Weekly Editors' Picks Weekly Editors' Picks (0723-0729)

"Weekly Editor's Picks" is a "functional" column of Odaily.On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Now, come and read with us:

Now, come and read with us:

Investment and Entrepreneurship

Investment and Entrepreneurship

The article compared the trend of Bitcoin and the Nasdaq 100 index year by year, and concluded three conclusions: the overall price trend of BTC is more and more positively correlated with NDX100; BTC often takes a long time to digest the impact of the bubble burst; BTC More sensitive to changes at the macro level than the stock market.

Conversation with Suji Yan: Resist the giants and become the giants

"Only talking about the economic part, the future digital world will be a world with higher efficiency and less friction. When everything is written on a decentralized platform and becomes a public attribute, it will bring higher economic efficiency than before Much more."

Essential guide for Web3 founders and builders: How to build a suitable community?

DeFi

The author's advice comes from research on 12 key projects and conversations with core contributors.

“One of the strongest principles of Web3 is a culture of building first and planning later. First mover advantage matters. Decentralize how work is done, including decision-making and execution, and allow for a middle layer of community leadership. Turn people into participants and builders. When measuring success, start by identifying where you really want to go. Act fast, break the rules, and build attraction and stickiness to people.

Comprehensive interpretation of the encrypted derivatives market: perpetual contracts become the "main battlefield", and the DeFi protocol is looking for a way to break the situation

The DeFi derivatives project proposes solutions to decentralization, capital efficiency, liquidity, user experience, etc. There are currently two core problems in this track: the amount of interaction on the decentralized derivatives platform is too small, and the risk of liquidation.

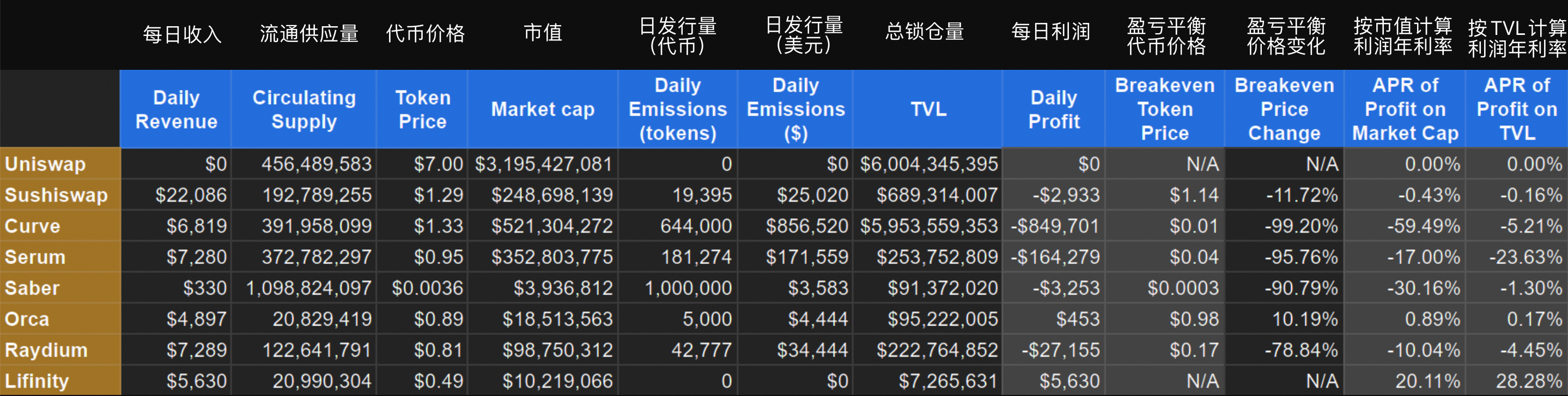

Learn about the profitability of mainstream DEXs such as Uniswap and Sushiswap in one article

Questions the article seeks to answer include:

Is the protocol making more money than it pays out (protocol fee > liquidity mining)? This helps us assess whether the protocol's current strategy is sustainable.

At what token price will the protocol break even (profit = 0)? This gives us a way to estimate the "fair value" of the token.

How much will token holders get if they receive a proportional share of the protocol's profits (APR on market capitalization profits)? This measures the desirability of holding tokens, assuming all income is distributed to holders.

Aave V3: Multi-chain Expansionism of the Master of Lending Kings

NFT, GameFi and Metaverse

NFT, GameFi and Metaverse

Uniswap integrates sudoswap, can it kick off a new prelude to NFT liquidity?

In fact, NFT needs to adapt corresponding liquidity solutions according to different demand scenarios. The existing OpenSea trading solutions are still applicable to NFT transactions in the form of pure artworks, and the closer to the general-purpose NFT type, the more similar it is. The liquidity scheme of the liquidity pool. As the boundaries and positioning of market products become more and more clear, the liquidity agreement of NFT will gradually be layered.

Delphi Digital 4D long article: Where will blockchain games go?

Many traditional game manufacturers/players are resistant to NFT/chain games. Delphi Digital reviewed the history of game monetization and analyzed the blockchain in the game, and found that the advantages of blockchain for players are reflected in digital property rights, secondary market liquidity, provenance, community governance, value accumulation, reputation on the chain, and Web3 The benefits of payment infrastructure for creators and developers are increased monetization opportunities, enhanced economic alignment, improved creator economics, and increased interoperability and composability.For developers looking at this space, it's a good time to think about the complexities involved in opening up economies, and the extent to which these games contribute to over-financialization. Additionally, UGC-focused platforms are well-suited for incorporating crypto. The ability to program royalties from derivative creations from third-party developers is very promising.Own part of the game, written after minecraft disabled NFTs

Web 3.0

secondary title

Foresight Ventures: Web3 Social Protocol Monopoly & Soul Bound Tokens

The essence of social products is matching. Web3 maximizes the matching ability of applications and improves the efficiency of user information acquisition by building a unified data bottom layer. The accumulation of high-quality relationships and network effects needs to reach a critical point to form a qualitative change.

Compared with the existing Web3 identity protocol, Soul Bound Token (SBT) has stronger advantages in scenarios such as non-transferable reputation, governance airdrop, negative reputation, and wallet recovery. Before the large-scale implementation of SBT, there are many issues such as privacy, security and storage to be resolved. In the future, it is very likely that SBT will coexist with multiple identity solutions, just like the L1 expansion solution.

Web 3.0 social ecology, from bottom to top, can be roughly divided into the underlying public chain application carrier, the decentralized data repository, the decentralized identity layer that presents user identities and relationships on the chain, the upper-layer social application products, and the user portal. Tools and plugins. Among them, the social graph captures the relationship between users on the chain and accumulates data, and is an important component of building a Web 3.0 decentralized identity infrastructure.

Ethereum and scaling

Ethereum and scaling

Explore the transaction cost composition of ETH from five aspects

Foresight Ventures: Mapping, Classifying, and Dominating MEVs

New ecology and cross-chain

A complete introduction to MEV.

The article takes stock of Fuel, Scroll, Aztec, Immutable X, Polygon zkEVM.

token economy

token economy

The advantage of the single-token model is high liquidity and simplicity, but it faces a paradox that is difficult to reconcile: if people spend Token on Gas, they will reduce their shares in the entire project ecology; if they refuse to consume Token, they will ignore actually use the network.

DAO

secondary title

hot spots of the week

In the past week,hot spots of the weekIn the past week,FTX, Alameda Ventures Propose Joint Plan, providing liquidity to Voyager users,Voyager responded thatThe joint proposal of FTX and others is a "low bidding" behavior disguised as a white knight rescue.Tiger TalismanIntroduced programs such as "debt-to-currency conversion", and stopped all trading services from August 1.Audius Community Vault Hacked, lost 18.5 million AUDIO,Harmony's Hard Fork and Additional ONE Compensation Proposalencountered community controversy,Computational Stability Protocol NirvanaAttacked, the token plummeted by 90%,

Public chain Juno NetworkDue to consensus issues, block generation has been suspended, and a patch will be released;In addition, in terms of policies and macro markets, the Central African Republic has begun toPublic Sale of Sango CoinAbandoning Enforcement of Cryptocurrency Laws

perspectives and voices,, in exchange for participation of the Central African State Bank in supervision;ZuckerbergV GodIt is believed that the metaverse competition between Meta and Apple will determine the direction of Internet development,V God,Pantera CapitalIndicates that Merge, Surge, Verge, Purge and Splurge will occur in parallel,Lido DAOIt is said that the centralized financial institutions are thundering, but DeFi is not dead,

Institutions, large companies and top projects,Voted against the sale of $14.5 million worth of LDO tokens to Dragonfly Capital;Institutions, large companies and top projects,UniswapBAI Capital

Completed the initial fundraising of US$700 million, and will focus on Web3, Metaverse and other fields,Or the "fee switch" will be turned on, and UNI holders can enjoy dividends;,Yuga LabsIn the field of NFT and GameFi, Coinbase releasedNFT WorldsWith "Editor's Picks of the Week" series

With "Editor's Picks of the Week" seriesPortal。

See you next time~