Why does Navarre say that ZCash is insurance for Bitcoin privacy?

- 核心观点:Zcash因隐私需求与技术创新而暴涨。

- 关键要素:

- ZEC价格从47美元涨至429美元,涨幅超1000%。

- Zashi钱包默认屏蔽交易,提升用户体验与采用。

- 2024年减半削减供应,配合需求增长推高价格。

- 市场影响:隐私币受关注,推动行业隐私技术发展。

- 时效性标注:短期影响

Original author: Max Wong, IOSG Ventures

Introduction

Over the past few months, Zcash ($ZEC) has been in the spotlight, surging 620% from $47 to $292 in 30 days in September 2025. It currently stands at an 8-year high of $429, giving it a FDV exceeding $8 billion.

In an era of increasingly stringent financial regulations, privacy-focused projects have once again become the focus of the cryptocurrency market. Therefore, Zcash (ZEC), as one of the pioneers of privacy coins, has once again attracted attention. This surge has reignited interest in "free money," a term often used to describe private, censorship-resistant digital cash. Zcash, as a rapidly growing privacy coin, delivers true financial privacy through encryption technology, expanding the vision of Bitcoin.

This report aims to delve into Zcash's technology and infrastructure, compare it with other privacy players, and analyze the catalysts behind the recent resurgence of the Zcash ecosystem.

Zcash - What is it and how does it work?

Zcash is a privacy-preserving digital currency launched in October 2016, a fork of the Bitcoin codebase. It deliberately adopted many of Bitcoin's monetary principles; Zcash runs on a proof-of-work blockchain.

It also has the following functions:

- Fixed supply: 21 million units capped and a predictable halving schedule.

- Fair emission: No upfront issuance, similar to Bitcoin's issuance model.

- Decentralized: No permissions, no central authority, and no reliance on intermediaries.

Privacy standards

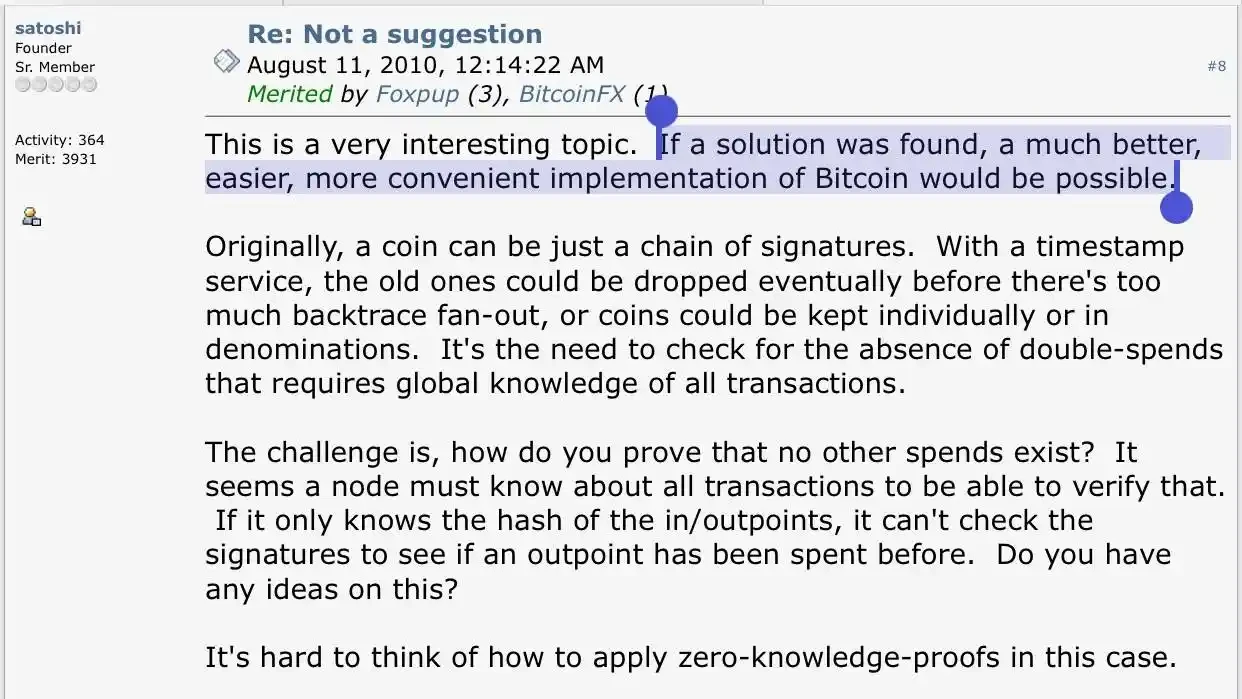

ZCash uses zk-SNARKs (zero-knowledge concise non-interactive knowledge arguments), which allow transactions to be verified without revealing any details about the sender, receiver, or amount. Simply put, Zcash provides users with fully encrypted transactions, shielding on-chain data—something Bitcoin's transparent ledger cannot achieve. In fact, this privacy mechanism of ZK is exactly what Satoshi Nakamoto wanted to explore in Bitcoin, but it was technically impossible to implement at the time.

# Transaction details encrypted

When a user makes a blocked transaction, key details such as the sender's address, the receiver's address, and the transaction amount are completely encrypted on the blockchain.

# Create ZK proof

The sender (provider) uses their private key to generate a zk proof (zk-SNARK) confirming that several conditions are met, all of which do not reveal sensitive data:

- The sender has sufficient funds to pay for the transaction.

- The funds spent were legally generated in previous transactions.

- The input value of a transaction equals the output value to prevent the generation of counterfeit currency.

- The sender has the right to use the funds (possessing the correct private key).

- The funds had not been used before (using a mechanism called "invalidation").

# Instant Verification

Other nodes on the Zcash network (validators) instantly verify zk-SNARK proofs using a publicly available verification key. The proof is very small (a few hundred bytes) and can be verified in just milliseconds, making the verification process highly efficient.

Dual transaction type

It's worth noting that Zcash's privacy is optional—users can remain transparent to meet compliance or auditing requirements, or they can choose to keep it completely confidential.

ZEC uses a dual-address system, including transparent addresses (t addresses) and masked addresses (z addresses). Transactions between transparent addresses are similar to those on any non-private blockchain, but transactions involving masked addresses are encrypted and private. When ZEC is sent, the ledger does not display any information about the transacting parties or value; it only shows that a valid transaction has occurred. Only the participants (and those who share the optional viewing key with them) can see the details.

This makes Zcash fungible (each unit is interchangeable) and unaffected by past history, thus enabling true financial confidentiality when using shielded transactions.

Three main capital pools

Implementing private transactions on a large scale is a significant technical challenge. Zcash has undergone three major upgrades and iterations to improve its cryptography and efficiency:

#Sprout (2016)

The initial release demonstrated that zk-SNARK-based privacy is feasible on public blockchains. However, Sprout transactions are computationally intensive (requiring gigabytes of RAM, impractical on mobile devices) and require a trusted setup (one-time parameter generation). Edward Snowden and others, using the pseudonym "John Doberdin," participated in this famous setup to ensure that no party could tamper with the parameters. The traditional Sprout z- address (typically zc...) is now deprecated but still usable.

#apling (2018)

--A major upgrade that dramatically improves performance and usability. Sapling reduces proof time and memory requirements by over 100 times, finally making private ZEC transactions feasible on everyday devices, even smartphones. It also introduces important features such as diversified addresses (allowing a single key to have multiple masked addresses, thus improving privacy) and view keys (allowing users to share access to read their transaction details for auditing or compliance purposes). Sapling still relies on multi-party trust settings, but it represents a significant step towards practical private payments. Sapling z addresses (Bech32, zs, etc.) are still supported, allowing users to use older tokens.

#Orchard (2022)

--The latest generation of products achieves trustless privacy. Orchard utilizes the Halo 2 proof-of-trust system (developed by Zcash engineers) without requiring any new trusted setup. It also further improves efficiency, supports features such as bulk transactions and improved synchronization. With Orchard, Zcash's privacy is not only stronger (no setup assumptions) but also more scalable—it is designed to support future Layer 2 solutions such as ZK-rollups. It also introduces unified addresses (UA, u1, etc.) , which can bind Orchard (and optional Sapling+ Transparent) receivers to a single address; wallets typically route new funds to Orchard by default. Therefore, Orchard is now the default shielding pool for modern Zcash wallets.

A common summary of Zcash's development is: Sprout proved the possibility of private funds, Sapling made it usable, and Orchard made it untrustworthy and scalable.

Upcoming upgrade

Crosslink: Zcash's technological infrastructure is constantly evolving. The project is currently undergoing a major upgrade called Crosslink, which will introduce a hybrid Proof-of-Stake (PoS) layer on top of Proof-of-Work consensus. This will allow ZEC holders to stake their coins to earn rewards and participate in the finalization of blocks, while miners continue to produce blocks—combining the advantages of PoW and PoS. This hybrid approach promises to improve network throughput and security (by providing fast finality and making 51% attacks more difficult).

Project Tachyon: Zcash developers (particularly cryptographer Sean Bowe) are spearheading Project Tachyon—a project designed to significantly improve the scalability of the Zcash shielding protocol. Project Tachyon aims to achieve "planetary-level" private payments by eliminating performance bottlenecks (such as each wallet having to download and scan every coin) through innovative technologies like proof-carrying data.

ZCash vs. Monero

Zcash (ZEC) positions itself as a Bitcoin-like currency, but with optional cryptographic privacy . Its shielded transfers use zk-SNARKs, allowing validators to check the correctness of transactions without seeing the sender, recipient, or amount. With a User Agent (UA) , wallets can transfer funds to the correct recipient while maintaining auditability: users can still transact transparently or share viewing keys with accountants/regulatory bodies. The trade-off is the user's choice; maximum privacy is achieved when you actually use a shielded pool.

Monero (XMR) uses different toolkits to provide privacy by default in each transaction: ring signatures (mixing the original transaction into many bait transactions so that an observer cannot tell which wallet actually sent the funds), RingCT (hidden amount), and stealth addresses (the recipient receives the payment through a one-time hidden address that cannot be linked back to their real wallet). This makes it easy to use, but the privacy is probabilistic : the strength depends on the size of the rings (e.g., 16), the choice of bait, and user behavior. In practice, it offers high privacy, but there is no selective disclosure during audits, and some trading venues avoid listing it due to compliance friction.

Generally speaking, ring signatures anonymize transactions by embedding them within multiple decoy transactions (Monero could be said to merely add a degree of plausible repudiation), while zk-SNARKs prove the truth of a claim without revealing any information beyond the validity of the claim itself. Initially, hesitation surrounding ZCash stemmed from the need for a trusted setup, but with the recent release of the Halo upgrade, ZCash can generate combinations of zero-knowledge recursive proofs without requiring a trusted setup. Despite the challenges, Monero has been shown to possess some degree of traceability in the paper "Monero Traceability Heuristics": "Wallet Application Bugs and Mordinal-P2Pool Perspective".

So, why did the market choose ZCash? What happened?

For the past two months, from the beginning of September until now, the ZEC has been in a continuous upward trend, rising over 1000% from a low of around $40 to $429. So, what are the catalysts for this surge? What are the reasons?

Introducing Zashi

One of the biggest contributors to ZCash's recent growth has been the ECC's (Electric Coin Co's) focus on consumers. Previously, the protocol primarily focused on the ZCash core—building the cryptography and technology—but now they are paying more attention to user experience and user login. A significant portion of this work is in developing Zashi, the official ZCash wallet.

Josh Swihart – CEO of ECC

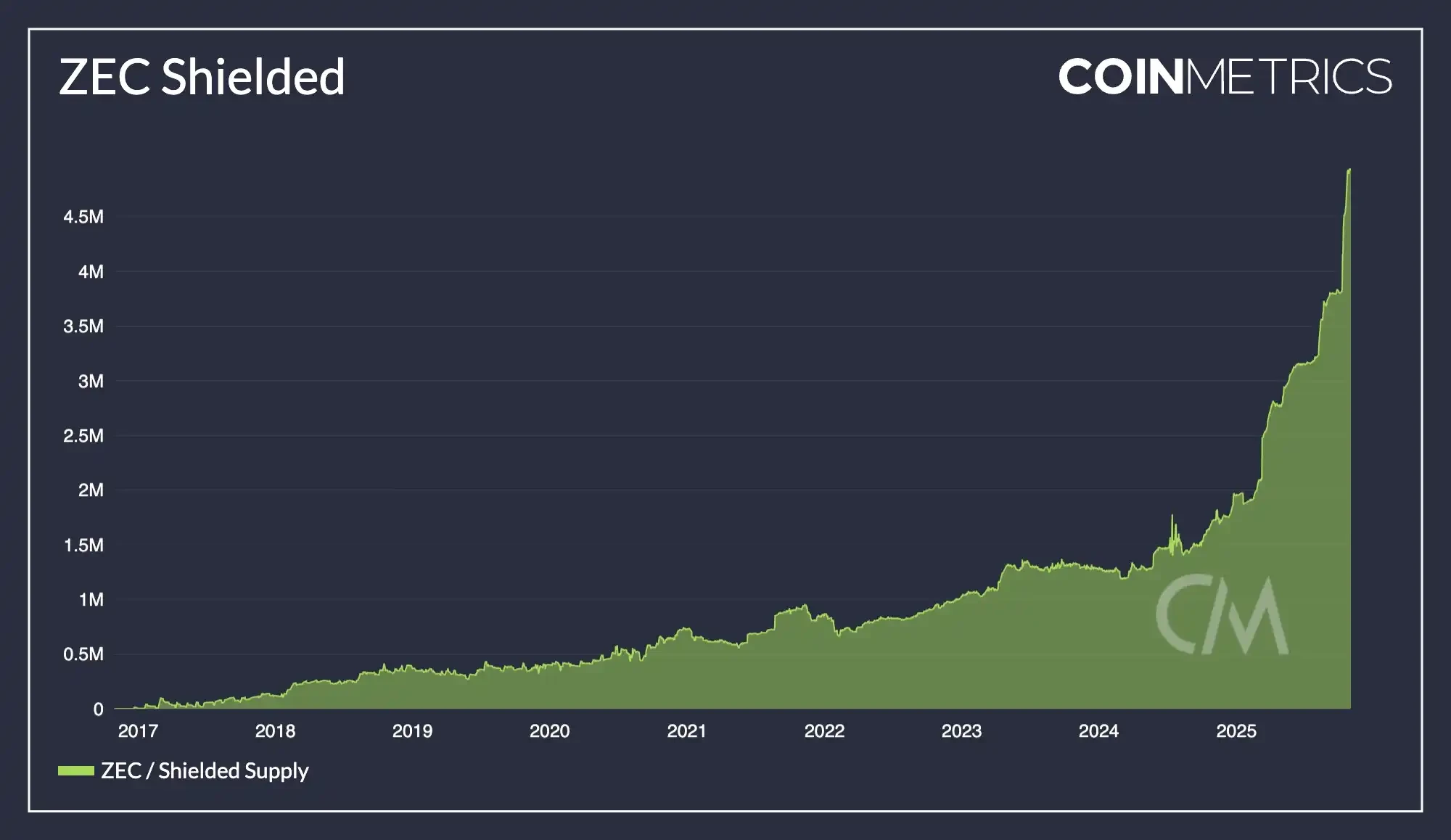

"When I took over as CEO of ECC in February 2024, we decided to really focus on user experience... We built a wallet called Zashi. After Zashi was launched, you could see an exponential increase in the total number of shielded transactions and the amount of ZEC in the shield pool."

The launch of Zashi significantly improves the Zcash user experience. It offers a smooth interface comparable to popular EVM wallets, supports secure storage features such as key viewing and hardware wallet integration, and even plans to enable shielded monitoring and delegation features after launch. More importantly, Zashi is specifically designed for shielded ZEC transactions, meaning all transactions sent on Zashi are private by default. If a user receives transparent ZEC, the wallet will require them to shield it before spending. Furthermore, Zashi supports single-address multi-pool support for all different liquidity pools (Sprout, Sapling, Orchard), meaning users can easily migrate funds from different pools.

This is a huge change compared to just a few years ago, when using Zcash privately required using multiple dedicated software programs across different products. Due to these breakthroughs in user experience, the usage of shielded pools has grown parabolically, demonstrating that many users will indeed choose privacy given a convenient alternative.

By simplifying private transactions with just a few taps and abstracting away technical complexity, these wallets have driven adoption by less tech-savvy users. Improved wallet user experience is considered a major driver of ZCash's recent growth.

One of the most striking signs of Zashi's contribution to the Zcash ecosystem's growth momentum is the explosive growth in on-chain shield usage. As of Q4 2025, over 4.5 million ZEC were stored in shield addresses, representing approximately 28% of the total supply. This is a record high, compared to just 5% a few years ago. The graph above illustrates how the shield pool began its parabolic growth trajectory around 2024, directly coinciding with Zashi's launch.

This means more ZEC is entering Zcash's crypto pool, which in turn strengthens the network's privacy protection for everyone (a larger set of anonymity). In practice, this also tightens circulating liquidity (because shielded funds are harder to trace and are typically held for longer periods to protect privacy), thus positively impacting price dynamics.

Introducing NEAR Intents - Crosspay

Zashi's CrossPay also serves as a large-scale onboarding mechanism for Zcash, fundamentally enabling interoperability within the Zcash ecosystem.

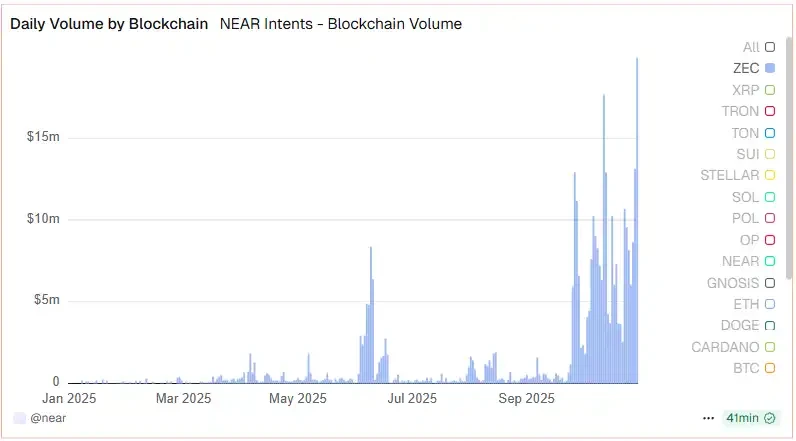

Crosspay is a cross-chain bridging/exchange solution that leverages NEAR intent to allow users to swap ZEC in or out of another chain while maintaining privacy. Zashi also utilizes NEAR to integrate decentralized offline services, allowing users to swap ZEC to another chain (or to a fiat currency gateway) without revealing their ZEC addresses—completely eliminating the need for centralized exchanges. This has driven a recent influx of capital and users into the ZEC ecosystem.

NEAR Intents is a chain-based abstract protocol: users (or agents) specify what they want (e.g., "swap BTC → ZEC" or "pay 50 USDC to this address"), and a decentralized network of solvers competes to execute it across chains; users simply sign an approval document. It hides bridge/DEX jumps and optimal price/liquidity routes.

• The user requests "swap X → ZEC" or "pay Y USDC on the Z chain".

The NEAR Intents solver competes and returns the best offer.

• The user approves once in Zashi; the solver performs cross-link processing; ZEC is blocked or the recipient receives the correct tokens.

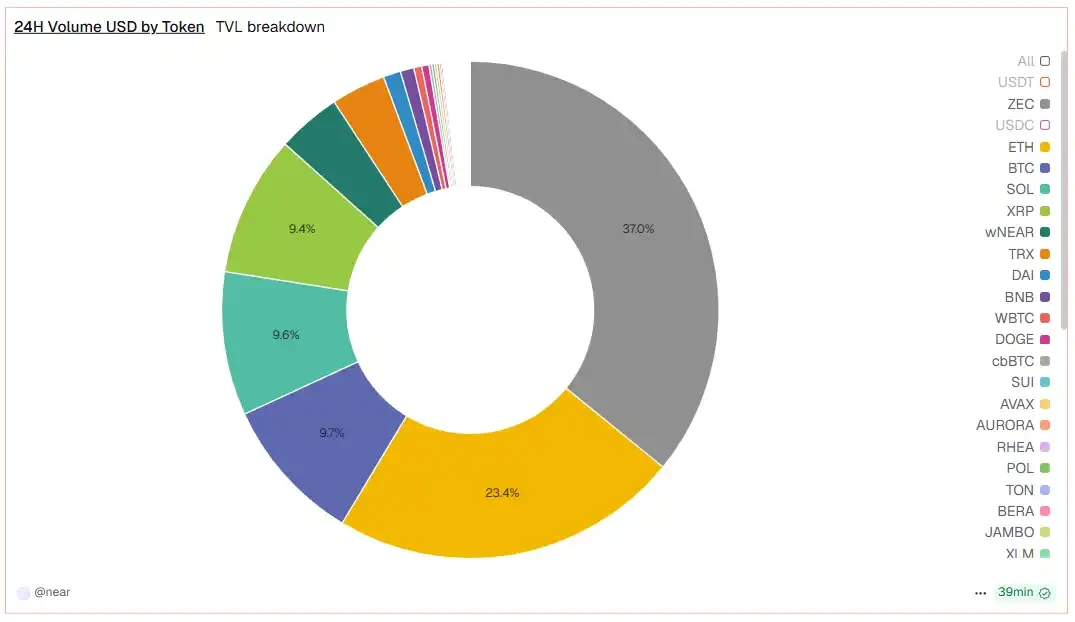

USDC and USDT were removed from the sample; currently, ZEC NEAR intents account for more than 30% of the total NEAR intents.

Overall, we can infer that the integration of Zashi and Crosspay is also one of the main drivers of market share growth. Starting in September 2025, the order of magnitude of ZEC NEAR intent will increase significantly, which is exactly when Crosspay will launch.

The New Importance of Privacy in Dual-Transaction Types – A Story

As governments and regulators around the world ramp up surveillance measures (from stricter KYC/AML to tracking central bank digital currencies), the cypherpunk spirit is once again in the spotlight. Zcash offers a safe haven for those concerned about these trends: a cryptographic, unmonitorable form of currency.

"They only focus on the rising numbers, but they don't notice the free fall."

As mainstream cryptocurrency users become aware of privacy erosion (e.g., Tornado Cash and other mixing protocols being blacklisted), many are seeking on-chain privacy alternatives. Zcash has emerged as a proven L1 solution with stronger privacy protection than mixing protocols (reportedly, Zcash has a wider range of uses than Tornado Cash).

In short, the rise of the "liberal narrative" has shaped Zcash into a key asset for maintaining financial freedom—a narrative that resonates with both ideological investors and those simply seeking to hedge against "Big Brother."

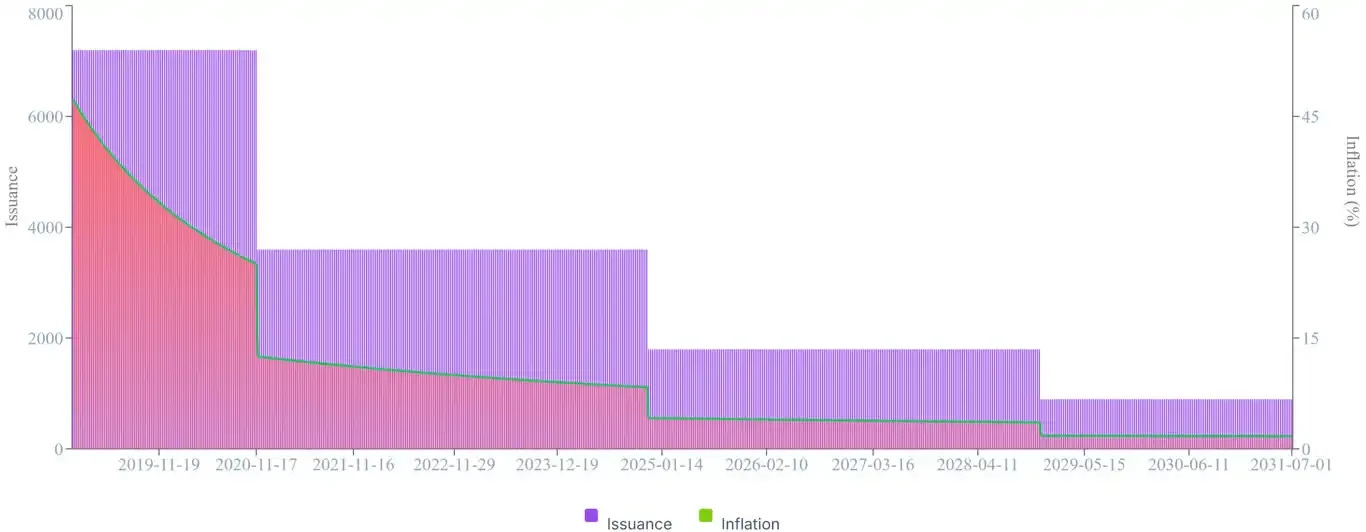

Supply dynamics after halving

Zcash's second halving (November 2024) significantly reduced its new coin issuance, and we are now seeing its effects. The block reward dropped from 3.125 ZEC to 1.5625 ZEC, and the annual inflation rate halved. Historically, Bitcoin's price didn't consistently exceed $1,000 until after its second halving—after which Bitcoin's price rose parabolically. Zcash's supply curve is exactly the same as Bitcoin's, only a few years phase-shifted, and it has just crossed the same milestone.

▲ ZEC Dollar Issuance and Inflation Timeline

While demand is rising, the circulating supply is tightening, a classic case of supply and demand squeeze. Investors speculate that once the "suspense" of high inflation disappears, ZEC may follow the early trajectory of Bitcoin. In fact, in the fourth quarter of 2025, ZEC's market performance has already surpassed most major cryptocurrencies. Some of this is simply a matter of market timing, but fundamentally, Zcash's tokenomics are becoming increasingly attractive as it matures: it has a fixed cap, emissions are decreasing, and the end of miner rewards is approaching, similar to Bitcoin's development path.

▲ ZEC Dollar Price and Halving Schedule

The halving narrative—even though misunderstood by some traders (the rumor of a halving in 2025 is false)—has still drawn attention to the Zcash story.