When the NFT bubble bursts, who will still be able to tell the "IP story" well?

- 核心观点:NFT泡沫破裂,IP需转向实体商业化。

- 关键要素:

- 版税取消致收入归零,社区经济难持续。

- 投机者主导市场,缺乏稳定内容生产机制。

- Pudgy Penguins通过实体产品实现主流突破。

- 市场影响:推动NFT从金融投机转向文化产品建设。

- 时效性标注:中期影响

When the NFT bubble bursts, who will still be able to tell the "IP story" well?

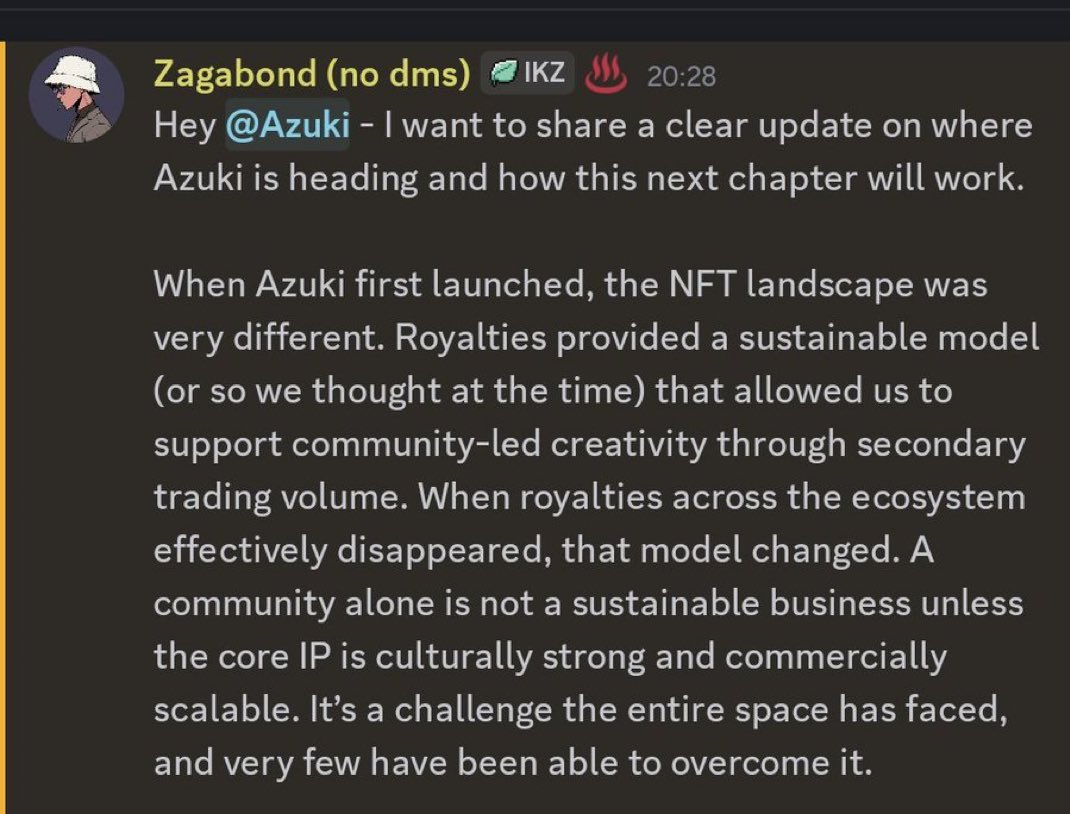

Not long ago, Azuki founder Zagabond made a statement in the community that sparked considerable discussion: "When Azuki first launched, NFT royalties convinced us that this was a sustainable model. But now, the entire industry is losing that support." In the short three-year history of NFTs, this statement almost serves as a footnote to an era—the era of maintaining popularity through consensus, sentiment, and hype is truly over. The topic of Azuki always carries a certain symbolic meaning. This project once represented the highest level of "Web3 streetwear": Eastern aesthetics, youth culture, and cutting-edge visuals—everything seemed to be painting a future version of Supreme for the crypto world. But when the secondary market's royalty mechanism was broken, and when platforms like OpenSea eliminated creator revenue sharing, Azuki and countless other NFT projects suddenly discovered that their "community economic model" had no second life. Without a continuous cash flow, there was no manpower or resources to maintain the dream that was once called "culture." In Zagabond's words, we hear not only Azuki's helplessness, but also the predicament of the entire NFT IP track—the "community + story + avatar" formula seems to have reached its limit.

Source: X

An illusion about "IP"

Looking back at the heyday of NFTs, almost all top projects attempted to tell an "IP story." From CloneX's virtual fashion to Doodles' cartoon universe and Moonbirds' creative ecosystem, everyone was replicating the "Disney myth" in a decentralized way—only replacing the audience with investors. Unlike other types of Web3 projects, the core of IP-based NFTs lies in "cultural resonance." They attempt to build a unique sense of belonging through visuals, stories, and community atmosphere. The problem is that Web3 "communities" are essentially not fans, but speculators. They embrace them enthusiastically when prices rise and quickly leave when the market cools down. This user structure makes IP-based NFTs economically unsustainable: they lack both the product monetization capabilities of traditional brands and a stable content production mechanism. Most projects can initially attract attention with their artistic style, conceptual narrative, or scarcity, but when market enthusiasm wanes and prices decline, community sentiment cools as well. For creativity and culture to translate into industrial value, what is needed is the continuous expansion of the content ecosystem and commercial channels, not just the rise in the price of a single asset.

With the disappearance of royalties, the revenue models of these projects have virtually disappeared, leaving teams clinging to their "beliefs," which themselves require constant narratives to sustain them. This reveals a deeper contradiction: the "cultural narrative" and "financial attributes" of NFTs have long been intertwined; the former requires time to accumulate, while the latter demands short-term returns, making it difficult for most projects to find a balance. This isn't just a mistake by a particular team, but a structural dilemma faced by the entire industry. As a "digital ownership" mechanism, NFTs were meant to be a new engine for the creative economy, but have been overexploited in the hype. We see Azuki and Doodles attempting "IP transformation": holding offline exhibitions, launching clothing collaborations, and doing animation partnerships, but these efforts often amount to more hype than substance, failing to truly drive user growth. For culture to become an industry, it relies on continuous narratives, content, and product implementation, not just fleeting resonance and emotions within the community.

The shift towards realism and commercialization

After the royalty model became ineffective, many projects began to explore new paths—shifting from purely on-chain narratives to real-world applications and branding. This trend is not only seen in established projects like Azuki, but has also become a consensus among new entrants: if NFTs want to become sustainable cultural symbols, they must have off-chain vitality.

Specific manifestations include physical productization, bringing NFT IPs into real-world consumption scenarios through toys, apparel, and art derivatives; content expansion, strengthening IP storylines through animation, comics, and games, making NFTs part of the narrative; and social dissemination, translating Web3 culture into symbols understandable to the general public through short videos and social media content. The essence of these attempts is to free NFTs from their status as "speculative assets" and return them to the logic of "cultural products."

From on-chain consensus to real-world business

Just when many were pessimistic about NFTs, Pudgy Penguins made a surprising comeback. This project, ridiculed as the "ugly penguin" in 2021, has become a "comeback example" in the NFT world after a reorganization by a new team. Luca Netz's first act upon taking over was to bring NFTs into the real world—he launched the Pudgy toy line, available in over 10,000 retail stores worldwide, including Walmart, Amazon, and Target, making it one of the first NFT brands to truly enter mainstream retail channels. Each toy comes with a digital identity, connected to the blockchain world, but more importantly, it's a product that children and families can enjoy, not just a speculative token.

Meanwhile, Pudgy Penguins achieved cross-platform dissemination on social media. Their Instagram and TikTok accounts went viral for their "healing, cute, and heartwarming" content, with individual videos often garnering tens of millions of views. Unlike other NFT projects that rely on "internal consensus," Pudgy Penguins' audience comes from ordinary people. It brings "Web3 culture" into the mainstream in a light and gentle way—no wallets or blockchain knowledge are required, just a liking for it. This is the difference: the former pursues a "decentralized ideal," while the latter pursues "centralized commerce," and the latter is more in line with the essence of IP—to be liked, spread, and purchased. Pudgy Penguins' path demonstrates a "multi-interface resonance" strategy: toy-making to connect with real-world channels, gamification with the mobile game Pudgy Party (which surpassed one million downloads in two weeks), and offline expansion with the opening of Pudgy Café in Gangnam, Seoul, and exploration of collaborations with brands such as BE@RBRICK and Hyundai.

More symbolically, PENGU is completing its leap from a meme to a "cultural symbol." When traditional financial giant VanEck changed its official avatar to a penguin wearing a "vaneck intern" hat, when its CEO Jan van Eck publicly released photos wearing a giant penguin costume, and when the adorable PENGU mascot appeared at Nasdaq's closing bell ceremony, these images conveyed signals that went beyond simple marketing—for the first time, mainstream financial institutions were proactively, openly, and even enthusiastically adopting crypto culture. The "warmth, humor, and friendliness" conveyed by PENGU contrasts sharply with the stereotypes of traditional finance and the "Degen" culture of the crypto world, making it a "translator" connecting the two worlds. Between the cold financial system and the vibrant Web3 community, this little penguin uses the most intuitive visual language to make complex financial concepts approachable. When culture, branding, and finance begin to converge, and when PENGU frequently appears in ETF advertisements and events of top financial institutions, it symbolizes not only the success of a project, but also how crypto civilization, with its unique charm and consensus, has moved from the periphery to the center and finally ascended to the mainstream financial hall.

Source: X

Precipitation and Continuation

Looking back at the evolution of NFTs over the past few years, we find an interesting phenomenon: those projects that have gone further are often not the ones with the most radical technological narratives, but rather those that best understand how to build emotional connections with users. Pudgy Penguins chose a more traditional path—using products, content, and channels to allow people to like an image without first understanding blockchain. This reveals a fundamental principle of IP projects: no matter how innovative the underlying technology, the establishment of cultural symbols always requires continuous content output and emotional accumulation. Blockchain can grant ownership, but the generation of meaning still depends on stories, experiences, and resonance. Projects that rely too much on technological concepts and neglect the content itself often struggle to build long-term user engagement. Pudgy Penguins' experience shows that the growth of an IP requires multi-dimensional support—products, stories, channels, and genuine user affection. When projects begin to differentiate between "holders" and "users," and when evaluation criteria shift from "floor price" to "cultural influence," NFTs may finally find their true place in the cultural industry. The market's fervor will eventually subside, but the cultural value accumulated in the process may continue in various forms. The significance of NFTs as a tool will ultimately be defined by these practices.