SignalPlus: Prelude to the Debt Crisis Special Edition

Dear friends, welcome to the SignalPlus macro review. SignalPlus macro reviews update macro market information for you every day, and share our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

Dear friends, welcome to the SignalPlus macro review. SignalPlus macro reviews update macro market information for you every day, and share our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

Markets were relatively quiet last Friday, with the market's attention fully focused on the latest debt ceiling news and Chairman Powell's interview with Bernanke, neither of which had a significant impact on asset price movements.

First of all, on the issue of the debt ceiling, the information is quite confusing. There is news that the negotiations are going well, but there are contradictory news, such as the Republican negotiators who think that the White House is "unreasonable" and withdraw from the debt negotiations; Discussions were dragged to the last minute to create an image of tough negotiations, so this type of political showmanship was expected, but it was clearly not appreciated by the market and SPX gains were capped early in the session.

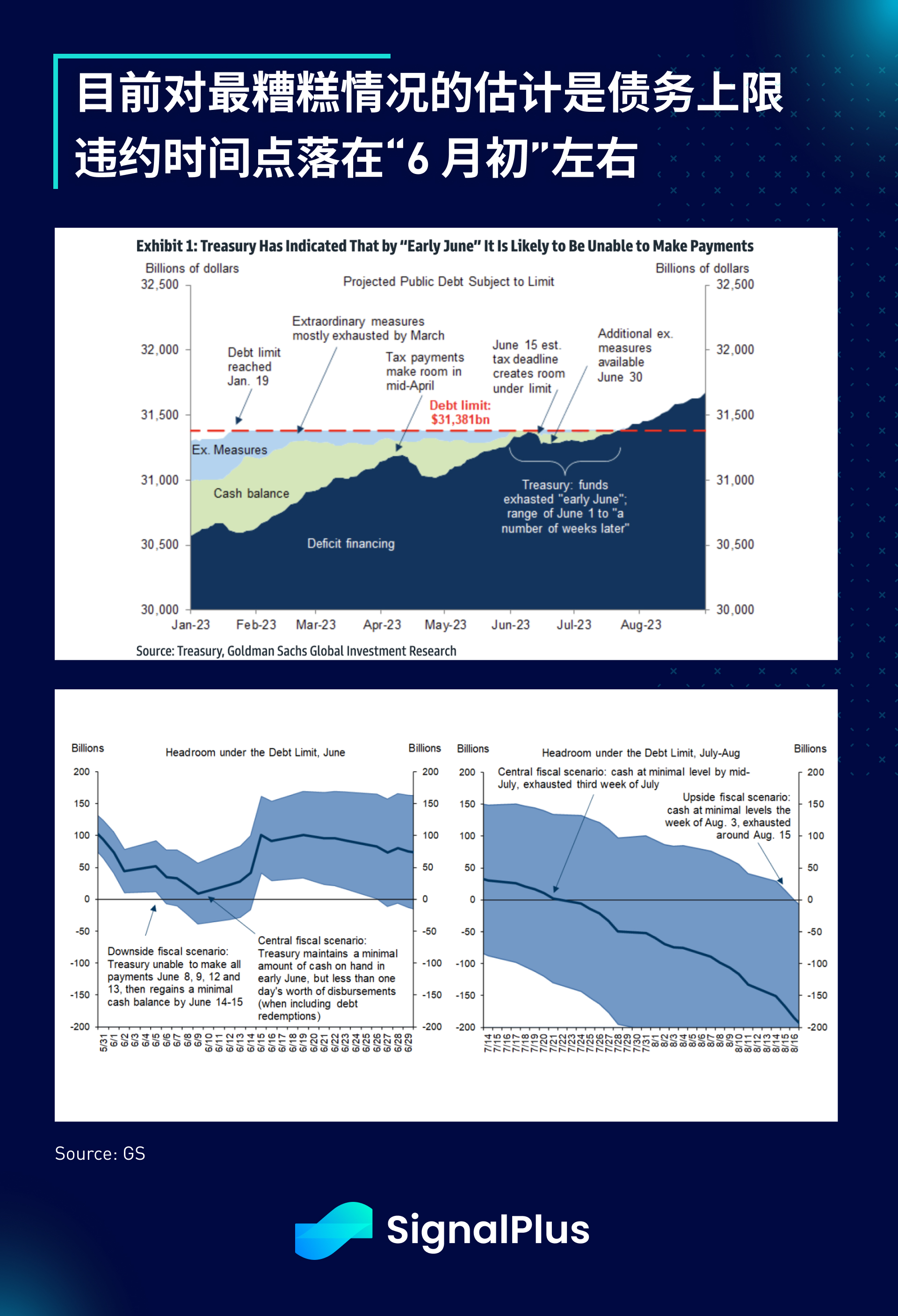

As mentioned in previous comments, the exact timing of a debt-ceiling default involves many dynamic micropayment components, making it difficult to pinpoint, although latest estimates suggest that in a worst-case scenario a default could occur on the 2nd of June. Weeks or so, although Minister Yellen emphasized the June 1 point in order to take precautionary measures; also, the government is expected to receive additional revenue around June 15, so if the X-Date happens after that, the parties may choose to renew Delay for a month or more, more brinkmanship. In short, the first week of June should be the first real potential deadline.

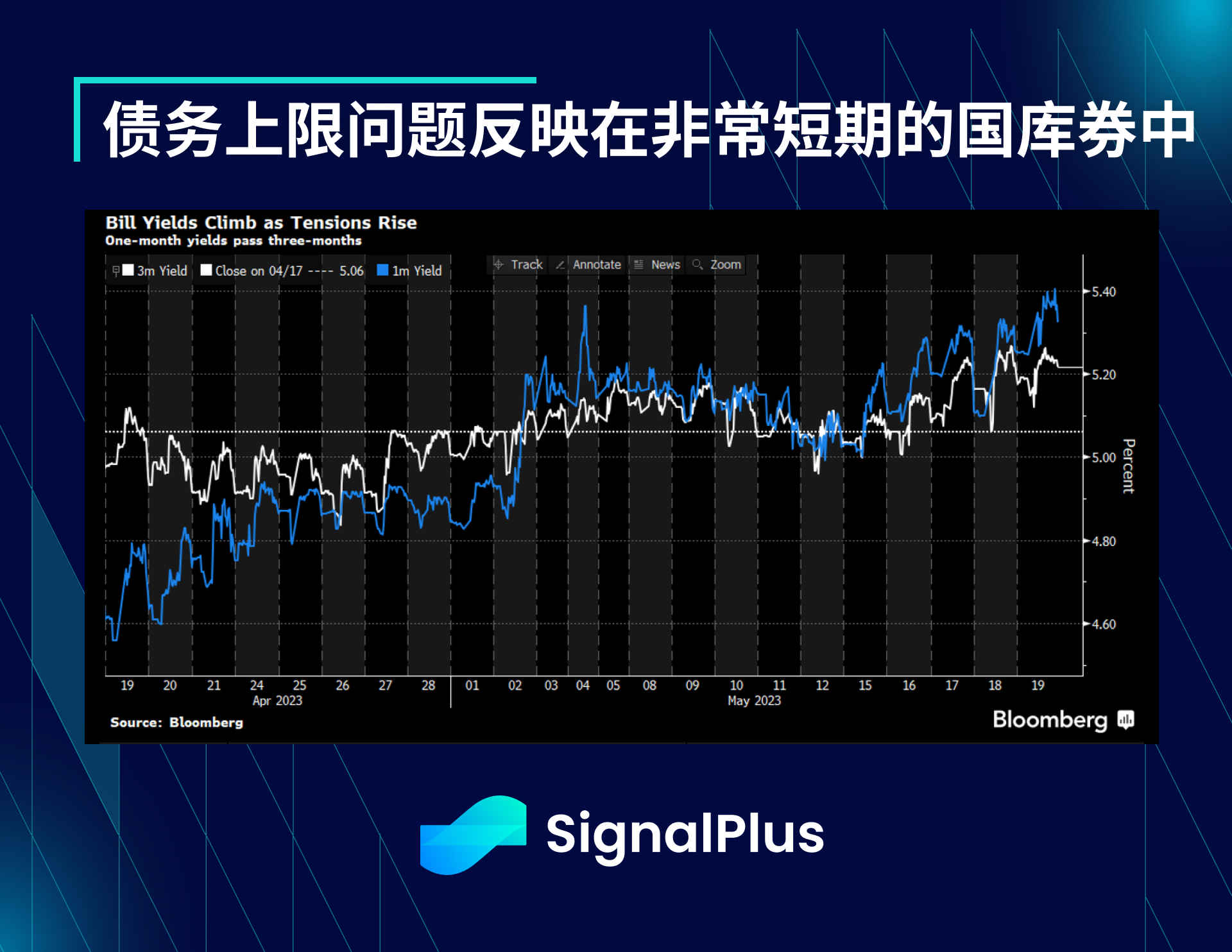

Much of the uncertainty around the debt ceiling issue has been priced into very short-dated Treasuries, with 1-month yields up about 80bp from about 4.65% in April (after the SVB event squeeze) as of Friday It reached a high of 5.40%. Although few investors really think that a default may occur, considering the asymmetry of risk and reward, it is reasonable for insurance premium to be included in the pricing.

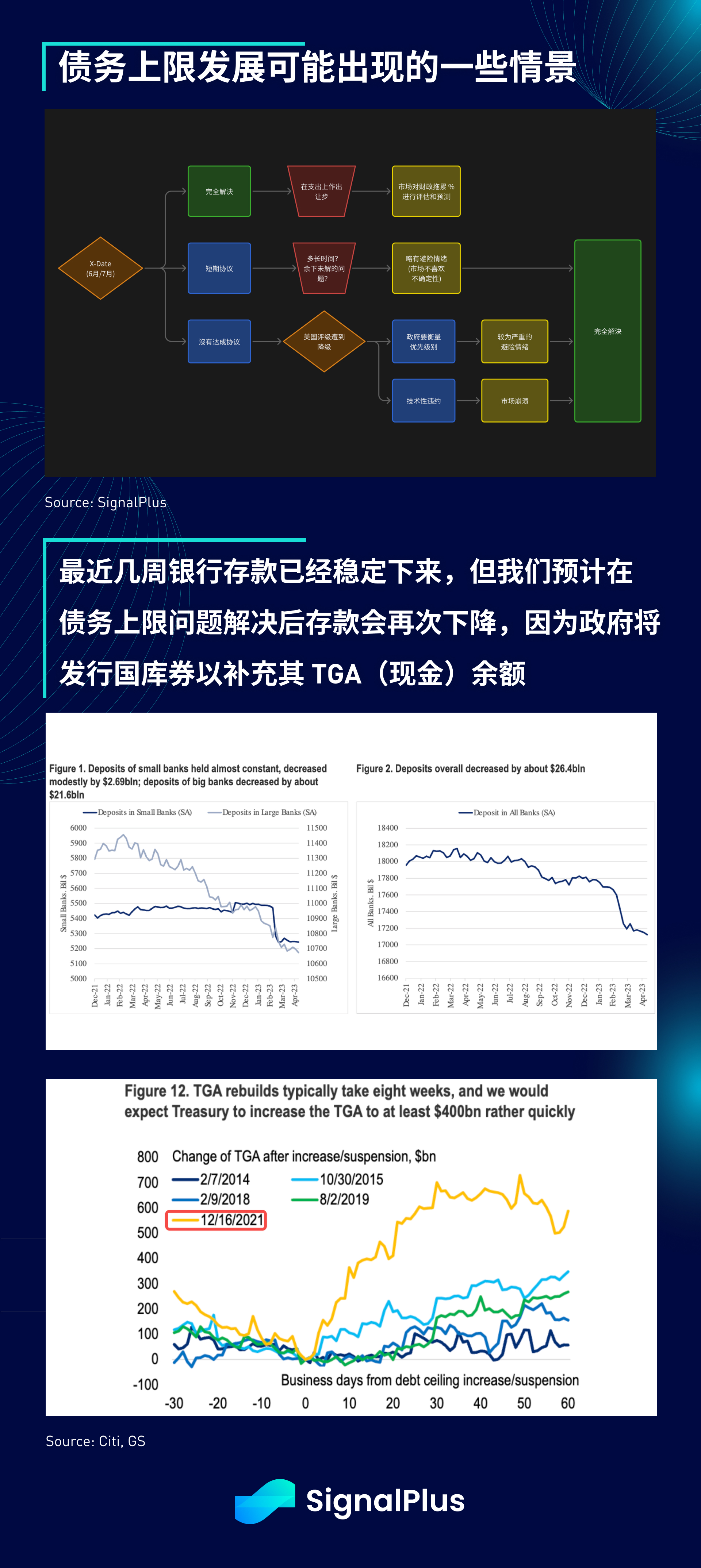

In terms of possible next steps, there are several possible scenarios ranging from a full resolution of pre-X-Date issues to a no-deal resulting in a downgrade; the most optimistic scenario is that both parties agree on a new budget and agree on a debt ceiling A deal, which would likely include some spending caps for the next 2-4 years, would be a negative fiscal drag on GDP; a worse-case scenario would be a failure to reach a deal in early June and running out of cash, which could lead to rating agencies downgrading the U.S. credit ratings and forced the government to furlough workers in order to prioritize interest payments.

In a more aggressive resolution, as the government needs to quickly replenish its TGA (working capital) account from less than $60 billion to about $600 billion, short-term yields may move higher due to the large number of Treasury bills issued, and this This liquidity will be drawn from both the open market and bank deposits. Stocks should be able to breathe a sigh of relief in the short term, though the longer-term impact will depend on how large a fiscal drag the spending cuts will be.

In a less favorable scenario, there could be risk aversion in equities, combined with a downgrade in the US and a potential technical default, there could be a bit of confusion in the bond market, although we would expect a flattening yield curve in this scenario. The stock market will obviously be affected and act as a catalyst for the government to come together, but hopefully all parties can find a way forward before this final trigger point.

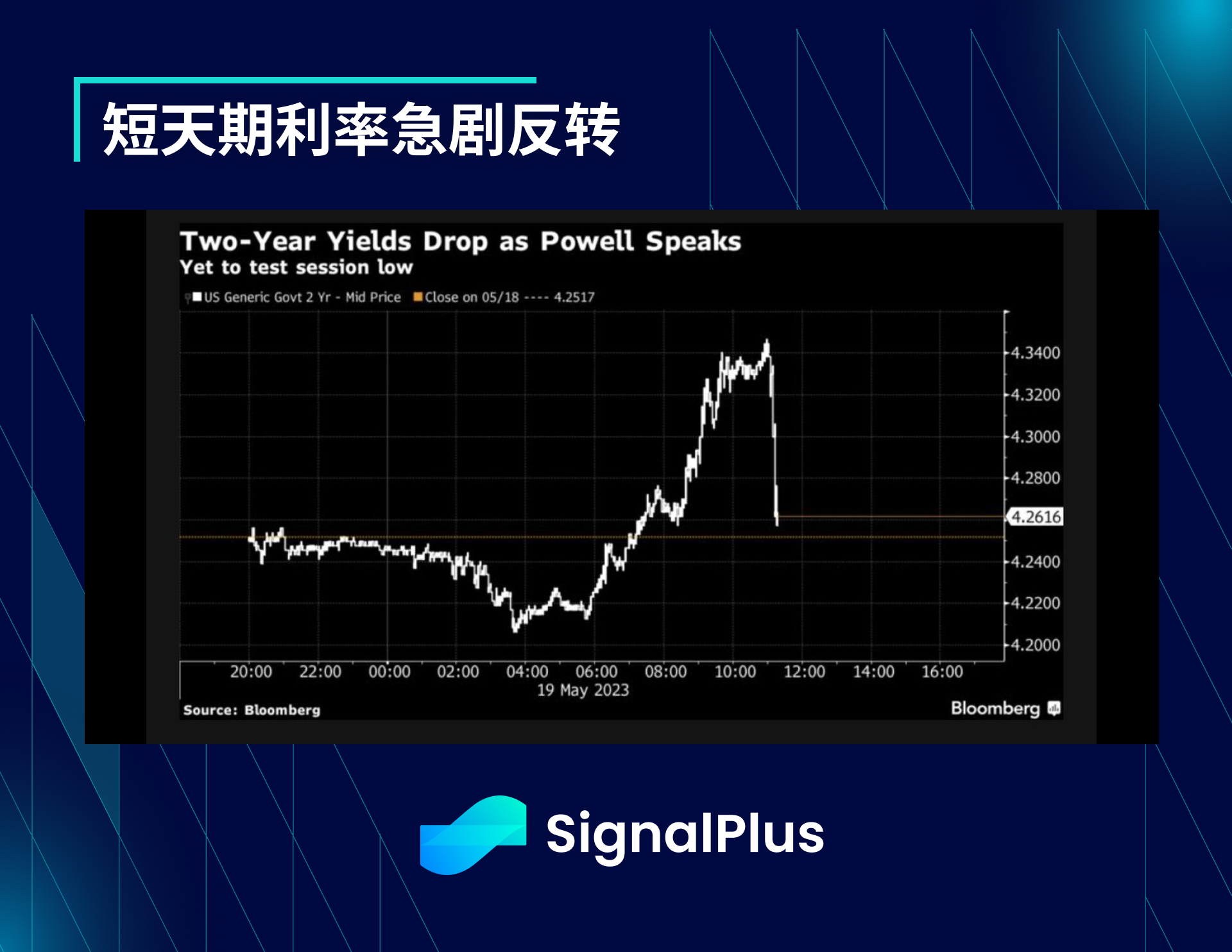

Outside of the debt-ceiling talks, Chairman Powell noted in an interview that the FOMC "has made a lot of progress on policy tightening," stressing that "as policy becomes more restrictive, there is a difference between doing too much and doing too little." Risks are also becoming more balanced", and while he stressed that the Fed has not yet "taken any decision on whether further policy measures are needed", since they have "already made a lot of progress", the FOMC can "consider data and changing outlook” to make decisions; it is also worth noting that, despite being in an interview, Powell chose to read his responses very carefully from a set of prepared notes, taking particular care not to miscommunicate.

With no clear indication that policy tightening is possible next month, short-term interest rates reversed sharply, reducing the chances of a rate hike in June to around 15%, and bonds recovered about half of the day's losses, with 2-year yields holding at 4.27 % around 3-month highs, while the 2/10 s yield curve inversion held steady at -60 basis points.

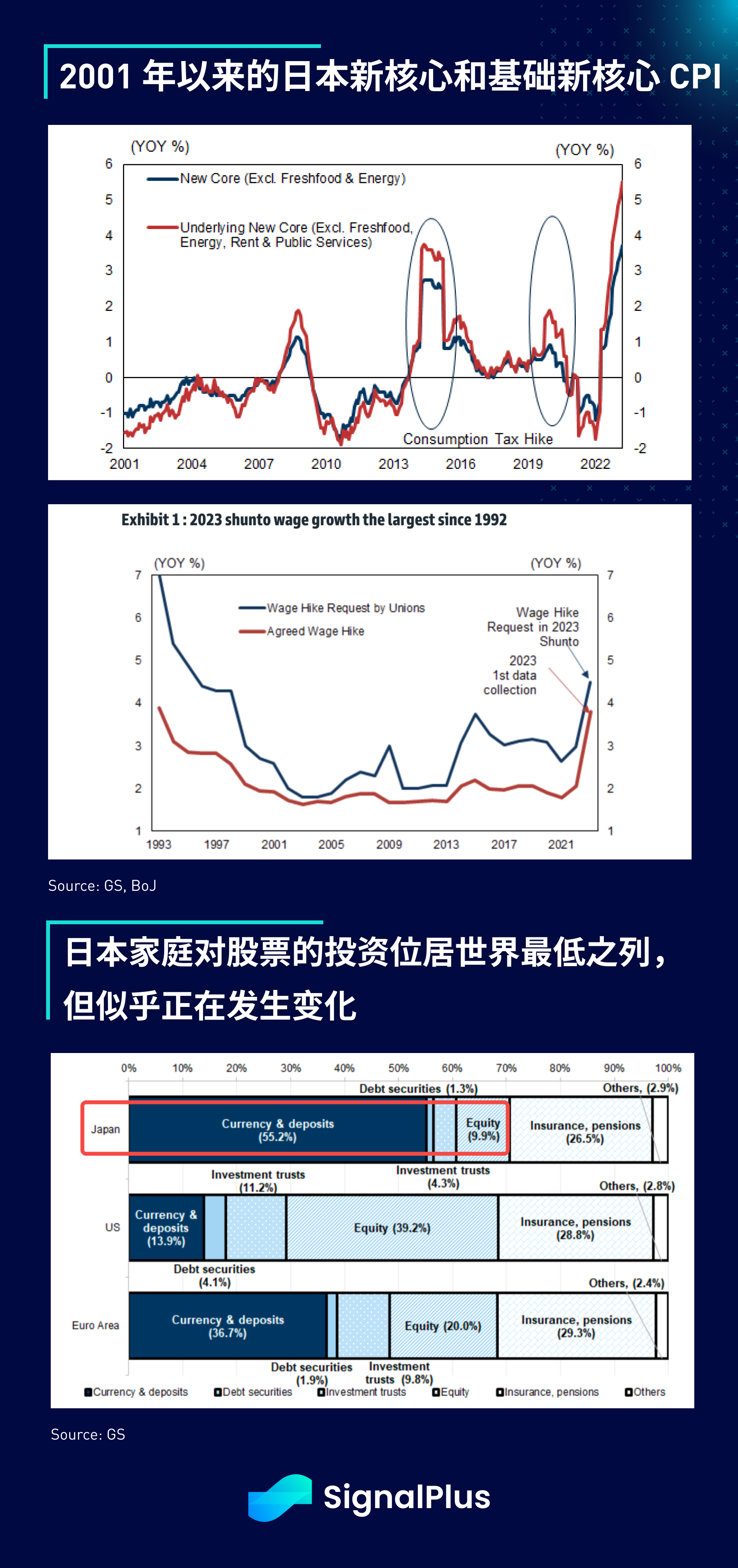

Taking the focus away from the US for a moment, one of the hottest macro sectors outside of AI this year is Japan, with the TOPIX index up 5% on Friday to close at its highest level in 33 years (up 14% YTD), and Japan Equity funds attracted $800m inflows over the past week, while both the US and Europe saw outflows (source: EPFR data).

Foreign interest in the region has increased throughout the year, with year-to-date inflows exceeding 4 trillion yen, and Warren Buffett has become the latest high-profile backer to encourage investors to focus on Japan. In its own right, Japanese share buybacks are at record highs in 2022, dividend growth is solid, and the TSE (Tokyo Stock Exchange) has recently explicitly called for listed companies with price-to-book ratios < 1 to raise their valuations.

Furthermore, at a time when Japan is finally emerging from the deflationary cycle and core CPI has soared to its highest level in 25 years, Prime Minister Fumio Kishida has also actively called for ("new capitalism policies") fundamental reforms of domestic asset management firms and even venture capital markets . Finally, with Japanese households owning only 10% of stocks compared to 20-40% in the West, will long-term inflation eventually lead to a change in Japanese consumer behavior and force the last holdout BoJ to break its Decades of zero interest rate policy deserves our continued attention.

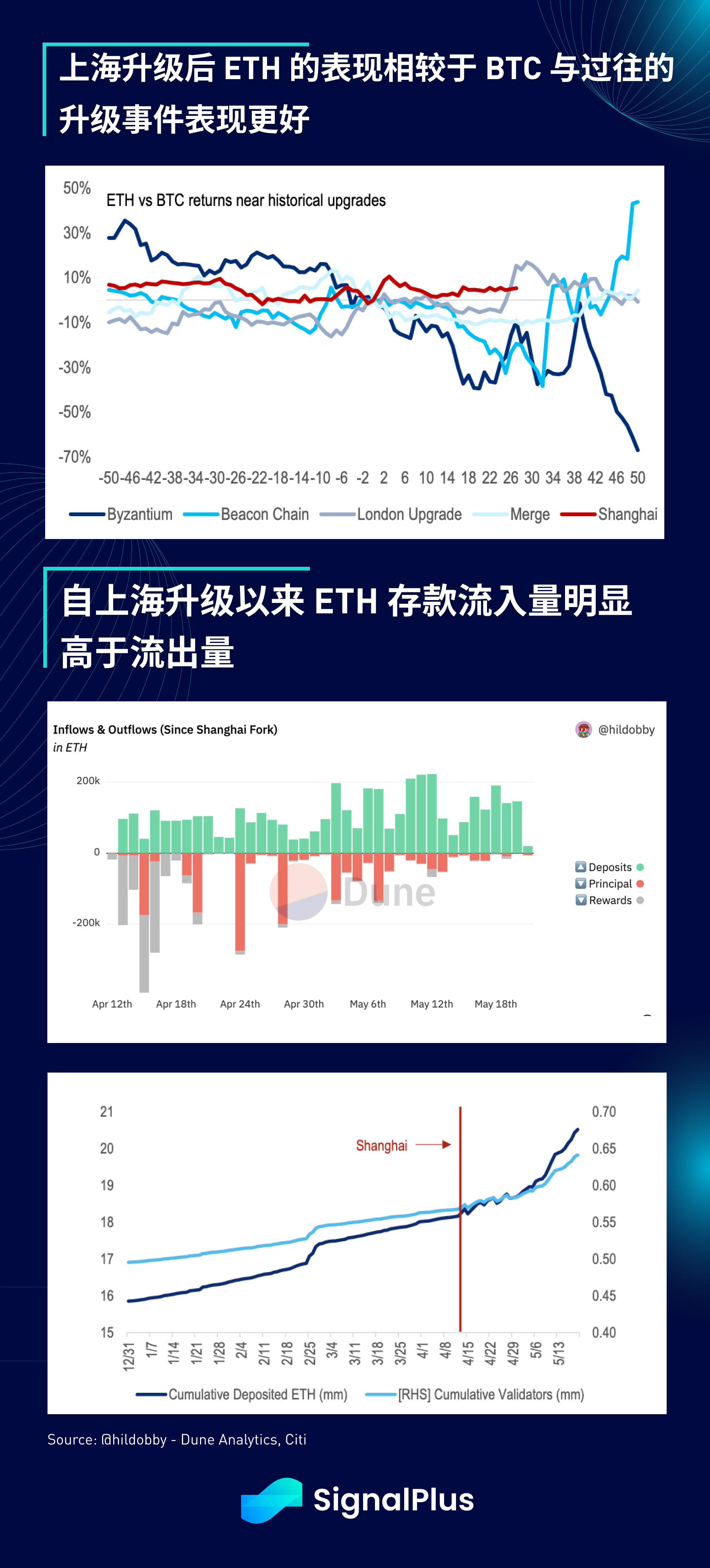

Cryptocurrencies continue to underperform as U.S. regulatory pressure on the industry continues unabated; BTC’s correlation with SPX continues to decline as mainstream interest wanes, though with gold after regional banking turmoil and debt ceiling events The correlation is still good.

Finally, interest in cryptocurrencies appears to continue to flow east, with BTC/ETH price performance significantly outperforming European and US timezones during Asian hours, with the US lagging since September 2022, as the regulatory landscape for cryptocurrencies continues to evolve. Being shaped, we may have to get used to new situations.

If you want to receive our updates immediately, welcome to follow our Twitter account @SignalPlus_Web 3 , or join our WeChat group (add a small assistant WeChat: chillywzq), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com/