Bloomberg 2022 Encryption Outlook: The "fate" of Bitcoin, Ethereum, and the encrypted dollar

This article comes fromBloomberg Intelligence, original author: BI Senior Commodities Analyst Mike McGlone

Odaily Translator |

Odaily Translator |Spurred by the proliferation of revolutionary technologies such as crypto dollars and non-fungible tokens (NFTs), we expect full acceptance of cryptocurrencies in the US and the introduction of proper regulation in 2022, which will have some impact on price increases. It should be noted,As quantitative easing has led to a massive increase in the U.S. dollar money supply, cryptocurrency prices should continue to rise, especially two cryptocurrencies with limited supply, bitcoin and ethereum. So, what might trip up the ever-advancing “Three Musketeers”—Bitcoin, Ethereum, and the cryptodollar? This may be an issue that needs to be discussed more deeply in 2022, but we expect that Bitcoin and Ethereum will gain wider market adoption and overcome most market volatility (such as the near 50% correction in the crypto market in 2021) . In addition, the normalization of stock market returns and the continued decline in US Treasury yields may also affect Bitcoin and Ethereum.

secondary title

Bitcoin, Bonds and the FedBitcoin, Ethereum, Cryptocurrencies, Federal Reserve and 2022 deflationary forces.

The Federal Reserve may re-evaluate its quantitative easing strategy, and falling bond yields may indicate that the macroeconomic environment in 2022 is favorable for the two leading cryptocurrencies, Bitcoin and Ethereum. At the end of 2021, crypto assets showed different strengths than stocks, which may indicate that the performance of digital assets in 2022 will continue to outperform.Is Bitcoin Expecting The Fed To End The Currency Game?

Some people think that the Fed will still not adopt monetary tightening policy in 2022 because they are worried that the stock market will fall. For Bitcoin, this situation may be a positive. As the benchmark in the cryptocurrency industry, Bitcoin is becoming a digital store of value, but it should be noted that Bitcoin is still in price discovery mode, so it is still a risk asset. Bitcoin is set to face growth headwinds if stocks fall, but the cryptocurrency could be a major beneficiary as falling stock prices weigh on bond yields and incentivize more central bank liquidity.

Our chart depicts the future pricing of one-year federal funds in 2022, which is expected to have a higher rate. The fact that the Fed's attempt to sustain a tightening cycle has failed, especially since raising rates in 2015, suggests that the U.S. is set to follow Japan and Europe toward negative yields.

Bottom: Could the Fed's contraction be a dream? Bitcoin may tell you the answer.。Bond Yields Defy Falling Consensus

While long-term bond yields on U.S. Treasuries are widely believed to be higher, in practice the metric remains unable to sustain above 2%, a figure that could favor Bitcoin as a major asset in a deflationary environment in 2022. Yields on long-term U.S. bonds fell below the 2% threshold for the first time in February 2020, mainly due to the outbreak of the new crown epidemic in the United States, which also led to a sharp decline in most risk assets in March. Our chart depicts that US yields are likely to follow Japan and Europe into negative territory, meaning that the upcoming digital reserve asset could be the most prominent beneficiary.

Below: Bitcoin could be the main beneficiary as U.S. Treasury yields move lower.

Funds in the market have shifted from gold to Bitcoin and Ethereum, and for 2022, the question centers on the reversal or acceleration of liquidity. As bond yields fall, we favor cryptocurrencies for greater liquidity.Do cryptocurrencies have an advantage over the stock market?

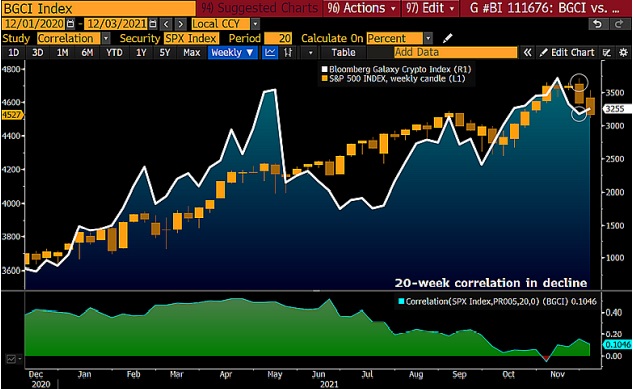

Different strengths from the stock market and the basis for a sharp decline in 2021 could set the stage for further appreciation in crypto asset prices in 2022. The market may have a relative advantage in 2022. Our chart depicts the rise of the Bloomberg Galaxy Crypto Index despite the S&P 500's decline at the end of November. It’s important to note that crypto remains a risk asset, but major assets — Bitcoin and Ethereum — may be transitioning to stores of value.

Bottom: Different strengths of cryptoassets versus stock markets.

secondary title

Cryptodollar, Bitcoin, EthereumWho are the "Three Musketeers" in 2022? Answer: Cryptodollar, Ethereum, and Bitcoin.

The crypto dollar represents a better way to transact, a stronger ecosystem, and an asset class that is here to stay. It is the most important advancing part of the digital currency revolution and the third leg of the crypto stool. The other two “muskee” — bitcoin and ethereum — look to be as durable in their bull run as stablecoins that track the U.S. dollar.Bitcoin, Ethereum and Crypto Dollar in 2022.

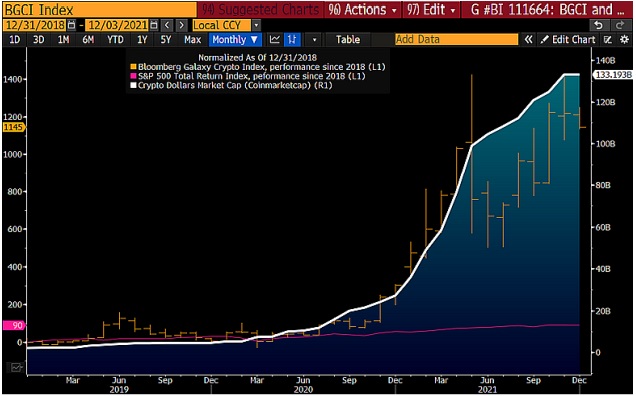

Past performance is not indicative of future results, but when a new asset class outperforms an existing one, there doesn't seem to be much reason to rebut it, and there seems to be only one option for you - follow through. In our opinion, this is expected to play a major role in 2022 because if money managers continue to own crypto assets, they may instead be exposed to greater risk if they do not have crypto assets allocated in their portfolios. According to our chart data, the Bloomberg Galaxy Crypto Index (BGCI) is up about 1,200% since the end of 2019, while the S&P 500 is up nearly 90%. Such stellar performance is usually accompanied by volatility, and it is worth noting that the BGCI has fallen by nearly 60% in 2021, but this situation may set the stage for further appreciation in 2022.

Bottom: Cryptodollar proliferation and rising BGCI index.

In the asset allocation of the BGCI index, 80% are Bitcoin and Ethereum, so we expect that in 2022, the trend of the cryptocurrency market will be further consolidated, and there may even be a surge. Following up our chart data shows that the market value of the encrypted dollar has already rose to more than $130 billion.The U.S. dollar has always held a dominant position among cryptocurrencies.

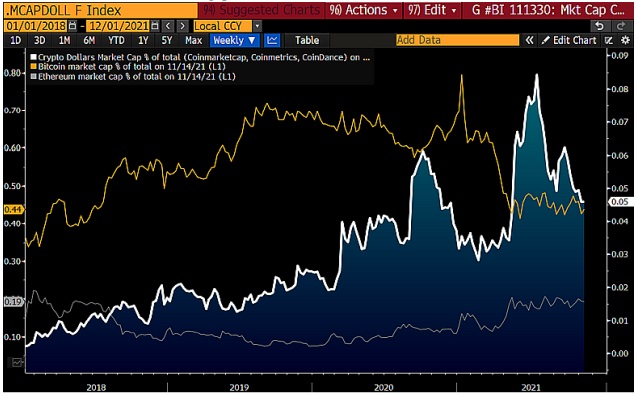

With roughly 15,000 cryptocurrencies vying for speculative leadership, bitcoin and ethereum are poised to remain at the top of the crypto ecosystem. BNB, SOL, and ADA have replaced XRP, BCH, and LINK near the head a year ago. Our chart depicts the continued upward trajectory of the crypto dollar market cap vs. bitcoin and ethereum. In our opinion, there is still a lot of speculation about changes in the crypto space, as Shiba and Dogecoin have shown, but in the top three positions , there shouldn't be too many changes.

Bottom: The crypto dollar will continue to maintain a bull market.

Ethereum’s market capitalization as a percentage of crypto’s market capitalization has been on the rise, to around 20% from around 10% a year ago, as most crypto dollars run on the Ethereum platform.Head digital asset bull market: encrypted dollar.

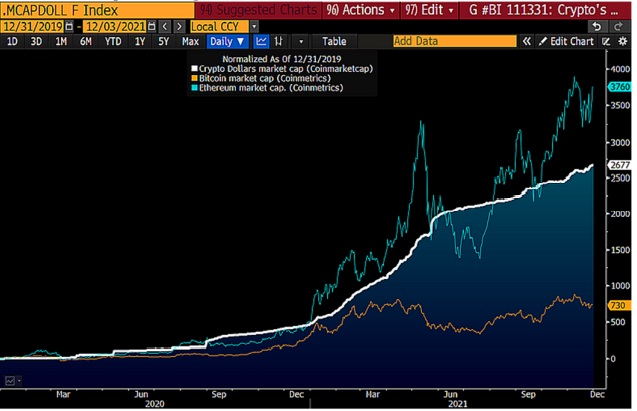

The attributes of encrypted dollars mainly include instant settlement of round-the-clock transactions, transfer of dollars, and earning interest far higher than that of EUR/USD. In this regard, encrypted dollars will have a huge impact on digital assets such as Ethereum, which will also boost the dollar and affect most other financial assets. In a world that is rapidly going digital, transacting via digital tokens may be the way to go. Our chart compares the market capitalization of the top five crypto dollars (Tether is number one) with Bitcoin and Ethereum. According to data from Coinmarketcap, Tether’s transaction volume usually exceeds the combined transaction volume of Bitcoin and Ethereum. Don’t forget that Tether is actually an Ethereum token.

Volatility in the crypto market is to be expected, after all the emergence of central bank digital currencies has happened organically, but judging by the data, the crypto market has turned to the US dollar.

secondary title

bitcoin bull marketHas Bitcoin Started a New Bull Market in 2021? An updated trend.

We are heading into 2022, and the key question for Bitcoin now is whether it has peaked or is just a consolidating bull market. We believe it is the latter, and in such a market environment, Bitcoin is on its way to becoming a global digital collateral. In 2022, Bitcoin's key support level may be around $50,000 and resistance around $100,000.The price range of Bitcoin in 2022 may be between $40,000 and $70,000.

As we have seen, Bitcoin has corrected by about 50% in 2021, but the fundamentals are still bullish, and it may see another price increase in 2022. China has banned cryptocurrencies across the board, but energy consumption concerns have improved bitcoin’s fundamentals, as evidenced by its rapid price recovery after bottoming out in July. Now that most mining operations have moved to places like the U.S. and Canada, the energy use of the world's largest decentralized network shows that Bitcoin still has strength. Our chart depicts the new bull market seen since July lows around $30,000.

Bottom: Bitcoin’s speculative glut problem in 2021 has cleared.

Support for Bitcoin should be around $40,000 – just below the 20-week moving average, and at the upper end of the trend channel, we find initial resistance around $70,000.Will Bitcoin hit $100,000 in 2022?

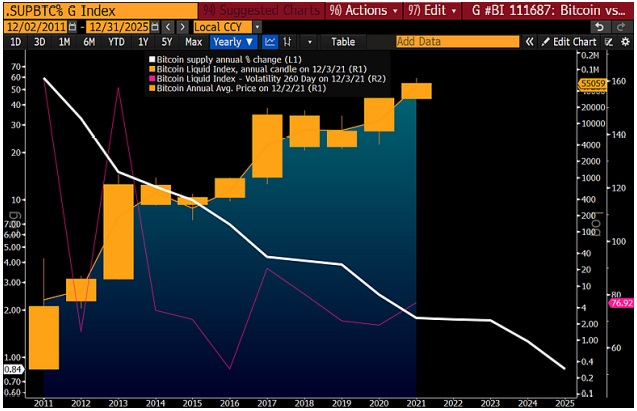

Bitcoin appears to be on track for $100,000. We think it should only be a matter of time, because there is an economic basis, one is the increase in market demand, and the other is the supply of Bitcoin. There are plenty of examples where Bitcoin will continue its journey into 2022 on its way to mainstream adoption. The launch of bitcoin exchange-traded funds and futures in the United States, Canada and Europe, and El Salvador's confirmation of bitcoin as a legal tender, all point to increased global adoption of bitcoin. Our chart depicts Bitcoin’s falling supply versus rising price and volatility, and the overall market looks benign.

Bottom: Bitcoin remains bullish as adoption rises and supply falls.

As an asset matures, it is normal to see a drop in volatility, and that is how we see it with Bitcoin. The current annualized volatility of Bitcoin is slightly below 80%, which is about the same as in 2018, but the price of Bitcoin is now much higher than in 2018, which shows that the mainstream is beginning to embrace Bitcoin.Bitcoin may no longer be limited to its role as a digital version of gold.

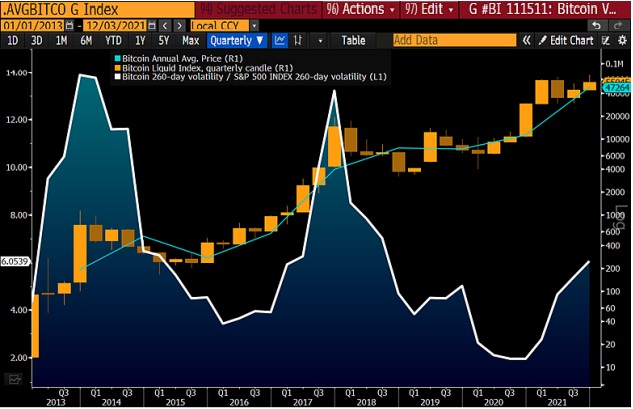

If assessed according to traditional models, the potential development path of Bitcoin price may be stable at about 100 times gold per ounce, and the volatility will be lower and lower. According to our chart data, compared to the price of gold, the price of Bitcoin continues to rise, and the 260-day volatility of Bitcoin has reached the lowest level since the beginning of 2021. At the end of 2016, Bitcoin's 260-day volatility, a relative risk measure, fell to the bottom, and then there was a bull market in 2017. There is a similarity between 2020 and 2016. Both are the years when the supply of Bitcoin is halved. In 2021, Bitcoin hit new all-time highs.

Bottom: Bitcoin price may stabilize around 100 times gold per ounce.

In our view, Bitcoin’s fundamental support remains on an appreciation path compared to gold.A solid, mature Bitcoin bull market.

As 2022 rolls around, we see a pause, correction, and renewed Bitcoin bull market is how we see Bitcoin approaching 2022. As depth and adoption increase, Bitcoin’s volatility will decrease in the long-term, while its price will trend upward. In early 2021, Bitcoin hit a milestone: Compared with most major asset classes (especially the S&P 500 index), Bitcoin's 260-day volatility fell to the lowest level ever. In 2021, the price of Bitcoin has increased by about 100%, and the average price of Bitcoin for the whole year is slightly less than 50,000 US dollars.

In the second quarter of this year, Bitcoin fell by about 50%, but this actually helped to strengthen the fundamentals. We believe that in 2022, Bitcoin has a greater potential to break through $100,000 than to remain below $50,000.

secondary title

Ethereum Bull MarketWhat might stop the Ethereum bull run in 2022? The answer, perhaps unexpectedly: higher prices.

At present, the market demand is increasing, but the supply is falling, and the centrality of Ethereum in the field of financial and currency digitization is the basis for its further price appreciation. Ethereum has been the best-performing major crypto asset in 2021. After falling by about 60% in the first half of the year, ETH began to turn bullish in the second half of the year.The Ethereum bull market price range may be between $4000-5000.

Heading into 2022, there are likely to be two trends for Ethereum: rising adoption and falling supply. In 2021, Ethereum has withstood a sharp correction, and the key question now is how long it may take for the price of Ethereum to pull back. According to our analysis, there may be a new bull market for Ethereum, of course, the analysis is based on the background of Ethereum falling to the July low, and finally established that $4,000 should be the key resistance level for Ethereum, and $2,000 is the key support level.

You see, future resistance is now support, and $4,000 could be a key pivot point into 2022.

Bottom: No reason to complicate a bull market.

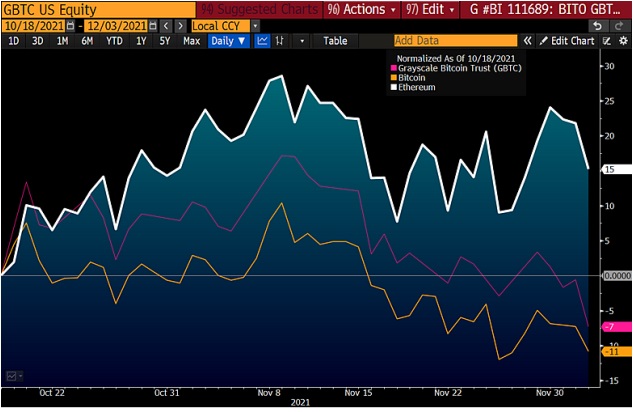

Ethereum is still the platform of choice for NFTs and encrypted dollars. This situation has emerged and played out in 2021, and we expect 2022 to build on this and successfully breed greater market competition. Of course, we have all seen many cryptocurrencies known as "Ethereum killers", but in the end they still failed to shake the status of Ethereum.Who Are the Biggest Beneficiaries of a Bitcoin ETF? Answer: Ethereum.

The fact that ethereum has gotten better since the U.S. launched the first exchange-traded fund to track bitcoin could point to a more sustained bull run for ethereum. October 19th. The Proshares Bitcoin Strategy ETF (BITO) officially launched on a day when ethereum was up about 20% while bitcoin was down about 8%. Ethereum seems to be in the early stages of becoming Internet collateral, and Ethereum is also becoming the center of DeFi, fintech and NFT building platforms.

Bottom: Ethereum’s performance since the launch of the Bitcoin ETF in the US.

In 2021, the Ethereum protocol will change (EIP-1559). Against this background, the supply of ETH will begin to decrease. Since then, CME Group has seen an increase in trading volume and open interest in Ethereum futures contracts. If it is considered an indicator, it should only be a matter of time before regulators approve futures-based Ethereum ETFs.

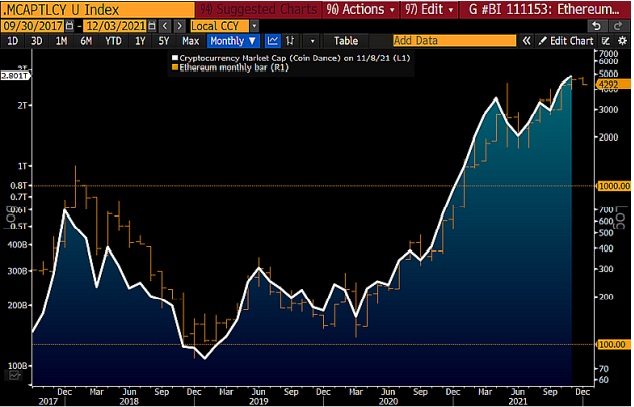

The Rise of Crypto, DeFi and Ethereum. Ethereum has always been at the forefront of leading the wave of digitization, tokenization, DeFi, fintech and NFT. According to our chart analysis, the price of Ethereum remains roughly in parallel with the total market capitalization of cryptoassets from Coinmarketcap. Most NFTs are denominated in Ethereum, which means that as the NFT ecosystem continues to expand, the market's demand for ETH will also increase. Bitcoin is gradually becoming the global digital reserve asset, while Ethereum is being used as collateral for the internet. At present, the most widely traded encrypted assets (Tether) are encrypted dollars and Ethereum tokens, and the most popular earning game Axie Infinity is also running on the Ethereum network.

Bottom: Ethereum – Crypto platform, collateral for the Internet.

Ethereum has gained depth and dominance. The success of Ethereum will stimulate market competition, and then more potential Ethereum killers will emerge, but we have seen that Ethereum can respond well to market adjustments and continue to maintain its market leadership.Ethereum supply may be in free fall.

A lot can go wrong with Ethereum upgrades, however, the incremental supply of ETH has started to continue to decline, which means that ETH will become more mature - if the rules of economics apply - a situation that is clearly beneficial for the price of ETH . The graph below depicts the 52-week rate of change in the number of new ETH tokens versus total outstanding, following the implementation of Ethereum EIP-1559, as supply began to decrease in early August, and the rate of ETH burns is becoming faster and faster It is on track to fall below 4% for the first time. Although the market demand for Ethereum is not so immediate, its supply may end up being lower than that of Bitcoin.