ステーブルコインのニルヴァーナが攻撃され、トークンは90%急落した

北京時間の今日正午、Solana をベースとした分散型アルゴリズムベースのステーブルコインプロトコルである Nirvana が攻撃され、そのステーブルコイン NIRV の価格は一時 1 米ドルから 0.09 米ドルまで下落しましたが、現在は 0.11 米ドルまで反発し、最大下落幅は一時は8.9ドルが1.5ドルまで下落し、最大85%下落した。

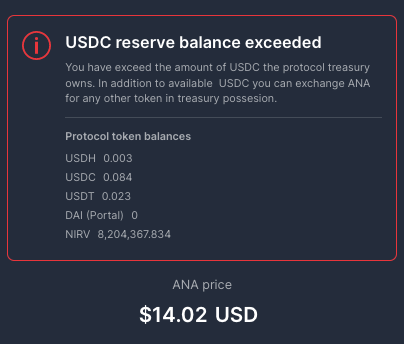

ユーザーが契約で ANA を売却する場合、流動性が不十分であることが示され、他の資産への変換がサポートされていないため、システム独自の安定通貨 NIRV にのみ変換できます。また、NIRVの価格も大幅に下落しており、ホームページ上のANAの価格も市場価格から大きく乖離している。

攻撃の具体的な原因についてはまだ公式発表がされておらず(海外では深夜です)、コミュニティメンバーの間ではフラッシュローン攻撃とプロトコル自体の抜け穴という2つの推測がなされています。

ツイッターユーザー@AndyBTC記事には、ハッカーがフラッシュローンを通じてニルヴァーナを攻撃し、プロトコルの資金プールが枯渇し、350万USDCが失われたと述べられていますが、現在、ハッカーはワームホールプロトコルを通じて資金をイーサリアムにクロスチェーンし、DAI(監視されていない)に変換しています。住所:0xB9AE2624Ab08661F010185d72Dd506E199E67C09。もちろん、コミュニティユーザーの中には、プロトコルに抜け穴がありハッカーに悪用される可能性があると指摘する人もおり、今後のコードレビューの強化に期待している。

「友達、信じてください。私にとってもストレスです。なぜなら、あなたたちがお金をつぎ込んでいるからです。私たち、チーム、MODは時間、労力、お金をつぎ込みました。これで終わりだとは思いません。 「しかし、チーム(次の行動を起こす)を待つ必要があります。」「ニルヴァーナ」コミュニティのDiscord管理者であるアシタはユーザーを慰めました。

「Nirvana」は、Solana ブロックチェーン ネットワークに基づいたアルゴリズムのステーブルコイン プロトコルで、ハイパーインフレを防ぐために設計されています。このプロジェクトでは、アルゴリズムの準安定トークンである ANA を富の貯蔵庫として使用し、ANA が担保として生成した分散型超安定通貨である NIRV トークンを価値の貯蔵庫として使用するというデュアル トークン システムを採用しています。特定の原則、推奨読書「清算リスクゼロのソラナアルゴリズムステーブルコイン「ニルヴァーナ」の解釈」

このプロジェクトの特徴は、ANAの準備価格回復を支援することです。具体的には、ANAの市場価格が回復価格を下回った場合、ユーザーはANAをリザーブ価格で契約に売却することができ、市場価格の上昇に応じてリザーブ価格は上昇し続けます。

襲撃前のANAの基本価格は6.92ドル、市場価格は8.9ドル、発行部数は220万部だった。これは、通常の償還を保証するには、財務省が 1,500 万 (220 万 * 6.92) を超える資産準備金を持っていなければならないことも意味します。

しかし現在、財務省の流動性は大幅に枯渇していることが、デイリー・クエリーの調査で判明した。財務省の住所 (クリックしてジャンプ)現在、14,000 USDC、680万 NIRV ステーブルコイン (634,000 米ドル相当)、および 224 万 ANA トークン (266 万米ドル相当) のみが存在し、残りのステーブル コイン USDT、DAI、USDH は、使い果たされ、国庫に残っている資産はわずか 330 万ドルです。

全体として、リザーブ価格の買い戻しをサポートするために、「ニルヴァーナ」には現在 1,200 万米ドルを超える資産ギャップがあります。このような莫大な財政的圧力は、初期のプロジェクトにとってはほとんど死刑宣告でした。 「ニルヴァーナ」が生き残りたいのであれば、クラウドファンディングで競合する豆の木農園の例に倣うかもしれない。

今年4月、分散型ステーブルコインプロトコルであるBeanstalk Farmsがフラッシュローン攻撃を受け、約7700万ドルを失った。 Beanstalk Farmsは今年6月に募金イベント「The Barn Raise」を立ち上げ、1,000ドル以上寄付したユーザーに合計1万枚のNFTを発行し、7月13日時点で総額1,100万ドルが集まっている。資金不足はまだ比較的大きいものの、現在の活動は継続しており、それが対外的な信頼にもつながっている。

オディアリーも引き続き「ニルヴァーナ」事件の最新動向に注目していきます。