E2M Research:Osmosis协议数据分析

E2M Research:Shawn ( 2023 年 10 月)

Osmosis 是一条基于 Cosmos SDK 搭建的跨链 DEX 应用链,目前已成为 Cosmos 生态中,连接最广泛,流动性最强的一条链。

1. 流动性数据

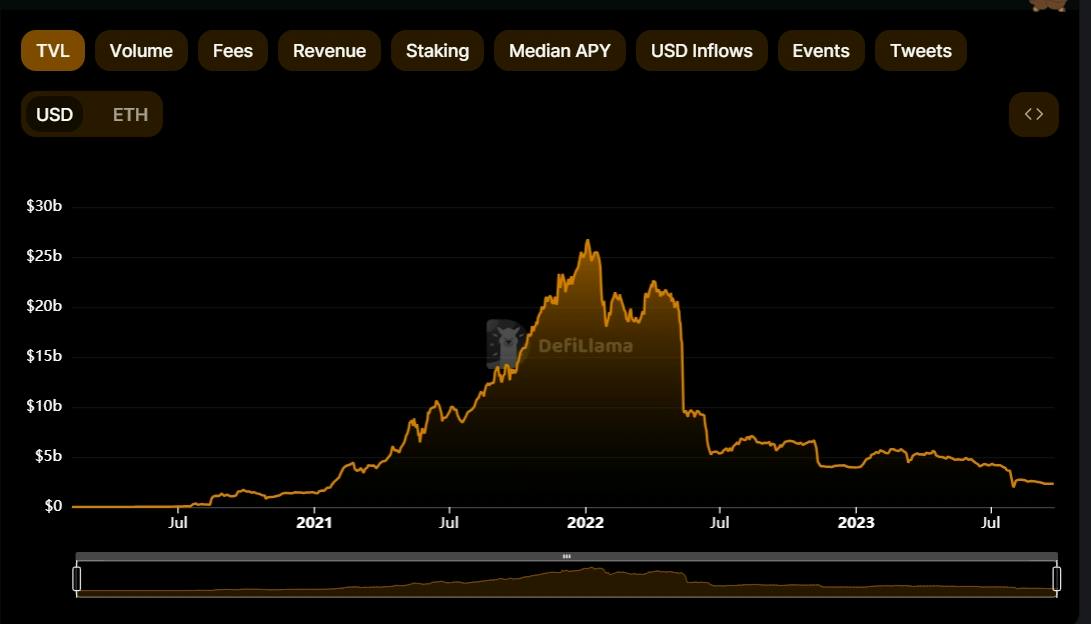

项目于 2021 年 6 月上线,此后 TVL 一直处于上升状态,于 2022 年 3 月份达到最高值,约 18 亿美元。自 2022 年中开始,TVL 也急剧下滑,至今已经降至 8000 万美元左右。

数据来源:https://defillama.com/protocol/osmosis-dex

其中 UST 最高时约 2 亿多美元:

数据来源:https://info.osmosis.zone/token/USTC

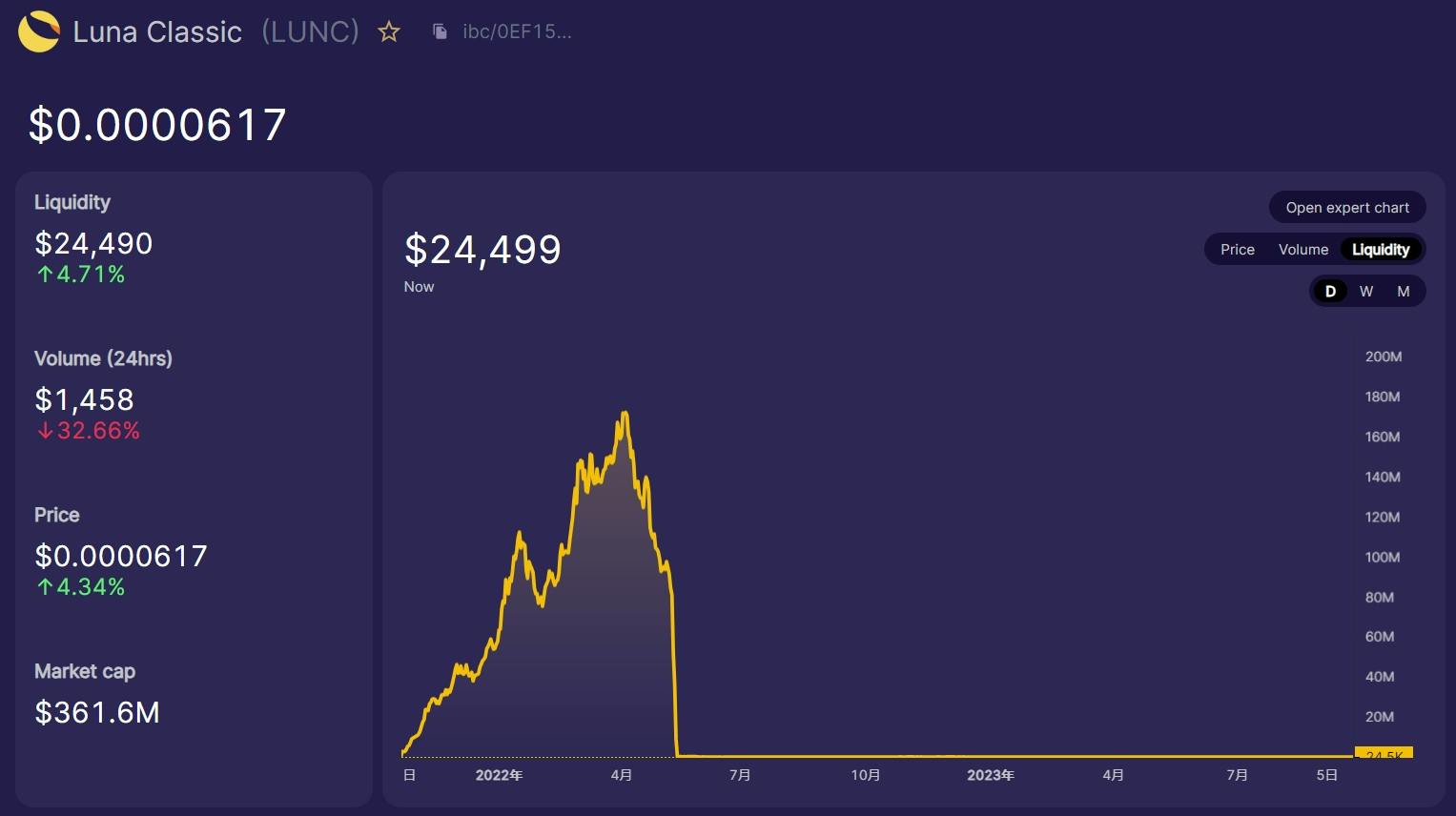

而 LUNA 最高时约 1.7 亿美元:

数据来源:https://info.osmosis.zone/token/LUNC

OSMO最高时约 7 亿美元:

数据来源:https://info.osmosis.zone/token/OSMO

ATOM最高 TVL 约 4 亿美元:

数据来源:https://info.osmosis.zone/token/ATOM

其他主要资产大致统计如下:

JUNO: 8000 万美元

STARS: 5000 万美元

AKT: 5000 万美元

SCRT: 2000 万美元

加上其他资产,其总 TVL 与 Defillama 提供的数据基本一致。

其中 LUNA+UST 总 TVL 约 3.7 亿美元,占比约 20% 。因此可以看到,虽然由于 LUNA 爆雷事件,导致 Osmosis 的 TVL 剧烈下降,但其占比并不是非常高。主要下降的原因还是由于 Cosmos 系的代币价格下跌导致的(但也存在由于 LUNA 爆雷导致大众对 Cosmos 生态的不看好原因)。

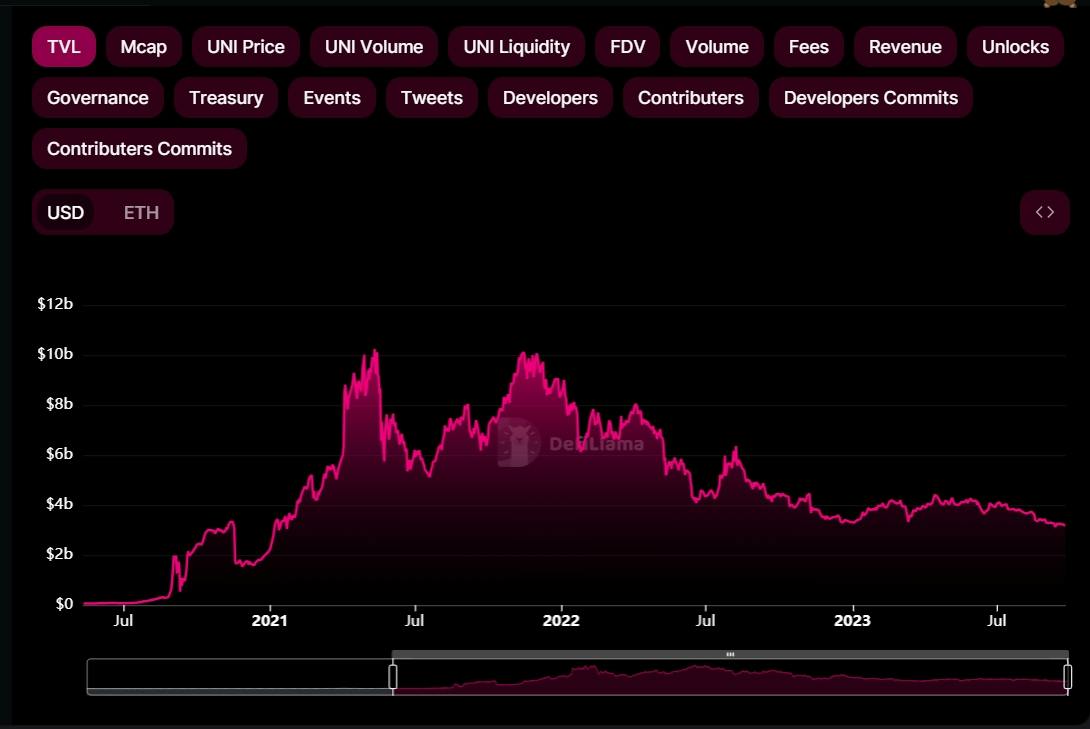

从 18 亿下降至 8000 万美元,跌幅达到了 95.6% 。对于其他主流 DEX 数据来看,

Uniswap 从 100 亿美元下降至 32 亿美元,跌幅约 68% :

数据来源:https://defillama.com/protocol/uniswap

Curve从 250 亿美元跌至 23 亿美元,跌幅达 90.8% :

数据来源:https://defillama.com/protocol/curve-dex

还有一个原因是 Cosmos 生态没有原生的 USDT 和 USDC 稳定币,导致其 TVL 受到币价波动影响更大。

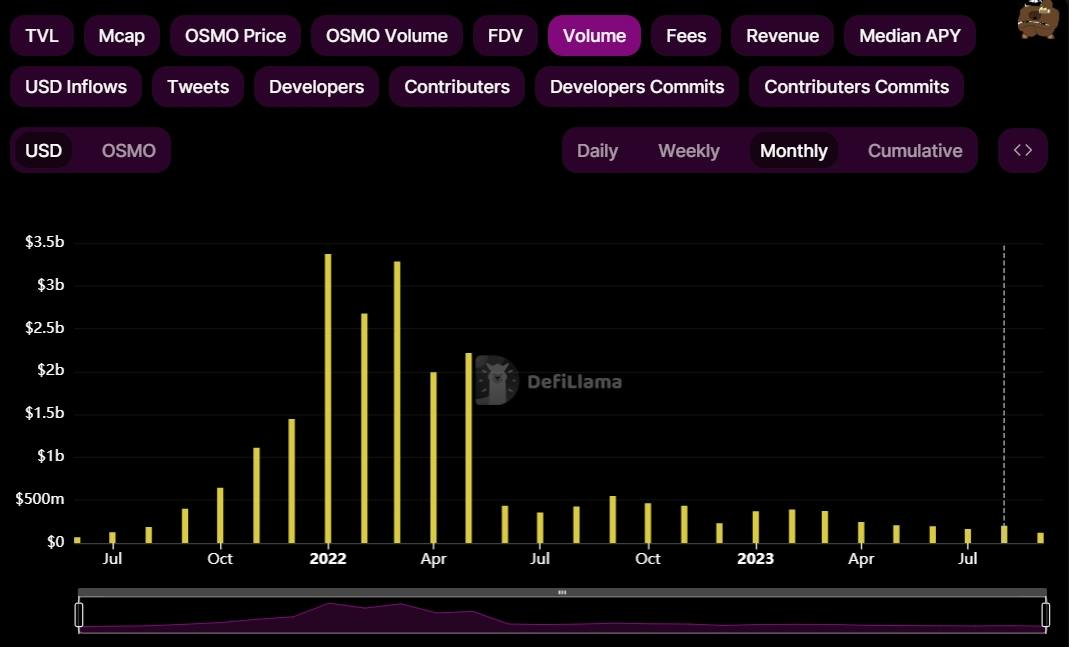

2. 交易数据

Osmosis 的交易量在 2022 年初达到最高峰,月交易量大约 30 亿美元。随后逐渐下降, 2023 年来月交易量约为 2 亿美元左右:

数据来源:https://defillama.com/protocol/osmosis-dex

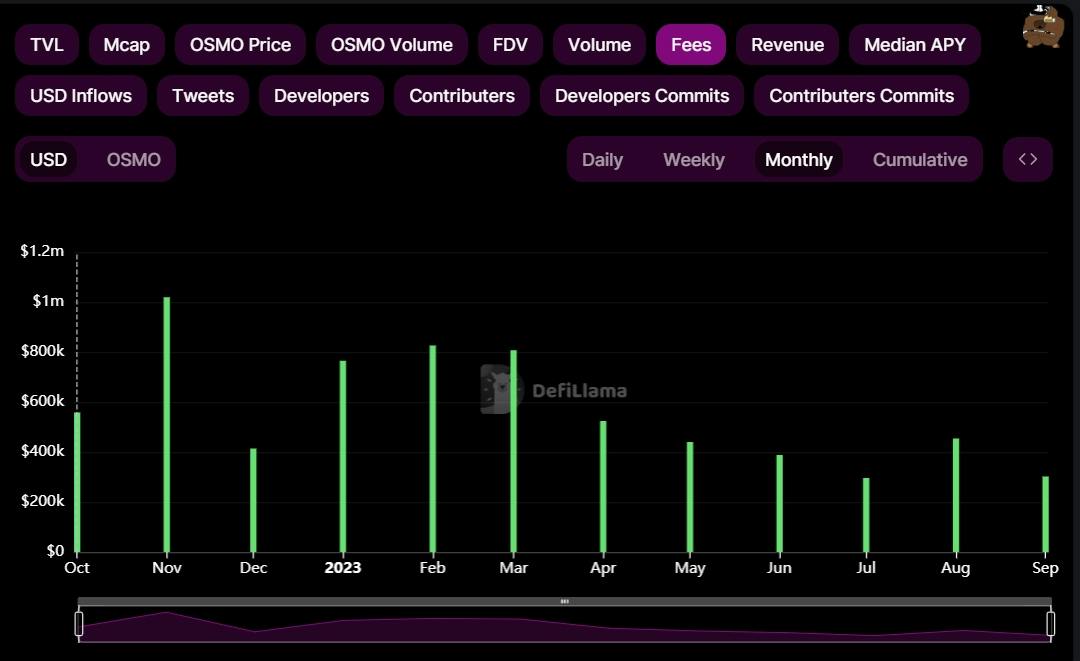

在 Osmosis 上交易将收取一定的手续费,大部分 Pool 收取费用为 0.2% 或者 0.3% ,费用目前会全部分配给流动性提供者。自 2023 年 1 月以来,月均手续费收入约为 50 万美元。

数据来源:https://defillama.com/protocol/osmosis-dex

3. 网络数据

Osmosis 是基于 Cosmos SDK 搭建的 DEX 应用链,因此我们需要分析其网络数据。

根据 MapOfZones 数据,当前通过 IBC 连接至 Cosmos 生态的链一共 62 条,其中与 Osmosis 相连的链数量最多,达到了 59 条:

数据来源:https://mapofzones.com/home

高于 Cosmos Hub 的 54 条以及 Axelar 的 46 条。其中 Cosmos Hub 是 Cosmos 生态的第一条链,而 Axelar 则是 Cosmos 生态最大的跨链桥,大量的以太坊资产通过该桥跨至 Cosmos 生态。

在连接性上是 Osmosis 与基于合约的 DEX 项目不同的一点。只有通过 IBC 连接至 Osmosis 的资产才能在上面交易,这一点上,Cosmos 生态其他的 DEX 都难以与 Osmosis 竞争,这是它的一个较大的优势。

其日活用户目前为 1-2 万之间:

数据来源:https://tokenterminal.com/terminal/projects/osmosis

在主流 DEX 项目中排名第 5 。其中 PancakeSwap 为 6.9 万,Uniswap 为 5 万:

数据来源:https://tokenterminal.com/terminal?panel=user_dau

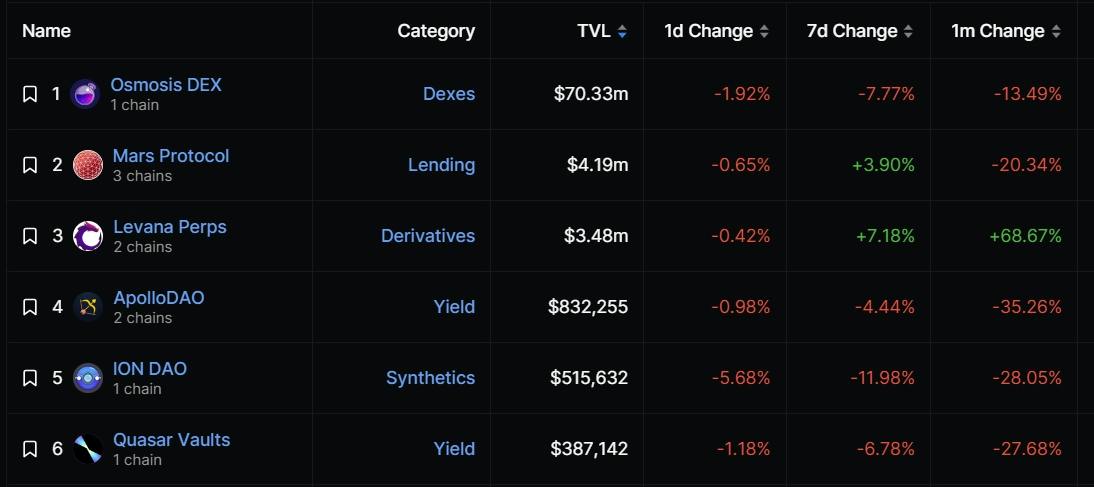

4. 生态数据

Osmosis 链上主要以 Osmosis DEX 为主,同时也有一些项目方在链上搭建其他类型的 DeFi 项目。

例如 Mars Protocol 为主要的借贷协议、Levana Perps 永续合约平台,以及 Quasar 是围绕 DEX 的收益协议等。

数据来源:https://defillama.com/chain/Osmosis

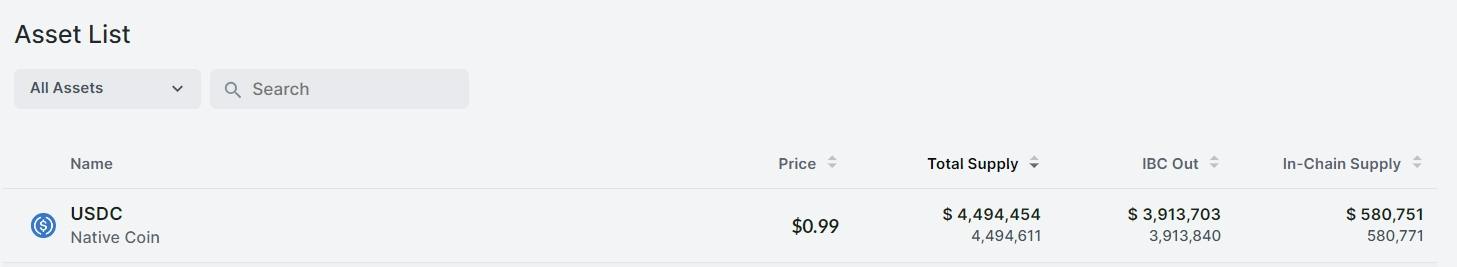

稳定币方面,由于 Circle 在 Noble 链上发行了原生的 USDC 资产,使得 Osmosis 有了原生稳定币支持,但目前的采用率仍然较低。

Noble 链上目前发行的 USDC 总量为 450 万美元左右:

数据来源:https://www.mintscan.io/noble/assets

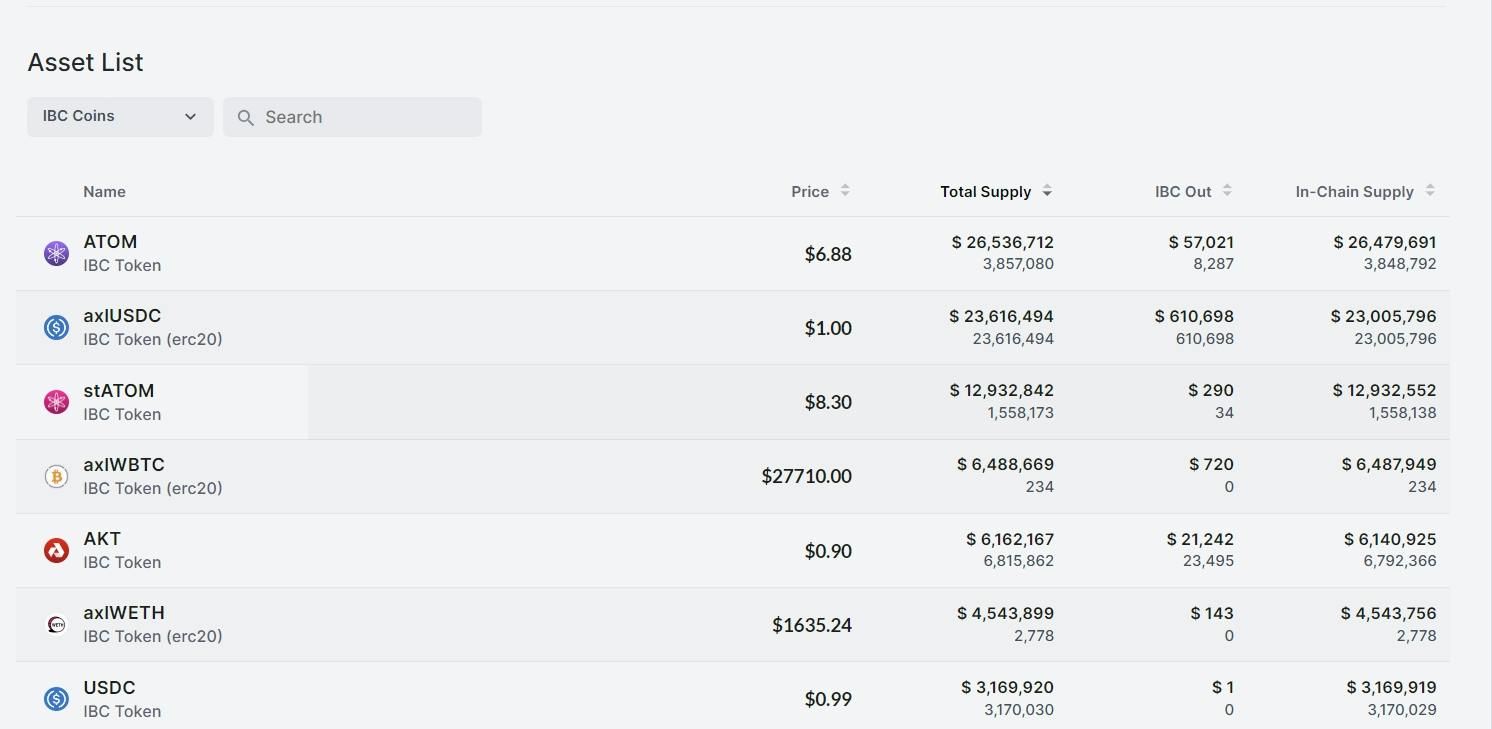

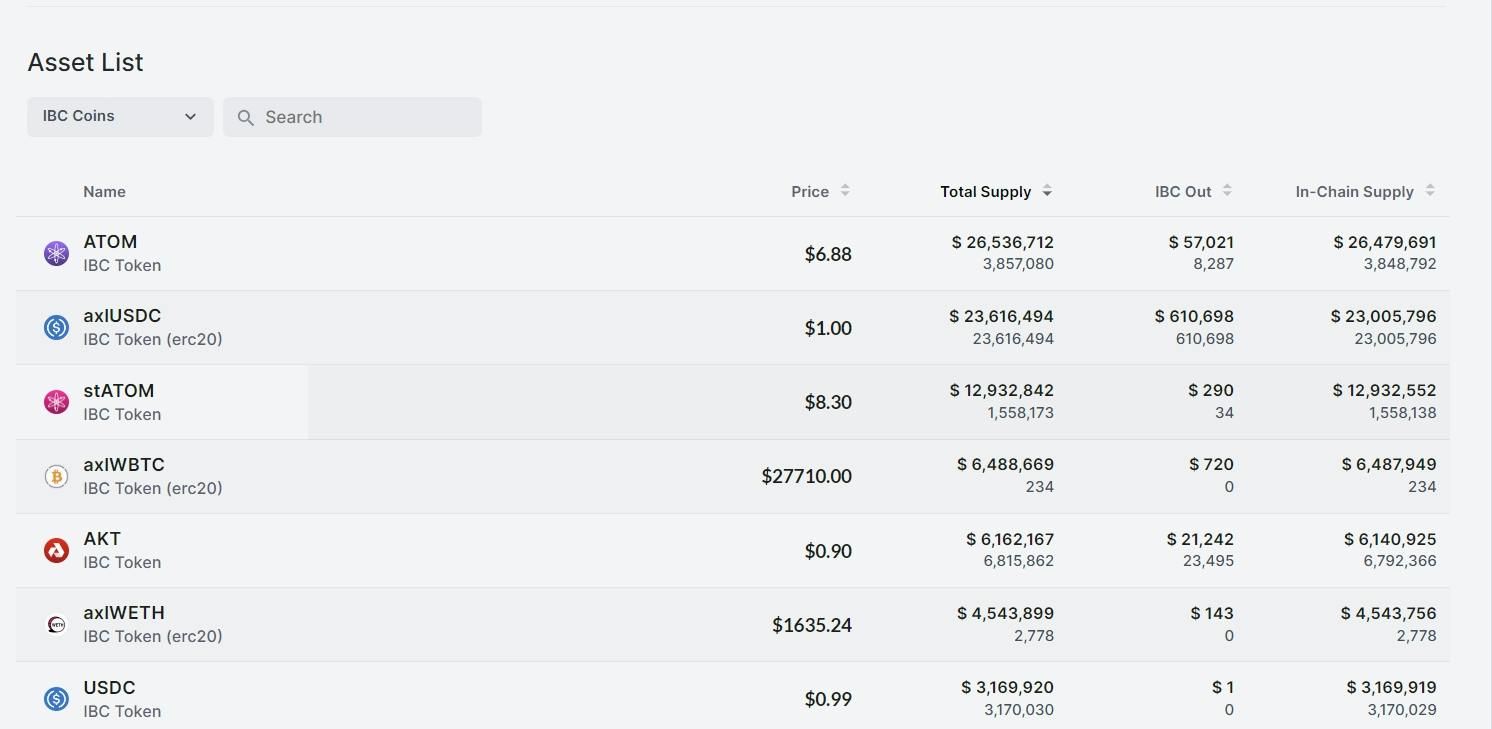

而跨链至 Osmosis 上的只有约 320 万美元,其余大部分仍为 Axelar 跨链来的 axlUSDC,同时来自 Kava 链的原生 USDT 稳定币只有约 60 万美元。

数据来源:https://www.mintscan.io/osmosis/assets

5. 代币数据

OSMO 代币是一种治理代币,允许质押代币持有者决定协议的未来,包括每个实施细节。OSMO 最初将用于以下用途:

对协议升级进行投票等治理作用

为不同的流动性池分配挖矿奖励

作为 Osmosis 链的 gas 代币

最近也有相关的收取交易费用分配给 OSMO 代币持有者的提案正在讨论中。

下图是 OSMO 代币的释放时间表,最初流通量为 1 亿枚,即空投 5000 万枚以及战略储备 5000 万枚。剩下 9 亿枚代币按第一年 3 亿枚,往后每年减产 1/3 的速度分配给 OSMO 质押激励、开发者、流动性激励、社区国库,直至释放完。

但在最近的 OSMO 2.0 更新中,社区通过了****减少通货膨胀并延长释放时间表的提案。****提案将通胀率降低了 50% ,所以目前每周的 OSMO 释放量大约为 128 万枚。其分配比例为 质押: 50% 流动性池奖励: 20% 社区池: 5% 开发者奖励: 25% 。

数据来源:https://osmosis.zone/blog/unveiling-osmo-2-0

根据 Coingecko 的数据,当前 OSMO 代币价格为 0.29 美元,达到了历史最低的价格,且仍处于持续下跌中。流通市值约 1.8 亿美元,FDV 约 2.9 亿美元。

按照当前价格每天释放的 OSMO 代币约为 5.3 万美元,一年约 1943 万美元。

数据来源:https://www.coingecko.com/

按照当前的协议收入月 50 万美元来估算,年收入为 600 万美元左右, 18000 / 600 = 30 倍;

6. 综合分析

综合以上来看,Osmosis 已经成为 Cosmos 生态的网络中心和流动性中心,这将形成很强大的网络效应。

例如在即将到来的 dYdX Chain,如果要从以太坊或者 Arbitrum 跨链 USDC 至 dYdX Chain 上,官方的方案需要通过 Axelar 跨链至 osmosis 上,再交换为原生 Noble 版 USDC 充值至 dYdX Chain,这将给 Osmosis 带来较大的流动性。

同时最新的基于 Cosmos SDK 搭建的项目都会针对 OSMO 的质押者进行空投,例如最近的 Celesita 等,这会进一步加强其垄断地位。随着未来更多的项目使用 Cosmos SDK 搭建,其原生代币的兑换都需要通过其他的 DEX 协议进行,而 Osmosis 拥有最大流动性和最强的网络连接性,必然会成为项目方的首选,而这又进一步增强了它的网络效应。

可以看到 Osmosis 的成功与 Cosmos 的繁荣息息相关,且随着 Cosmos 生态的发展,Osmosis 将捕获大量的交易价值,成为 Cosmos 生态的 DeFi 中心。

但从另一方面来看,如果 Cosmos 生态未能获得良好的发展,而是在与 Layer 2 或者其他公链例如 Solana 等的竞争中失败,则将导致 Osmosis 陷入危机。我们看到最近有例如基于 Cosmos SDK 搭建的 Canto 最近宣布转为 Layer 2 ,Base chain 等的迅速发展对 Cosmos 发展产生了挤压,但也有即将到来的基于 Cosmos SDK 搭建的 dYdX Chain 和 celestia 等应用链。

如果 dydx v4版本迁移后,其交易量,用户数并未出现增长,甚至后退,则可能说明应用链的叙事不成立,将会对其他观望的项目方带来不好的影响,导致 Cosmos 生态进一步的萎缩。

当然 Osmosis 也将面临 Cosmos 生态内部的其他对手的竞争,例如 Kujira、Crescent 以及 Astroport 等。

因此如果观察到如下指标的变化,则说明 Osmosis 的优势正在丧失:

dYdX Chain 发展不如预期,迁移过程受到巨大阻力;

整个 Cosmos 生态通过 IBC 连接的链的数量正在减少;

Osmosis 在 IBC 中的网络地位下降(例如与 Osmosis 连接的链在减少,而与其他 DEX 的链的连接在增加);

其他网络活跃指标,例如原生稳定币数量的下降,每日交易量的下降等。

反之,如果观察到以上指标在增加,则说明 Osmosis 的网络地位在增强。

而对于 Cosmos 生态的发展,则又涉及到主权应用链和 Layer 2 的竞争,这也将是未来区块链发展的一个重要方向。作者认为当前的 Layer 2 的扩展性仍然无法满足大规模用户的使用,一旦行情好转,链上活动繁荣起来,Layer 2 依然会面临拥堵和手续费高的问题,同时 Layer 2 也不能完全解决所有的问题,某些大型项目依然需要主权链的形式去实现特定的需求,这一点从 dydx 的迁移和 MakerDao 考虑利用 Solana 分叉搭建后端可以看出。故在未来一段时间仍将是 Layer 2 与主权应用链共存的时代,其中以以太坊生态为主,其他生态为辅。

参考文章及数据

关于 E2M Research

From the Earth to the Moon E2M Research 聚焦投资和数字货币领域的研究与学习。

文章合集 :https://mirror.xyz/0x80894DE3D9110De7fd55885C83DeB3622503D13B

关注推特 :https://twitter.com/E2mResearch️

音频播客:https://e2m-research.castos.com/

小宇宙链接:https://www.xiaoyuzhoufm.com/podcast/ 6499969 a 932 f 350 aae 20 ec 6 d