SignalPlus Macro Analysis Special Edition: October Rally

- 核心观点:市场风险情绪高涨,多类资产创新高。

- 关键要素:

- BTC ETF周流入32亿美元创纪录。

- 美股受AI交易和板块轮动推动上涨。

- 法币贬值主题持续,流动性极度宽松。

- 市场影响:强化风险资产偏好,资金加速流入。

- 时效性标注:短期影响

As in previous years, markets got off to an explosive start in “Rising October,” with BTC and stocks surging to new all-time highs, with US stocks boosted by another multi-billion dollar OpenAI/AMD deal, and Japanese stocks surging 5% (-2% for the yen) after Sanae Takami unexpectedly won the leadership race (as a fiscal dove).

Despite a data blackout caused by the government shutdown, the stock market continued its upward trend last week, led by semiconductors (+4.4%), biotech (+10%), and consumer durables (+3.6%). The limited data released continued to point to a strong US economy, with the economic surprise index rising to a year-high, far exceeding already lowered expectations. The consensus expectation is that US GDP will bottom out in the fourth quarter and rebound significantly by 2026, supported by ample systemic liquidity and a resilient US consumer.

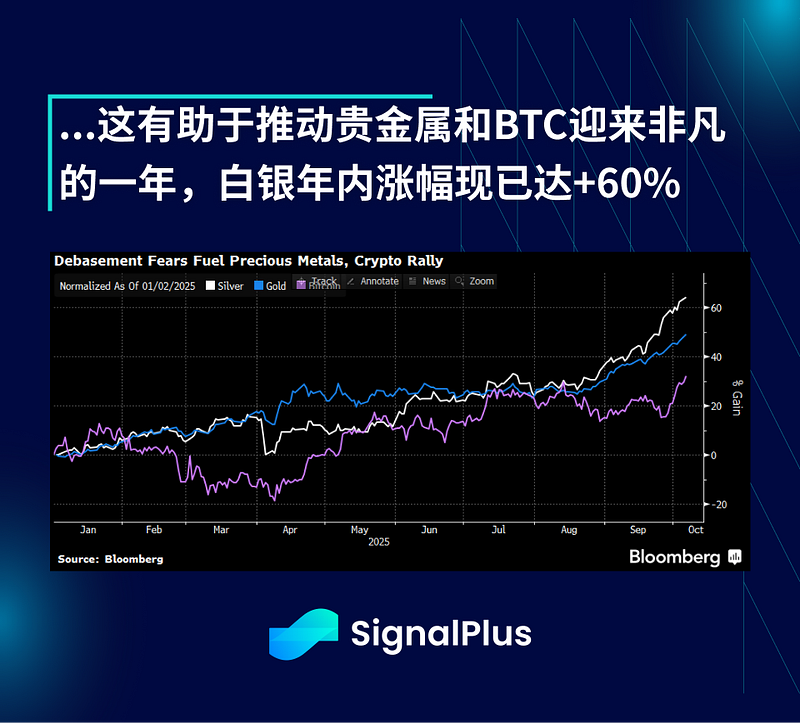

The biggest losers last week were global bonds, where we saw renewed pressure on yields due to aggressive fiscal spending plans in the US, China, and now potentially Japan as well. All of this came at a time when risk assets were at all-time highs and inflationary pressures remained top of everyone's mind. The sudden political crisis in France (with the resignation of Prime Minister Le Cornu) exacerbated the bond market's woes but benefited gold, which enjoyed its most sustained rally since the early 1980s.

The current theme of “fiat debasement” continues, with most indicators of M2 liquidity, loan supply, and other credit availability pointing to record levels of monetary easing, which has led to historically low cash allocations, according to JPMorgan estimates.

Retail traders have once again benefited from this rally, and they have been the primary participants in the current market, accounting for over 12% of individual stock trading volume. SPX options volume is also approaching its April high again. It appears that President Trump's efforts to "monetize" the US economy through a positive wealth effect are working as intended.

Not to be outdone, BTC also rallied to a new all-time high ($126,000), driven by a resurgence in ETF buying. U.S. investors poured over $3.2 billion into BTC ETFs last year, the second-largest weekly inflow ever. BlackRock's IBIT ETF open interest also rose to a record $49.8 billion on Friday, now the largest single source of ETF revenue for the giant asset manager—an incredible feat for a newly launched product.

BTC ETFs now hold over 1.47 million BTC (dominated by the US at ~90%), followed by DATs at 1 million (MSTR at 630,000), while miners hold just 93,000. It’s no exaggeration to say that Wall Street’s takeover of the crypto space is complete, at least in terms of driving day-to-day price movements.

Given the US government shutdown, there's little immediate data to look forward to. Market attention is expected to intensify in late October around the FOMC and the earnings reports of the "Big Seven" (presumably the "Big Seven"). Options market pricing reflects an implied probability of a 5% increase in the SPX by year-end. At this juncture, it's difficult to identify any negative catalysts that would contradict this view.

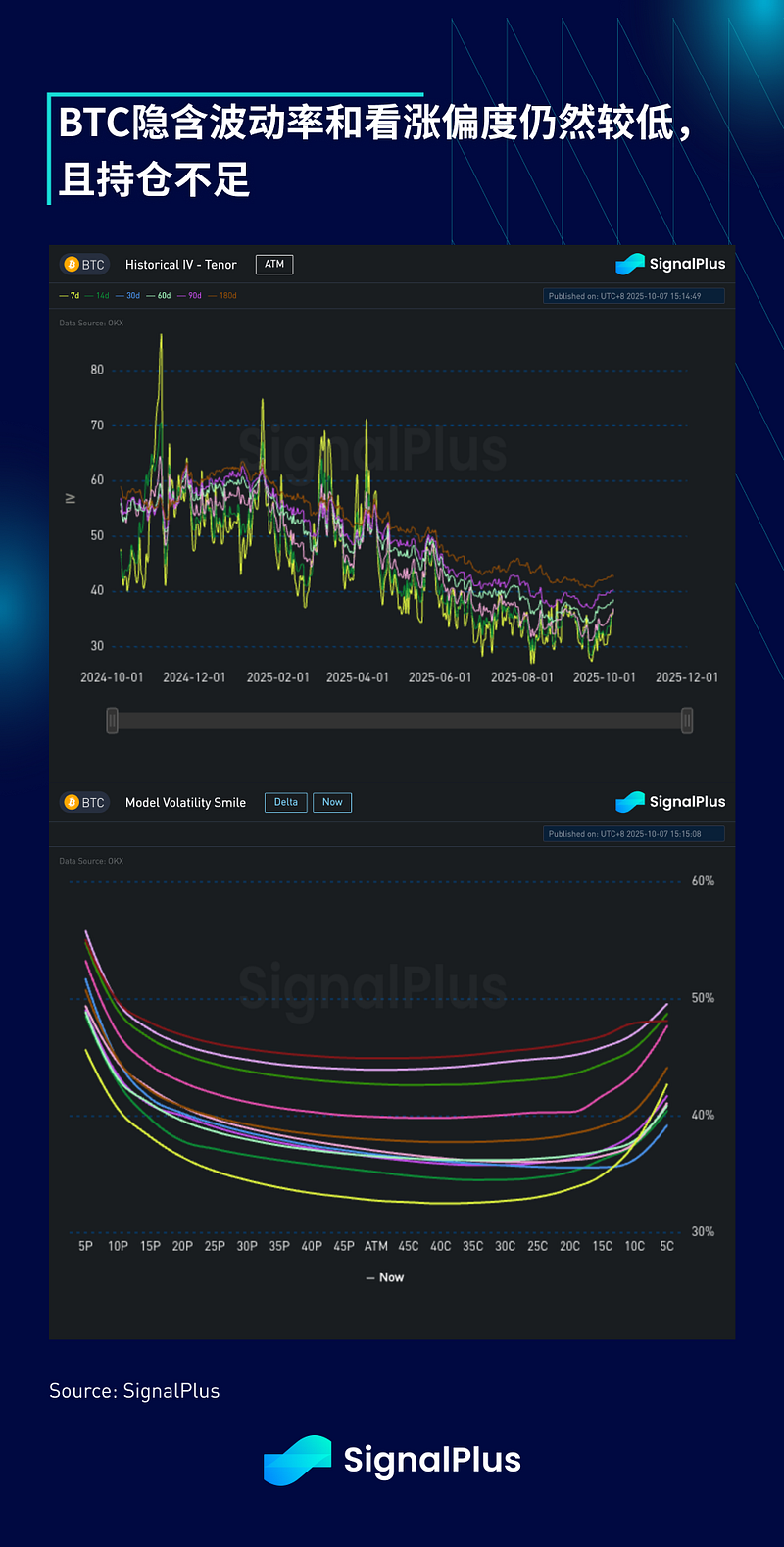

In the cryptocurrency space, we've seen virtually no short liquidation during the recent rally (ETF buying), suggesting that market participants are underweight with minimal risk exposure. BTC implied volatility remains very low (and at a record high relative to ETH IV), with skewness only slightly positive, suggesting the path of less resistance during this period may be upward, as the name "Rising October" suggests.

Regardless, risk sentiment in the equity markets will remain a key driver in the coming weeks. Good luck, and happy Golden Week to our friends in the region!

You can use the SignalPlus Trading Vane feature for free at https://t.signalplus.com/crypto-news/all. It uses AI to integrate market information and clearly understand market sentiment.

If you want to receive our updates in real time, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat: Logicrw), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com