When War Is Settled Before the News: How Prediction Markets "Priced" Maduro's Arrest Operation 6 Days Early

- Core Viewpoint: Prediction markets become a new channel for insider trading.

- Key Elements:

- Three Polymarket addresses placed bets in advance, profiting over $630,000.

- The earliest bet was placed 6 days before the official news, suspected to be based on insider information.

- Platform anonymity (no KYC) facilitates insider trading.

- Market Impact: Triggers regulatory scrutiny, challenging the compliance of prediction markets.

- Timeliness Note: Medium-term impact.

Original | Odaily (@OdailyChina)

Author | Golem (@web3_golem)

A Small Story Before the Arrest of the Venezuelan President...

On January 1, 2026, Eastern Time, after experiencing troubles like assassination attempts, coin launches, and tariff trade wars, Trump managed to survive the first year of his presidency relatively smoothly. But he had no time to celebrate. At that moment, he was secretly plotting a world-shocking military operation with several key White House figures and military generals at Mar-a-Lago in Florida.

They were finalizing the operation details in a secret, highly anti-eavesdropping room. The atmosphere was tense, and Trump felt thirsty. He pressed the cola button on the table, wanting an iced cola. A waiter, carrying the cola, passed through layers of Secret Service personnel and delivered the still-fizzing drink to Trump's hand. "There must be no mistakes in tomorrow's operation against Maduro," Trump muttered.

Those who have long served political elites know to be appropriately "deaf and mute" at times, or else they might invite trouble they cannot handle. However, this "Cola Kid" was clearly willing to take a risk.

That night, the waiter "Cola Kid" opened the world's largest prediction market, Polymarket, and registered an account. He didn't understand the crypto industry, but he knew this platform had correctly predicted Trump would become the 47th US President last year. Then, he bought "yes" on several related prediction outcomes, including "The US will invade Venezuela before January 31, 2026." The probability was only 6% at the time. He invested his entire month's salary.

At 22:46 Eastern Time on January 2, 2026, Trump issued the raid order. Over 150 fighter jets took off from 20 bases, conducting a low-altitude surprise attack on the Venezuelan coast.

At 01:01 Eastern Time on January 3, US forces breached Venezuela's air defense system. The US Delta Force ground special forces arrived at Maduro's residence, broke through the steel door, exchanged fire, subdued Maduro and his wife, and immediately evacuated without a single US casualty. Two hours later, the Maduros were taken to the US warship USS Iwo Jima and subsequently transferred to New York.

Thus, an operation to capture the president of a sovereign state ended within 5 hours. Trump watched the entire process unfold from Mar-a-Lago.

At 04:30 Eastern Time on January 3, Trump announced on Truth Social that the President of Venezuela and his wife had been arrested and removed from the country.

Simultaneously, multiple predictions on Polymarket, such as "Maduro's time of stepping down" and "Trump's time of taking military action against Venezuela," were swiftly settled. That "Cola Kid" had already resigned on January 2. Because by betting early, he had earned his first pot of gold...

(PS: This story is purely fictional. If any director wants to make a movie based on this, I am willing to provide this script for free.)

Insiders Knew About the US Military Operation 6 Days in Advance

While the above plot smells too much like a fast-food novel titled "Rebirth: I Work as a Waiter at Mar-a-Lago," it might not be entirely false. The "Cola Kid" is purely fictional, but the arrest of Venezuelan President Maduro by US forces is real, and it's highly likely that "insiders" placed early bets on Polymarket.

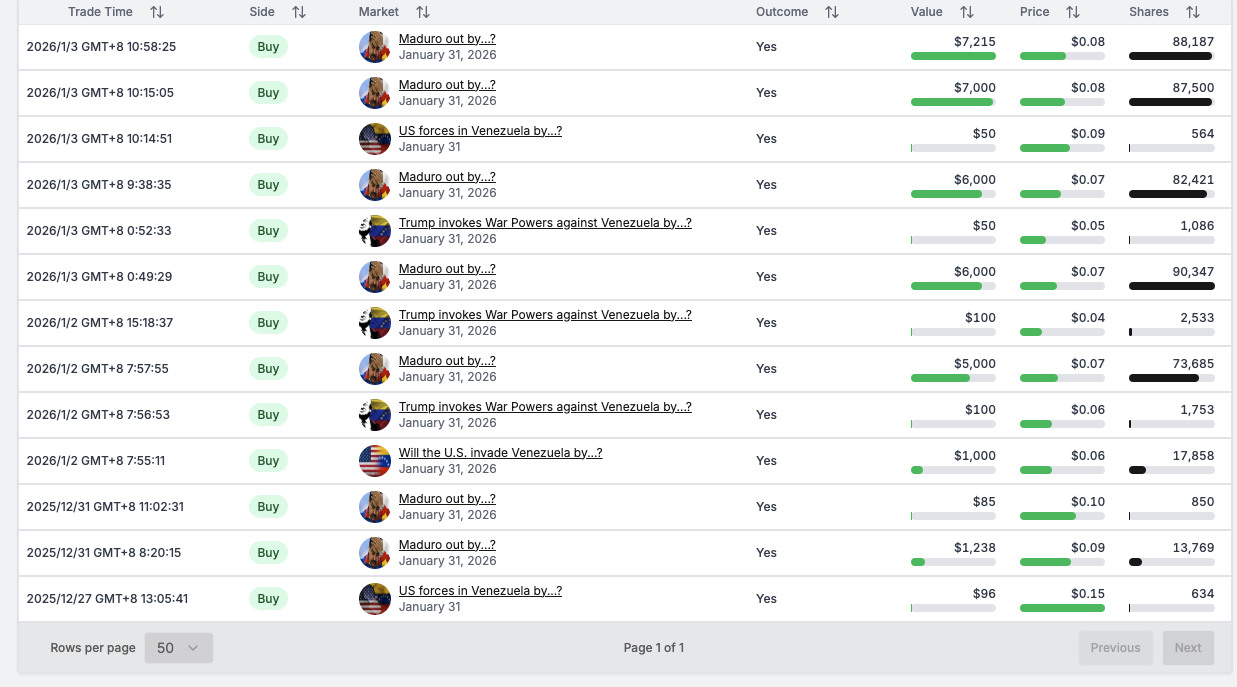

According to Lookonchain monitoring, before Trump announced the arrest of the Venezuelan president, three insider addresses on Polymarket suddenly bet on his ousting, collectively profiting $630,400. Without exception, these addresses were created and funded just days before the event. Among them, address 0x31a5 (0x31a5...8eD9) invested $34,000, profiting $409,900; address 0xa72D (0xa72D...eBd4) invested $5,800, profiting $75,000; address SBet365 invested $25,000, profiting $145,600.

The most impressive among these three addresses is 0x31a5 (0x31a5...8eD9). The US military operation to capture Maduro occurred at 01:00 Eastern Time on January 3. The media and other countries first learned this news at 04:30 Eastern Time on January 3, when Trump announced the operation's completion on Truth Social.

However, this insider with address 0x31a5 (0x31a5...8eD9) first bet on "Maduro will step down before January 31, 2026" at 19:20 Eastern Time on December 30, 2025. He even bet on "The US military will attack Venezuela before January 31, 2026" as early as December 27.

0x31a5 (0x31a5...8eD9) placed bets before the actual US military action

This means insiders knew about the US military operation 6 days in advance and began building positions on Polymarket. Obtaining the operational plans of the US military—arguably the world's strongest armed force—so early is something perhaps no hacker or national intelligence agency could achieve, but Polymarket did.

It doesn't employ any eavesdropping methods; it merely opens an express lane for the greed inherent in human nature. Undoubtedly, this insider must be close to US political elites or senior military officers, perhaps even holding a high position themselves (it's unlikely to be a US soldier participating in the operation, placing orders while fighting?).

More importantly, the actors have almost no fear of exposure. Polymarket structurally possesses inherent advantages in anonymity: no KYC, near-zero account creation cost, sufficient liquidity, and crypto settlement ensuring privacy. Under such conditions, it's highly difficult to trace addresses and confirm real identities afterward.

So when the participation cost is minimized while potential returns are maximized, it's no longer a moral issue but a problem of incentive design. Faced with such a mechanism, even outwardly respectable, righteous politicians can hardly guarantee they will never cross that line.

Predicting Truth or Rejecting Insider Information

But let's consider another possibility: if the Venezuelan government had monitored abnormal buying activity related to this on Polymarket in advance, would things have changed slightly? (This isn't difficult because the insider's bets were quite obvious—large buys in a low-probability market. With prior monitoring, anomalies would likely be detected.)

Then, perhaps the Venezuelan government would have become alert before the US operation. To be safe, Maduro might have moved to a more impregnable underground fortress earlier; or he might have prepared the army for battle (Odaily Note: During the operation, half of Venezuela's army was in a relaxed state due to Christmas holidays). Then, the US military might not have suffered zero casualties but rather a bloody conflict. At the very least, Venezuela could have sought support from other countries in advance or publicly declared the possible US action at the UN to politically constrain the opponent.

Of course, the above assumptions are very rough, and this event might truly be a coincidence. But the fact remains: "Probability changes for major political events on Polymarket always precede mainstream information release."

When this pattern is repeatedly verified, the price signals of prediction markets cease to be mere trading outcomes and begin to be viewed by the outside world as reference indicators. Their function gradually resembles the Pentagon's "Pizza Index"—an informal yet highly sensitive risk thermometer.

This is certainly something US authorities do not want to see.

Previously, US Representative Ritchie Torres planned to introduce the "Predictive Markets Public Integrity Act of 2026," aiming to establish restrictive rules against potential "insider trading" in prediction markets. The bill proposes to prohibit federal elected officials, political appointees, and executive branch employees from trading prediction market contracts related to government policies or political outcomes if they possess or can reasonably access material non-public information in the course of their duties.

Following the exposure of this Polymarket insider event involving Maduro, this bill may receive high-level attention from the US government. The Kalshi PR account immediately responded, stating that its platform rules explicitly prohibit any trading based on material non-public information.

Kalshi can guarantee this because it has been compliance-oriented from the start, with extremely high KYC requirements for platform users. If insider trading occurred, Kalshi could immediately investigate user identities and even freeze funds.

Polymarket naturally becomes a haven for these insiders. To some extent, insider trading and Polymarket are mutually beneficial. Polymarket provides a safe house for insiders to make money, while insider trading brings more trading volume and fame to Polymarket.

Many of Polymarket's breakout moments have been due to revealing truths earlier than traditional media. This isn't because Polymarket players are exceptionally clever, but because a minority guides the probabilities. Ideally, prediction markets reflect the wisdom of the crowd, but in reality, they are just a playground for insiders.

For most ordinary people, this isn't necessarily bad. Through prediction markets like Polymarket, people can sense the direction of certain events earlier, reducing passive reception of sudden news and no longer being entirely subject to emotional public opinion and lagging media narratives. In effect, this resembles a form of "decentralization" at the information level.

But for those at the top of the pyramid, the situation is precisely the opposite. For a long time, "who knows what and when" has been an order in itself. The truth isn't something that cannot be disclosed; it needs to be released at the right time and in the right concentration. Anyone attempting to disrupt this rhythm is seen as challenging the established rules.

Therefore, Polymarket might once again run into the iron wall of US regulation. In 2024, Polymarket's founder was raided by the FBI at his New York home, marking the most tense confrontation between Polymarket and the US government. Now, Polymarket has returned to the US market and obtained CFTC approval, suggesting relations have eased.

However, regarding highly classified military or security affairs like the Maduro capture operation, any form of premature information leakage is unacceptable to the US government. Currently, as prediction markets are in a critical phase of seeking compliant positioning and institutional space, the emergence of such events, even if ultimately deemed coincidental, will be interpreted by regulators as a potential threat.

What prediction markets face is not just a technical compliance issue, but whether they are unintentionally encroaching upon the sensitive boundaries of traditional information security and national governance.

If predictions no longer lead the truth, what remains? This question cannot be avoided in the future.