Capture 100,000 NFT orders from X2Y2 and analyze real user behavior after the royalty reform

On 8.26, X2Y2, the leading platform in the NFT trading market, announced that the royalties paid to NFT creators for trading NFTs on its platform will be free for users to choose their willingness to pay royalties (0%, 50%, 100%). There were thousands of waves, and a conflict broke out between the platform borrowing the hands of users and the NFT creators.

There are many opinions on the discussion of royalties, but there are still a few with actual data. Therefore, this article will analyze the impact of this news on the market through the following three points.

Through the combing of the X2Y2 contract operation structure

And grab its 12W NFT transaction order records

first level title

1. X2Y2 NFT Market System Operating Architecture

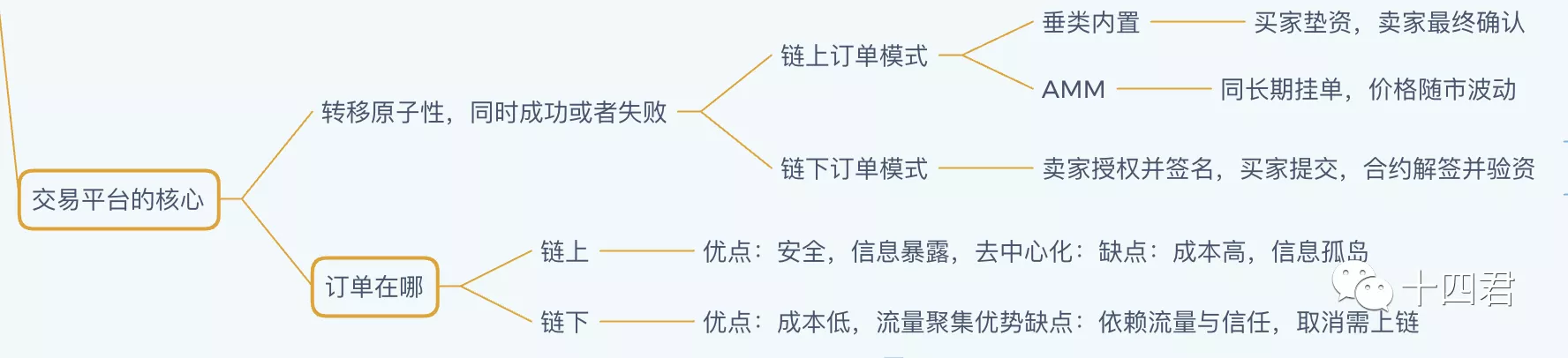

We once roughly described the operating models of the three major types of NFT trading markets. The author distinguishes them based on the three core aspects of the transaction circulation life cycle.How to publish, how to bid, and where to make deals【Contract Interpretation】CryptoPunk is the world's earliest decentralized NFT trading market

Vertical built-in market:【Contract Interpretation】CryptoPunk is the world's earliest decentralized NFT trading market

Explain in one article - the AMM mechanism of SudoSwap, a rookie in the NFT market - innovation challenges and limitationsExplain in one article - the AMM mechanism of SudoSwap, a rookie in the NFT market - innovation challenges and limitations

secondary title

1.1. The core logic of the third-party market

How to deliver reliably? It is the basis why the trading market is naturally suitable for the realization of smart contracts. Under the guarantee that the blockchain cannot be tampered with, it realizes the atomicity of one-hand payment and one-hand delivery.Fully on-chain operation, can be used almost only by the contract itself, and has the highest advantage of decentralized trust, without worrying about security.

But this also has natural flaws:High occupancy rate of funds, resulting in inefficiency

Therefore, punk locks more than 6,000 ETH every day, which are all quotations from the buyer. At the same time as the quotation, the funds are locked into the contract and wait for the seller to deliver.

Therefore, Sudoswap provides income for LP through setting its own handling fee, which has also become a blatant anti-royalty shot.

In order to solve this problem, the third-party trading market Opensea, X2Y2, etc., the overall operation mode isOff-chain publishing and matching pricing, the order is formed on the chain, combined with a variety of auction mechanisms to evaluate the rationality of the price

There are several features that necessarily emerge from the transaction record under this mechanism

Before placing an order to sell NFT, you must first withhold authorization, so the third-party market is highly centralized, and you can harvest NFT assets from all authorized addresses (including Weth withholding authorization assets) at any time

Although the pending order is signed off the chain, no gas is required, because the signature is valid for a long time, so the cancellation of the order must be on the chain

Collection of royalties: It is necessary to register with the centralized server of the trading market, and the contracts controlled by them are transferred to the NFT creators at the time of transaction, because Eip2981 is used as a royalty standard, in fact, it can only declare royalties and cannot be enforced at the contract layer

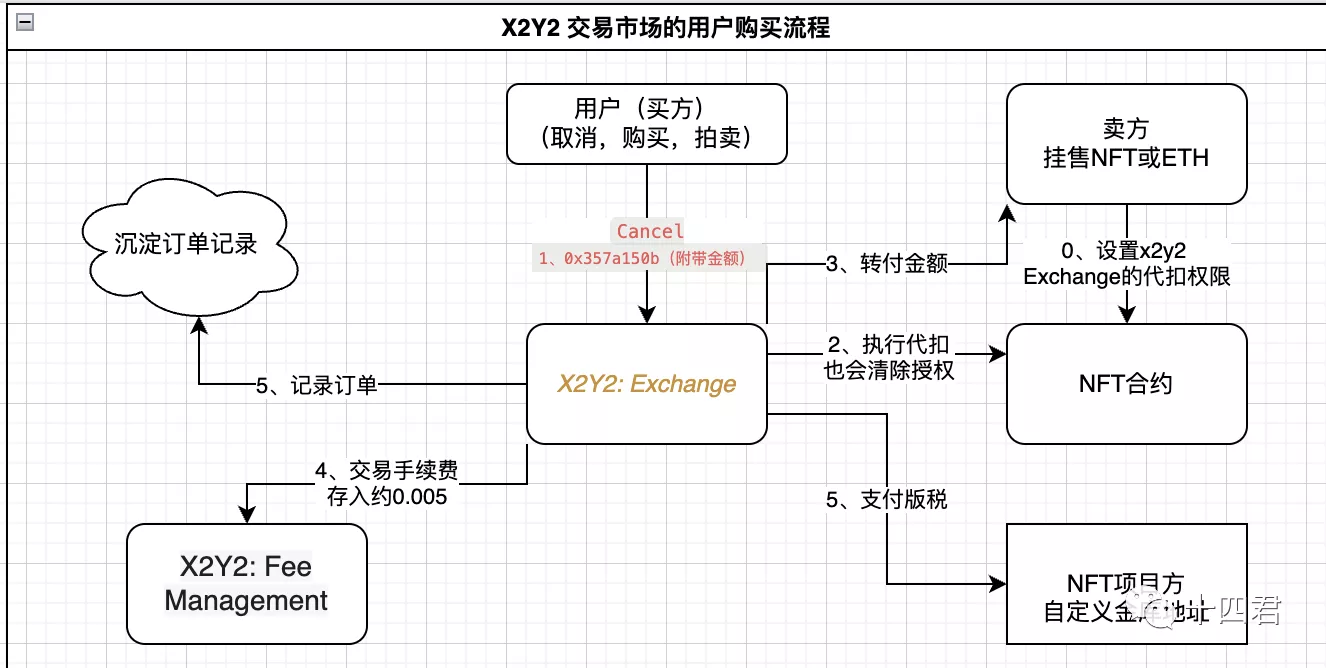

1.2. The process of X2Y2 executing NFT transactions

With the theoretical basis, the X2Y2 execution transaction flow chart is easy to understand

The overall process of purchasing NFT involves the following links:

Seller:

The seller sets the X2Y2 contract's withholding authorization for its assets to the NFT contract (such as azuki)

The seller submits the signature of the order to X2Y2's centralized server

The seller can initiate a Cancel transaction to the X2Y2 contract to cancel the order

buyer:

The buyer sees the order (including signature) in the X2Y2 centralized server

The buyer puts the value in the transaction and submits it to X2Y2Exchange

X2Y2:

Confirm the authority of the order by signing, transfer the amount to the seller, and execute the NFT withholding and transfer it to the buyer

If the NFT project party has a registered royalty vault address in X2Y2, it will be transferred in proportion

Finally, according to the proportion of handling fee (thousand 5), it will be transferred to X2Y2’s Fee Management contract, and operations such as continuing to trade mining pledge income, handling fee dividends, etc.

first level title

secondary title

2.1. Objectives and data sources

First define the goal,Research the changes in the number of royalties paid by users before and after X2Y2 does not pay royalties

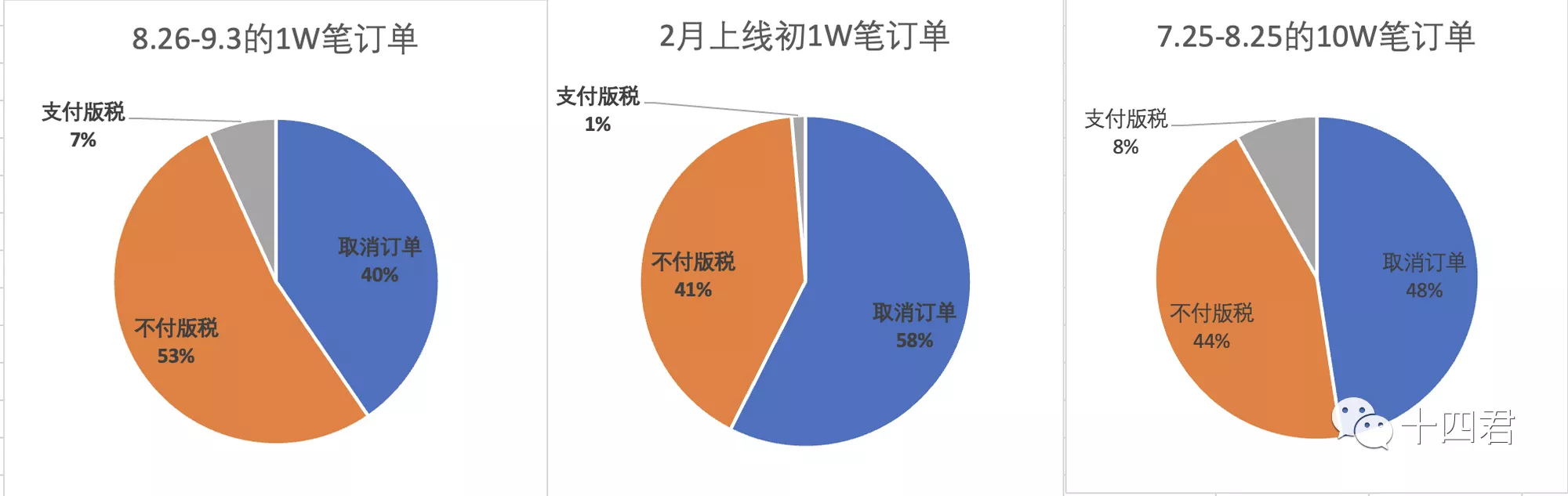

The collected transaction data is divided into 3 batches: a total of 12W transactions are taken from the beginning, the end and the middle

1W transactions in February when the X2Y2 operation started

A total of 10W transactions from 7.25 to 8.25

8.26-9.3 Latest 1W transactions

secondary title

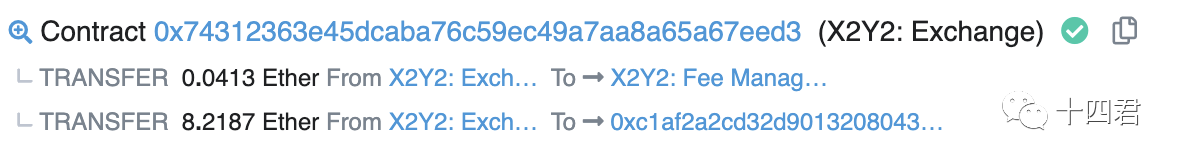

0x74312363e45dcaba76c59ec49a7aa8a65a67eed3

2.2. How to judge which transaction gave royalties?

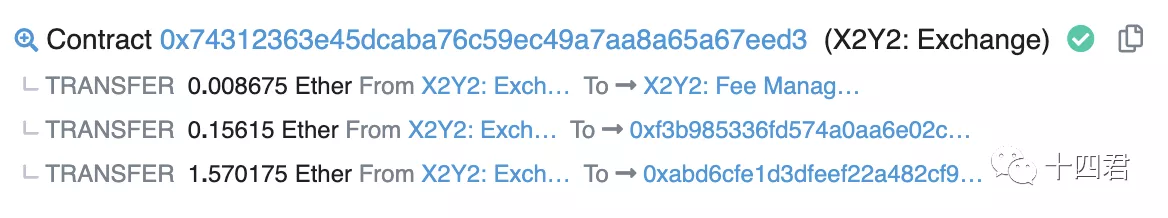

In this regard, the author distinguishes each transaction through the inline transaction. I will add that the inline transaction is a sub-transaction initiated by the contract. In the above flowchart, the X2Y2 distribution fee and amount royalties are all initiated by the contract, so is an inline transaction.

then it's obvious

There is no payment procedure for 1 inline transaction (always give money to the seller)

For 2 inline transactions, the fee is paid (both thousand and five)

For 3 inline transactions, royalties are paid (10% royalties in the third line in the figure below)

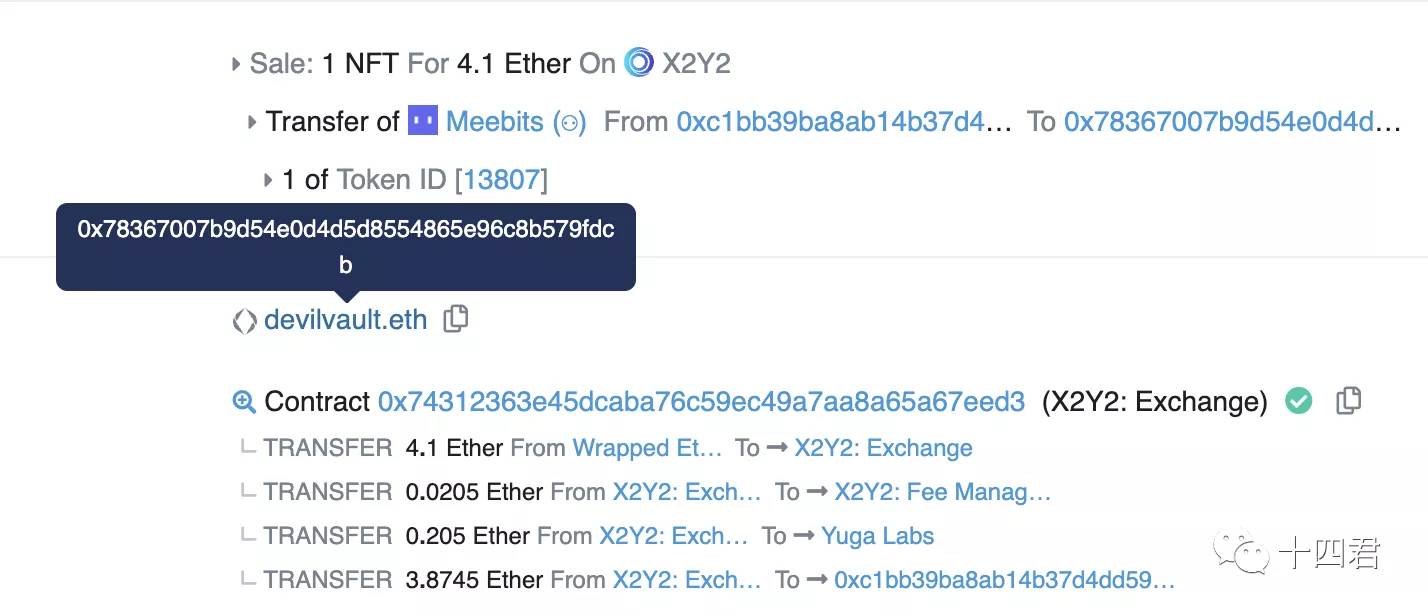

For the 4 inline transactions, NFT buyers provide quotations and NFT sellers submit transactions. Pay attention to the picture below, devilvault.eth is the transaction initiator, and it is the TO address of the NFT, so this kind of transaction will have Weth transferred to the X2Y2 contract.

secondary title

2.3 How many users have implemented it after the royalties are not paid?

The author pulled the inline transaction list of 120,000 transactions, and made the following figure through the number of transactions.

It seems that only when X2Y2 was first launched, it expanded through the number of royalty-free blocks. After all, the early trading market lacked blue chips to settle in, so the number of royalties was small, which is understandable. In the latest 1W transactions, the number of royalty orders is in terms of quantity. 1% less,There has not been a general non-payment of royalties by a large number of users.

Is it surprising? Yes, the author did it with the expectation that a large number of users will not pay royalties. After several calculations, it is true that there are not a large number of non-payment of royalties in terms of the total number of orders.The author has opened up the fetched order transaction data on the chain, interested friends can enter "X2Y2 Royalty Analysis Order" through the background of the official account to obtain

For further verification, Fourteen later found out that the original project party had also calculated it by itself. On 8.26-8.29, among the total 4600 orders, there were still96.66% of users implemented a 100% royalty. Note that this is the category that should pay royalties but deliberately choose not to pay, because many NFT projects themselves do not require royalties.

secondary title

2.4 How to explain it?

Regardless of whether the author pulls data for calculation or X2Y2 official announcement, it does not seem to be a significant change in royalty collection.

Is it really because the users fought back bravely and insisted on paying royalties?

In my opinion, there are three factors

In fact, 8% of the number of royalties paid by itself, excluding canceled orders, is calculated as 11% according to the transaction order, which is relatively low in itself. For small-scale transaction projects, it is difficult for project parties to successfully pass manual audit records on X2Y2. address.

Half of X2Y2 orders come from aggregatorsThat is, platforms such as Gem and Genie that help users purchase NFT collections in batches, the royalty amount is attached to the parameters of the transaction, and the aggregator, nftnerds and other NFT tools have not yet been revised, so the default full royalty.

first level title

3. Summary: The current situation is the same, what is the follow-up?

In this regard, the NFT project is the disadvantaged party. If there is no preset in the early stage of the contract transaction, it cannot be modified later, and royalties cannot be forced to be collected. A bunch of big brothers who say Eip2981, go and see the original text of eip, is it good? The standard is useful, the principle is similar to 4907, just declare that the role is not the mandatory restriction of transfer rights like 5058! ! Further reading:

[Source Code Interpretation] How does the new Ethereum standard EIP-4907 realize NFT leasing?

[Source Code Interpretation] How does the new Ethereum standard EIP-4907 realize NFT leasing?

The exchange blacklist mechanism can only be added by subsequent project parties, but this will also seriously damage the degree of decentralization.

Therefore, in the short term, the project party can basically only make a solemn statement and let X2Y2 wait and see.

In the long run, in fact, X2Y2’s move is also stimulated by the AMM mechanism of sudoSwap, which directly ignores royalties, but can sudo go far?

What the author sees is that sudo has only exploded but has not yet broken the circle. At present, there are too few blue-chip projects settled in, and almost all of them are waiting for airdrops. The free loss is large, and most of the arbitrage space can be seen from the transaction data. Pain points.

The core contradiction of royalties is not whether to pay or not, but how much to pay?

A bunch of local dogs come up with the grand blueprint of the white paper, and then lie in the 10% royalty collection. Therefore, discounting the royalty is the future trend, which can reduce the pure operation of the project party.

Should the third-party market itself reflect on whether such a high degree of centralization is a historical retrogression?

In the follow-up, the author will continue to study OpenSea, X2Y2, Looksrare, Gem and other top NFT market platforms, starting from the contract, to see its advantages and limitations, interested readers, please like and follow up quickly~

Like and follow 14, bring you value from a technical perspective

Like and follow 14, bring you value from a technical perspective