Popularization is the only way for the development of encryption: looking at the industry development trend from three typical paths

- 核心观点:加密行业面临大众化困境。

- 关键要素:

- 技术成熟但用户体验复杂。

- 用户需承担更多金融责任。

- 监管不确定性阻碍参与。

- 市场影响:推动行业转向降低用户门槛。

- 时效性标注:中期影响。

The Dilemma of Popularization in the Crypto Industry

Over the past decade or so, the crypto industry has made tremendous technological progress. From decentralized consensus mechanisms to smart contract platforms, from stablecoins to on-chain financial instruments, innovations are endless. However, from a macro perspective, the industry still faces a fundamental problem: most people have yet to truly enter the crypto world.

This disparity between technological maturity and user adoption reflects the core challenges of the crypto industry. From a technical perspective, blockchain infrastructure is already quite mature, enabling users to perform nearly all traditional financial services on-chain. However, from a user experience perspective, wallet usage, gas fee payments, complex interaction logic, and even a basic understanding of cryptocurrency itself pose significant obstacles for the average user. The deeper issue lies in the differences in user psychology—traditional finance appears to be a "black box" to the average user, while the crypto world requires users to assume greater responsibility: maintaining their own private keys, understanding the risks of smart contracts, and assessing the reliability of projects.

While this shift in responsibility aligns with the philosophy of decentralization, it falls significantly short of the habits and expectations of the general public. This dilemma is further exacerbated by the uncertainty surrounding the regulatory environment. Global regulatory stances on cryptocurrencies are still evolving, impacting not only companies’ product designs but also the willingness of ordinary users to participate.

The rise of popular exploration

Faced with these structural challenges, the crypto industry is gradually rethinking its traditional technology-driven approach. In the past, most projects focused on technological innovation, emphasizing advantages like faster transactions, lower fees, and enhanced security. However, while this "technology-first" approach has driven industry development, it has failed to effectively address the issue of mass adoption. Against this backdrop, some projects have begun exploring different approaches. Their common characteristic is that they no longer prioritize technology as their sole selling point, but instead emphasize "accessibility for all," attracting average users by lowering barriers to entry, strengthening incentives, and building trust.

These explorations have gradually shaped several representative mass adoption strategies: the first is a community-driven approach, which cultivates a large user base through extremely low barriers to entry and then leverages network effects to create value; the second is an identity-based approach, which seeks to establish a global identity system to achieve equitable distribution; and the third is a scenario-based application approach, which packages complex crypto concepts into practical, real-life applications. While these diverse exploration paths differ significantly in their specific implementation, they all point to a common goal: enabling more ordinary people to truly participate in the crypto world. After several years of development, the effectiveness and limitations of these strategies have gradually become apparent, providing the industry with valuable practical experience and profound lessons.

Community-driven model: the game between scale and value

The first approach emphasizes building a large user base through extremely low barriers to entry, then relying on network effects and community consensus to create value. The core principle of this model is that with enough people participating, a valuable network can be formed. Pi Network (also known as Pi Coin) is a prime example of this model. Since its launch in 2019, it has championed the slogan "Everyone can mine," allowing participants to participate with just a smartphone and the click of a button. Compared to traditional mining, which requires expensive equipment, Pi's entry level is virtually zero. After several years of growth, its global registered user base has reached tens of millions, and its user-to-user invitation mechanism has generated a powerful fission effect. However, these years of development have also exposed a core challenge of this model: how can this massive user base be converted into real value? Although Pi has gradually progressed towards its mainnet launch, ecosystem development has been slow, and actual application scenarios remain limited. User enthusiasm has begun to diverge, and skepticism has gradually increased.

Facing these challenges, Pi Network is pursuing breakthroughs on multiple fronts. Regarding technical upgrades, the team has upgraded the protocol from version 19 to version 23, drawing on the proven design of the Stellar protocol to improve network scalability. They have also added Linux node support and launched the Testnet 2 test network in preparation for the mainnet migration. Regarding ecosystem development, the project is actively cultivating the DApp ecosystem through development tools such as the Pi App Studio and the Brainstorm App. The ongoing Pi Hackathon 2025 will focus on incentivizing the development of practical applications in business, education, and governance, while continuously integrating more core applications into the PiNet platform. Pi Network has made particularly significant progress in real-world application breakthroughs. The project has partnered with renowned platforms such as Onramper, Onramp Money, TransFi, and Banxa, enabling fiat-to-Pi coin conversion channels in over 60 countries and regions, enabling users to more conveniently participate in real-world financial activities. Through the merchant partnership program, users can now directly purchase goods and services with Pi coin in select emerging markets, marking a significant transition from proof-of-concept to real-world application.

To build user trust, Pi Network is embedding KYC verification directly into the blockchain through protocol upgrades and introducing trusted third-party verification agencies to create a more decentralized identity authentication system. To address the long-standing issue of KYC processing speed that has plagued users, the team has pledged to launch automated verification testing and mobile-friendly solutions. Regarding transparency, the project founders will deliver a keynote speech at the TOKEN 2049 Singapore Conference, sharing insights on how blockchain can generate real-world benefits. They will also maintain open communication with the community through regular blog updates. This case study demonstrates that while a community-driven model can rapidly build user scale, user numbers alone are not sufficient to build a sustainable ecosystem. Translating community consensus into tangible value requires simultaneous efforts across multiple dimensions, including technological optimization, ecosystem development, real-world applications, and trust mechanisms. Pi Network's ongoing systematic efforts demonstrate that, despite facing skepticism, this model is actively pursuing a viable path to transition from pure user growth to practical value.

Source: Pi official website

Identity authentication model: the collision of idealism and reality

The second path seeks to democratize access through the establishment of a global identity authentication system, emphasizing fair distribution and financial inclusion. This model believes that true financial inclusion can be achieved by ensuring the unique identity of each individual. Worldcoin is a representative project of this model. Since its announcement in 2021, this project, led by OpenAI co-founder Sam Altman, has established a "globally unique identity" through iris scanning and distributed tokens to individuals. Its starting point is to promote financial inclusion: everyone can receive tokens free of charge based on their identity. After several years of promotion, Worldcoin has established scanning points in multiple countries and accumulated a sizable user base. The token will begin trading after the project's official launch in 2023.

However, the reality is far more complex than idealized. Governments in several countries have raised concerns about privacy and data security, and some regions have even suspended scanning activities. To address these challenges, Worldcoin has taken a series of measures: making the Orb software open-source to increase transparency; launching a "personal data hosting" feature that allows users to store iris data on their own devices rather than on centralized servers; allowing users to "unverify" their identities to permanently delete their iris codes; and implementing face-to-face age verification to ensure that only users over 18 can use the service.

Despite these efforts, Worldcoin has faced intense regulatory scrutiny and even bans in some countries. For example, the Spanish Data Protection Authority ordered the deletion of all collected iris data. These cases highlight the clash between technological idealism and the realities of the regulatory landscape. Even well-resourced and well-established projects struggle to cope with cross-border regulatory challenges. While theoretically appealing, the identity authentication model faces significant compliance and privacy challenges in practice.

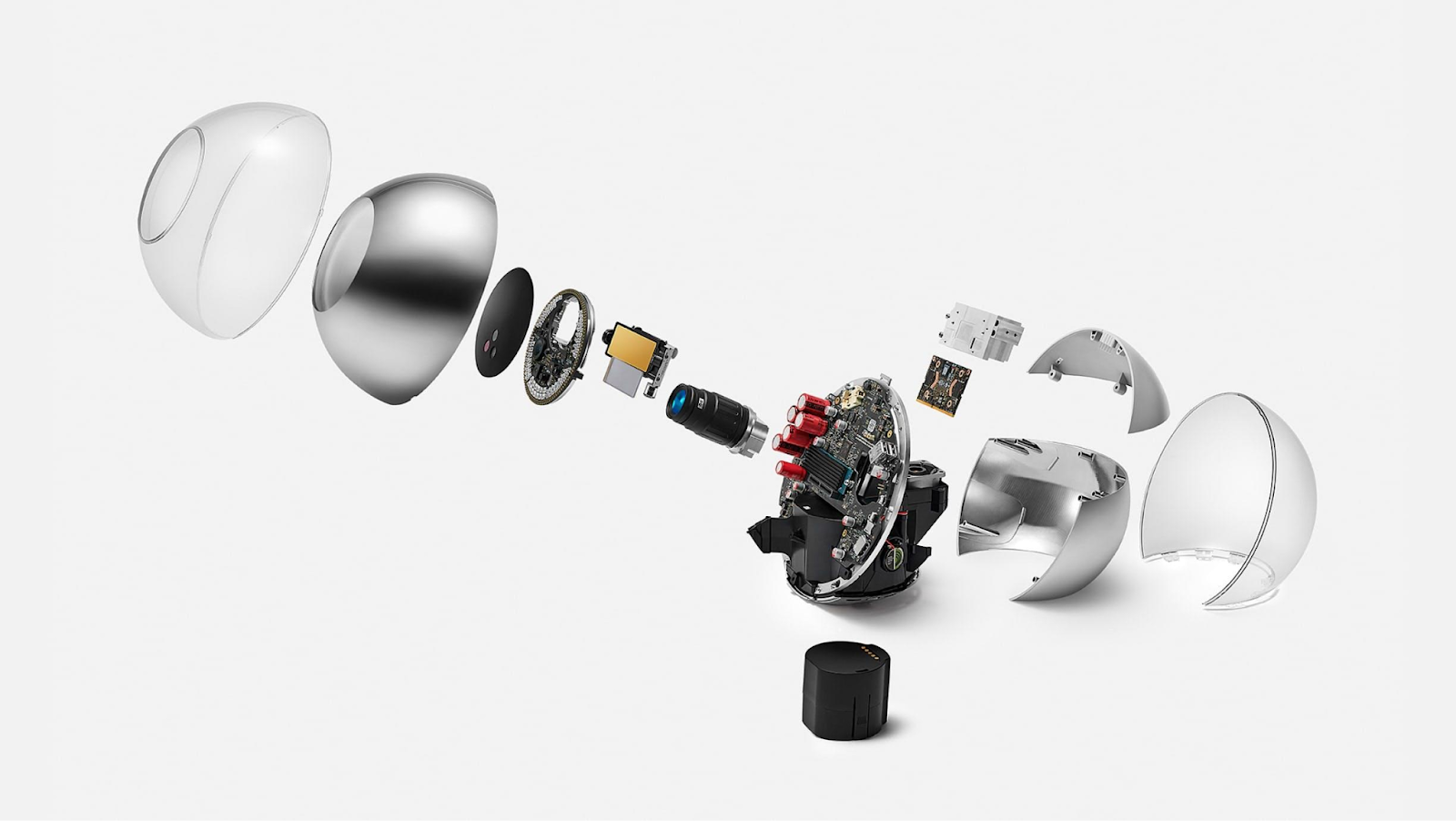

World Coin Iris Scanner

Scenario-based application model: the cycle of prosperity and bubble

The third approach attracts users through concrete, everyday scenarios, packaging complex crypto concepts into simple, accessible application experiences. This model's advantage lies in its ability to quickly reach new audiences, allowing users to participate even without a full understanding of the underlying technology. StepN's explosive popularity in 2022 is a prime example of this model. Its "exercise-as-mining" design allowed countless users to experience NFTs and on-chain assets for the first time. The project amassed millions of users in just a few months, sending token prices soaring. Its success stemmed from finding a relatable use case: everyday exercise could generate income. However, StepN's decline was equally rapid. As new user growth slowed, the unsustainability of its token economic model became clear. High NFT prices, declining mining returns, and a lack of alternative application scenarios led to a significant user exodus, and by the second half of 2022, the project's popularity had waned significantly.

Faced with these challenges, the StepN team explored various measures. Regarding the economic model, they adjusted the issuance and destruction mechanisms for GST and GMT, introduced energy caps, maintenance fees, and the ability to burn GST to upgrade shoes to reduce the circulating supply of tokens. Regarding application development, they launched a marathon mode and co-branded NFT shoes, and planned to add new game modes and social features. Regarding compliance, they actively engaged with the community, listened to feedback, and closely monitored regulatory developments to ensure operational compliance. Despite these efforts, these technical adjustments haven't fundamentally resolved the issues. Core challenges remain: establishing a sustainable economic model, expanding application scenarios, and rebuilding user confidence. This case study vividly illustrates the characteristics of a scenario-driven model: while it can quickly ignite a market, prosperity often struggles to sustain without sustainable economic mechanisms and ecosystem support. It demonstrates that relying solely on gamified incentives and short-term profit expectations is insufficient; true mass adoption requires deeper value support.

Source: Adidas

Path reflection and future prospects

These three exploration paths offer valuable lessons for the democratization of crypto. The community-driven model demonstrates the powerful appeal of a low-barrier-to-entry strategy, but also exposes the difficulty of converting user scale into value. Network effects alone cannot automatically generate sustainable economic value. The identity authentication model demonstrates the importance of institutional development, but also illustrates the regulatory complexity of global solutions. Balancing technological ideals with practical constraints is a key challenge. The scenario-based application model demonstrates the disruptive power of specific use cases, but its rapid decline also serves as a reminder of the importance of sustainability. Short-term incentives cannot replace long-term value creation and ecosystem development.

These practical experiences demonstrate that the popularization of cryptocurrencies isn't a problem that can be solved with a single path, but rather a systematic project that requires comprehensive consideration of multiple dimensions. Judging from the development history of these cases, true popularization may require several key elements: a sustainable economic model is fundamental and must be built on real value creation, rather than simply token distribution or speculative incentives; regulatory compliance is becoming a necessity, and future projects must consider compliance issues from the outset; user experience remains key, and lowering the technical threshold should be reflected not only in ease of operation, but also in conceptual understanding and perceived value; incremental development is more sustainable than explosive growth, and healthy popularization should be a steady, step-by-step process.

Conclusion

As the crypto industry matures, technological innovation is no longer the sole competitive factor. The future of the industry will be determined by who can find a sustainable path to mass adoption. While these three exploration paths each have their limitations, they provide valuable practical examples for the industry as a whole.

True democratization won't happen overnight; it requires the coordinated development of multiple aspects, including technological advancement, institutional improvement, regulatory clarity, and user education. Only when we balance ideals with reality, innovation with compliance, and speed with sustainability can the crypto world truly open its doors to everyone. This is not only an inevitable trend in technological development but also the path to realizing the original vision of blockchain technology.