一文了解Uniswap、Sushiswap等主流DEX的盈利能力

原文作者:Talking About Fight Club

原文编译:DeFi之道

最近的熊市给各种项目的代币经济学带来了更加严格审查。叙事在很大程度上已经从追求在牛市期间创造奇迹的自反性(reflexive)机制转向可持续的利润,这反而使项目能够经受散户兴趣减弱的时期。然而,很少看到根据盈利能力直接比较项目的情况,甚至很少有资源专门用于这一目的。

因此,本文进行了以下研究,根据盈利能力比较主要的以太坊和 Solana DEX(重点关注后者) 。利润将定义为:

利润 = 收入(协议费)- 费用(流动性挖矿)

实际上,项目可能还有流动性挖矿以外的费用(例如团队工资、营销等),但这些数字通常不会公开发布,并且找到协议费用为每个项目和流动性挖掘数据并非易事;这涉及加入他们各自的 Discord 服务器并持续不断地提出问题。此外,并非所有协议都与其代币持有者分享利润,有些协议要求你锁定代币才能获得你的份额。因此,我们对利润进行了这样的定义,以便绕过这些差异,并在一个标准化的基础上对协议进行比较。

我们想回答的问题是:

协议赚的钱是否比它支付的钱多(协议费 > 流动性挖矿)?这有助于我们评估该协议目前的策略是否可持续。

在什么代币价格下,该协议会达到盈亏平衡(利润=0)?这为我们提供了一种估算代币「公允价值」的方法。

如果代币持有者按比例获得协议的利润(市值利润的年利率 APR),他们将获得多少钱?假设所有收入都分配给持有者,这衡量了持有代币的可取性。

协议使用其 TVL(TVL 的 APR 利润)能够产生多少利润?这让我们了解到该协议能够如何有效地利用其存入的资产。

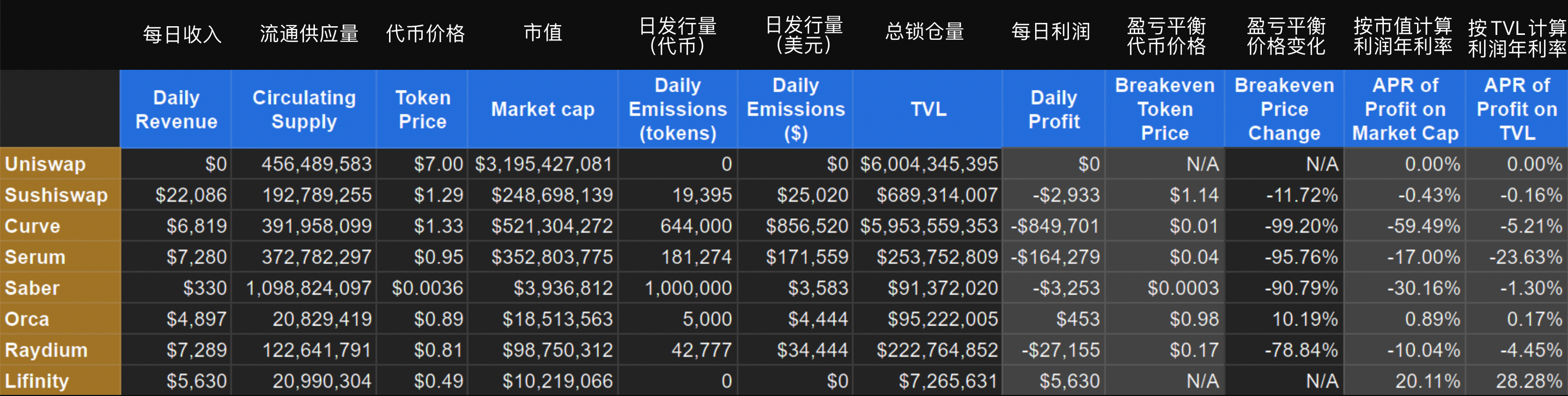

在单独讨论项目之前,让我们看一下整体结果:

右边突出显示的栏目提供了上述问题的答案。

每日利润是简单的收入减去发行量。

盈亏平衡代币价格是每日利润等于 0 的价格,而盈亏平衡价格变化是到达该价格的代币价格变化的百分比。这很有趣,但并不意味着是规定性的;这些数字不应被解释为代币「应该」的价值。它只是量化协议所赚取的收入与通过流动性挖矿(LM)释放的价值之间差异的一种方法。(注意:它不能应用于没有任何 LM 的项目。)

市值和 TVL 利润的 APR 是通过将每日利润视为市值和 TVL 产生的收益,并将其转换为 APR 来计算。

Uniswap

尽管从数据的角度来看并不有趣,但我觉得有必要将 Uniswap 包括在内,因为它在所有 DEX 中产生的交易量最大。

Uniswap 既没有 LM 排放,也没有协议费,所以它没有利润或损失。然而,它确实有一个「费用开关」,治理者可以在任何时候决定打开。

开启收费无疑会增加利润,但也会造成 LP 费用减少→流动性减少→交易量减少→LP 费用减少的循环,直到达到平衡。

SushiSwap

SushiSwap 是 Uniswap 的一个分叉,已经扩展到提供各种服务。

SushiSwap 似乎是更可持续的协议之一。我对他们的生态系统不太熟悉,所以除了他们的 LM 释放量相对较低之外,似乎没有更好的说法来解释这种情况的出现。

Curve

Curve 是以太坊上最大的稳定币 DEX,最近已扩展到非稳定币对。

在本次研究的协议中,Curve 的 LM 释放量最大,是其收入的 10 倍以上。Curve 最近发布了他们的 V2 池,所以看看他们是否能有意义地增加 Curve 的收益将是很有趣的。

Serum

Serum 是 Solana 上的一个中央限价订单簿。

相对于它产生的收入,Serum 也有大量的 LM 释放。它有一个完全稀释的市值,甚至比 Uniswap 还要大,这也是它在提供激励方面有很大余地的部分原因。

Saber

Saber 是 Solana 上最大的稳定币 DEX。

虽然 Saber 产生了相当数量的交易量,但其极低的费用意味着该协议的收入很少,大部分来自其 USDC-USDT 池的 0.5% 提款费用。不管怎么说,相对于其产生的收入,其 LM 释放量是相当可观。

Orca

Orca 是 Solana 上最大的 Uniswap v3 风格的 DEX。Orca 是 Solana 上最大的 Uniswap v3 风格的 DEX。

Orca 目前仅为其固定产品池收取协议费用,并且与 Uniswap 一样,尚未为其集中的流动性池开启协议费。打开它们会增加利润,但也会减少交易量,因此很难判断它会产生多大的影响。

Raydium

Raydium 是 Solana 上的一个 DEX,它既拥有自己的资金池,也在 Serum 的订单簿上发布其流动资金。

Raydium 已通过稳定的 LM 奖励流来激励其大部分的资金池,目前这些奖励已远远超过其收入。随着集中流动性在 Solana 上变得越来越普遍,Raydium 越来越难以像以前那样获得主要货币对的交易量份额。

Lifinity

Lifinity 是 Solana 上一个相对较新的 DEX,具有许多独特的功能:

无 LM 释放量

该协议拥有其提供的大部分流动性(因此可以获得该部分流动性 100% 的费用)

围绕预言机价格集中流动性,显着降低甚至逆转 IL(即通过平均低买高卖而无需任何类型的价格预测,从做市中获得利润)

值得注意的是,Lifinity 是本研究中唯一产生有意义利润的 DEX。

总结

所有的 DEX 在某种程度上都是有用的基础设施。它们使做市商能够提供流动性,而交易者能够有偿获得这种流动性。然而,LM 释放的存在往往隐含着这样一种认识:交易者作为任何交易的发起者具有优势,因此流动性提供者除了收取费用外,还需要额外的补偿。

LM 释放的必要性使人们质疑协议是否可以捕获比其释放量更多的价值。TCP/IP 等 Internet 协议也非常有用,但未能捕捉到它们创造的任何价值。这也是大多数 DEX 的命运吗?

这也揭示了为什么像 TVL、数量和收益等参数不如人们提及它们的频率那么有用。这些数字可以通过增加 LM 释放而被人为夸大。归根结底,如果一个协议无法为其代币持有者创造利润,这些指标是否重要?

当然,在考虑投资时,盈利能力并不是最重要的。协议如何使用其利润也很重要,而且投机在代币价格是否升值方面起着重要作用。但是没有办法量化这种力量,我们只需要关注当前产生的利润。所以这似乎是一个正确的分析起点,特别是与上面提到的参数相比。

我希望这种类型的数据变得更容易获得,并成为一种标准指标,不仅用于比较 DEX,也用于比较其他类型的协议(借贷、杠杆收益农场等)。我相信其他人能够比我更有效地收集这些数据。理想情况下,有人会创建一个仪表板,可以实时监测协议的盈利能力。