IOSG Ventures:如何通过金融化和商品化扩展NFT市场需求?

原文作者:Sally

原文编辑:Olivia

原文来源:IOSG Ventures

中本聪认为比特币是一个自我实现 (self-enforcement) 的预言。以此类推,如果 NFT 能够和比特币一样实现信念和选择的同调,我们也有理由认为 NFT 的价值可以在远期的纳什均衡中被持续加固。当然信念和选择的锚定是浮动的,目前 NFT 远远没有达到比特币的共识程度,自然很难去控制或确保这种锚定。

想要解决这个问题,意味着我们仍然需要增加支撑纳什均衡等式的条件——NFT 的内在价值和使用价值。道理其实非常容易理解,郭敬明老师就曾在他的青春疼痛文学作品中告诉我们:「没有物质的爱情就像一盘散沙」,高度提炼了唯物主义价值观的精髓。所以兴趣和信念仅仅是必要不充分条件,只有实实在在的价值提升了,需求才会刚性,选择才会坚定。

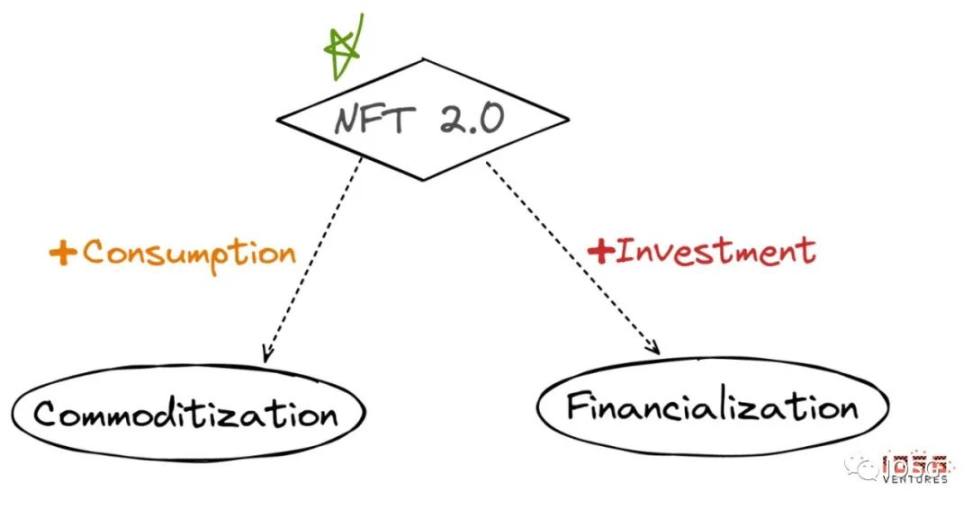

不难看到,目前市场上已经演化出两种打开需求侧的思路:

向右迈步提升投资属性——NFT 金融化(Financialization)

向左迈步提升消费属性——NFT 商品化(Commoditization)

接下来我们会对这两种思路分别展开进行论述。

1. NFT 金融化:DeFi x NFT = NFT Fi

NFT 金融化并不是一个新奇的话题,早在 2021 年上半年我们就已经看到许多围绕这个叙事的讨论(详见 IOSG, 1kx, Hashkey 等研报)。因为本身 NFT 就是一种链上的代币标准,包含 ERC20,ERC721,ERC1155 等几种协议,所以将其视为一种投资品,并想进一步延展探索其金融属性和衍生品是非常直接和鲁棒的逻辑链传导。那么问题就在于:(1)NFT 金融化能不能解决需求?(2)NFT 金融化到底能多大程度上打开 NFT 需求侧?

我们认为 NFT 的金融化可以很大程度上帮助拓展和提升需求,主要基于以下两点:

通过结合 DeFi 玩法提升 NFT 共识。NFT 在与 DeFi 协议结合后,可以降低参与 NFT 市场的门槛和教育成本。因为对非传统金融工具的交易进入门槛相对较高,玩家在缺乏对这种独特或奇异资产的知识信息时,往往会承担更高的交易风险,从而阻碍了更多长尾买家进入市场。而缺乏足够的交易深度和市场信心,自然会延缓 NFT 整体价值共识的累积。

通过证券化提升可交易性并激发流动性。通过将非流动性的 NFT 资产转换为可交易证券,NFT 可以像传统证券资产一样被用作抵押品等帮助切割和分散基础资产池和信用风险。而 NFT 资产及其衍生交易品的诞生与应用,Web3 参与者就可以通过分仓的方式将风险分散到更广泛的类目中,从而使自己获益。

在以上认知的基础上,我们认为可以首先重点关注 NFT Fi 赛道中如下 3 个方向:

Exchanges:建立 NFT 即时交易对

Collaterals:将 NFT 用作抵押品

Derivatives::发展 NFT 衍生品

A. Exchanges

类似 Opensea、LooksRare 样的传统挂单交易所存在的一个很大瓶颈就在于其无法为 NFT 提供即时流动性,进而无法进一步提升资本效率。而解决这一问题最直白且有效的思路就是搭建 NFT(ERC-721)和 FT( ETH/ERC-20)的瞬时交易对。

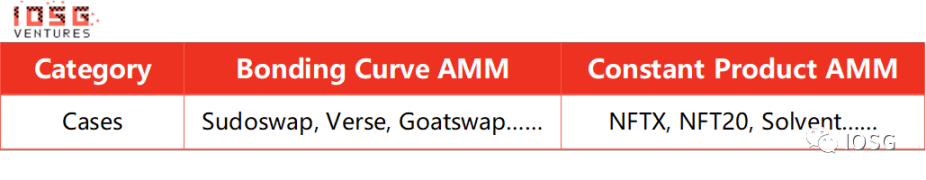

AMM 毫无疑问是实现这一思路的极佳形式。过去典型地如 NFTX、NFT20 这类碎片化的 NFT 流动池解决方案,已经成功实现了同系列 NFT 藏品的价值汇聚与平均化处理。但问题在于其单个 NFT 由固定数量的 FT 表示,近似于 uniswap V2 的 x*y=k 恒定乘积 (constant product) 算法,而 NFT 与 FT 在流通量上相差悬殊,因此很容易会导致 NFT 市场深度不足和高滑点。

以 Sudoswap 为代表近期新兴出现的另一种升级版 AMM 机制在很大程度上改进了这一问题。一方面,其允许 LP 通过恒定、线性或指数形式的联合曲线(Bonding Curve)自行设置参数变量 delta,从而在报价模式上解放了自由度,控制住了大额订单滑点的恶化。另一方面,与 NFTX 等传统 AMM 不同的地方还在于 Sudo 省去了将 NFT 兑换为 ERC-20 的过程,并且玩家可以自行选择设置单边或双边交易池。因而这类基于联合曲线的 AMM 之于恒定乘积的 AMM 可以被认为是 Uniswap 的 V3 之于 V2。

不过目前市面上的 NFT AMM 机制仍然只是简单地将 NFT 同质化为 FT,很大程度上只适用于中长尾的游戏类 NFT 资产。对于属性特征明显藏品价差较大的头部 NFT 来讲远远算不上令人满意的流动性解决方案。同时在用户操作流程和联合曲线的设置上,现有平台的处理都十分粗糙,期待其未来可以添加一些简单的阶跃函数和用以参考的数据分析界面。

B. Collaterals

考虑到目前主流的 NFT 借贷实际都是基于蓝筹的 pfp NFT,我们可以先以传统的艺术藏品借贷市场用作参考。历史上看,通过将艺术藏品抵押获得贷款的金融范式在传统银行业中存在已久。而艺术藏品贷款产业的估值早已占到全球艺术品市场总价值的四分之一。德勤和 ArtTactic 在去年的 Art&Finance 报告 (p193-202) 中预估全球艺术藏品抵押贷款总额已超 240 亿美元,同比增长 10.7%。此外,过去的相关研究也指出在经济萧条时期,艺术藏品的借贷需求反而会基于地缘性出现上升。

那么由此引发的下一个问题就是,这种抵押借贷的需求由何而来?

我们认为相对代币而言,市场进入者对于直接出售手中蓝筹 NFT 藏品的意愿往往更低。然而长持 NFT 也意味着大量资金会被锁在非流动性资产中。因此一方面,在市场环境较好时,持有人容易发现更好的短期投机机会,自然地,将 NFT 用作抵押品临时出借释放流动性会是一个优良选项;另一方面,当经济环境较差时,持有人会倾向于利用类似 Compound, Aave 等 DeFi 协议中存在的超额抵押方式,在确保不失去手中 NFT 的同时持有更多现金来预防潜在或突发的短缺危机(这也解释了为何总体 NFT 借贷的违约率较低)。

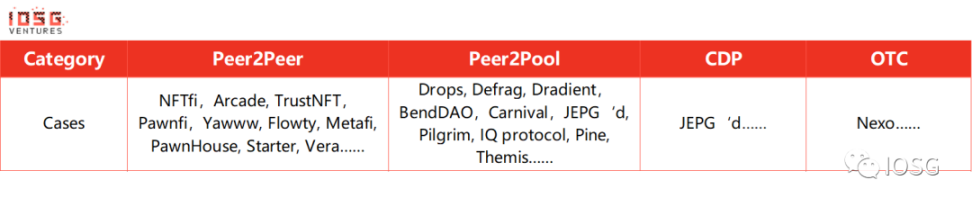

一般地,我们可以将目前市面上的 NFT 抵押借贷解决方划分成点对点(P2P), 点对池(P2Pool),抵押债仓(CDP)和场外借贷(OTC)四类:

C. Derivatives

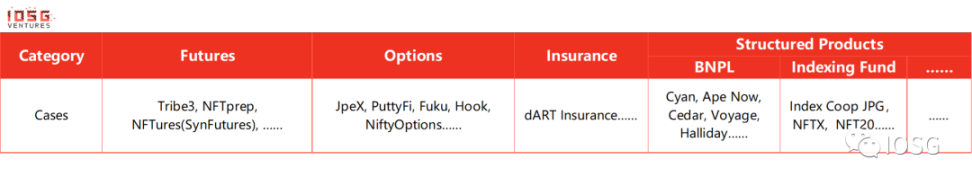

金融衍生品即围绕标的资产(Underlying Asset)所产生的一种合约或金融工具。常见的金融衍生品包括远期(prediction)、期货(futures)、期权(options)等等。通常金融衍生品都具备高风险高收益的特性,并被广泛用于对冲和分散风险。以房产为例,买家可以在不持有原生资产(实际房产)的情况下买入顶层(senior tranche)CDO 看多,但同时也面临违约可能性。针对 NFT 这类标的资产,我们也观察到目前市场上正不断涌现新兴的衍生品协议,试图进一步激活 NFT 市场流动性并降低交易成本。简单地,我们可以将 NFT 金融衍生品分为期货、期权、保险和结构性产品这四类。

以 NFTprep, NFTures 为代表的 NFT 期货方案可以帮助实现针对 NFT 资产的长短交易,并推高盈亏杠杆。但这也对预言机的价格喂送和做市商的供池深度提出了更高的要求。目前市面上主要产品都还在测试网的阶段。

以 JpeX,Nifty 等为代表的 NFT 期权方案允许用户通过购买看涨(call)或看跌(put)期权来对冲手中 NFT 的地板价波动,并在一定程度上降低了 NFT 的投机门槛。但目前几个项目也都处于早期,面临流动性困境。

为稀缺 / 高净值或代表链下资产的 NFT 进行投保,也是一种值得探索的风险转移方式。考虑到 NFT 的特性需要在传统保险模式的基础上进行一定调整。

类似 Index Coop JPG 这样根据不同 NFT 或 NFT 产品建立起来的指数基金,以及 Cyan, Cedar 等为代表的先买后付项目,都是对 NFT 结构化产品不错的探索。

在过去的研究中,我们已经对上述提及的部分借贷和衍生品项目做过解读和梳理,更多内容将会在未来的《NFT Fi Report》进一步展开论述。

2. NFT 商品化:新消费 x NFT = NFG

NFT 商品化是一个很有意思的话题,因为这也许意味着对整个大消费赛道的颠覆。但在讨论 NFT 商品化之前,我们有必要首先回答的一个问题是:

NFT 究竟能不能被视为传统商品?

从根本上讲,消费品的存在是为了解决和镇静马斯洛金字塔中广泛存在的诉求和烦恼。人们购买和消费大宗商品的首要目的必定不是为了投机或获利,而是为了利用其特有的功能性价值,来缓解自己短期内的某种痛苦。举几个简单的例子,我们买米是为了果腹,买车是为了代步,买游戏是为了娱乐,买咖啡是为了提神。由此逆推,当一件商业化的物品被人购买的主要原因是想利用和交换其本身的功能属性,而非谋求盈利回报时,它理应可以被视为一种消费品。

遵照民众消费的底层逻辑进行逆推,并结合当下的时代背景,我们可以做出一个待验证的假设,即如果 NFT 能够实现:

首要购买目去投机化

内生文化的大众认同

功能品类 (assortments) 的规模覆盖

就可以被嵌套进传统商品和消费品的叙事逻辑中。

而如果可以把 NFT 直接和传统商品划上约等于号的话,一个值得探讨、但不一定对的想法将会是:把 Web2 电商的投资逻辑平移至 web3 的 NFT marketplace 赛道。

那么回归正题,究竟 NFT 商品化的发展有哪些方向?能代表哪些使用场景?

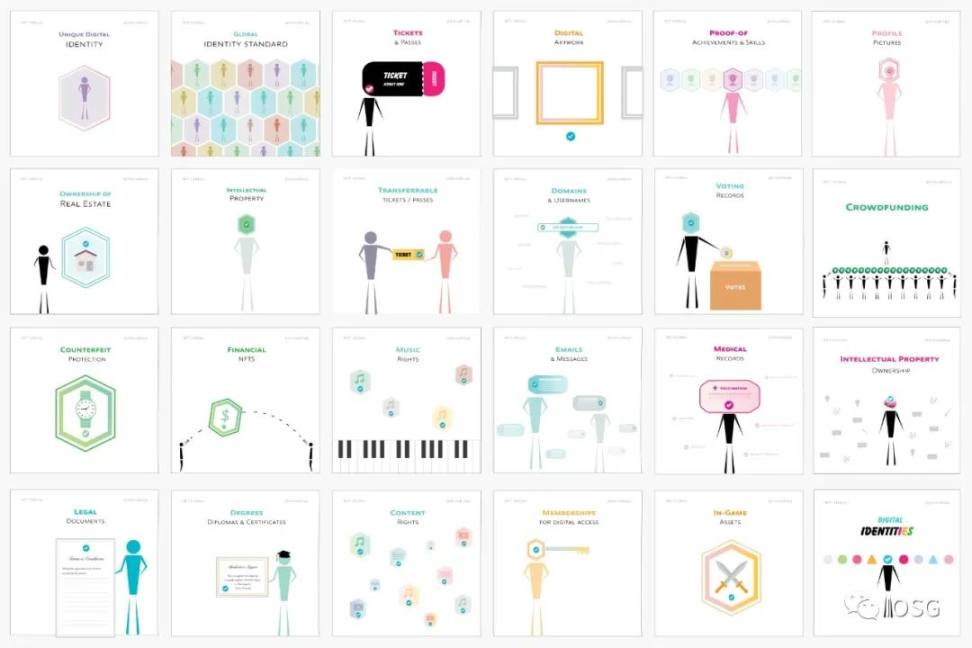

我们认为凡是具备 (1) 非完全同质(2)受益于所有权数字凭证。这两类属性的任何产品其实都可以依托于 NFT 的形式进行表现。并且由此引发的一个有趣的概念将会是非同质化商品(Non-Fungible Goods, NFG)。这种虚拟资产与实体经济相结合的叙事概念,可以在很大程度上进一步拓宽 NFT 的实际使用价值和未来应用场景。

NFT 相关商品化用例( 图片来源:@shivsakhuja )

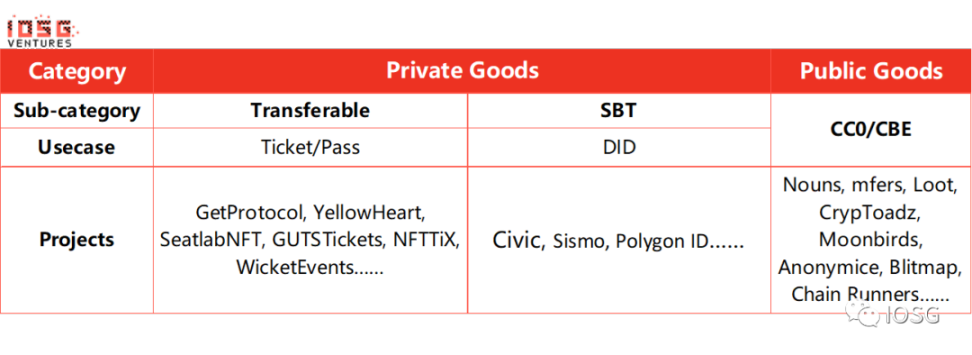

简单地,我们可以根据 NFG 针对所具备的不同将其划分为私有型(Private Goods)和公共型(Public Goods)两类。其中私有型又可以细分为可转让 (Transferable) 与不可转让 / 灵魂绑定(SBT)两种范式,公有型主要以 CC0/CBE(can’t be evil) 叙事为代表进行讨论。

1. Private Goods

可转让(Transferable)

典型可转让的 NFG 用例即门票和通行证。

由于通常演唱会、体育比赛及其他大型活动门票的数量都有限制,并且访问场馆需要出示相关凭证才能获得进入许可。因此以 NFT 为依托是一个非常合适的选择。

一方面 NFT 门票可以在最大程度上消除伪造问题,使得验证门票的所有权和真实性变得更为容易;另一方面,NFT 化门票也可以极大激活二级市场的交易流动性。在 Ticketmaster 或 Vividseats 等类似传统 web2 门票二手平台上,市场交易的效率较为低下,并且买方的权益很难得到保障。NFT 化门票则可以帮助建立起一种公平的保护双方权益的标准化市场。

此外,通过收集门票持有人在链上的历史归属数据,表演者或主办放也可以在未来考虑空投通行证、折扣、赠品等给粉丝进行回馈。

灵魂绑定(SBT)

不可转让的 NFT(SBT)可以被广泛地用于充当去中心化数字身份证明(DID)或可验证凭证(Verifiable Credential)。考虑到本质上 NFT 就是防伪且任何人都可以验证的数字证书,那么将学历证书、技能证书、文凭、分数和成就等通过 SBT NFT 的形式实现发布和持有,就意味着可以让任何人核实其合法性,从而实现用户身份的去信任化验证。而其中类似 Sismos 这样基于 zk 证明技术为用户发放 SBT(ERC-1155)身份徽章的协议,还能够在保护用户数据隐私的基础上完成闭环。

更进一步地,SBT NFT 还可以被用来解决验证选票这样的问题,并有可能成为全球性的身份标准,帮助消除区域间因身份认证系统互不兼容而产生的摩擦与隔阂。

B. Public Goods

CC0/CME

日本社会学家三浦展在《第四消费时代》中将日本消费社会的发展划为四个阶段,指出民众的需求也和西方一样正在经历由基础性消费,到追求个性品牌与文化消费的演化。而这一现象正在逐步延展到全球许多发展中国家。越来越多的人正在跨过基础消费层,对商品的品牌文化的重视取代了对性价比的追求。

而 CC0(Creative Commons Zero)这种代表作者放弃一切 IP 版权的协议形式,毫无疑问能够进一步激发人们对于这类项目品牌文化的追捧以及二次创作热情。与传统私有化品牌创作的 NFT 商业模式相比,CC0 通过将商品带入公有领域而使其逐渐演化为了一种开源并具备网络效应的「应用程序」或’「平台」。在衍生品被不断创作和分享的正循环下,原作品牌所获得注意力以及社区内部的集体共识自然可以获得延长和加固。这也不难解释为何在运营难度大大增加的情况下,仍然不断有 NFT 项目宣布转向 CC0 模式。

3. 写在最后 Closing thoughts

NFT 是一个浪漫又理想主义的概念,罗曼罗兰中又夹杂了一些聂鲁达。但诗意并不能解决我们现实中的问题,也无法提供形成强共识的基础。NFT 的发展需要更多的马基雅维利去实实在在地提升用户的边际效用,否则 NFT2.0 的前进也许只能止步于空想。

从亚当斯密的生产消费论,到阿尔弗雷德马歇尔和哈特的「消费者主权」(Consumer’s Sovereignty) 说,再到哈耶克「消费者对生产者主权行使」的诠释,我们看到随着互联网技术的发展,消费者对个人自身偏好完全实现越来越强烈和明确的诉求。

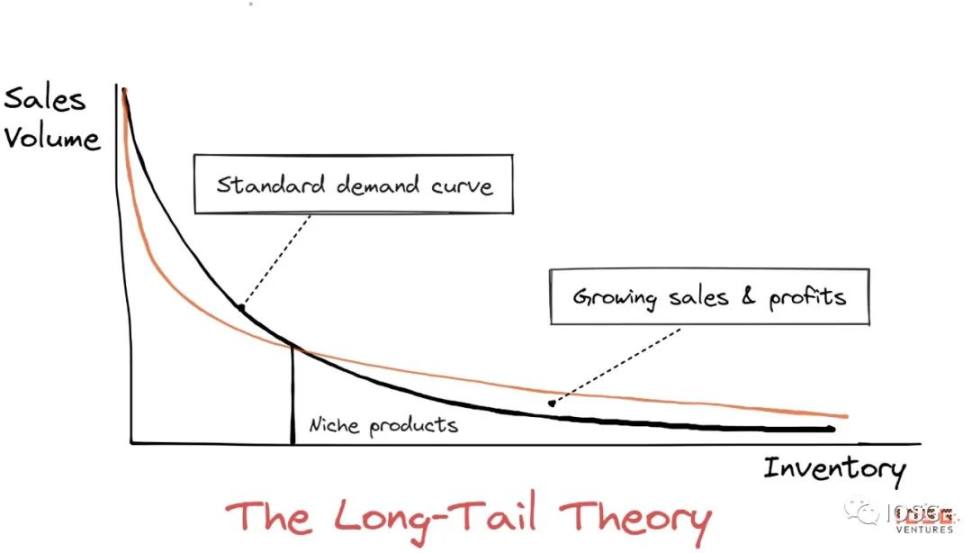

18 年前,克里斯安德森(Chris Anderson)在《连线》发表了经典的「长尾理论」(The long tail),其中就指出关注成本在网络时代的降低,使得在正态分布曲线尾部的个性化和分散的长尾需求,有可能累加起来形成一个比流行需求更大的市场,并且经济效益甚至会超过「头部」(the hits)。这意味着面向小众细分市场的利基商品很可能蕴藏着更大的价值和增长潜力。

我们相信在金融化和商品化两步齐迈的背景下,NFT 的需求侧增长会实现进一步的飞跃。而 NFT 这类利基商品有机会在未来爆发出更大的价值增量,在真正意义上改变 Web3 的进程和人们的生活方式。