투자 필수 요소: 프로젝트의 토큰 공급을 평가하는 방법은 무엇입니까?

원저자:NAT ELIASON

원문 편집: The Way of DeFi

원저자:

원문 편집: The Way of DeFi

이 게시물에서 저자는 토큰 공급 문제를 탐구합니다. 토큰의 수와 토큰이 변경될 수 있는 다양한 방법이 프로젝트의 상태에 어떤 영향을 줍니까?

언뜻 보기에 이것은 사소한 요소처럼 보일 수 있습니다. 그러나 토큰의 공급과 그 공급이 시간이 지남에 따라 어떻게 변하는지 이해하는 것은 프로젝트에서 좋은 투자 수익을 달성하는 데 중요한 요소입니다. 어디서 데이터를 찾아야 하는지, 어떻게 데이터를 찾아야 하는지 알지 못한다면 프로젝트의 토큰 공급에 대해 잘못된 인상을 주기 쉽습니다.

시가 총액과 같이 단순해 보이는 지표도 조작되어 투자자가 예상하지 못한 방식으로 투자자를 오도할 수 있습니다. 따라서 투자하기 전에 더 많은 정보를 얻기 위해 토큰 공급을 평가하는 방법을 배워야 합니다.

토큰 공급의 어떤 측면에 집중해야 합니까?

토큰 공급에서 중요한 것은 반드시 토큰의 총 수량이 아니라 토큰 공급의 현재 단계, 향후 단계, 현재 단계에서 미래 단계로의 변화 속도입니다.

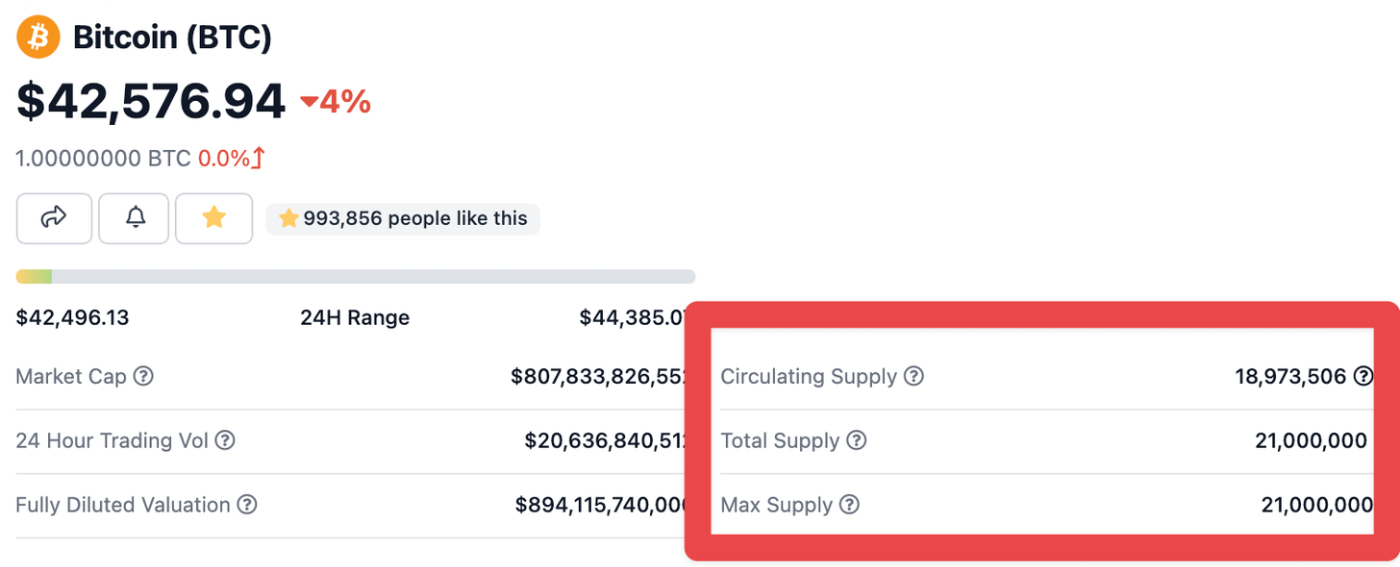

비트코인부터 시작하겠습니다. 비트코인의 현재 순환 공급량은 18,973,506이며 총량은 항상 21,000,000에 불과합니다.

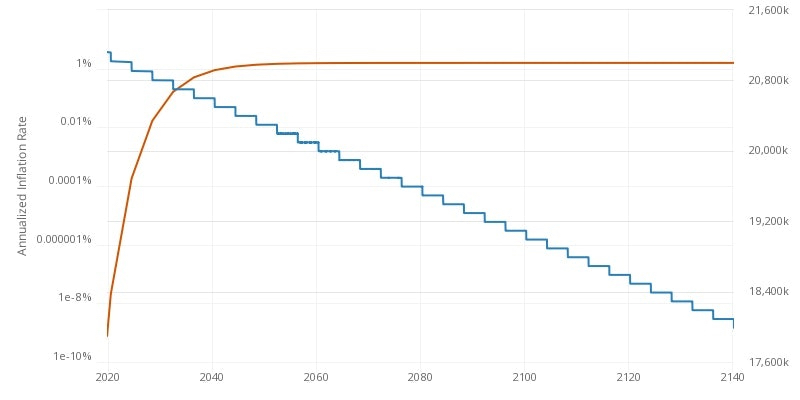

비트코인 공급의 마지막 9.6%는 2140년경까지 완전히 풀리지 않을 것이며, 이는 상당한 시간이 소요될 것입니다. 그리고 우리는 비트코인의 현재 인플레이션율이 얼마인지 언제든지 볼 수 있으며 그 과정에서 예상치 못한 변화는 없을 것입니다. 고정되어 있습니다.

Bitcoin의 토큰 공급량은 투자자 잠금 해제, 팀 금고 및 토큰 락업 베스팅이 없기 때문에 계산하기 쉽습니다.

그러나 대부분의 암호화폐의 토큰 공급은 그리 간단하지 않습니다. 따라서 Bitcoin의 경우 순환 공급, 최대 공급 및 인플레이션 차트만 보면 무슨 일이 일어나고 있는지 알 수 있지만 대부분의 동전은 더 복잡한 상황에 직면합니다.

우리가 파악하려는 주요 사항은 다음과 같습니다.

1. 현재 가용성

2. 향후 가용성

3. 미래의 공급 상태는 언제 도달할 것인가

4. 미래 공급 상태에 도달하는 방법

이러한 문제에 영향을 줄 수 있는 다양한 요인을 살펴보고 몇 가지 예를 분석해 보겠습니다.

시가 총액 및 완전히 희석된 가치

시가 총액 및 완전 희석 가치(FDV)는 토큰 평가를 위한 두 가지 간단한 시작 지표입니다.

시가 총액은 토큰 가격에 토큰의 순환 공급량을 곱한 것입니다. FDV는 현재 가격에 최대 공급량을 곱한 값입니다.

따라서 토큰의 가격이 $10, 순환 공급량이 1,000만 개, 최대 공급량이 1억 개라면 시가 총액은 1억 달러, FDV는 10억 달러가 됩니다.

이 두 지표는 우리가 다룰 다른 변수와 결합할 때 유용합니다. 현재 시장이 프로젝트를 평가하는 방법과 현재 가격을 정당화하기 위해 향후 프로젝트가 어떻게 발전해야 하는지에 대한 아이디어를 제공할 수 있기 때문입니다. .

시가 총액과 FDV 사이에 큰 차이가 있는 경우(즉, 상장을 위해 락업된 토큰이 많다는 의미) 이러한 락업된 토큰이 어떻게 시장에 진입할지 조사해야 합니다(3 및 4).

시가 총액이 FDV의 10%이고 내년에 토큰이 발행된다면 프로젝트는 현재 가격을 유지하기 위해 1년 이내에 10배 또는 1000% 성장해야 합니다.

그러나 시가 총액이 FDV의 25%이고 4년 후에 토큰이 발행되면 4년 동안의 성장률은 4배에 불과합니다. 즉, 전년 대비 약 40%입니다.

따라서 시가 총액 대 FDV 비율은 순환 공급과 최대 공급이 실제로 무엇을 의미하는지 알아보기 전에 확인해야 할 첫 번째 지표 중 하나입니다.

순환 공급 및 최대 공급

순환 공급량과 최대 공급량은 현재 공급량과 미래 공급량에 대한 질문 1과 2에 대한 답을 제공하여 시가 총액과 FDV를 이해하는 데 도움이 됩니다.

최대 공급량은 매우 간단합니다. 비트코인의 경우 2,100만입니다. 이더리움에는 상한선이 없습니다. Yearn의 경우 36,666입니다.

순환 공급이 복잡해집니다. 얼마나 많은 주어진 토큰이 유통되고 있습니까? 비트코인의 경우 이것은 쉽습니다. 최대 공급량에서 아직 해제되지 않은 양을 빼면 답이 나옵니다. Ethereum 및 Solana와 같은 다른 L1은 자체적으로 보고하거나 모니터링할 수 있는 API가 있습니다.

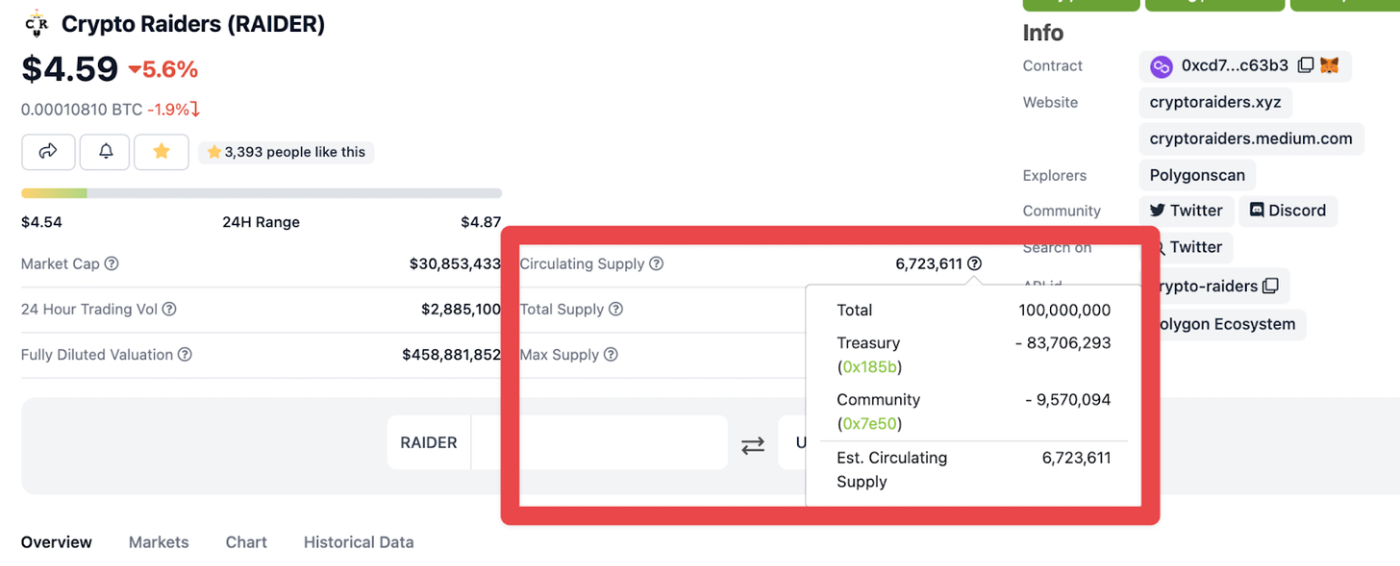

반대로 프로젝트 토큰은 더 복잡합니다. 예를 들어. Crypto Raiders의 경우 총 공급량 1억개 중 약 1,600만개를 출시했습니다. 하지만 코인게코를 열어 확인해보면 유통량이 6,723,611개에 불과하다는 것을 알 수 있습니다. 나머지는 어디에 있습니까?

Coingecko 및 기타 API는 해당 토큰이 이전에 시장에 출시된 경우에도 순환 공급에서 "비활성" 토큰을 빼려고 시도합니다. 우리의 경우 투자자는 3-12개월 동안 스테이킹 계약에서 950만 개의 토큰을 잠갔으므로 Coingecko는 공급에서 다음 토큰을 뺍니다.

이것은 비합리적으로 보일 수 있습니다. 투자자는 950만 개의 토큰을 약정하고 잠그는 것을 선택하기만 하면 되며, 이 부분의 토큰은 이미 시장에 출시되었습니다.

이 예는 또한 토큰의 순환 공급을 깊이 이해하는 것이 얼마나 중요한지 알려줍니다. 처음에는 6%만 더 많은 토큰이 시장에 출시된다고 느낄 수 있습니다. 즉, 현재 토큰 가격을 유지하려면 이 프로젝트가 거의 20배 성장해야 합니다. 그러나 실제로 토큰의 16%가 이미 잠금 해제되어 있으므로 현재 가격을 유지하려면 프로젝트가 약 6배만 성장하면 됩니다.

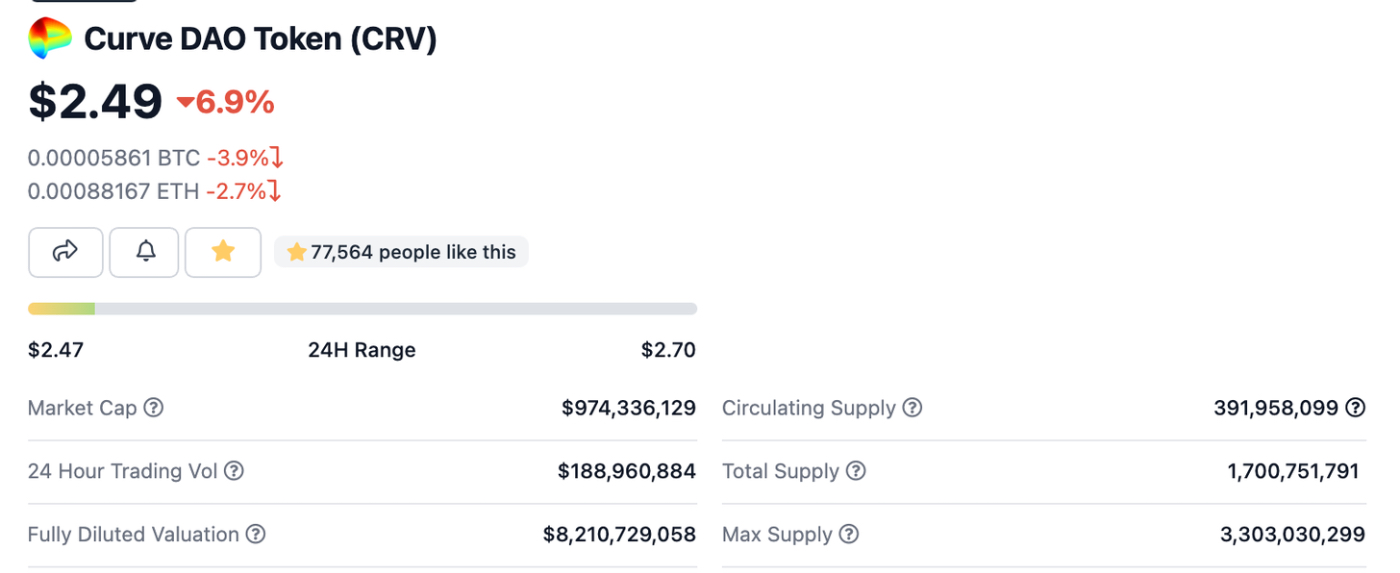

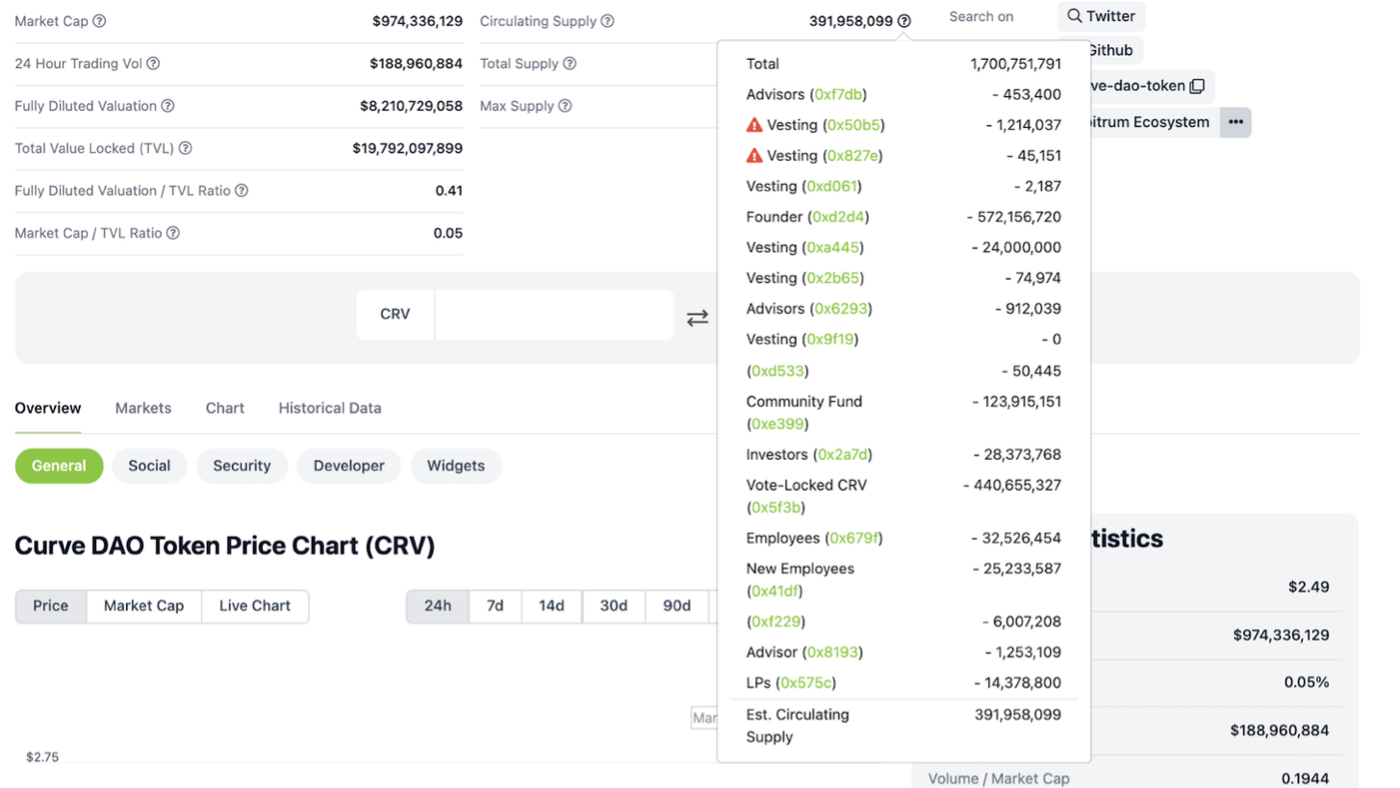

곡선도 아주 좋은 예입니다.

Curve의 FDV는 시가 총액의 약 9배이며 토큰의 11%만 유통되고 있는 것으로 보입니다. 그러나 순환 공급량을 더 깊이 파고들면 다양한 계약에 많은 수의 토큰이 잠겨 있음을 알 수 있습니다.

이 중 설립자 "Founder"의 계약 주소에는 5억 7,200만 개의 토큰이 있으며, 4억 4,000만 개의 CRV가 투표에 의해 락업됩니다. 창립팀이 소유하고 있는 토큰의 총량은 조금 의외인데, 컨트랙트 정보를 보면 이 락업된 토큰은 락업 기간이 4년 이상인 것으로 나와 있습니다.

저자는 투표로 잠긴 CRV가 시장 가치에 포함되어야 한다고 생각하므로 시장 가치는 9억 7400만 달러가 아닌 21억 2000만 달러가 되어야 합니다. 이것은 또한 CRV의 시장 가치를 FDV에 더 가깝게 만듭니다.

그러나 순환 시가 총액과 최대 시가 총액의 비교는 분석의 일부일 뿐이며 토큰 출시 일정도 이해해야 합니다.

토큰 출시 일정

우리의 분석은 항상 다음 네 가지 질문을 중심으로 이루어졌습니다.

1. 현재 가용성

2. 향후 가용성

3. 미래의 공급 상태는 언제 도달할 것인가

4. 미래 공급 상태에 도달하는 방법

순환 공급량과 최대 공급량은 1번과 2번, 토큰 출시 일정은 3번과 4번입니다.

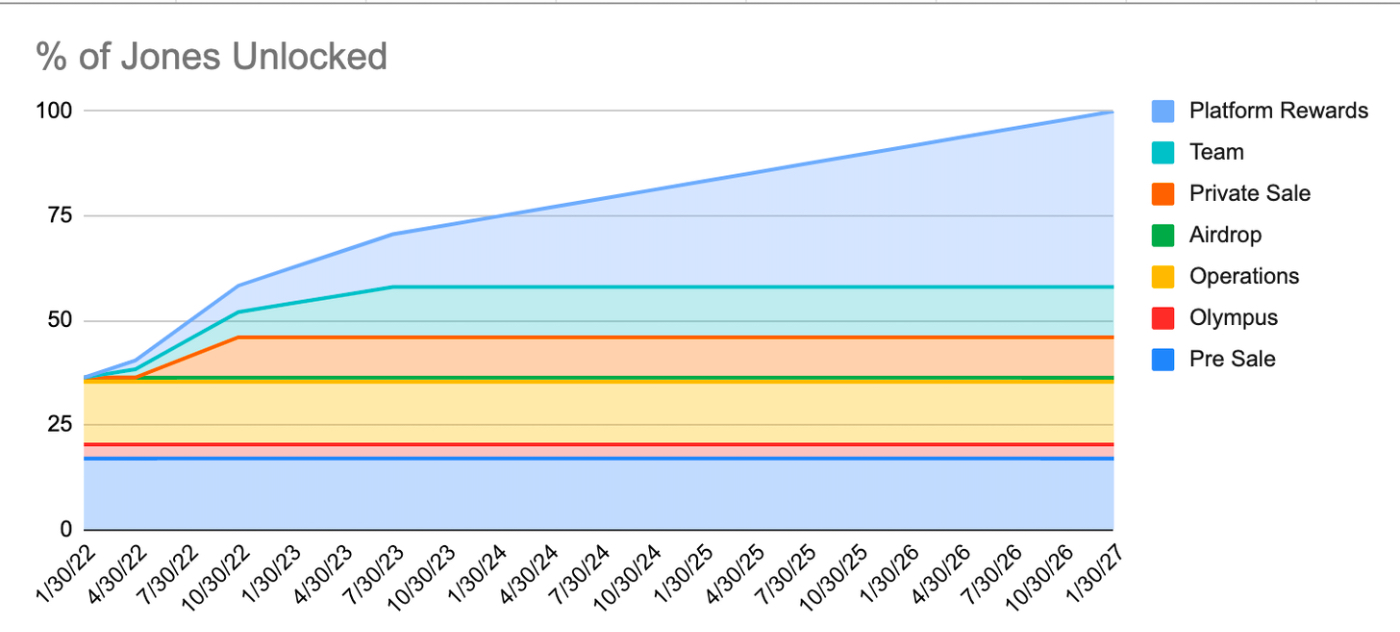

토큰 출시 일정을 확인하려면 일반적으로 프로젝트의 문서를 확인해야 합니다. 아래 그림은 작성자가 만든 JonesDAO 토큰 릴리스 차트입니다.

JonesDAO 토큰의 출시가 처음에는 비교적 온화했지만 2022년 4월 30일부터 10시 30분까지 출시가 가속화되었음을 그림에서 알 수 있습니다. 이 기간은 개인 투자자에 의해 토큰이 잠금 해제되는 시간으로 매달 약 3%의 토큰이 릴리스되며 4월 30일 이전에는 매달 1.36%의 토큰만 유통 시장에 진입합니다.

개인 투자자는 비용면에서 큰 이점이 있으며 토큰을 버릴 큰 인센티브가 있습니다. 이 투자자들이 악의적이거나 반드시 악의적이라는 말은 아닙니다. 그러나 토큰을 구매하기 전에 이러한 상황을 미리 고려해야 합니다.

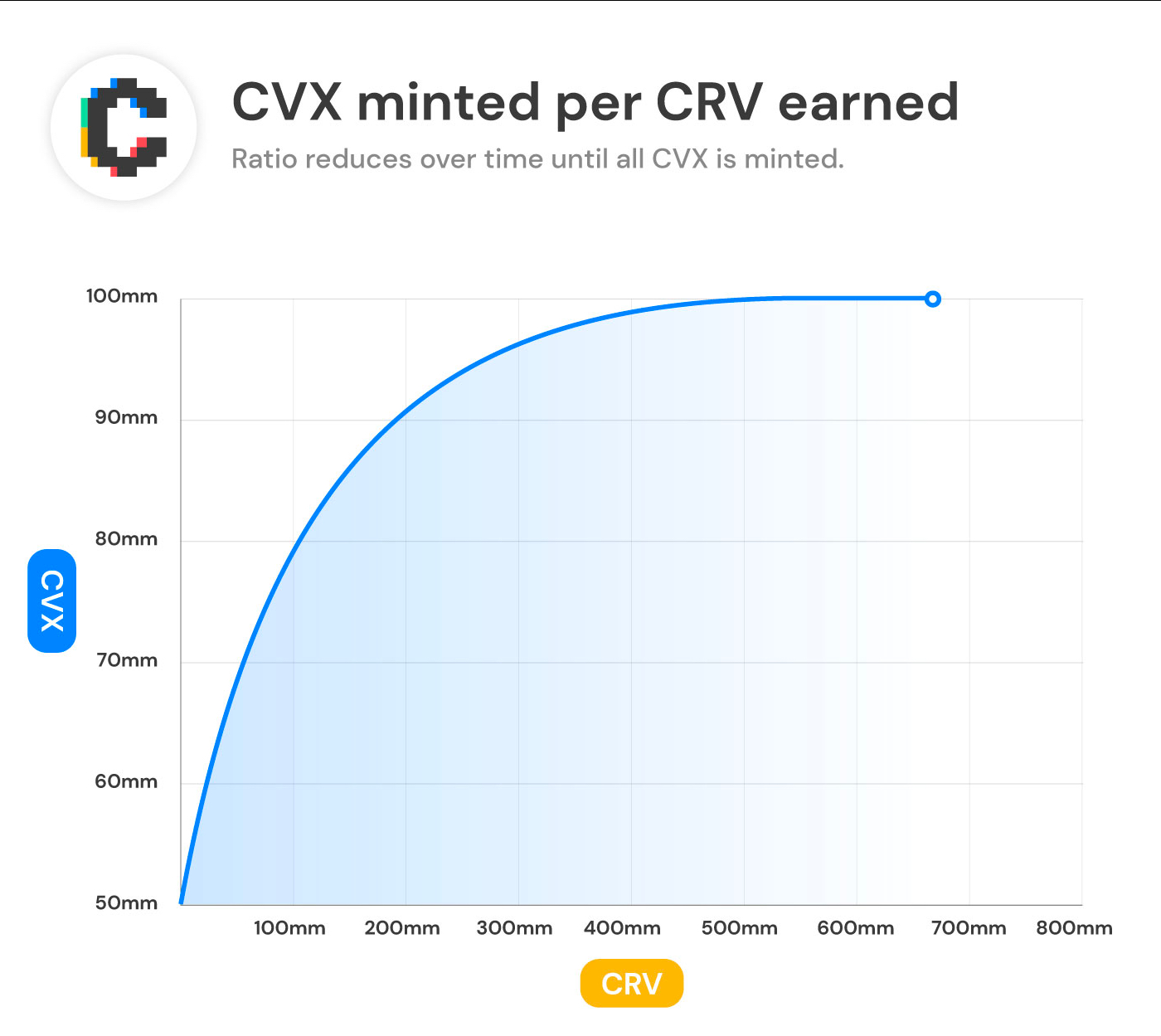

다른 하나는 플랫폼 성능에 기반한 릴리스입니다. Convex가 대표적이며 CVX 토큰의 출시는 토큰 풀이 획득한 CRV 토큰 수에 따라 결정됩니다.

CVX와 CRV의 발행 비율이 CVX의 유통량이 1억 개에 도달할 때까지 계속 감소하기 때문에 CVX의 인플레이션율은 감소하고 있습니다.

초기 유동성이 토큰 발행률에 미치는 영향

또한 토큰 분배의 각 부분의 비율 변화도 고려해야 합니다. 프로젝트의 출시 일정은 4년이지만 초기에 잠긴 토큰이 너무 적으면 초기 투자자에게 피해를 줄 수 있습니다.

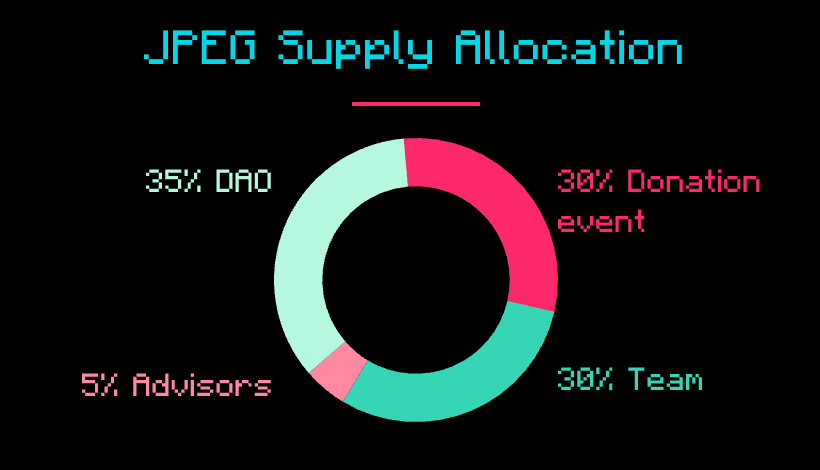

예를 들어 JPEG는 방금 토큰을 발행했습니다. 프로젝트 당사자는 공개 경매에서 토큰 공급량의 30%를 판매한 다음 모금된 자금 중 일부를 토큰 유동성 풀에 추가했습니다.

토큰의 35%는 팀과 컨설턴트에게 할당되며 2년 잠금 속성이 있으며 6개월 이내에 판매할 수 없습니다(판매는 소유권의 이 부분을 잃게 됩니다). 30%의 토큰이 처음부터 유통되고 있으며 35%의 토큰이 6개월부터 18개월 동안 릴리스됩니다. 이 기간 동안 월 인플레이션율은 약 2%였습니다.

2% 인플레이션율은 30% 순환에 비해 상대적으로 작습니다. 토큰의 공급은 15개월 만에 두 배가 되었지만 프로젝트 측에서도 토큰 가격을 유지하기 위해 프로젝트의 가치를 높일 수 있는 충분한 시간이 있습니다.

토큰의 초기 릴리스가 10%이면 5개월 이내에 토큰의 순환이 두 배가 되어 가격에 큰 영향을 미칩니다.

초기 토큰 배포 및 수확량 농업

대부분의 프로토콜은 LP 보상으로 많은 양의 토큰을 배포합니다.

표면적으로 이 방법은 매우 커뮤니티 기반입니다.누구나 토큰을 구매하고 유동성을 생성하며 스테이킹에 참여하여 더 많은 토큰을 얻을 수 있습니다.하지만 이 방법은 창립 팀이나 내부자가 토큰 점유율을 크게 높이는 데 도움이 될 수 있습니다.

대표적인 예가 LooksRare입니다. Cobie의 이전 기사에서도 프로젝트 채굴 보상의 절반이 초기 투자자의 주머니로 흘러들어갔다고 밝혔습니다.

또 다른 상황은 팀이나 투자자의 토큰이 잠금 해제되어 유동성 풀에 추가되는 것입니다. 우리가 보고 싶은 것은 팀과 투자 기관이 최소 3-6개월 동안 잠근 다음 선형적으로 해제하는 것입니다.

터놓다

토큰 잠금 해제도 매우 중요합니다. Convex와 같은 일부 프로토콜에는 사용자가 토큰에 대한 보상을 받으려면 고려해야 하는 특별한 잠금 해제 메커니즘이 있습니다.