Weekly Editors Picks (1028-1103)

Weekly Editors Picks is a functional column of Odaily. In addition to covering a large amount of real-time information every week, it also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news and pass you by.

Therefore, our editorial department will select some high-quality articles worth spending time to read and collect from the content published in the past 7 days every Saturday. From the perspectives of data analysis, industry judgment, opinion output, etc., we will provide those in the encryption world with You bring new inspiration.

Next, come and read with us:

invest

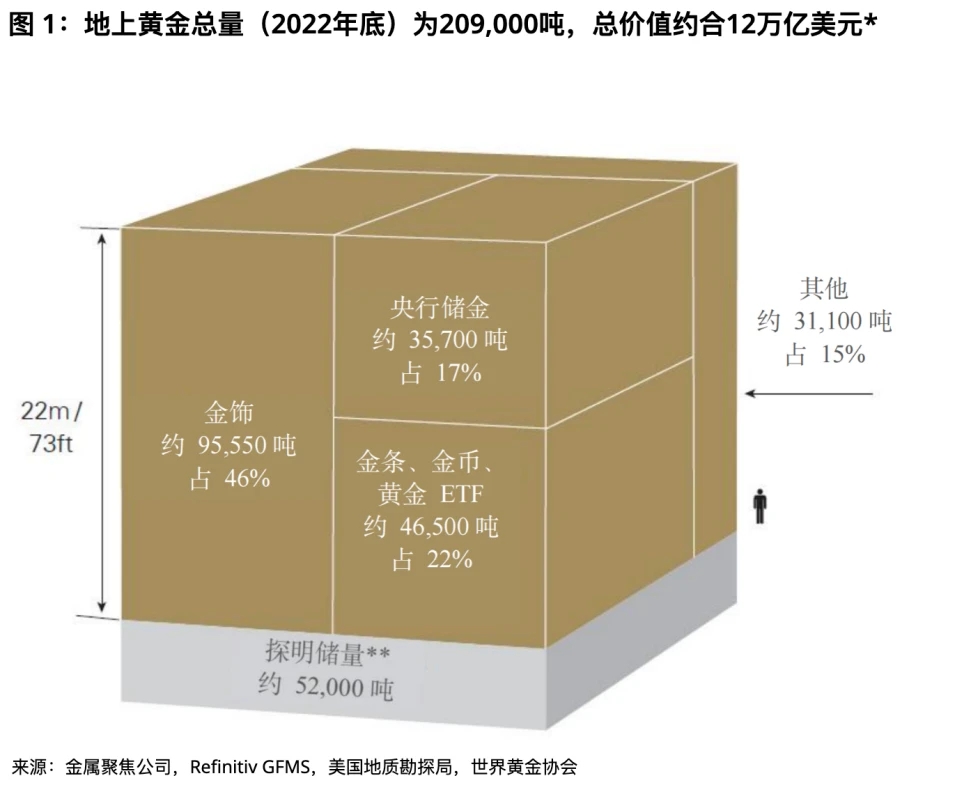

LD Capital: Multi-dimensional analysis of whether BTC is truly a safe haven asset

Gold is one of the most liquid assets in the world, with an average daily trading volume of $131.6 billion in 2022.

Gold is one of the most liquid assets in the world, with an average daily trading volume of $131.6 billion in 2022.

The 24-hour trading volume of BTC is approximately US$24 billion, of which the main trading volume occurs in perpetual contracts. The average daily trading volume of BTC has increased significantly recently, and the 24-hour trading volume is approximately 15% of gold (before this round of market conditions, it was probably less than 10% level).

The current total market value of BTC is US$677.7 billion, which is approximately 5.6% of the total market value of gold.

The current inflation rate of BTC is about 1.75%, and the annual inflation rate of gold is about 2%. The two are relatively close.

In theory, the price of gold is usually inversely proportional to the value of the U.S. dollar. Gold is an interest-free asset and the U.S. dollar is an interest-earning asset. U.S. dollar yields and inflation expectations are the two forces driving gold price changes. The real interest rate in the United States (nominal interest rate - inflation expectations) is the opportunity cost of holding gold. Theoretically, the two are negatively correlated. Gold is the most obvious asset that has risen since the Palestinian-Israeli conflict; this wave of BTC and the Nasdaq have almost completely opposite trends and have gone out of independent trends.

From the actual price of the asset so far, BTC has not shown obvious hedging properties.

Generally speaking, the allocation window for gold and BTC is approaching, and it is more a matter of timing.

Detailing the giant VC Paradigm: a model of value in crypto investment

Paradigm made its fortune by perfectly hunting for BTC, and later participated in early investments in Uniswap, Lido, Optimism, dYdX, Blur, etc. and achieved success. Paradigm integrates technical research into its organizational structure. The overall style of Paradigm is similar to Hillhouse, and it also has the investment characteristics of taking only a small amount of money and dare to make big bets.

Essential tools for airdrops: Head CEX multi-address recharge function analysis

To prevent the project side from witch determination, the most important thing is to implement address isolation. To put it simply, do not distribute/collect funds on the chain, but use the exchange to generate multiple different addresses for collection to avoid this problem.

In addition, it is best not to choose the same amount for transfers and withdrawals, but random amounts and random times; do not use multiple accounts to interact on the chain with the same path at the same time. For example, multiple accounts perform the same several DeFi interactions in the same order within a day. .

Start a business

For Founders: How to Live Y Combinator’s “Startup Bible”

In the early stages, startups have to: manually recruit users; manually provide them with an extraordinary experience. These are things that few big companies do, so they are considered Dont Scale things (that is, what we loosely translate as dumb things).

Crypto does offer a native, scalable way to acquire early adopters, namely token incentives. Token incentives may be one of the biggest breakthroughs for Crypto. However, token incentives are not a panacea, they are not a replacement for things that are “non-scalable”, they work as a supplement, but not as a meal replacement. Many AllianceDAO alumni in this article launched token incentives while performing heavy manual work.

DeFi

Forbes: The RWA trend among Wall Street financial giants is dying

Tokenization still faces interoperability and liquidity issues. Some practitioners believe that there is no need to take the tokenization route. To date, the only relatively successful use of tokenization has been in stablecoins. Whether investors trust the cryptocurrency market is also key.

A multi-dimensional comparison of Maker and Frax: Is Maker still the king of cash?

Maker provides the over-collateralized decentralized stablecoin DAI, backed by ETH, stablecoins, and RWA (most of which are U.S. Treasury bonds); Frax provides the decentralized stablecoin FRAX and a series of financial products built around it.

DAI’s collateral includes ETH, stablecoins, and RWA—most of which are U.S. Treasuries. FRAX’s collateral is about to change. Currently moving towards 100% CR and no longer supported by FXS. The recently added sFRAX and the upcoming FXB (bonds) will provide RWA support.

Frax currently leads the way in yields. Maker is currently one of the most profitable protocols in DeFi. Over $80 million in revenue. Because their supply keeps growing.

MKR has a market capitalization of $1.3 billion and is used to sustain repurchase agreement revenue. FXS has a market capitalization of $450 million and earns revenue from the protocol (all efforts are currently aimed at increasing CR to 100%).

Key points to focus on next: Maker’s Endgame includes token reshaping, decentralized stablecoins, subDAO launch, artificial intelligence integration, and ultimately the Maker Chain; Frax includes Frax bonds, frxETH staking product updates, and the new L2 on Ethereum Frax Chain.

Bitcoin Ecology

Recommended reading: brc 20-swap is online, with a detailed explanation of its development history, product model and future expectations》

Ethereum and Scaling

Connection to Ethereum has two key dimensions: the security of withdrawing money to Ethereum, and the security of reading Ethereum data.

There are many items of value in this design space. For some applications, high security and tight connectivity are important. For other applications, some looser connectivity may be acceptable for greater scalability.

PSE Trading: Under the Rollup wave, VM still has stories to tell

zkEVM has made certain zk-proof generation efficiency optimizations in terms of EVM equivalence/compatibility;

zkVM abandons EVM equivalence/compatibility and increases the priority of zk-friendliness;

privacy zkVM superimposes native privacy features on zkVM;

SVM, FuelVM, and MoveVM have in common the pursuit of ultimate performance through parallel execution, but they have their own characteristics in design details;

ESC VM and BitVM have conducted certain innovative computing layer experiments on the ETH and BTC chains respectively, but the actual demand for implementation is low in the current environment.

EVMs huge user ecosystem determines that any blockchain network that abandons it will have difficulty competing with it in the short term. Therefore, the non-EVM ecosystem introduces EVM ecological users through translators/compilers/bytecode interpreters and even VM compatibility layers to utilize non-EVM Using virtual machine features to build a new ecological narrative may be a necessary path to success.

Ecological development trends include: wallet front-end compatibility and VM back-end compatibility.

Founder of IOSG Ventures: The growth dilemma of L2 ecosystem and how to break it

As the studio gradually faded out, the transaction volume and TVL of several major zkEVMs failed to meet expectations. At present, most of the L2 arms race does not focus on ecological construction, and still spends a lot of money to recruit ZK and technical experts from PSE at high prices, but high concurrency compatible Rollup without applications is of little value.

Choosing the right partner has become a difficult problem for applications. For this reason, each L2 wants to have exclusive applications, and then the applications in different L2s will be divided.

The way to break the situation is as follows: the leading L2 project takes the initiative to take on the important task of ecological construction, and competition should focus on the art of combining vertical and horizontal lines.

The end result of the ecosystem will be that a hundred flowers bloom - L3 and application chains begin to grow.

New ecology and cross-chain

Aiming for the Next Celestia, These Modular Projects Are Worth Watching

Introduction and interaction suggestions for Fuel, Altlayer, Polygon Avail, Caldera, Eclipse.

In addition to directly participating in interactions with project parties, staking ATOM or Osmos, and EVM chain interactions can also help ordinary users obtain airdrops.

E 2 M Research: With 1.3 billion users, can TON create a new paradigm?

The development logic of the TON public chain is to turn 30% of Telegram users into a Mass Adpotion strategy for Crypto users. The several TON ecological tracks that will be the core focus in the future should be wallets, social networking, games, NFT, etc. that are more focused on the application layer.

Telegram’s development is more like WeChat.

The difficulties faced by both are:

TONs current market value has reached the top 15 in an ecologically barren situation. Will it have any impact on future development?

Telegrams popular Telegram Bots like Unibot or Gamefi like Tap Fantasy essentially rely more on Telegram Bot functions rather than TON?

TON has a poor ecology and relies heavily on Telegram for traffic. Can it withstand the huge initial expenditure?

OKX Ventures: The history, technology and future of the TON ecosystem from an investment perspective

When the TON balance is exhausted, the smart contract will be automatically deleted to avoid blockchain data expansion. TONs asynchronous design also makes the extensive consistency and atomicity of calls between smart contracts more difficult to maintain, making application development and maintenance work more complex.

The current Telegram ecological form is Bots+API+Wallet Hosting, which has good data but no actual support for the TON public chain.

Be optimistic about officially supported infrastructure; be optimistic about mini program applications; be cautiously optimistic about DeFi, MEV and ZK.

Hot Topics of the Week

In the past week,When FTX token asset liquidation is underway,SBF’s lawyer completed his closing argument and insisted on defending SBF’s innocence.,SBF was found guilty on all seven counts.,PYUSD receives SEC subpoena,ProShares launches short Ethereum futures ETF,Celestia (TIA) is listed on major exchanges,Floki gets off to a bad start,SOL experienced the strongest rebound after the bull market,Memeland airdrop and FireSale’s MEME are now open for redemption;

In addition, in terms of policy and macro markets, Powell:There has been no consideration or discussion of an interest rate cut.,The Hong Kong Securities and Futures Commission issues a circular regarding intermediaries engaging in tokenized securities-related activities and SFC-authorized investment products;

In terms of opinions and voices, Coinbase Chief Policy Officer:Crypto legislation has emerged from FTX’s shadow, and it’s only a matter of time before a prairie fire breaks out, MicroStrategy Lianchuang:Fairly Optimistic About Next Twelve Months, SEC Approval of Bitcoin Spot ETF Won’t Threaten MicroStrategy;

In terms of institutions, large companies and leading projects,Elon Musk plans to turn X into a dating site and digital bank next year,Informed sources:a16z plans to raise US$3.4 billion for its next early-stage fund, scheduled to launch by the end of the year,PayPal is registered with the UK Financial Conduct Authority and is authorized to provide cryptocurrency services,Coinbase launches regulated crypto futures trading service in the US,DWF Labs may launch institutional-grade OTC trading platform DWF Liquid Markets,Wintermute plans to launch crypto derivatives exchange and crypto-related index,HashKey plans to issue 1 billion platform tokens HSK, the exchange is expected to be launched in the middle of next year.Hong Kong licensed exchange OSL: APP plans to be launched in November and platform currency will not be launched,LayerZero announces the launch of an “all-chain version” (OFT) for Lido Finance’s liquid pledged derivative token wstETH, allowing the token to be freely transferred across Ethereum, Avalanche, BNB Chain and Scroll using LayerZero’s communication protocol, triggering controversy and counterattack, raised by PlutusDAOVoting begins on the proposal to launch the staking function of Arbitrum’s governance token ARB,BNB Chain launches Safe multi-signature wallet service,Bitget Wallet Upgrade“MEV protection function to improve the user experience of Swap transactions,Starknet launches early community membership program,UniSat Wallet:brc 20-swap mainnet has been launched,Dune launches DuneAI,Aragon announced its dissolution and will provide 86,000 ETH to ANT holders for redemption of ANT...Well, it’s been another week of ups and downs.

Attached is the Weekly Editors Picks seriesportal。

See you next time~