空投申领在即,如何对Jupiter(JUP)准确估值?

オリジナル - 毎日

著者 - あづま

北京時間の今夜23:00に、注目のSolanaエコロジカルトランザクション集約プロトコルであるJupiterがガバナンストークンJUPを正式に開始し、数百万のSolanaアドレスにエアドロップアプリケーションをオープンします。

Solana エコシステムのもう 1 つの人気プロジェクトとして、Jupiter のエアドロップは、昨年 11 月初旬の Breakpoint 期間以来温められてきましたが、現在では、以前の 2 つのテスト プロジェクト mockJUP と WEN と合わせて、Solana エコシステムで集団的な急増を経験しています。その優れたパフォーマンスにより、JUP のエアドロップに対するコミュニティ ユーザーの期待も高まっています。

現時点で、エアドロップを受け取る資格のあるユーザーにとって最も興味深い疑問は、JUP を正確に評価する方法と、手元にあるエアドロップ チップをどのくらいの価格で処分する必要があるかということです。次に、発売前の取引状況、発売プールの流動性分布、競合製品の比較という 3 つの側面から、上場後の JUP の潜在価格を探っていきます。

次元 1: リリース前のトランザクション ステータス

以前はデリバティブ取引プラットフォームのAevoがJUPの発売前契約取引を開始しており、TGE以前はJUPの主な価格発見場所でもあった。

Aevo のデータによると、JUP の発売前契約の現在の価格は一時的に 0.6455 米ドルとされていますが、先月の最高価格は 0.8464 米ドルに達し、最低価格は 0.2620 米ドルに下落しました。

しかし、Aevo は当面まだニッチなプラットフォームであり、発売前契約の変動が大きく、取引量が少ないことを考慮すると、プラットフォームの相場は一定の参考価値があるものの、JUP 後の実際の市場価格を完全に表すことはできません。 TGE。

次元 2: スタートアッププールの流動性分布

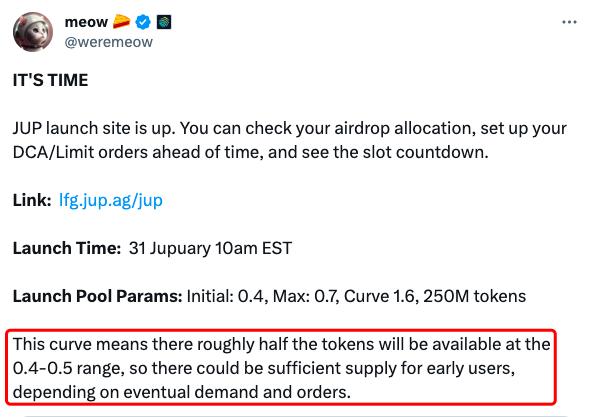

昨日の夕方、Jupiter の共同創設者 Meow が、ソーシャル プラットフォーム上の LFG Launchpad (https://lfg.jup.ag/jup) に JUP のローンチ ページを正式に公開しました。ユーザーはこのページでエアドロップの数量を確認し、カウントダウンを請求できるようになりました。事前に指値注文を購入または売却します。

LFG LaunchpadはJupiterが今月初めに立ち上げたトークン発行プラットフォームで、以前にミームトークンWENの発行をテストしており、JUPはこのプラットフォームを通じて発行される2番目のトークンとなる。 LFG Launchpad は Meteora の DLMM メカニズムを採用しています。これは、一方的な流動性を提供することで初期流動性を構築し、コミュニティが「オーガニック」流動性への投資を継続できるように導くことを目的としています。

LFG Launchpad データ表示、初期流動性を構築するために、合計 2 億 5,000 万トークンが JUP のスタートアップ プールに投資されており、JUP の価格帯は 0.4032 USDC ~ 0.6987 USDC に設定されており、スロープ カーブは 1.6 です。

ニャーはこの傾きの間隔を説明します。1.6 の傾きは、打ち上げプール内の JUP の約半分が 0.4 USDC ~ 0.5 USDC の価格範囲で配布されることを意味します。

次元 3: 競合製品の比較

Meow はまた、昨日の夕方、JUP トークン経済学に関する重要な情報を更新しました。JUPの総供給量は100億個、初回発行部数は13億5000万個となる。、そのうち 10 億はエアドロップに使用され、2 億 5,000 万は Launchpool に使用され、5,000 万は CEX マーケットメイキングに使用され、5,000 万はオンチェーン LP 需要に使用されます。

次に、上記のデータに基づいて、Jupiter をいくつかの同様のプロジェクトと比較できます。なお、ジュピターの既存事業風景(アグリゲーション+コントラクト+DCA等)と組み合わせると、その業態と完全に一致するプロジェクトを見つけることが困難であるため、主力事業をベースとすることにしました(トランザクションアグリゲーション)およびトラックポジショニング(DeFiサービス)は、イーサリアムエコシステムのUniswap(UNI)および1インチ(1INCH)、およびSolanaエコシステムのRaydium(RAY)およびOrca(ORCA)と比較されます。

流通時価総額(MC)と完全ロック解除評価額(FDV)に基づいて取得した比較データは次のとおりです。

プロジェクトごとに流通状況が異なるため、上記のフレームワークに従って取得されたデータにも大きな差があり、さらに極端な値も存在する可能性がありますが、総合的に判断すると、JUP の価格予測はほとんどの場合 (0.209 ~ 0.627) になります。は依然としてスタートアッププールによって与えられた価格帯(0.4032~0.6987、その半分は0.4~0.5に集中している)と大きく重なっています。

上記の計算は、同様のポジショニング プロジェクトに基づいて Odaily によって作成された JUP 価格の概算にすぎず、取引に関するアドバイスは含まれていないことを強調しておく必要があります。

まとめ

上記は、OdailyがJUPの上場後の始値パフォーマンスを、発売前の取引状況、発売プールの流動性分布、競合商品の比較という3つの側面から暫定的に分析したものですが、具体的な価格の見積りとなると、それぞれの側面は具体的に何を意味するのでしょうか?それがどのくらいの重量を表すかは意見の問題です。

JUPが近づくにつれ、OKXやBitgetを含む多くのCEXが可及的速やかに取引サポートを提供すると相次いで発表しており、市場でのJUPの人気はさらに高まる可能性がある。

最終的に脚本がどのように解釈されるかは今夜明らかになります。