グレースケール: 暗号通貨のファンダメンタルズは改善しますが、ビットコインは上昇し続けるでしょうか?

オリジナル編集: Felix、PANews

要点

ビットコイン価格は11月も上昇を続け、仮想通貨の回復はより幅広い市場セグメントに広がった。

中東の地政学的紛争や米国経済の「ハードランディング」のリスクなど、金融市場における特定のマクロリスクは低下した。

トークン供給の「逼迫」、マクロリスクの緩和、政府の過剰借入に焦点を当てた米国大統領選挙の組み合わせは、2024年のビットコインの評価にプラスとなる可能性がある。

ビットコインは2022年に「失速」した後、2023年には130%回復し、今年最もパフォーマンスの高い主流資産の1つになる軌道に乗っている。金融市場におけるさまざまなマクロリスクが低下したため、仮想通貨市場は11月も回復を続けた。これにより、デジタル資産市場では、市場のリーダーシップがビットコインから仮想通貨市場のますます広範なセグメントに移ることになりました。グレイスケールは、暗号通貨のファンダメンタルズは徐々に改善しており、主要コインの供給状況は(ビットコインの現在の所有構造などにより)比較的逼迫していると考えています。これは、特に連邦準備制度が金融引き締め政策を終了し、米国経済が「ハードランディング」(景気後退)を回避できる場合、来年の仮想通貨の評価額の上昇と一致する可能性がある。

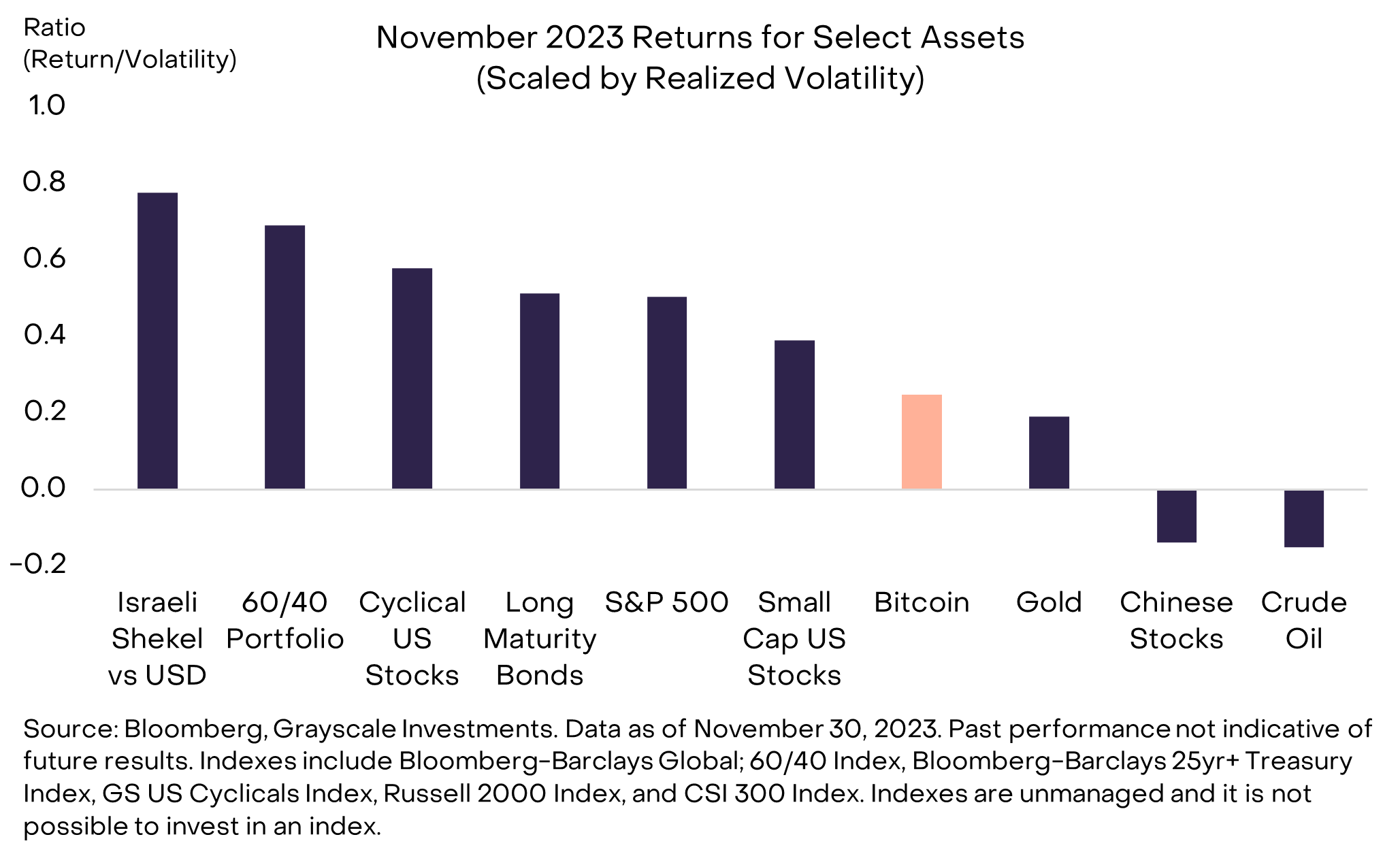

金融市場におけるさまざまなテールリスクは過去 1 か月間で低下したようで、これまでパフォーマンスが低かった資産の回復に貢献しています。例えば、中東紛争からの明るい兆しは、より広範な地域混乱に対する懸念を軽減するように見え、その結果、イスラエル経済に関連する資産は回復しました(図1)。同様に、財務省が借入需要の増加が予想よりも小幅だったと発表した後、長期国債価格は上昇(利回りは低下)した。消費者物価指数(CPI)も低下が続いており、市場では連邦準備理事会による利下げと米国経済の「軟着陸」の可能性への期待が高まっている。ボラティリティ調整後のベースでは、ビットコインは今月はアンダーパフォームしましたが(8月下旬からアウトパフォームした後)、それでも9%上昇しています(イーサリアムは11月に13%上昇しました)。

図表 1: テールリスクの減少が 11 月の資産市場の回復を促進

より広範な仮想通貨市場の回復

ビットコインは、金に代わるデジタル代替品としての需要と、ビットコインスポットETFの承認に対する楽観的な見方により、最近他の暗号資産をアウトパフォームしている。しかし、上昇がビットコインを超えて拡大するにつれて、暗号通貨市場のリーダーシップは11月に変化しました。

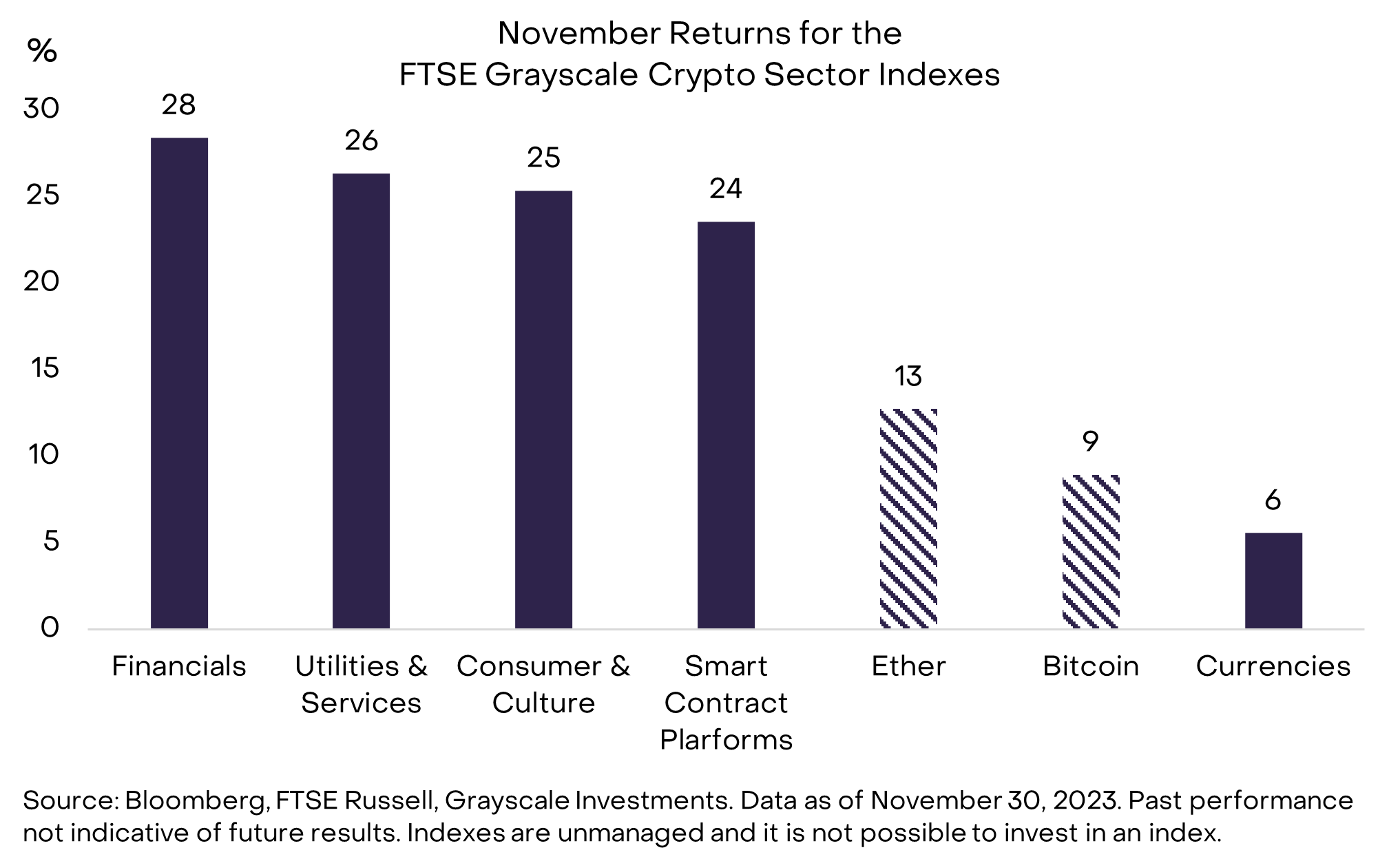

暗号資産クラス基準の新たな枠組みのもとで索引(注: グレースケールは、ロンドン証券取引所の子会社である FTSE Russell およびロンドン指数プロバイダーと協力して発売された暗号通貨指数製品です。この指数シリーズには、通貨、スマートコントラクトプラットフォーム、金融、消費、消費者および文化の 5 つの異なる暗号通貨業界指数があります。 、公共事業とサービス、150 以上のプロトコルをカバー)、先月最もパフォーマンスが良かったセグメントは、財務指標、公共事業とサービス、および消費者と文化でした(表 2)。金融セクターで傑出したパフォーマンスを見せたのは、Thorchain (RUNE) トークンの 131% の上昇でした。Thorchain は分散型取引所 ThorSwap を運営しており、最近取引活動が増加しています。消費者および文化分野で目立った業績は、ゲーム関連トークンの ImmutableX と Illuvium の成長でした。 11 月 28 日、Illuvium (119% 上昇) はその同名ゲームを Epic Games ストアに掲載し、一方イーサリアム上の暗号ゲーム アプリケーション用のレイヤー 2 ブロックチェーンである ImmutableX (87% 上昇) は Ubisoft との提携を発表しました。

図表 2: 金融、消費者、文化の暗号通貨セクターがアウトパフォーム

最新の価格動向に加え、OpenAI の経営陣の混乱を受けて、市場は再び仮想通貨と AI テクノロジーの融合に注目しています。 Grayscale の見解では、パブリック チェーンと AI テクノロジーの間には相乗効果がある可能性があります。具体的には、ブロックチェーンは、ディープフェイク、ボット、誤った情報の拡散など、AI によってもたらされる潜在的な社会的リスクと闘い、対処することができます。さらに、分散型コンピューティング プロトコルは、機密の個人情報を保持する AI モデルの集中管理に対抗することができます。 Grayscale が AI トピックに関連すると考える主要な暗号プロジェクトには、Akash と Render (GPU 共有)、Worldcoin (アイデンティティ)、および Bittensor (オープン アーキテクチャ AI 開発) が含まれます。

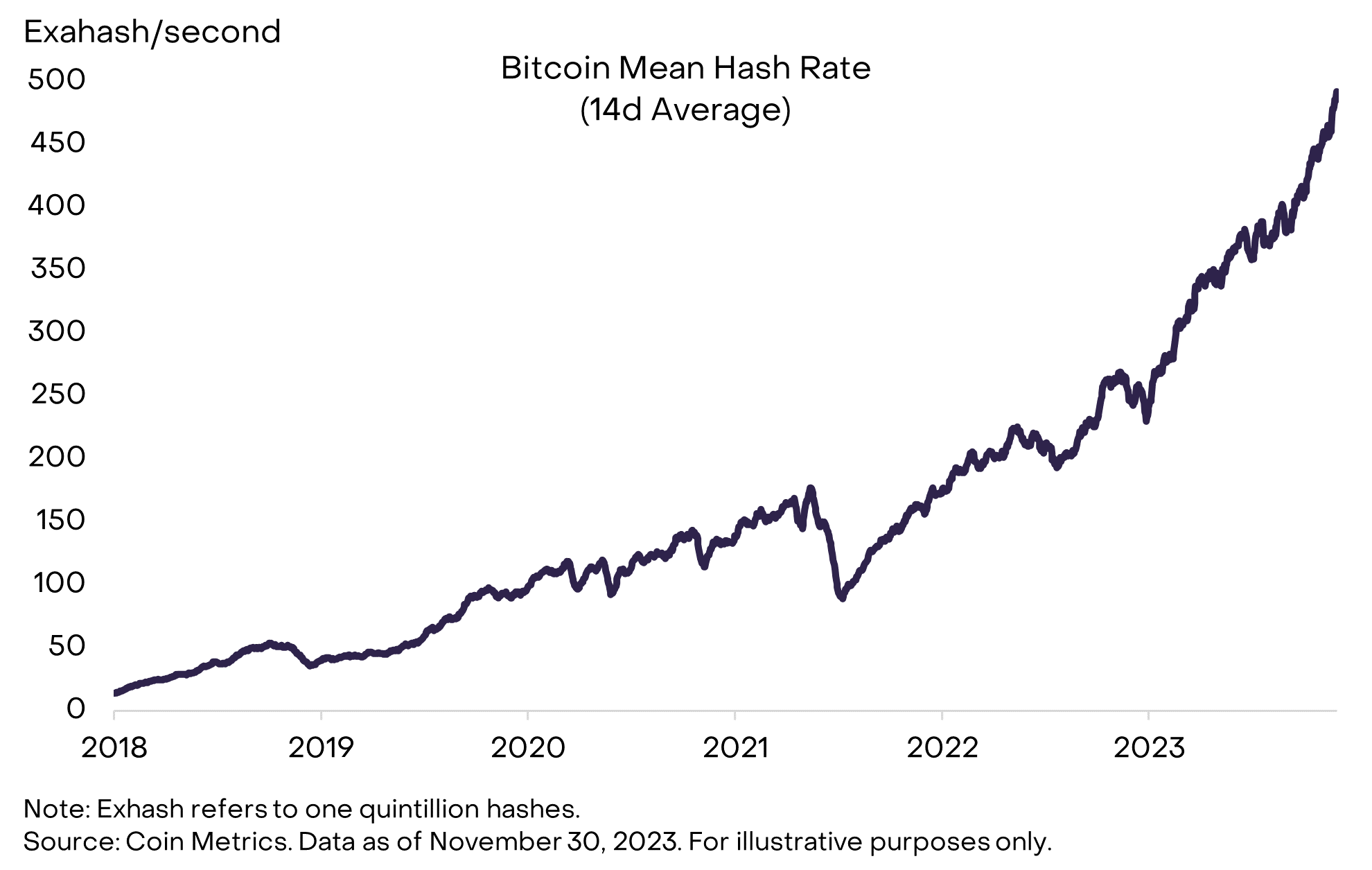

評価額が上昇するにつれて、暗号通貨業界のファンダメンタルズも向上します。たとえば、ネットワークを保護するために使用される計算能力の尺度であるビットコインのハッシュ レートは、11 月に史上最高値に達しました (表 3)。この傾向は、来年のビットコイン半減期に先立ったマイナーのアップグレード、トークン価格の上昇(古いマシンが収益性を高める)、およびマイニング機器メーカーが運用する比較的新しいマシンの供給過剰に起因すると考えられます。さらに、ステーブルコインの活動の増加も、暗号通貨のファンダメンタルズを改善する原因となります。過去 1 か月間で、ステーブルコインの時価総額は 40 億ドル増加し、ステーブルコイン取引で使用されるガスの量も増加しました。

チャート 3: ビットコインのハッシュレートが史上最高値に達する

ビットコイン価格を左右する基本的な要因

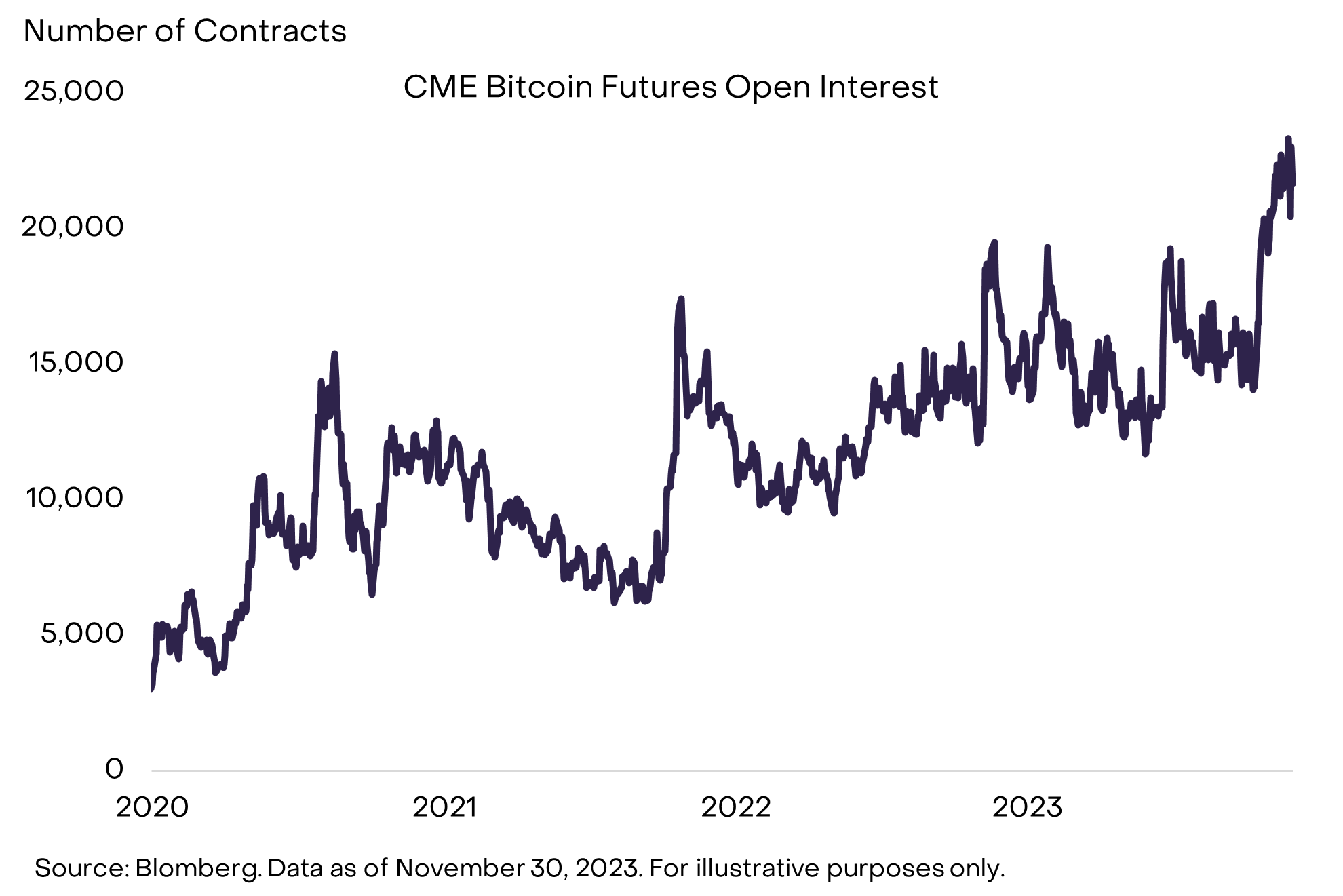

アクティブな仮想通貨トレーダーは、大幅な利益を上げた後、比較的「長い間」ポジションを維持しています。例えば、シカゴ・マーカンタイル取引所(CME)に上場されているビットコイン先物の建玉は11月に過去最高値を記録したが、これは市場における機関投資家の活動の増加を示している可能性がある(図4)。一方、米国の先物商品や海外のスポット商品を含む上場商品(ETP)は11月に純流入となった。グレイスケールは、11月の世界の仮想通貨ETP純流入額は合計13億ドルで、通年では22億ドルになると推定している。

チャート 4: CME ビットコイン先物建玉が過去最高値を記録

市場の短期的な見通しという点では、「ロング」トレーダーのポジショニングは、価格がさらに上昇するのは難しい可能性があることを意味します。主要な暗号トークンの価格は大幅な上昇を経験しており、そのメリットは事前に消費されています。さらに、今年の前向きな勢いを台無しにする可能性のある経済見通しに対するいくつかのリスクもあります。これらには、米国経済の「ハードランディング」(景気後退)、連邦準備制度による利上げの再開または予想を下回る利下げ、および/または規制当局によるビットコインスポットETFの承認の長期遅延が含まれます。米国市場。これらのリスクは、少なくとも短期的には仮想通貨の回復を妨げる可能性があります。

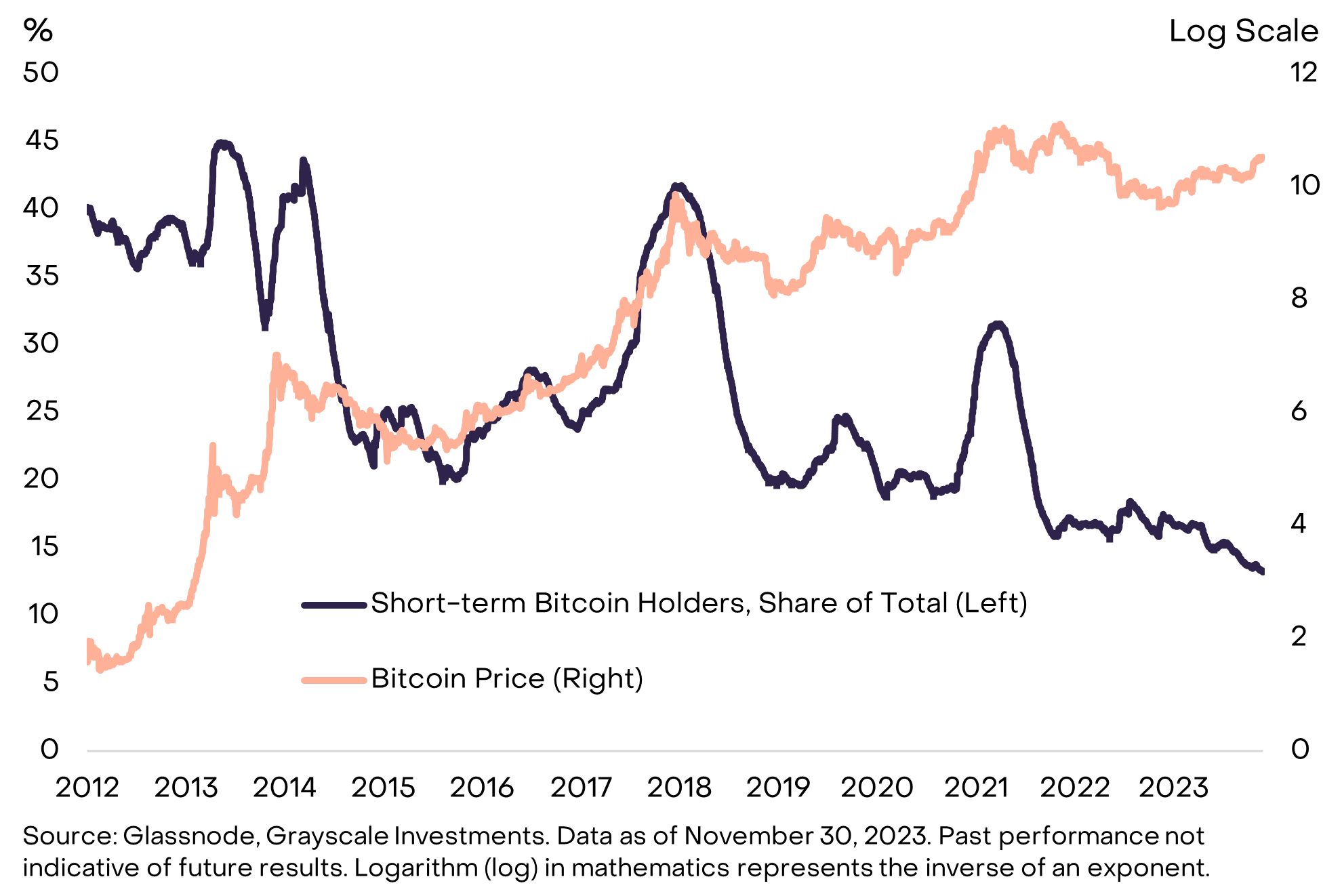

そうは言っても、グレイスケールの見解では、金融市場とマクロ経済状況はビットコインやその他の暗号資産にとって有利になる可能性があります。潜在的な投資家が米国のスポットETF商品に群がる前は、ビットコインの供給は比較的「逼迫」していた。例えば、Glassnodeのデータによると、短期投機家が保有するビットコインの供給シェアは過去最低に達した(表5)。同様に、Grayscale の分析は、ビットコインの大部分が長期保有者によって保有されていることも示しています (関連記事:グレースケールでビットコイン保有者のパターンが明らかに: 1 ビットコイン以上所有しているのは 2.3% のみ)。来年のビットコインの半減期も、新しいコインの供給量の増加を制限するだろう。グレイスケールの見解では、ビットコインの供給の弾力性と潜在的な新規投資家の流入の組み合わせが評価にプラスの影響を与えるはずだという。

図 5: 長期保有者がビットコイン供給量のより大きなシェアを保持している

しかし、技術的な背景よりも重要なのは、ビットコインの基本的な見通しです。ビットコインは、物理的な金のデジタル代替品として多くの人に見られているマクロ資産です。その結果、ビットコインの価格は、連邦準備制度の金融政策、米国経済の健全性、法定通貨システムの健全性など、デジタルゴールドの需要を促進する要因の影響を受ける可能性があります。ハビエル・ミレイ氏(ビットコイン支持者)がアルゼンチン大統領に選出されたことに対する市場の反応は、これらの要因が及ぼし得る影響を示す最新の例である(関連記事:アルゼンチン新大統領の過去の経験と主な見解をざっと振り返る:両親との関係を断ち切り、ビットコインを支援する)。マクロ見通しには不確実性があるものの、エコノミストらは一致して、連邦準備制度が来年利下げし、米国経済が景気後退を回避すると予想している。来年には米国大統領選挙も予定されており、過剰な政府借入や連邦準備制度の独立性、その他ドルの長期価値に影響を与える問題が焦点となることが予想されている。グレイスケールは、この組み合わせが物理的およびデジタルの金の需要にプラスの影響を与え、ビットコインの評価の上昇と一致する可能性があると予想しています。