Real Estate "Shorting Tool" Emerges, Polymarket Launches Real Estate Prediction Market

- Core Viewpoint: Prediction markets provide a new hedging tool for real estate.

- Key Elements:

- Parcl provides a transparent home price index for settlement.

- Users can trade expectations of price increases or decreases without dealing with physical assets.

- Initial coverage focuses on high-liquidity US cities, with future expansion planned.

- Market Impact: Introduces new pathways for risk management in low-liquidity markets.

- Timeliness Note: Long-term impact.

Original | Odaily (@OdailyChina)

Author | Asher (@Asher_ 0210)

The value proposition of "everything is predictable" continues to rise.

On the evening of January 5th, the on-chain real estate platform Parcl announced a partnership with the prediction market Polymarket, aiming to integrate Parcl's daily housing price indices into Polymarket's new real estate prediction market. Influenced by this news, Parcl's native token PRCL surged by over 150% at its peak before retracing. Its current price is approximately $0.042, with a market capitalization of $19 million.

Operational Details of Polymarket's Real Estate Prediction Market Segment

Partnership Details:

- Parcl provides daily housing price indices, serving as an independent, transparent reference data source for market settlement;

- Polymarket is responsible for listing and operating the markets, where users can trade using USDC on the Polygon chain;

- Market settlements are based on Parcl's publicly verifiable indices, avoiding the delays (typically monthly) and subjectivity associated with traditional real estate data.

Market Types:

- Predicting whether housing prices will rise or fall within a month, quarter, or year;

- Threshold-based markets: e.g., whether prices will exceed a specific level;

- Each market links to a dedicated settlement page on Parcl, displaying final values, historical data, and index calculation methodology.

Coverage:

- Initially launching with high-liquidity U.S. cities such as New York, Miami, San Francisco, Austin, etc.;

- Plans to expand to more cities and market types based on user demand.

Current Status:

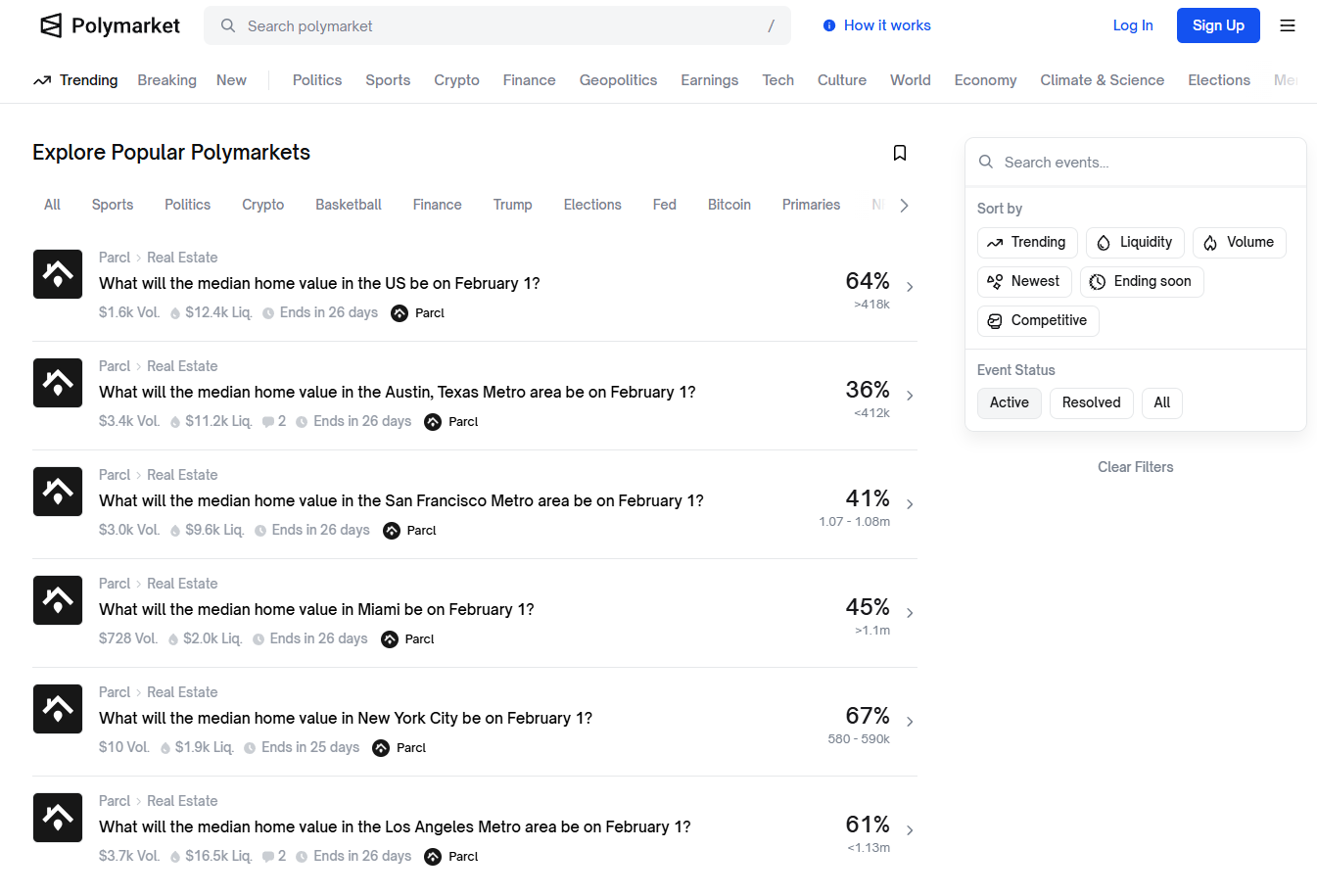

Currently, this segment has only launched 7 monthly real estate prediction events with relatively low liquidity. The event with the highest trading volume, "Los Angeles, USA - House Median Price on Feb 1st," has only $3,700 in volume.

New Real Estate Prediction Market Segment on Polymarket

In traditional real estate markets, whether bullish or bearish, such expectations are difficult to express directly, let alone form continuous market signals. Polymarket's introduction essentially separates "judgments on housing prices" from asset transactions. As long as there is a clear settlement standard, the expectation itself can be priced independently.

Real Estate Markets Finally Have a "Shorting Tool"

An easily overlooked fact is that the potential demand for real estate-related markets does not solely originate from native speculators in the crypto world.

In the traditional financial system, "falling housing prices" is almost a risk that cannot be directly hedged. Whether holding property or having an asset structure and income source highly dependent on a particular city's real estate cycle, the practical response is often to continue holding or directly sell the physical asset—both involve high transaction costs, long cycles, and lack flexible intermediate options. As KOL 0xMarioNawfal (@RoundtableSpace) stated: "This is far more than betting; it's bringing liquidity to one of the world's most illiquid markets. Imagine housing prices are at historic highs, you expect a crash but can't sell your house—now you can hedge, short the market."

The introduction of prediction markets abstracts the risk of falling housing prices into a tradable judgment. When prices are high and market expectations begin to weaken, the price trend of real estate itself can be priced separately without having to manage risk by disposing of the underlying asset.

Through Polymarket, the downside risk of real estate prices is abstracted into a tradable judgment rather than necessitating the disposal of physical assets. From this perspective, Polymarket's real estate prediction markets resemble a simplified macro hedging mechanism more than a mere speculative game around price movements. It does not change the liquidity structure of real estate assets themselves but provides a tradable layer for a traditionally low-liquidity market that can reflect expectations in real-time.

Polymarket CMO Matthew Modabber stated: "Prediction markets work best for events with clear, verifiable data. Parcl's daily housing price indices provide us with a transparent, consistent settlement foundation. Real estate should be a first-class category in prediction markets."

This collaboration between Polymarket and Parcl also introduces traditional real estate price signals into the crypto system: Originally low-frequency, closed, and high-barrier-to-entry assets are decomposed into settleable, verifiable, and tradable index outcomes, taking a form closer to stock indices or crypto derivatives. This may represent a more practical and demand-aligned implementation path within the RWA narrative.