Weekly Editors' Picks Weekly Editors' Picks (0528-0603)

"Weekly Editor's Picks" is a "functional" column of Odaily.On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Now, come and read with us:

Now, come and read with us:

Investment and Entrepreneurship

Investment and Entrepreneurship

Panoramic analysis of the status quo of the encryption ecosystem: which tracks and projects will be the first to break the deadlock?

The author predicts that the verticals that will start to develop next and deserve to be focused on are: GameFi - economies begin to leverage and incorporate existing DeFi; wallets expand their services; expand NFT use cases and liquidity, and their downstream impact; Omnichain's protocol and NFT leverage various chains to enable new use cases; developments around Rollup’s liquidity and Ethereum compatibility; SOL continues to gain traction across the NFT ecosystem and create demand for DeFi tokens; LooksRare’s growth and The launch of SudoSwap; the continued growth and symbiotic relationship of FXS, Curve, Convex, and BTRFLY; whether Ethereum can successfully merge.

At present, Alameda Research plays a role similar to a "think tank" in the entire ecology, and its business lines are trading business (quantitative trading + market maker), OTC business, research and analysis business, and investment business.

DeFi

Coinbase: Stablecoins and Volatile Yields

NFT, GameFi and Metaverse

NFT, GameFi and Metaverse

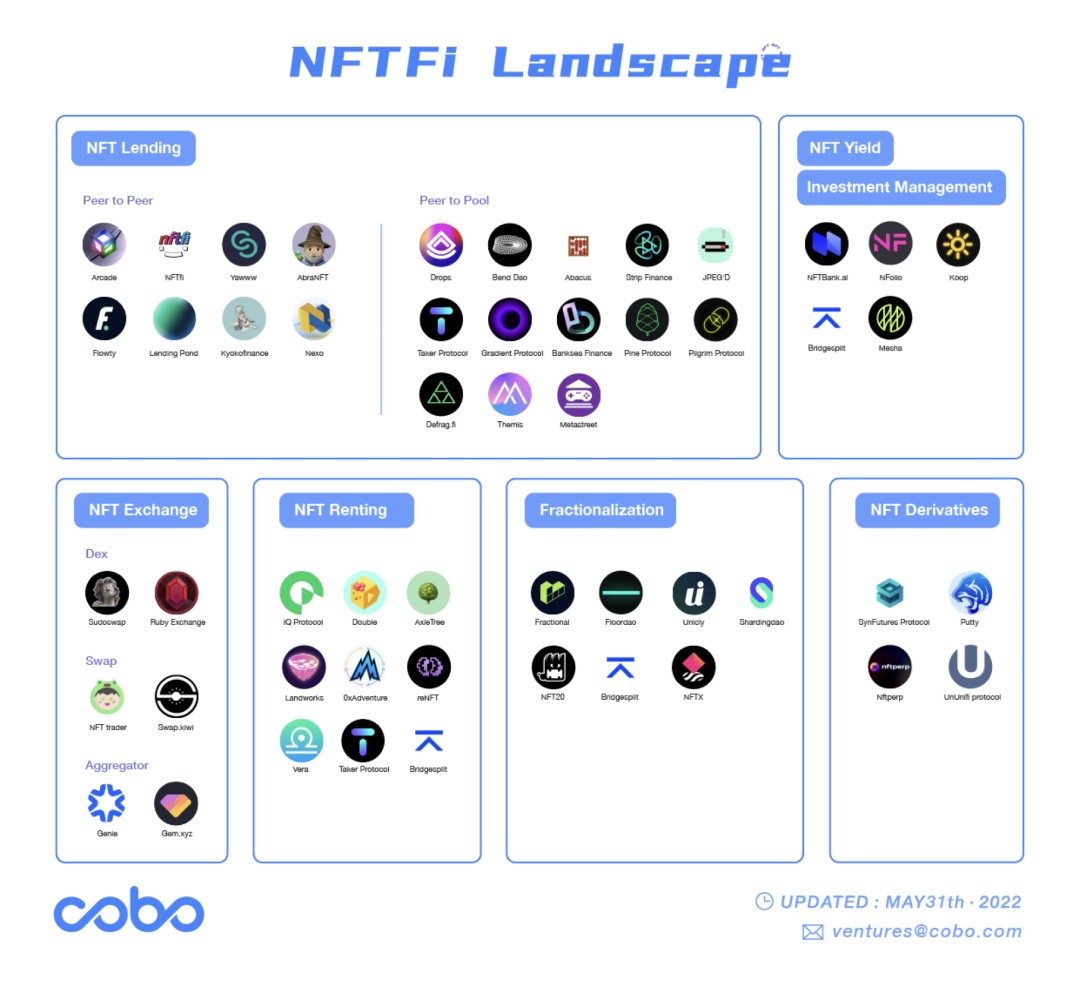

Cobo Ventures: An all-round analysis of the development status and trends of the NFTFi track

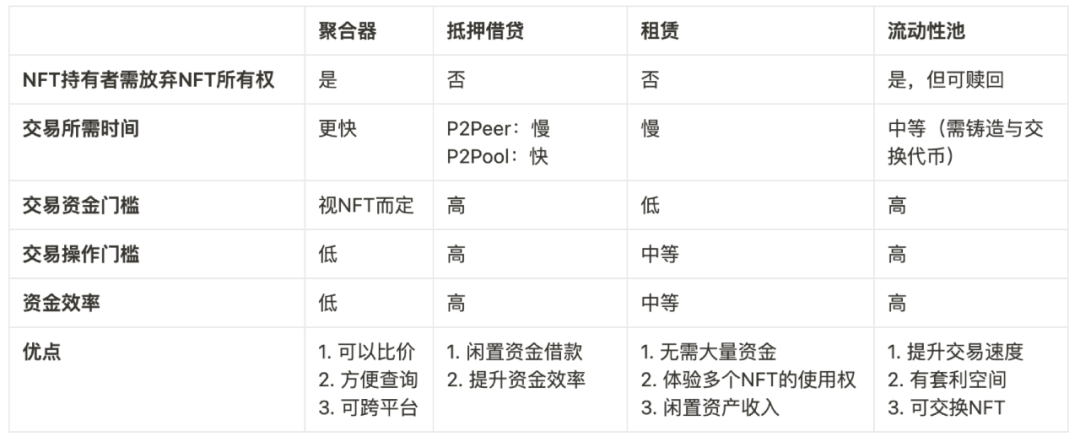

Break down, NFTFi includes NFT lending (P2P NFT lending agreement, P2Pool NFT lending agreement), NFT liquidity solutions (NFT leasing agreement, NFT liquidity pool agreement, NFT capital crowdfunding agreement, NFT aggregator), NFT special pricing mechanism And oracle machine (NFT game theory pricing model, NFT autonomous computing oracle machine), NFT derivatives (NFT option platform, NFT perpetual contract platform, NFT automatic market maker). The differences and advantages of each solution are as follows:

Panoramic view of NFT painting style: from the explosion of GoblinTown

The unique style of painting is a way of publicity that combines creativity and organicity of the project party. The display form of PFP NFT can not only bring a sense of belonging to the community for the holders; The same identity personality, and most importantly - attitude.

To blockchain game designers: Single currency or dual currency model?

The advantage of the dual currency model is that it can separate speculation and game economy; the disadvantage is that the fixed supply token (FST) does not necessarily have meaning, unless the team finds a way to increase the value or utility of FST, otherwise it will be sold, allowing Speculators act as takers.

Web 3.0

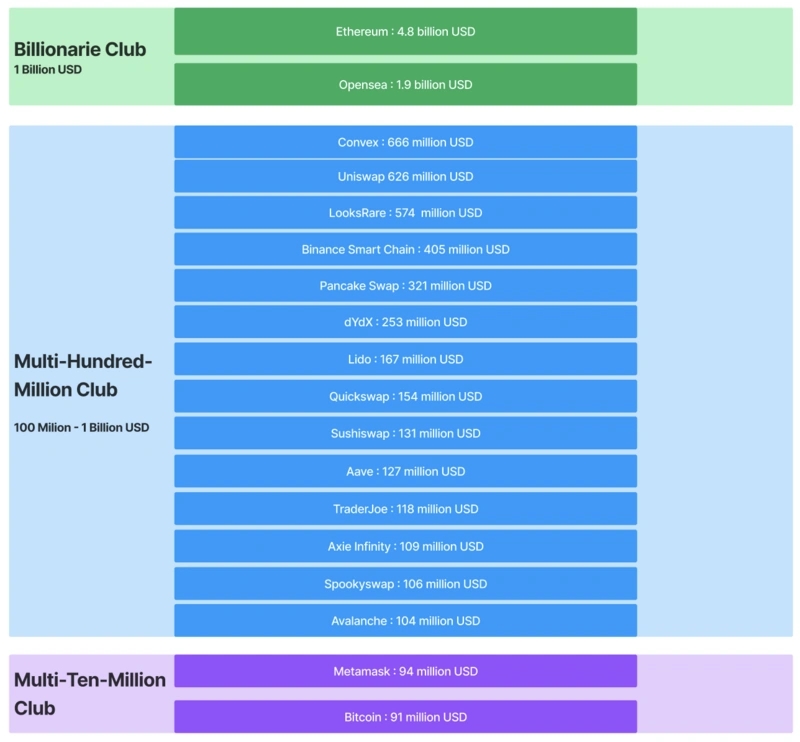

Overview of Web3 Revenue: Ethereum Becomes the Strongest Revenue Machine

Web3 business models have grown a lot, the most powerful of which is still "sell block space", followed by NFT trading platforms, DeFi, GameFi and infrastructure. Most of the income of the agreement still comes from the supply side income created by roles such as LP and Lender, and the profitability of the agreement itself is still relatively small, and even less of it flows to token holders. Although users enjoy staking income and governance rights, the core economic interests are still not guaranteed.

image description

Total revenue ranking of Web3 projects/protocols in the past 180 days

The author divides the income into: Explicit Revenue—the user’s payment for using the service, practical attribute; Internal revenue (Implicit Revenue)—the user’s payment in order to obtain the protocol Token, the speculative arbitrage attribute; found some income The essence is Token Sale, which is very unstable. Some income is not provided for risk, and some income is never disclosed, such as the income from additional issuance in the dual currency system.

Mario Gabriele's comprehensive interpretation of social tokens.

Ethereum and scaling

From the perspective of gas fees, in-depth research on the seven use cases of Ethereum

New ecology and cross-chain

New ecology and cross-chain

This paper examines five independent multi-chain architectures: Polkadot, Cosmos, Avalanche, Polygon Supernets, and Binance BAS, comparing their trade-offs in terms of shared consensus, capacity, and interoperability. Each project makes a different trade-off between speed/power and shared security.

Messari: Overview of Solana’s ecological development in the first quarter

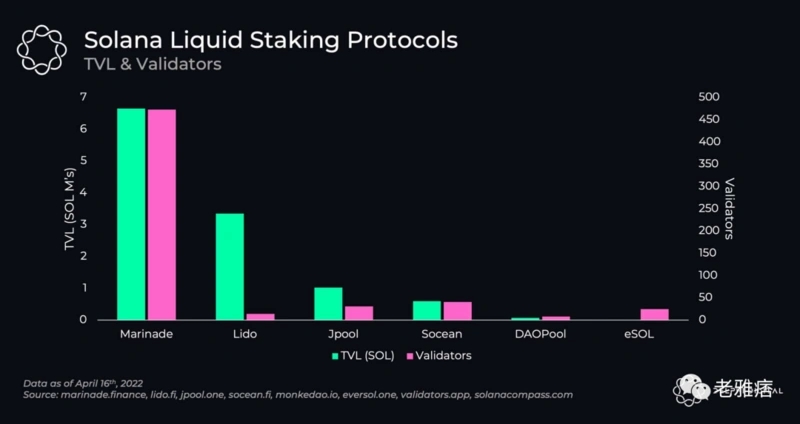

A detailed analysis of Solana's liquidity staking ecosystem, who will be the winner?

DAO

secondary title

The author's experience sharing also includes the following details: Deposits, Governance, Meetings, Practices, Communication, Pros and Cons of Discord and Telegram, DAO Enabler, DAO Governance, Documentation, Treasury/Vault and Hot Wallets, Contributor Payments and Rewards, Ledger /Accounting and taxation, exit, incentives, wallet management, and finally a batch of recommendations for DAO tools.

hot spots of the week

secondary titlehot spots of the week,During the past week, according to,TerraNansen ReportUST crash could be orchestrated by multiple large walletsNew chain mainnet online, Terra 2.0 defaultConfirm that the user's lock-up tokens are entrusted and pledged to a random validator node, Do Kwon was accused ofFraud using Mirror Protocol;

MicroStrategy CEO, Do Kwon or is makingTim DraperBitcoin is still expected to rise to $250,000,Three Arrows CapitalandAlameda ResearchThree Arrows Capitaland,CoinbaseTransferring large amounts of ETH to FTX; Coinbase,Executives earn about $1.2 billion from stock salesShare price down 71.72% in 2022Fidelity's Crypto SubsidiaryPlanning a massive hiring spree, and offering Ethereum custody and trading services,Binance LabsGoldman Sachs and FTX

is negotiating a derivatives trading agreement,Launched a new $500 million fund that will focus on Web3 projects;wall street bankagainst the implementation of a digital dollar,Tether issues USDT on Polygon, Optimism opens itsAirdrop of native token OP;

, but encountering scientists rushing away, RPC strikes, etc., Maker Lianchuang proposed "The Endgame Plan",Proposal to create MetaDAO and synthetic ETH token MATHWETH offer on OpenSea,Or Put Users at Risk of Fund Theft, DOJ AllegesFormer OpenSea product manager involved in NFT insider trading"Goblin" goblintown.wtf serieswhite paper adjustmentopen letterWith "Editor's Picks of the Week" series

With "Editor's Picks of the Week" seriesPortal。

See you next time~