Weekly Editors' Picks (0903-0909)

"Weekly Editor's Picks" is a "functional" column of Odaily.On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Now, come and read with us:

Now, come and read with us:

Investment and Entrepreneurship

Investment and Entrepreneurship

Most investment institutions tend to watch more and move less. They pay more attention to infrastructure projects, among which ZK, new public chain and middleware are the most concerned. In terms of application projects, DeFi, Game, and social networking rank the top three. Among them, DeFi is the most promising direction for institutions, and games and social networking are very controversial.

Most investment institutions tend to watch more and move less. They pay more attention to infrastructure projects, among which ZK, new public chain and middleware are the most concerned. In terms of application projects, DeFi, Game, and social networking rank the top three. Among them, DeFi is the most promising direction for institutions, and games and social networking are very controversial.

Dialogue with three former encrypted VC partners: the next wave of encrypted track that may explode

The next wave of encryption explosion may appear in the B2C application field, which requires a sufficiently attractive UI or front end that can aggregate various other protocols, and the core narrative is to capture more users. The next killer app might not be something fully crypto-native or fully on-chain. Web2.5 is actually pretty cool too. Other points of interest include: strong decentralized stablecoins, smart contract wallets.Jason Choi predicts that within the next five years, there will be a trillion-dollar TVL across all applications. Darryl Wan predicts that the market value or FDV of GameFi related projects will reach 100 billion.For more trending results of investment and financing behaviors, see "Web3 Investment in a Bear Market: Which High-Quality Projects Are Top Funds Betting on?》。

DeFi

", readers who are interested in specific projects are welcome to read "

53 Web3 Startups with the Most Potential in the Eyes of 53 VCs

4D deep research: a panoramic review of the development of DeFi, how to rebirth from the ashes?

First, all given DeFi protocols must prioritize their ability to generate sustainable cash flow to a greater extent. Next, the token economics models that dominate the DeFi space must also evolve to adapt to changing times. In the end, the rise of synthetic assets will propel the DeFi space forward and largely sustain it for many years to come.

Big data indicators, perspective of 50 leading DeFi protocols

DEX, Staking, and lending are the DeFi scenarios with the clearest needs and models. When any new ecology emerges, these three types of DeFi protocols are always the first to be deployed. TVL, user volume, transaction volume, protocol revenue, MV, FDV, MV/TVL, P/S (market-sales ratio), P/E (price-earnings ratio), and innovation can be used to evaluate DeFi protocols.There are obvious homogenization problems among DeFi protocols. This market needs more innovations, such as the research and integration of NFT AMMs, such as the development of decentralized derivatives markets. They may constitute the driving force for the second round of DeFi rise.》。

Readers who are interested in specific projects are welcome to read "

Self-help guide for DeFi retail investors: 5 ways to develop unilateral liquidity

NFT, GameFi and Metaverse

NFT, GameFi and Metaverse

IOSG Ventures: How to expand NFT market demand through financialization and commercialization?

2. Improve consumption attributes - NFT commercialization can be subdivided into transferable (Transferable) and non-transferable/soul binding (SBT) paradigms, or represented by CC0/CBE (can't be evil) narrative discuss.

Echoo Research: Will the blue-chip NFT continue to fall when the giant whale leaves the market?

At present, the trading volume of the NFT market is still sluggish, and there is no sign of a strong rebound. At present, most of the NFT market is traded by retail investors, and the influence of giant whales is very weak.

Capture 100,000 NFT orders from X2Y2 and analyze real user behavior after the royalty reform

Improbable founder: Why are Web3 games so easy to fail?

Web 3.0

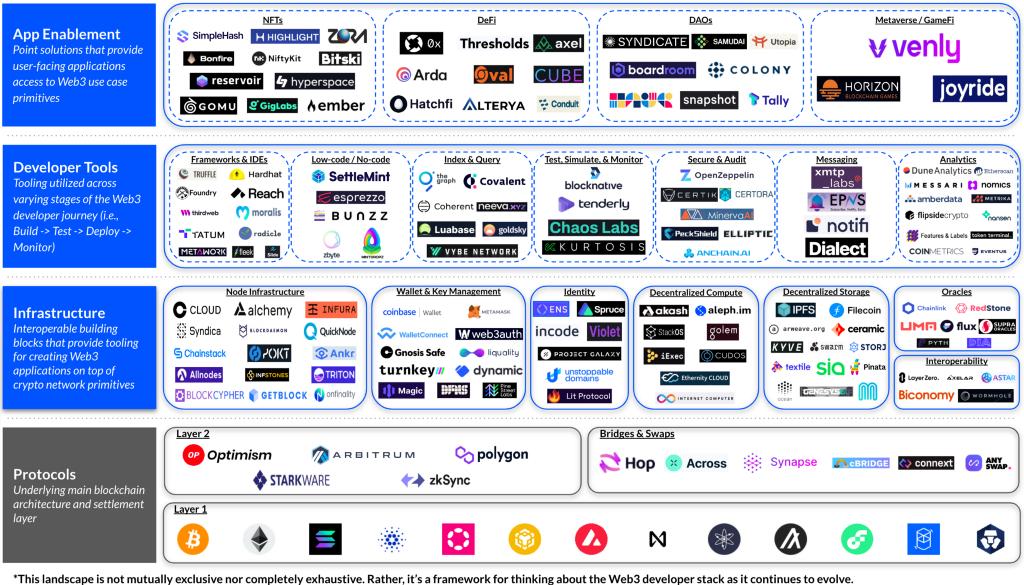

Coinbase Research: A Developer's Guide to the Web3 Stack

ArkStream Capital: A comprehensive analysis of the current status and future direction of soul-bound tokens

SBT is a relational proof rather than an authoritative proof. Its value lies in the accumulation of a large amount of data. Complexity, richness and diversity will be the core competitiveness of SBT data sources.

The accumulation of data will endow each account with a "soul". By preprocessing and classifying information, labeling and personalizing accounts can greatly enrich the application scenarios of identities on the chain, and even predict their behavior.

The formation of a decentralized society requires a strong binding between natural persons and identities on the chain, which increases the replacement cost of identities and creates identity dependence.

Ethereum and scaling

SBT can be applied to decentralized financial scenarios such as lending by building on-chain credit points and grading KYC.Ethereum and scaling》《Next week, Ethereum will usher in a merger. The number of related articles has exploded, and the following are recommended: "》《Conversation with Vitalik: PoW will eventually turn to PoS, and token-driven governance is a backward model》《Merged MEV: A new source of income for staking ETH》《How the Ethereum Merger Affects the Crypto Ecosystem: 4 On-Chain Metrics to Watch》《Peek into market expectations for Merge from ETH futures data》。

7 steps to get the most airdrops before Ethereum merges

The report covers the market landscape, impact of zero-knowledge technology on the mining market, and potential opportunities.

New ecology and cross-chain

New ecology and cross-chain

LD Research: In-depth analysis service subdivides the track public chain

Compared with the new public chain whose valuation is still high in the bear market, we should not ignore the characteristic public chain that is under construction and has a relatively reasonable valuation. Perhaps it is not the Fork of Ethereum, but a more disruptive public chain that can help Web3.0 to mature. The combination of public chains that serve market segments and large public chains such as Ethereum will eventually bring a more secure, private, fast, and life-like blockchain to Web3 users, developers, and mainstream users who use blockchain in the future.

Parallel execution can solve the low performance problem of EVM sequential execution. The authors respectively introduced how Aptos, Sui, Linera, and Fuel identify and execute independent transactions.

DAO

secondary title

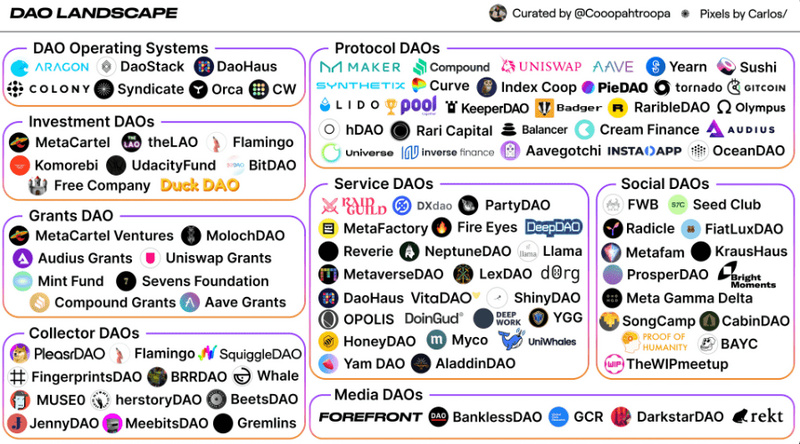

The History and Evolution of DAO Governance

The article introduces DAO's governance foundation, governance scope (from the perspective of collaboration, it can be divided into three types: protocol type, application type, and resource allocation type), governance dilemma and improvement suggestions. From the perspective of voting mechanism, there are weighted voting, proxy voting, quadratic voting, belief voting, and EI voting based on game theory. From the perspective of the distribution of governance rights, POAP, which records the historical participation certificate of the governance person, can effectively screen out candidates who meet the governance conditions. With a good reputation and a sound system, DAO has an infinitely broad future.

Take a look at 16 new tools developed by the DAO community

This paper locates the fragility of Lido's governance in terms of the system's dynamics at the social, technological, and economic levels, and makes improvements to improve Lido's adaptability and resilience. Because systems are dynamic and ever-changing, the process of turning governance vulnerabilities into opportunities will also be continuous.

hot spots of the week

secondary titlehot spots of the weekIn the past week, BinanceWill automatically convert USDC, USDP, TUSD to BUSD,temporaryDoes not automatically convert USDT to BUSD, Circle CEO agrees,And said this will reduce the advantage of USDT,, Biyin Mining Pool responded to the difficulty of withdrawing coins:,Assets are safe due to illiquidityA zero-fee discount and corresponding settlement adjustments will be implemented for some mining poolsBendDAOThe semi-homogeneous token standard ERC-3525 was proposed by Solv Protocol and passed

, becoming the official standard of Ethereum,The liquidation threshold will be adjusted to 80%, and the auction cycle will still be 24 hours;In addition, in terms of policies and macro markets, the IMF saidEncrypted assets are no longer niche and require a globally consistent regulatory framework, the White House reportedBitcoin Mining Must Be Greener Or U.S. Should Restrict, Pennsylvania and Washington willTaxing NFTs, our countryNational Copyright Office;

: Severely crack down on the unauthorized use of other people's film and television works to cast NFT and make digital collections. South Korea willEstablishment of an encrypted token securities marketIn terms of opinions and voices, V God said, God V issued a statement saying;

Institutions, large companies and top projects,Break the monopoly of ENS domain names and set normal fees based on demandInstitutions, large companies and top projects,, parent company of Snapchat,BinanceBinanceCurve uploads the native stablecoin crvUSD code to GitHub,Officially launched the soul binding token BAB,;

Curve has been deployed on Kava NetworkProgressive Ownership Optimization Model (GOO)With "Editor's Picks of the Week" series

With "Editor's Picks of the Week" seriesPortal。

See you next time~