每周编辑精选 Weekly Editor's Picks(0127-0202)

Weekly Editors Picks is a functional column of Odaily. In addition to covering a large amount of real-time information every week, it also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news and pass you by.

Therefore, our editorial department will select some high-quality articles worth spending time to read and collect from the content published in the past 7 days every Saturday. From the perspectives of data analysis, industry judgment, opinion output, etc., we will provide those in the encryption world with You bring new inspiration.

Next, come and read with us:

Investment and Entrepreneurship

IOSG Ventures: How to price fair valuation (FDV) of projects in irrational markets?

It is critical to define the principles that guide market capitalization calculations. These principles should be consistent with the value that each token can generate. For example, tokens allocated for employees, VCs, and airdrops should be included in market cap calculations regardless of their locked status, as they have specific uses. Conversely, tokens reserved for future undefined use shall not be considered future supply until their intended use becomes apparent.

Applying these principles results in general rules for token classification. Tokens with a clear purpose and allocation, intended for VCs, the community, employees or developers, should be included in the market capitalization. But discounts can be applied to account for long-term release plans. Conversely, tokens lacking a specific allocation should be dismissed from consideration until their intended use becomes apparent. Ecosystem funds and reserves are examples of these.

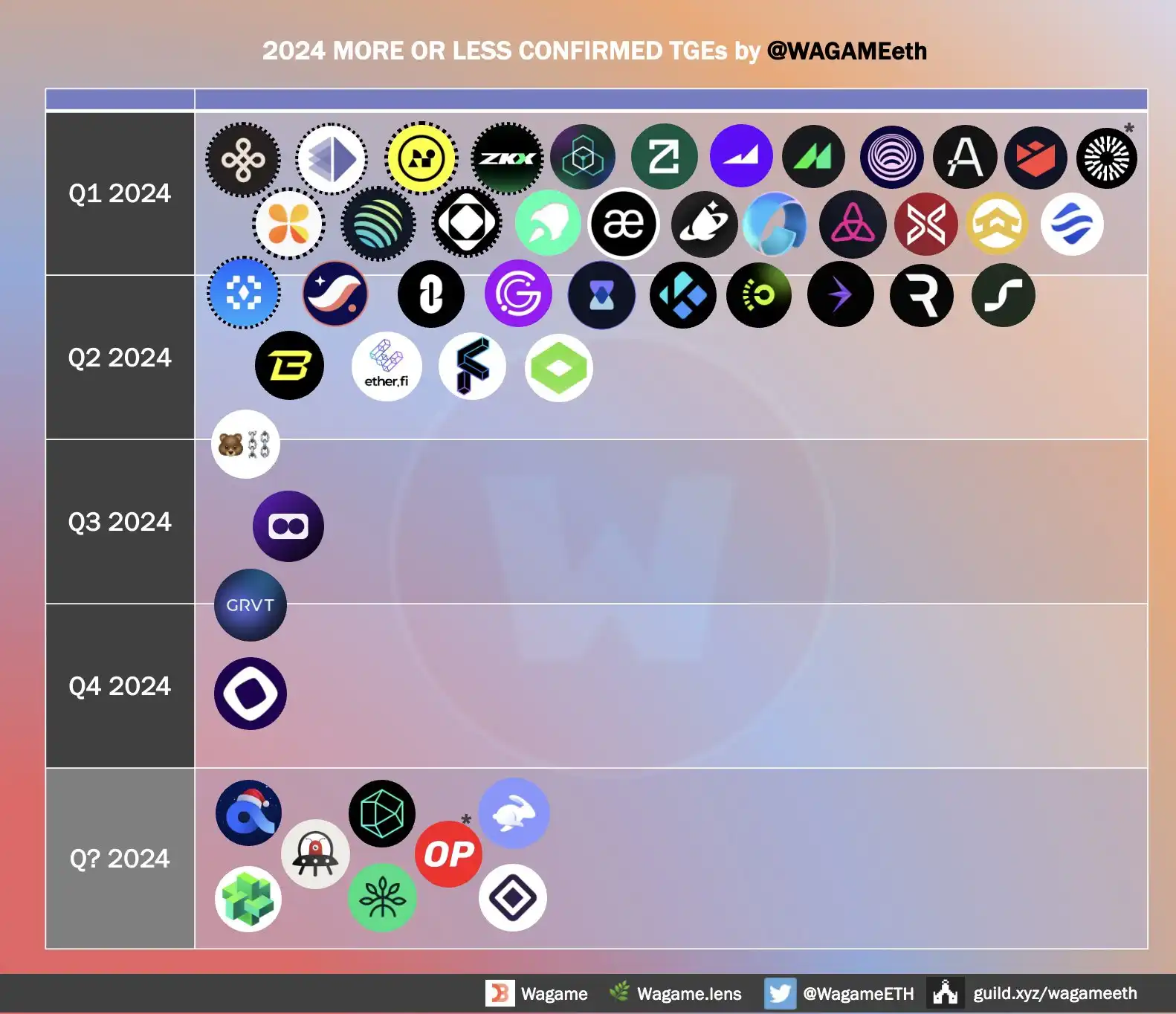

An article reviewing potential airdrops in 2024

Potential airdrop opportunities in the Cosmos ecosystem include public chain Polymer, public chain Berachain, cross-chain transaction and liquidity routing protocol SquidSquid, ecological application chain Noble Cosmos, public chain Initia, privacy public chain Fairblock, game public chain Tabi Chain, and modular settlement layer Eclipse, Ethereum re-pledge protocol EigenLayer, cross-chain bridge Wormhole.

The safest way is to stake as many tokens as possible and actively participate in voting.

CoinList Ups and Downs: How to regain past glory as the wealth effect fades?

CoinLists product business has now been organized into two major sections, namely the three major platforms for user-side transactions, OTC, and staking, as well as the developer-side functions such as launch, testnet, seed, and registration.

In fact, CoinList, which focuses on compliance, is quite strict on KYC. Users in many countries under jurisdiction are prohibited from participating in public offerings of new projects. For example, the common United States, China, etc. are often strictly prohibited from participating in any projects. Before each new project is put on public sale, users need to select the corresponding country and region and submit certification materials. If they do not meet the regulations, they will not be able to enter the public sale. This protects their own brand compliance to a certain extent, but it also makes many players lament that they have missed out on wealth.

Ethereum and Scaling

The Cancun upgrade is coming soon, and it is expected that this upgrade will be completed by the end of February at the earliest. The biggest purpose of this upgrade is to expand the capacity of the Ethereum main chain, enhance the scalability, security and availability of the Ethereum network, improve the TPS of the main chain and reduce gas fees.

The introduction of Blob has significantly reduced L2 transaction fees and improved throughput to a certain extent. At the same time, it also further promoted the development of the Restake track and DA track projects. Favorable projects include Arbitrum, Optimism, EthStorage, THORChain, Metis, EigenLayer, Kelp DAO, ether.fi, Celestia, etc.

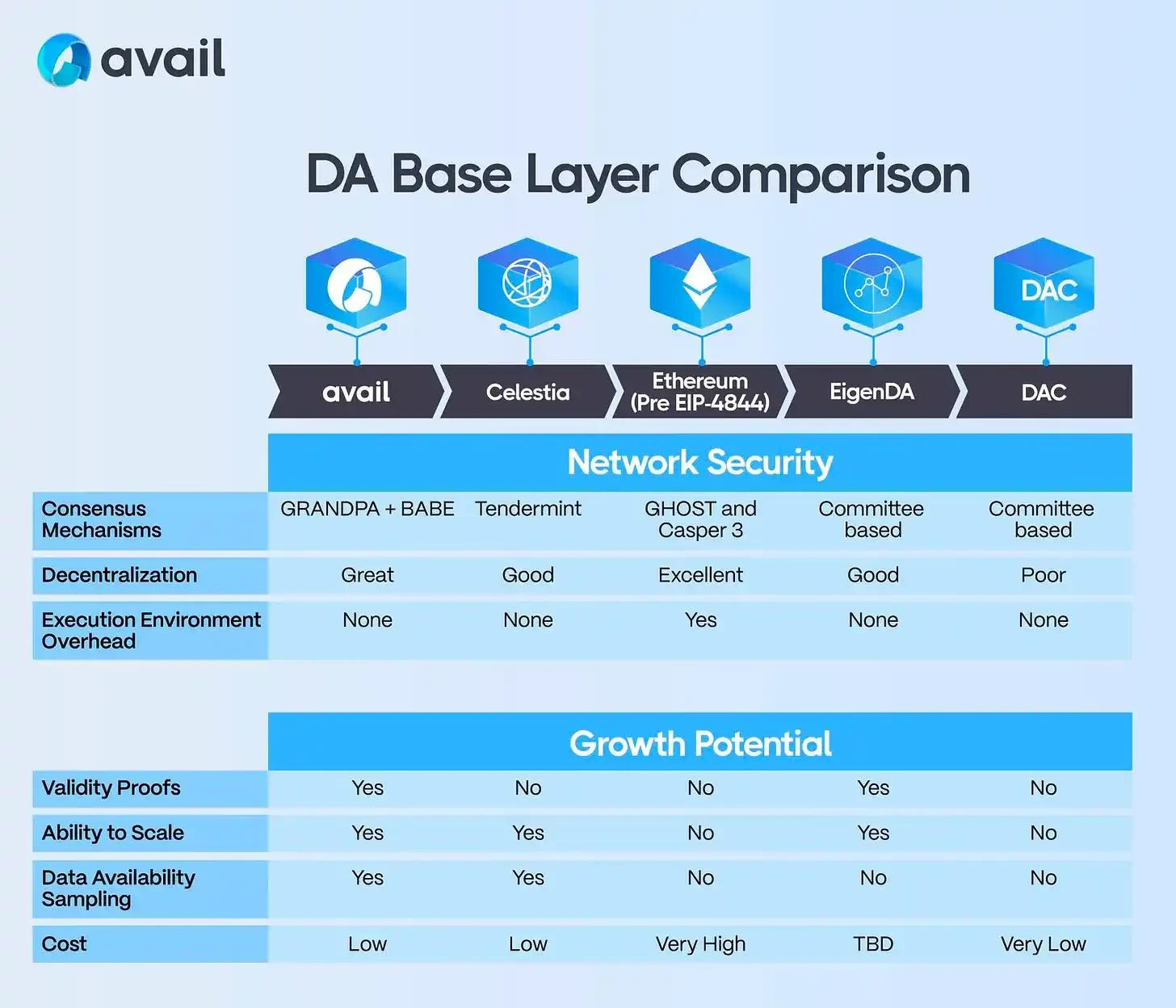

MT Capital research report: DA track dismantling, comparative study of Celestia and EigenDA

Celestia currently shows a solid staking trend, maintaining 100 active nodes, and no new tokens will be unlocked before November; user demand is expected to come from high-TPS applications and games, and there will be a large number of Celestia RaaS-based projects in the next few months. chains emerge.

EigenDA provides superior performance far beyond the Ethereum DA solution in terms of transaction throughput, node load and DA cost; it has the advantages of lower startup and staking costs, faster network communication, data submission speed and higher flexibility. .

Celestia’s competitive advantage lies in its extremely low data availability cost and higher data throughput. In the future, it will be able to enjoy the incremental market gains brought by the dual trend wave of modularization + application chain, while EigenDA will gain more attention to security. Ethereum is a stock market with higher requirements.

The NEAR protocol enhances scalability and decentralization through sharding technology and stateless verification, simplifying data management for L2 projects. Avail optimizes blockchain data processing and storage through a modular system, supports asynchronous interaction between application chains, improves network performance, and enables light clients to effectively verify data integrity.

Understand the DA Competition: Celestia, EigenDA and Avail, who will be the ultimate winner?

Avail, EigenDA and Celestia are the protagonists in the DA ecosystem - each serving the same space but taking slightly different approaches to infrastructure stack, execution and go-to-market.

The author believes that there may be an oligopoly-style market, and projects will choose the DA layer that best suits their needs.

In addition to AltLayer, what other projects are on the RAAS track?

Early projects on the RAAS (Rollups-as-a-Service) track, a service provider that helps project parties build the Rollup public chain, include: AltLayer, Gelato, Conduit, Caldera, Lumoz, and Cartidge Slot.

How to incubate or find products that can develop independent application chains and how to create sustainable income, including empowering token holders, is a high wall that these RAAS projects need to break through.

In the 24th year, stimulated by new primitives such as modularization and restaking, Rollup began to differentiate into four types: orthodox Rollup, sovereign Rollup, modular Rollup, and Restaking Rollup.

Legitimacy Rollup actively pursues being one of the outsourcers of the Ethereum execution layer, pursuing EVM equivalence or even Ethereum equivalence. Optimism, Linea, and Scroll fall into this category.

Sovereign Rollup is represented by Starknet jointly launched by Metis, Vitalik and Eli.

Modular rollups are currently divided into two sub-types: universal rollups such as Manta and Dapp rollups such as Aevo and Lyra. The current state of modular Rollup makes people feel that it is just changing the DA layer from Ethereum to modular blockchain DA such as Celesita and Avail. But such an idea ignores the deeper meaning of modular rollup, that is, modular rollup is an innovation and challenge to the current mainstream rollup hub-and-spoke structure. Restaking Rollup is a new primitive jointly launched by Raas service provider AltLayer and EigenLayer. Compared with Metis in sovereign Rollup, its verification network and consensus network are guided from the EigenLayer AVS node network, and its economic security comes from Restakings ETH and LST, and its security is higher than that guaranteed by L2 native protocol tokens.

Restaking Rollup inserts a relay layer named AltLayer Vital before the settlement layer, and inserts a relay layer named Altlayer Mach before the consensus layer and data availability layer, which carry the settlement layer, consensus layer and data respectively. Some features of the available layers. Such an architecture can improve Rollups security, final confirmation, and reduce data availability verification costs.

re-pledge

EigenLayer provides re-pledge services for Cosmos sub-chains, allowing Cosmos to obtain the security of Ethereum, and also opens up a new world of incremental returns for Ethereum stakers.

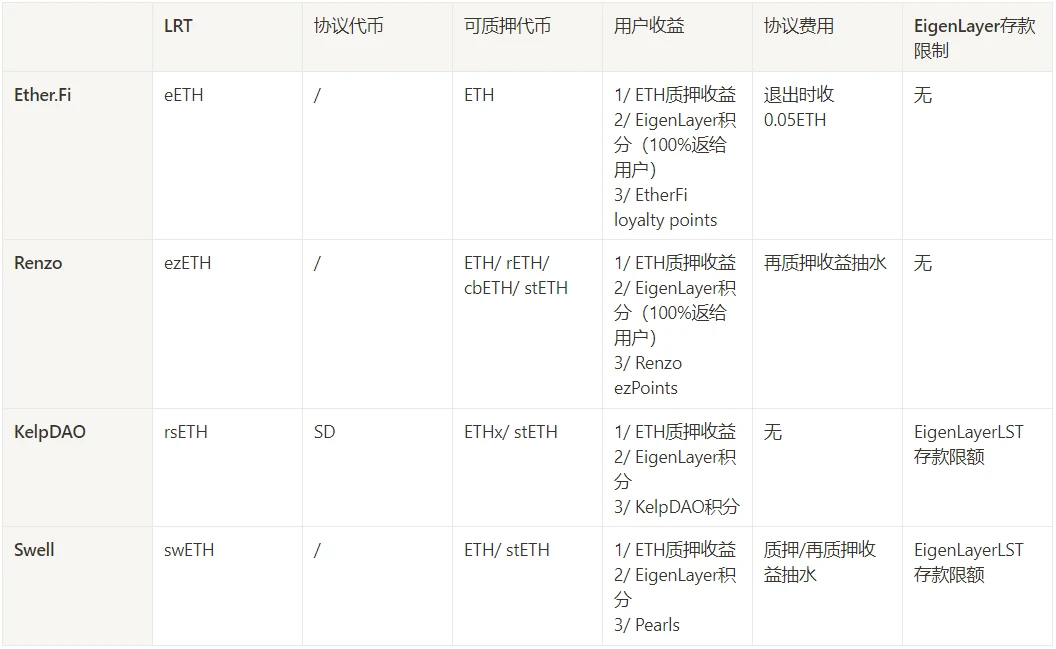

Five re-pledge projects with unissued coins can earn EigenLayer points while earning points for their respective projects: Kelp DAO, Swell, ether.fi, Renzo, and Puffer Finance.

You can also participate in re-pledge using the decentralized interest rate trading market Pendle.

Re-pledge increases penalty risk, centralization risk, contract risk, etc.

A quick overview of the principles, ecology and gameplay of LRTFi in one article

EigenLayer provides a pool security mechanism and a security market, that is, multiple projects can share the Ethereum security pool, and users need to weigh the benefits and risks provided by each project to choose to join or exit the re-investment system built on EigenLayer. Staking module.

Users pledge to EigenLayer and get a lot of profit, but they may not be able to pledge, locking liquidity, increasing risks and strategic complexity. The emergence of the LRTFi project mainly solves these problems and lowers the threshold for re-pledge. The income of LRT is built on LST, which will obviously have higher returns. At the same time, LRT projects will also carry higher risks.

Currently, LRT projects have been launched, including EtherFi, Renzo, Swell and KelpDAO, and nearly ten more are on the test network. There is not much difference in the gameplay of the projects. The main difference lies in the ability to mine EigenLayer points and exit liquidity.

The funds on the market are limited, so it is crucial to seize the opportunity and lead the market. However, LRT has its complexity, and how to manage risks is also a major competitiveness of LRT projects.

The LRT project, like the LST project, will seek cooperation with DVT technology projects, such as Obol and SSV, in order to ensure stable node operation; lending, dex, and derivatives based on LRT will gradually appear; in addition, it will provide services for multi-chain projects Support will also be one of the development directions of the LRT project.

The reason why network verification becomes a pain point under the POS mechanism is the background of re-staking.

The operation of the Eigenlayer protocol relies on secondary staking and the construction of a security sharing system (pooled security and free market). There are three roles: pledger, operator, and AVS service demander. The positive significance of Eigenlayers ecology outweighs the potential risks (logical problems of safe sharing and profitability problems), and potential projects deserve great attention.

Multiple ecology and cross-chain

Exploring the Blast Ecosystem: Which projects are worthy of attention and ambushes?

Which sectors Blast is officially optimistic about can be seen from the BIG BANG competition theme categories, namely, perpetual contract DEX, spot DEX, lending agreement, NFT / game, SocialFi, GambleFi, infrastructure. In addition, it also covers especially Projects that leverage Blasts native revenue or Gas revenue sharing in unique ways.

Specific projects include: DEX/liquidity (Thruster, ambient, MonoSwap, Ring Protocol, BLASTER), derivatives (SynFutures Protocol, Particle, Roguex, Easy X, Bloom, SphereX, Blast Futures, Cyber Finance), Launchpad (ZAP, BLASTOFF ,), SocialFi (EarlyFans, UpTo 3.xyz), Lending (Natrium, Blastway), NFT/Games (BAC Games, Blast Penguins, Blastopians), Infrastructure (Tornado Blast, Boom Bots, Pyth Network, RedStone Oracles, The Graph , QuickNode, Galxe), others (Blast Name Service, Zest, Layer Rating).

E 2 M Research: Osmosis Protocol Data Analysis

Osmosis has become the network center and liquidity center of the Cosmos ecosystem, which will form a very powerful network effect.

For example, in the upcoming dYdX Chain, if you want to cross-chain USDC from Ethereum or Arbitrum to dYdX Chain, the official plan needs to cross-chain to osmosis through Axelar, and then exchange it for the native Noble version of USDC to recharge to dYdX Chain. This will give Osmosis brings greater liquidity.

At the same time, the latest projects based on the Cosmos SDK will conduct airdrops for OSMO pledgers, such as the recent Celesita, which will further strengthen its monopoly position. As more projects are built using the Cosmos SDK in the future, the exchange of their native tokens will need to be carried out through other DEX protocols. Osmosis has the largest liquidity and strongest network connectivity, and will inevitably become the first choice of project parties.

But on the other hand, if the Cosmos ecosystem fails to develop well and instead fails in competition with Layer 2 or other public chains such as Solana, it will cause Osmosis to fall into crisis. Osmosis will also face competition from other competitors within the Cosmos ecosystem, such as Kujira, Crescent, and Astroport.

LayerZero announced the launch of V2. What are the highlights of the protocol design?

LayerZero V2 highlights include: universal messaging, modular security, permissionless execution, unified semantics, and V1 compatibility.

Coinbase: Detailed explanation of the current status and trends of cross-chain bridges

Bridges can be divided into 3 categories: native bridges, third-party bridges, and bridge aggregators. The main purpose of bridging is to provide incremental services between data and assets (the ledger/chain/location) and the expected execution destination of the data and assets. The main use case remains asset transfer (tokens on one chain to tokens on another chain) + exchange (tokens on chain A are exchanged for tokens on chain B). Its liquidity/usage is usually measured by on-chain AUC (or TVL).

Bridges are competing for differentiation, and there may be multiple winners depending on use case and distribution. CCTP (Circle’s multi-chain USDC standard) will become an important data point for the impact of the bridge. CCTP is Circles standard for helping USDC multi-chain issuance. The adoption of CCTP has had an impact on the bridges long-term defense capability. Bridges will continue to be used as long as the number of chains and the need for user experience abstractions increases. Bridges and oracles will eventually compete for data publishing rights.

Web3+

Frames can turn any content published by Farcaster into an interactive application. This brings more possibilities to the Farcaster ecosystem, including an airdrop checker built into the cast and one-click gas-free NFT minting. The arrival of Frames has sparked a surge in activity on Farcaster, with reactions (comments, likes and retweets) increasing by more than 100%, and registered users exceeding the 70,000 mark.

The article also introduces 10 early Frames applications that attracted market attention, and lists relevant resources and analysis articles.

Vitalik’s new work: Application prospects and challenges of Crypto+AI

The interaction between artificial intelligence and blockchain is divided into four categories:

AI as a participant in the game (highest feasibility): In the mechanism of AI participation, the ultimate source of incentives comes from the agreement of human input.

AI as a gaming interface (high potential, but risks): AI helps users understand the cryptographic world around them and ensure that their actions (such as signed messages and transactions) match their intentions to avoid being tricked or deceived.

AI as the rules of the game (requires great caution): Blockchain, DAO and similar mechanisms directly call AI. For example, AI Judge.

AI as a Game Goal (Long-Term and Interesting): The goal in designing blockchains, DAOs, and similar mechanisms is to build and maintain an AI that can be used for other purposes, and the part using cryptography is either to better incentivize training or To prevent AI from leaking private data or being abused.

Hot Topics of the Week

In the past week,FTX abandons restart, expects to pay cryptocurrency customers in full in bankruptcy liquidation,Analysis shows that FTX and Alameda still hold 76% of the total supply of FTT, which has not been sold in the past two months.,DOJ says missing $400 million from FTX was stolen in SIM swap attack,Celsius begins distributing over $3 billion in crypto and fiat to creditors,BlockFi:More than $500 million in cryptocurrency has been returned, and next round of fund returns will begin,Crypto derivatives exchange OPNX to shut down in February,Ripple was hacked and 213 million XRP was stolen, worth approximately $112.5 million;

In addition, in terms of policy and macro market,Google updates advertising rules to allow promotion of Bitcoin and crypto trust products,YieldMax files with SEC to launch Bitcoin options income strategy ETF,Harvest Fund submits application for the first Bitcoin ETF in Hong Kong, which will be launched as soon as after the Spring Festival,Hong Kong Enforces 50% Minimum Insurance Requirement for Compliant Crypto Exchanges,Hong Kong launches investigation into Worldcoin’s alleged illegal collection of customer iris data, interface news:China’s Anti-Money Laundering Law Receives Its First Major Revision, Covering Combating Virtual Asset Money Laundering Crimes;

In terms of opinions and voices, Needham:The two major factors that caused the recent Bitcoin sell-off, FTX and arbitrage funds have basically ended,Informed sources:Binance has begun allowing some large traders to store their assets with independent banks such as Sygnum Bank, BNB Chain released its 2024 outlook:The BNB beacon chain will be phased out and the “One BNB” interconnection paradigm will be built, Founder of Jupiter:No tokens will be sold after 7 days, all tokens in the Launchpool will go into the treasury or be used for LP;

In terms of institutions, large companies and leading projects,21 Shares Publish ARKB Bitcoin Position Dune Panel,Bitcoin staking chain BounceBit goes online,Jupiter launches its governance token JUP and opens airdrop applications,Altlayer opens the airdrop collection process for TIA pledgers,Dmail opens for first quarter airdrop application,Frame:Airdrop query reopened, mainnet launch time postponed;

In the field of NFT and GameFi, OpenSea CEO:Received interest in acquisitions and remains open to potential acquisitions,SkyArk Chronicles embroiled in fake financing controversy...Well, it’s been another week of ups and downs.

Attached is the Weekly Editors Picks seriesportal。

See you next time~