LD Capital: BTC가 진정한 안전 자산인지에 대한 다차원 분석

원저자: Lisa, LD Capital

BTC는 디지털 금으로 알려져 있으며 거래자들은 BTC 가격 변동에 대한 중요한 참고 자료로 나스닥 지수를 자주 사용합니다. 금과 나스닥 지수는 각각 안전 자산과 위험 자산을 대표하는 대표적인 지표입니다. 이는 모순되는 것처럼 보입니다. 이 기사에서는 BTC와 금 가격에 영향을 미치는 요소를 탐색하여 BTC가 안전자산인지 여부를 알아봅니다.

1. 금과 BTC의 개요

1. 골드

금의 측정 단위

온스는 국제적으로 인정되는 금 측정 단위입니다. 1트로이 온스 = 1.0971428 일반 온스 = 31.1034768그램입니다.

금의 섬세함

섬도는 금속의 순도를 말하며 일반적으로 천분의 일로 표시되며 K 또는 K로 표시할 수도 있습니다. 금의 색상/순도는 24개의 캐럿 또는 K 레벨로 분류됩니다. 각 캐럿(영어 캐럿 및 독일어 캐럿의 약어, 종종 k로 표시됨)의 금 함량은 4.166%입니다. 각 캐럿의 금 함량은 다음과 같습니다.

8 k= 8* 4.166% = 33.328% ( 333 ‰) 9 k= 9* 4.166% = 37.494% ( 375 ‰)

10 k= 10* 4.166% = 41.660% ( 417 ‰) 12 k= 12* 4.166% = 49.992% ( 500 ‰)

14 k= 14* 4.166% = 58.324% ( 583 ‰) 18 k= 18* 4.166% = 74.998% ( 750 ‰)

20 k= 20* 4.166% = 83.320% ( 833 ‰) 21 k= 21* 4.166% = 87.486% ( 875 ‰)

22 k= 22* 4.166% = 91.652% ( 916 ‰) 24 k= 24* 4.166% = 99.984% ( 999 ‰)

예를 들어, 런던 금의 표준 배송 대상은 금 함량이 99.50% 이상인 400온스 금괴이며, 상하이 금에는 Au 99.99, Au 99.95, Au 99.5, Au 50g, Au 100g과 같은 배송 종류가 있습니다.

Au 99.99는 표준 중량이 1kg이고 순도가 99.99% 이상인 금괴입니다.

Au 99.95는 표준 중량 3kg, 순도 99.95% 이상의 금괴입니다.

Au 99.5는 표준 중량 12.5kg, 순도 99.50% 이상의 금괴입니다.

Au 50g은 표준중량 0.05kg, 순도 99.99% 이상의 금괴입니다.

Au 100g은 표준중량 0.1kg, 순도 99.99% 이상의 금괴입니다.

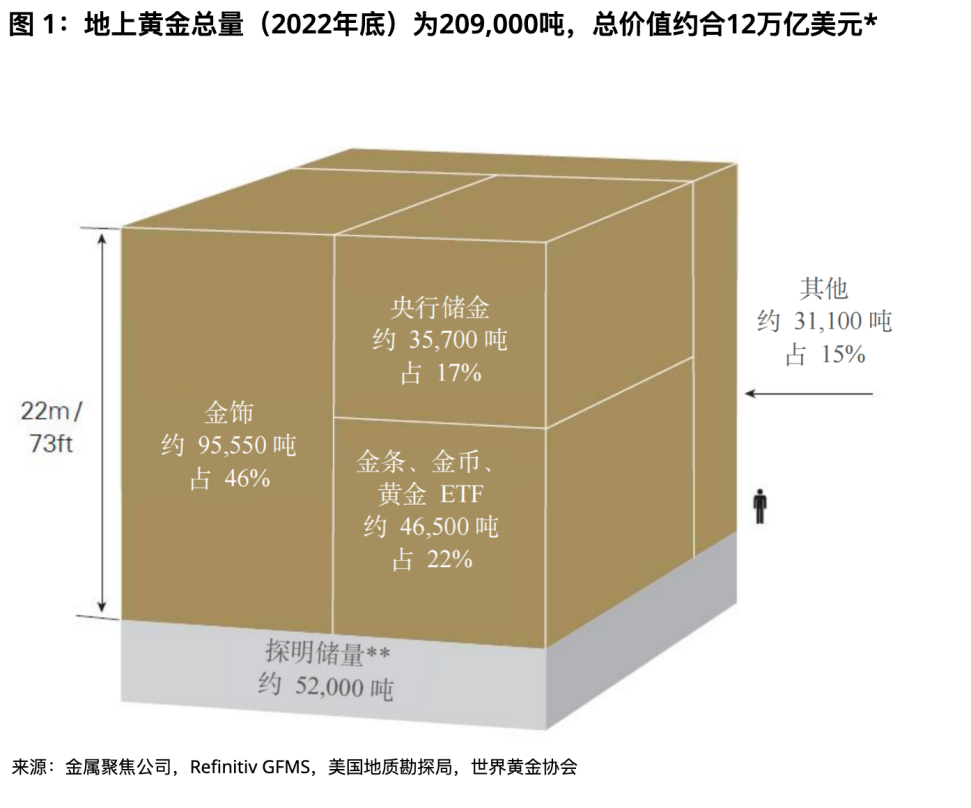

금의 총 시장 가치

세계금협회(World Gold Council)의 추산에 따르면, 약 12조 달러 상당의 금이 약 209,000톤 채굴되었으며, 그 중 약 3분의 2가 1950년 이후 채굴되었습니다. 기존의 모든 금을 함께 쌓으면 측면 길이가 최대 22미터(또는 73피트)인 순금 입방체를 형성하게 됩니다.

금 장신구 형태의 금은 전체의 약 46%(약 95,547톤, 약 6조 달러)를 차지합니다.

중앙은행은 금의 17%(약 35,715톤, 약 2조 달러)를 준비금으로 보유하고 있습니다.

막대와 동전 형태의 금은 전체의 약 21%(약 43,044톤, 약 3조 달러)를 차지합니다.

실물 금 ETF 펀드는 전체의 약 2%(약 3,473톤, 약 0.2조 달러)를 차지합니다.

나머지는 다양한 산업적 목적으로 사용되거나 다른 금융기관이 보유하고 있으며 전체의 약 15%(약 31,096톤, 약 2조 달러)를 차지합니다.

금 거래량

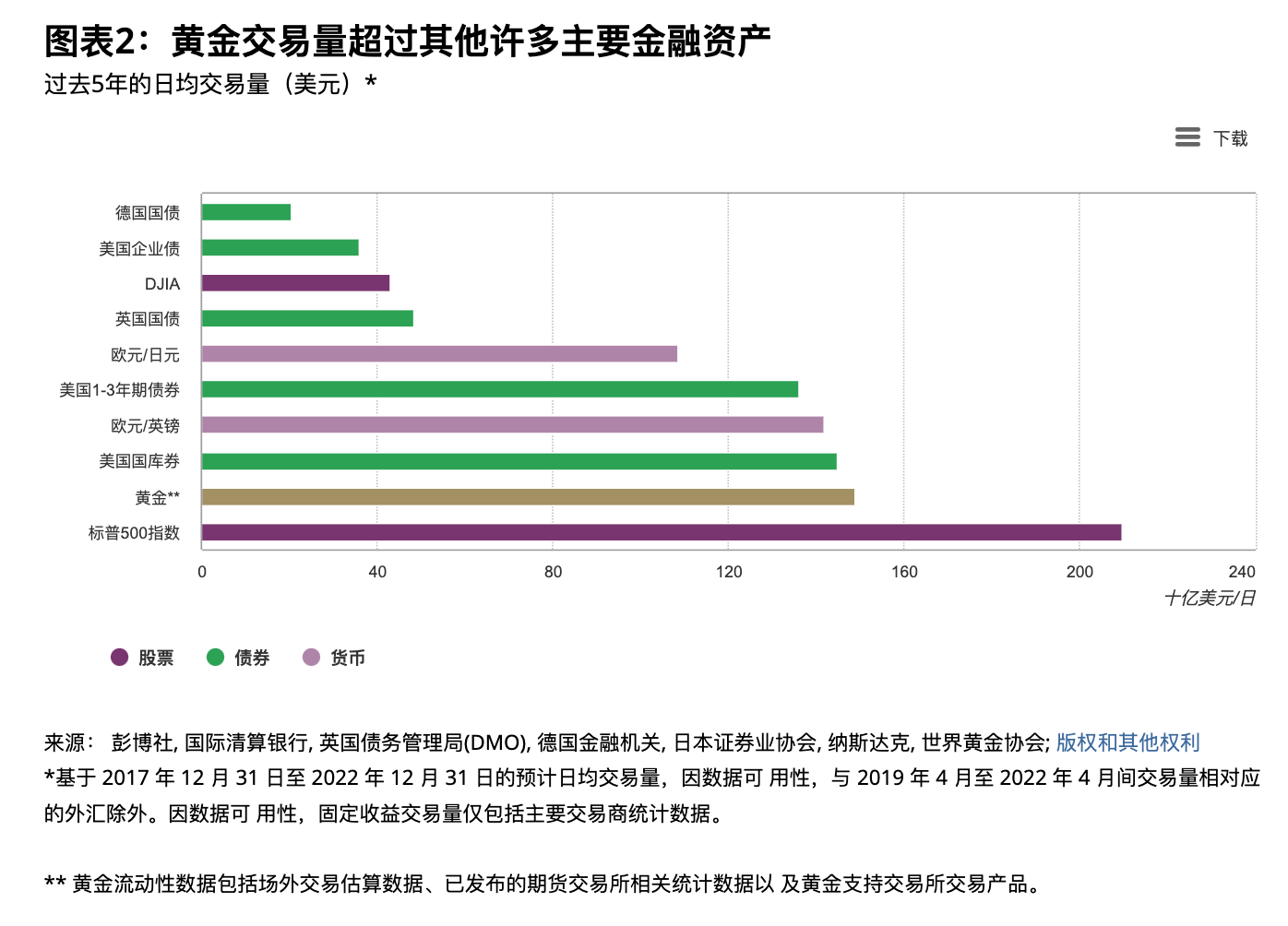

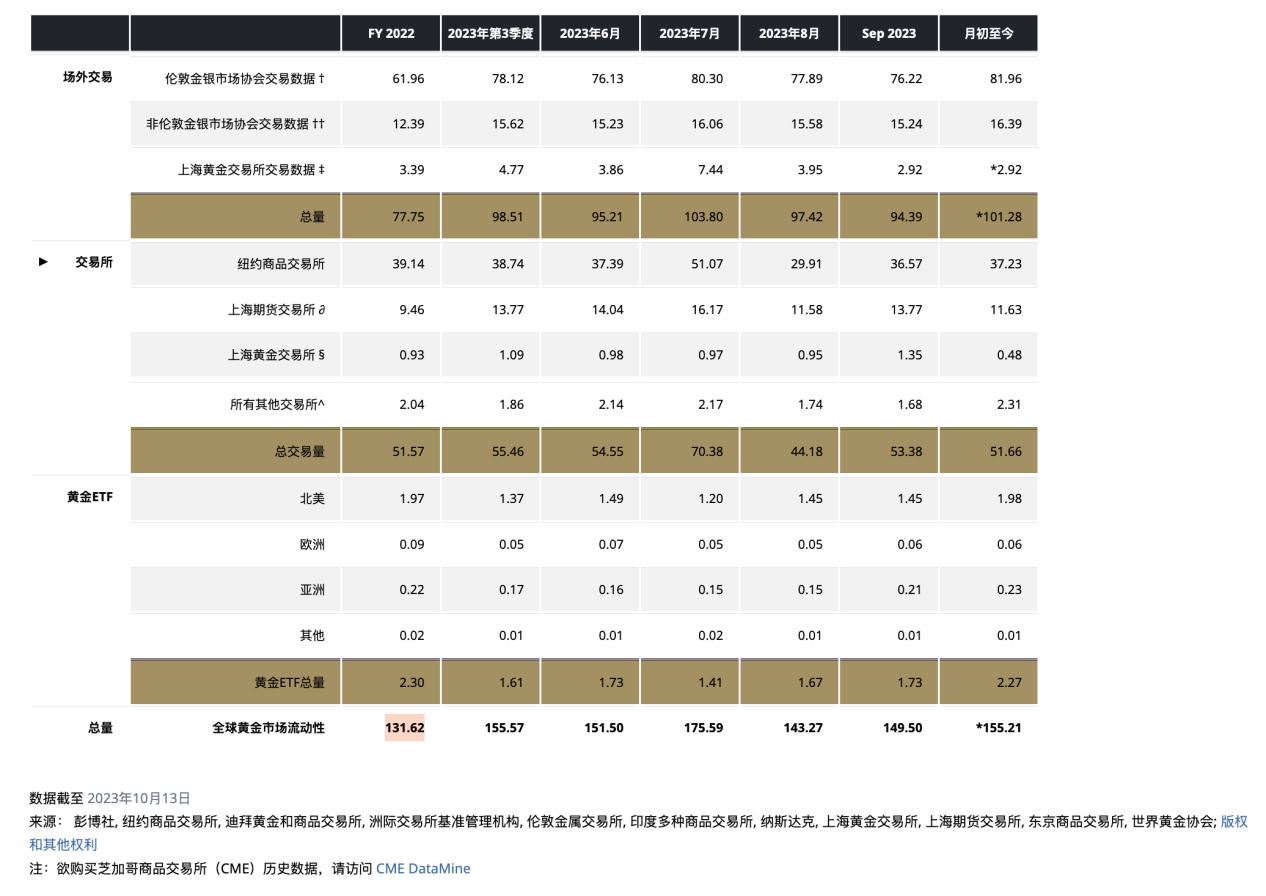

금은 세계에서 가장 유동성이 높은 자산 중 하나이며, 2022년 일일 평균 거래량이 1,316억 달러에 달합니다. 주요 거래 장소로는 런던 OTC 시장, 미국 선물 시장, 중국 시장이 있습니다. 런던 OTC 시장은 1919년에 시작되었습니다. 금 현물 OTC 시장이자 금 거래의 중심지입니다. 런던 금시장 협회(LBMA)는 하루 2회(런던 시간 기준 오전 10시 30분, 오후 10시 30분) 금 기준 가격을 생성합니다. ). 3:00) 시장참가자들이 거래하는 벤치마크로 뉴욕상업거래소(COMEX)의 금시장은 현재 세계 최대의 금 선물시장이며 상하이금거래소(SGE)는 2002년 10월 30일 기준 같은 날 공식적으로 개장한 이 곳은 중국 금 시장을 위한 현물 거래 플랫폼을 제공하며, 상하이 선물 거래소(SHFE) 선물 거래는 상하이 금 거래소의 현물 거래를 보완합니다.

일일 평균 금 거래량(단위: 수십억 달러)

2、BTC

BTC의 24시간 거래량은 약 240억 달러이며, 그 중 주요 거래량이 무기한 계약으로 이루어지고 있으며, 최근 BTC의 일평균 거래량이 크게 증가하여 24시간 거래량이 금의 약 15%에 달합니다. (이번 시장 상황 이전에는 아마도 10% 미만이었을 것입니다.) 현물 및 무기한 계약의 가장 큰 거래 장소는 바이낸스입니다.

현재 BTC의 총 시장 가치는 6,777억 달러로 금 전체 시장 가치의 약 5.6%에 해당합니다.

2. 금과 BTC 가격에 영향을 미치는 요인

1. 수요와 공급 관계

금

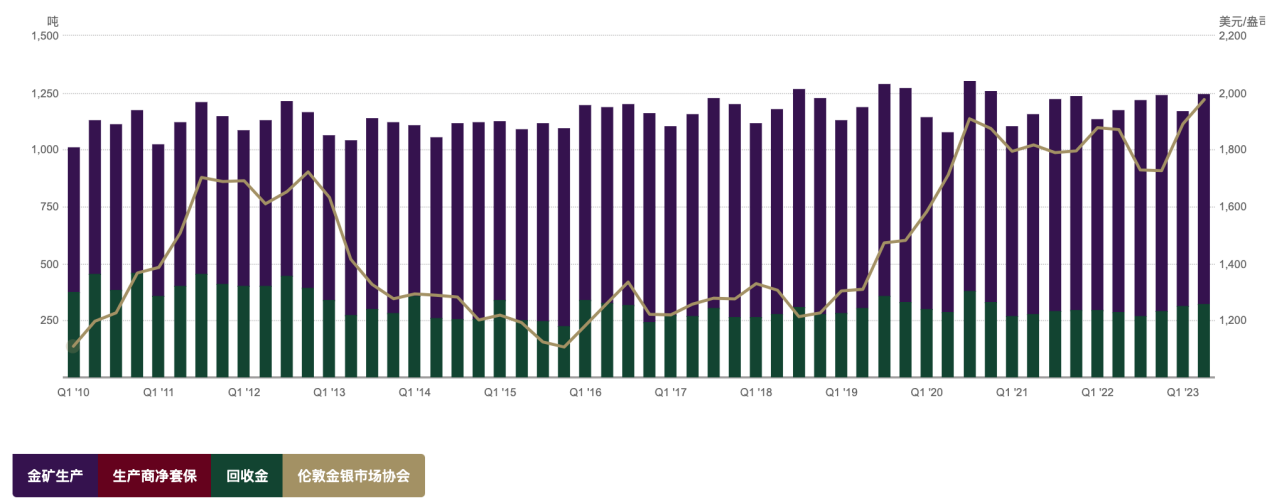

금 공급

글로벌 금의 연간 신규 공급량은 2016년부터 2022년까지 약 4,800톤을 유지하면서 상대적으로 안정적입니다. 금은 쉽게 손실되지 않기 때문에 소비자 부문의 금은 여전히 어떤 형태로든 존재하며 재활용되고 다시 공급될 수 있습니다. 따라서 금 공급은 채굴 생산과 금 재활용이라는 두 부분에서 이루어집니다. 2022년 금 재활용 총량은 1,140.6톤, 총 광산 생산량은 3,626.6톤이 될 예정이며, 공급량의 약 3/4은 금광 채굴에서, 4분의 1은 금 재활용에서 나옵니다. 아래 차트에서 볼 수 있듯이 금 공급은 안정적이고 수년 동안 큰 추세 변동이 없었으므로 상대적으로 금 공급이 경직되어 가격에 미치는 영향이 거의 없습니다.

금 수요

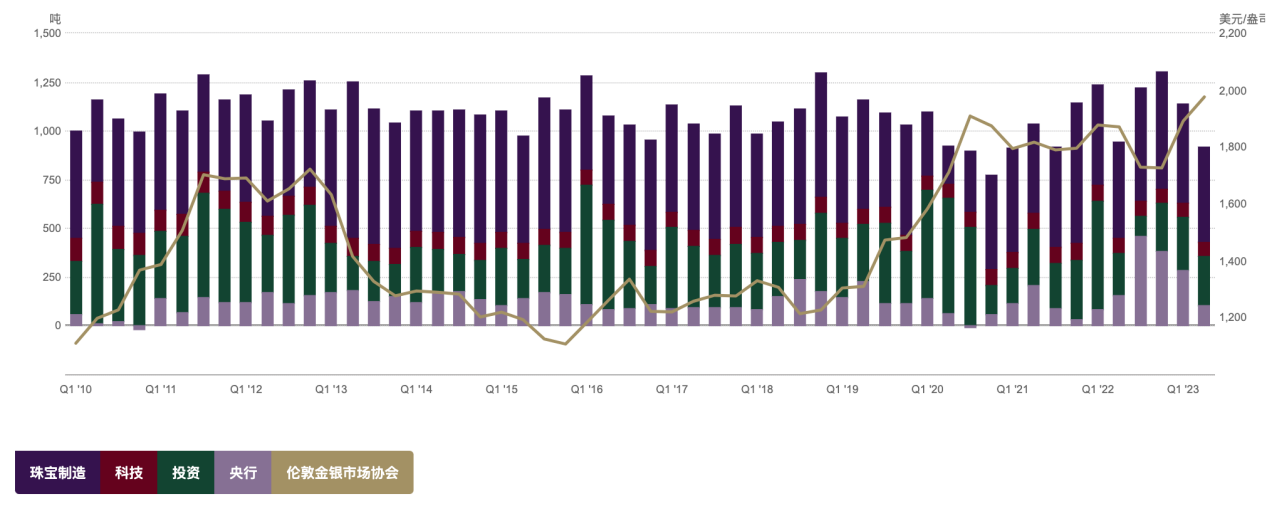

2022년 전 세계 금 수요 총계는 4,712.5톤이 될 것이며, 2023년 상반기 전 세계 금 수요 총계는 전년 동기 대비 5% 증가한 2,460톤에 이를 것으로 예상된다. 금 수요에는 금 주얼리, 의료 기술, 투자 수요, 각국의 중앙은행 준비금 등 소비 분야가 포함됩니다. 2022년 보석 제조, 기술, 투자 및 중앙은행의 금 수요는 각각 2195.4톤, 308.7톤, 1126.8톤, 1081.6톤이 될 것이며 가장 큰 비중은 보석 제조가 47%에 달하고 중앙은행 수요는 23톤을 차지할 것이다. %. 전통 문화의 영향을 받아 중국과 인도는 세계 최대의 금 주얼리 소비국이며, 2022년에는 중국과 인도가 각각 전 세계 금 주얼리 수요의 23%를 차지할 것으로 예상됩니다.

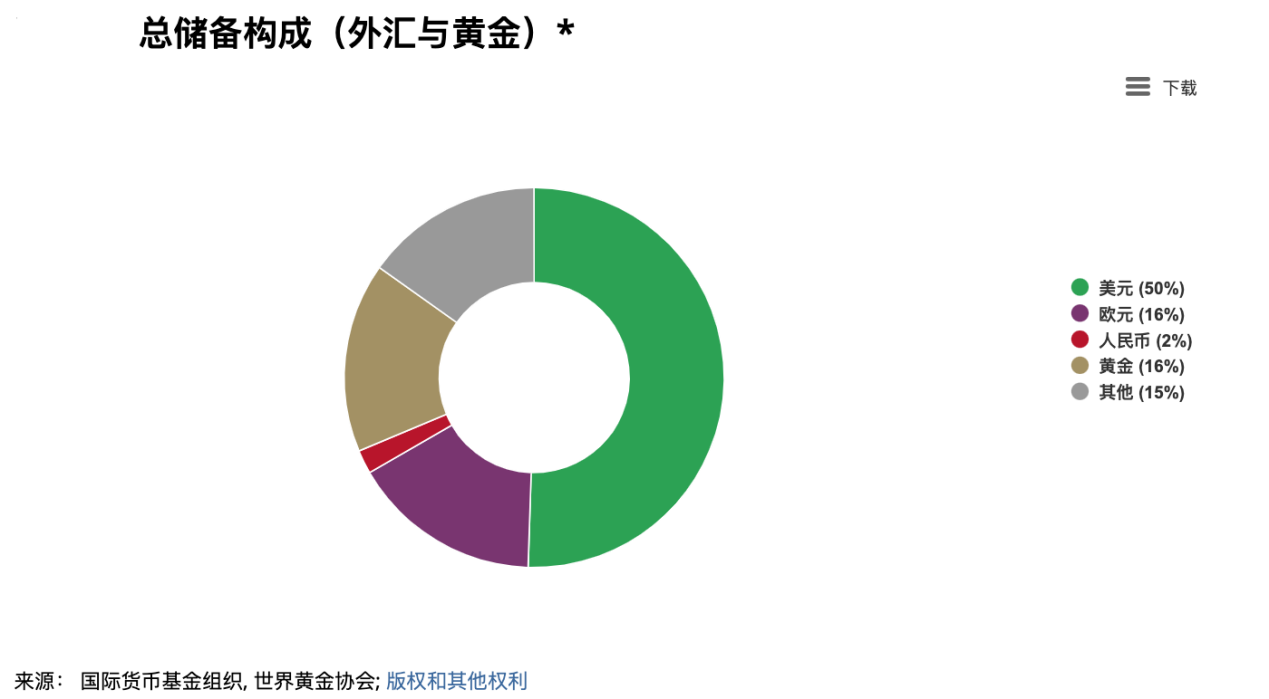

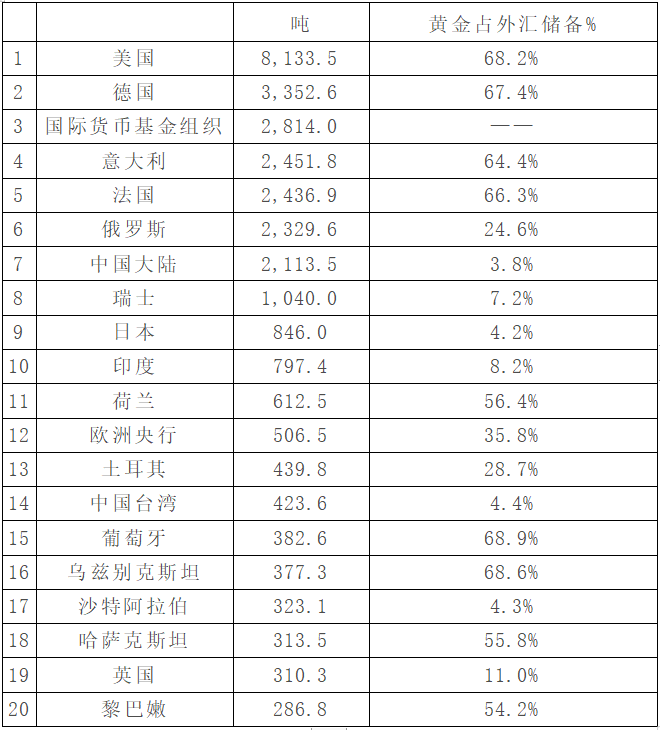

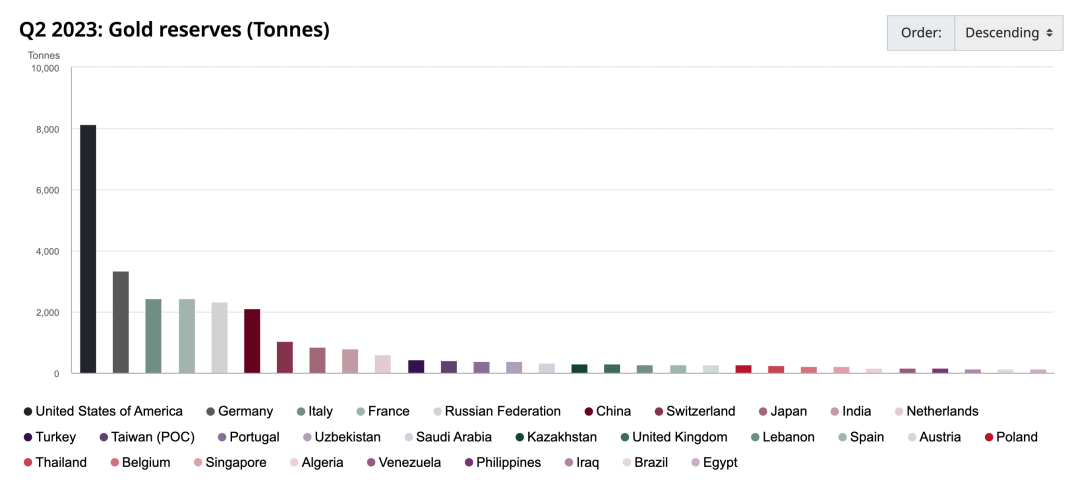

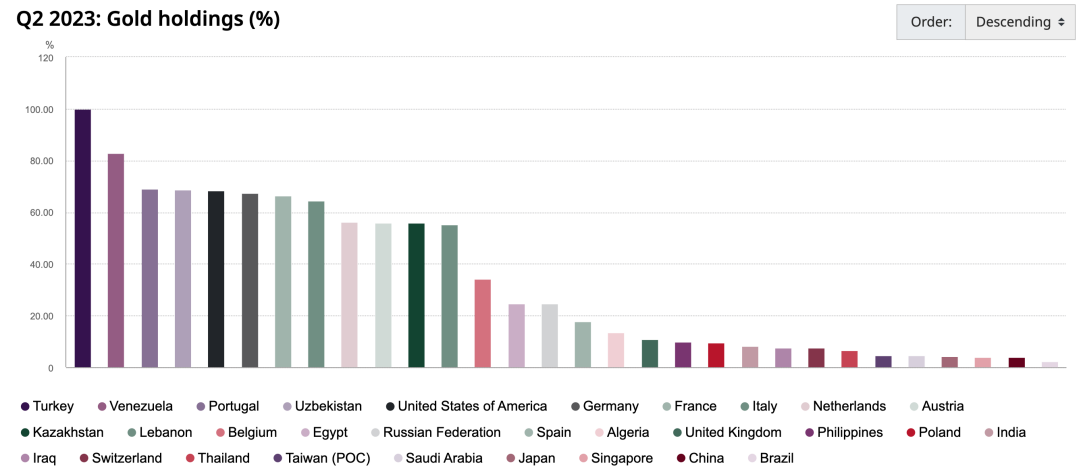

금은 글로벌 중앙은행 준비금의 중요한 구성요소입니다. 중앙은행 준비금에서 금이 차지하는 비율은 국가나 지역에 따라 크게 다릅니다. 예를 들어 미국과 독일은 70%에 가까운 반면 중국 본토는 3.8%, 일본은 4.2%를 차지한다. 러시아-우크라이나 분쟁 발발 이후 미국과 유럽이 러시아 중앙은행의 달러화 외환보유액을 동결하면서 미국 이외의 경제권이 달러화의 안정성을 흔들게 되면서 다각화된 외환보유액에 대한 수요가 증가했고, 금 보유량 증가로 바뀌었습니다. 향후 탈달러화가 진전됨에 따라 글로벌 중앙은행들이 체계적으로 금 보유량을 늘리는 추세는 장기적으로 더욱 두드러질 것입니다.

전 세계 금 보유량 상위 20개 국가/조직

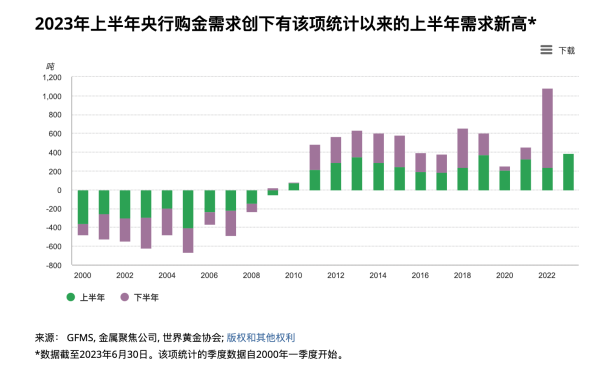

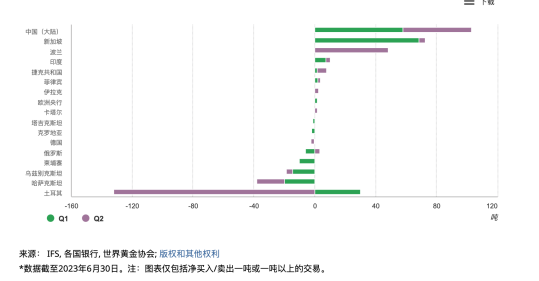

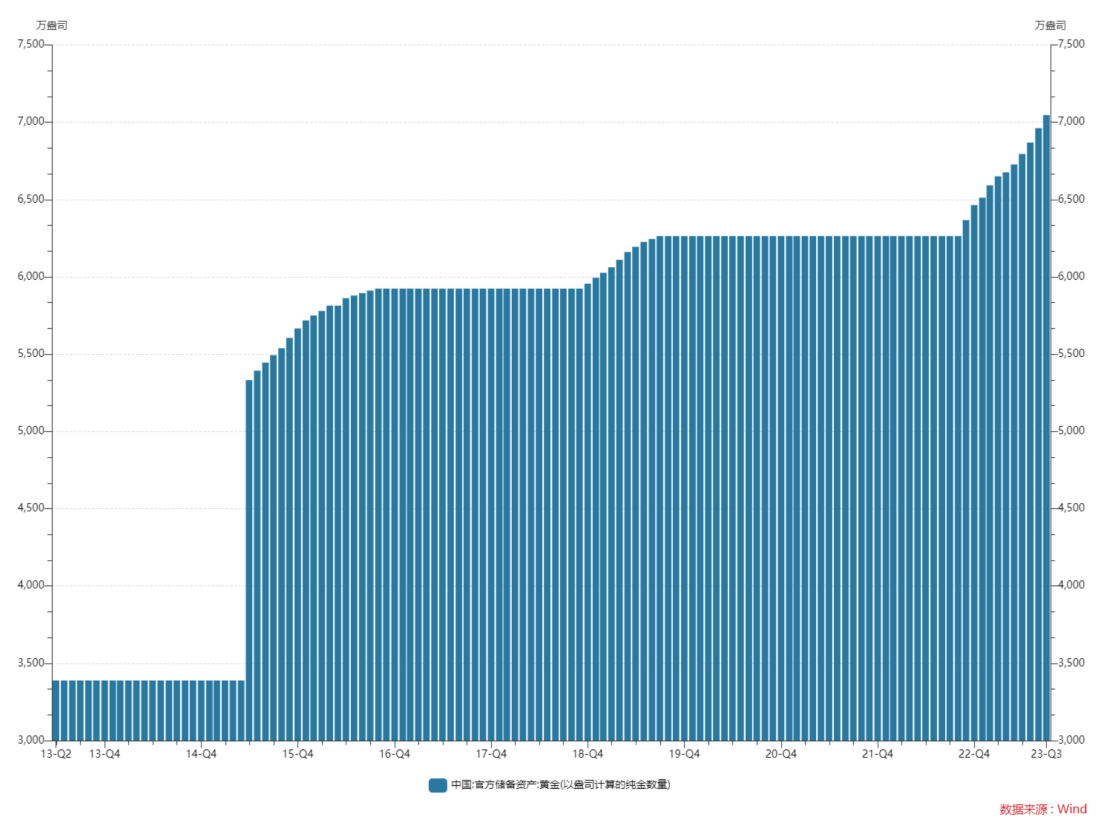

세계금협회(World Gold Council) 자료에 따르면 중앙은행의 금 구매 수요는 2022년 하반기부터 급격히 증가해 2022년 하반기 총 금 구매량은 840.6톤으로 2021년 전체의 1.8배에 이른다. 올해 상반기 중앙은행의 금 매입 수요는 지난해 하반기보다 소폭 줄었지만 387톤으로 최고치를 기록해 2000년 통계 작성 이후 최고치를 경신했다. 그 중 터키의 국내 금 수요는 불안한 정치 상황으로 인해 강세를 보였으며, 정부가 일시적으로 일부 금괴 수입을 금지하고 금을 국내 시장에 판매한 것은 터키의 장기적인 금 전략의 변화를 의미하지 않습니다. 일반적으로 터키의 2분기 금 판매는 전체 중앙은행 금 수요의 긍정적 추세를 약화시키지 않았습니다. 그 중 금 구매량이 가장 많은 곳은 중국 본토에서 1분기와 2분기에 각각 57.85톤과 45.1톤을 구매했습니다. . 10월 13일 자료에 따르면, 9월 말 중국의 금 보유량은 7,046만 온스로 전월 대비 84만 온스가 증가해 11개월 연속 증가세를 기록했다. 중국인민은행의 금 보유량은 782만 온스에 달했다. 역사적으로 중국 중앙은행의 금 구매는 전략적이었고 거의 판매되지 않았습니다.

BTC

BTC의 총 공급량은 2,100만 개로 고정되어 있으며, 현재 유통량은 1,951만 개로 전체 공급량의 약 90%를 차지합니다.

현재 BTC의 인플레이션율은 약 1.75%이고 금의 연간 인플레이션율은 약 2%로 둘은 비교적 가깝습니다. 비트코인 반감기 설정으로 인해 향후 비트코인 BTC의 인플레이션율은 금보다 훨씬 낮아질 것입니다. 가장 최근(2020년) 반감기는 각 블록에서 발행되는 비트코인의 수를 12.5에서 6.25로 줄였습니다. 다음은 반감기는 2024년 4월 말에 이뤄질 것으로 예상된다.

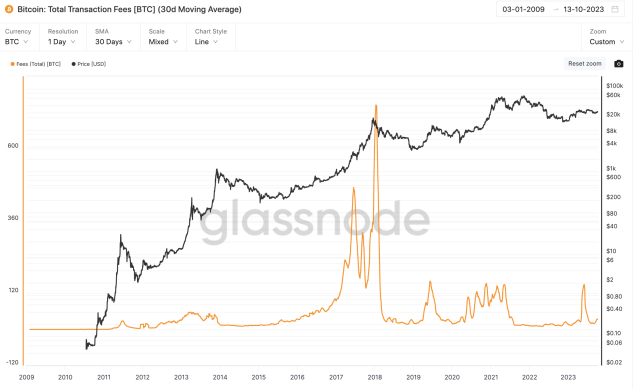

수요 측면은 처리 수수료와 투자 수요의 두 부분으로 나뉩니다. 올해 대부분 동안 BTC가 매일 소비한 처리 수수료는 약 20~30 BTC 정도이며, 대략적으로 처리 수수료 지출은 연간 약 10,000 BTC로 전체 유통량의 0.5%를 차지하는 것으로 추산됩니다. 나머지는 투자나 투기 수요이다.

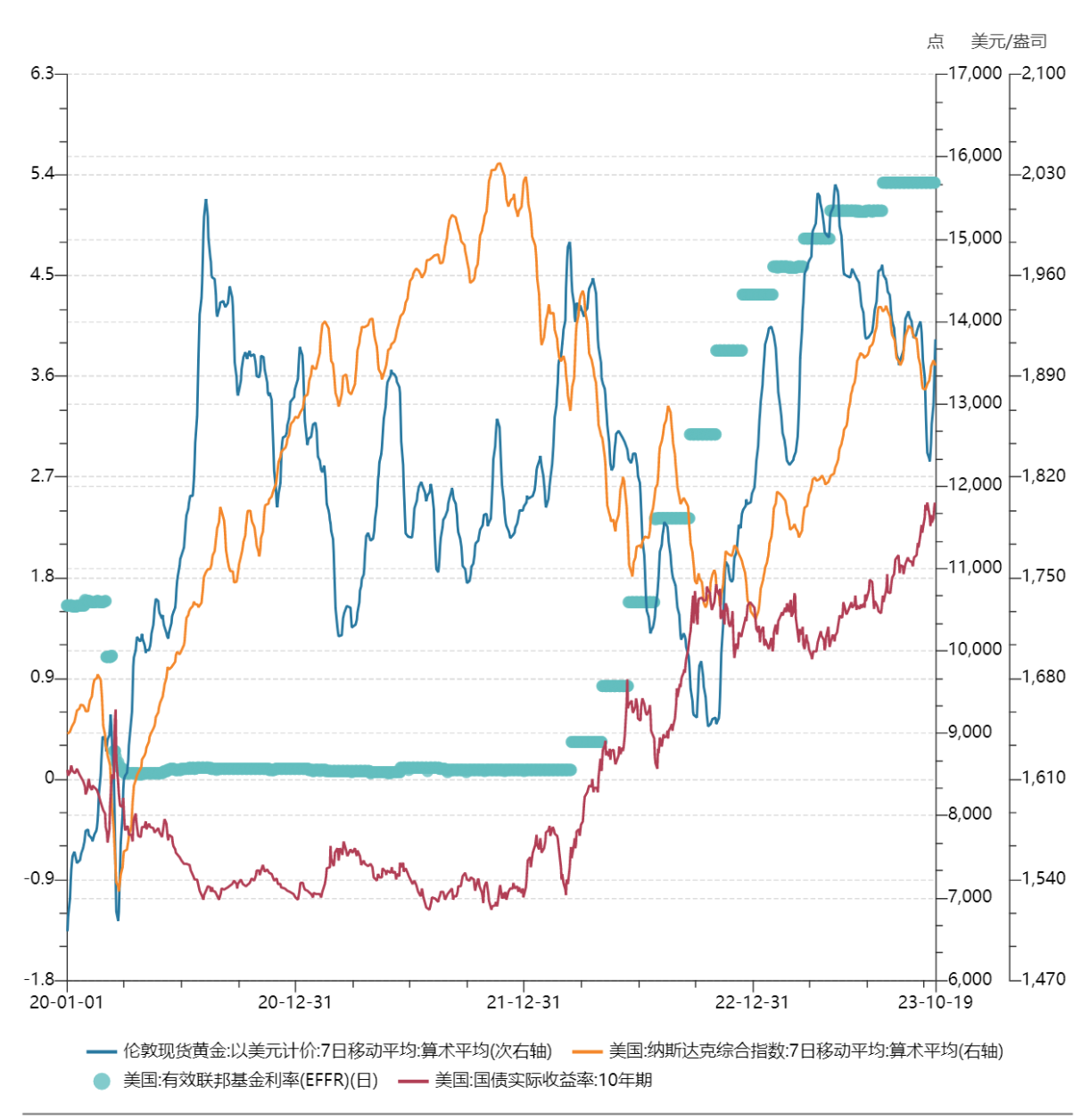

2. 매크로 환경

브레튼우즈 체제 붕괴 이후 2000년경까지 인플레이션 기대와 헤지수요가 금 가격의 주요 결정요인이었으며, 2004년부터 금시장에 ETF가 도입되기 시작했다. 시장이 확대되면서 금 속성의 재정 상태가 향상되고, 실질 금리와 미국 달러 지수가 금 가격에 영향을 미치는 중요한 요소가 되었습니다.

달러 지수

이론적으로 금 가격은 미국 달러화 가치에 반비례하는 경향이 있는데, 금은 미국 달러화로 가격이 책정되기 때문에 미국 달러화 가치가 상승하면 금 가격이 상대적으로 높아지게 됩니다. 변함없이 금 가격에 하락 압력을 가하고 있습니다. ; 또 다른 관점에서 보면 장기적인 관점에서 보면 브레튼 우즈 체제 붕괴 이후 미국 달러는 금본위제를 떠났습니다. 금은 본질적으로 신용 통화(주로 신용 통화)에 대한 헤지 수단입니다. 미국 달러), 미국 달러의 신용이 강할수록 금 할당 가치는 낮아지고, 미국 달러 신용이 약해질수록 금 할당 가치는 높아집니다. 금과 미국 달러가 동시에 상승하는 기간에는 석유 위기, 서브프라임 모기지 사태, 부채 위기 등 지정학적 또는 경제적 충격이 수반되고 시장 경계심과 위험 회피가 크게 증가했습니다.

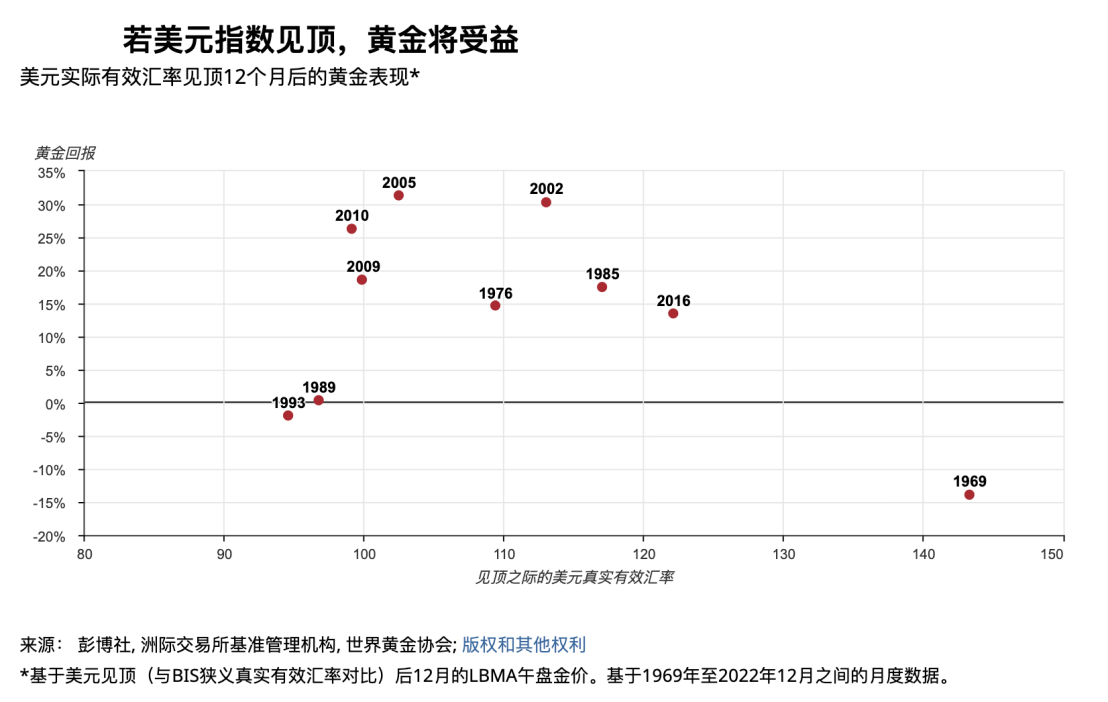

역사적으로 금 수익률은 USD 지수가 정점에 도달한 후 12개월 동안 80% 동안 플러스였습니다(평균 수익률 +14%, 중앙값 +16%).

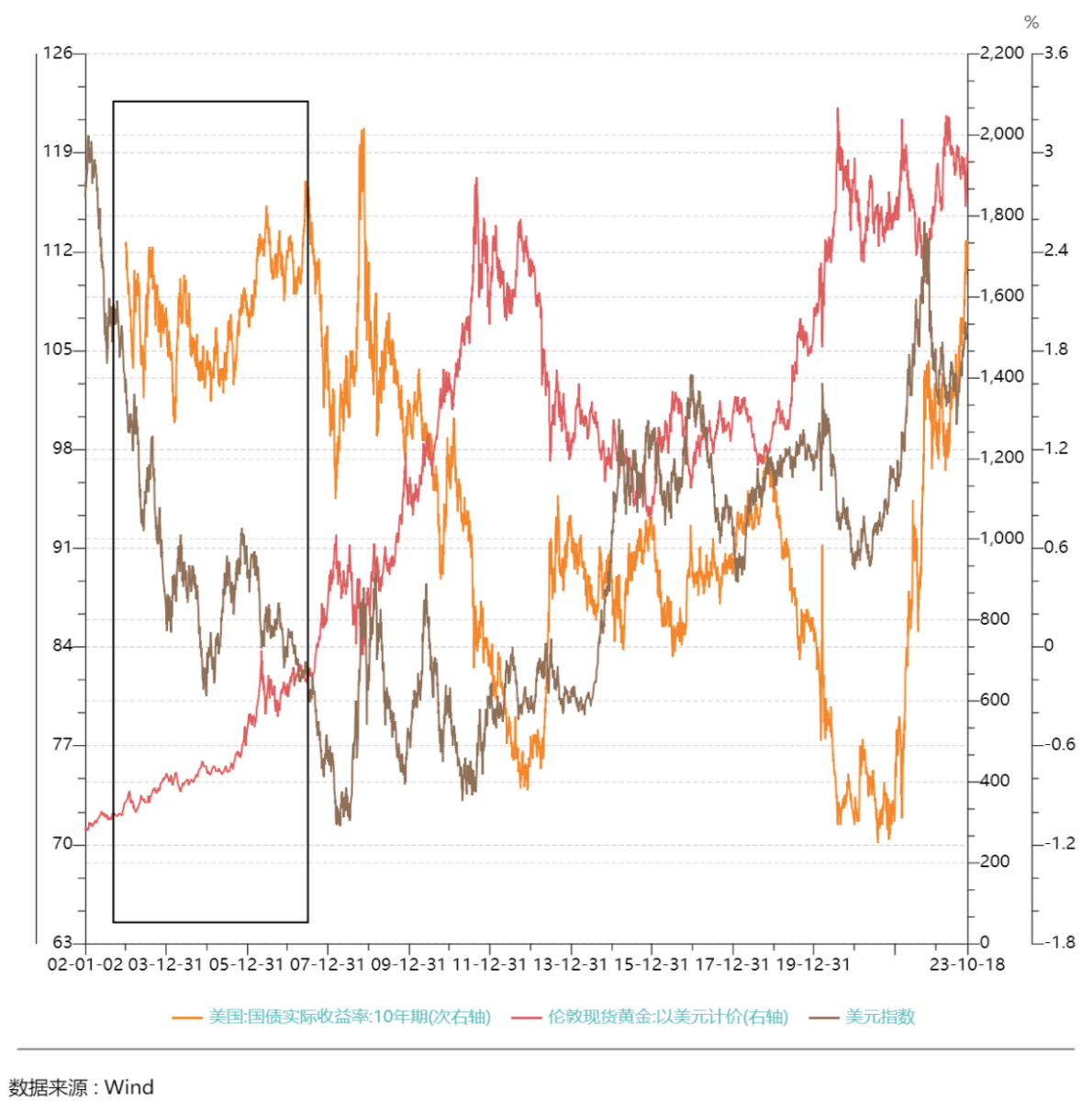

2022년 4분기부터 2023년 초까지 10년 만기 미국 국채의 실질수익률은 큰 변동 없이 변동성을 유지했으나, 금값이 온스당 약 1,600달러에서 2,000달러로 최저치까지 오르면서 금값은 일탈하는 모습을 보였다. 미국 장기 국채수익률의 제약 때문이다. 2022년 10월부터 2023년 1월까지 중국의 전염병 완화 이후 예상되는 경제 회복과 유럽 경제의 반등으로 인해 미국 이외의 성장 모멘텀이 더욱 강해 DXY가 9% 가까이 하락했습니다. 주로 DXY의 상승을 따릅니다.

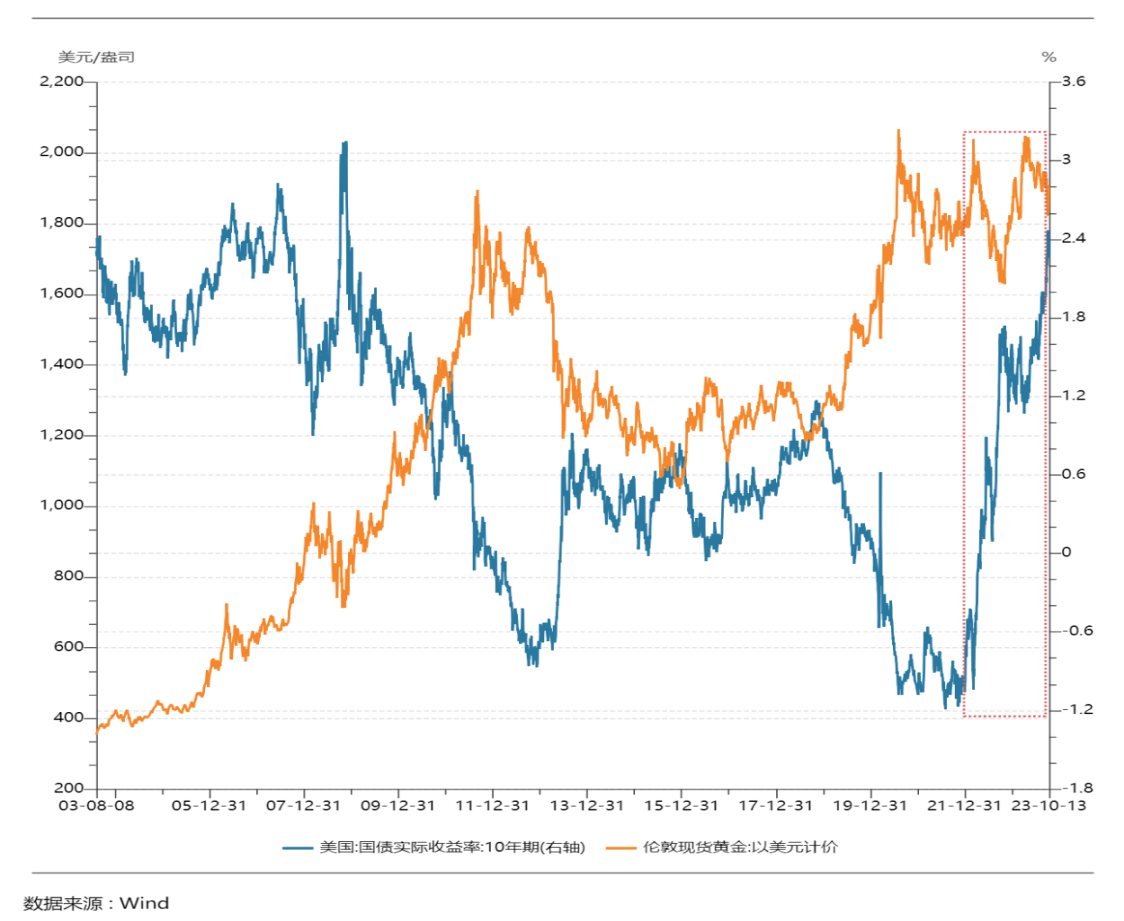

미국 재무부 실질수익률

금은 무이자 자산이고, 미국 달러는 이자 수익 자산입니다. 미국 달러 수익률과 인플레이션 기대는 금 가격 변화를 이끄는 두 가지 요인입니다. 미국의 실질 금리(명목 금리-인플레이션 기대) 는 금 보유에 따른 기회비용입니다. 이론적으로 둘은 음의 상관관계를 가지고 있습니다. 또 다른 관점에서 볼 때, 미국 실질이자율은 미국 달러 체제에서 달성할 수 있는 실질 수익률을 나타내며, 미국 달러의 신용도를 측정하는 데 사용할 수 있는 지표입니다.

미국 달러 지수와 미국 국채 실질 수익률 모두 금 가격 변동을 설명하는 데 사용될 수 있습니다. 금과 둘 사이의 상관관계는 기간에 따라 다릅니다. 21세기 이후 2005년 이전 기간을 제외하면 대부분의 경우 금 가격은 미국 10년 만기 국채 실질수익률과 유의한 음의 상관관계를 보여왔습니다. 미국 달러 지수보다 상대적으로 오랜 기간 동안 실질이자율이 장기적으로 금 가격에 영향을 미치는 가장 중요한 요소라고 볼 수 있습니다.

실질이자율에 대한 금가격의 민감도는 2022년 이후 감소했습니다. 이 기간 금 가격 변동을 설명하자면, 이는 주로 2022년 하반기부터 시작될 중앙은행의 금 매입 열풍과 관련이 있을 수 있습니다. 세계금협의회(World Gold Council)는 10월 9일 보고서를 통해 글로벌 중앙은행의 연간 총 금 보유량이 강한 성장세를 유지할 것이라고 발표했는데, 8월 세계 중앙은행의 금 보유량은 7월 대비 38% 증가한 77톤 증가했다. 금 시장의 수요 측면에서 변화가 일어날 수 있습니다.

3. 지정학

소위 어려운 시기에 금을 사들이는 것, 지정학적 갈등의 발발은 자본 헤징에 대한 수요를 증가시키고 단기적으로 금 가격의 급격한 상승을 자극할 것입니다. 2022년에는 금 가격이 온스당 미화 2,000달러 정도 오를 것입니다. 이는 미국의 실질 수익률이자 달러가 설명하지 못하는 것입니다.

러시아-우크라이나 전쟁 이후 자산 가격 변동

2022년 2월 24일, 블라디미르 푸틴 러시아 대통령은 러시아군이 우크라이나의 비무장화와 비나치화를 목표로 군사작전을 실시할 것이라고 발표했다. 사람들. 그렇죠. 푸틴 대통령의 연설이 끝난 지 몇 분 뒤, 러시아군은 키예프, 하르키우, 드니프로의 군사 기지와 공항에 순항 미사일과 탄도 미사일을 발사해 우크라이나 방위군 본부를 파괴했습니다. 이후 러시아군은 우크라이나가 지배하는 루한스크 지역과 수미, 하르키프, 체르니고프, 지토미미르 등지에 대한 공격을 감행했고, 우크라이나 남부 도시인 마리우폴과 오데사에도 공격을 가해 러시아군은 대규모 상륙작전을 감행했다. 착륙.

2월 25일부터 3월 8일까지 금값은 약 8% 상승을 이어갔고, BTC는 전쟁 후 3~4일 동안 뚜렷한 변동을 보이지 않았고, 3월 1일에는 15% 상승했으나 곧 상승 전으로 돌아갔습니다. 금이 최고점에 도달한 3월 8일 기준 BTC는 충돌 전 가격보다 4% 오른 38,733달러에 거래됐고, 나스닥 지수는 약 1.5% 하락했다.

3월 9일부터 3월 말까지 유럽과 미국 등 국가들이 러시아에 대한 제재를 발표하면서 시장은 최악의 결과가 나올 것으로 예상했고, 금값은 곧바로 역사적 고점에서 하락했다. 며칠간 잠깐 등락을 보였는데, 3월 14일부터 금값이 등락을 보이면서 BTC와 나스닥이 함께 상승했습니다. 3월 말까지 BTC는 20% 상승했고, 금 상승폭은 2%(2월 24일 대비)로 줄었고, 나스닥은 6% 상승했습니다.

동시에, 연준은 2022년 3월에 이번 라운드의 금리 인상 주기를 시작했습니다. 러시아-우크라이나 전쟁이 자산 가격에 미치는 영향은 점차 약화되었으며, 거래 논리는 연준의 금리 인상으로 이동했습니다.

4월 금리 인상을 시작으로 BTC와 나스닥 지수는 동시에 장기 하락세를 보였으며, 금값도 잠시 상승한 뒤 4월 19일부터 장기 하락세를 보였다. 나스닥은 2022년 10월 금리 인상 이후 누적 하락폭이 28%로 약 10,000포인트에서 바닥을 쳤고, 금은 금리 인상 이후 누적 하락폭이 16%로 9월과 10월에 1,615달러로 바닥을 쳤습니다. 11월 누적 하락률은 16%였으며, 최저치는 16,000달러 부근으로 금리 인상 이후 누적 하락률은 66%에 달했다.

금은 바닥을 친 후 가장 먼저 새로운 시장을 시작하며 11월 초부터 지속적으로 상승했으며, 5월 4일 고점은 2,072달러로 나타났고 저점은 28% 상승했습니다. BTC와 나스닥 지수의 가격은 금보다 두 달 늦게 시작되었고, 2023년부터 BTC와 나스닥 지수가 다시 동시에 상승하기 시작했으며, 7월 중순에 BTC와 나스닥 지수의 고점이 동시에 나타나 BTC가 최고치를 기록했습니다. 31,500 부근에 도달하면서 저점이 1배 가까이 올랐고, 나스닥은 최고가 14,446에 도달하고 저점이 44% 상승했습니다.

이러한 상승세는 주로 11월 초 미국 채권 금리가 단계적으로 정점을 찍은 것과 관련이 있으며, 11월 초 이후 미국 채권 금리 하락으로 인해 위험자산 가격이 크게 반등했습니다. 주요 원인은 10월 CPI와 핵심 CPI 지표가 예상보다 크게 하락했고, 미국 10년-2년 국채 금리 역전폭이 더욱 심화된 점으로, 이는 경기와 인플레이션에 대한 시장의 기대가 하향 조정되었음을 반영합니다. 상당 부분. 미국 CPI와 근원 CPI의 고점과 하락은 미국 10년 만기 국채수익률의 고점과 하락을 가져왔고, 이는 연준의 금리 인상 속도 둔화로도 이어졌다. 이후 나스닥의 인공지능 열풍으로 금과 BTC도 각자의 독립적인 서사적 축복을 누리며 각 시장의 한층 더 상승세를 이어갔다.

전반적으로 러시아-우크라이나 분쟁 이후 BTC 가격과 금 간의 동기화로 판단하면 BTC는 강력한 헤지 속성을 반영하지 않는 것으로 여겨집니다.

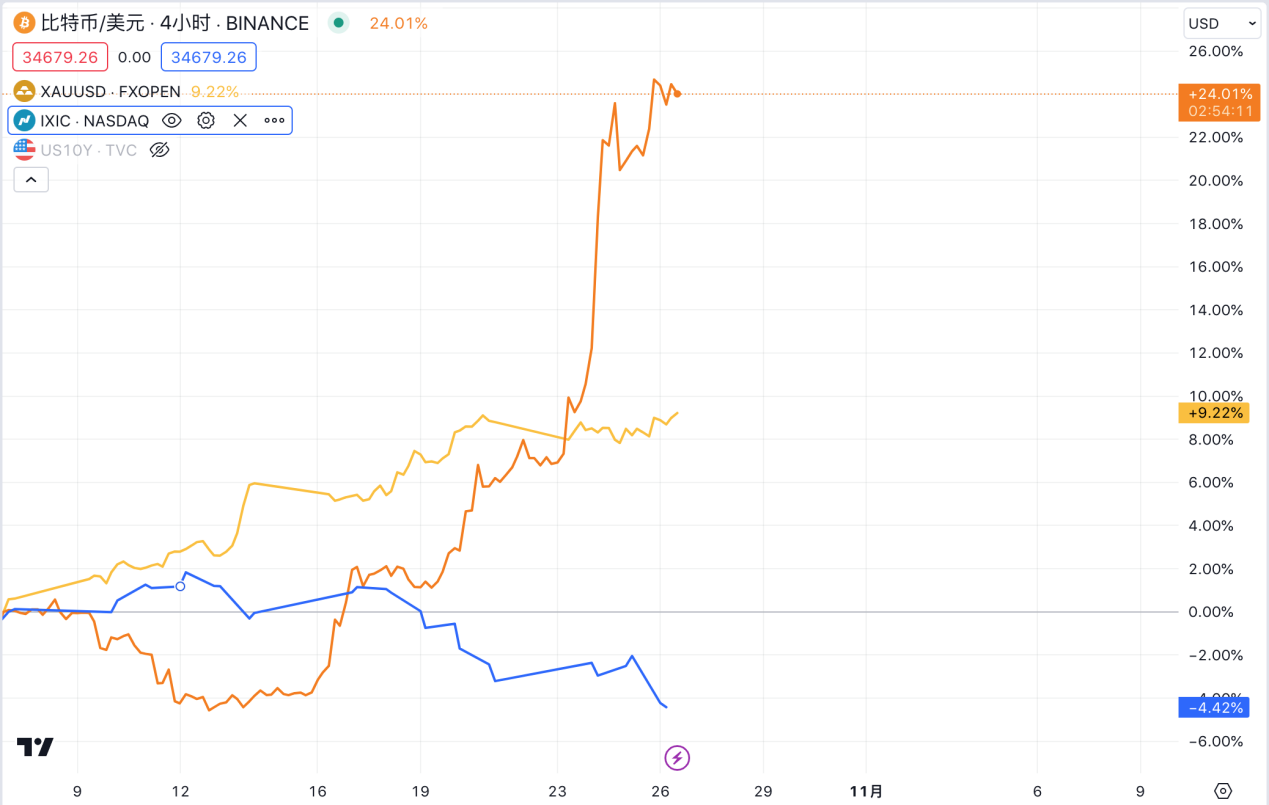

이스라엘-팔레스타인 분쟁 이후 자산 가격의 변화

현지 시간으로 2023년 10월 7일 이른 아침, 팔레스타인 이슬람 저항 운동(하마스)은 코드명 아크사 홍수(Aqsa Flood) 작전을 개시해 짧은 시간에 이스라엘을 향해 5000발 이상의 로켓을 발사했다. 입체공격 전투 방식은 가자지구에서 이스라엘로 진입해 이스라엘군과 충돌하는 방식이었다. 이후 이스라엘은 가자지구에 여러 차례 공습을 가했고, 네타냐후 이스라엘 총리는 이스라엘이 전쟁 상태에 돌입했다고 선언하고 이스라엘군이 하마스를 파괴하기 위해 모든 군사력을 사용할 것이라고 말했습니다.

금은 분쟁 이후 가장 크게 오른 자산으로, 10월 9일 1832년부터 10월 26일 거의 2000달러로 상승했는데, 이는 러시아-우크라이나 분쟁의 증가와 동시에 발생하며 약 8% 증가한 수치입니다. 10월 7일 13일 28000에서 26770으로 4.4% 하락했다가 13일부터 반등 시작 16일 BlackRock BTC ETF 신청이 승인되면서 자체 사건을 겪었습니다. 상승 후 하락세를 보였으며, 종가에는 여전히 상승폭의 절반을 유지하며 28546까지 상승했으며, ETF는 기대감을 통해 계속 발효되어 25일 기준 34,183달러까지 상승했고, 나스닥은 10월 9일부터 11일까지 소폭 상승했으며, 12일부터 하락하기 시작해 10월 20일 13,672포인트에서 125,956포인트로 하락했다.

이번 BTC와 나스닥의 흐름은 거의 정반대이며 독립적인 시장을 형성하고 있습니다.먼저 전쟁 후 지난 일주일 동안 금과 반대였던 BTC의 가격 성과로 볼 때, BTC가 여전히 안전자산의 속성을 반영하지 못하고 있으며, 이에 따른 반등은 BTC 현물 ETF 승인에 대한 시장의 신뢰가 다시 불붙었고 SEC가 그레이스케일 비트코인에 대한 항소를 하지 않은 이후에도 계속 발효되고 있기 때문이다. 신탁 사례.

3. BTC는 안전자산인가요?

BTC는 수요와 공급, 인플레이션 등의 측면에서 금과 매우 유사합니다. 모델 설계 및 논리에서 BTC는 헤징 속성을 가져야 합니다. Arthur Hayes가 For the War라는 기사에서 설명했듯이 전쟁은 폭력적인 인플레이션으로 이어질 것입니다. 일반 시민이 재산을 보호하는 일반적인 방법은 금 경화를 선택하는 것입니다. 그러나 국가에서 대규모 전쟁이 발생하면 , 정부가 이를 금지할 수도 있습니다.귀금속의 개인 소유, 귀금속 거래 제한, 심지어 금 소유자가 자신의 금괴를 정부에 저렴한 가격에 팔도록 강요하는 것입니다. 강력한 통화를 보유하는 것도 엄격한 자본 통제를 받습니다. 오직 비트코인의 가치와 전송 네트워크는 정부가 승인한 은행 기관에 의존하지 않고 물리적인 존재도 없으며, 일반 사람들이 통제를 받지 않고 어디든 가지고 갈 수 있습니다. 실제 전쟁 시나리오에 직면했을 때 BTC는 실제로 금과 강력한 통화를 능가하는 최고의 자산입니다.

그러나 현재까지 자산의 실제 가격으로 판단할 때 BTC는 뚜렷한 헤징 특성을 보이지 않았습니다.

전체 사이클에서 다양한 자산의 변화를 더 잘 이해하기 위해 러시아-우크라이나 분쟁 이전의 이번 미국 달러 흐름 이전의 자산 가격 변화를 보완합니다. 2020년 초 코로나19 전염병이 발생하면서 인플레이션 기대치가 급락했고, 이로 인해 연준은 금리를 0~0.25%로 대폭 인하하고 2020년 3월 말에 무제한 QE를 시작했습니다. 자산가격은 전체적으로 상승했고, 금값도 가장 급격하게 올랐습니다.2020년 8월 런던 금값은 온스당 2,075달러로 사상 최고치를 기록한 뒤 하락세를 보이기 시작해 2020년 3월 30일 6,631에서 11월 21일 6,631까지 올랐습니다. 2021년 16,212포인트에서 나스닥은 총 144% 상승했고, 같은 기간 BTC는 6,850달러에서 58,716달러로 총 757% 상승했습니다.

2020년부터 전통적 펀드가 진입하면서 BTC의 가격은 일부 주요 자산의 특성을 점점 더 많이 보여주었고, 이 기간 동안 BTC의 상승과 하락은 나스닥의 추세와 더욱 일치했습니다. 여기서 금은 실질금리 외에 금값 상승의 원동력인 전염병이라는 특수한 시기의 안전자산의 기능과 전염병 패닉의 확산, 심각한 경기악화에 대한 우려 등을 반영한 것으로 평가된다. .한편, 새로운 크라운 전염병은 금 운송에 여러 층의 장애를 초래하여 금 가격을 상승시켰습니다.더 빠르게 상승하세요.

이번 미국 달러 흐름의 장기적인 등락을 살펴보든, 단기 지정학적 갈등을 살펴보든 BTC는 뚜렷한 헤징 속성을 보이지 않지만 초기 성과는 다음과 더 일치한다는 것을 알 수 있습니다. 나스닥 지수, 높은 상관관계. 소위 안전자산이라고 불리는 금의 가격은 빅사이클에서 매우 강한 재무적 속성을 보이고 있으며, 또한 장기적으로 금리의 영향을 받으며 나스닥과 동일한 가격추세를 유지하고 있다는 점을 지적할 필요가 있다. .

4. 향후 동향 전망

지난 10월 많은 연준 관계자들은 비둘기파적인 발언을 했다. 예를 들어, 이전에는 매파적이었던 댈러스 연준 총재인 로건은 미국 채권 금리 상승이 금리 인상 필요성을 줄일 수 있다고 말했고, 제퍼슨 연준 부의장은 향후 통화 정책을 판단할 때 다음과 같이 말했다. 최근 채권수익률 상승으로 인한 금융여건의 긴축도 고려해볼 만하다. 파월 연준 의장은 10월 19일 목요일 뉴욕 이코노믹 클럽 연설에서 최근 인플레이션을 낮추려는 노력이 계속 진전을 보이는 한 미국 장기 채권 수익률 상승으로 인해 중앙은행이 금리를 인상할 수 있다고 암시했습니다. 파월 의장은 다음 회의에서 금리 인상을 계속 유예하지만, 동시에 연준은 인플레이션을 2%까지 지속적으로 낮추기 위해 노력할 것이며 향후 금리를 다시 인상할 가능성도 배제하지 않고 있다고 파월 의장은 연설했습니다. CME 금리선물이 암시하는 11월 금리 인상 불발 확률은 99.9%로 높아졌으나 10년 만에 미국 채권 금리는 지난주 또 급등해 장중 한때 5.0%를 넘어섰다. 금리 인상은 더 이상 미국 채권 수익률 거래자들에게 게임의 목적이 아닙니다. 연설 당일 금리 인상은 한편으로는 파월 의장의 신중한 태도를 반영한 것일 수도 있습니다. 연설은 매파적인 어조로 해석되었습니다. 다른 한편으로는 한편, 미국 재정이 계속 확대되어 부채 발행이 늘어날 수도 있다는 우려도 있었습니다.

전반적으로 현재 경제지표에 따르면 미국 10년 만기 국채수익률은 5% 수준이 연준이 믿는 최고 포지션인 것으로 추측된다. 장기적으로 점선과 시장전망에 따르면 내년 연준 회의에서 금리 인하가 시작될 가능성이 있으며, 연준 통화정책의 주축 변화가 가장 중요한 변화를 가져올 것으로 보인다. 2024년 글로벌 자산 배분의 기본 논리. 일반적으로 금과 BTC의 배분 기간이 다가오고 있으며 이는 타이밍의 문제입니다.

1. 골드

미국 국채의 실질 수익률은 여전히 금 가격의 주요 동인입니다. 내년에 주기가 역전된 후에는 금과 10년 만기 미국 국채의 실질 수익률 사이의 음의 상관관계가 다시 살아날 것입니다. 미국 국채의 실질 수익률 금 가격의 주요하고 지속적인 동인이 될 것입니다. 가격 동인 요인, 둘째, 국제 통화 시스템의 다극화 추세, 반세계화 촉진, 비미국 통화 상승이 신용에 영향을 미칠 것입니다. 장기적으로 미국 달러의 가치를 높이고 중앙은행의 지속적인 금 구매를 지원합니다. 따라서 장기적으로 금은 사이클 반전과 구조적 변화의 이중 영향으로 상승 사이클을 이끌며 이전 역사적 고점을 돌파할 것으로 예상됩니다.

금 가격은 단기적으로 변동성이 클 것입니다. 지정학은 여전히 주요 영향 요인이고 가격 추세는 팔레스타인-이스라엘 분쟁이 중동의 다른 지역으로 확대되는지 여부에 따라 결정됩니다. 저자는 분쟁이 팔레스타인과 이스라엘에 국한된다면 금의 성장은 멈출 가능성이 높으며, 온스당 2000달러라는 심리적 압박 수준도 돌파하기 어려울 것이라고 본다. 이란, 사우디아라비아 등 산유국은 극단적인 경우에도 석유 금수 조치를 취하거나 생산량이 급격히 감소하면 원유 공급망에 더 큰 영향을 미쳐 원유와 금의 추가 상승을 촉발할 수 있습니다. , 에너지 가격 상승 및 기타 원자재 가격으로의 전환은 CPI 상승 반등을 촉진하여 거시 환경에 더 많은 문제를 야기할 것입니다. 현재 상황에 따라 첫 번째 시나리오의 확률이 더 높아질 수도 있습니다.

2、BTC

마찬가지로 2024년 연준이 다음 주기를 시작함에 따라 시장의 전반적인 유동성이 개선되고 글로벌 투자자의 위험 선호도가 높아지며 독특한 시장 논리가 중첩됩니다.ETF 및 반감기 시장의 영향을 받아 비트코인은 상승장도 전고점을 돌파할 것으로 예상된다. 단기적인 원동력은 여전히 SEC의 현물 BTC ETF 승인이며, BTC 가격은 최근 34,000달러 이상으로 급등했습니다. 현물 ETF가 BTC 가격에 미치는 구체적인 영향과 향후 연구 보고서에서 BTC 통과 후 가격 예측에 대해 심층적으로 논의할 예정이니 계속 지켜봐 주시기 바랍니다.

이 글은 전적으로 작성자의 개인적인 의견이며 누구에게도 투자 조언을 제공하지 않습니다.