Compilation of the original text: Bai Ze Research Institute

Compilation of the original text: Bai Ze Research Institute

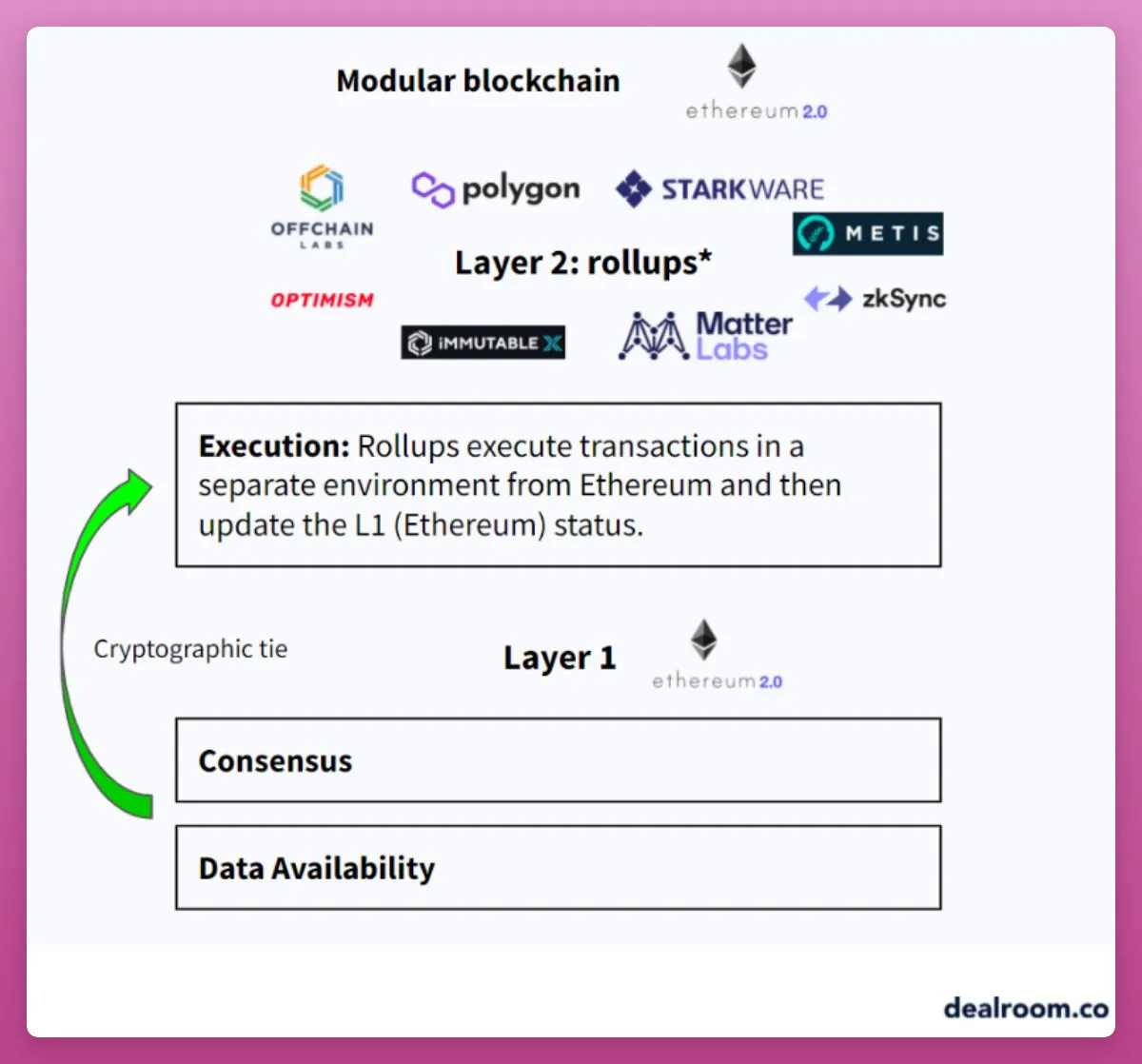

Optimism and Arbitrum are the most popular L2 solutions designed to make Ethereum transactions faster, cheaper, and more accessible.

They batch transactions and then publish a "compressed version" back to Ethereum.

first level title

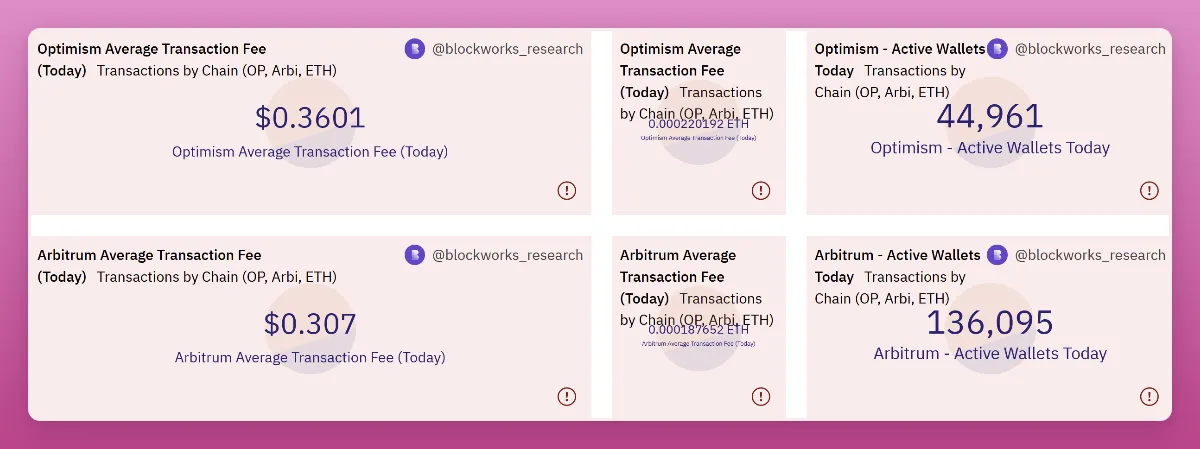

Transaction volume and active addresses

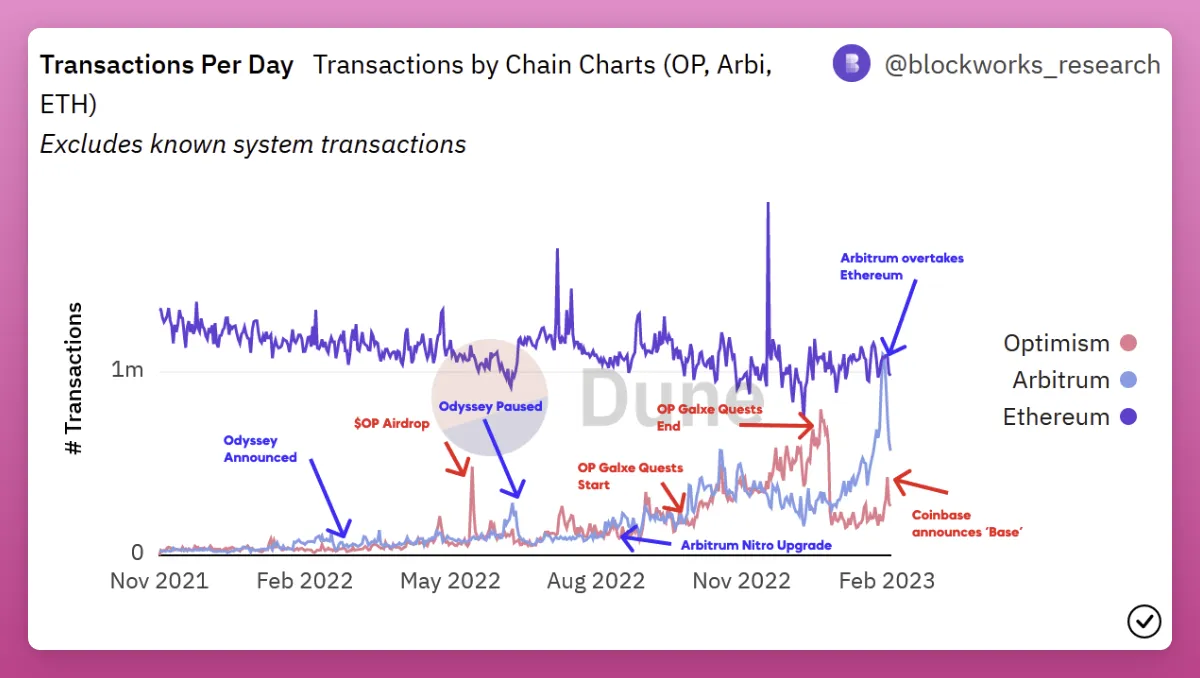

Although both Optimism and Arbitrum have advantages over Ethereum, they are still slightly behind Ethereum in terms of daily transactions. However, Arbitrum’s transaction volume did surpass Ethereum’s one day before falling back again.

In late September 2022, Galxe (formerly known as Project Galaxy) and Optimism will cooperate to launch a "earn while learning" activity - Optimism Quests, which aims to give users a deeper understanding of Optimism's ecology.

Since the end of Optimism Quests, however, Optimism's transaction volume has dropped significantly. The drop in transaction volume could also be attributed to Optimism’s previous whitelist restrictions, which gave Arbitrum a head start in terms of transactions and users.

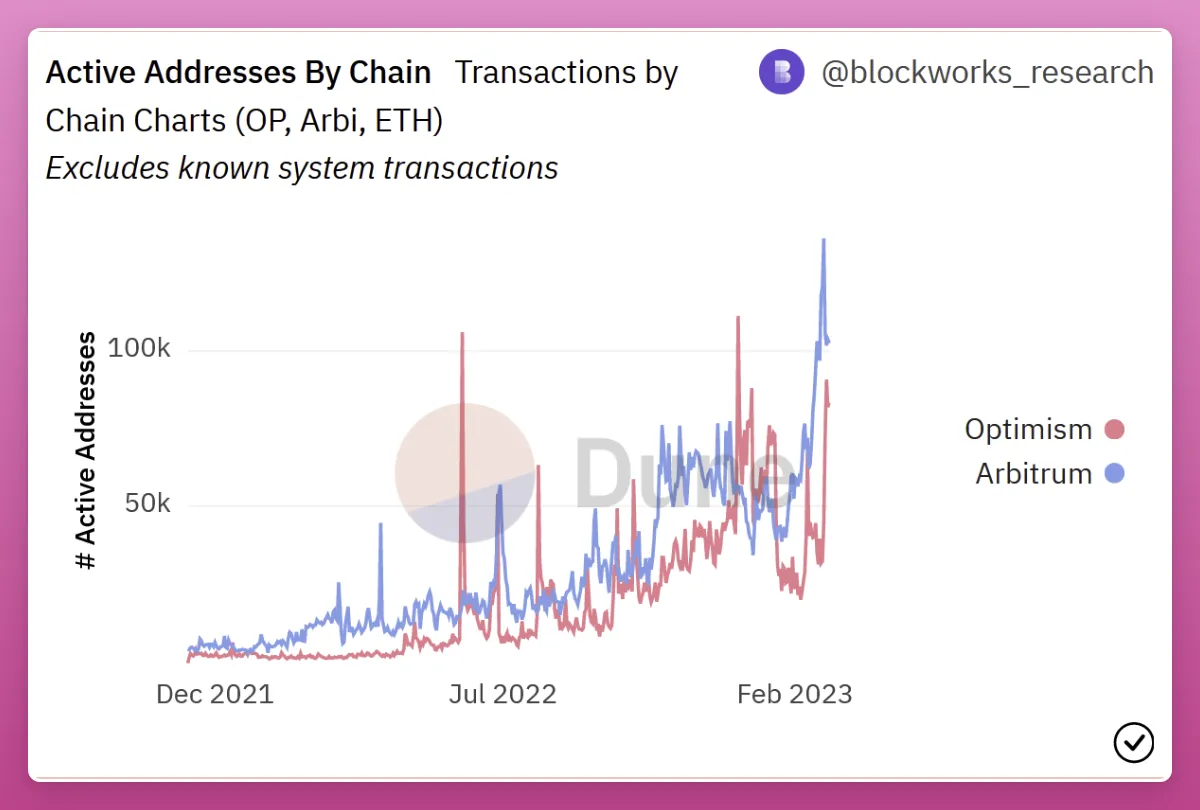

Arbitrum is also leading in terms of active addresses.

first level title

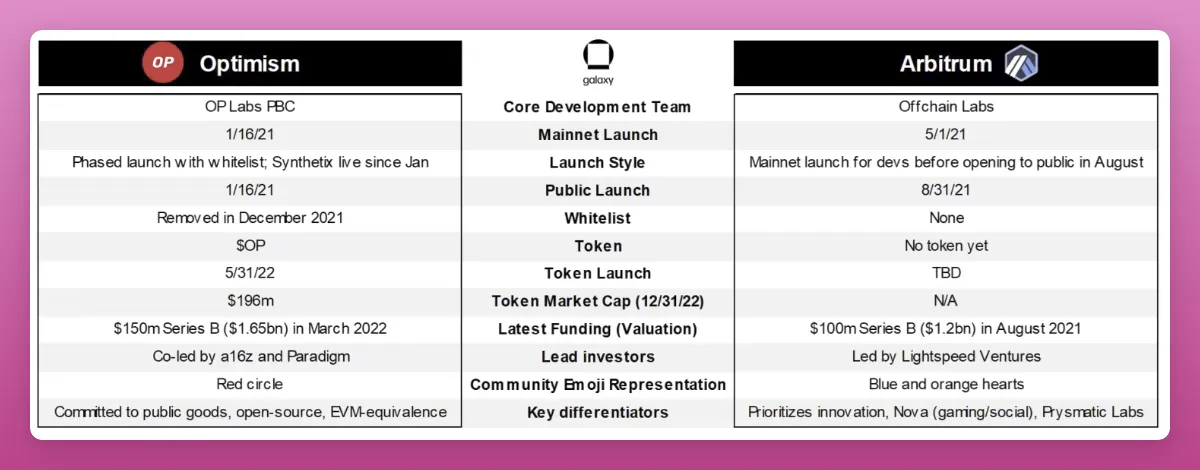

Funding and Investors

Optimism and Arbitrum have raised similar funding from top VC firms. Optimism raised $178 million at $1.65 billion, while Arbitrum raised $143 million at $1.2 billion. Notably, Pantera and Coinbase have investments in both protocols.

first level title

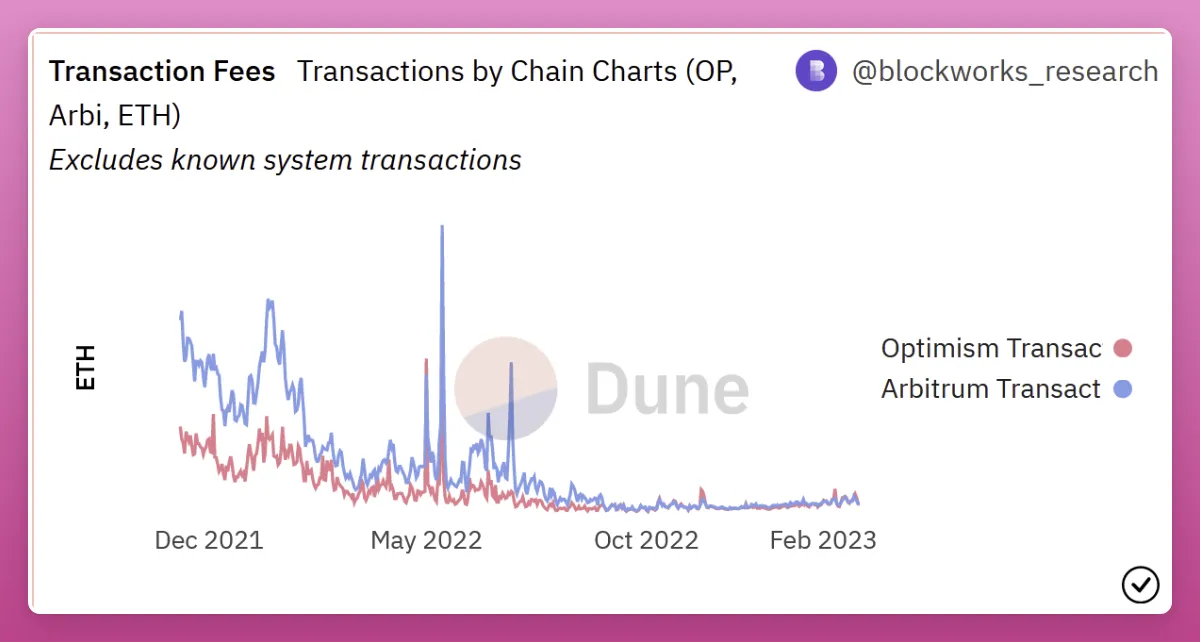

Gas cost and throughput

Despite processing more transactions and having 3x the number of active wallets than Optimism, Arbitrum also currently has cheaper gas fees.

Due to Arbitrum's technology upgrade, gas fees have dropped by 50% since last year, even with an increase in transaction volume.

Additionally, Rollups L2 solutions such as Arbitrum and Optimism could reduce gas fees by a factor of 100 to 1000 due to the EIP-4844 upgrade arriving sometime in mid-2023. The main purpose of EIP-4844 is to reduce the Gas fee on the Ethereum network without sacrificing decentralization, especially for the Rollups L2 solution.

Gas fees haven’t always been this low, and Arbitrum’s gas fees surpassed those on the Ethereum mainnet at one point in May last year when Arbitrum launched the Oddysey campaign, with users flocking in for a potential airdrop.

first level title

Optimism Major Upgrade: Bedrock

Optimism is planning a major upgrade this April.

Bedrock will provide Optimism with modularity, simplicity, and Ethereum equivalence. It will enable performance improvements including transaction costs, throughput improvements, and sync speeds.

More importantly, Coinbase, the largest cryptocurrency trading platform in the United States, has launched its own L2-Base based on OP Stack. Coinbase will join the Optimism Collective (Optimism's DAO) as a core developer to continue to improve and promote the OP Stack - a development toolkit composed of a series of modules developed by Optimism that can be used to develop specific blockchains.

At the same time, Optimism also bet on its own future and proposed the concept of SuperChain - based on OP Stack, a unified network composed of multiple L2s, sharing security, communication layers and open source technology stacks with each other.

They all share a common vision for SuperChain - a network of interoperable L2s that gradually increase their interoperability until they form a "mesh" that collectively scales Ethereum.

The idea is that many Rollups L2 with significant activity will act as "hubs" for different ecosystems and lay the groundwork for a more vibrant developer ecosystem than standalone blockchains.

first level title

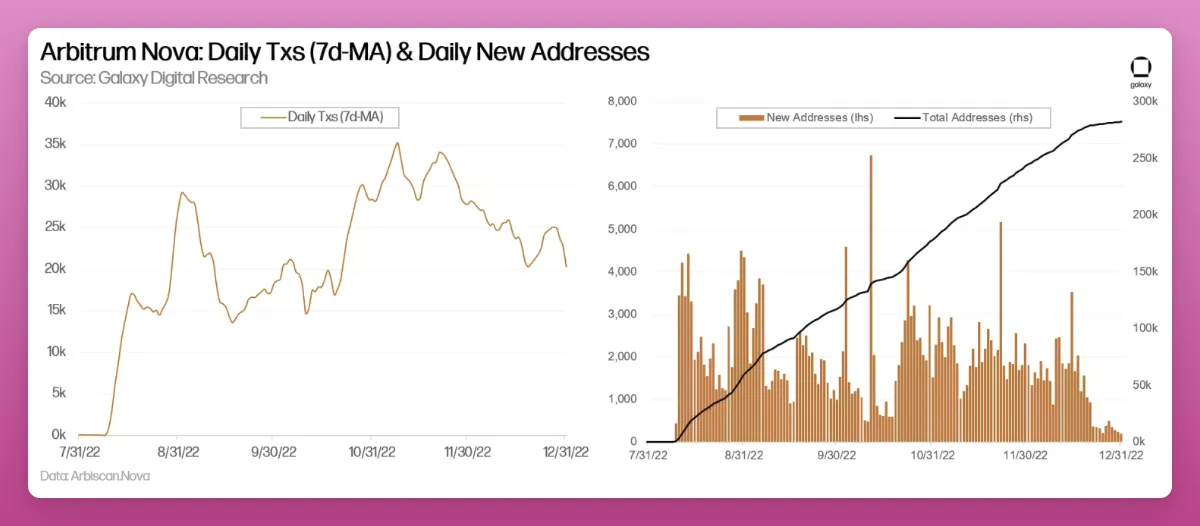

Arbitrum Nova

Arbitrum has the same "hub" vision.

In fact, Arbitrum has 2 networks:

• Arbitrum One for DeFi, NFTs

• Arbitrum Nova for games, social applications.

Generally, "Arbitrum" refers to Arbitrum One, since it is the network that centralizes most of the on-chain activity.

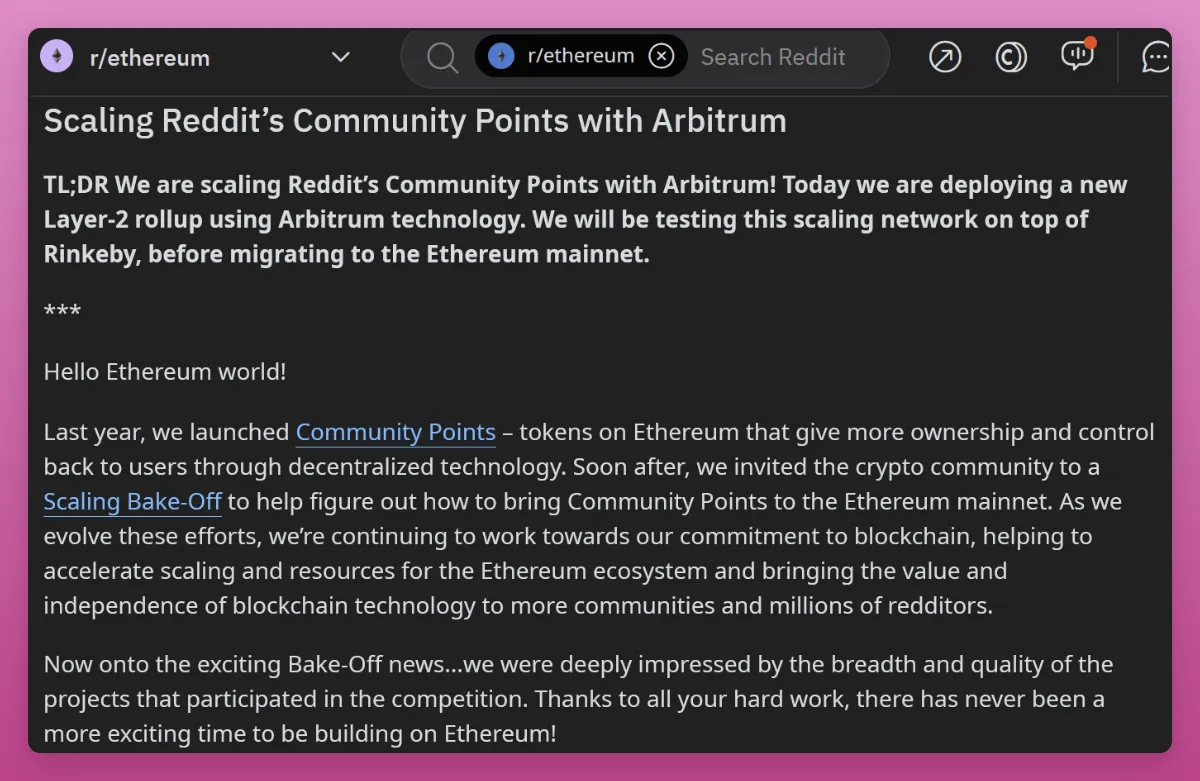

Arbitrum Nova achieves low fees at the expense of security due to off-chain management of data through an external data availability committee. Committee members include Offchain Labs, Consenys, GoogleCloud, P2P, Quickode, and Reddit.

More importantly, Reddit chose Arbitrum Nova to host its Community Points, proving that purpose-built "hubs" have become a reality.

We found Arbitrum optimistic rollups to be the most promising technique for scaling community points. — A post about scaling Reddit community points with Arbitrum

Other contenders for Reddit Community Points include Solana, StarkWare, and Polygon.

first level title

DeFi Ecosystem

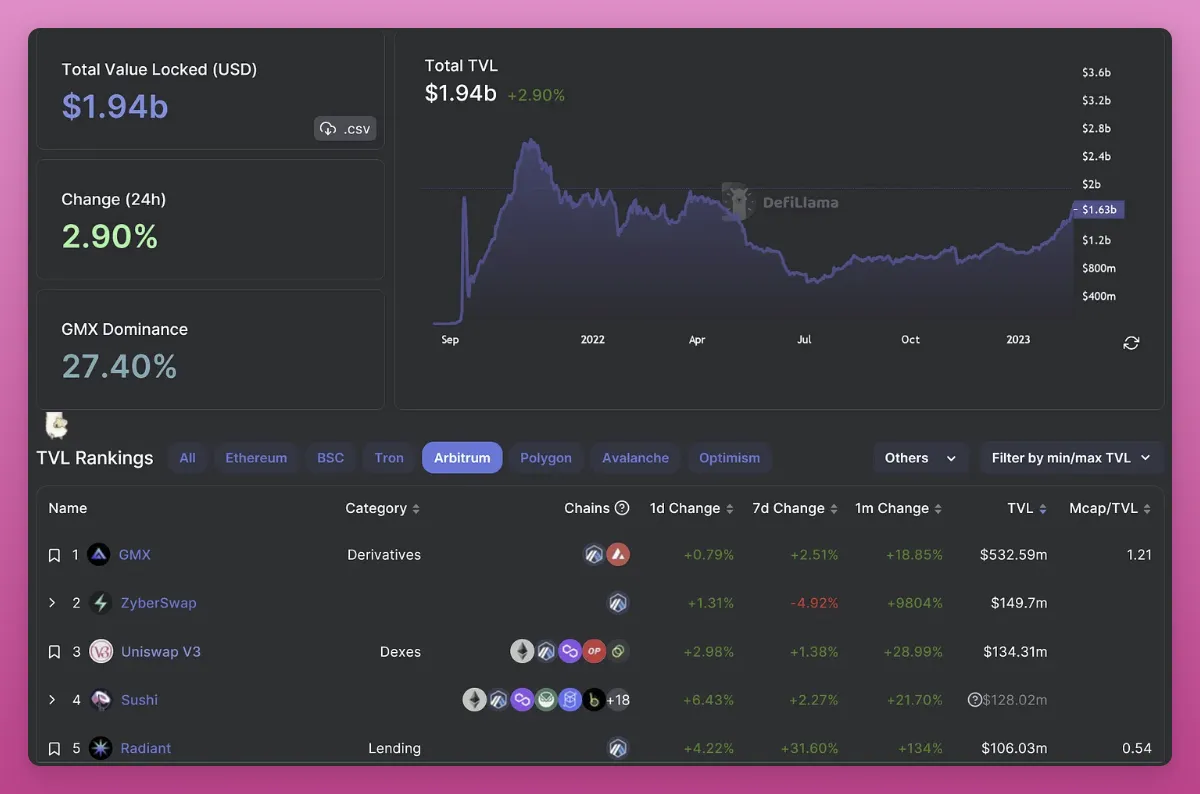

Both Arbitrum and Optimism are growing the DeFi ecosystem much faster than any other L2 or even L1. Aribrum's TVL rose 62% to $1.15 billion in just one month. Has surpassed Polygon and Avalanche.

Although Optimism is lower than Polygon and Avalanche, its TVL increased by 35% to $950 million in the same period.

first level title

Popular dApps on Arbitrum

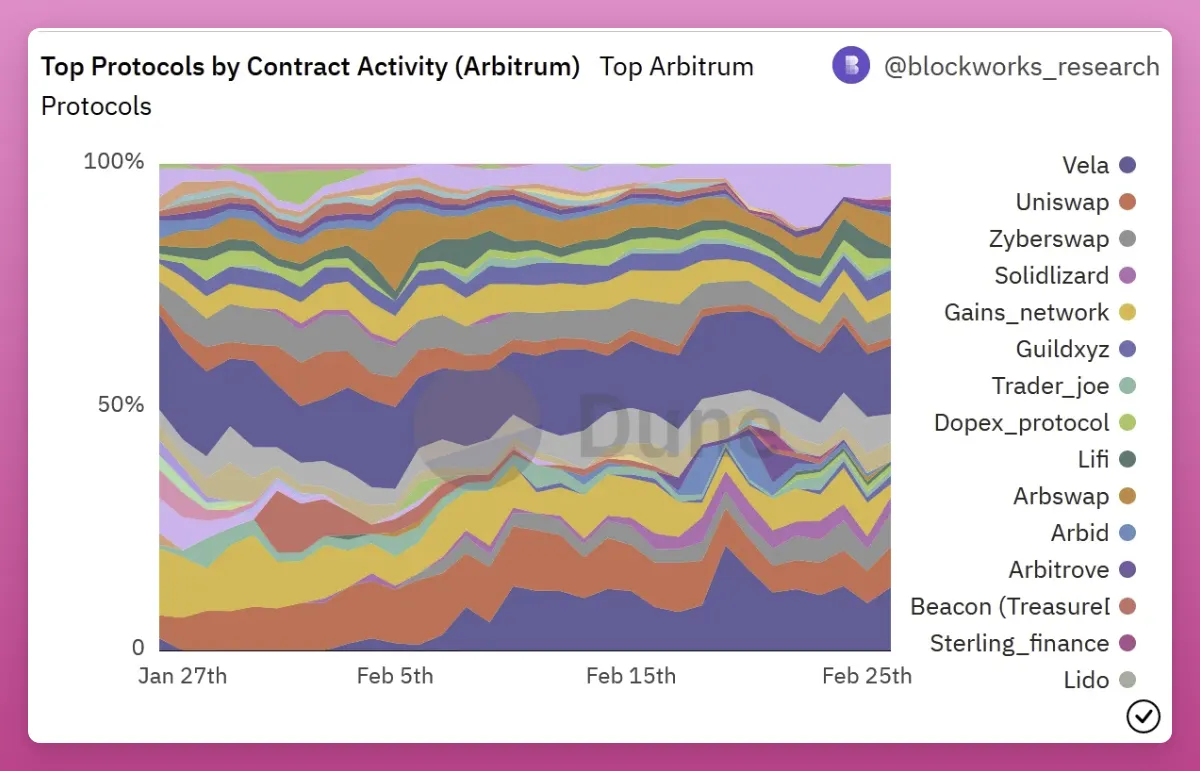

DeFi-related dApps dominate Arbitrum's TVL (and transaction volume), with GMX leading the way. This makes sense, since transactions need to be fast and have low fees.

secondary title

ZyberSwap

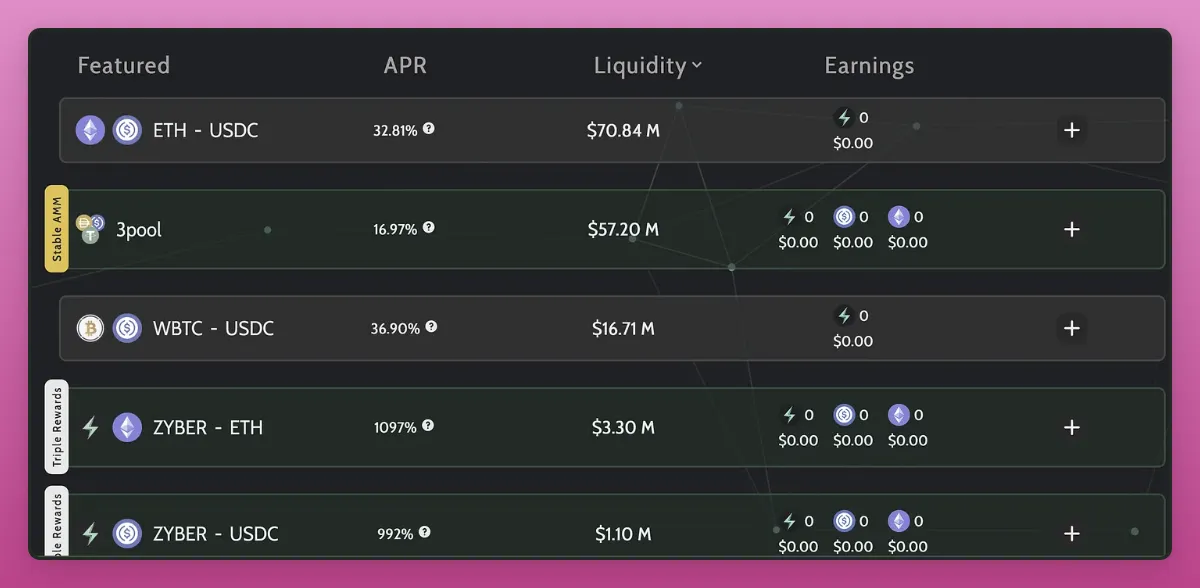

ZyberSwap suddenly "emerged" and surpassed Uniswap.

It has a "generous" liquidity mining reward, with an APY of 32% for ETH-USDC and 17% for the stablecoin 3 pool.

secondary title

Radiant

Radiant is a cross-chain lending platform on Arbitrum that solves the problem of liquidity fragmentation in DeFi. It allows users to deposit any mainstream encrypted assets on any chain, and borrow and lend on another chain, thereby improving user experience.

Radiant v2 introduced true yield-based incentives, scaled to serve many chains, and generated nearly $5.5M in fees.

While there are risks, Radiant uses LayerZero to handle cross-chain activity and ensure collateral is backed by real assets.

Additionally, Sushi and Vela are also leading dApps in Arbitrum’s DeFi activity.

first level title

Top dApps on Optimism

secondary title

Velodrome

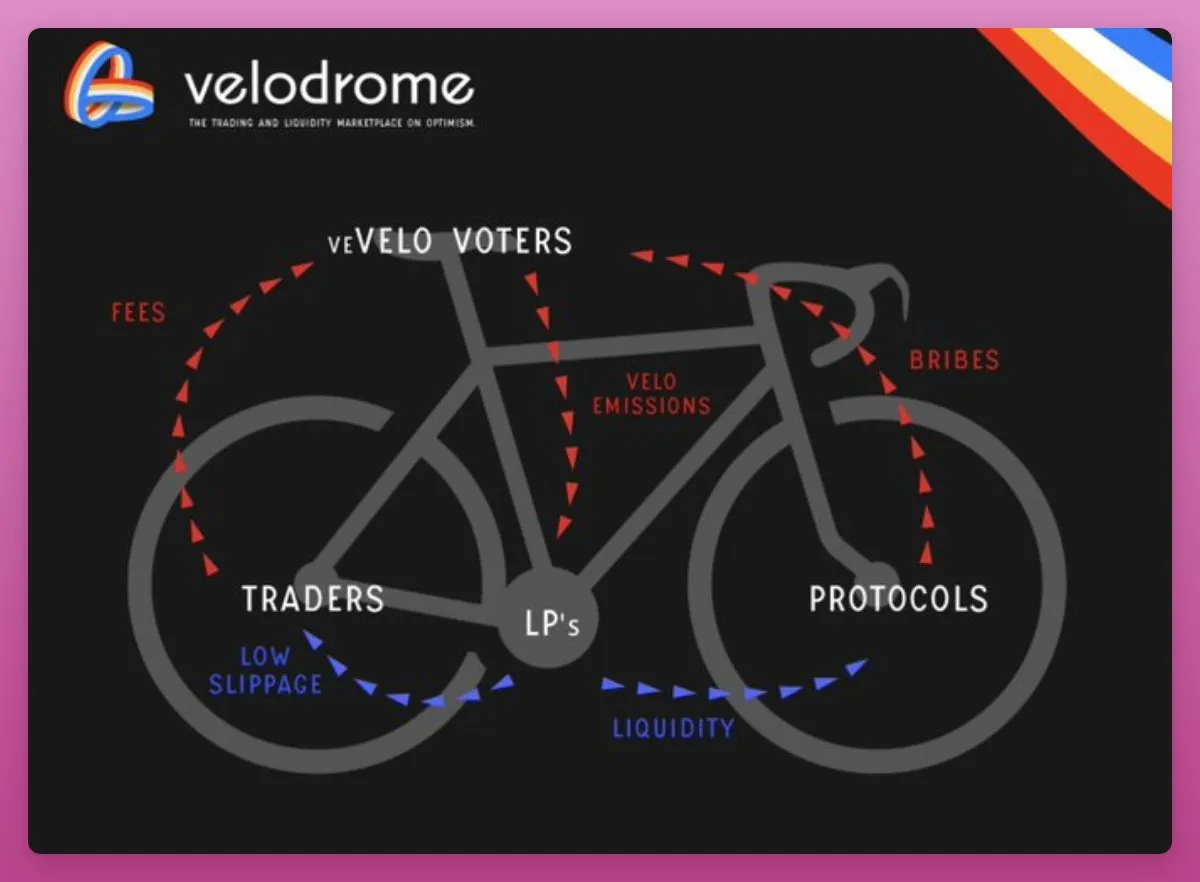

As a successful fork of AC (Andre Cronje)'s Solidly project, Velodrome's TVL increased by 132% in just one month, while $VELO token price increased by 290% in the same period.

Velodrome owes its success to taking veToken to the next level.

By staking $VELO for up to 4 years, users can get veVELO: an ERC-721 governance token in the form of NFT, which uses the ve( 3, 3) mechanism.

Holders of veVELO will receive a "bribe" by voting on the weight of $VELO allocated to each liquidity pool. It has proven popular with Optimism’s projects as they can access cheaper liquidity than launching their own liquidity mining campaign.

Synthetix

Optimism's oldest project, Synthetix, just launched V3 - a complete rebuild of the protocol from the ground up.

Their mission is to help projects increase liquidity through "liquidity as a service" and launch any derivative assets you want.

The protocol, combined with a decentralized oracle network, creates a "liquidity API" that allows the marketplace to create derivatives collateralized by ERC-20 tokens.

first level title

The future of L2 competition is faster and cheaper

Both Optimism and Arbitrum are very promising L2s that are already playing an important role in the future "modular Ethereum" narrative. While they still lag behind the Ethereum mainnet in terms of daily transactions, faster and cheaper transactions make them an attractive option for users.

Both networks have some new developments:

EIP-4844 will further reduce the gas cost of both

Coinbase's partnership with Optimism will ensure more innovation

Arbitrum's native token launch could boost on-chain activity (depending on how it's launched, many expect airdrops, so on-chain transaction volume will be high).

"Modular Ethereum" narrative grows, we'll see more development activity on L2

Ultimately, the competition between them is very beneficial to us, users, and the entire DeFi ecosystem, because we will get a better user experience with each upgrade.

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.