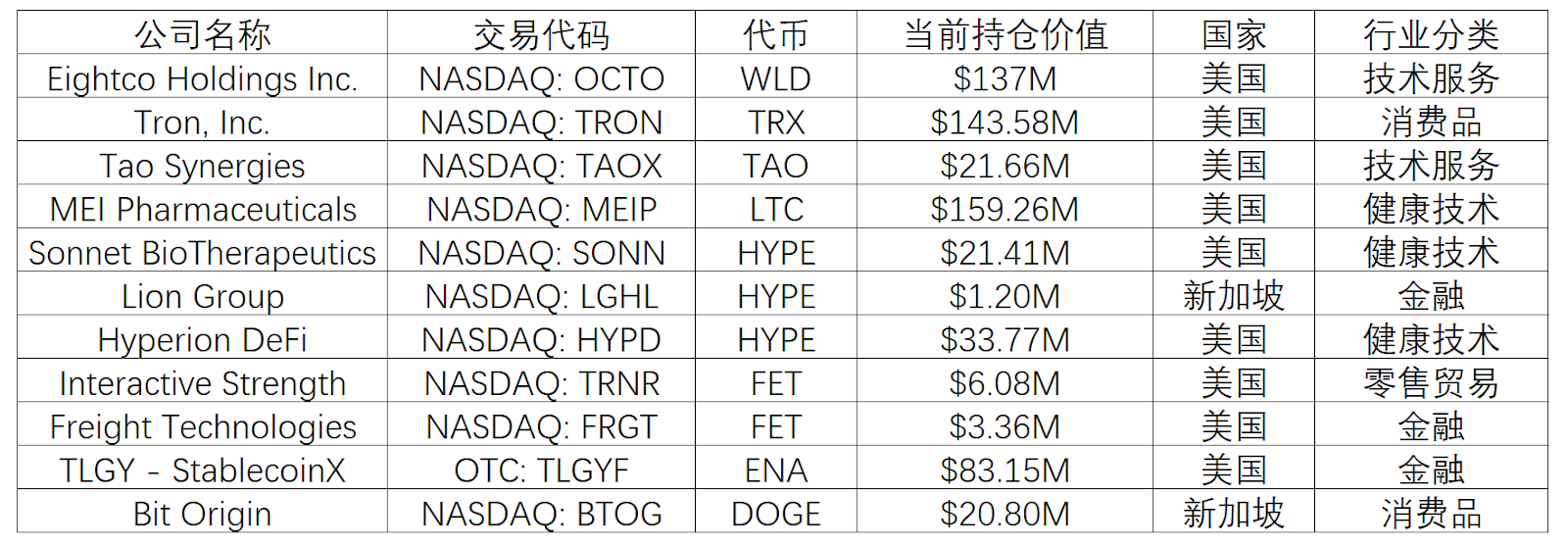

Looking at the financial situation: Which counterfeit products are being paid for by companies with real money in 2025?

- 核心观点:企业财库配置揭示山寨币机构化趋势。

- 关键要素:

- 企业公开披露持仓,约束力强于口号。

- 配置常伴随技术合作与业务整合。

- AI、DeFi基建及支付币成三大主线。

- 市场影响:推动加密资产向价值锚定转变。

- 时效性标注:中期影响。

If market conditions are a thermometer of sentiment, then treasury allocation is a company's voting machine. Who's putting real money on their balance sheets and which altcoins they're betting on is often more reliable than social media buzz. In 2025, we'll see more and more publicly disclosed companies adding non-BTC and non-ETH tokens to their treasuries, such as FET and TAO in the AI sector, HYPE and ENA in emerging DeFi infrastructure, payment veterans LTC and TRX, and even the more socially engaged DOGE. These holdings reflect both business synergies and the desire for asset diversification, offering ordinary investors a window into the market: who's buying, why, and how they're using their holdings. By asking these questions, you'll more easily distinguish strong from weak narratives and understand which altcoins are being taken seriously by institutional investors.

Why look at treasury configuration?

Use "real money" to identify strong narratives. First, it's harder to falsify. Once a company includes tokens in financial reports or regulatory filings, management must explain the size of its holdings, accounting policies, custody, and risks. This is more binding than just slogans. Second, it's closer to "holding for use." During this treasury boom, many companies aren't just buying tokens; they're also signing technical partnerships, introducing tokens for product use, or generating on-chain staking returns. Typical examples include Interactive Strength's plan to purchase approximately $55 million in FET and partner with fetch.ai; Freight Technologies integrating FET with logistics optimization scenarios; Hyperion DeFi using HYPE for staking and establishing a revenue and staking pathway with Kinetiq; and TLGY (to be merged into StablecoinX) planning to establish an ENA treasury to stake Ethena, a synthetic stability and yield structure. The common thread among these initiatives is that tokens are not just prices; they are "certificates" and "fuel." Third, they provide an alternative path for ordinary investors. You can research tokens directly or gain indirect exposure by researching publicly traded companies that hold them. Of course, this is a double-edged sword: when small-cap companies are paired with highly volatile tokens, the stock price often becomes a proxy for the token, leading to more dramatic fluctuations. If you choose indirect stock exposure, position control and a good sense of timing are crucial.

Judging from the market context of 2025, this trend is accelerating. On a macro level, the launch of US spot crypto ETFs has boosted risk appetite. The strength of BTC and ETH has provided a window for altcoins to see a "split-to-global" spillover, garnering more attention for high-quality sectors. Corporate attitudes are also evolving: from "exploratory holdings" a few years ago, they have evolved into "strategic allocations," and even a new breed of "crypto treasury-focused businesses" has emerged. Some companies have proactively transformed, explicitly making the construction and operation of crypto treasuries their core business. Regarding disclosure, companies are no longer content with press releases, but are increasingly disclosing holdings, fair value, custody details, and risk management arrangements through regulatory filings, quarterly reports, and investor presentations. This enhances the verifiability of this information. In short, the excitement is back, the path is clearer, and investors are becoming more serious. This also means that observing treasury dynamics is becoming a reliable window into the direction of the industry.

Recent statistics on altcoin holdings in the treasury of listed companies

Three major altcoin themes: AI, new DeFi, and traditional payment currencies

AI Track (FET, TAO): The key signal of this track is "use and hold." Tokens of AI-native networks are often not simply speculative targets, but rather "tickets and fuel" for access and settlement: the invocation of intelligent agents, access to computing power and model markets, and network incentive mechanisms all require the inherent use of tokens. The entry of corporate treasuries is often accompanied by technical collaboration and business integration, such as closed-loop logistics optimization, computing power deployment, or intelligent agent implementation. Therefore, speculative weighting is relatively low, and strategic allocation is more inclined. However, this track also has uncertainties: the integration of AI and blockchain is still in the verification stage, valuations may preempt future expectations, and the long-term sustainability of the token economy (inflation/deflation mechanisms, incentive models, and cost recovery) remains to be seen.

New DeFi Infrastructure (HYPE, ENA): This sector focuses on a combination of efficiency and profitability. HYPE represents performance-oriented DeFi infrastructure: It leverages a high-performance chain to facilitate derivatives trading and staking derivatives, creating a capital cycle of "earning income + liquid staking and re-hypothecation," providing an efficient utilization path for institutions and capital pools. Corporate treasuries are interested in it, as it not only provides on-chain governance and profitability, but also enhances liquidity and market stickiness through capital circulation.

ENA's appeal lies in its design of synthetic stability and hedging returns. By combining staking derivatives with hedging strategies, Ethena seeks to create a "dollar-like" stable asset and generate an endogenous source of income without relying on the traditional banking system. If this model can be integrated with exchanges, custodians, and payment gateways, a truly closed-loop "cryptodollar + income" system could emerge. For corporate treasuries, this means holding a stable unit of account while also generating income and a tool to hedge against volatility. However, the risks are also more complex: clearing security, the robustness of smart contracts, and stability in extreme market conditions are all key areas that require rigorous auditing and risk control.

Source: X

Payments and established majors (LTC, TRX, DOGE): By comparison, this group of assets tends to serve as a "hassle-free base and payment gateway." Their longer history, greater liquidity, and more established infrastructure make them suitable for use as "cash-like" assets in corporate treasuries, fulfilling both long-term value storage and payment needs. LTC and TRX's efficiency advantages in payment and settlement make them readily accessible to treasuries. DOGE, with its community and brand influence, offers unique value in lightweight payments and buzz generation. Overall, these assets play a more stable and foundational role, but new growth stories are limited, and they may face increasing competition from stablecoins and Layer 2 payment networks.

Know what to buy, but also know how to look at it

Be aware of the direction of the wind, but avoid simplistic analogies. The token a company includes in its financial reports is a vote of faith, a vote of faith that can help filter out a lot of noise, but it's not a universal indicator. A more comprehensive framework examines three aspects simultaneously: business synergy (is the company actually using this token?), formal disclosure (including regulatory filings detailing how much has been purchased, how it's stored, and what risks are involved), and whether on-chain data is up to date (activity, trading depth, and liquidation stability). The true value of corporate treasury allocation lies not in providing investment advice but in revealing the underlying logic of industry evolution. When traditional listed companies begin to allocate large amounts of specific tokens, it reflects the structural shift of the entire crypto ecosystem from "pure speculation" to "value-anchored."

From a macro perspective, this surge in treasury allocations marks the convergence of three key trends: a maturing regulatory environment—companies are now more willing to disclose their crypto holdings in public documents, signaling the establishment of a compliance framework; a more specific application scenario—moving beyond the abstract "blockchain revolution" to quantifiable business needs such as AI training, DeFi returns, and cross-border payments; and a shift in funding structures—from retail investor dominance to corporate participation, implying longer holding periods and more rational pricing mechanisms. A deeper meaning lies in the fact that treasury allocations are redefining the very nature of "digital assets." Previously, cryptocurrencies were often viewed as high-risk speculative instruments. However, as more and more companies use them as operational assets or strategic reserves, they begin to take on attributes similar to foreign exchange reserves, commodity inventories, or technology licenses. This shift in perception may be more disruptive than any technological breakthrough.