ดูความคาดหวังของตลาดสำหรับการผสานจากข้อมูลฟิวเจอร์ส ETH

ผู้แปล: Odaily Azuma

ผู้แปล: Odaily Azuma

ตลาดฟิวเจอร์สเป็นสมรภูมิของสถาบัน นักป้องกันความเสี่ยง และนักเก็งกำไร

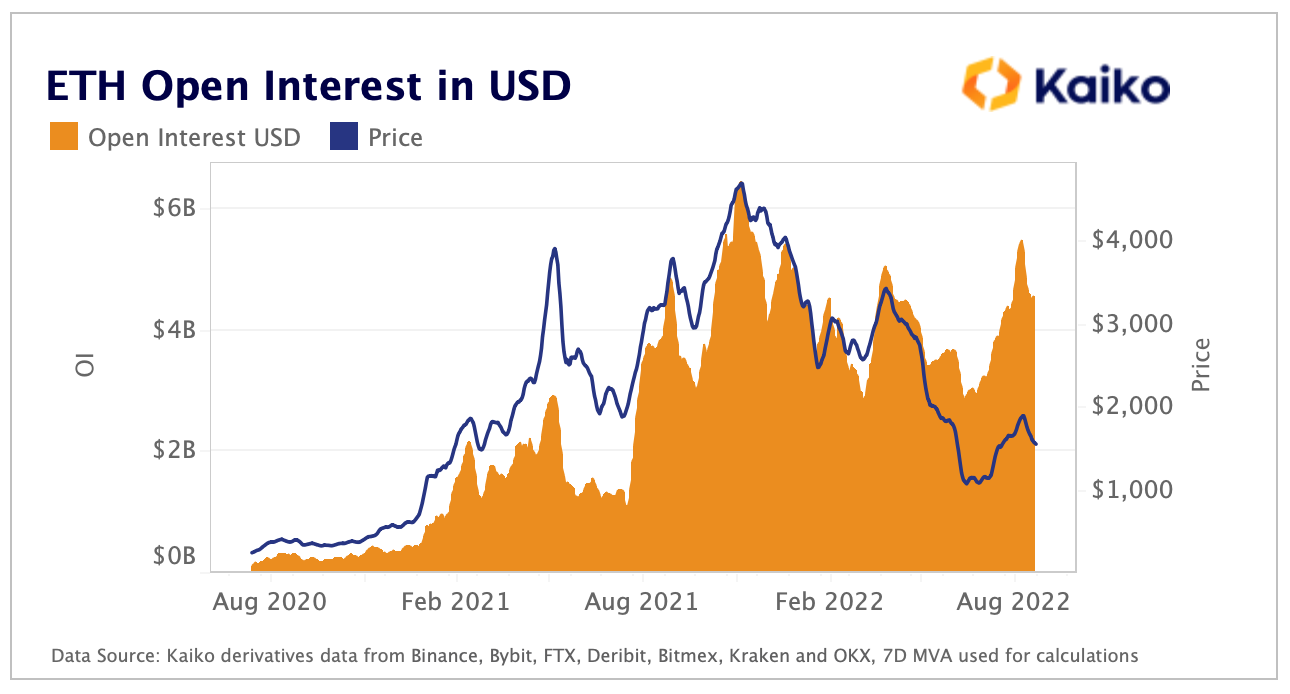

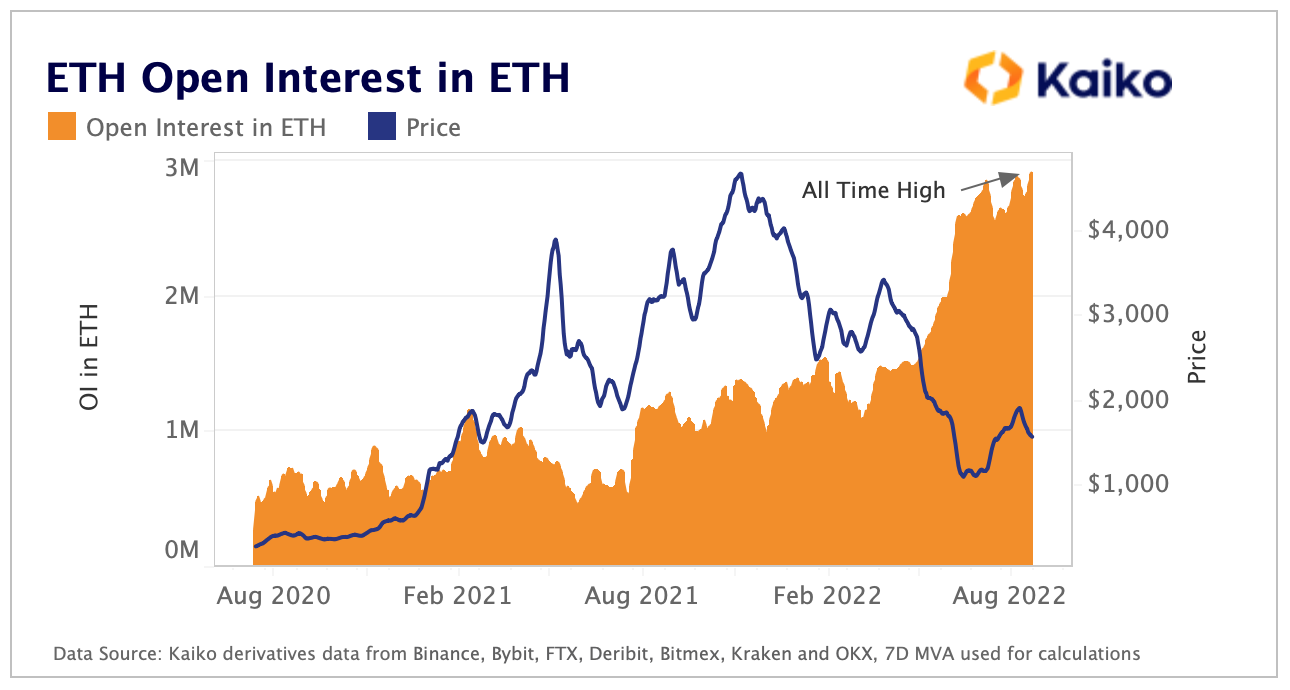

ในตลาดกระทิงปี 2021 ตลาดฟิวเจอร์สเป็นหนึ่งในตัวเร่งหลักสำหรับตลาดกระทิงนั้นให้แตะระดับสูงสุดใหม่ เนื่องจากเงินใหม่ที่หลั่งไหลเข้ามาในตลาดด้วยเลเวอเรจที่มากเกินไป ก้าวไปข้างหน้าอย่างรวดเร็วจนถึงเดือนกันยายน 2022 และเราเห็นว่ากองทุนใหม่เหล่านี้กำลังกลับไปสู่ฟิวเจอร์ส ตลาด "รุนแรง" มากขึ้นกว่าที่เคยเป็นมา โดยเฉพาะตลาด ETH ก่อนการผสานที่คาดการณ์ไว้มาก ความสนใจแบบเปิดของ ETH ได้ทำลายสถิติสูงสุดตลอดกาล

ชื่อเรื่องรอง

จุดสนใจของผู้ชม - ETH

ด้วยหนึ่งในช่วงเวลาที่สำคัญที่สุดในประวัติศาสตร์ของ Ethereum นักลงทุน ETH รู้สึกกังวลและตื่นเต้น

ในขณะที่ผู้คลางแคลงเปรียบเทียบการผสานที่กำลังจะมาถึงกับ "การเปลี่ยนเครื่องยนต์ของเครื่องบินกลางเที่ยวบิน" ผู้เสนอยกย่องการอัปเกรดว่าเป็นการปรับปรุงเชิงคุณภาพสำหรับการยอมรับจำนวนมากของ ethereum ความไม่ลงรอยกันนี้ปูทางไปสู่การเติบโตของปริมาณในตลาดฟิวเจอร์ส ETH เนื่องจากการอภิปรายทั้งสองฝ่ายพยายามที่จะปรับตำแหน่งของตนให้สอดคล้องก่อนการควบรวมกิจการ

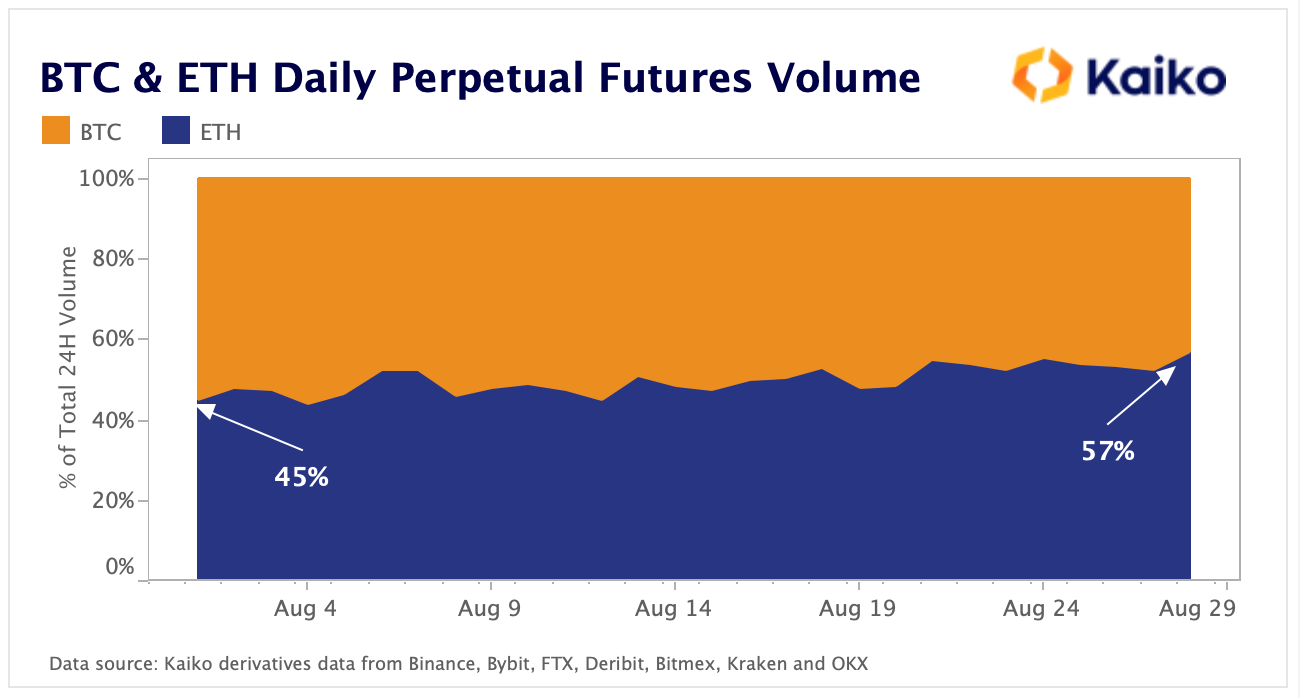

เราได้เห็นแนวโน้มนี้จากการเปรียบเทียบปริมาณการซื้อขายล่วงหน้าของ BTC และ ETHชื่อเรื่องรอง

เงินไหลเข้า

ผมได้กล่าวไว้ในบทความที่แล้วว่าแนวทางของการ Merge โมเมนตัมของกองทุนใหม่ที่เข้าสู่ตลาดฟิวเจอร์สนั้น "รุนแรง" กว่าที่เคยเป็นมา

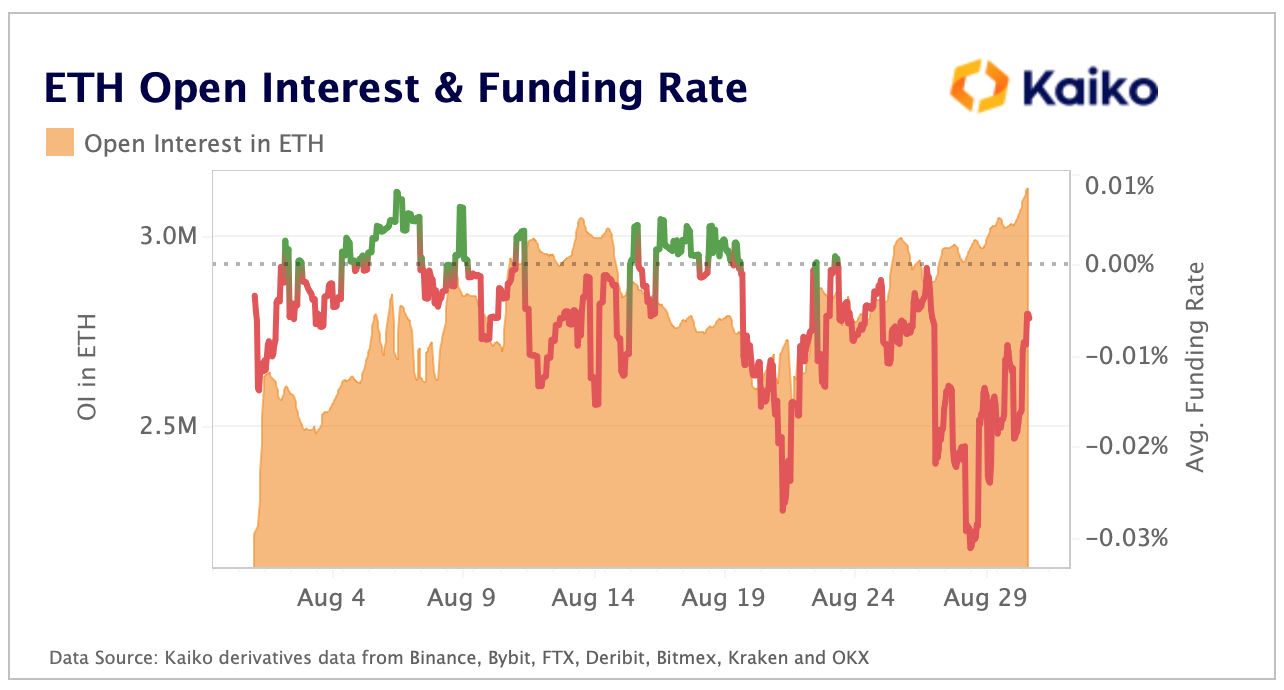

ดอกเบี้ยเปิดคือข้อมูลที่วัดจำนวนตำแหน่งฟิวเจอร์สที่เปิดอยู่ในปัจจุบัน ซึ่งแสดงถึงจำนวนเงินที่ลงทุนในฟิวเจอร์สในปัจจุบัน สิ่งที่ฉันต้องการเน้นในที่นี้คือการให้ความสนใจกับดอกเบี้ยที่เปิดอยู่ซึ่งจำเป็นต้องสังเกตในหน่วยของสินทรัพย์อ้างอิง นั่นคือ จำเป็นต้องให้ความสนใจกับสถานะที่เปิดอยู่ในสกุลเงิน ETH เนื่องจากเมื่อคุณดูข้อมูลเป็นดอลลาร์ คุณกำลังคำนึงถึงผลกระทบด้านราคาอย่างแท้จริง

ดังที่แผนภูมิด้านล่างแสดงไว้ ดอกเบี้ยที่เปิดในสกุลเงินดอลลาร์จะติดตามราคาอย่างใกล้ชิด ซึ่งมักเป็นตัวบ่งชี้ที่ยากต่อการเคลื่อนย้ายของเงินทุนในตลาดฟิวเจอร์ส

ในทางตรงกันข้าม,ชื่อเรื่องรอง

อัตราเงินทุน

อัตราการระดมทุนมีอยู่เพื่อช่วยให้ราคาฟิวเจอร์สขยับเข้าใกล้สินทรัพย์อ้างอิงที่พวกเขาติดตาม หากความต้องการซื้อขายล่วงหน้าเพิ่มขึ้น อัตราการระดมทุนจะเป็นบวก และนักลงทุนที่มีสถานะซื้อ (Long Position) จะต้องจ่ายเงินให้กับนักลงทุนที่มีสถานะขาย (Short) เพื่อจูงใจให้มีความสมดุลระหว่างสถานะ

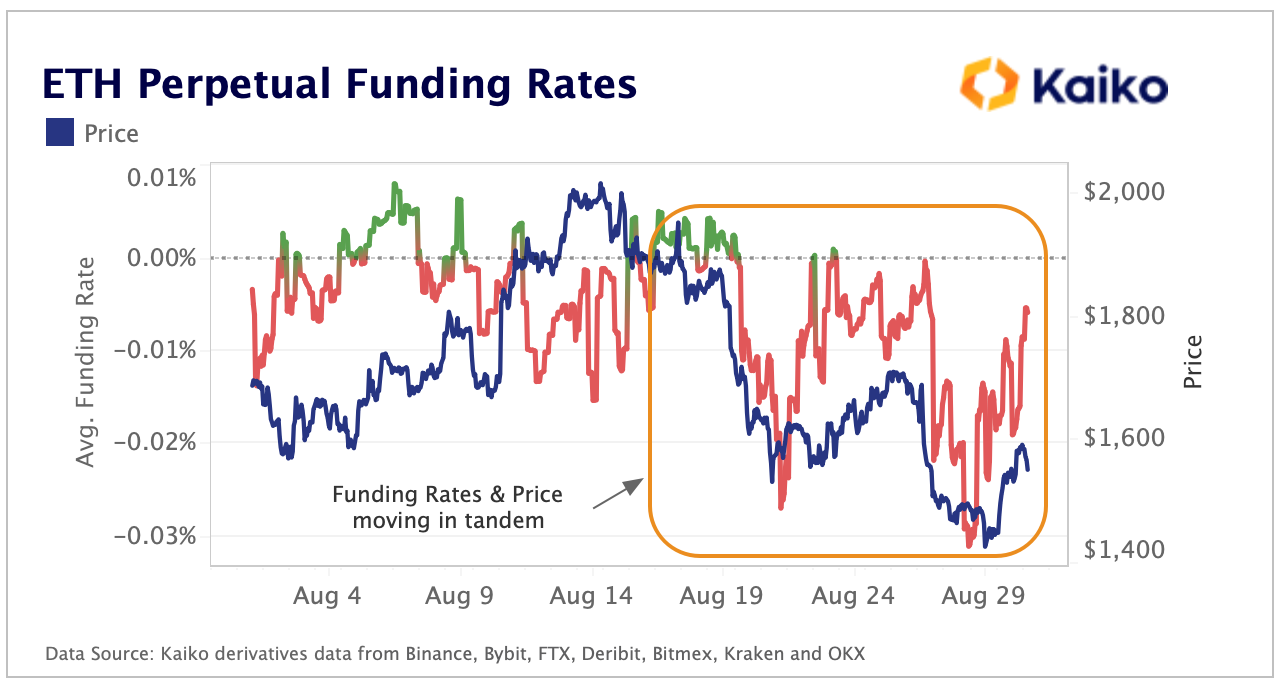

โดยปกติแล้ว เนื่องจากอารมณ์ของตลาดมักไม่สมดุล ดังนั้น อัตราการระดมทุนจึงมีแนวโน้มที่จะสนับสนุนด้านใดด้านหนึ่งต่อไป ไม่ว่าจะเป็นด้านบวกหรือด้านลบ ตั้งแต่ตลาดกระทิงในปี 2021 เนื่องจากการมองโลกในแง่ร้ายอย่างต่อเนื่อง อัตราการระดมทุนจึงลอยอยู่ต่ำกว่า เป็นกลาง.

ที่น่าสนใจ เมื่อการควบรวมกิจการใกล้เข้ามา เราเห็นว่าอัตราการระดมทุนในตลาดฟิวเจอร์ส ETH ลดลงอย่างมาก ซึ่งสิ้นสุดในเดือนสิงหาคมในแดนลบ การเติบโตในทางลบนี้ ซึ่งเกิดขึ้นพร้อมกันกับการเติบโตของความสนใจอย่างเปิดเผย ทำให้เราสรุปได้ว่า -เงินใหม่ส่วนใหญ่ที่ไหลเข้าสู่ตลาดฟิวเจอร์ส ETH มีอคติสั้นๆ

มีเหตุผลหลายประการที่นักลงทุนเลือกที่จะเปิดชอร์ต:

เหตุผลแรกคือการไม่ซื้อ ETH โดยพนันว่า Merge ล้มเหลวหรือล่าช้า การเดิมพันนี้ไม่ใช่เรื่องยากที่จะเข้าใจเนื่องจากข้อเท็จจริงที่ว่าวันที่ Merge ถูกเลื่อนกลับไปหลายครั้งก่อนหน้านี้ แต่การ Merge นั้นมีแนวโน้มที่จะประสบความสำเร็จมากขึ้นเรื่อย ๆ โดยเฉพาะอย่างยิ่งเมื่อ testnet ทั้งหมดถูกผลักกลับหลังจากการเปลี่ยนแปลงที่ราบรื่น . มันยากสำหรับฉันที่จะเชื่อว่าก่อนที่เหตุการณ์จะบานปลายถึงระดับนี้ นักลงทุนรายใดก็ตามเลือกที่จะขาย ETH โดยตรง

เหตุผลที่สอง (เป็นไปได้มากกว่าในความคิดของฉัน) คือนักลงทุนป้องกันสถานะระยะยาวของ ETH ก่อนการควบรวมกิจการ ซึ่งสามารถช่วยนักลงทุนป้องกันความเสี่ยงก่อนเหตุการณ์ อีกกลยุทธ์หนึ่งที่เป็นไปได้คือการใช้การเก็งกำไรในตลาดฟิวเจอร์ส โดยการซื้อ ETH spot และ shorting ETH futures นักลงทุนสามารถหลีกเลี่ยงความเสี่ยงจากความผันผวนของราคาและมีโอกาสที่จะได้รับ airdrops ของโทเค็น fork chain ที่มีศักยภาพ

หากการผสานสำเร็จและห่วงโซ่ PoW ล้มเหลวในการ "ปิด" เราควรเห็นตำแหน่งสั้น ETH จำนวนมากถูกชำระบัญชี นี่ควรเป็นข่าวเชิงบวกสำหรับราคาของสินทรัพย์ที่เกี่ยวข้อง โดยเฉพาะอย่างยิ่งหากปริมาณการซื้อขายของสินทรัพย์ส่วนใหญ่กระจุกตัวอยู่ในตลาดฟิวเจอร์ส (เราจะพูดถึงเรื่องนี้ในภายหลัง) หากคุณรวมตำแหน่งสั้นที่รอดำเนินการเหล่านี้เข้ากับแรงกดดันการขายของนักขุดรายวันหลายสิบล้านดอลลาร์ คุณอาจมีแนวโน้มที่ดีสำหรับ ETH เนื่องจากแรงขายจำนวนมากทั้งสองคาดว่าจะคลายตัวในเวลาเดียวกัน

ชื่อเรื่องรอง

สปอตหรือฟิวเจอร์ส ใครเป็นผู้นำราคาของ ETH?

ก่อนหน้านี้เราเห็นอัตราการระดมทุนติดลบและดอกเบี้ยเปิดเพิ่มขึ้นในขณะที่ ETH ลดลงกว่า 30% จากระดับสูงสุดของเดือนนี้ สิ่งนี้ทำให้เกิดคำถามว่าตลาดฟิวเจอร์สมีอิทธิพลต่อราคาของสกุลเงินดิจิตอลมากแค่ไหน? นี่เป็นคำถามของการค้นพบราคา และมันก็สรุปได้ว่าตลาดใดที่เป็นผู้นำในการค้นหาราคาในขณะนี้ สปอตหรือฟิวเจอร์ส

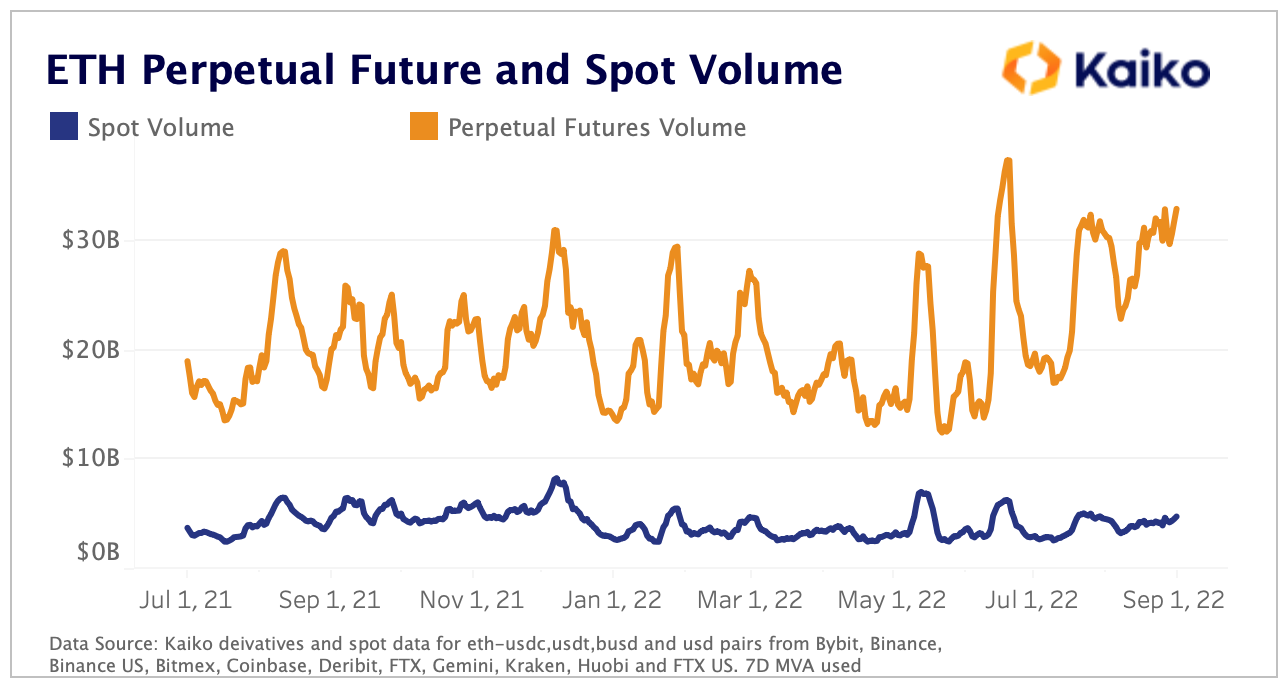

วิธีหนึ่งในการตอบคำถามนี้คือการดูที่ปริมาณการซื้อขาย ปริมาณมักจะสัมพันธ์กับการเคลื่อนไหวของราคา และหากปริมาณในตลาดฟิวเจอร์สเพิ่มขึ้นมากกว่าตลาดสปอตในช่วงระยะเวลาหนึ่ง เราอาจตัดสินว่าตลาดฟิวเจอร์สเป็นผู้นำในการค้นหาราคา ในช่วงนั้น.

ตั้งแต่ปีที่แล้ว ปริมาณการซื้อขายรายวันของตลาดฟิวเจอร์ส ETH เพิ่มขึ้นอย่างมากจาก 19 พันล้านดอลลาร์เป็นมากกว่า 33 พันล้านดอลลาร์ ในขณะที่ปริมาณการซื้อขายรายวันเพิ่มขึ้นจาก 3.7 พันล้านดอลลาร์เป็น 4.8 พันล้านดอลลาร์

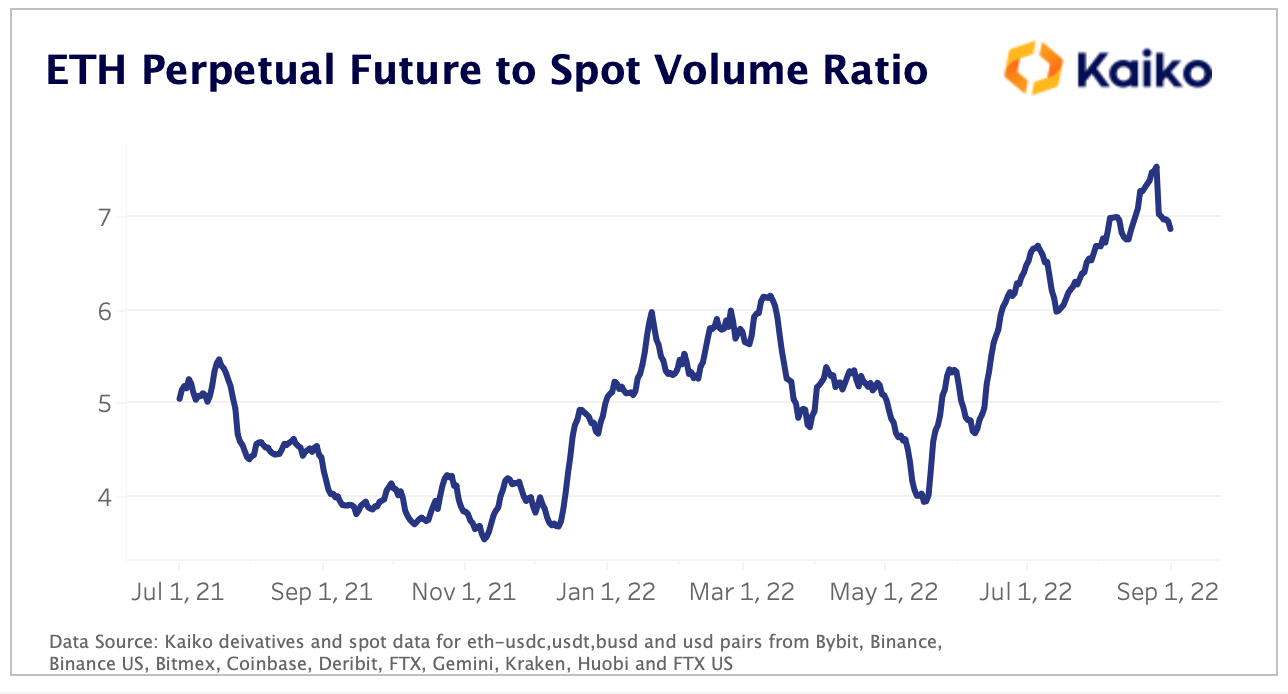

การแบ่งปริมาณเหล่านี้ออกเป็นอัตราส่วนเพื่อประเมินว่ามีการเปลี่ยนแปลงอย่างไรเมื่อเทียบกัน เราจะเห็นว่าปริมาณฟิวเจอร์ส ETH ที่เพิ่มขึ้นนั้นเพิ่มขึ้น เนื่องจากอัตราส่วนของฟิวเจอร์สต่อปริมาณสปอตเพิ่มขึ้นจาก 5 เท่าเป็นประมาณ 7 เท่า

ชื่อเรื่องรอง

ตัวเลือก

แนวโน้มที่เราเห็นในตลาดฟิวเจอร์สสำหรับ ETH นั้นสะท้อนให้เห็นในตลาดออปชันด้วย

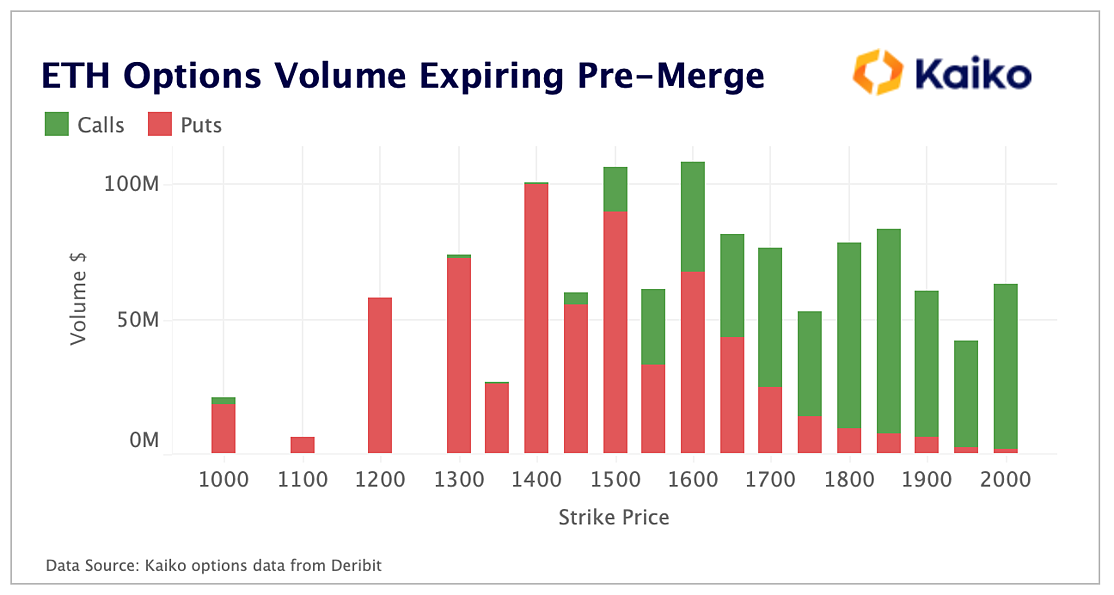

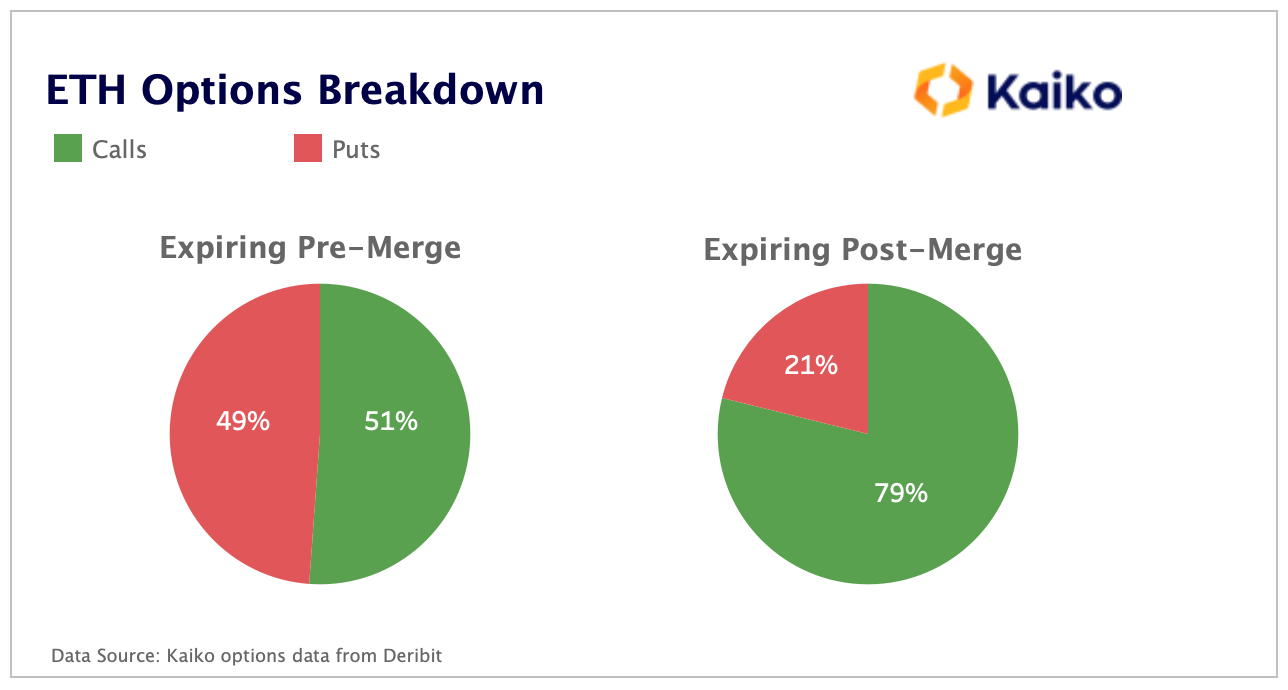

ผู้ซื้อตัวเลือกใส่ต้องการล็อค (กำไร) ในระดับราคาที่พวกเขาสามารถหยุดการขาดทุนได้ เมื่อดูที่ปริมาณการซื้อขายของตัวเลือก ETH ที่หมดอายุก่อนการผสาน เราจะเห็นได้อย่างชัดเจนว่าในช่วงราคา $1,000-$2,000 สามจุดที่มีปริมาณการซื้อขายสูงสุดคือ 1,600, 1,500 และ 1,400 ซึ่งสองจุดสุดท้ายคือ เกือบทั้งหมดประกอบด้วยตัวเลือกการใส่

เมื่อผู้คนนึกถึงการซื้อขายออปชั่นในตลาด crypto การเก็งกำไรตำแหน่งระยะยาวมักจะนึกถึง แต่ตลาดออปชันก่อนการควบรวมกิจการอาจเป็นกรณีทั่วไปของการป้องกันความเสี่ยง สำหรับออปชันที่หมดอายุก่อนการผสาน อัตราส่วนของปริมาณการซื้อขายแบบพุท/คอลคือเกือบ 50-50 ซึ่งหายากมากในตลาดออปชันสกุลเงินดิจิทัล อย่างไรก็ตาม หลังจากการควบรวมกิจการ การเดิมพันตัวเลือกการโทรกลับมาที่ 73% อีกครั้งเนื่องจากการเก็งกำไรยังคงครองตำแหน่งสูงสุด

สรุปแล้ว

สรุปแล้ว

การครอบงำของตลาดฟิวเจอร์สนั้นเพิ่มขึ้นเมื่อเทียบกับตลาดสปอต และปัจจุบันอนุพันธ์มีผลกระทบอย่างมากต่อการเคลื่อนไหวของราคาของสินทรัพย์ crypto

ETH เป็นตัวอย่างทั่วไปที่สุด มันจะนำไปสู่การอัพเกรดที่สำคัญและไม่แน่นอนในอีกไม่กี่สัปดาห์ ตลาดฟิวเจอร์สได้รับการปรับแต่งสำหรับเหตุการณ์ที่มีความผันผวนสูงเช่นนี้ จากหลักฐานในตลาดออปชั่น นักลงทุนดูเหมือนจะมีความหวังในอนาคตระยะยาวของ Ethereum แต่ก็ยังมีช่วงเวลาที่คาดไม่ถึงในระยะสั้น

โดยไม่คำนึงว่าการผสานนี้เป็นเพียงเหตุการณ์ล่าสุดที่ไม่ได้ขับเคลื่อนด้วยมาโครในพื้นที่ crypto และจะน่าสนใจมากหากนำไปสู่ความก้าวหน้าในการลดความสัมพันธ์ระหว่าง crypto และตลาดหุ้น