Web3 Investment in a Bear Market: Which High-Quality Projects Are Top Funds Betting on?

Author: Jessica, Aaron, Rosie

Summary:

Summary:The Web3 market has encountered a cold winter, but builders are still working hard and deploying. Which tracks are still hot? What projects did top funds invest in in the bear market? A&T Capital counted the financing data of the cryptocurrency market during 2022.5.1-2022.8.13, and summarized the financing situation in the primary market, the trend of Alpha & Beta projects, and the main investment preferences of some leading institutions.

Table of contents

Primary Market Data Funding Overview

Alpha & Beta Project Trend Summary

Major investment preferences of some leading institutions

text

foreword

First define the investment direction that our research involves.

Layer 1 includes expansion solutions for the data layer, network layer, consensus layer, and incentive layer. Typical examples include Avalanche, Solana, etc.

Layer 2 includes - contract layer projects, typical examples include Perpetual protocol, Scaling, etc.

The application layer project involves 21 different industry labels, among which need to be specified:

Web Builder: Indicates the web3 network, blockchain building services, and distinguishes it from infrastructure

Legal: Indicates compliance services

Environment: Indicates ESG-related services

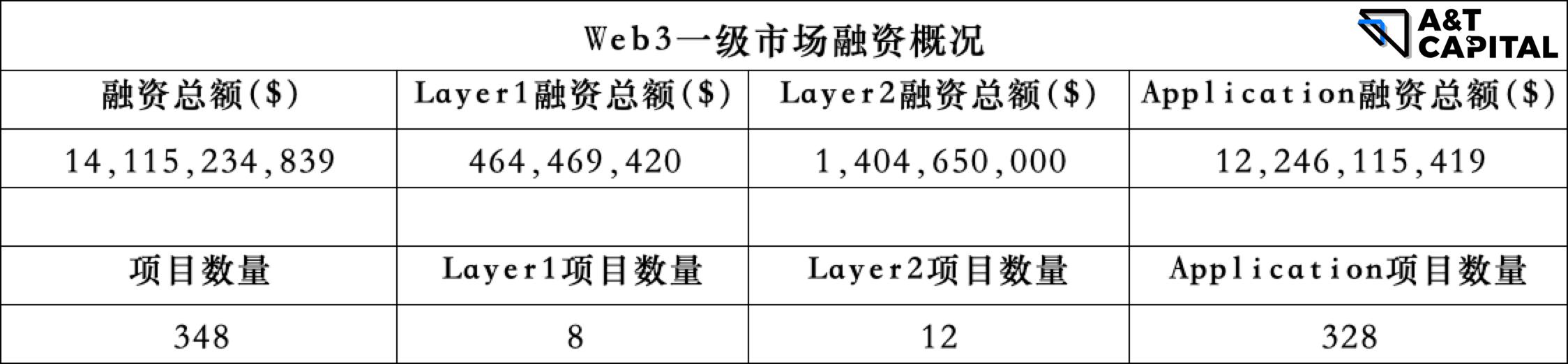

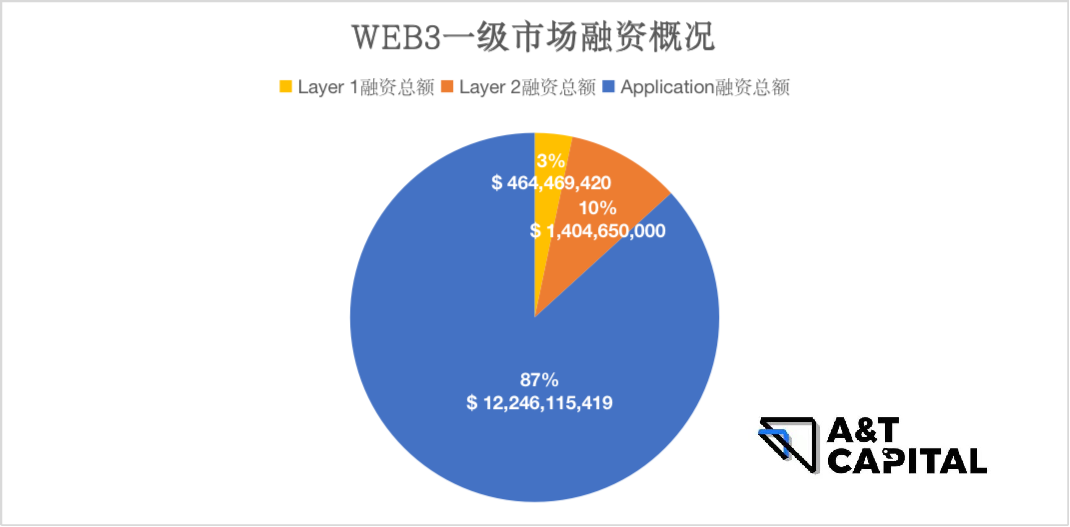

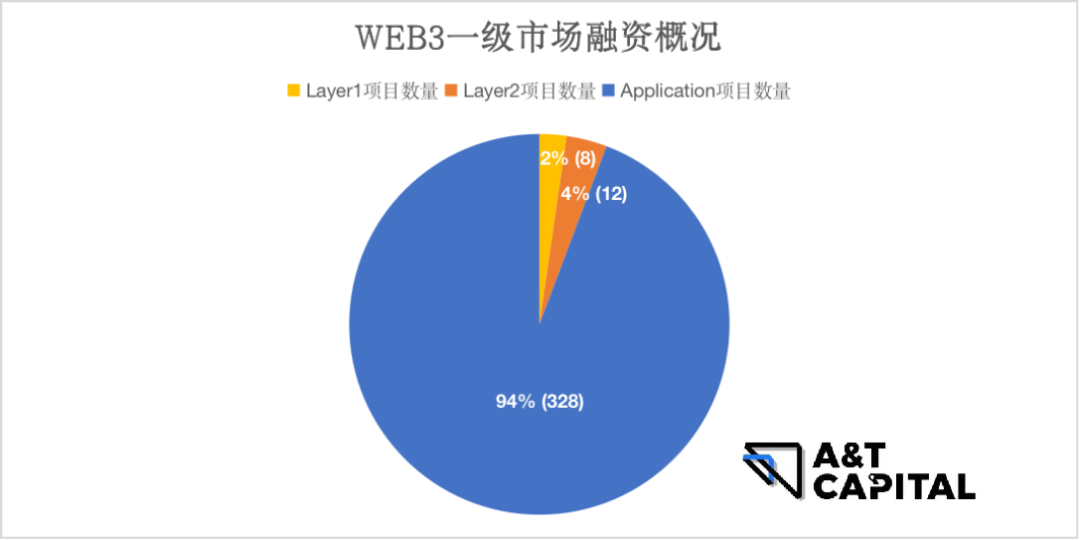

01 Overview of Encrypted Primary Market Financing

Based on the above statistical data, 2022.5.1-2022.8.13The application layer is most favored by Web3 industry capital, the most invested projects appeared: 87% of the funds flowed into the application layer, and 94% of the financing projects were also in the application layer.

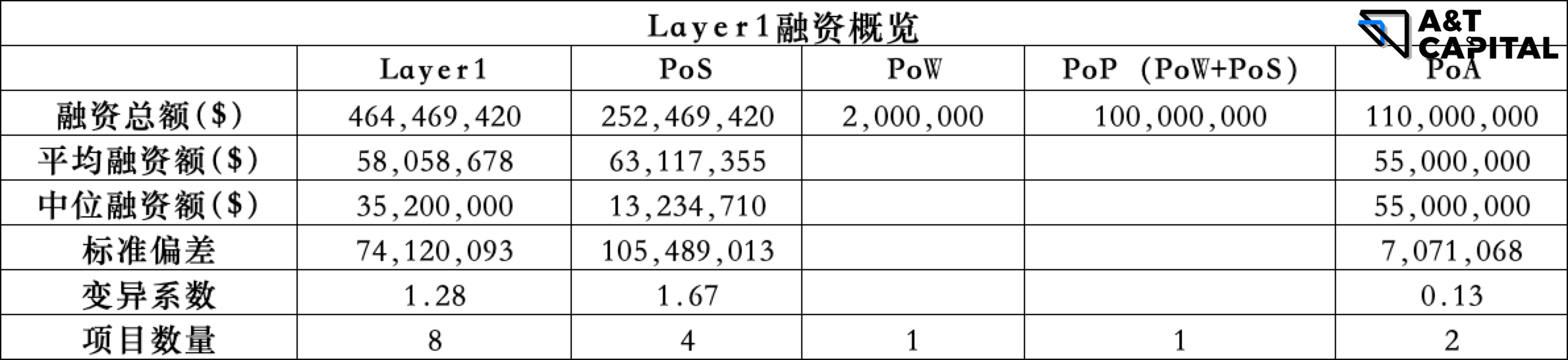

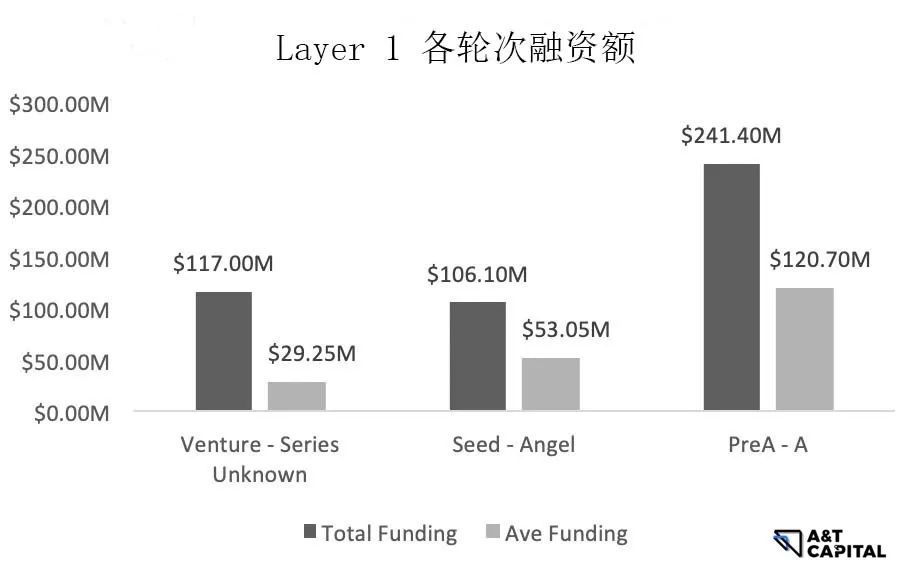

1.1 Layer 1

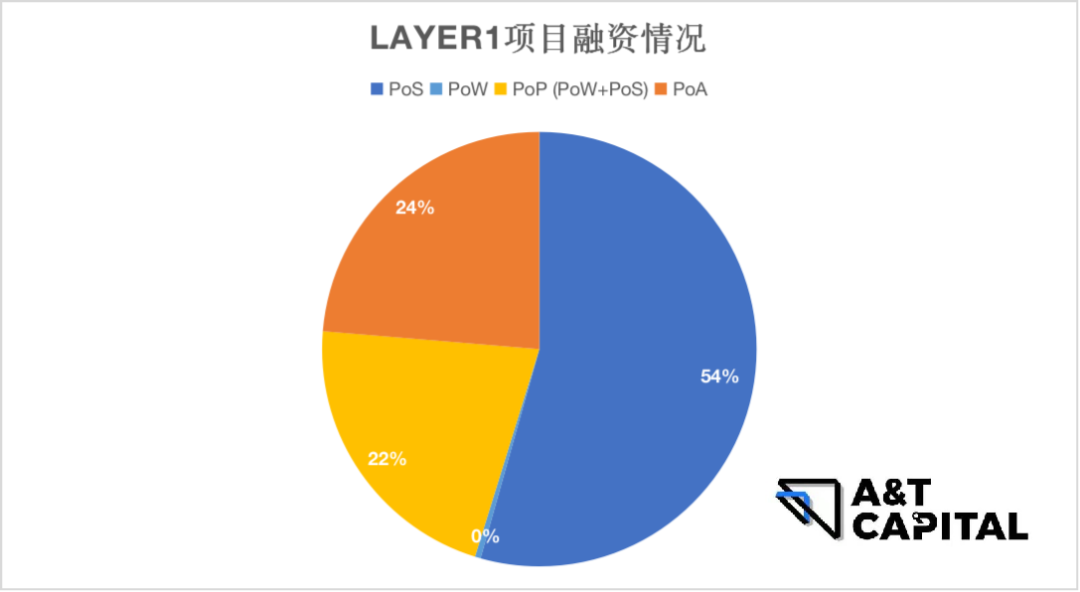

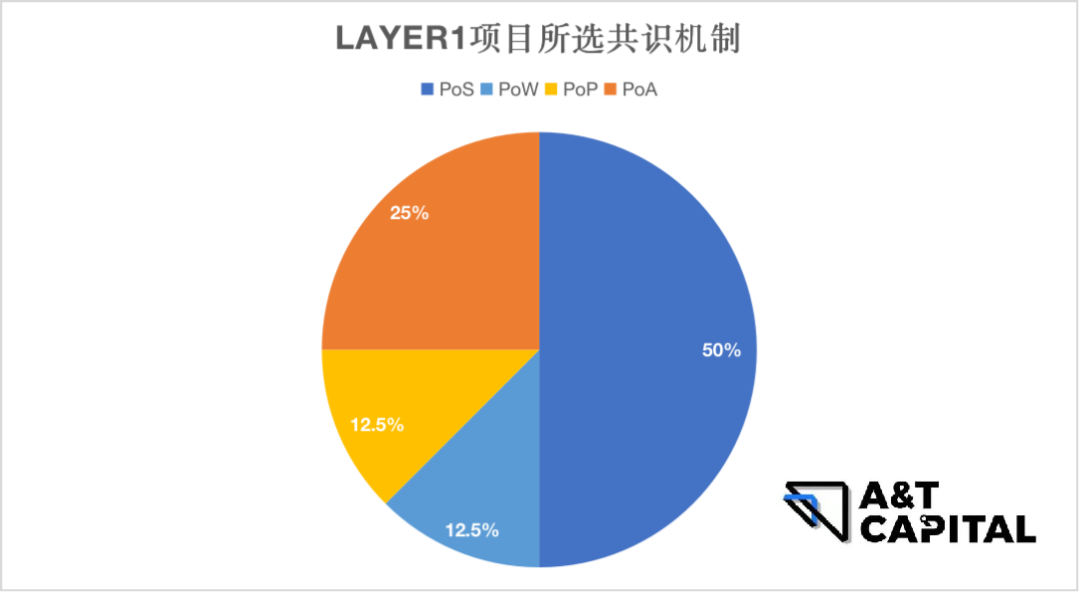

The proportion of PoW is very small, and its financing amount is less than 1% of the total financing amount: it can be seen that there are many problems in PoW (excessive energy consumption, inefficiency in large-scale use scenarios, and the high hardware cost of PoW and the competitive environment) , which brings the characteristics of capital intensity to the mining industry, which gave birth to the trend of centralization), so capital prefers models other than PoW.

PoS is the track with the best financing performance in layer1, accounting for about 50% of the total amount, which obviously surpasses other categories. Looking at the financing situation, the market is particularly optimistic about PoS Layer1. Compared with PoW, PoS has lower energy consumption, higher scalability and transaction throughput.

PoP (mixed mode of PoW and PoS): the amount of financing obtained accounts for 22% of the total

. PoS is not a perfect solution, the hybrid mechanism combines the benefits of PoW and PoS

. Avoid 1. Centralization 2. Security risk 3. MEV risk 4. DoS risk caused by PoS protocol

. Avoid the high energy consumption and low performance of PoW

The amount of financing received by PoA accounts for about 25%. Patterns can guarantee speed and high performance without sacrificing security. Differs from how blockchains traditionally operate, but offers an emerging blockchain solution that may be well suited for private blockchain applications

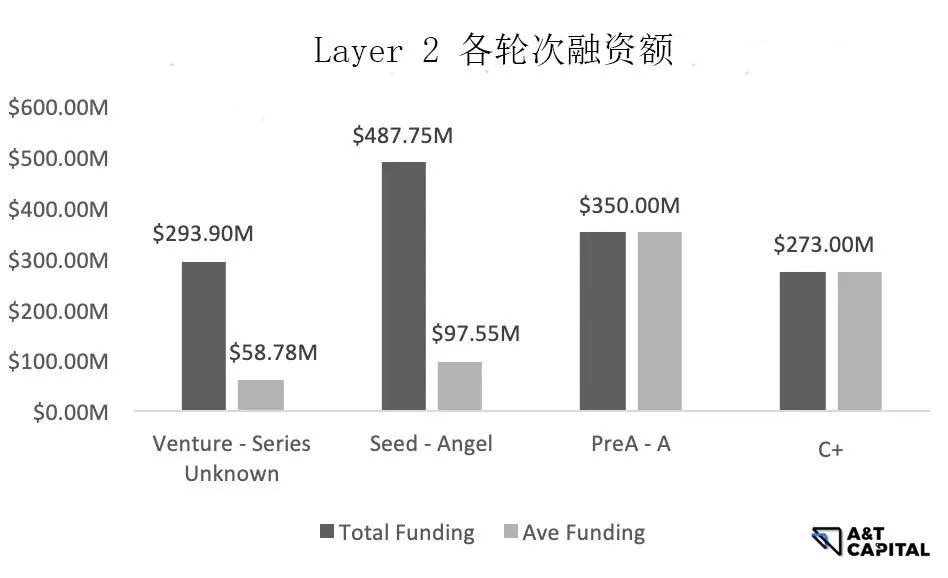

1.2 Layer 2

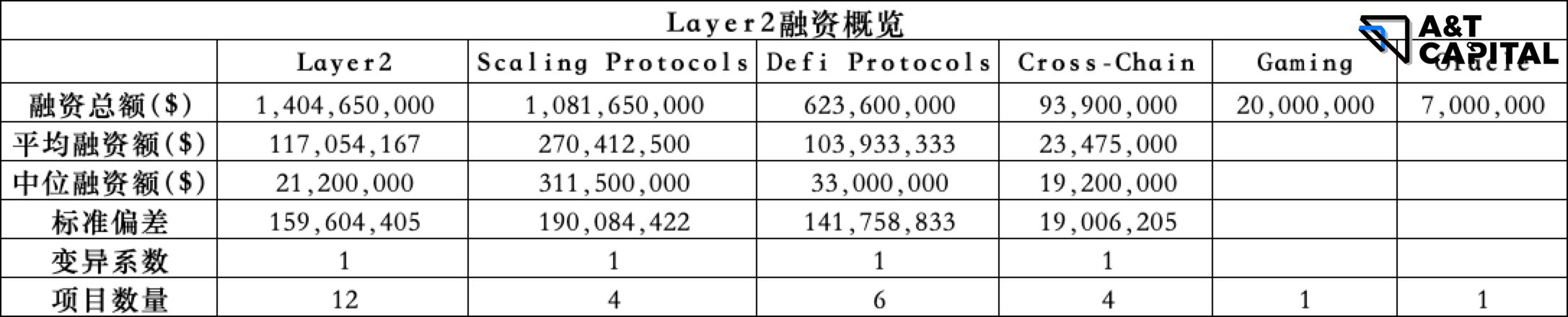

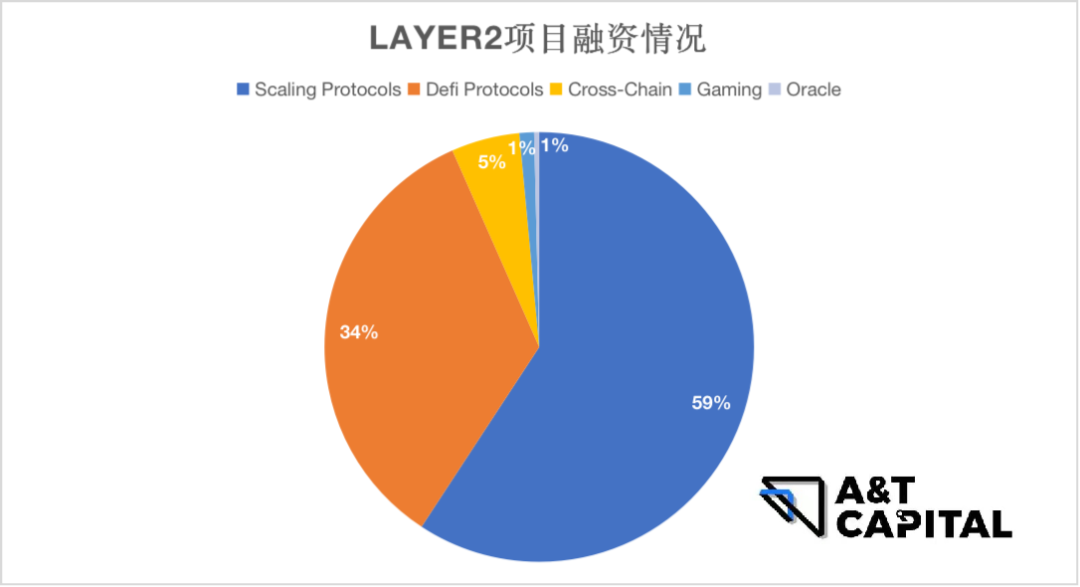

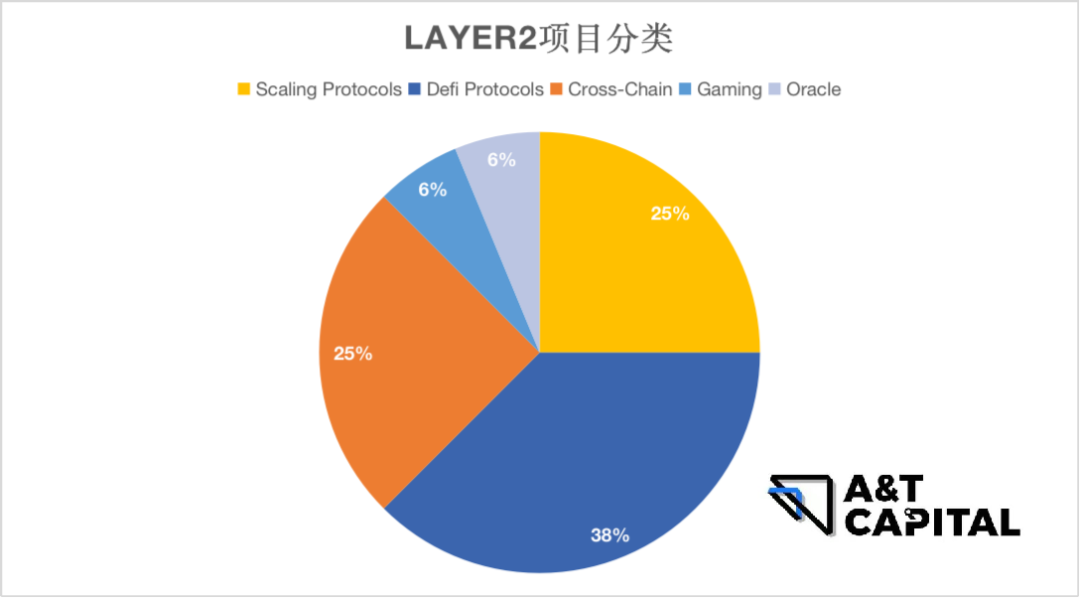

In general,Scaling Protocols and DeFi Protocols have better financing performance.

Scaling Protocols

. Scaling Protocols: Investment institutions have increased their bets on the overall track of the scaling protocol

. The market demand for expansion solutions is stronger because of higher gas fee / TPS / latency

Defi Protocols

。The overall attention of the Defi Protocols track is high (34%)

. 66% of the projects are in the direction of cross-chain agreement (DEX cross-chain aggregation agreement), but the performance is not outstanding in terms of financing amount, accounting for only 11.5% of the total financing amount

. Among Defi Protocols, infrastructure financing accounted for 56%, and stablecoin lending agreement financing accounted for 32%

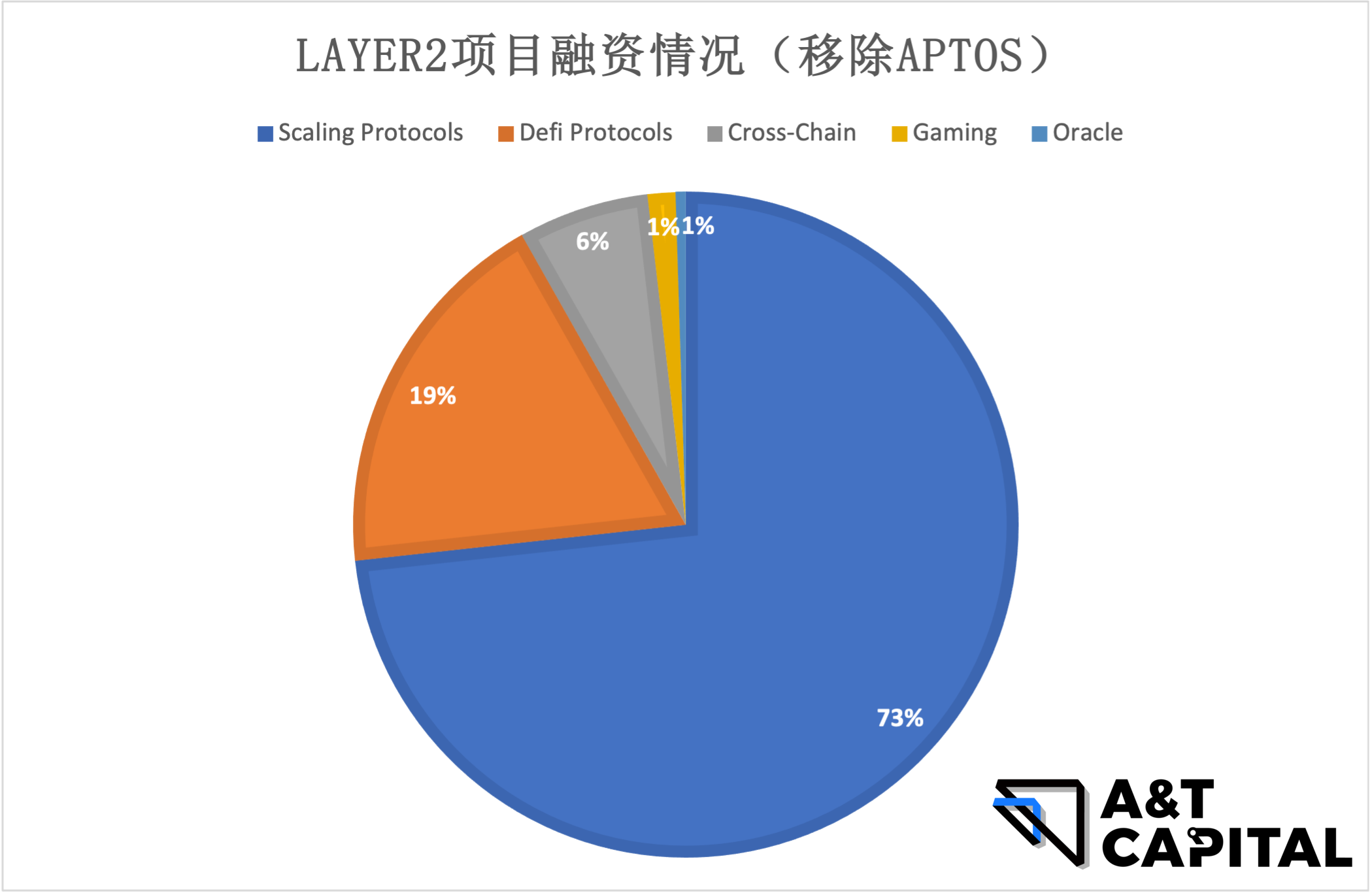

. Aptos is industry alpha and considered an outlier. With the removal of Aptos from Defi Protocols, the proportion of the funding amount of Defi Protocols decreased to 19%, indicating that the attention of the Defi track is showing a cooling trend. In comparison, the proportion of the Scaling Protocols track has reached an overwhelming majority (73%), which is the most popular trend in the market.

Oracle

game

game

Compared with other tracks such as DeFi, GameFi has higher requirements on transaction speed and gas fee. General Layer 2 provides a potential expansion solution, but a protocol specially built for GameFi appeared in the project narrative covered by this research. This may indicate that GameFi-type applications have specific requirements that cannot be perfectly solved by the general Layer 2, and this direction is worthy of further research.

1.3 Application

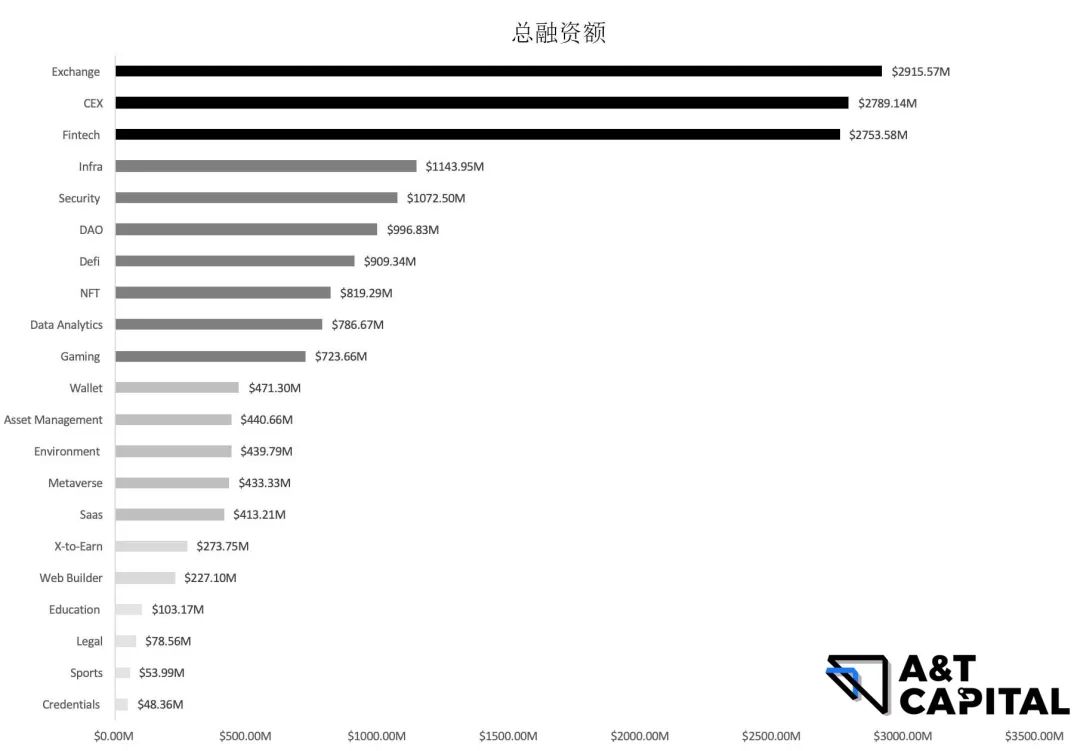

As seen from the figure above,Among the financing targets, exchanges and financial technology accounted for 47%, and the rest were less than 6%., the distribution is relatively uniform.

megatrend (overall)

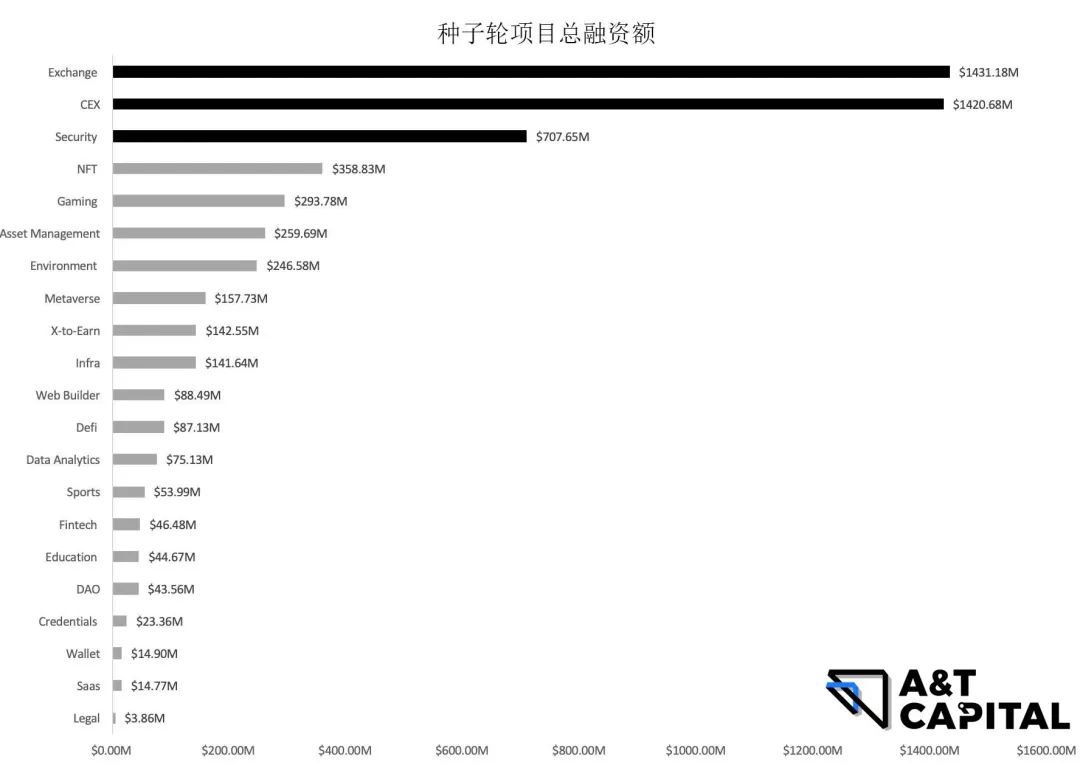

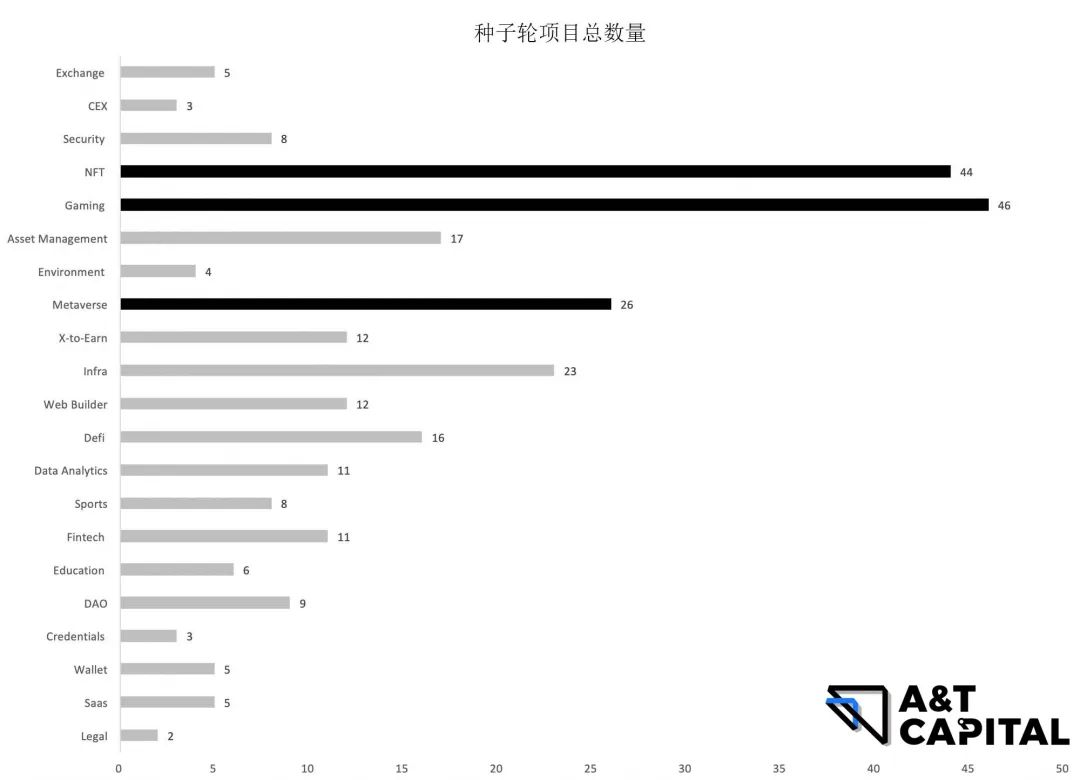

The top three categories of financing amount: exchanges, centralized exchanges, and financial technology.

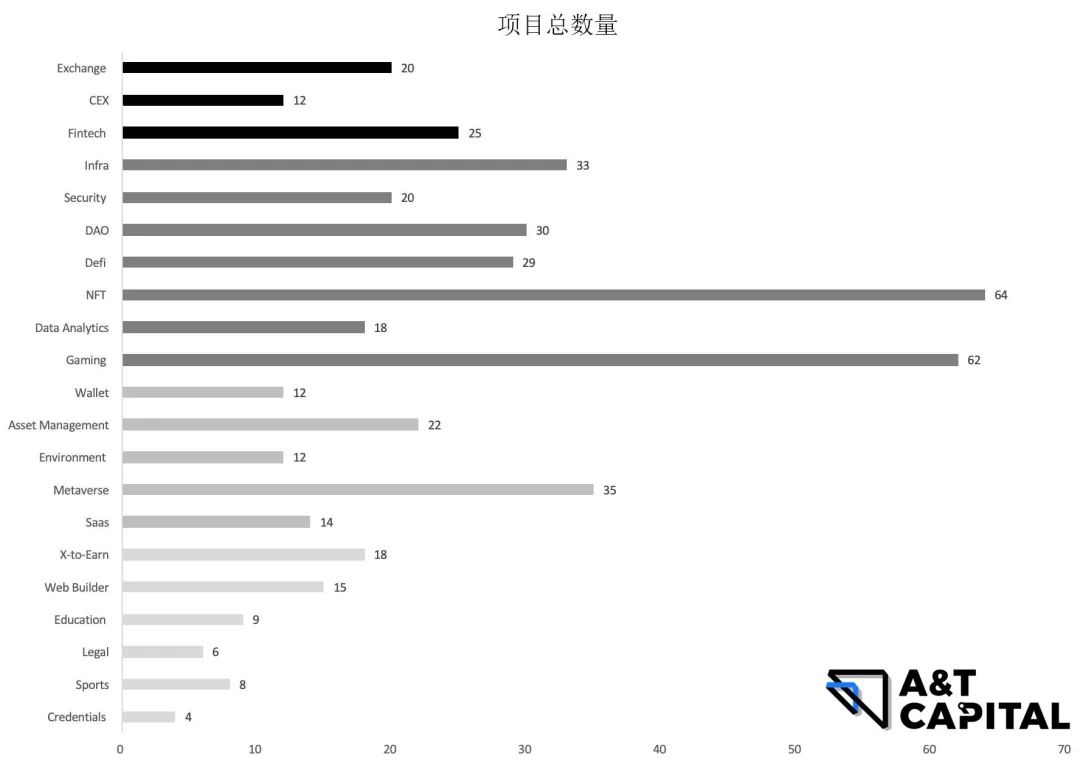

The top three categories by the number of financing projects: NFT, games, metaverse.

New Trends (pre-seed round - preA round)

It can be seen from the figure that the top three categories of seed round financing projects are games, NFT, and Metaverse. The top three categories of seed round financing amount: exchanges, centralized exchanges, and security.

1.4 Summary

Layer 1 - PoS and hybrid chain are the main hot trends, it can be seen that the attention of hybrid chain is getting higher and higher, which indirectly proves that everyone has paid attention to the potential security problems of PoS, and is looking for a solution that can balance security and efficiency.

Layer 2 - The general scaling protocol is the main hot trend, the new direction includes layer 2 chain for the industry.

Application - Both major trends and new trends focus on projects that can be circulated in the secondary market in the short term, and a new major direction is security.

02 Alpha & BetaTrends

2-1 Alpha

First define Alpha:

Alpha markets are characterized by deal-driven financing. Projects with Alpha characteristics need to be clearly superior to other projects in the category of the same Layer. The Alpha projects we are looking for in this article need to meet the requirements that the total financing should be more than twice the average financing of its track.

2-1.1 Layer1

As shown in the figure, no alpha is seen in Layer1.

2-1.2 Layer2

As shown in the figure,Alpha exists in the Seed-Angel stage in Layer2, Polygon is the alpha project in this stage. Others such as PreA-A, BC, and C+ have no Alpha.

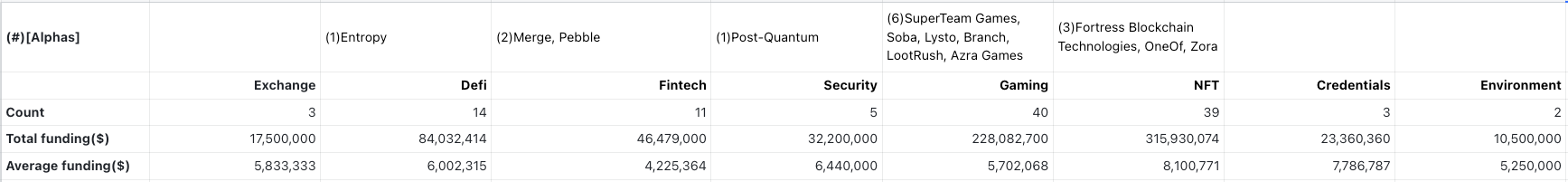

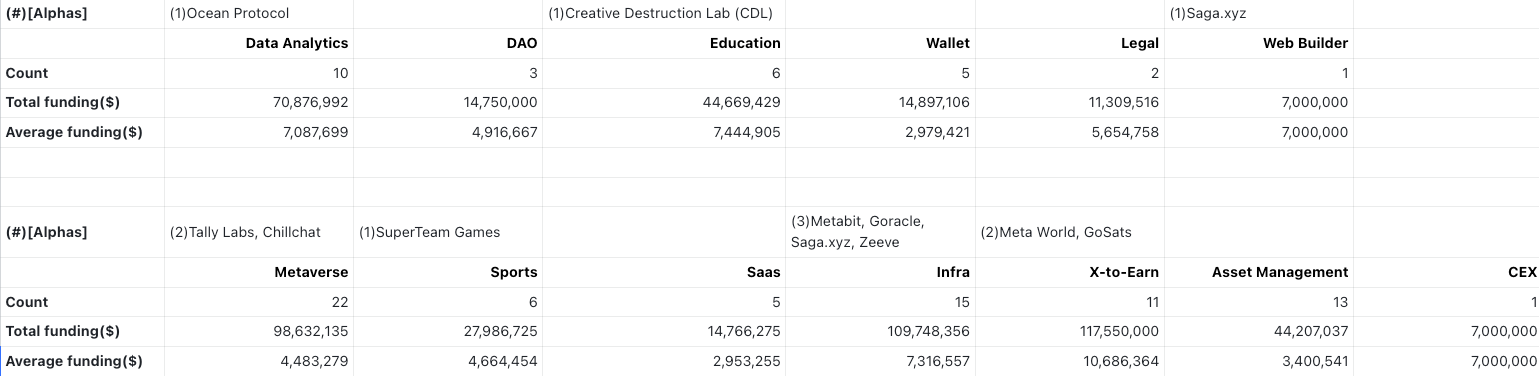

2-1.3 Application layer

Seed-Angel

PreA-A

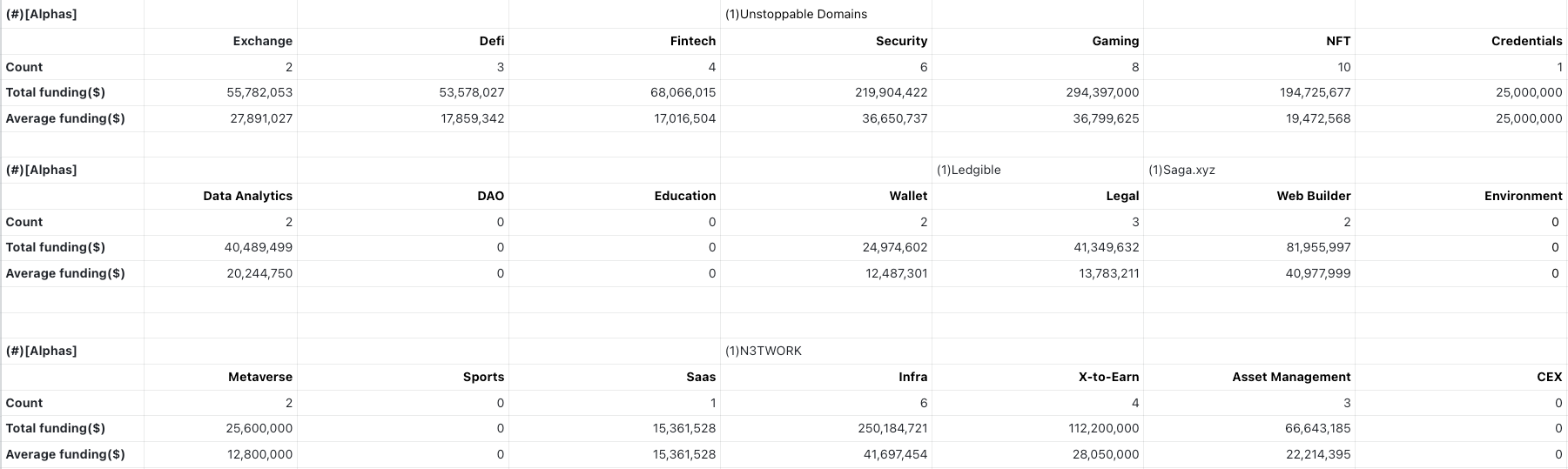

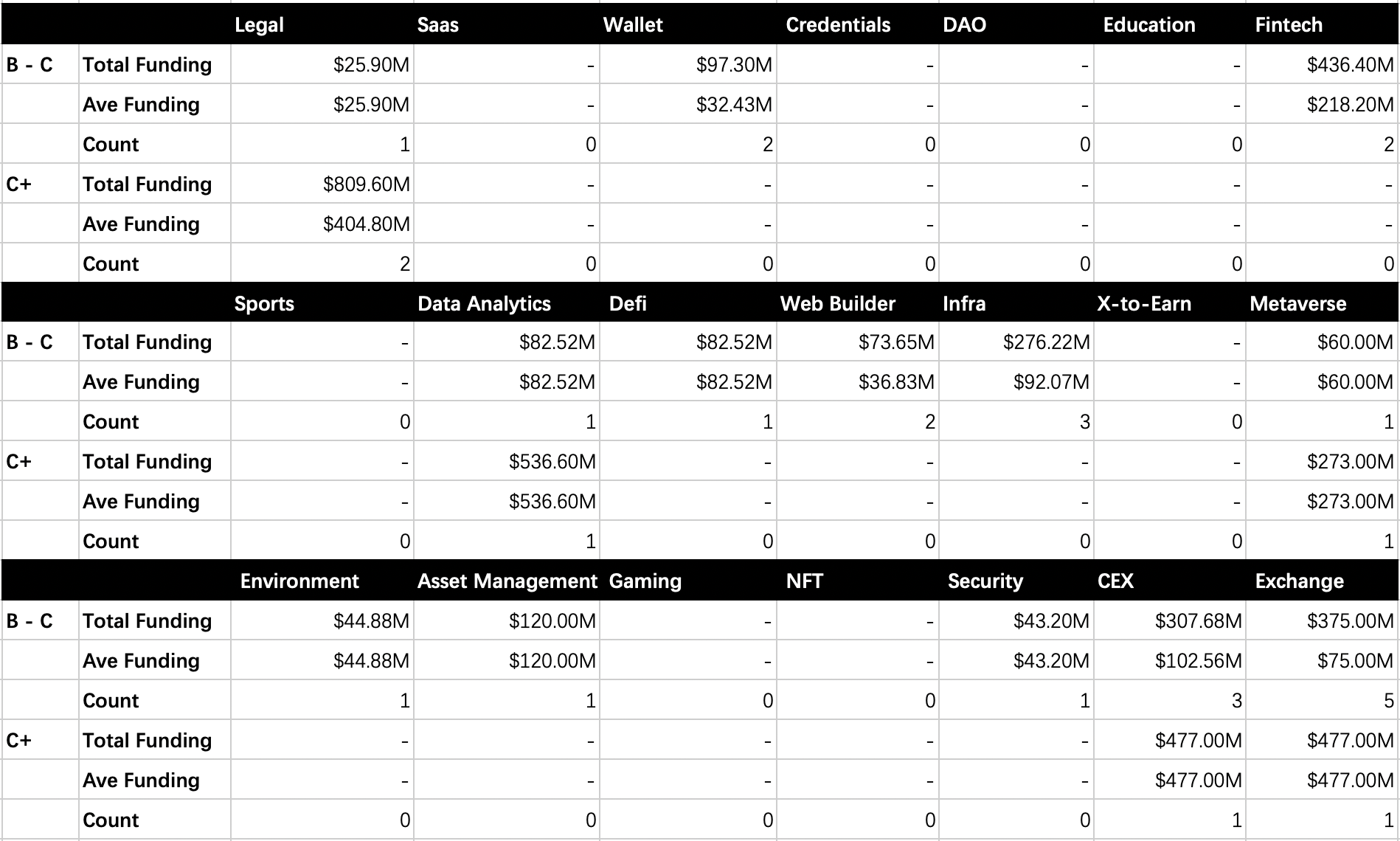

B-C & C+

2-2 Beta

Define Beta:

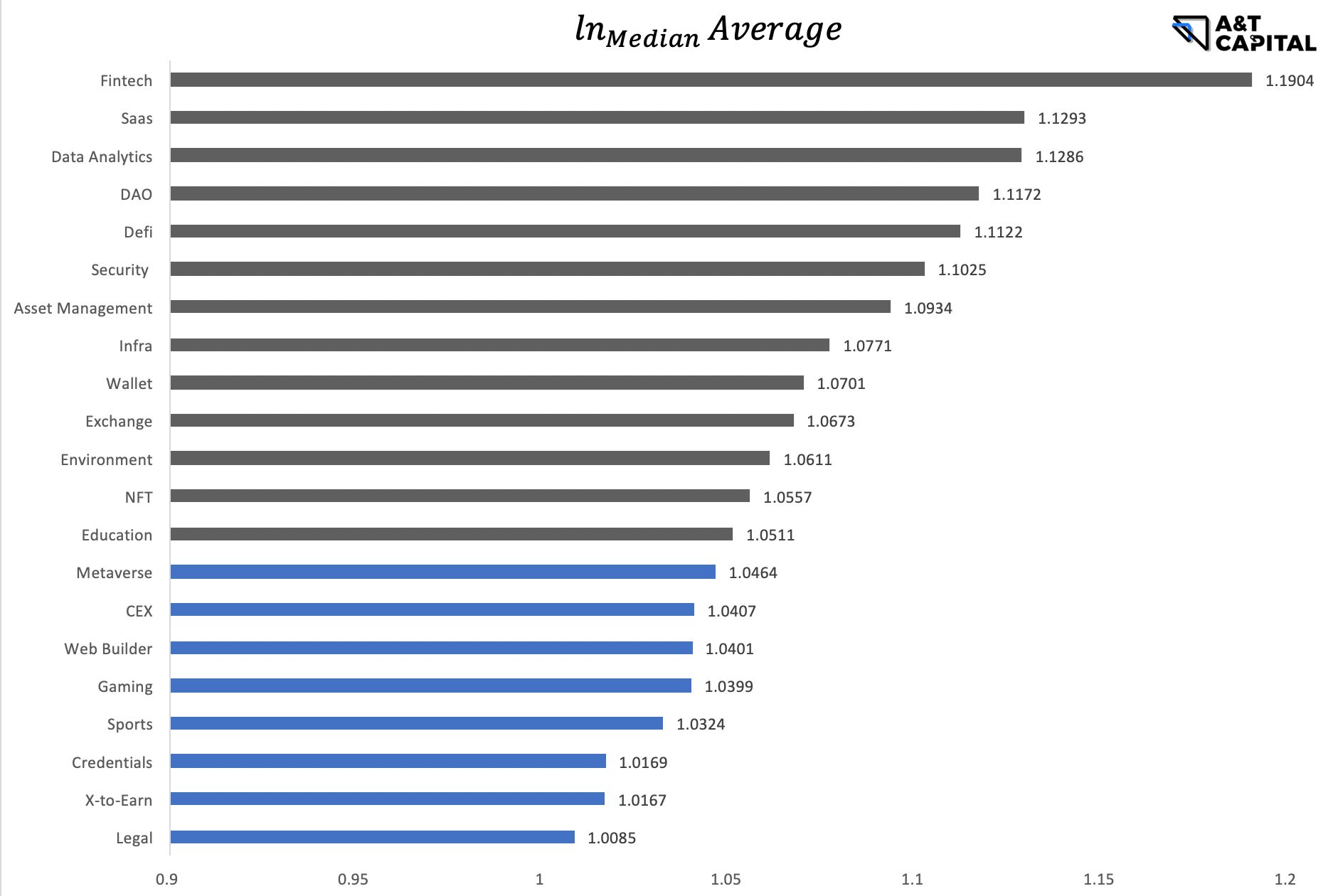

The characteristic of the Beta market is market-driven financing. Beta measures whether the market is optimistic about an industry/technology category as a whole. Track financing with Beta attributes is generally good. The lower the statistical dispersion coefficient (coefficient of variation), the lower the dispersion of track financing, which in turn reflects the beta attribute of the market. We further use the difference between the mean and the median for cross-contrast validation. A market with a low CV and a small gap between average and median is more beta-characteristic. We use CV < 1.5 and log(average)/log(median) < 1.05 to judge.

2-2-1. Layer 1 & Layer 2

The overall number is too small to be statistically significant. Generally speaking, Layer 1 & Layer 2 belong to the high financing amount and hot track. According to the technical flow of projects, the financing amount is not much different.

2-2-2. Application

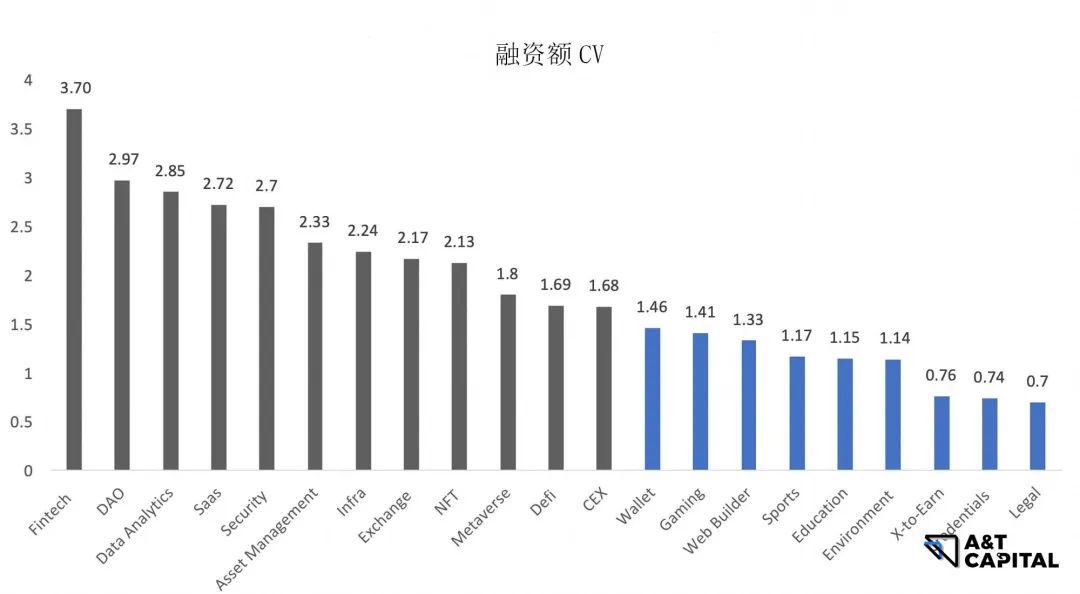

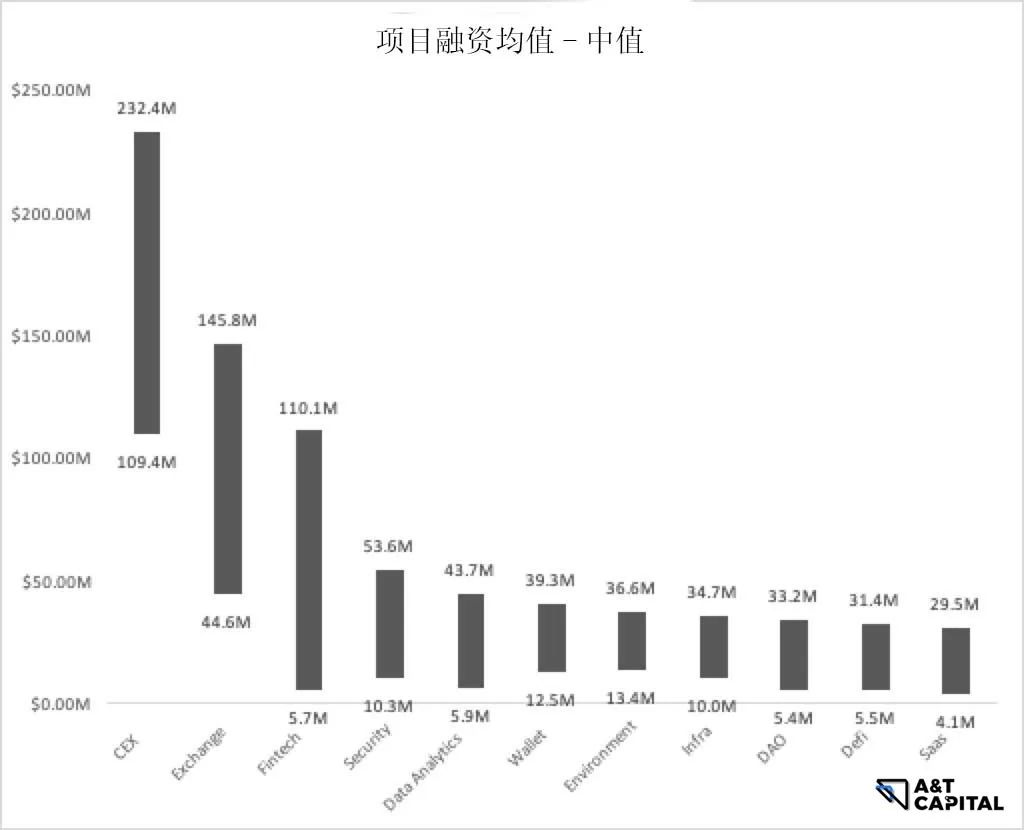

As can be seen from the figure above, from the perspective of low dispersion below CV1.5, the beta market can be roughly defined as Wallet, Gaming, Web Builder, Sports, Education, Environment, X-to-earn, Credentials and Legal. However, because the amount of data in one quarter will affect the credibility of CV, here we use AVE-MEDIAN for cross verification, as follows.

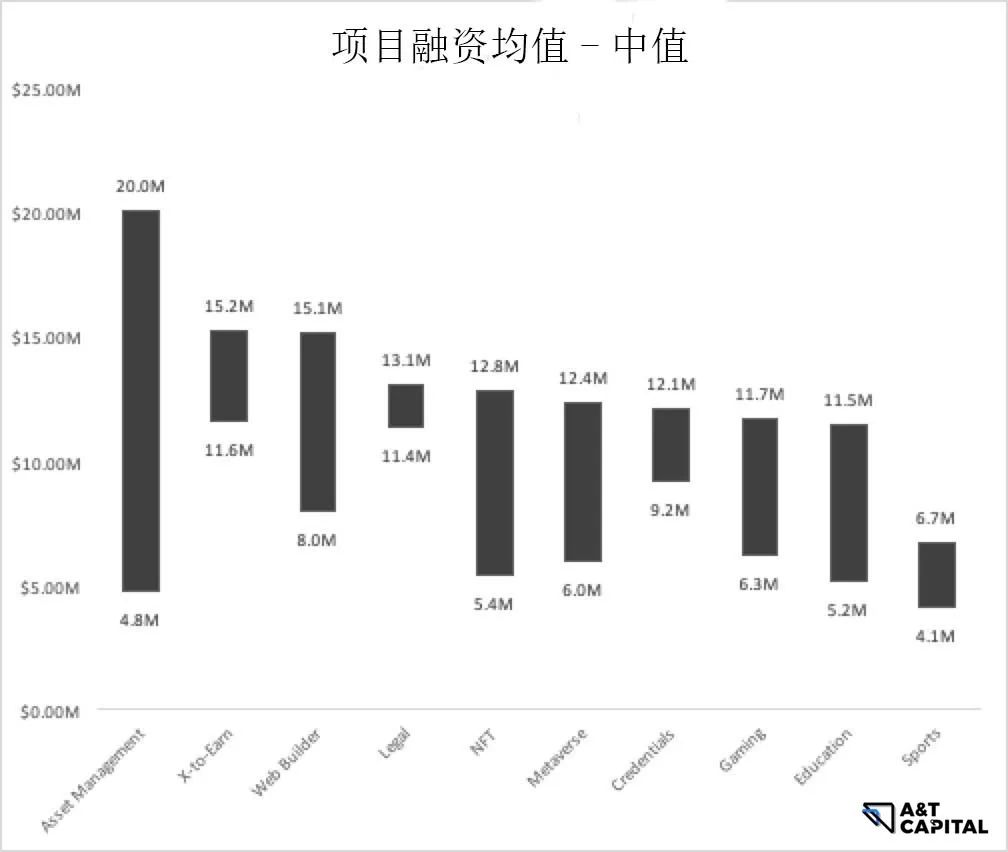

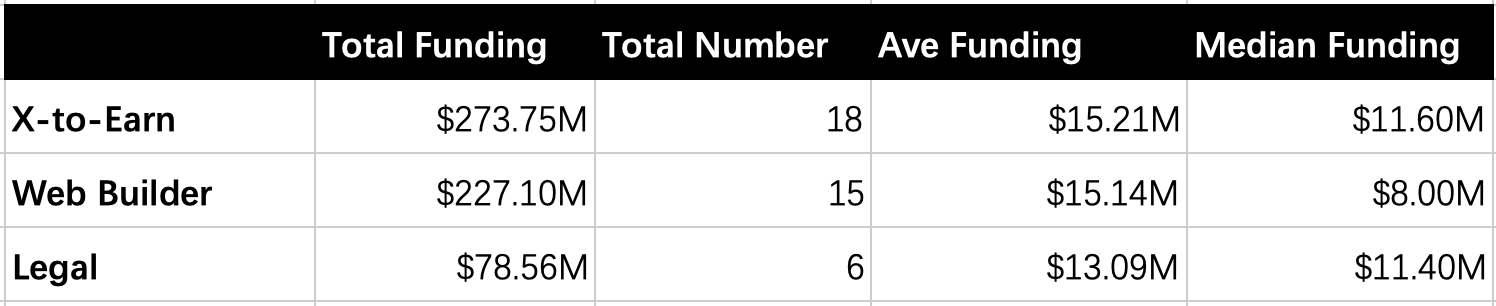

As can be seen from the figure above,X-to-earn, Web Builder, Legal are verified betas.The specific financing data are as follows.

2-2-3. Summary

In the application layer, through the comparison of the two beta calculation methods, it is concluded that X-to-earn, Web Builder, and Legal have beta attributes.

03 The main preferences of some head institutions

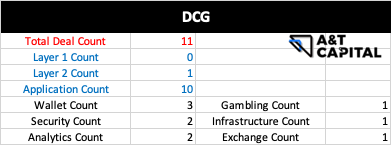

3.1 Digital Currency Group

DCG invested in 10 projects in total. There is no preference in stages, there are layouts from seed to series F. The layer 2 project invested by DCG is polygon, and the other nine projects are application. Among the 9 applications invested in, the preferences are from high to low:

Wallet, this also includes the wallet with built in in the exchange

Security, including code audit, security detection

secondary title

3.2 A16Z Crypto

A16z crypto launched 2 application projects, both of which are seed rounds. Both projects are platform projects:

Creator platform gathers creators and helps them NFTize their original works

The NFT pledging platform allows all players who cannot play some games due to the high threshold nft to successfully access these games through this nft lending platform, and finally have the ownership of these NFTs after the platform completes all payments

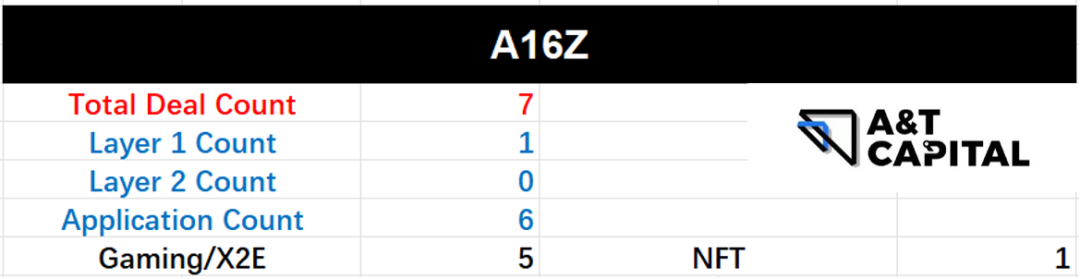

3.3 A16Z

A16Z took 7 shots in total, including 1 Layer 1 project - Aptos, and 6 application projects.

Among the 6 applications invested, the rounds include 2 rounds of seed and 4 rounds of series A, and the directions include:

5 gaming/x-to-earn

1 nft item

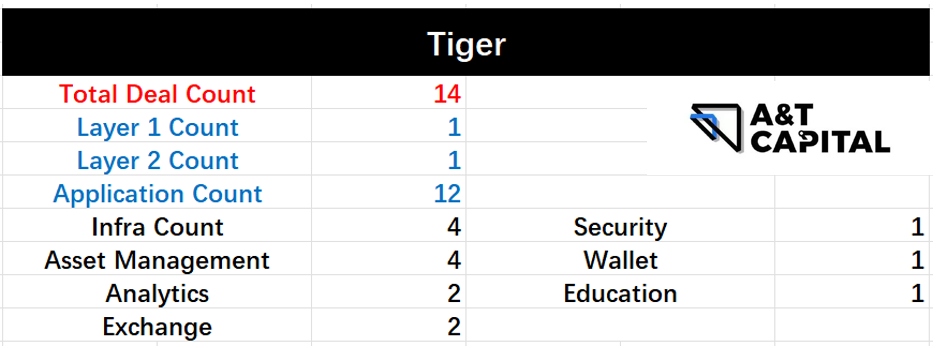

3.4 Tiger

Tiger took a total of 14 shots, 1 layer1, 1 layer 2 and 12 applications. The Layer 1 item is Aptos, and the Layer 2 item is polygon. In terms of investment stage, 14 projects have been sold from seed to series D, and there is no obvious stage preference.

Among the 12 applications invested in, the preferences are from high to low:

4 Infra projects, including staking service, DID, deployment platform

4 asset management

2 analytics and 2 exchanges

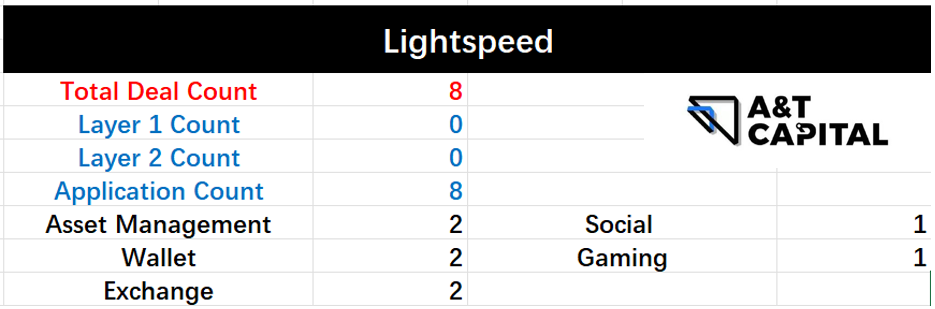

3.5 Lightspeed

Lightspeed made a total of 7 shots, and the investment time of the 7 shots was application. In terms of investment stage, there are sales from seed to series D, and there is no preference in stage.

Among the 7 applications invested in, the preferences are from high to low:

2 asset management

2 wallets

2 exchanges

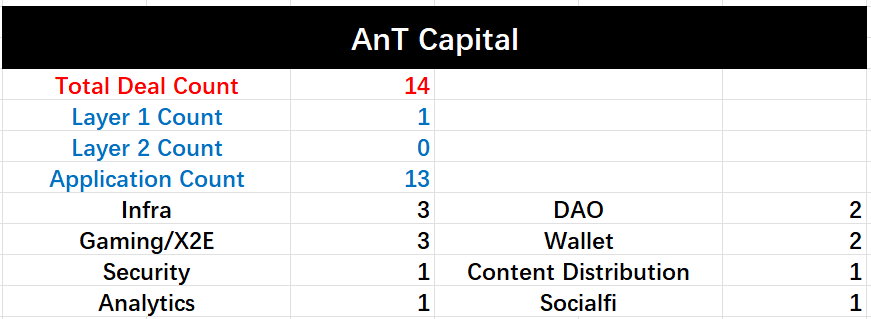

3.6 A&T Capital

A&T Capital has sold a total of 14 projects, including 1 Layer1 - Mysten Labs. In terms of investment rounds, there is a clear preference for the early stage, including 7 seed rounds and 2 A rounds.

Among the 13 applications invested, including:

3 infrastructures

3 gaming/x2e

2 wallets

2 DAO tools

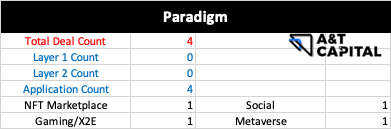

3.7 Paradigm

Paradigm made a total of 4 investments, all of which were applications. In terms of investment rounds, all 4 shots are seed rounds. The 4 applications invested include nft marketplace, gaming/x2e, social, and metaverse.

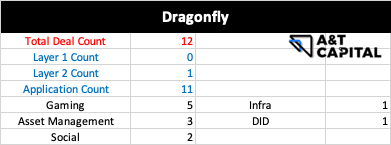

3.8 Dragonfly

Dragonfly took a total of 12 shots, including a layer 2 cross chain bridge, and the other 11 were application. In the investment round, the main focus is on the early seed round and the growth stage. Among the 12 applications invested in, the preferences are from high to low:

5 games

3 asset management

2 social

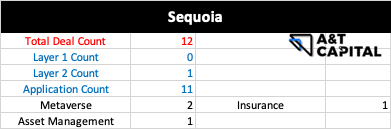

3.9 Sequoia

Sequoia took 5 shots in total, including 1 layer 2 - starkware, and the other 4 were application. In terms of investment rounds, there is a clear tendency to prefer the later stage, including an ICO round project. Among the 4 applications invested, including:

2 metaverses

1 asset management

Summarize

Summarize

from

frominvestment stagefrom

frominvestment trendsLook, Layer 1 is dominated by PoS, and the attention of hybrid chain has increased significantly; Layer 2 is dominated by general scaling, and the attention of industry-specific chain has increased; the application layer is dominated by games and NFT, and the attention to safety tracks obviously increasing.