Uniswap或将开启“费用开关”,UNI持有者可享受分红

除了投票,我持有的UNI还有什么用?作为DeFi的龙头项目,UNI与其他DeFi治理代币相比,一直因缺乏应用机制和价值捕获而饱受诟病。

其实,早在2020年5月Uniswap V2发布之时,团队就已开始着手解决这一问题。在Uniswap V2的代码中,一直潜藏着一个名为“费用开关”(fee switch)的功能,让代币持有者能够获得手续费分红,只是一直未被激活。如今这一功能似乎终于要被开启了。

UNI持有者欢欣鼓舞

近几日,Odaily星球日报观察到在Uniswap治理论坛上关于费用开关功能的讨论,由PoolTogether的CEO Leighton Cusack发起。

“费用开关”(fee switch)这一功能开启之后,将会把交易手续费的一部分捕获,作为协议收入。而这一收入将用于为UNI持有者分红。

此外,这些资本积累还可为Uniswap做更多的事情:

·用作公共产品资金(目前协议金库的第一大用途)

·建设协议拥有的流动性

·资助协议开发人员等

·我们可以想象的其他事情

对于UNI持有者来说,这一提案颇具吸引力。

成功实施之后,这一举措或会赋予Uniswap一个与Sushi类似的机制:Sushi将协议赚取的收入支付给投资者,通过持有XSUSHI即可享受整个协议赚取的手续费收入分红。

Cusack认为,这一功能是否会产生积极影响,需要尝试看看,“如果“费用开关”打开后,交易执行没有减弱,那么这个实验就是成功的。”

他提议这一举措先从最大的两个交易对开始实施,即开启 USDC/ETH 0.05% 池和 USDC/USDT 0.01% 池的费用开关。这一举措若实施,将会使LP的收入下降10%,但这一部分资金具体转移至何处仍有待讨论。

在讨论中,大多数声音都对此举措表示了支持。有投资者指出,“ 从长远来看,这将使交易费用的一部分不可避免地流向 UNI 持有者。”

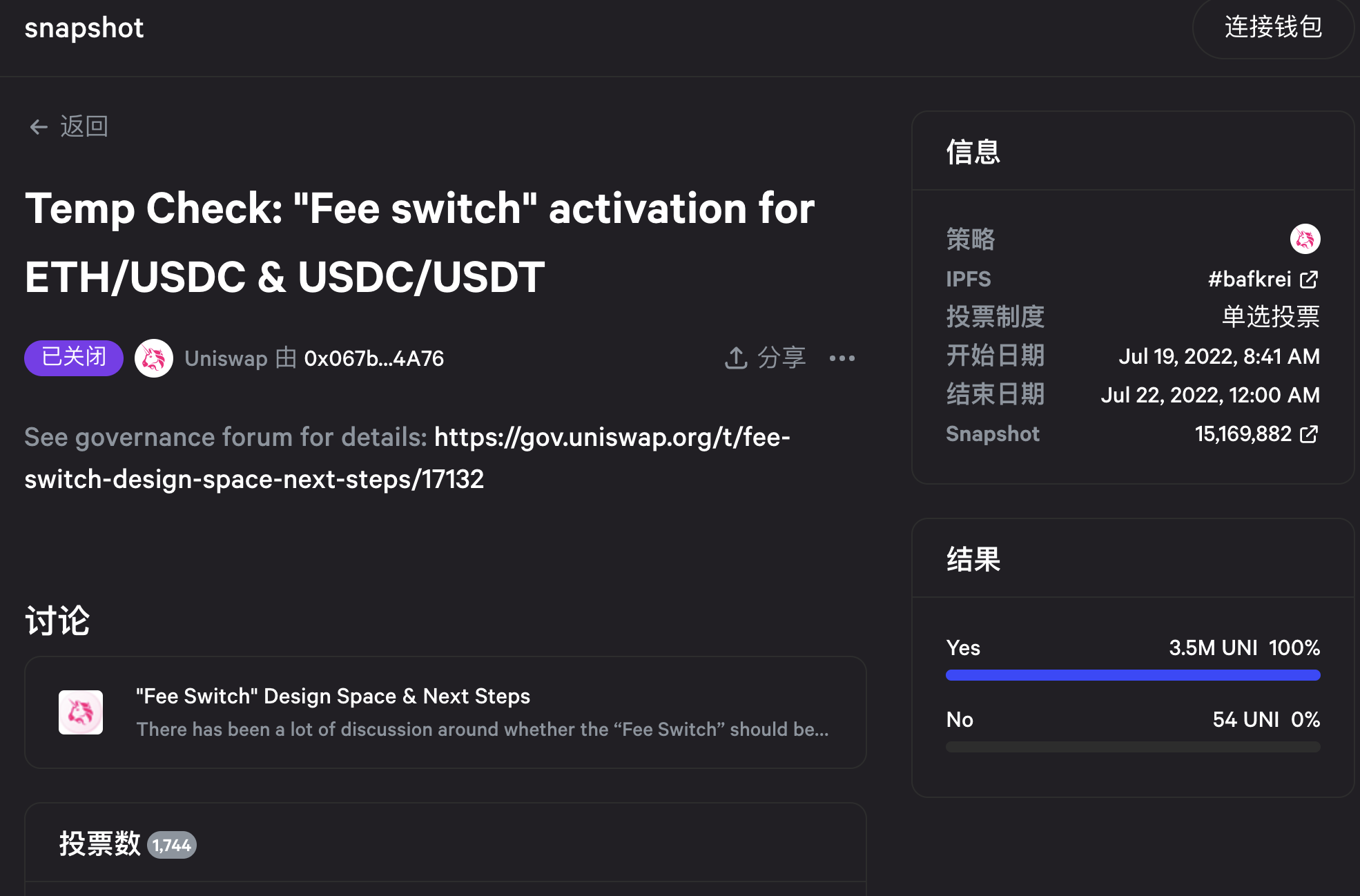

在非正式的链下投票中,350万枚UNI持有者都投出了支持票,仅有54枚UNI持有者选择了反对。目前,该投票已经结束,尚未进入正式的链上提案投票表决流程。

LP逃离风险加剧

尽管大多数人对此表示了支持,但这一举措将直接伤及LP的收益。有人担心,目前0.05%和0.01%的手续费已经较为微薄了,若进一步削减LP利润空间,LP们或许会因收入下降而撤离这些资金池,并前往Uniswap的竞争对手处提供流动性。

LP做市商“BP333”就对此严厉的表示了批评:“我认为收取费用是一种自满的选择。从LP那里拿走价值可被视为沾沾自喜。‘嘿,我们占据了市场上80%的交易量,所以为什么不现在就开始货币化呢?’”署名为“lpuniswap”的LP更直截了当的表示,“我成为LP的唯一原因就是费用。我反对以任何形式减少这笔费用。”

目前,Uniswap上的大多数流动性池仍以0.3%作为手续费费率。按照费用开关最初的设计,这些手续费中将有0.05%被协议收取,剩余0.25%仍为LP赚取。在过去的一个月中,Uniswap平均每日交易量约为8300万美元,若以此推算,每日将为协议带来约4万美元的收入。