"Weekly Editor's Picks" is a "functional" column of Odaily. On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Therefore, every Saturday, our editorial department will select some high-quality articles that are worth spending time reading and collecting from the content published in the past 7 days. You bring new inspiration.

Now, come and read with us:

DeFi

Therefore, every Saturday, our editorial department will select some high-quality articles that are worth spending time reading and collecting from the content published in the past 7 days. You bring new inspiration.

Now, come and read with us:

secondary title

This article takes stock of the development status of 5 ve(3, 3) projects

Velodrome has been online for the longest time, there are enough projects to bribe, the pledge rate is high, and the lock-up time is long, but after the recent rapid rise in the price of VELO, the yield of voting has also continued to decline.

Thena also attracted a large number of projects when it was launched, and now there are many projects in the ecology that use their own issued tokens for bribery, which is relatively healthy.

Solidlizard has been online for a short time, but because of the rapid development of the Arbitrum ecosystem, it has achieved more than $100 million in liquidity. But currently the main income for voters is SLIZ and a small fee.

Solidly v2 seems to be mainly to attract the liquidity of stablecoins, while giving its own token trading pairs a higher rate of return, which does not help the long-term development of the project.

Rug, Rug or Rug, an article reviewing the history of blood and tears in (3, 3) mode

By sacrificing part of the savings income, the forks of OHM continue to increase their APY, and in this way attract the attention of retail investors. The reason for the final failure of the (3, 3) model: Some speculators have found the fastest, purest and most attractive money-circulating model and played its role to the greatest extent.

Whether it is (3, 3) or reverse (3, 3), the evolution of the mechanism cannot change the essence of the game behind them, and running away is also a matter of time. In the DeFi 2.0 era where "protocols have liquidity" , high APY has brought extreme FOMO sentiment and irrational behavior, users and agreements have also exchanged positions, and the promise of the agreement and the trust between users seem to be the only reliance for investors.

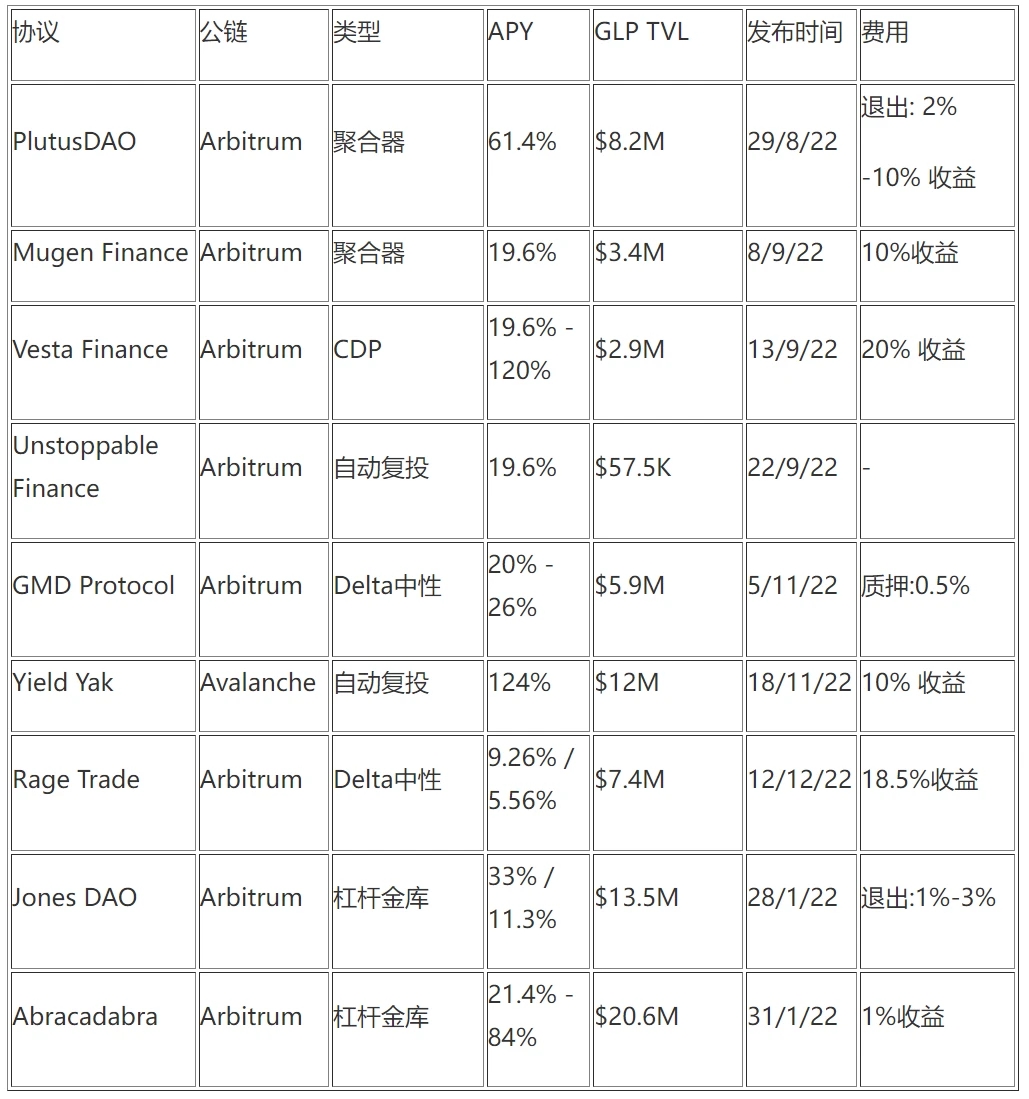

GMX is a representative project that generates real income. GMX uses GLP as the liquidity of transactions, and 70% of the losses generated by user transactions and platform fees will be distributed to LPs and GMX Token holders in the form of ETH or AVAX.

NFT, GameFi, and the Metaverse

Comparison of key indicators of related agreements

NFT, GameFi, and the Metaverse

Bankless: 4 ways NFT creators are coping with declining royalties

Suppress supply, become a supply LP, DIY market, incentivize royalties.

Digging into on-chain data: Why is Blur's airdrop strategy more effective?

What really makes the difference between Blur and OpenSea is the top 1% of traders, who are the key drivers of the NFT market. Blur attracted top traders with its recent airdrop and zero fees. More than 59% of LOOKS and 85% of X2Y2 airdrop wallets finally chose to sell tokens.

Blur's overall wash trade percentage is relatively low at around 11%.

Folius Ventures: "Taxation system" business model is more suitable for Web3 games

Zonff Partners: Ten Questions about Web3 Game Industry Observation

Web 3.0

A good Ponzi standard is that the in-game asset inflation rate is consistent with the user growth rate;

Full-chain games may become the growth point of the next wave of Web3 games.

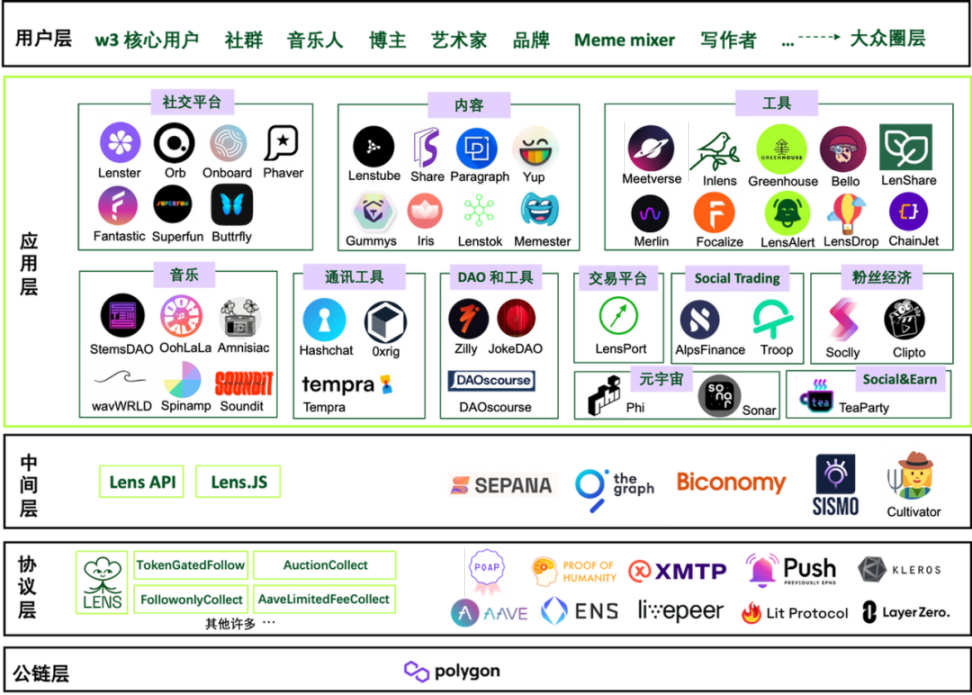

Buidler DAO x SevenX Research Report: Comprehensive Interpretation of Lens Protocol

There are three steps to breaking down data islands: data transparency, data ownership confirmation, and data interoperability.

In addition to the often-mentioned data right confirmation, Lens is more important to the industry: as a soft standard of the protocol layer under the premise of being sufficiently open. In addition, it is derived from social protocols to creator economy and DAO governance in support scenarios. Developers are no longer trapped in the zero-sum game of competing for users like the traditional Web2, but can cooperate with each other to make the cake bigger. Every application that uses Lens Protocol is beneficial to the entire ecosystem. At the same time, as a user in the ecosystem, you can roam freely in various products, and creators no longer need to worry about losing their own data due to algorithms, policies or competitive strategies of individual platforms.

Ethereum and scaling

Lens Protocol Ecological Mapping

Ethereum and scaling

The battle for the LSD market has begun, and this article sorts out 9 potential agreements

LSD matryoshka war is upgraded again: not only liquidity, but also the pursuit of high returns

Think of ETH as the "dollar" of the encrypted world, then stETH is a "dollar treasury bond" that is rigidly redeemed and has its own yield. Frax Finance has launched a new LSD-related product that puts yield in the spotlight. In order to compete for users and funds, the LSD protocol must not only provide liquidity, but also have a higher rate of return.

LSD hides "sevenfold income", APR-War ending is TVL 1 0X growth?

New ecology and cross-chain

The Ethereum mainnet pledge rate of return and the overall lock-up amount are mutually exclusive. The current pledge rate is about 14.6%, and the rate of return will decrease as the number of pledges in the entire network increases.The article explains how the rate of return of the LSD track is multi-dimensionally expanded from the two dimensions of time and space of rate of return.》《The income model is diversified and has "partially combinable characteristics": the first guaranteed "fixed income" with the main network pledge, the second revolving loan expansion leverage in DeFi will double the yield rate, and the third lsdETH /ETH forms LPs in Dex to provide liquidity benefits, and the incentive benefits of the fourth foreseeable "Hundred Regiments War" LSD protocol (the old DeFi protocol uses Curve and other bribery to manipulate votes and increase the upper limit of incentives, while the new protocol mines governance tokens emission, similar to the initial LDO), the fifth re-pledging agreement represented by Eigenlayer gives additional verification node rewards to third-party projects, and the sixth comes from the introduction of (lsdETH/a token) liquidity incentives on Dex Income, the seventh income aggregator will mine rewards and reinvest the "fixed income + market" brought about by high-value reporting wealth management products.》《New ecology and cross-chain》。

There are many articles comparing L2 this week, and I recommend "

Optimism vs Arbitrum: The battle for Ethereum L2 supremacy is on

An article comparing Optimism and Arbitrum data: which ecology is more promising?

In-depth interpretation of Arbitrum: Layer 2 leader

This article compares 23 cross-chain bridges and provides an overview of the current L2 bridge pattern

An L2-L2 bridge should ideally meet the following criteria:

Third parties must be able to independently build interfaces—ideally standardized interfaces—to the target L2 protocol.

hot spots of the week

In the past week,L2 bridges have very different trust assumptions, e.g., trusted vs. trustless bridges, and very different design choices, e.g., lock-mint-burn vs. liquidity networks. New developments are underway using the latest ZKP techniques that effectively solve the two-bridge trilemma and contribute to improving the overall safety of the bridge.,secondary titlehot spots of the weekIn the past week,;

Coinbase to Suspend BUSD Trading120,000 ETH Stolen in Wormhole Hack Last Year Has Been Recovered by Jump Crypto;

, Silvergate has confirmed that a series of recent events may affect its ability to continue as a going concern,Several encryption companies and exchanges have come forward to distance themselves from their relationship with SilvergateIn addition, in terms of policies and macro markets, Coinbase launched the "Crypto 435" advocacy campaign,Pro-encryption policies to advance in 435 U.S. congressional districts,Sui CTO :Clean and functional UI is important for wallet adoption, Forbes:, Animoca co-founder Yat Siu:Giving up NFT royalties will "kill" Web3, Forbes:;

Institutions, large companies and top projects,Binance Misappropriated Nearly $1.8 Billion in B-peg USDC Collateral Assets Last Year, Binance responded: Forbes mentionedInstitutions, large companies and top projects,,The Uniswap Foundation Announces the Establishment of the Uniswap Bridge Evaluation Committee and Starts the Evaluation Process,Justin Sun’s wallet address pledges a large amount of ETH in Lido,one timeTrigger the Lido "Staking Rate Limit" limitThe Uniswap Foundation Announces the Establishment of the Uniswap Bridge Evaluation Committee and Starts the Evaluation ProcessThe Solana network experienced a fork event that limited transaction processing;

NFT and GameFi fields,Yuga Labs to Launch Bitcoin NFT Series TwelveFold, Binance launchedAI Products Bicasso Beta,Base:The artwork will be refined on a commemorative NFT, telling the story of the builder...well, another week of ups and downs.

With "Editor's Picks of the Week" seriesPortal。

See you next time~