The data doesn’t lie: Why is Pendle the hidden gem of DeFi?

- 核心观点:Pendle凭借真实收益远超高估值公链。

- 关键要素:

- 日收入6.57万美元,年化超4300万。

- TVL达94.4亿美元,年增20倍。

- 收益代币化机制创造可持续需求。

- 市场影响:凸显DeFi估值应重基本面非叙事。

- 时效性标注:中期影响。

Original article | @MeshClans

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator | Dingdang ( @XiaMiPP )

In the crypto market, we often see some “emerging” public chains triggering a wave of public opinion with their negligible daily revenue.

However, while the outside world was excited about the "growth" of a few thousand dollars, Pendle quietly generated annual revenue of $43.68 million with a fully diluted valuation (FDV) of $1.53 billion.

Even more ironic is that public chains with valuations three to five times higher than Pendle have far less actual business volume. This mismatch is precisely why we need to re-evaluate Pendle.

Crazy digital gap

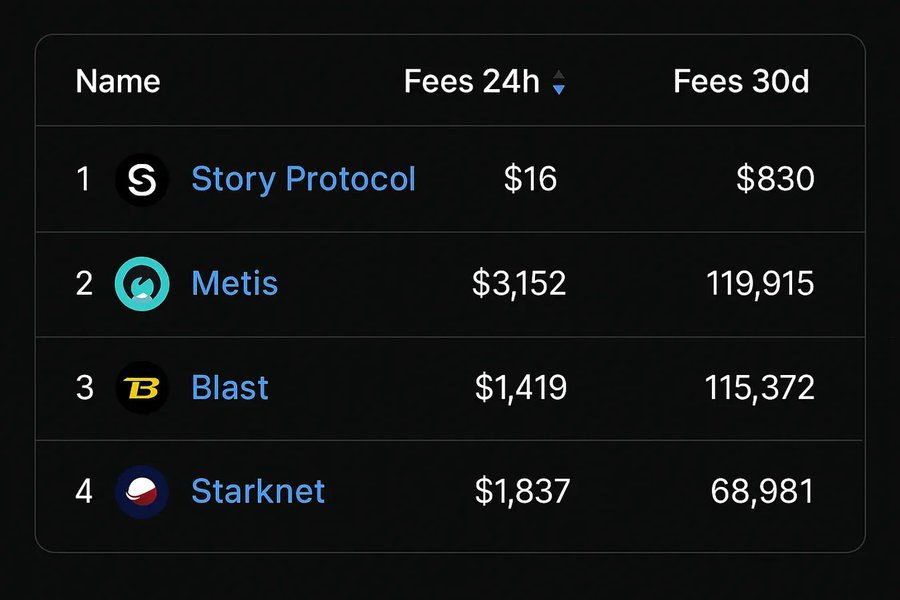

Just look at these income comparisons to see the absurdity of the market:

- Story Protocol: $16/day

- Metis: $3,152/day

- Blast: $1,419/day

- Starknet: $1,837/day

- Pendle: $65,740/day

In other words, Pendle's revenue in one day is equivalent to Story Protocol's total revenue in eleven years.

The gap between a storytelling project and a real cash flow-generating agreement is starkly clear.

A true portrait of Pendle

Pendle maintains its popularity not by relying on concepts, but by proving its intrinsic value with data:

- Market capitalization: $883 million

- FDV: $1.53 billion

- TVL: $9.44 billion (nearly 20x year-over-year growth)

- Daily income: $65,700

- Annual revenue: $43.96 million

Behind these numbers is not "paper prosperity", but the real value exchange between the protocol and users.

Market capitalization comparison: a huge gap that is overlooked

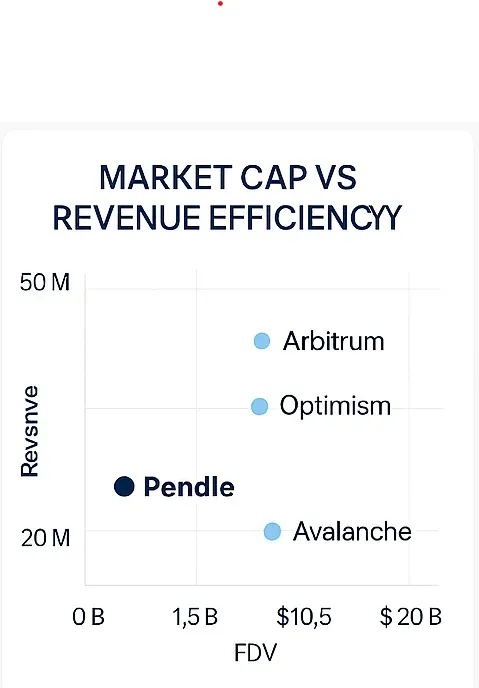

If we compare Pendle with mainstream public chains, the dislocation is even more obvious:

- Pendle FDV: $1.53 billion ($43.96 million in annual revenue)

- Arbitrum FDV: $5.2 billion

- Optimism FDV: $7.5 billion

- Avalanche FDV: $17 billion

Pendle's revenue is almost comparable to that of these protocols, which are valued 3 to 10 times higher . This misalignment between valuation and fundamentals is almost unimaginable in traditional financial markets.

What is Pendle doing?

Pendle is essentially a DeFi protocol centered around tokenized returns, providing users with a tool to trade future returns through innovative mechanisms. By splitting interest-bearing assets (such as stETH and GLP) into two types of tokens, it builds a new market for returns trading:

- Principal Token (PT) : represents the principal portion of the asset;

- Yield Token (YT) : represents future revenue streams.

This mechanism allows users to buy and sell the income rights of an asset, just like trading derivatives, without having to directly hold the underlying asset.

Pendle's core value lies in its ability to transform itself into a viable profit model, not just a mechanistic innovation. In the Pendle marketplace, users can flexibly allocate their income by trading PT and YT tokens—locking in principal to mitigate risk or speculating on yield tokens to pursue higher returns.

The protocol charges a fee for each transaction, which is the main source of Pendle's revenue. Unlike projects that rely on subsidies, Pendle's revenue is a byproduct of real user demand, not a pile of venture capital.

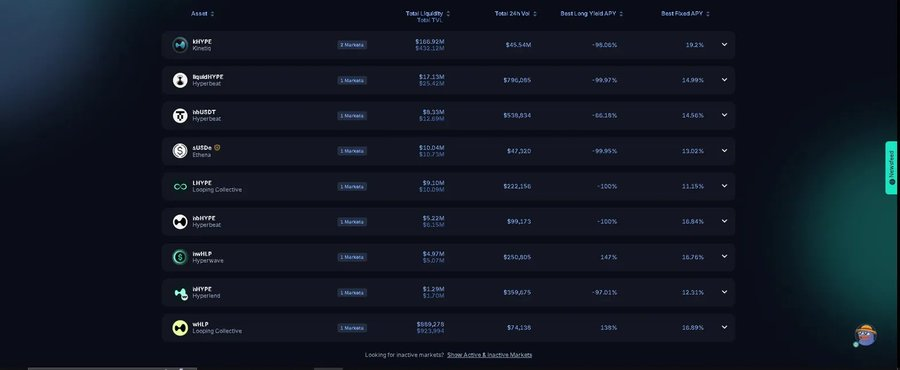

Examples of current product revenue:

- Hype: 19.2% annualized

- LiquidHype: 14.99%

- nHUSDT: 14.56%

- sUSDe:13.02%

This model not only fills the gap in income management for DeFi, but also "financializes" the element of income, allowing users to flexibly configure and manage it.

Adoption stories behind the data

Pendle's growth is also reflected in key metrics:

- TVL rose from $7.7 billion to $9.44 billion in just a few weeks;

- DEX daily trading volume peaked at $300 million;

- The token price recently rose 45% to $5.60.

This isn't just "growth" data; it's the process of Pendle gaining real trust in the market. In contrast, many subsidy-driven protocols can only burn venture capital to create "fake activity."

Comparison with other DeFi protocols

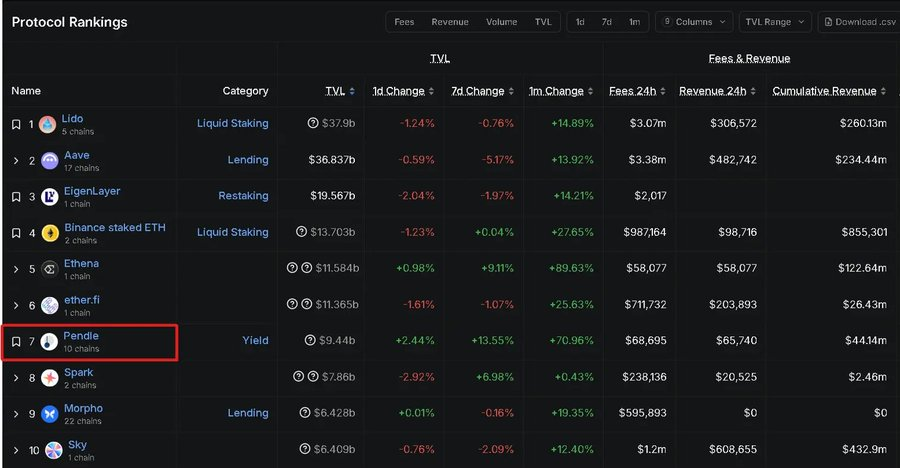

Putting Pendle into the broader DeFi ecosystem:

- Lido: $306,000 in daily revenue

- Aave: $482,000 in daily revenue

- Eigenlayer: $2,000 a day

- Pendle: $65,700 per day (ranked 7th)

Despite Pendle ranking among the top ten DeFi protocols by revenue, its valuation is significantly lower than that of leading protocols. This asymmetry reflects the market’s immature understanding of its potential.

More importantly, it’s all still very early days.

In traditional finance, trading future cash flows, such as bonds, derivatives, and asset-backed securities, constitutes a multi-trillion dollar market. However, in DeFi, this sector has a very low penetration rate, perhaps less than 1%. As a pioneer in this field, Pendle provides the infrastructure for yield trading through technological innovation and is currently in the early stages of development.

The recently launched new product, Boros , brings perpetual futures funding rates to the blockchain, enabling users to trade or hedge directly around these rates. This not only boosts Pendle's TVL growth but also opens up new possibilities for the convergence of DeFi and TradFi. Related reading: " How to Leverage Pendle's New Killer Tool, Boros ."

If we refer to Uniswap’s growth trajectory when its early trading volume was less than one million US dollars, Pendle’s current stage may correspond to the window period where “the value has not yet been fully priced”.

The hype of popular public chains and the essence of Pendle

Let’s take a look at the current “hot public chains”:

- Daily income: $5,000 to $30,000;

- FDV is generally higher than Pendle;

- Relying on roadmaps and promises to maintain the narrative;

- Millions of dollars are burned every day as incentives.

Pendle comparison:

- Daily income: $65,000;

- FDV $1.53 billion;

- TVL is $9.44 billion and growing rapidly;

- A sustainable model supported by real revenue demands.

The former relies on stories to keep the flame burning, while the latter demonstrates solid value through calm data. Ultimately, the market's focus has shifted away from the core of value.

Pendle, with a fully diluted valuation (FDV) of $1.53 billion and annual revenue exceeding $43 million, demonstrates a solid business foundation. However, public chain projects, with daily revenue hovering around $10,000, easily achieve comparable or even higher valuations thanks to their storytelling and marketing savvy. This disconnect between valuation and actual performance reflects a flawed market valuation mechanism. Pendle's revenue-based trading model, fueled by users' pursuit of real returns, demonstrates enduring vitality. Meanwhile, "ghost public chains" that rely on empty promises are experiencing growth fatigue after a brief period of brilliance.

The market has yet to realize that the potential for revenue trading far exceeds that of those ghost public chains that are driven by narratives but have little substance.

Conclusion

While the market is still celebrating the daily revenue of $5,000 to $30,000 for “emerging” public chains, Pendle has quietly built a “profit machine” with an annual revenue of over $43 million, demonstrating real use value and explosive growth in TVL.

Sometimes the best opportunities are right in front of us, but they are ignored.

This isn't investment advice, but the numbers don't lie.