LSD暗藏「七重收益」,APR-War终局为TVL 10X增长?

原文作者:shutong

原文来源:SevenUp DAO

LSD 暗藏“七重收益”,即将到来的 APR-War 会推升 DeFi TVL 1 0X增长,且基于此以太坊主网质押 APR 和 TVL 相斥的魔咒将被击破。

本文主要探讨三个部分内容,第一部分 ETH-Staking 的定义和四种质押途径,第二部分 LSD 质押高收益的故事如何通过 7 种途径延续,第三部分一些题外话和潜力赛道。

一、ETH-Staking 的定义、痛点和四种途径

1.1 质押挖矿定义:

简单来说就是挖矿,不过在 2.0 的语境中“质押者”替代“矿工”的验证工作,并获得收益权;最大的门槛在于,固定成本由之前的矿机支出转为至少存入 32 个 ETH。

1.2 痛点:

成本高:设有最低投入门槛,且质押资本效率低,长时间锁定,无法提取;另外用户单独验证节点需要保持节点性能良好,避免离线带来的成本消耗

收益低: 4% - 6% 且处于下降状态,硬件成本虽低,但是不可忽略

1.3 四种质押途径:

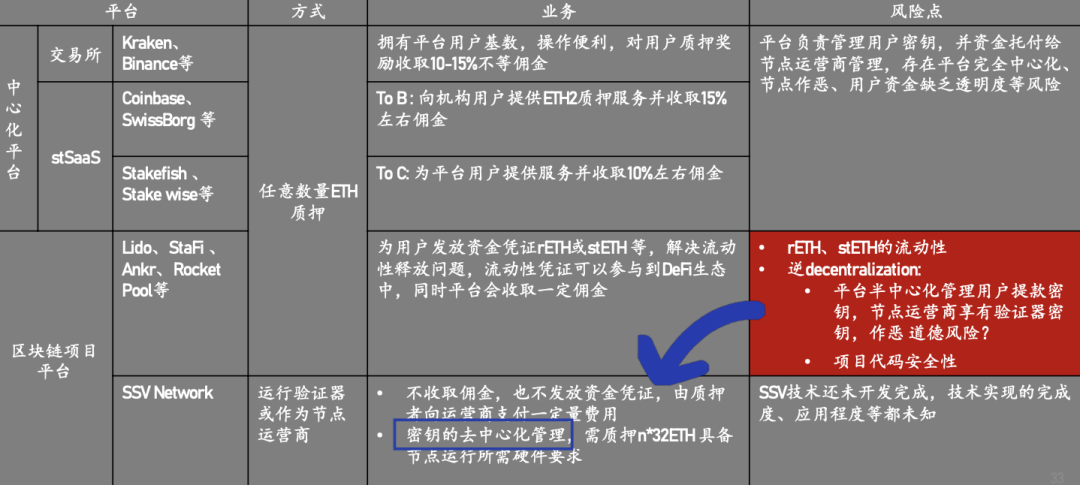

分类方式,用户将资产质押到 ETH 主网后会获得两份私钥——验证私钥(负责主网节点运行时的验证签名)和提款私钥(负责以太坊质押主网存入取出权限),根据两把私钥的不同归属,衍生出四种 Staking 解决方案:

Solo(直接质押)、Sass(拿着 32 个 ETH 让节点帮跑)、Pool(类似 LDO 的联合质押方案)、CEX(交易所及类 Coinbase 的合规方案)

图片来源:Robert. Hu SSV 中国大使 @RobertHu Web3

从上到下安全性和去中心化程度逐渐降低,solo 方式用户对两把私钥都有的控制权,自由处置收益和节点验证的状况,sass 方案用户只有提款私钥,能保证资金的安全,而 Pool 和 CEX 属于托管的范畴,两把私钥都交了出去,相对来说 CEX 不透明程度更高,最起码 Pool 相对来说还是“去中心化的托管”

四种方案各有优劣,用户主要集中在资金安全、便捷程度、成本付出、收益水平等几个维度做综合的考量。无疑 Pool 方案属于折中也是最吸引市场关注的方案,因为保证了收益率的前提下降低了用户进入 LSD 门槛,同时以“看似去中心化托管”的方式,质押者安全心理得到补偿;

当前市场着重抨击的是 CEX 解决方案,其中心化质押的方式,附带虚高或者标高的收益率,协议并没有详细披露,用户在没有知情权的情况下容易被“搭便车”,不明就里的规则往往是平台方笼络资产的手段,不过 CEX 作为最直接的质押入口,方便或合规的需求可能是相对去中心化质押协议最大的竞争对手,否则也不会占有 30% 的份额。

二、ETH 质押高收益率叙事能延续吗?

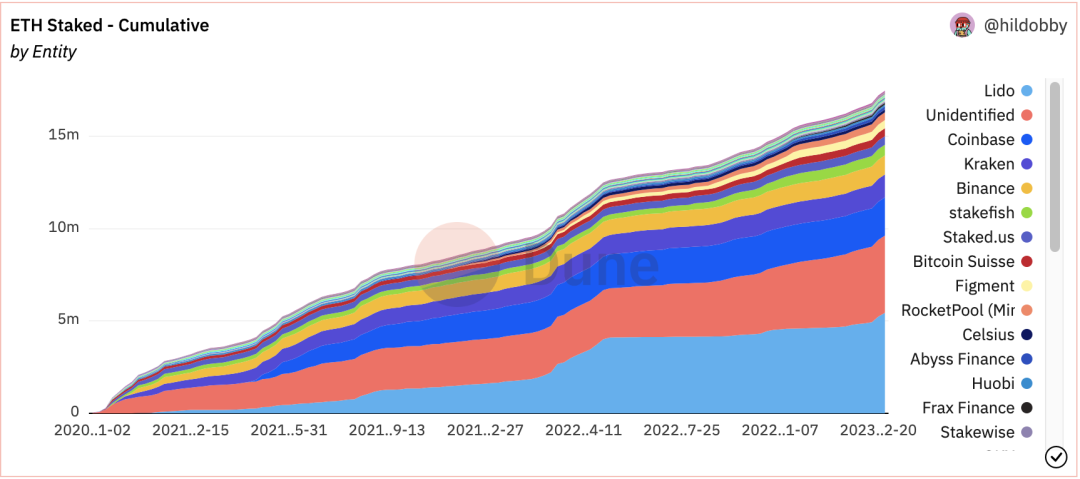

以太坊主网质押收益率和整体锁仓量是相互排斥的状态,当前质押率大概是 14.6% ,且收益率会随着全网质押数量提升而降低,因此市场很多人预计上海升级后收益率会大幅度下降,作为固定收益产品其竞争力比不上美国国债同期水平,由此 LSD 市场可能并没有如此大的想象空间,下面由收益率的时间和空间两个维度说明 LSD 赛道的收益率是如何做多维拓展。

2.1 时间维度:

主流公链质押率普遍在 60% +的水平,Solana-70% 、Bnb-90% , 2020 年 12 月 ETH 信标链发布并开启 POS 质押存款,经过 21 年全年验证节点的“同舟共济”,才将质押率提升至不到 15% ,因此验证节点和质押率的提升并不是一蹴而就,需要市场和矿工之间的博弈。

并且按照当前质押主网的规则,每天大概能够容纳 5 w 个以太坊新进入合约,在没有大额提款的前提下一年才能够增加 15% 的份额,因此 LSD 收益率并不会骤降,会在较长时间内维持在一定的水平。

在此空档期,基于 LSD 衍生出的各种加杠杆工具会提振收益率,甚至外部赛道的补贴也会流入 LSD,因此收益率因为主网质押率提升而下降的部分会被中和。

2.2 空间维度:LSD APR-War 初露端倪

Ⅰ、循环借贷并质押

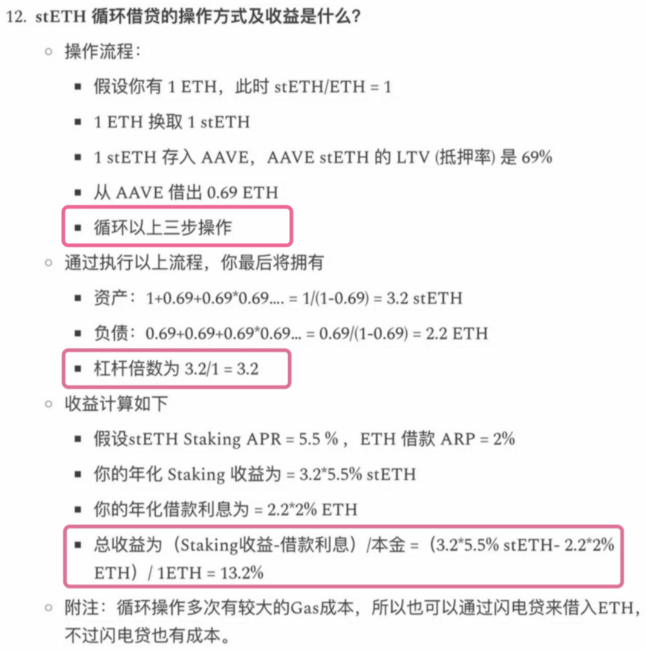

当前 LSD 赛道拓展收益的方式主要集中在两种,其一是将 stETH 以循环贷的方式放大杠杆,如果不考虑借贷成本最终能够获得 3 X 杠杆、 13% 的收益率,相对于国债收益率有很大的溢价空间,利差的抹平也需要时间的考量;

另外通过 Aave V3高效模式,循环质押能够将杠杆放到 1 0x的水平,收益率也会随着扩大,不过值得注意的是,一方面此举有较高的借贷费用,另外杠杆放大倍数过高会为退出造成阻碍,循环贷市场的虚假流动性,1 亿美金的流动性可能背后只能由 2000 美金市值的资产作为背书,加杠杆的过程很容易,但是争相踩踏解杠杆会让流动性快速枯竭。

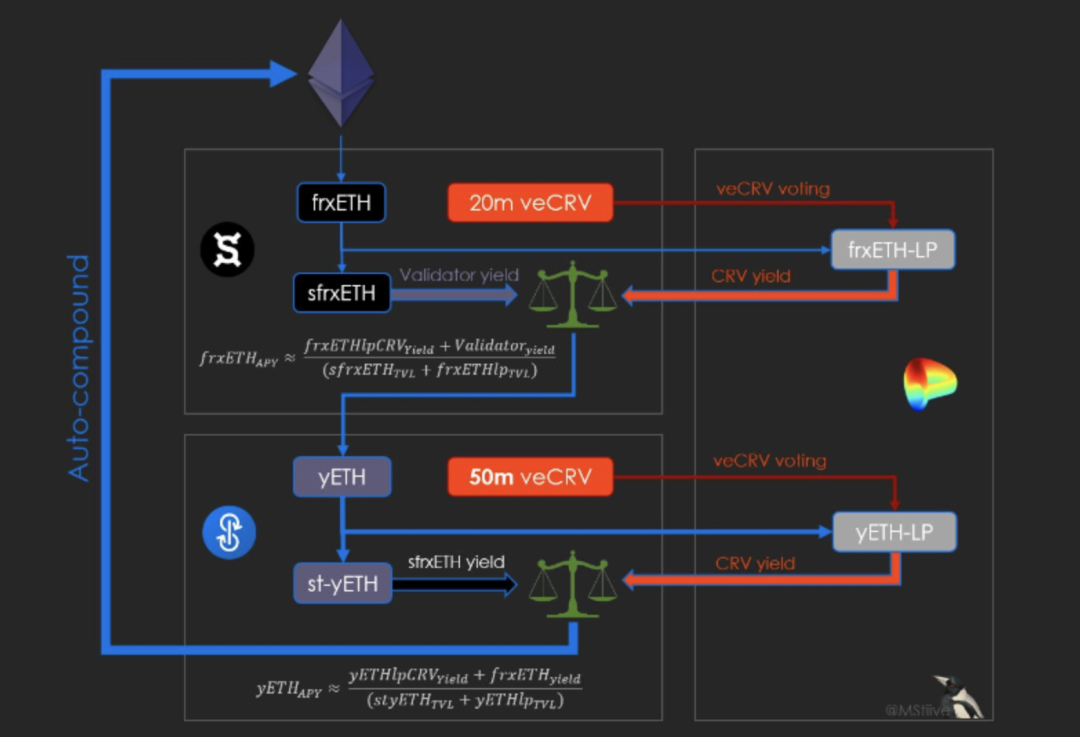

Ⅱ、老牌 DeFi 协议外部补贴

不以加杠杆的方式,也有类似 FXS 和 YFI 等老牌 DeFi 协议,手中握有大量 veCRV 选票,操纵贿选的方式改变 curve LP 排放收益的力度,本质上是以外部补贴的方式补贴 LSD 质押者的收益,并作为核心手段切入到 LSD 赛道。

其实这些老牌协议从 DeFi 协议中切入到 LSD 赛道是非常明智的做法,一方面早期 DeFI 积累的资源可以做二次开发利用,在 LSD 赛道中开垦相当于出场就有好牌在手;

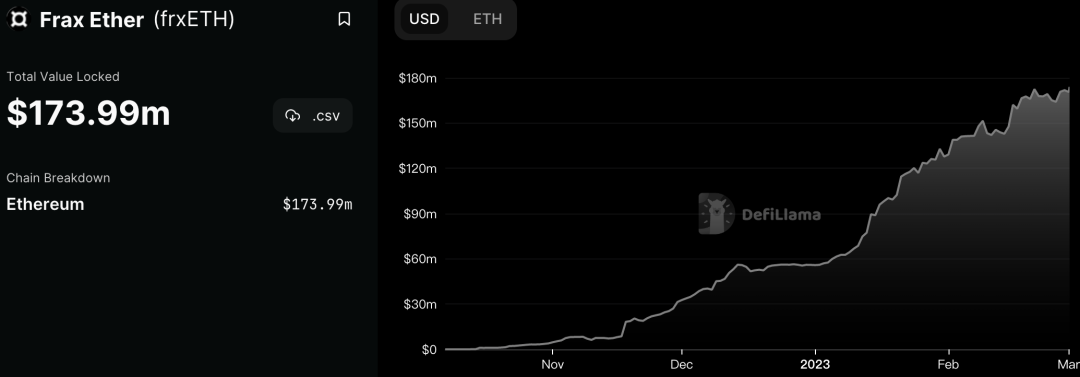

另一方面老牌 DeFi 协议增长陷入瓶颈,YFI 自 21 年 11 月开始 TVL 就处于持续出逃的状态,峰值 50 亿滑落至当前 4 亿附近,近期 FXS 将 LSD 作为容纳资金的新敞口后,TVL 从 12 亿快速增长至 15 亿。

在 LDO 成为第一大锁仓协议后,可以遇见的是老牌 DeFi 协议会想尽方法切入 LSD 赛道分一杯羹,在协议代币分配已经耗尽的情况下只能引入外部补贴吸引资金的进入重新推高 TVL;

不过后续的回报可能也是丰厚的,例如 FXS 本身稳定币的玩法,在吸纳大量 ETH 铸造 frxETH 后有可能开发出 lsdETH-USD 稳定币的玩法,叠加一层资产创造,后续会是各个 DeFi 协议瞄准的重点,由初期单纯堆 lsd-TVL 锁仓量逐渐过渡到 APR War 和套娃加杠杆的过程。

Ⅲ、新协议代币挖矿奖励

对于新的 LSD 协议来说,尚未开垦的经济模型是他们的最大优势,直接以代币激励的方式挖矿吸引资金流入,对老牌协议发起一场类似“吸血鬼攻击”,说不定来一场 LSD 挖矿 Summer 呢?类似 Aura Finance 背靠 Balancer 的流动性支持,或许也能成为一匹黑马。

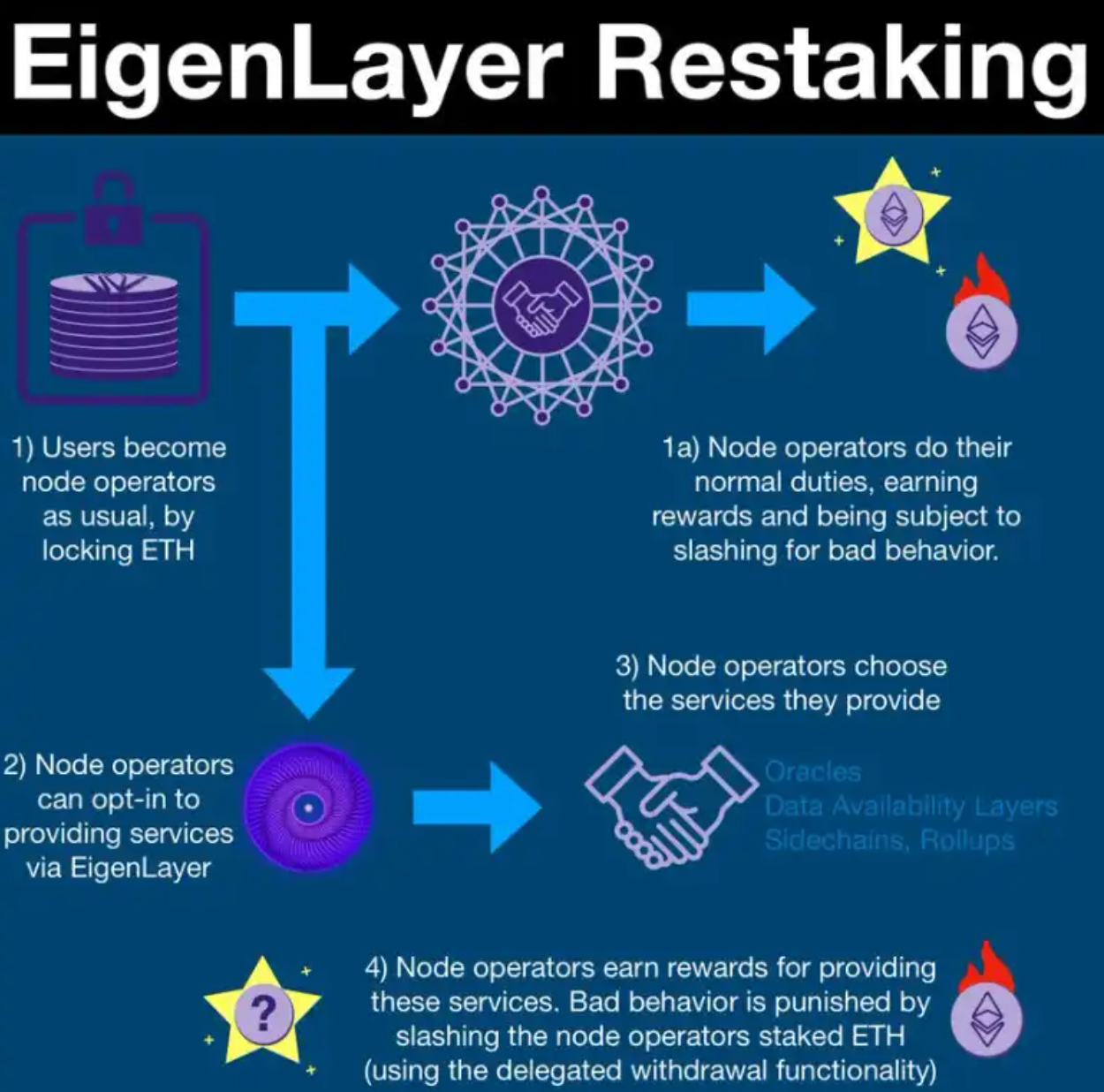

Ⅳ、Re-staking 再质押方案的真实收益

在未来 Eigenlayer 作为 ETH 共识层的扩容方案,透过 Eigenlayer 提出的再质押方案,LSD 流动性代币除了在 ETH 本身的捕获收益外,节点在其他跨链桥、预言机等也能获得收益,如果后续推出 lsdETH 的 LP 质押,可以做到收益的三位一体。

①质押以太坊收益

②合作项目方节点构建、验证的代币奖励

③流动性 Token 质押 DeFi 组 LP 的奖励

详情可以参见:LSD 没整明白,“再质押”叙事就来了

Ⅴ、Dex 上引入 lsdETH 交易对的流动性收入

当前大部分 dex 上的交易对多以 eth 和 usdx 为主,未来随着 ETH 在主网质押率提升,市场上的 ETH 将会减少,其流动性也会不可避免的降低,取而代之的是 lsdETH 的份额会在 Dex 上放大,因此在 ETH 交易对逐渐弱势的前提下,会激发更多资产将 lsdETH 作为锚定资产,基于此会为 LSD 用户叠加一层组交易对、提供流动性的收入。

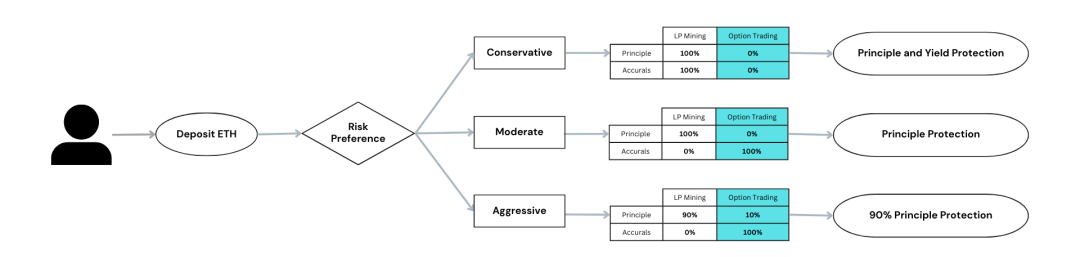

Ⅵ、“固收+”理财产品收益更上一层

ETH-Staking 收益率将代表加密生态系统的“无风险利率”,就像国债收益率在传统金融市场的地位。

固收产品例如存款、国债是传统理财市场中具有最大的规模,衍生出来的“固收+”产品也有几十亿美元的规模。固收+”是一种增加回报率且可保本的投资策略,放在加密世界中,就等于将用户本金存入稳健的固定收益即——POS 质押中,将小部分资金(收益率可以弥补的部分)放入高风险资产,例如合成资产、加密货币、指数基金、量化策略等,以博得较高的收益率。

#小结

因此,对于未来 LSD 赛道整体的收益水平是无需悲观的,收益模式多样化并且具有“部分可组合的特性”。

第一份自带主网质押的保底“固定收益”,第二份在 DeFi 中循环借贷扩大杠杆将收益率成倍提升,第三份 lsdETH/ETH 在 Dex 组成 LP 提供流动性的收益,第四份可预见的“百团大战”LSD 协议的激励收益(老 defi 协议用 curve 等贿选操纵选票,提高激励上限,而新协议挖治理代币排放,类似于初期的 LDO),第五份 Eigenlayer 为代表的再质押协议赋予额外的第三方项目的验证节点奖励,第六份来自于 Dex 上引入(lsdETH/某 token)交易对的流动性激励收入,第七份收益聚合器将挖矿奖励复投高额汇报理财产品所带来的“固收+市场”。

以上的 7 种收益虽然不能完全叠加,但是可以通过“部分叠加组合”的方式扩大收益率。

例如 LSD 收益聚合器协议 Shield 采用的策略之一是,质押者一半 ETH 存入 LDO,获得主网①节点验证奖励的同时得到流动性质押代币 stETH,然后将剩下的一半 ETH 共同组成 stETH/ETH 的 LP 存入 curve 获得②平台流动性奖励和③curve 激励奖励,此举可以将纯质押的收益率提高 20-30% ;另外如果用户想要获得更高的收益,shield 会将部分收益④购入锚定 ETH 价格的期权获得价格增值的收益,是一款加密世界的“固收+”产品。

综上,从时间上,POS 质押的速率会延缓收益率大幅骤降的可能性,期间所形成的时间窗口会给出 LSD 赛道更多创新性的玩法,推高锁仓量的同时扩大质押资产收益与流动性,叠加的金融属性将打破 TVL 和 APR 在 LSD 赛道互斥的魔咒。

下文再聊一聊阿尔法的方向,不涉及具体标的。

三、关于一些题外话:

Ⅰ、上海升级后 lsdETH 协议是否还有存在的必要?

我们的可以回到用户对以太坊进行流动性质押的目的是什么,最直观的目的主要是三点:门槛、流动性和金融属性。

上海升级主要是优化了退出和质押奖励提取的流程,只能解决流动性的需求,白瞟一份甚至更多收益率更多是大户所注重的,降低质押门槛+方便更多是散户所看中的,增加 lsdETH 的金融属性和杠杆规模是协议方所注重的。

为此,lsdETH 协议不光会存在,而且竞争激烈,如果未来出现市场上 lsdETH 相比原生 ETH 更普遍的使用、流通也不会意外。

Ⅱ、未来可以重点关注 LSD 哪些赛道?

某个赛道的价值发现一般是遵循中游到上下游逐渐扩散的过程,例如 LDO 等去中心化的质押协议更多的是聚焦中游赛道,不过中游赛道也是率先被价值发现,当前估值水平(P/F≈ 1 0X)已经可以同 UNI 匹配。

另外 LSD 中游当前属于收益存量有限(每日 1500 产量上限),红海赛道,一众新老 DeFi 协议带着外部补贴和代币激励抢市场,同时也有交易所与合规赛道对其虎视眈眈。

因此,未来中游更深一步的价值发现依托上海升级后 TVL 质押率的提升及相关协议例如 Re-Staking、DVT、DeFi 协议对 Lego 的搭建等,用加杠杆的方式弥补收益率的不足。

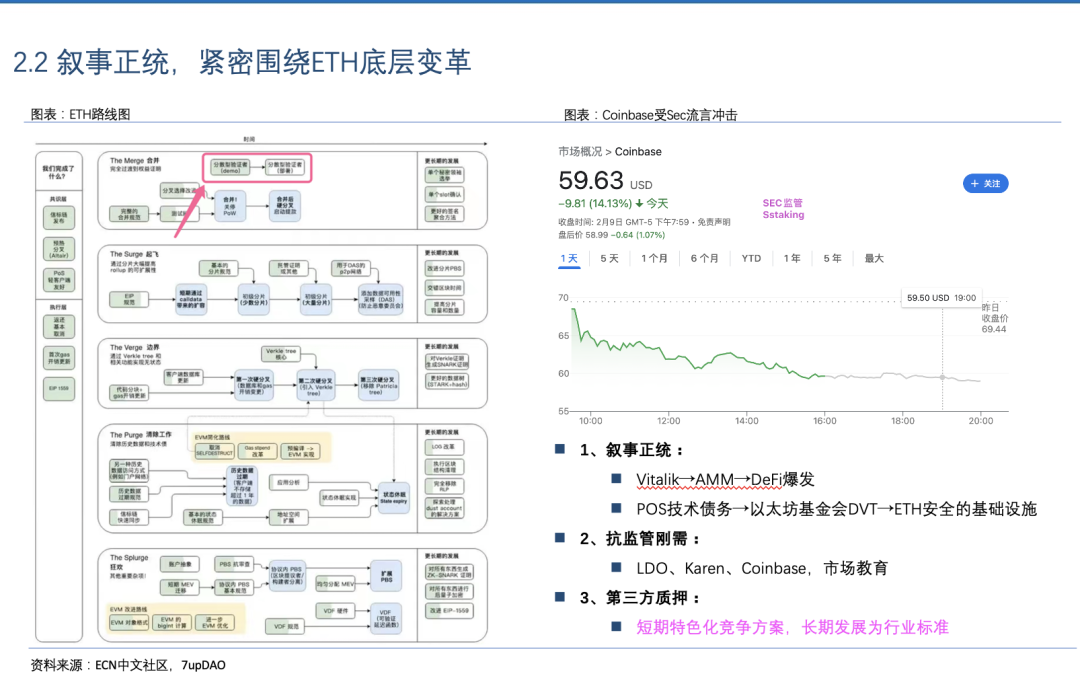

LSD 上游赛道最直接的就是 DVT 相关技术的协议。

→叙事面:DVT 技术是 ETH 生态安全必不可少的一环,源自 Merge 转 POS 后所形成的技术债务,且 DVT 本就是以太坊基金会提出,只是分拆单拎出来做,DVT 和 ETH 可以说是相互依赖,且 to B 业务更具有市场壁垒和技术积攒。

→生态面:短期特色化竞争方案,长期发展为行业标准,经过足够的市场教育(SEC、kraken、Coinbase 等)事件,会逐渐认识到抗监管、抗审查的重要性。众多 DVT 协议主网尚未上线仍是优势。

下游赛道主要是尚未上线的一些收益聚合器和 Re-staking 协议。

收益聚合器是最直接的 LSD 质押入口,高收益是抓住用户注意力最直接的方式,前文讲到后续 LSD 赛道一定会有一场关于 APR 的 War,这也是收益聚合器的机会所在。

最重要的,带领行业走向高光时刻的,更多时候是市场没有预料到的项目,新的玩法叠加上海升级会为 LSD 添上一抹光景。