Cross-chain, copy trading, lightning-fast order placement... Six aggregators to help you lead the prediction market

- 核心观点:预测市场聚合器正成为专业交易新焦点。

- 关键要素:

- 聚合器融合DeFi高阶玩法,提升交易效率。

- 产品形态多样,解决流动性割裂与使用门槛问题。

- 旨在连接市场孤岛,推动行业从博彩化向金融化转型。

- 市场影响:加速预测市场价格发现与流动性弥合。

- 时效性标注:中期影响。

Original article | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web3 )

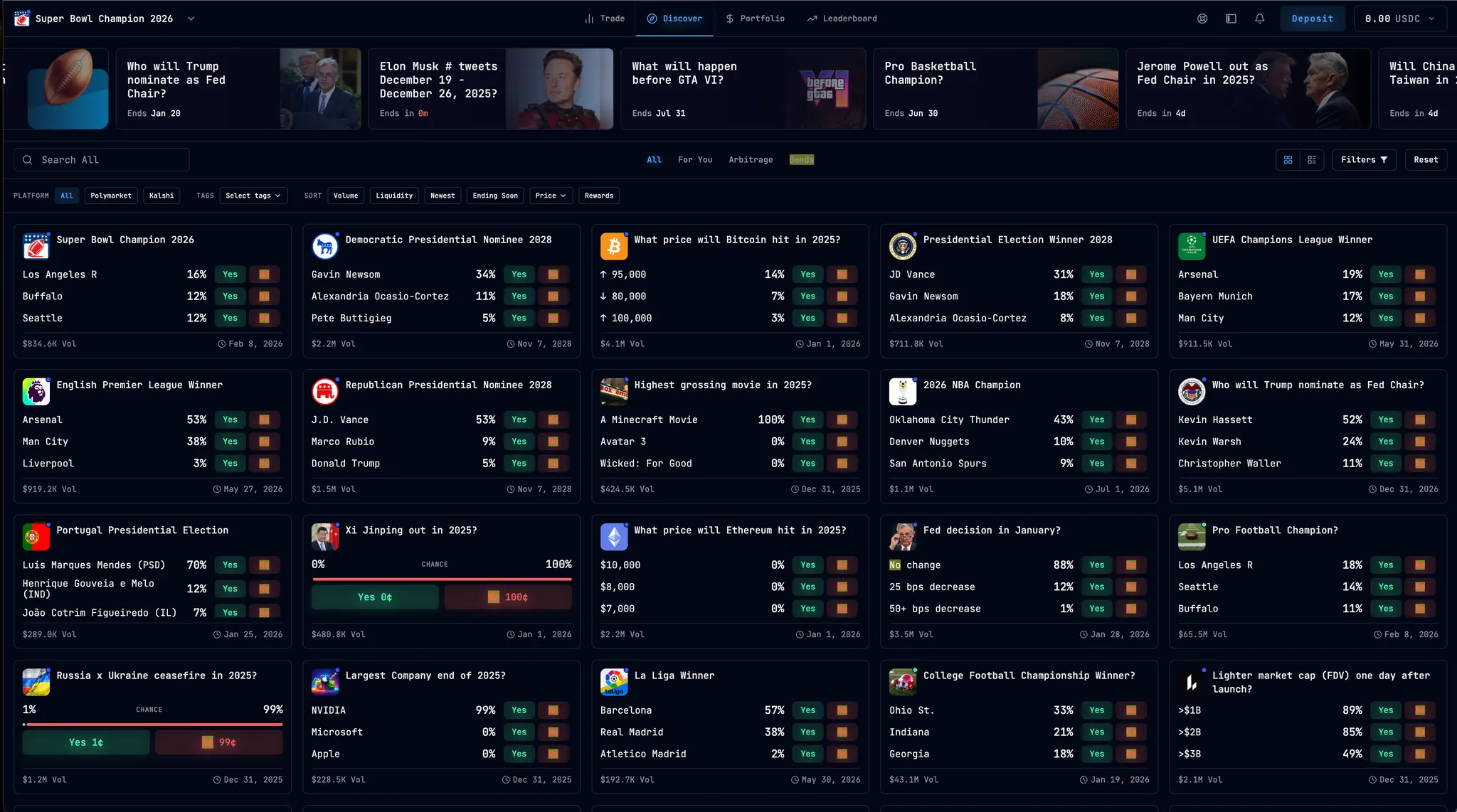

In 2025, the market for predictions remained hot throughout the year, continuing to heat up. Leading platforms Polymarket and Kalshi saw their valuations climb with each funding round, and their trading volumes frequently broke new records, leading the industry.

With the market boom, a new ecosystem of related tools has emerged rapidly. In addition to the auxiliary tools already introduced, a low-profile but rapidly evolving field is becoming a new focus for professional players—prediction market aggregators ( Recommended reading: "Odaily Highlights: Positioning Yourself in Prediction Markets, These Tools Can Double Your Trading Win Rate" ).

"Prediction market aggregators" are not simply a compilation of order book information. The new generation of tools has integrated advanced DeFi features: supporting whale monitoring, copy trading, lightning-fast order placement, cross-chain liquidity pools , and even introducing common CEX functions such as stop-loss and take-profit orders , significantly improving trading efficiency and strategic flexibility.

In this field, products take many forms: some focus on liquidity routing, aiming to become the "1 inch" of the prediction market; others break with tradition, reconstructing the "winner-takes-all" game logic of fund pools. Odaily Planet Daily will review 6 unique prediction market aggregators to help readers find a more "handy" money-making tool than native platforms.

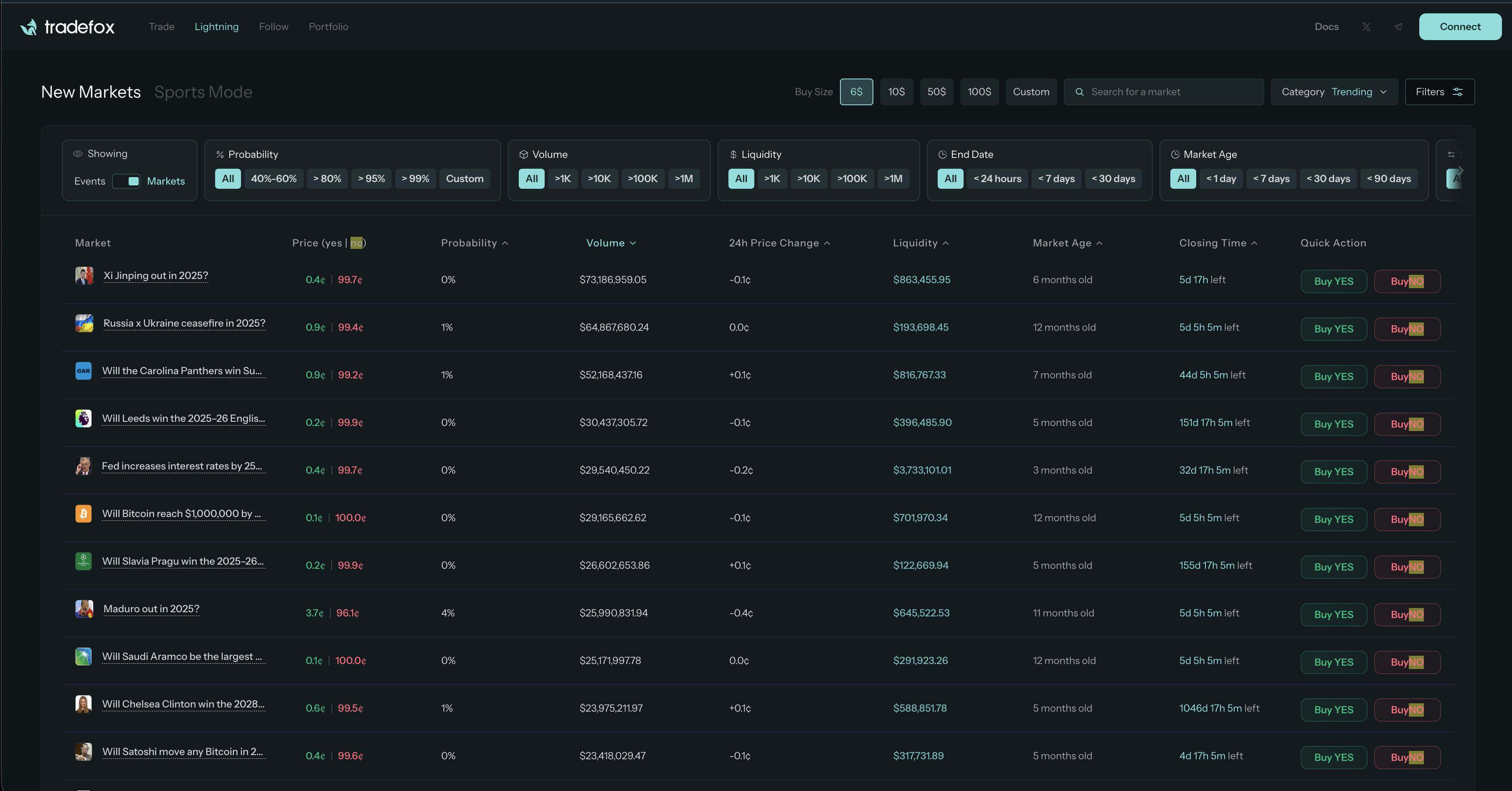

TradeFox (formerly factCheck)

Tradefox can be seen as an "advanced aggregation terminal" or "professional auxiliary tool" in the prediction market field. While Polymarket has garnered significant attention, its native experience for high-frequency traders suffers from poor smoothness and limited functionality. After receiving investment from top institutions such as CMT Digital and Alliance, Tradefox aims to address these pain points. Its core idea is not to create a new trading platform, but rather to act as a universal connector, integrating Polymarket, Kalshi, and even the sports betting platform SxBet, allowing users to participate in trading across all popular markets on a single page. (Currently, only Polymarket is integrated; integration with other markets is still pending.)

For ordinary users, Tradefox offers significant advantages: low barrier to entry and powerful tools. In terms of lowering the barrier to entry, it leverages Stripe's Privy technology to achieve convenient operation without real-name authentication. Users don't need to deal with complex cross-chain processes; they can directly deposit their BTC or SOL, and the system will automatically convert it into available funds. Regarding trading tools, Tradefox provides users with two major advantages: first, a "copy trading" function for users who prefer simple operation, which automatically replicates every move of large traders after the user sets their risk control threshold; second, a "flash buy" function for advanced traders, allowing users to buy instantly when breaking news occurs. Most importantly, by trading on this platform, users can not only retain their original Polymarket airdrop rewards but also accumulate Tradefox points (not yet available), truly "gaining double benefits with superior tools," highly recommended.

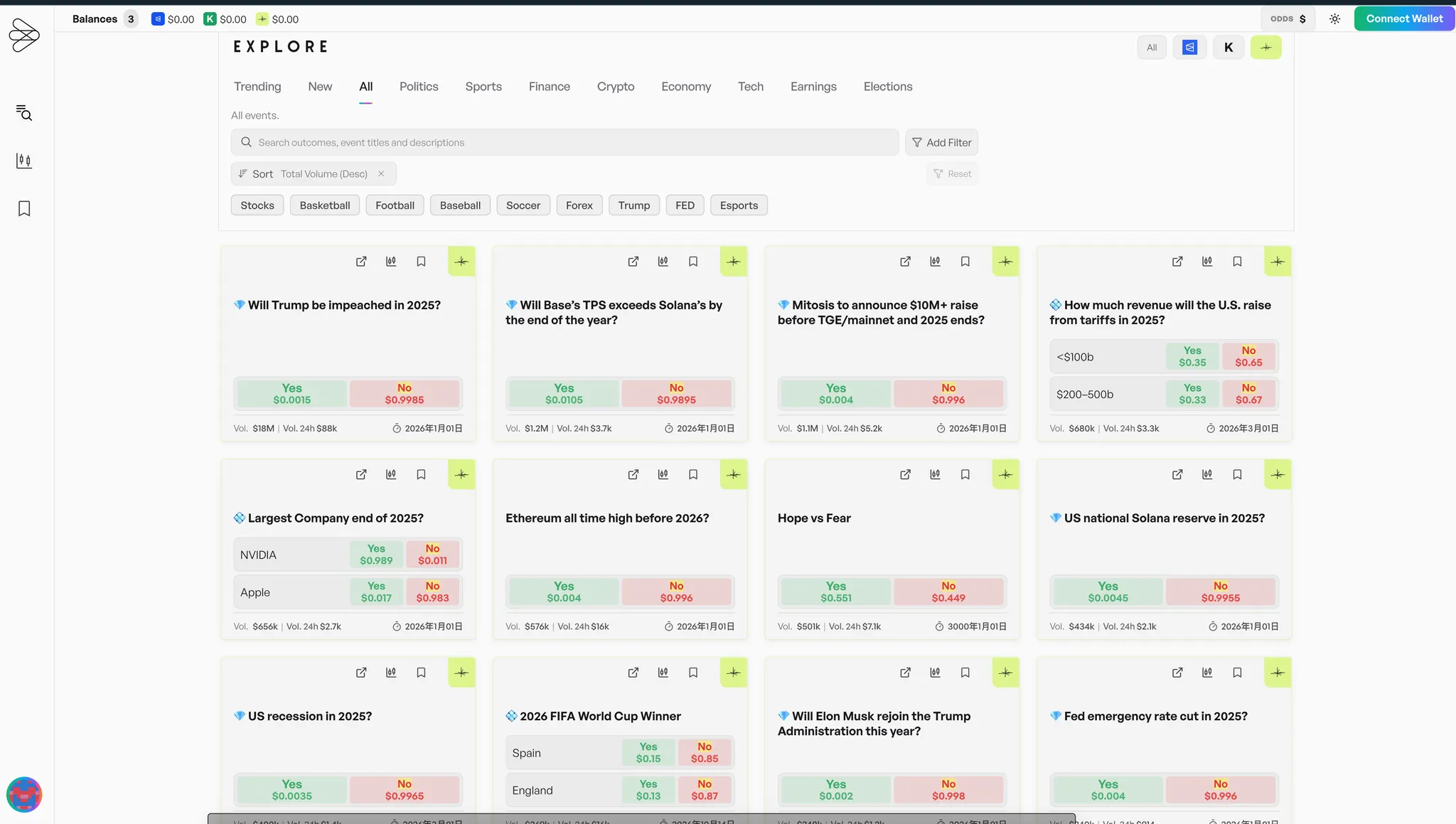

Converge

Converge is an aggregator and trading terminal for prediction markets and betting platforms. It compares real-time odds across different platforms, supports free trading, and offers professional tools such as filtering, charting, position tracking, and arbitrage insights. (Currently in beta testing, obtaining whitelist access is relatively easy.)

Compared to Tradefox's diverse range of tools, Converge focuses more on information aggregation. For example, users can add a market to their watchlist for quick access. During trading, users can use buy/sell ladders and recent trading data to assess liquidity and slippage, and can pre-set slippage before trading to reduce losses.

Currently, the platform has integrated with three major trading platforms: Polymarket, Kalshi, and Limitless. It's worth noting that Converge does not establish a unified fund account; instead, it configures separate wallets for each of the three platforms and directly bridges transactions with them. This makes the user's trading experience nearly identical to operating on the original platform. User funds do not pass through the Converge platform itself but are traded directly on the respective platform.

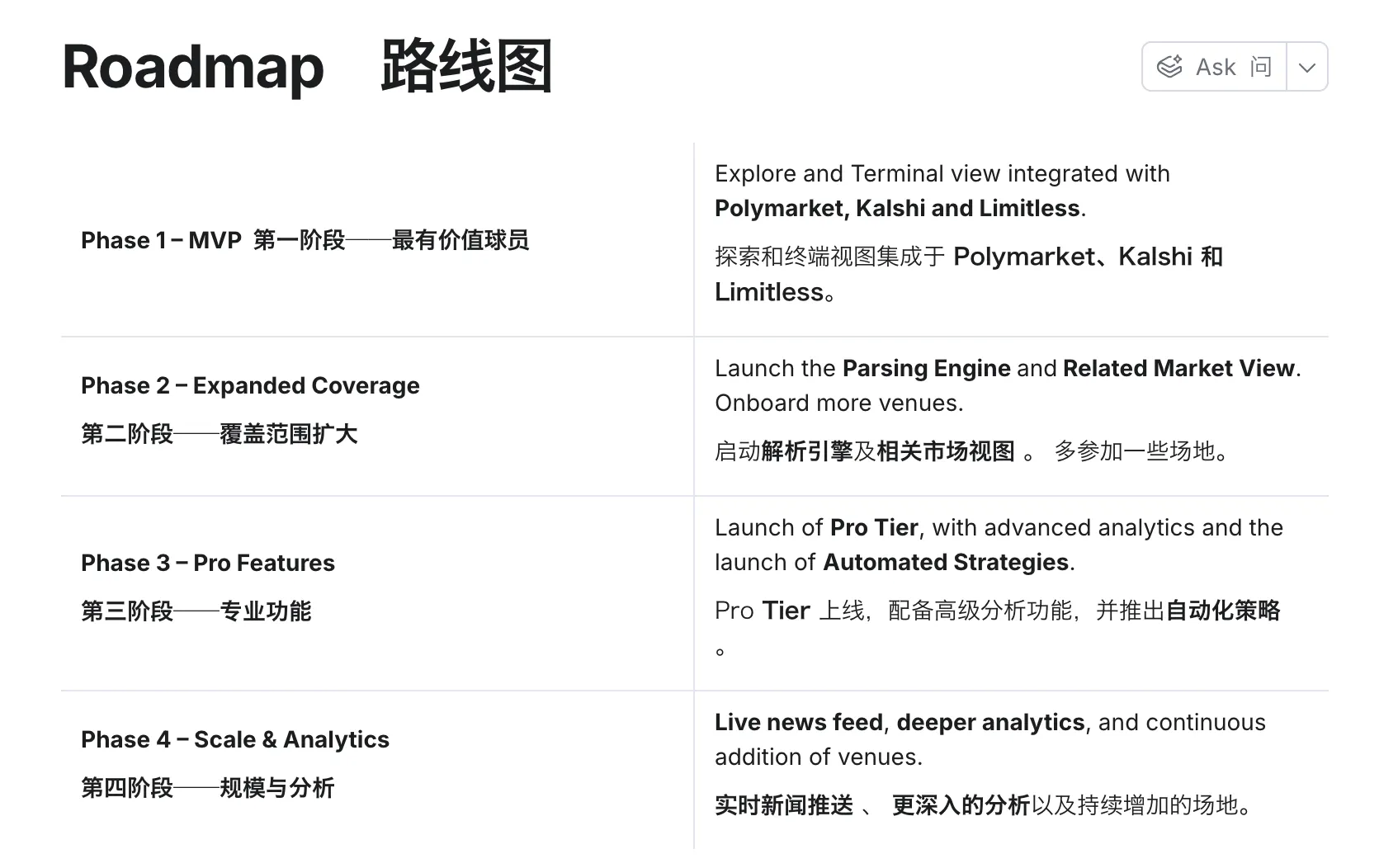

Roadmap (Based on the roadmap, the product is currently in the MVP stage):

Predictefy (not TG Bot)

There is a prediction market tool with the same name (a TG bot), but Predictefy, which is being introduced here, is not a bot, but a trading terminal. According to the limited information currently available from the official sources, this terminal is in the internal testing phase, and is being used by a limited number of beta testers. It currently has functions such as finding value, comparing odds, identifying mispricing, and revealing arbitrage opportunities, all with one goal: to bring together all prediction markets on a single platform, providing actionable data and analysis.

Predictefy aims to create a comprehensive platform similar to the Bloomberg Prediction Market Terminal, integrating market intelligence, arbitrage tools, and trading competitions, with the goal of providing traders in the prediction market with richer information than ordinary front-ends.

Upon entering the main interface, users are greeted by a highly visualized intelligence center. Switching between "Sports" and "Encryption" modes caters to the needs of users in different fields. A prominently displayed red dashboard provides real-time updates on "Trending Topics" and "Most Gaining" lists. A trading topic leaderboard in the upper right corner allows users to quickly locate actively traded markets. When selecting trading targets, Predictefy's data presentation is extremely detailed: the list page directly displays liquidity depth, 24-hour trading volume, and micro-price trend charts for the past 7 days, allowing traders to quickly scan and judge market trends without clicking on details.

Predictefy's core competitiveness lies in its deep aggregation capabilities on single-currency detail pages. It integrates price trends from prediction markets (currently only Polymarket and Kalshi) onto a single candlestick chart. Through comparison, users can intuitively identify price divergences, and the system automatically calculates the "advantage" ratio, clearly indicating arbitrage opportunities. To assist users in making better decisions, the platform features a dashboard-style "Prediction Rating" that provides buy and sell suggestions and includes a "Quick Buy" button. Users can smoothly complete the entire process from identifying price differences and analyzing data to quickly placing orders on this single page.

The platform is currently accepting whitelist applications, so it's worth trying.

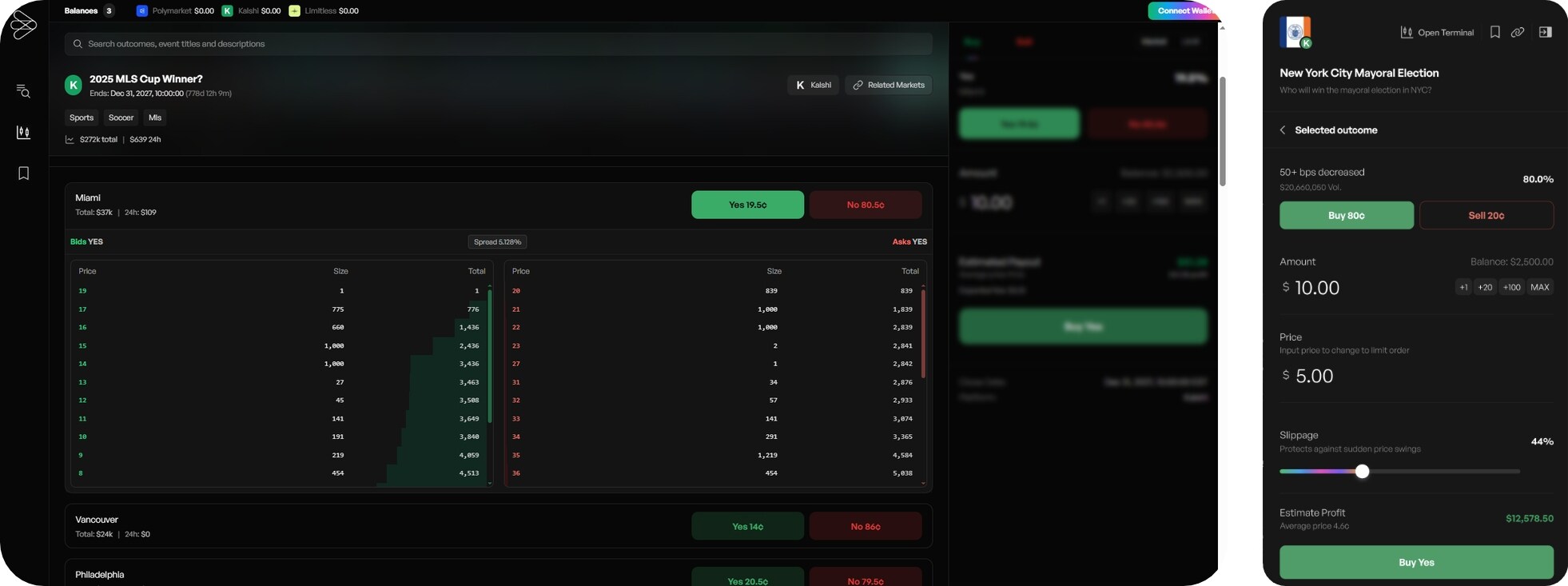

Synthesis

This aggregator is arguably the most comprehensive terminal product in the current prediction market sector. It not only integrates multi-dimensional market filtering, whale activity monitoring, and a customizable panel of top traders on the front end, but its core competitiveness lies in its unified self-custodied fund account system .

As is well known, Polymarket, Kalshi, and other mainstream prediction markets are often deployed on different blockchain networks (such as Polygon and Solana), resulting in varying standards and circulation paths for USDC. To address this liquidity fragmentation, the team cleverly introduced the dflow protocol as a foundational "bridge": when users operate within a unified account, the protocol automatically and seamlessly converts their USDC into the on-chain fund form required by the target market, thus achieving true "single-account access to the entire network." Furthermore, Synthesis supports depositing USDC, USDC.E, USDT, and ETH on Polygon, BSC, Ethereum, Solana, Tron, Optimism, Arbitrum, and Base chains.

Built on this solid technological foundation, the tool has undergone deep optimization for the trading experience. Especially for professional traders, it supports limit order functionality, often lacking in native front-ends, effectively avoiding the high slippage associated with large sums of money entering and exiting trades. Simultaneously, the built-in arbitrage monitoring system can capture cross-market pricing discrepancies in real time, intuitively displaying potential profits. In discussions with the official team, we also learned that leading prediction markets are highly open to this aggregated liquidity, with more markets currently integrating it. Furthermore, this entire aggregation service, encompassing professional trading, copy trading systems, and DFlow fund bridging, is currently completely free, providing users with an excellent opportunity to seize early-mover advantages.

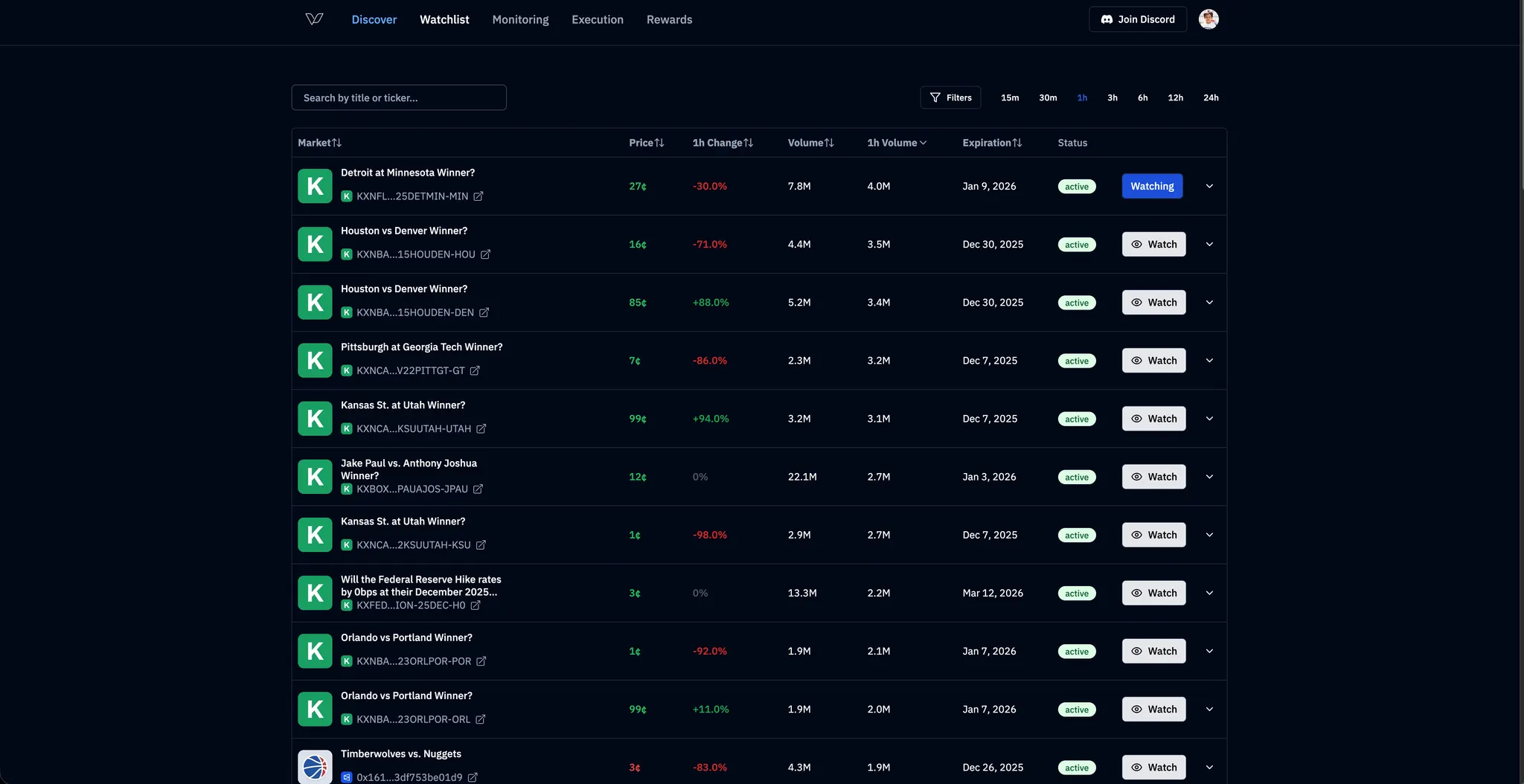

Verso Trading

In a market where companies are vying to cram in features, Verso Trading, developed by 16-year-old engineer @agpkeleta, appears rather laid-back.

Instead of piling on complex features, it focuses on a data dashboard, aggregating all markets on Kalshi and Polymarket. It then adds a filter function, allowing for highly flexible selection of topics within corresponding odds ranges. Users can also filter by topic category, or by specific time periods (15min, 30min, 1h, 3h, etc.) based on factors such as price fluctuations, market capitalization, market capitalization changes, market creation time, market expiration time, and market activity status (active, finalized, closed, etc.). This allows for more detailed filtering, precisely targeting your desired or preferred areas.

Furthermore, you can add topics to your watchlist for easy access later. These are the current features of Verso Trading. Based on the information on the official website, more features such as monitoring, execution, and reward mechanisms may be added in the future.

Currently, Verso Trading's basic functions are free, but a paid version is also available (located in account management). While details of the paid features have not yet been fully disclosed, the free version is already quite usable for users who prefer a minimalist style and are skilled in data mining.

Rocket

To be precise, Rocket, which recently completed a $1.5 million Pre-seed funding round, is a uniquely innovative prediction market aggregator. Unlike all the trading models mentioned above, it does not rely on order books or AMA market makers, but is built on three core concepts (the product is not yet online; the following is based on the official preset functions):

- Based on market predictions : Redefining the proposition, eliminating the impact of slippage, and making trading results more purely based on market predictions.

- Settlement cycles every 5 seconds : This high-frequency settlement method effectively reduces volatile losses and makes transaction risks more controllable.

- Unified Margin Account : Allows users to use funds from the same account in multiple predictions, greatly improving the efficiency of fund utilization and the convenience of operation.

In an environment free from market manipulation, winners can consistently profit from a pool of funds accumulated from flawed predictions. Rocket is essentially a redistribution market specifically designed for real-time prediction of various price dynamics. It genuinely solves some long-standing problems in traditional prediction markets and the Meme coin market.

Traditional prediction markets often ask users to bet on a fixed future point in time, such as "Will X happen in six months?" This approach completely ignores market changes during those six months. Markets are complex and volatile; focusing solely on the final result is like looking only at the finish line and ignoring the process, easily missing crucial information. The Meme coin market, while attracting attention and many investors, also leaves investors with a lot of worthless coins they can't sell. Investors in this market face various uncontrollable risks, such as sudden project cancellations, supply changes, and developers running away with investors' money. Furthermore, time costs and the issue of worthless coins constantly plague investors, like two inescapable burdens.

Rocket creatively draws on the strengths of different markets. It separates signals from risks, carefully analyzing each prediction based on the outcome, the relevant index price of the token or stock, successfully eliminating waiting costs and inventory speculation. Specifically, it obtains a fair price for reality from the prediction market, like finding a fair scale of value; it learns from the rapid market reaction of Meme Coin, enabling it to quickly respond to market changes; and it introduces the continuous, indefinite, and non-fragmented characteristics of perpetual contracts, making trading more stable and sustainable.

On the Rocket platform, the trading scope is exceptionally broad. Whether it's sports odds, stock prices, cryptocurrency exchanges, market probability predictions, or social media metrics, anything with a price can become a trading market, allowing users to buy and sell its trends. The user investment method is also quite interesting; instead of placing large bets all at once, it's automatically divided into consecutive 5-second rounds. For example, if you bet $100 for one hour, you're actually participating in 720 rounds of 5-second small bets. This approach has several advantages: it avoids losing everything at once, allows users to gradually learn to judge market trends through repeated small trades, and settlements every 5 seconds minimize waiting time, resulting in a better investment experience.

Rocket also has a very practical goal: to establish a unified margin account. This way, a user's multiple investment projects can share a single margin. When the market fluctuates, gains and losses across different projects can offset each other, allowing users to express complex investment ideas in multiple markets simultaneously without having to add extra funds.

However, the product has not been officially launched yet, and we will have to wait patiently for a while before we can experience it, which is a pity.

Conclusion: A new species of arbitrage.

Looking back at the six products mentioned above, it's easy to see that the emergence of market aggregators is upgrading the originally fragmented and primitive "betting" experience into a professional and efficient "trading" experience.

However, as mentioned at the beginning, the current aggregator market still seems to have shortcomings: the widespread lack of native high-leverage functionality and the incomplete deep integration with all long-tail prediction protocols across the network. The reasons behind this include both the objective reality of fragmented underlying liquidity and the thorny issues of compliance and risk control. (Regarding the leverage problem, I recommend reading the in-depth article compiled by Azuma: " After researching how to apply leverage to the prediction market, I found this problem is almost unsolvable ." )

However, this "imperfection" precisely reflects that the prediction market is at a critical juncture in its transformation from "gambling" to "financialization." Whether it's TradeFox's attempt to create a "prime broker" narrative, synthesis.trade's efforts to solve cross-chain fund unification, or Rocket's underlying reconstruction of the game mechanism, what we see is not just the accumulation of tools, but the self-evolution of infrastructure.

At the end of this article, I had an interesting discussion with Mr. Fangzhou, who raised a thought-provoking question: "For ordinary traders, are aggregators really a necessity? We don't need to compare prices across the entire network when buying BTC on Binance, so why do prediction markets need them?" The answer to this question reveals the underlying logic of the existence of prediction market aggregators and defines their industry role as a " new species that flattens out arbitrage."

Current prediction markets differ fundamentally from mature crypto asset markets (such as Bitcoin). Bitcoin's liquidity is globally interconnected, and the market is extremely efficient; however, prediction markets remain in a fragmented, isolated era —Polymarket is confined to on-chain operations, Kalshi is hampered by compliance restrictions, and Limitless is confined to its base. When faced with the same event (such as election odds), significant price discrepancies and liquidity gaps often exist between different platforms. In this non-standard and fragmented market environment, aggregators play an indispensable dual role :

- For arbitrageurs, it's a "shovel": tools like Predictefy and Converge, through visualized price spread monitoring, allow arbitrageurs to quickly identify and smooth out pricing discrepancies between different markets, much like hunters. It is these arbitrage activities that objectively help the entire prediction market achieve price discovery and liquidity bridging.

- For ordinary users, it's a "stepping stone": terminals like TradeFox and synthesis.trade, through their underlying cross-chain protocols and seamless account systems, help novice users overcome the headache-inducing technical and compliance barriers.

Therefore, prediction market aggregators are not simply "information directories." They are bridges connecting these liquidity silos and accelerators that drive the industry from "wild arbitrage" to "efficient pricing."

Future prediction market aggregators are highly likely to evolve into entities similar to 1inch or Blur in the DeFi space. They will no longer be merely price comparison dashboards, but the ultimate gateway to liquidity. When leverage, lending, portfolio construction, and risk control are fully integrated on these terminals, prediction markets may have truly completed their transformation from "casual conversation topics" to "global information pricing centers."

For traders caught in the wave, mastering these tools may be the first step to outperforming most people in this emerging market.