以太坊合并如何影响加密生态:4项值得关注的链上指标

本文来自 Chainalysis,原文作者:Chainalysis Team,由 Odaily 星球日报译者 Katie 辜编译。

9 月 15 日左右,以太坊的共识机制将从工作量证明(PoW)转换为权益证明(PoS)。在 PoS 协议下,验证器将区块链的原生加密货币“质押”,将其发送到一个保持锁定的智能合约,随机选择一个验证器来确认每个新区块并接收相关的奖励。验证者必须持有 32 个 ETH,用户可以通过加入质押池获得质押奖励。

PoS 比 PoW 共识机制更环保,在 PoW 机制下,矿工通过消耗大量算力和电力来竞争验证新的区块。除了对环境的影响之外,许多人认为,向 PoS 的转变可以减少过度中心化的风险,因为它向任何拥有 ETH 的人开放了验证者的角色,而不是只向那些拥有昂贵挖矿设备的人开放。

下面,我们将从链上指标的角度看看合并带来的连锁反应。

合并后,以太坊质押增加

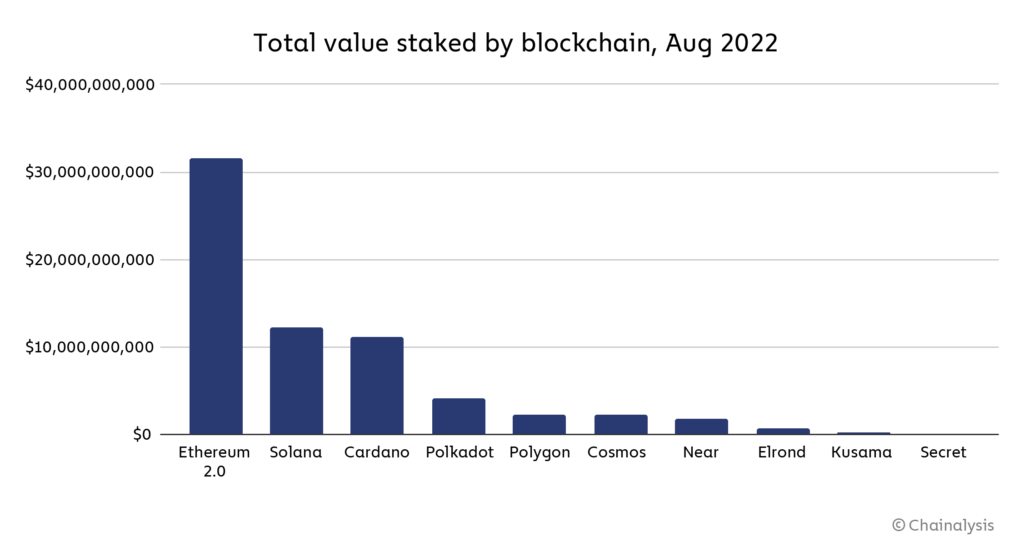

用户已经在 Eth2 区块链上质押了价值超过 300 亿美元的 ETH,使其在取代 Eth1 之前就成为价值最大的 PoS 区块链。有些人直接通过设置自己的验证节点来实现,除了 32 个 ETH 之外,还需要专门的软件和硬件。其他人则发送以太坊到质押池,质押池允许几个用户聚集他们的资源,增加他们被选中提议一个新区块的机会,并在他们分享奖励。

在合并后,基于以下几个原因,质押可能会成为一个更有吸引力的提议。首先,一旦 PoS 正式到位,PoW 成为过去式,用户质押的意愿可能会更强。重视环保的机构投资者也会更青睐以太坊网络活动。

合并还为以太坊的未来改进奠定了基础。现在,直接质押在 Eth2 上的 ETH 被锁定在合约中,不能被撤回。一些质押服务提供代表用户质押 ETH 的流动合成资产,但这些合成资产并不总是与 ETH 保持 1:1 的联系。虽然合并不会立即改变这一点,但计划在合并后的 6 到 12 个月内进行的“上海升级”将允许用户随意提取质押的 ETH,为质押者提供更多流动性,并使质押成为更具吸引力的整体方案。

合并后,分叉和其他为了降低 gas 费和提高交易速度的可扩展性改进也即将出现。

总的来说,从合并开始的这些变化将使以太成为一种更具吸引力的资产,因此也更适合质押。

机构投资者拥抱以太坊

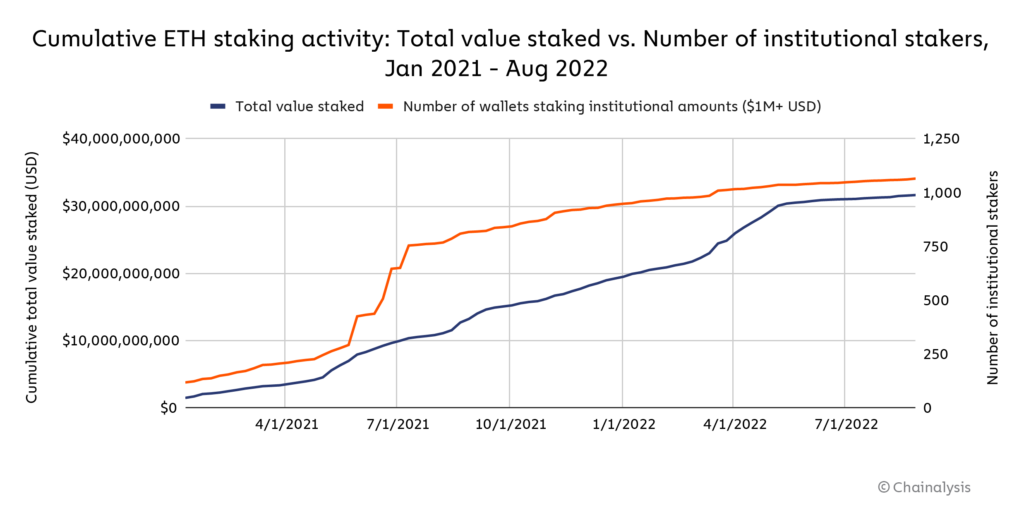

除了增加整体质押外,我们还将特别关注机构投资者开始或增加其以太坊质押活动。

比特币等加密资产的价格与科技股和其他高风险、高收益资产的价格之间的关联度越来越高。然而,ETH 的价格可能会在合并后与其他加密货币脱钩,因为它的投资回报将使其类似于债券或商品等工具,具有套利溢价。一些人预测,在质押奖励和分配给验证者的交易费用之间,质押者可以预期以太坊的年收益率为 10-15%,这是在考虑以太坊本身价格上涨的潜力之前,这也会增加按法币价值计算的回报(当然,以太坊的价格也可能下跌,这将损害法币回报)。对机构投资者来说,这些回报可能会使以太坊成为一种诱人的债券选择。相比之下,截至 2022 年 9 月,一年期美国国债的收益率为 3.5%,尽管这一数字在过去一年一直在上升。

数据显示,持有 ETH 价值超过 100 万美元的钱包数量(我们将其称为机构投资者)已经在稳步增加。

有趣的是,在合并之后,可以观察大户质押者数量是否会以更快的速度增长,因为这可能表明机构投资者确实认为持有以太坊是一个良好的收益策略。

以太坊矿工将不得不另谋“新出路”,但比特币可能不是合适的选择

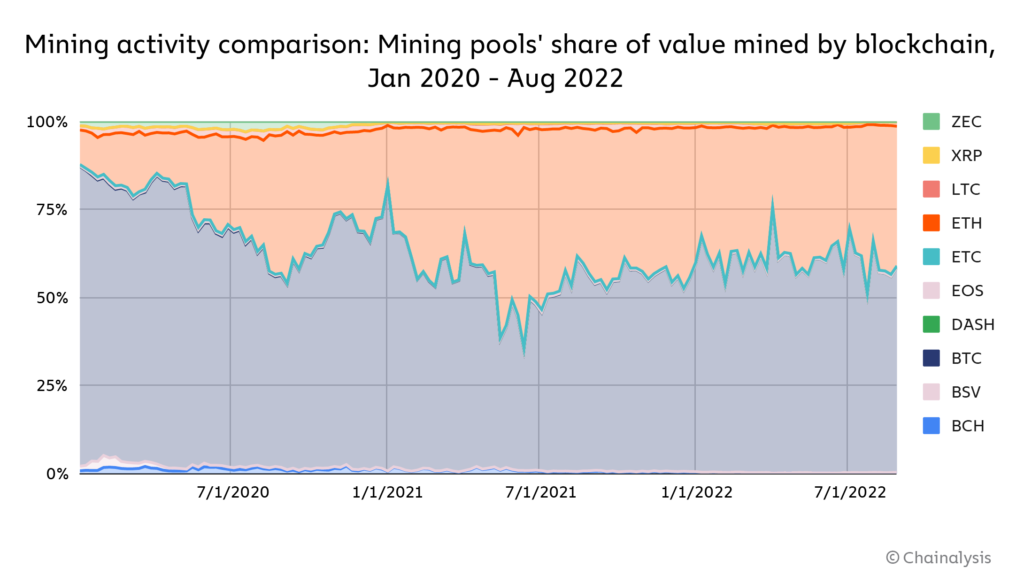

以太坊向 PoS 的转变也将导致挖矿活动的改变。目前,许多矿工和矿池在几个不同的区块链上开挖资产,并根据市场趋势在区块链之间动态分布他们的哈希率。不过一般来说,大多数挖矿都集中在比特币和以太坊上。

合并后,以太坊挖矿专用的哈希率将消失或分散到其他区块链。然而,不要指望哈希率会转移到比特币上。为什么?

用于挖以太坊的设备不适合比特币。大多数以太坊矿工使用 GPU,而比特币矿工使用更强大的 ASIC。这意味着以太坊转向 PoS 对 GPU 矿工来说是一个巨大的打击。以太坊目前占所有 GPU 挖矿活动的 97%,所有剩余的可挖矿 GPU 代币的总市值仅为 41 亿美元,仅为以太坊的 2%。这不足以支持 GPU 矿工。

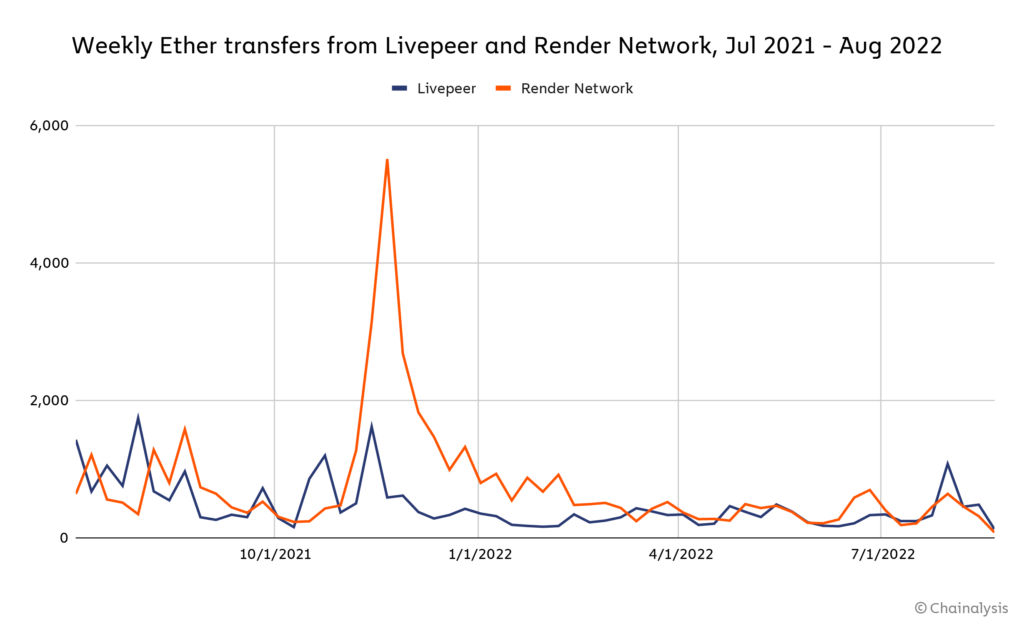

那么,这是否意味着数百万曾经高效的 GPU 现在将闲置,它们的所有者失去了用加密货币赚钱的机会?不一定。有几种基于以太坊区块链构建的服务,它们利用分布式 GPU 的能力以去中心化的方式完成特定的计算任务,GPU 所有者会收到以太坊或 ERC-20 代币奖励作为回报。考虑以下两个例子:

Livepeer 是一个去中心化的视频流服务,允许 GPU 所有者转码视频以换取加密货币奖励;

Render Network 为 3D 图像的渲染提供了类似的服务,也允许 GPU 所有者通过捐赠算力来收集加密货币奖励。

下图显示了每周从 LivePeer 和 Render 智能合约发送的以太坊交易数量,其中一些反映了对服务各自网络贡献的 GPU 所有者的奖励(注意:该图不包括每个网络的原生代币支付的奖励)。

虽然链上活动最近有所下降,但值得关注的是,这些网络和类似的网络是否会因为 GPU 所有者在以太坊合并后寻求收益机会而兴起。当然,GPU 也有非加密的用途,例如为数据中心、游戏计算机和其他重型机器提供处理。一些矿工可能会选择将自己的 GPU 卖给这些行业的企业。

合并对加密市场的影响始于链上数据

总的来说,合并可能会对以太坊的价格和作为一种资产的整体吸引力产生重大影响,进而影响质押、挖矿和加密货币的机构采用。虽然不可能预测准确的市场反应,但我们上面概述的链上指标可以帮助您跟踪它们之后的合并情况。