ประวัติและวิวัฒนาการของการกำกับดูแล DAO

การตีความคำว่า Governance ในทางรัฐศาสตร์มักหมายถึงการปกครองประเทศ กล่าวคือ การที่รัฐบาลใช้อำนาจปกครองในการบริหารประเทศ ประชาชน และดินแดน เพื่อให้บรรลุวัตถุประสงค์ในการดำเนินประเทศต่อไปและให้ ประเทศให้พัฒนา ในด้านธุรกิจ ยังขยายความจากบรรษัทภิบาลไปสู่บรรษัทภิบาล หมายถึง วิธีการและระบบการจัดการในองค์กร เช่น บริษัทต่างๆ" - Wikipedia

DAO เป็นองค์กรอิสระแบบกระจายอำนาจที่สร้างขึ้นบนบล็อกเชนที่เข้ารหัสกฎการกำกับดูแลในรูปแบบของสัญญาอัจฉริยะ ในฐานะองค์กรปกครองตนเองแบบกระจายศูนย์แห่งแรก ชุมชน Bitcoin ถือเป็นต้นกำเนิดของ DAO นอกจากนี้ยังมีมุมมองว่า DAO เป็นชุมชนแรกที่ดำเนินการโดยสัญญาอัจฉริยะ สามารถเรียกได้ว่าเป็นผู้ริเริ่มของ DAO ในความหมายที่แท้จริง กฎที่เขียนลงในสัญญาอัจฉริยะสามารถกระตุ้นการดำเนินการโดยอัตโนมัติเมื่อตรงตามเงื่อนไข ซึ่งไม่เพียงช่วยปรับปรุงประสิทธิภาพการดำเนินการ แต่ยังทำให้การกำกับดูแลมีความโปร่งใสมากขึ้น

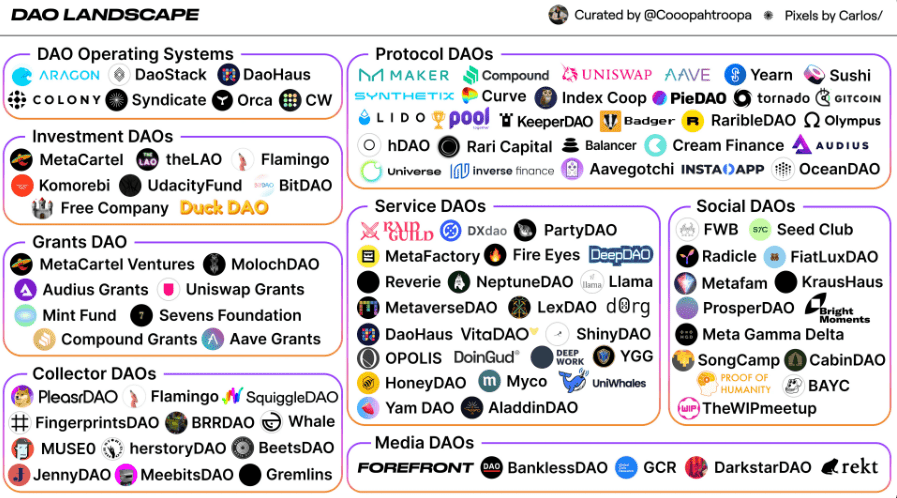

คำอธิบายภาพ

ระบบนิเวศ DAO ปัจจุบัน สถิติไม่สมบูรณ์

โครงสร้างพื้นฐาน

โครงสร้างพื้นฐาน

โดย

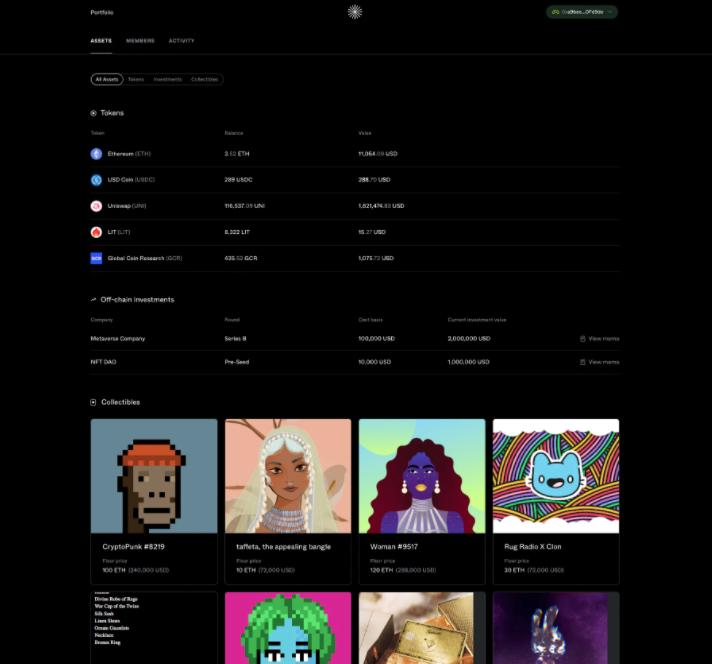

โดยSyndicate DAOคำอธิบายภาพ

Web3 Investment Club บนซินดิเคท

ความสามารถในการจัดองค์ประกอบได้ของ DAO สร้างโครงสร้างองค์กรที่ประกอบได้และใช้ซ้ำได้ ซึ่งเป็นปัจจัยขับเคลื่อนการพัฒนาระบบนิเวศของ DAODAO และ DAO ร่วมมือกันและรวมกันเป็น "เลโก้องค์กร" ห่วงโซ่อุปทานที่ใช้สัญญาอัจฉริยะนี้คาดว่าจะสร้างระบบนิเวศอุตสาหกรรมของการทำงานร่วมกันที่มีประสิทธิภาพระหว่างองค์กรต่างๆ Gnosis Safe ซึ่งเป็นแพลตฟอร์มการจัดการสินทรัพย์ดิจิทัลเป็นกระเป๋าเงินหลายลายเซ็นที่ใช้กันอย่างแพร่หลายที่สุดในระบบนิเวศ EVM ไม่เพียงเป็นเครื่องมือสำคัญสำหรับ DAO ในการจัดการคลัง แต่ยังพัฒนาเป็นระบบการจัดการบัญชีที่มีมาตรฐานหลักอีกด้วย

เครื่องมือโครงสร้างพื้นฐานที่คล้ายกันที่ DAO สามารถใช้ได้ ได้แก่ Utopia, ระบบการจ่ายเงินเดือน, Snapshot, ระบบการลงคะแนนแบบออฟไลน์, Tally, แดชบอร์ดการกำกับดูแล, Sybil, เครื่องมือลงคะแนนเสียงผ่านตัวแทน และอื่นๆ

อุดมการณ์

"พวกเขาดูเหมือนจะเป็นเสรีนิยมทางการเมืองอย่างไม่มีที่ติ - พวกเขาหวังว่าเทคโนโลยีสารสนเทศจะสร้าง "ประชาธิปไตยแบบเจฟเฟอร์สัน" ใหม่ในโลกไซเบอร์อย่างหลีกเลี่ยงไม่ได้ และอุดมการณ์ของรัฐแคลิฟอร์เนียเป็นธรรมชาติและหลีกเลี่ยงไม่ได้ของตลาดเสรีที่มีเทคโนโลยีสูง Dodged Triumph นำเสนอวิสัยทัศน์ที่ร้ายแรง "

— Richard Barbrook, Andy Cameron, “California Ideology,” Mute, 1 กันยายน 2538

ธรรมาภิบาลเป็นปัญหาโบราณที่มนุษยชาติต้องเผชิญ การพัฒนาคนเป็นกระบวนการจากการปกครองแบบรวมศูนย์ไปสู่การปกครองในระบอบประชาธิปไตย "ภาวะกลืนไม่เข้าคายไม่ออกของตัวการหลัก" หมายความว่าเมื่อคนไม่กี่คนสามารถเป็นตัวแทนผลประโยชน์ของคนส่วนใหญ่ได้ อันตรายทางศีลธรรมก็เกิดขึ้น: ตัวแทนอาจเสียสละผลประโยชน์ของตัวการเพื่อผลประโยชน์ของเขาเอง ในทางกลับกัน ในรูปแบบการปกครองแบบดั้งเดิม กระบวนการดำเนินการและการกำกับดูแลยังเผชิญกับอันตรายทางศีลธรรมอีกด้วย

การกำกับดูแลของ DAO ขยายขอบเขตของผู้เข้าร่วมในการตัดสินใจ และการลงคะแนนคือเกมของผู้เข้าร่วมทั้งหมดชื่อเรื่องรอง

ขอบเขตการกำกับดูแล

ข้อดีของธรรมาภิบาลของ DAO คือกฎและการจัดการเปิดกว้างและโปร่งใสสำหรับสมาชิกทุกคน อย่างไรก็ตาม ผู้เข้าร่วมในการตัดสินใจมากขึ้นก็หมายความว่าประสิทธิภาพในการตัดสินใจจะลดลงด้วย จากมุมมองของการทำงานร่วมกัน DAO ในขั้นตอนนี้สามารถแบ่งออกเป็นสามประเภท:โปรโตคอล DAO, แอปพลิเคชัน DAO, การจัดสรรทรัพยากร DAO。

โปรโตคอล DAO: โครงสร้างพื้นฐานสำหรับแอปพลิเคชันแบบกระจายศูนย์ เช่น เครือข่ายสาธารณะ โครงสร้างพื้นฐานที่นำมาใช้อย่างแพร่หลายโดยระบบนิเวศการเข้ารหัส เช่น MakerDAO เช่นเดียวกับโลกแห่งความเป็นจริง DAO ที่ใช้โปรโตคอลเป็นเหมือนฐานราก และมีอยู่เพื่อรักษาการพัฒนาที่ยั่งยืนของระบบนิเวศการเข้ารหัสบนพื้นฐานของสิ่งเหล่านี้ ดังนั้นขอบเขตการกำกับดูแลจึงส่วนใหญ่เป็นการบำรุงรักษาและอัปเกรดโปรโตคอล การตั้งค่าพารามิเตอร์ระบบ ฯลฯ ข้อกำหนดสำหรับคุณภาพของข้อเสนอและความเป็นมืออาชีพของผู้เสนอนั้นค่อนข้างสูง ตัวอย่างเช่น Ethereum Foundation เลือกการกำกับดูแลแบบ off-chain ปัจจัยหนึ่งคือ Vitalik มีบทบาทสำคัญในการเลือกเทคโนโลยี

แอพพลิเคชั่น อพท: ทั่วถึงระดับแอพพลิเคชั่นเพื่อความบันเทิง ศิลปะ เกม และชีวิต เช่น แอปพลิเคชันโซเชียล แอปพลิเคชันเกม แอปพลิเคชัน DeFi แอปพลิเคชันข้อมูล เป็นต้น DAO ประเภทนี้จัดตั้งองค์กรเชิงพาณิชย์ขนาดต่างๆ โดยทั่วไปเพื่อวัตถุประสงค์ในการแสวงหาผลกำไรหรือการพัฒนาชุมชนของตนเอง การกำกับดูแลมุ่งเน้นไปที่การจัดการบุคลากรขององค์กร การจัดการกองทุนเงินคงคลัง แผนการเก็บมูลค่าโปรโตคอล ฯลฯ

การจัดสรรทรัพยากร อพท: DAO ประเภทนี้ไม่ได้จัดทำข้อตกลงหรือผลิตภัณฑ์ใด ๆ แต่สร้างผลกำไรให้กับสมาชิกผ่านการจัดการสินทรัพย์คลัง เช่น การลงทุนใน DAO หรือให้บริการจับคู่กองทุนและสนับสนุนทางเทคนิค เช่น DAO สวัสดิการสาธารณะ การวางแผนจัดสรรทรัพยากรเป็นจุดเน้นของการกำกับดูแล

ชื่อเรื่องรอง

การบริหารสินทรัพย์ของกระทรวงการคลัง

สินทรัพย์คงคลังของ DAO สนับสนุนการพัฒนาผลิตภัณฑ์ขององค์กร การขยายบุคลากร และการพัฒนาระยะยาว หลักการสามประการของการจัดการสินทรัพย์ DAO คือ:

ก. ตั้งเป้าหมายระยะเวลาถาวร (แม้ว่าการชำระบัญชีมักจะเสร็จสิ้น);

ข. ตรวจสอบให้แน่ใจว่ามีกระแสเงินสดเป็นบวก

ค. การกระจายสินทรัพย์

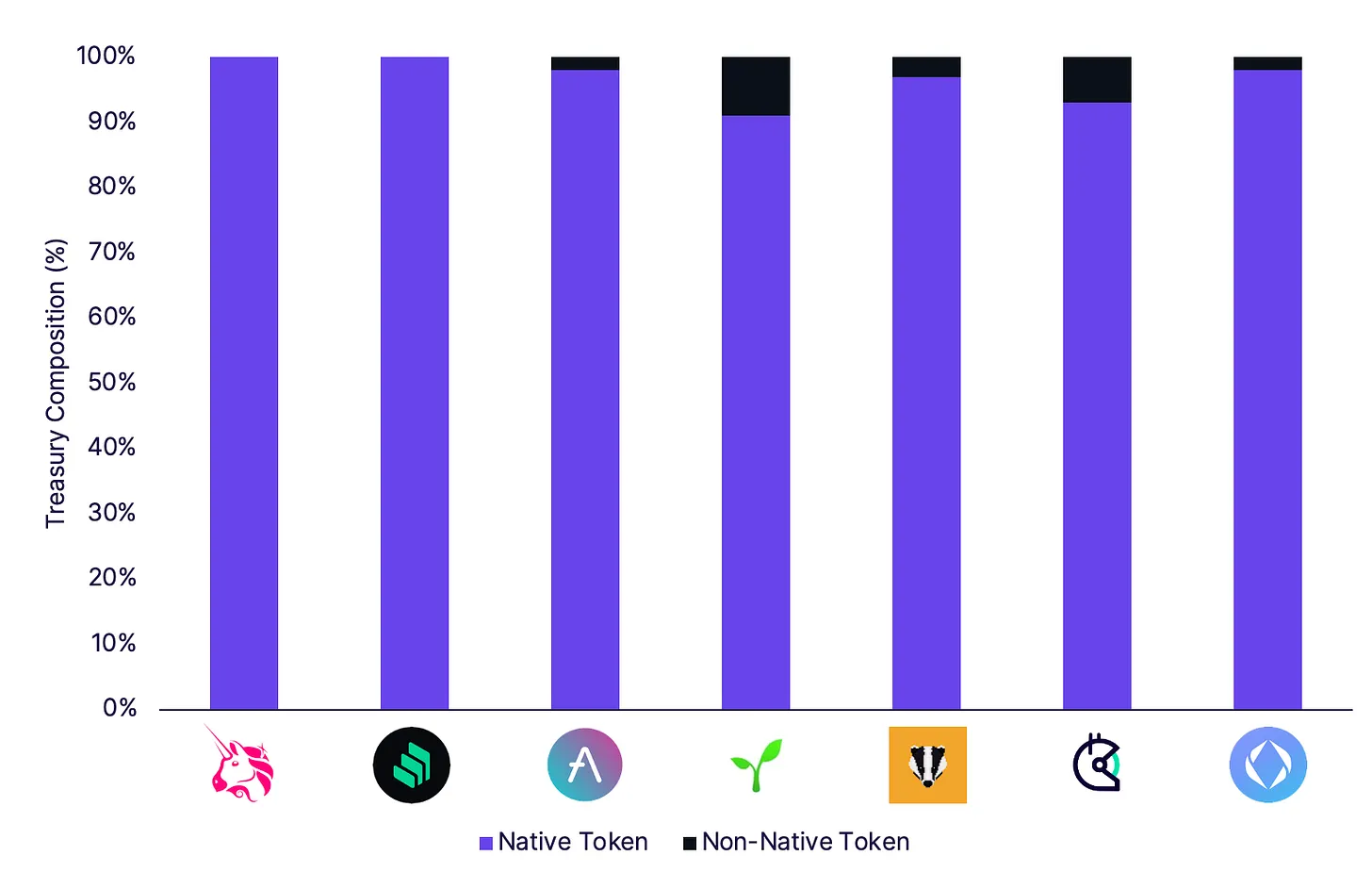

ในขั้นต้น คลังของ DAO ถูกกำหนดให้เป็นส่วนที่ยังไม่ได้ออกของโทเค็นดั้งเดิมของโครงการ มูลค่าตามราคาตลาดของโทเค็นดั้งเดิมกำหนดตำแหน่งทางการตลาดของ DAO อย่างไรก็ตาม ความผันผวนสูงและระยะเวลาของสกุลเงินดิจิทัลทำให้มูลค่าตลาดของโทเค็นไม่สามารถสะท้อนถึงกำลังซื้อที่แท้จริงของ DAO ได้ ผู้ว่าการตระหนักว่าการพึ่งพาคลังที่ประกอบด้วยโทเค็นพื้นเมืองเท่านั้นไม่สามารถสนับสนุนการพัฒนาระยะยาวและมั่นคงของ DAO ได้

เพื่อสร้างใบสินทรัพย์ที่สามารถสะท้อนถึงกำลังซื้อของ DAO ได้จริง จำเป็นต้องแทนที่สินทรัพย์ดั้งเดิมเพียงรายการเดียวด้วยองค์ประกอบสินทรัพย์ที่หลากหลาย. วิธีแก้ปัญหาทั่วไปในปัจจุบันคือการเพิ่มเนื้อหา: วิธีแก้ปัญหาทั่วไปในปัจจุบันคือการเพิ่มเนื้อหา:

ก. Stablecoins;

ข. ทรัพย์สินที่เข้ารหัสด้วยชิปสีน้ำเงิน

คำอธิบายภาพ

เครดิตรูปภาพ: Bankless

สินทรัพย์ที่หลากหลายมักจะมาพร้อมกับการขายโทเค็นดั้งเดิม เพื่อลดผลกระทบด้านลบของการกระจายความเสี่ยง DAO มักจะเลือก:

ก. กระจายทรัพย์สินคงคลังบางส่วน;

ข. ใช้กลไกการประมูลเพื่อลดผลกระทบของการขายโทเค็นต่อราคา เช่น การประมูล Gnosis

ในทางกลับกัน,

ในทางกลับกัน,DAO ยังสามารถปรับปรุงประสิทธิภาพของสินทรัพย์คงคลังและลดความเสี่ยงของสินทรัพย์โดยใช้เครื่องมือทางการเงิน DeFi. ตัวอย่างเช่น สามารถใช้เหรียญ Stablecoin สำหรับการขุดสภาพคล่องเพื่อสร้างดอกเบี้ย ซื้อประกันหรือตัวเลือกระยะสั้นเพื่อต้านทานความเสี่ยงของหงส์ดำ ออกพันธบัตร เงินกู้ที่ไม่มีหลักประกันตามการจัดอันดับเครดิต สินเชื่อเครดิตระหว่างข้อตกลง ฯลฯ

ชื่อระดับแรก

ภาวะที่กลืนไม่เข้าคายไม่ออกของการกำกับดูแล DAO

แม้ว่าโครงสร้างพื้นฐานของ DAO จะสมบูรณ์แบบมากขึ้นเรื่อย ๆ การสร้าง DAO จะง่ายขึ้นเรื่อย ๆ แต่การเรียกใช้ DAO นั้นไม่ใช่เรื่องง่าย ตามรายงานการสำรวจระบบนิเวศของ DAO ที่เผยแพร่โดย Chainalysis ในเดือนมิถุนายนปีนี้ อำนาจการกำกับดูแลของ DAO นั้นรวมศูนย์อย่างมาก จากการวิเคราะห์การกระจายของโทเค็นการกำกับดูแล DAO สิบโทเค็น Chainalysis พบว่าใน DAO หลักหลายแห่ง ผู้ถือน้อยกว่า 1% เป็นเจ้าของ 90% ของอำนาจการลงคะแนน

การกำกับดูแลของ DAO ประสบปัญหาการมีส่วนร่วมต่ำ ตามสถิติของเว็บไซต์ข้อมูล DeepDAO ซึ่งเป็นหนึ่งใน 10 อันดับแรกของ DAO ในสินทรัพย์คลัง Olympus DAO มีกิจกรรมการกำกับดูแลสูงสุด (ผู้ใช้ที่ใช้งานอยู่/จำนวนผู้ถือโทเค็นการกำกับดูแลทั้งหมด) ถึงเกือบ 50% รองลงมาคือ Aave แต่กิจกรรมดังกล่าว มีเพียง 13.5% เท่านั้น

มีเหตุผลหลักสามประการสำหรับการมีส่วนร่วมในการปกครองต่ำ:

ก. นักเก็งกำไรระยะสั้นไม่สนใจเกี่ยวกับการพัฒนาในอนาคตของชุมชน แต่พวกเขาอาจมีสิทธิในการออกเสียง

ข. ผู้ถือหุ้นส่วนน้อยอาจคิดว่าเป็นเรื่องยากสำหรับพวกเขาที่จะมีอิทธิพลต่อกระบวนการของข้อเสนอซึ่งทำให้ความกระตือรือร้นในการมีส่วนร่วมลดลง

ค. กลไกการลงคะแนนเสียงเองไม่ยุติธรรมพอ และสิทธิในการออกเสียงกระจุกตัวอยู่ในมือของคนเพียงไม่กี่คน

การเปิดกว้างของ DAO ทำให้ทุกคนที่มีเป้าหมายร่วมกันสามารถเป็นสมาชิกขององค์กรได้ เกณฑ์การมีส่วนร่วมที่ต่ำกว่ายังหมายถึงความเหนียวแน่นของสมาชิกที่ลดลงด้วย ในช่วงแรก มักจะมีแกนนำหลายคนที่มีบทบาทสำคัญในการตัดสินใจในการส่งเสริมชุมชนและพัฒนาสมาชิกใหม่ เมื่อจำนวนสมาชิกเพิ่มขึ้น เพื่อให้มั่นใจในคุณภาพของข้อเสนอ ชุมชนมักจะตั้งกฎของข้อเสนอ เช่น: ผู้ใช้ต้องถือ 0.1% ถึง 1% ของการจัดหาโทเค็นที่ค้างอยู่เพื่อสร้างข้อเสนอ ด้วยจำนวนผู้ถือโทเค็นดังกล่าว อาจคิดเป็นเพียงหนึ่งในพันของสมาชิกของชุมชน DAO

จะเห็นได้ว่าการใช้โทเค็นเป็นใบรับรองสิทธิในการออกเสียงเพียงใบเดียวจะนำมาซึ่งปัญหาการรวมศูนย์การปกครอง แม้ว่าสิทธิในการออกเสียงจะไม่กระจุกตัวอยู่ในมือของสมาชิกเพียงไม่กี่คนในขณะนี้ แต่สภาพคล่องของโทเค็นทำให้ทุกคนสามารถซื้อโทเค็นจำนวนมากจากตลาดเพื่อรับข้อเสนอหรือสิทธิในการออกเสียงที่กำหนดอนาคตของชุมชน หากข้อเสนอส่งผลเสียต่อชุมชน ก็จะสร้าง "การโจมตีโทเค็นการกำกับดูแล"

การโจมตีด้านธรรมาภิบาลที่เลวร้ายที่สุดคือ "การกำกับดูแลที่แยกมูลค่า": การลงคะแนนเสียงในการกำกับดูแลให้เลิกใช้ซอฟต์แวร์ระบบทั้งหมดเพื่อรับผลประโยชน์ เมื่อสิทธิในการออกเสียงอยู่ในมือของผู้ที่มีผลประโยชน์ระยะสั้น แรงผลักดันจากผลประโยชน์เฉพาะหน้า (ค่าธรรมเนียมการจัดการ/การแข็งค่าของโทเค็น) อาจทำลายโมเมนตัมการพัฒนาในระยะยาวของชุมชน ในกรณีที่รุนแรงกว่านั้น ข้อเสนอจะชำระคลังและยุติข้อตกลง

เมื่อวันที่ 19 สิงหาคม หนึ่งในองค์กร DAO ที่ใหญ่ที่สุด Tribe DAOชื่อระดับแรก

การปรับปรุงการกำกับดูแล DAO

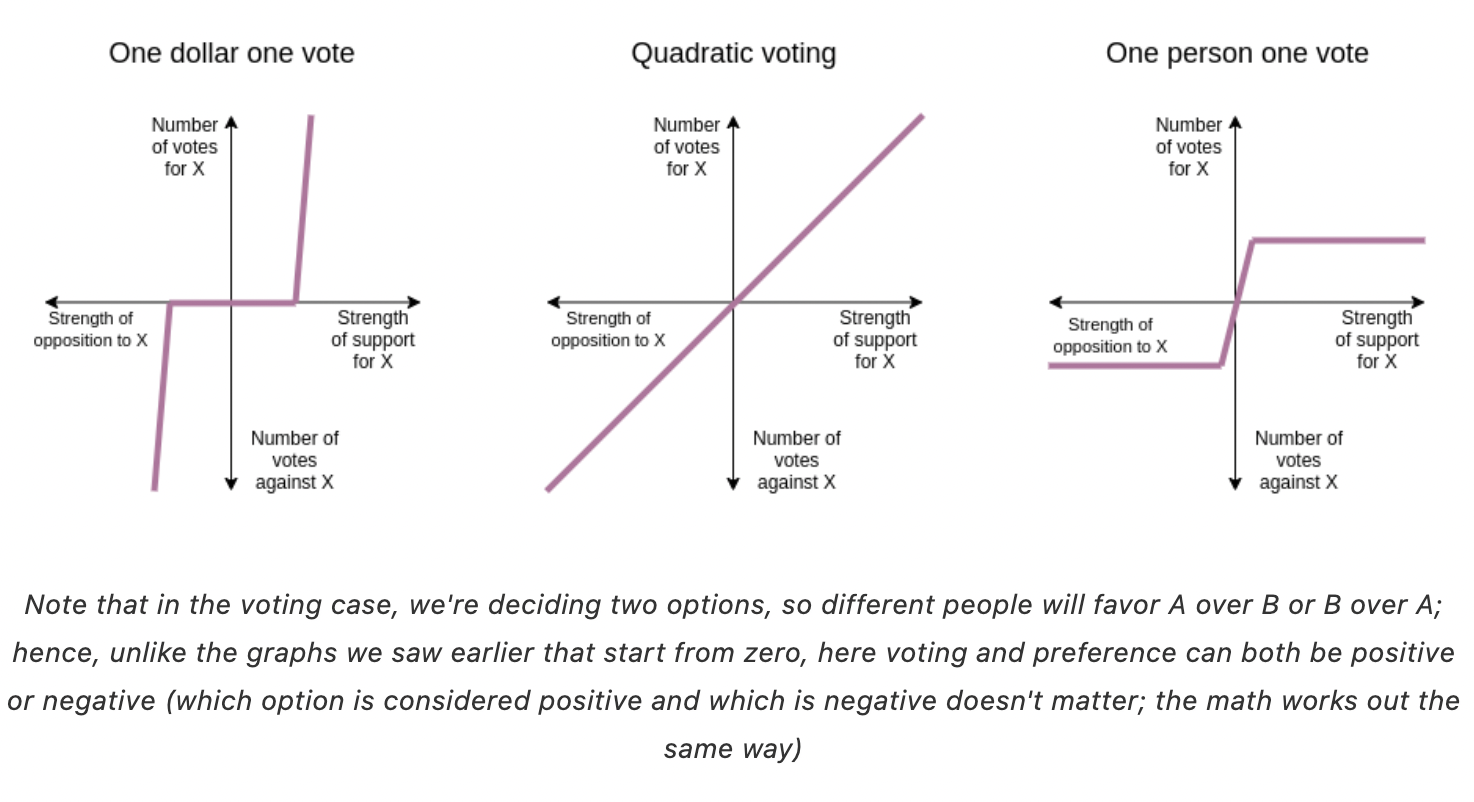

การพัฒนา DAO ยังอยู่ในช่วงเริ่มต้น และโครงสร้างพื้นฐานยังคงอยู่ในการปรับปรุง DAO หลายแห่งกำลังพยายามใช้กลไกการกำกับดูแลที่เป็นวิทยาศาสตร์มากขึ้น จากมุมมองของกลไกการลงคะแนน มีการลงคะแนนแบบถ่วงน้ำหนัก การลงคะแนนด้วยตัวแทน การลงคะแนนกำลังสอง การลงคะแนนด้วยความเชื่อ และการลงคะแนน EI ตามทฤษฎีเกม จากมุมมองของการกระจายสิทธิ์ในการกำกับดูแล POAP ซึ่งบันทึกใบรับรองการมีส่วนร่วมในอดีตของบุคคลที่กำกับดูแล สามารถคัดกรองผู้สมัครที่มีคุณสมบัติตรงตามเงื่อนไขการกำกับดูแลได้อย่างมีประสิทธิภาพ

กลไกการลงคะแนนต่างๆ มีผลใช้บังคับที่แตกต่างกันในสถานการณ์การกำกับดูแลที่แตกต่างกัน ความคุ้นเคยกับข้อดีและข้อเสียของกลไกการลงคะแนนแต่ละแบบสามารถช่วยพัฒนาจุดแข็งและหลีกเลี่ยงจุดอ่อนเมื่อกำหนดกฎการกำกับดูแล

การลงคะแนนเสียงแบบองค์ประชุมถ่วงน้ำหนักด้วยโทเค็น: นี่คือกลไกการลงคะแนนเสียงที่ใช้บ่อยที่สุดโดย DAO ต่างๆ การผ่านข้อเสนอต้องใช้คะแนนเสียงเป็นเปอร์เซ็นต์ กลไกนี้ตรงไปตรงมาสำหรับผู้เข้าร่วม แต่มีข้อเสียตรงที่ต้องมีผู้เข้าร่วมในระดับสูงและสามารถจัดการการโหวตได้

การลงคะแนนเสียง: สมาชิก DAO สามารถมอบหมายหรือ "มอบหมาย" การลงคะแนนให้กับพรรคอื่น ซึ่งโดยปกติแล้วจะเป็นผู้เชี่ยวชาญในอุตสาหกรรม ข้อดีคืออัตราการเข้าร่วมลงคะแนนเสียงจะเพิ่มขึ้น ในทางกลับกัน ผู้เชี่ยวชาญสามารถให้คำแนะนำที่มีประสิทธิภาพมากขึ้นและส่งเสริมการพัฒนาของ DAO ผลเสียคือความไม่ยุติธรรมที่เกิดจากการติดสินบนและการสมรู้ร่วมคิด

การลงคะแนนกำลังสองคำอธิบายภาพ

เครดิตรูปภาพ: การชำระเงินแบบ Quadratic

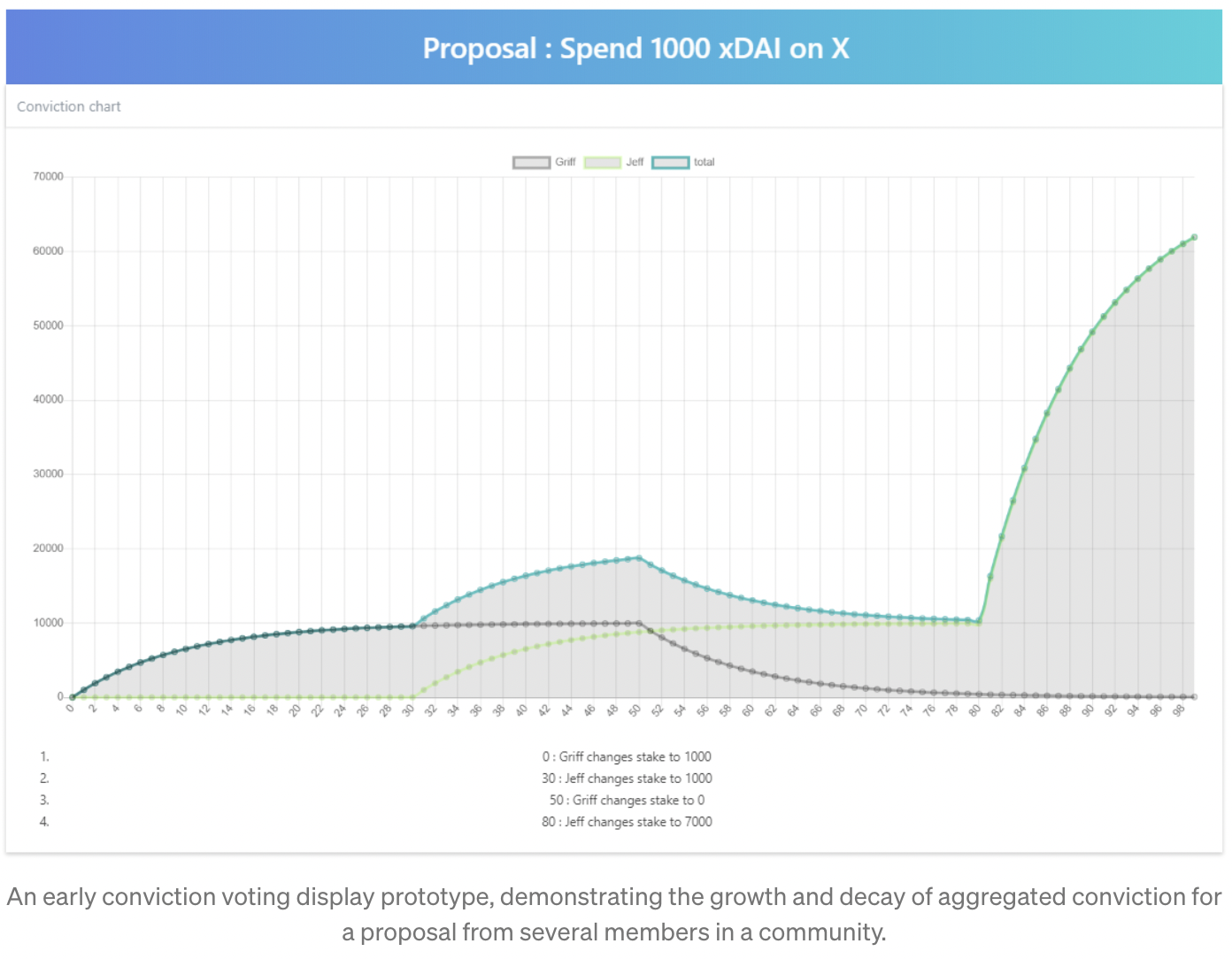

การออกเสียงลงคะแนนคำอธิบายภาพ

เครดิตรูปภาพ: เจฟฟ์ เอ็มเม็ตต์

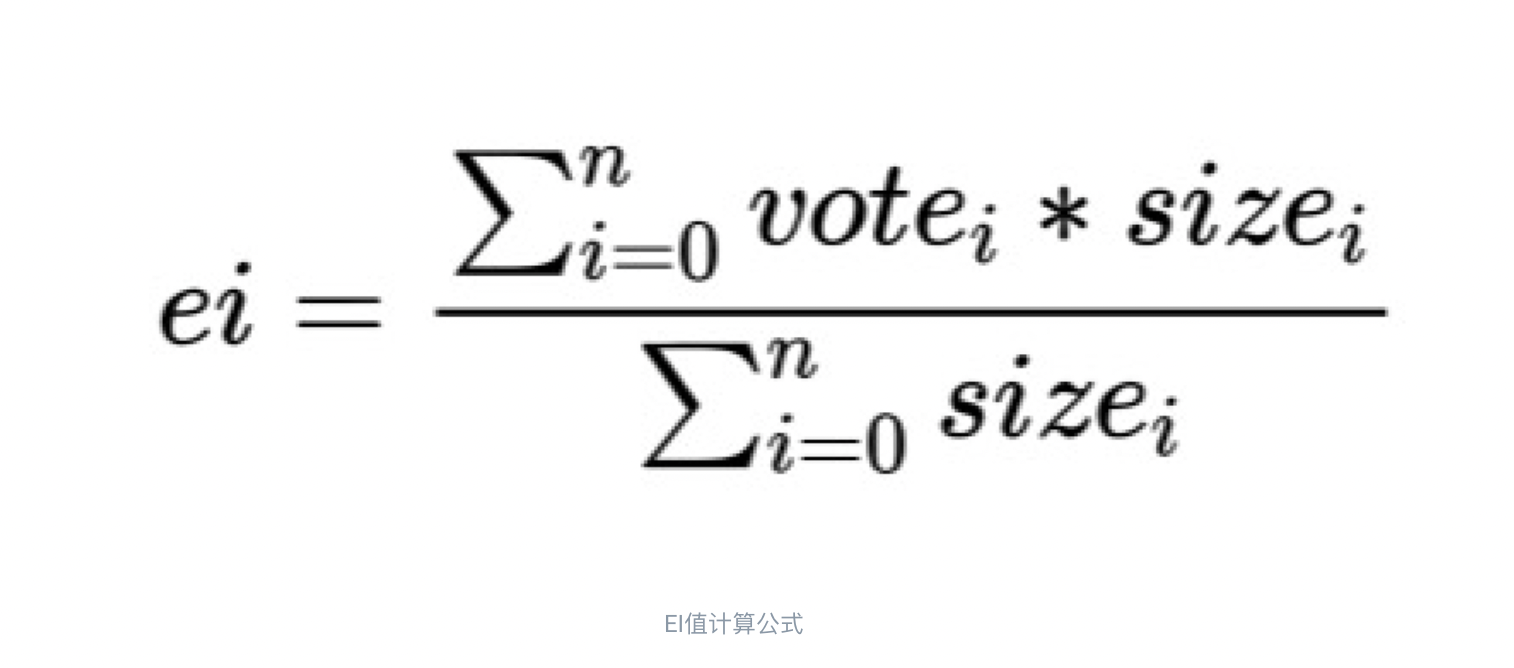

การลงคะแนน EI: EI เป็นตัวย่อของดัชนีประสิทธิภาพซึ่งเดิมเสนอโดย ICPDAO เป็นชุดของระบบรางวัลและการลงโทษการลงคะแนนข้ามแบบไม่ระบุชื่อตามทฤษฎีเกมเศรษฐกิจ โดยจะเพิ่ม 2 เท่าของจำนวนเงินที่ทำเครื่องหมายไว้ทั้งหมดในแต่ละเดือน จับคู่ปัญหากับบุคคลที่แตกต่างกันแต่มีขนาดใกล้เคียงกัน แล้วส่งให้สมาชิกคนอื่นๆ ลงคะแนนเสียง โดยไม่ระบุชื่อ และคำนวณค่า EI แต่ละรายการของเดือนตามผลการลงคะแนนทั้งหมดสำหรับรางวัลและการลงโทษการลงคะแนน EI ใช้กับระบบการให้รางวัลและการลงโทษของ DAOผ่านการกำกับดูแลของกลไก ทุกคนสามารถควบคุมใบเสนอราคาได้ด้วยตนเอง และลดอิทธิพลของคู่แข่งใบเสนอราคาที่เป็นอันตราย ข้อเสียคือไม่สามารถหลีกเลี่ยงการติดสินบนการเลือกตั้งได้ และอาจก่อให้เกิดสถานการณ์ที่คนกลุ่มเล็กๆ หรือที่เรียกว่าการกำกับดูแล PoW ชุมชนภายในประเทศที่มีชื่อเสียงอย่าง SnapFingers DAO ก็ได้เริ่มทดลองใช้โครงการนี้เมื่อไม่นานมานี้ ICPDAO สร้างเกมเล็ก ๆ สำหรับสิ่งนี้เอล โหวตคำอธิบายภาพ

ที่มาภาพ: ICPDAO

ไม่มีกลไกการลงคะแนนเดียวที่ได้รับการพิสูจน์ว่าสมบูรณ์แบบ และกำลังได้รับการพัฒนามากขึ้นเมื่อระบบนิเวศของ DAO เติบโตขึ้น กลไกการลงคะแนนเสียงแต่ละแบบมีข้อดีและข้อเสีย และ DAO จะต้องพิจารณาสถานการณ์การนำไปใช้เป็นรายบุคคล เลือกวิธีแก้ปัญหาที่เหมาะสมที่สุดในสถานการณ์ที่กำหนด

การกำกับดูแลโดยใช้โทเค็นนั้นถูกควบคุมโดยเจ้าของปลาวาฬได้อย่างง่ายดาย การกระจายสิทธิในการออกเสียงอย่างสมเหตุสมผลได้กลายเป็นมาตรการที่จำเป็นสำหรับการเพิ่มประสิทธิภาพการกำกับดูแล การกระจายสิทธิในการออกเสียงสามารถแก้ไขได้จากมิติต่อไปนี้:

คัดกรองผู้ลงคะแนนที่มีคุณสมบัติโดยการระบุผู้ลงคะแนน เช่น POAP ที่ให้หลักฐานบันทึกการมีส่วนร่วมแก่ผู้ใช้ และ Soulbond Token ที่สร้างระบบชื่อเสียงแบบออนไลน์สำหรับผู้ใช้

โดยการแบ่งโครงสร้างองค์กรตามสาขาต่างๆ ที่ผู้มีสิทธิเลือกตั้งถนัด สิทธิในการออกเสียงจะถูกจำกัดให้อยู่ในขอบเขตที่เล็กลง เช่น กลไกของ Parent DAO & Sub DAO;

บทส่งท้าย

บทส่งท้าย

ข้อจำกัดความรับผิดชอบ

อ้างอิง

https://medium.com/giveth/conviction-voting-a-novel-continuous-decision-making-alternative-to-governance-aa746cfb9475

https://medium.com/1kxnetwork/a-guide-to-dao-treasury-diversification-sales-eee65f89d0b5

https://newsletter.banklesshq.com/p/how-daos-should-approach-treasury

https://www.chaincatcher.com/article/2069415

https://multis.co/post/nail-your-dao-a-guide-to-dao-treasury-management

https://newsletter.banklesshq.com/p/why-daos-need-to-diversify

ข้อจำกัดความรับผิดชอบ

ข้อมูลมากกว่านี้

ประกาศเกี่ยวกับลิขสิทธิ์

หากไม่ได้รับอนุญาตจาก DODO Research Institute จะไม่มีใครใช้โดยไม่ได้รับอนุญาต (รวมถึงแต่ไม่จำกัดเฉพาะการคัดลอก เผยแพร่ แสดง สะท้อน อัปโหลด ดาวน์โหลด พิมพ์ซ้ำ ข้อความที่ตัดตอนมา ฯลฯ) หรืออนุญาตให้ผู้อื่นใช้สิทธิ์ในทรัพย์สินทางปัญญาข้างต้น หากงานนั้นได้รับอนุญาตให้ใช้ ให้ใช้ภายในขอบเขตของการอนุญาต และจะต้องระบุแหล่งที่มาของผู้เขียน มิฉะนั้นความรับผิดชอบทางกฎหมายจะถูกสอบสวนตามกฎหมาย

เกี่ยวกับเรา

"สถาบันวิจัย DODO" นำโดยคณบดี "Dr.DODO" นำกลุ่มนักวิจัย DODO ดำดิ่งสู่โลก Web 3.0 ทำการวิจัยเชิงลึกที่เชื่อถือได้ มุ่งถอดรหัสโลกที่ถูกเข้ารหัส แสดงความคิดเห็นที่ชัดเจน และค้นพบ มูลค่าในอนาคตของโลกที่เข้ารหัส "DODO" เป็นแพลตฟอร์มการซื้อขายแบบกระจายอำนาจที่ขับเคลื่อนโดยอัลกอริทึม Proactive Market Maker (PMM) ซึ่งมีจุดมุ่งหมายเพื่อให้สภาพคล่องบนเครือข่ายที่มีประสิทธิภาพสำหรับสินทรัพย์ Web3 ทำให้ทุกคนสามารถออกและซื้อขายได้อย่างง่ายดาย

ข้อมูลมากกว่านี้

Official Website:

GitHub:

Telegram: t.me/dodoex_official

Discord:

Twitter:

Notion:

Mirror: