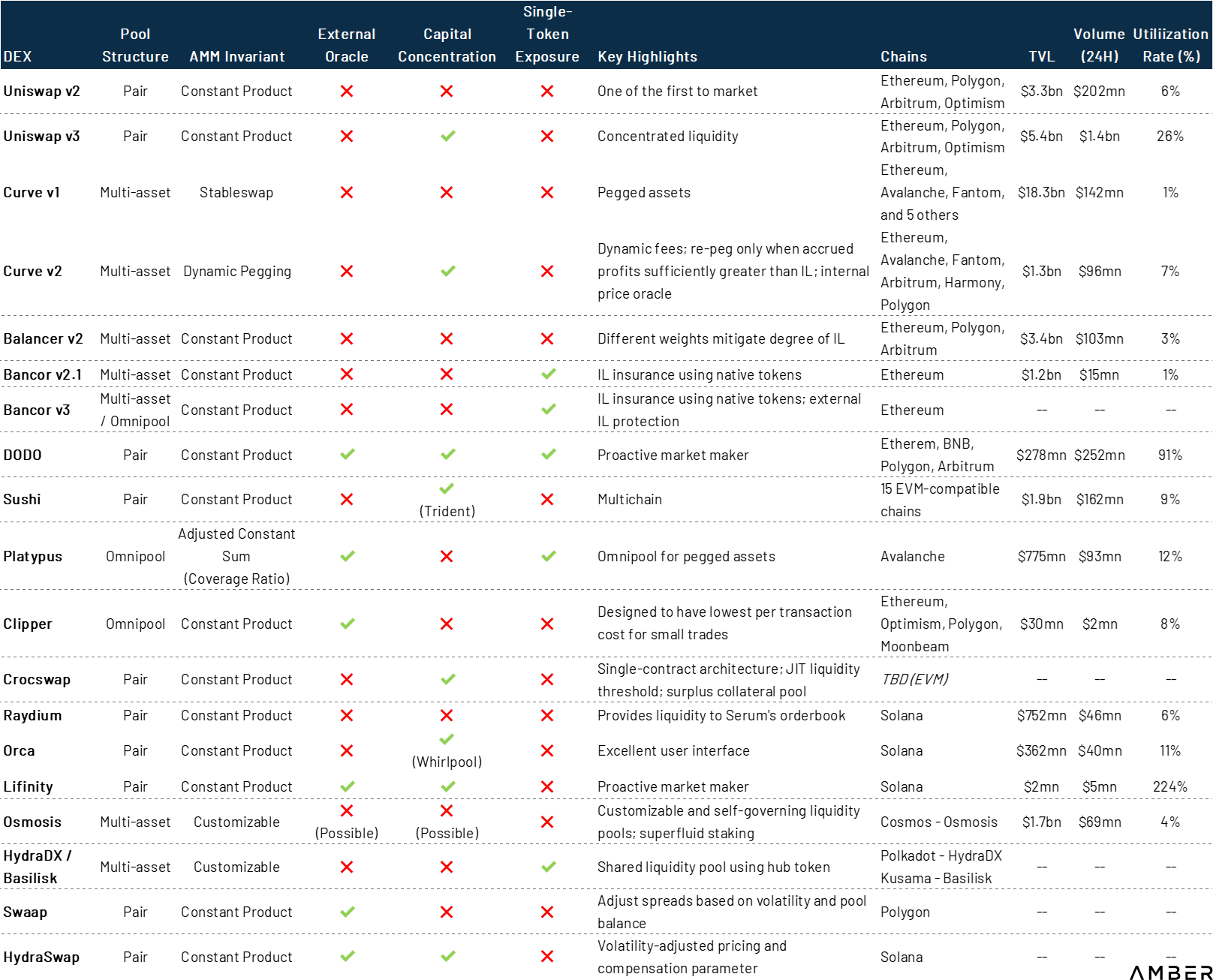

It should be the most complete report on AMM that I have seen. The article reviews important AMM architecture designs and market trends, and highlights some noteworthy projects. It also discusses sudden behaviors induced by AMMs, such as impermanent losses, centralized liquidity management, and instant liquidity. In the end, the author summarizes the main trends of AMM as follows: More emphasis is placed on protecting LP and managing IL risks rather than ensuring capital efficiency. Efficiency improvements are now more concentrated in protocol architecture design, and composability is still the primary consideration.

Paradigm: Explaining Progressive Dutch AuctionsSupplement a related article, which introduces the Synchronous Multi-Round Auction (SMRA): "》。

NFT, GameFi and Metaverse

NFT, GameFi and Metaverse

Where does the value come from: Is the rarity and price of blue-chip NFTs correlated?

"Many assets do not need any form of restricted supply, but the value of rarity will affect the sum of consumer demand and market-level demand, and artificial rarity and quantity design will have different effects." The rarity value of blue-chip NFT can be changed from Measured in the following four points: the scarcity of the item where the NFT is located, the rarity value compared with other NFTs in the total collection, the use value (premium) brought by the scarcity effect of NFT, the difficulty of acquisition or the time value. NFTGO selected six blue-chip projects with their own characteristics, evaluated the impact of NFT rarity on its price, and came to the following conclusions:

Holders of rare NFTs have pricing power that is more than 10 times higher than ordinary NFT holders.

Contrary to the common perception that "rare NFTs are more expensive", the impact of rarity on price is not completely positively correlated. The NFT with the highest selling price is not necessarily the rarest. There is no obvious price stratification for rarity, and rarity cannot represent and reflect the core value of NFT itself.

The influence of rarity sometimes gives the degree to other factors that are more recessive than rarity, such as aesthetic value and community consensus.

The impact of rarity on price has a certain "failure" in the waist.

Among the 6 items listed, the rarity of Doodles has the strongest correlation with the price, and BAYC obviously has other variables that affect the price.

For those project parties who intend to make NFT valuation tools, they need to understand that the value of NFT is determined and influenced by various factors. Through cooperation and meme communication, the PFP project redefines the rarity while expanding its own influence, and implicitly increases the price of NFT.

Bankless: What does the era of full-chain NFT mean?The recently launched bridge protocol Stargate Finance is the first application to go live on LayerZero. It has the potential to make NFT and related projects move towards the whole chain and exist in a wider way, and solve the problem of cross-chain tracking of NFT. Full-chain NFT can make big cakes for many projects and many chains at the same time. Odaily also specially introduced Gh0stly Gh0sts before, see "》。

Web 3.0

NFT ghosts walking through 7 chains

secondary title

Web3 New Creator Economy Report: Detailed Explanation of 144 Creator Economy Platforms and 100 VCshttps://airtable.com/shrsrUMBTwytxEtT2/tblJHsTq8C54ZQe0D

Web3 New Creator Economy Report: Detailed Explanation of 144 Creator Economy Platforms and 100 VCshttps://airtable.com/shrsrUMBTwytxEtT2/tblJHsTq8C54ZQe0D

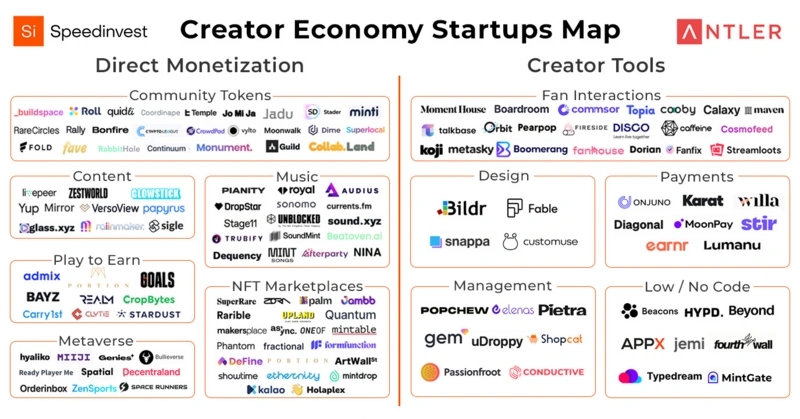

It brings together the judgments of Web3 investors on the opportunities and challenges of the track. The Creator Economic Field Mapping is as follows:

The author's criteria for selecting and ranking startups include: direct monetization companies must be community-led, allowing creators to monetize in a Web3-native way; primary data sources are Crunchbase and Pitchbook, supplemented by their deal flow, and dialogue with other VCs . Investors in this field see:

The author concludes that when investors are looking for targets, they will consider some key data (transaction volume, payment volume, search volume, developer activity volume, number of wallets traded on the chain, number of casting, monthly activity, etc.), and will also pay attention to the community’s Audience targeting, utility of NFT/social tokens and fan token economics, distribution strategies, teams, etc.

A Web3 Builder's Guide to Decentralization: Principles, Models, Methods

"Decentralization of power can be thought of as a single design challenge spanning three distinct but interrelated elements: technical, economic, and legal." When Web3 systems are well designed, decentralization becomes a virtuous circle. Make good use of the components of the Web3 system (blockchain network and smart contract protocols, digital assets, decentralized governance) to achieve decentralization.

Ethereum and scaling

Ethereum and scaling

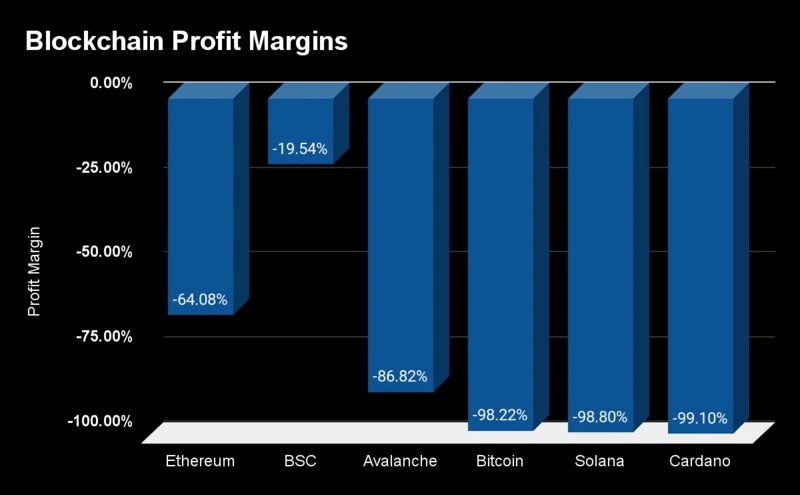

Bankless: Ethereum may become the first profitable blockchain

The angle is very interesting, the author believes that "profit = total income - total expenses" is also applicable to the blockchain. The business of the blockchain is to act as a secure settlement layer for value while remaining neutral through decentralization. The revenue of the blockchain is selling blocks, and the fee is security. Because from a business perspective, the product of blockchain is blockspace; the goal is to drive value into blockspace and collect revenue through it. And security drives value. This makes security a major cost of blockchain.

Operation guide: teach you how to bridge from Ethereum to Layer 2

New ecology and cross-chain

New ecology and cross-chain

Is Anchor, whose stable currency interest rate has been as high as 20% for a long time, a Ponzi scheme?

Since Terra's native token Luna is not only used to pay public chain gas fees and participate in governance, it also needs to issue stable currency UST by burning Luna. Therefore, there are two currency systems naturally in the Terra ecosystem, and these two tokens also have relatively independent interest rate systems - Luna's PoS pledge rate and Anchor's UST deposit rate. Currently, Luna’s interest rate is about 7%, while UST’s deposit interest rate in Anchor is as high as 19.4%. The article first clarifies that the PoS pledge rate guaranteed by minting rights can be considered risk-free, and then discusses whether Anchor is Ponzi.

Through the traditional income statement, analyze the composition of Anchor deposit income. Its biggest and only cost is to pay depositors interest on deposits. The income side includes two parts: the loan interest collected by Anchor for issuing loans to the outside world; the collateral pledged by the lender to the Anchor agreement, that is, the income generated during the mortgage period, such as the liquid pledge certificate bLuna. As the main source of income for Anchor, the interest rate generated by the three types of collateral supported by Anchor currently does not exceed 10%. In other words, even if the size of the collateral increases to twice the size of the total deposit, the income it generates cannot cover the cost of interest expenses. As a result, Anchor's current business structure, regardless of market conditions, is not profitable on its own (albeit not a Ponzi).

DAO

secondary title

hot spots of the week

In the past week,hot spots of the weekus treasury secretaryRussiaSaid that no one guarantees that stablecoins can be redeemed,MacroStrategyRussiaContinue to ban cryptocurrency payments, but explore issues related to crypto mining;Purchased 4,167 bitcoins again for about $190 million,Luna Foundation Guardannounced that it has purchased 230 million US dollars of BTC,Goldman SachsWill purchase AVAX worth $100 million as UST reserve,Goldman SachsCryptocurrency services will be launched to high-net-worth clients in Q2 2022,FTX.USBank of America and BakktReached cooperation, will provide customers with Bitcoin and Ethereum transaction services,Invest in the US stock exchange IEX to jointly create a digital asset securities market structure. After Musk purchases shares in Twitter, he willBig improvements to twitter,MetaDogecoin may be introduced to TwitterV GodA virtual currency "Zackcoin" for the Metaverse is being explored;V GodPost in support of Bitcoin maximalism: Bitcoin is a powerful asset worth holding,Ethereum developerIt is said that UST is not good for Ethereum and will threaten the solvency of all Ethereum DeFi; currency security is restoredRonin networkDevelop mobile versionnew round of financingnew round of financingJay ChouWith "Editor's Picks of the Week" series

With "Editor's Picks of the Week" seriesPortal。

See you next time~