การตีความของอัลกอริทึม Solana สกุลเงินที่มีเสถียรภาพ "Nirvana" โดยไม่มีความเสี่ยงในการชำระบัญช

ผู้แต่ง | ฉิน เสี่ยวเฟิง

บรรณาธิการ | ห่าวฟางโจว

ผลิต | Odaily

ผู้แต่ง | ฉิน เสี่ยวเฟิง

บรรณาธิการ | ห่าวฟางโจว

ผลิต | Odaily

ในช่วงไม่กี่วันที่ผ่านมา โครงการที่ชื่อว่า "Nirvana" ได้รับความสนใจอย่างมากและทำให้เกิดการถกเถียงกันอย่างกว้างขวางในชุมชนการเข้ารหัส

โครงการใช้ระบบโทเค็นคู่: ANA ซึ่งเป็นโทเค็น metastable แบบอัลกอริทึมที่ใช้เป็นคลังความมั่งคั่ง โทเค็น NIRV ที่สร้างโดย ANA เป็นหลักประกันซึ่งเป็นสกุลเงินที่กระจายอำนาจและมีเสถียรภาพสูงซึ่งใช้เป็นที่เก็บมูลค่า

ข้อมูลเว็บไซต์อย่างเป็นทางการแสดงให้เห็นว่าในสัปดาห์ที่ผ่านมา ราคาของ ANA พุ่งสูงขึ้นจาก 3.6 ดอลลาร์สหรัฐฯ เป็น 20 ดอลลาร์สหรัฐฯ โดยเพิ่มขึ้นสูงสุด 455% และราคาปัจจุบันยังคงอยู่ที่ 19.1 ดอลลาร์สหรัฐฯ ราคาพื้นฐานของการรีไซเคิล ANA ก็เพิ่มขึ้นจาก 1 ดอลลาร์สหรัฐฯ เป็น 4.65 ดอลลาร์สหรัฐฯ เพิ่มขึ้น 365% ปัจจุบัน ยอดขายของ ANA อยู่ที่ 1.966 ล้าน มูลค่าตลาดหมุนเวียนอยู่ที่ 37.55 ล้านดอลลาร์สหรัฐ และอัตราผลตอบแทนต่อปีของคำมั่นสัญญาของ ANA อยู่ที่เกือบ 300%

ในการอภิปรายอย่างเผ็ดร้อนเกี่ยวกับอัลกอริธึม Stablecoins เมื่อเร็ว ๆ นี้ "มีข้อบกพร่องในกลไกของ Nirvana หรือไม่" และ "Nirvana จะกลายเป็นผู้ทำลายเกมในแทร็กนี้หรือไม่" ปรากฏขึ้นบ่อยครั้ง ซึ่งจะเป็นประเด็นสำคัญของบทความนี้ด้วย

ชื่อเรื่องรองhttps://app.nirvana.finance/DeFi matryoshka, จำนำแบบวงกลม, เงินกู้

ด้านล่างนี้ เราใช้กรณีต่างๆ เพื่อช่วยให้คุณเข้าใจการออกแบบกฎและการเล่นเกมที่เกี่ยวข้องของโปรเจ็กต์ "Nirvana"

ก่อนอื่นให้ผู้ใช้ลงชื่อเข้าใช้เว็บไซต์อย่างเป็นทางการก่อน (

โทเค็น ANA เป็นเครื่องมือการลงทุนที่ออกแบบเป็นพิเศษโดยโปรโตคอลของ Nirvana เพื่อผลตอบแทนที่ยั่งยืนและ APY สูง มีความผันผวนสูง (ความเสี่ยง)——ราคาเริ่มต้นของ ANA อยู่ใกล้ $10 จากนั้นลดลงอย่างรวดเร็วเป็น $3.1 เมื่อเร็ว ๆ นี้ราคาเพิ่มขึ้นอย่างรวดเร็วเป็น ปัจจุบัน $19.1

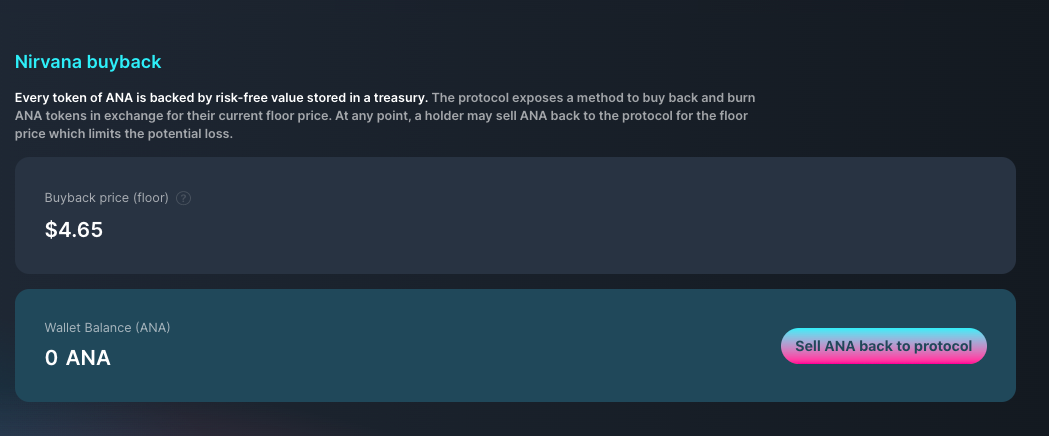

ดังที่ได้กล่าวไว้ก่อนหน้านี้ ANA มีราคาพื้นสำหรับการกู้คืน (ราคาพื้น) ซึ่งปัจจุบันอยู่ที่ 4.65 ดอลลาร์ หมายความว่าเมื่อราคาของ ANA ลดลงต่ำกว่า $4.65 ผู้ใช้สามารถขายโทเค็น ANA ของตนคืนตามข้อตกลงได้ในราคา $4.65 ซึ่งจะช่วยลดการขาดทุน (เทียบเท่ากับข้อตกลงที่กำหนดราคาตลาดต่ำสุดสำหรับ ANA) สิ่งที่สนับสนุนการฟื้นตัวของ ข้อตกลงดังกล่าวเป็นมูลค่าสำรองของข้อตกลง (Reserve Value) ซึ่งปัจจุบันอยู่ที่ 19.11 ล้านเหรียญสหรัฐ (ตามภาพด้านบน) ราคาพื้นและทุนสำรองจะนำเสนอในรายละเอียดต่อไป

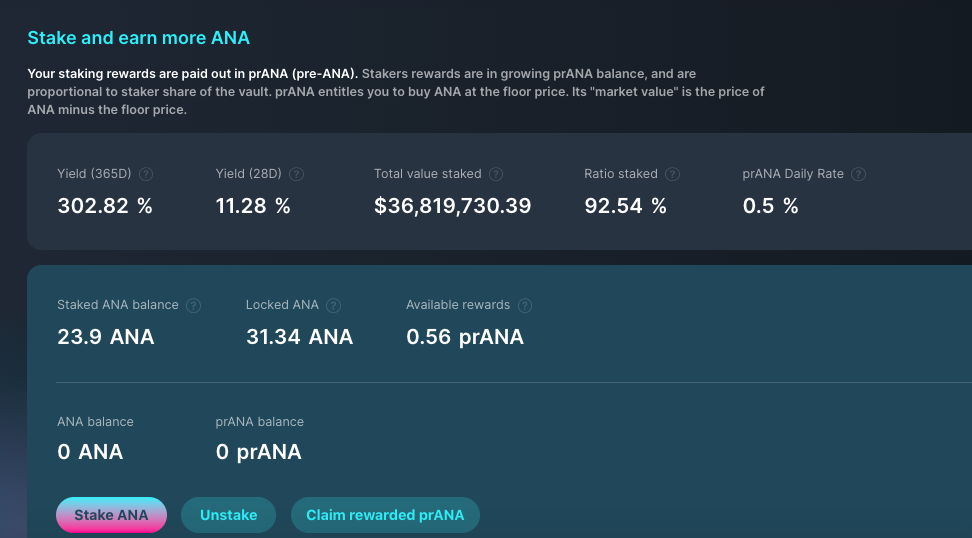

หลังจากได้รับโทเค็น ANA แล้ว ผู้ใช้สามารถคลิกฟังก์ชัน "เดิมพัน & รับ" เพื่อจำนำ ANA เพื่อรับรายได้ อัตราผลตอบแทนต่อปีปัจจุบันอยู่ที่เกือบ 300% รางวัลการจำนำปรากฏในรูปแบบของโทเค็นพิเศษ: pre-ANA หรือ PRANA (มาจากคำสันสกฤตว่า "ชีวิต")

คำอธิบายภาพ

(คำมั่นสัญญาของ ANA)Get/Repay NIRVPRANA เป็นเครื่องมือทางการเงินพิเศษ ซึ่งเป็นตัวเลือกที่มีราคาใช้สิทธิ์แบบไดนามิก เช่น โทเค็น PRANA ให้สิทธิ์แก่เจ้าของในการซื้อ ANA ในราคาจองปัจจุบัน พูดง่ายๆ ก็คือ ราคาตลาดปัจจุบันของ ANA คือ $19.1 และราคาพื้น (Floor Price) คือ $4.65 ผู้ที่ถือ PRANA สามารถจ่าย 1 PRANA บวก $4.65 เพื่อรับ 1 ANA (หมายเหตุ: ข้อตกลงจะทำลายโทเค็น PRANA ในภายหลัง) กำไรสุทธิ 19.1-4.65 = 14.45 เหรียญสหรัฐ ซึ่งเป็นที่มาของรายได้จากการขุด

รางวัล PRANA จะแจกจ่ายหนึ่งครั้งต่อยุค จำนวนรางวัล PRANA = ค่าสัมประสิทธิ์การให้รางวัลของ ANA * เมื่อการจัดหา ANA เพิ่มขึ้น รางวัลก็จะเพิ่มขึ้นด้วย จำนวนของ PRANA ที่บัญชีส่วนตัวได้รับขึ้นอยู่กับ ANA ที่จำนำไว้โดยบัญชีเป็นเปอร์เซ็นต์ ของการจำนำทั้งหมด

"การทำงาน. สมมติว่าผู้ใช้ให้คำมั่นสัญญากับ ANA 100 รายการ ราคาตลาดคือ $19.1 และราคาจองคือ $4.65 ในขณะนี้ จำนวนเงินทั้งหมดที่เขาสามารถยืมได้คือ: 100*4.65=$465 และระบบจะให้เงินสูงสุดแก่ผู้ใช้ 465 โทเค็น NIRV

โทเค็น NIRV เป็นสกุลเงินที่เสถียรของโปรโตคอล Nirvana หรือที่เรียกว่าสกุลเงินที่มีเสถียรภาพสูง มูลค่าที่อยู่เบื้องหลังนั้นรองรับโดยราคาด้านล่างของ ANA ตราบใดที่ข้อตกลงสามารถรับประกันได้ว่า ANA สามารถกู้คืนได้ในราคาต่ำสุด เงินกู้ NIRV จะไม่ทำให้เกิดการชำระบัญชี และราคา NIRV จะไม่มีการผันผวน ดังนั้นเจ้าหน้าที่จึงกล่าวว่าข้อตกลงเนอวานาเป็นการปล่อยสินเชื่อที่ไม่มีความเสี่ยงในการชำระบัญชี

สุดท้ายนี้ หลังจากที่ผู้ใช้ได้รับโทเค็น NIRV แล้ว เขาสามารถกลับไปที่ขั้นตอนแรกและใช้โทเค็น NIRV เพื่อซื้อโทเค็น ANA อีกครั้ง จำนำครั้งที่สอง เงินกู้ครั้งที่สอง...ตุ๊กตาไม่จำกัด ก่อตัวเป็นดอกเบี้ยทบต้น ตราบเท่าที่ยังมีข้อตกลงอยู่ ตุ๊กตาทำรังชนิดนี้โดยพื้นฐานแล้วไม่มีความเสี่ยง

ชื่อเรื่องรอง

จองรับประกันราคาจองซื้อคืน

ส่วนนี้จะแนะนำฟังก์ชันสุดท้ายในโปรโตคอลของ Nirvana นั่นคือ "Nirvana buyback" (การรีไซเคิล) เมื่อราคาของโทเค็น ANA ตกลงอย่างรวดเร็วและต่ำกว่าราคาจอง ผู้ใช้สามารถคลิกฟังก์ชันนี้เพื่อขาย ANA ทั้งหมดกลับไปที่ข้อตกลงในราคาจองปัจจุบันโดยไม่มีการคลาดเคลื่อนใดๆ

แน่นอนว่าโอกาสของเหตุการณ์นี้เกิดขึ้นได้น้อยมาก เนื่องจากโปรโตคอลของ Nirvana ได้คิดค้นกลไก AMM เสมือนที่เข้ารหัสราคาพื้นของ ANA ลงในฟังก์ชันการกำหนดราคา AMM รับประกันว่า ANA จะไม่ซื้อในราคาที่ต่ำกว่าราคาจอง และมีสภาพคล่องเพียงพอที่จะกู้คืน ANA ในราคาจอง

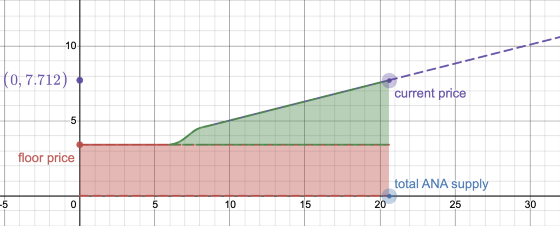

ตลาดของ Nirvana protocol-owned (POM) เชื่อมต่อกับโรงกษาปณ์กลางของ ANA แทนที่จะล็อคโทเค็น ANA ที่ไม่ได้ใช้ในพูล AMM แบบดั้งเดิม POM จะเก็บ ANA เสมือนไว้ เมื่อผู้ใช้ซื้อ ANA ใหม่ POM จะผลิตโทเค็น ANA ให้ทันเวลา เมื่อผู้ถือ ANA ขายคืนให้กับ POM ANA จะถูกเผาและนำออกจากแหล่งจ่าย นอกจากนี้ ไม่มีกลุ่ม ANA ที่รอการซื้อใน POM เนื่องจากกลุ่ม ANA ที่ไม่ได้ใช้ดังกล่าวจำเป็นต้องสงวนสภาพคล่องที่เกี่ยวข้องสำหรับแต่ละโทเค็นที่ไม่ได้ใช้ในราคาจองโมเดล POM นี้มีประสิทธิภาพด้านเงินทุนสูงสุด ซึ่งแตกต่างจาก AMM แบบดั้งเดิมตรงที่เงินทุนต้องถูกล็อคสำหรับโทเค็นทั้งสองในราคาที่เป็นไปได้ทั้งหมด POM ของ Nirvana ไม่ต้องการ ANA และไม่ต้องการสภาพคล่องที่สูงกว่าราคาตลาดปัจจุบันของ ANA POM จะรวมสภาพคล่องไว้ที่ราคาต่ำกว่าราคาสปอตปัจจุบันของ ANA ซึ่งเป็นทางออกสำหรับผู้ที่ขายคืน ANA กราฟการแสดงภาพสภาพคล่องของ POM มีดังนี้:พูดง่ายๆ เมื่อมีคนซื้อ ANA เงินสดที่พวกเขาจ่ายจะเข้าสู่ทุนสำรองและให้สภาพคล่องแก่ผู้ที่ขาย ANA ของพวกเขาคืน เมื่อมีคนขาย ANA ของพวกเขาให้กับ POM พวกเขาจะได้รับสภาพคล่องของตลาด Sex ANA ของพวกเขาจะถูกเผา

โปรดทราบว่าใช่

การมีอยู่ของทุนสำรองคือเพื่อให้แน่ใจว่า ANA สามารถกู้คืนได้ในราคาจองซึ่งเป็นความสามารถในการแข่งขันหลักที่ใหญ่ที่สุดของข้อตกลงเพื่อให้การรับประกันนี้ เงินสำรองต้องมีความเสี่ยงต่ำมาก ใกล้เคียงกับ "ความเสี่ยงเป็นศูนย์" มากที่สุดเท่าที่จะเป็นไปได้ในทางทฤษฎี ดังนั้น เมื่อมีการซื้อ ANA ในตอนแรก โปรโตคอลของ Nirvana รองรับการซื้อ Stablecoin เท่านั้น ซึ่งจะช่วยลดความเสี่ยงของระบบ และการรับตะกร้า Stablecoin หลายประเภท มูลค่าที่แท้จริงของ ANA ไม่ได้ขึ้นอยู่กับ Stablecoin เดียว

เกี่ยวกับราคาจอง ANA มีประเด็นหนึ่งที่ต้องเน้นย้ำ:ข้อตกลงระบุว่าราคาจองจะยังคงเพิ่มขึ้นเมื่อเวลาผ่านไปและจะไม่มีวันลดลง

การเพิ่มขึ้นของราคาจองต้องเป็นไปตามเงื่อนไขต่อไปนี้: ก่อนราคาจองจะขึ้นต้องรับประกันสภาพคล่องขั้นต่ำใกล้กับราคาตลาดปัจจุบัน - สภาพคล่องต้องสูงถึง 30% ของสินทรัพย์สำรองทั้งหมด เมื่อเกณฑ์สภาพคล่องรองรับ ถึงราคาที่จองแล้วบางส่วน จะมีการจัดสรรใหม่เพื่อเพิ่มราคาพื้นซึ่งจะช่วยลดสภาพคล่องที่สนับสนุนราคาเหลือ 25% ของมูลค่าสำรองทั้งหมด และเพิ่มราคาพื้นไปเรื่อยๆ