Weekly Editors' Picks Weekly Editors' Picks (0625-0701)

"Weekly Editor's Picks" is a "functional" column of Odaily.On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Now, come and read with us:

Now, come and read with us:

Investment and Entrepreneurship

Investment and Entrepreneurship

Dismantling the beginning and end of the 2008 financial crisis: What are the similarities and differences between the Three Arrows crisis and Lehman Brothers?

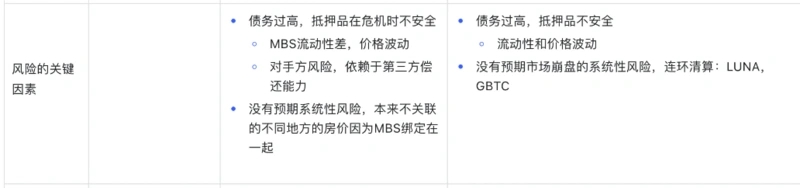

The reasons why both are vulnerable to downtrends include: excessive debt and insecure collateral, and insufficient expectations for systemic risk.

Why did the former "bull market engine" GBTC become an "oil barrel" that caused thunderstorms in institutions?

DCG is actively applying to the US SEC to convert GBTC into a Bitcoin ETF. Once successful, the ETF will track the price of Bitcoin more effectively, eliminating discounts and premiums, which means that the current negative premium of more than 35% will disappear, leaving room for arbitrage. The deadline for the SEC to approve or reject the application is July 6, so 3AC told a large number of institutions that they can obtain more than 40% of the profits in just 40 days, essentially betting that the SEC will approve the application.

Analysis of Messari’s fund holdings in the first half of the year: DOT wins again, public chain and DeFi are the most popular

Similar to Q4 in 2021, funds have clearly shifted to smart contract platforms and DEXs. The average investor, when tracking institutional investing activity, needs to keep in mind that the institutional environment works very differently, and it is impossible for the average investor to own or use certain strategies without substantial capital. Funds are better able to weather turmoil and make profits at a lower cost.

DeFi

Explain the risk situation of stable currency in detail: Will USDT really crash?

Explain in detail the risk control mechanism of lending agreements Maker, Aave, and Compound

NFT, GameFi and Metaverse

NFT, GameFi and Metaverse

Multi-dimensional analysis of the giant whale's NFT bargain hunting strategy

During the decline in mid-June, the order of the giant whales’ bargain hunting was: Bored Ape Yacht Club > Yuga Labs’ other NFTs > other blue-chip and emerging projects, and the type and price of bargain hunting were related to the size of the funds.

The bottom-hunting strategies of giant whales have some things in common, such as: buying in batches, buying more and more as they fall; they will also try multiple platforms such as X2Y2 and LooksRare, not limited to OpenSea.

Most people's current view of the game guild is: a group of scholars who focus on P2E games and mainly extract value from games. This is due to the token mechanism brought by the game itself, which eventually contributed to an unhealthy virtual economic cycle in the game.

Web 3.0

secondary title

Comprehensive analysis of what use cases will Web3 have in the future?

It's a bit long, so let's summarize the conclusions: social networking, games, content creation, tokenized commerce, zero-knowledge proof, soul-bound tokens, DAO and other tracks.

Vitalik believes that NFTs (including governance rights, proof of attendance protocol, etc.) can achieve "soul binding" in a non-transferable manner. Through on-chain tracking to check whether the current owner is the same address as the original owner, proof-of-humanity can achieve non-transferability in practice, and add privacy to soul-bound items through ZK-SNARK. In essence, SBT is a non-transferable identity and reputation token, like the "achievement badge" in real life, using blockchain technology to verify the authenticity of all information.

Ethereum and scaling

Ethereum and scaling

Understanding MEV2.0: How can users become MEV beneficiaries?

As background, the authors detail today's advanced MEV players, the MEV economic market structure, general proof-of-stake systems and the role of validators, and some game theory. In summary, we can see a Proof-of-Stake MEV scenario where everyone (including users) is better off and validators and users depend on each other.

Comprehensive interpretation of Layer 2 development status: data, expansion solutions and ecological applications

At the same time, various DAPPs on the Ethereum mainnet are deployed to Layer 2. Between different Layer2s, the repeated layout of DAPP has also become a norm. The accompanying liquidity fragmentation between Layer 2 and security issues of cross-chain bridges have become new important topics. The richness, complexity, and challenges faced by the Layer2 ecology are no less than the Ethereum mainnet. For a long time to come, Layer 2 will be the main theme.

zk rollups is recognized by the industry as the ultimate solution for blockchain expansion, and StarkWare is recognized as one of the best zk rollups teams in the world. Unlike the L2 field, which generally charges through operating nodes, StarkWare has created a scaling as a service (scaling as a service) business model by providing a scaling technology solution, StarkEx, and has served leading customers in the industry such as dYdX, Sorare, ImmutableX, and DeversiFi.

New ecology and cross-chain

New ecology and cross-chain

IOSG Ventures: The battle between the application chain and L2 Rollup under the dYdX departure event

New multi-chain narrative changes: High-quality applications show a weak attachment relationship to the underlying chain, while the underlying chain/network shows a strong attachment relationship to high-quality applications. In the past, applications would think about how to retain users, but now it is the public chain's turn to think about the issue of "app retention".

technology

technology

A complete introduction to Zero-Knowledge Proofs (ZKPs), including definitions, history, classifications, risks, applications, and more.

DAO

secondary title

Comprehensively analyze the interaction mode and relationship model of DAO-2-DAO

hot spots of the week

In the past week,hot spots of the weekIn the past week,Goldman Sachs is raising $2 billion, plans to buy Celsius' distressed assets, BlockFi currentlyValuation is less than $500 million,Morgan Creek DigitalNegotiating with Ledn to lead a $400 million funding round for BlockFiVoyager Digital Announces Notice of Default to Three Arrows Capital,Trying to raise $250 million to acquire a majority stake in BlockFi,,Voyager Digital Announces Notice of Default to Three Arrows CapitalBlockchain.com has applied to liquidate all assets of Three Arrows CapitalMonetary Authority of Singapore, is currently cooperating with the court investigation,Monetary Authority of SingaporeAlleges that Sanjian provided false information and its asset management scale exceeded the registration limit, FatMan saidGenesis, but does not intend to use the proceeds of the sale to repay creditors,

In addition, in terms of policies and macro markets,is facing potential losses of "hundreds of millions of dollars";In addition, in terms of policies and macro markets,The US government may pass stable currency legislation before the end of this year,Plans to Impose Billion Dollar Taxes on Crypto Sector Delayed,grayscaleUS SEC rejects Grayscale's application to convert its GBTC into a spot ETFgrayscale,File lawsuit against SEC, Fed's Powell saysEU Adopts MiCA Encryption RegulationEuropean UnionEuropean UnionEl SalvadorCryptocurrency platforms may be prohibited from issuing interest on stablecoin deposits,

El SalvadorBuy 80 bitcoins again at a unit price of 19,000 US dollars;In terms of opinions and voices, Cathie Wood saidNFT, DeFi, digital wallets will become important and huge opportunities”,, while indicating "Founder of Pangea

Institutions, large companies and top projects,Believe that there is a huge short-selling opportunity in the future market;Institutions, large companies and top projects,FTXMicroStrategy buys 480 BTC for $10 million, with a total holding of 129,699 pieces,Internally considering whether to buy stock and cryptocurrency trading platform Robinhood, Ethereum completesGray Glacier hard fork,upgrade,Postpone the difficulty bomb, no user action requiredGMXdYdX "Escapes" Ethereum, Embraces CosmosArbitrumlead to discussion,Polkadotannounced the suspension of Odyssey activities,

NFT and GameFi fields,OpenSeaWith "Editor's Picks of the Week" series

With "Editor's Picks of the Week" seriesPortal。

See you next time~