แอปพลิเคชัน Airdrop กำลังจะสิ้นสุดลง จะประเมิน Celestia (TIA) ได้อย่างแม่นยำได้อย่างไร

ต้นฉบับ - โอเดลี่

ผู้เขียน - อาซึมะ

เมื่อวันที่ 27 กันยายน เครือข่ายบล็อกเชนแบบโมดูลาร์ Celestia ได้เปิดตัวการกำเนิด Airdrop ของโทเค็นดั้งเดิม TIA หน้าต่าง Airdrop จะเปิดเป็นเวลา 20 วัน จนถึงสิ้นสุดเวลา 20:00 น. ตามเวลาปักกิ่ง คืนพรุ่งนี้ (17 ตุลาคม)

ตามแผนของ Celestia นั้น TIA ที่อ้างสิทธิ์โดย airdrop จะถูกเพิ่มโดยตรงไปยังที่อยู่ (รูปแบบที่เริ่มต้นด้วย celestia) ที่ผู้ใช้กรอกไว้เมื่อสมัครพร้อมกับการเปิดตัว Celestia mainnet แม้ว่า Celestia ยังไม่ได้ประกาศเวลาเปิดตัว mainnet ที่เฉพาะเจาะจง แต่ในวันนี้เมื่อ OKX Ventures ประกาศการลงทุนอย่างเป็นทางการใน Celestia Labs ก็กล่าวว่าเครือข่ายจะเปิดตัวในปลายปีนี้ ซึ่งหมายความว่า TIA จะเข้าสู่การหมุนเวียนอย่างเป็นทางการภายในปีนี้ .

เมื่อพิจารณาถึงการแจกแจง Celestia จำนวนมากในรอบนี้ (มีนักพัฒนาทั้งหมด 7,579 คนและที่อยู่ 576,653 แห่งที่มีสิทธิ์) ผู้ใช้จำนวนมากมีคุณสมบัติที่จะสมัครเข้าร่วม TIA ดังนั้นพวกเขาจะสงสัยโดยธรรมชาติว่าจะประเมินค่า TIA ได้อย่างถูกต้องและควรทำอย่างไร คุณควรทิ้งชิปแอร์ดรอปในมือในราคาเท่าไร

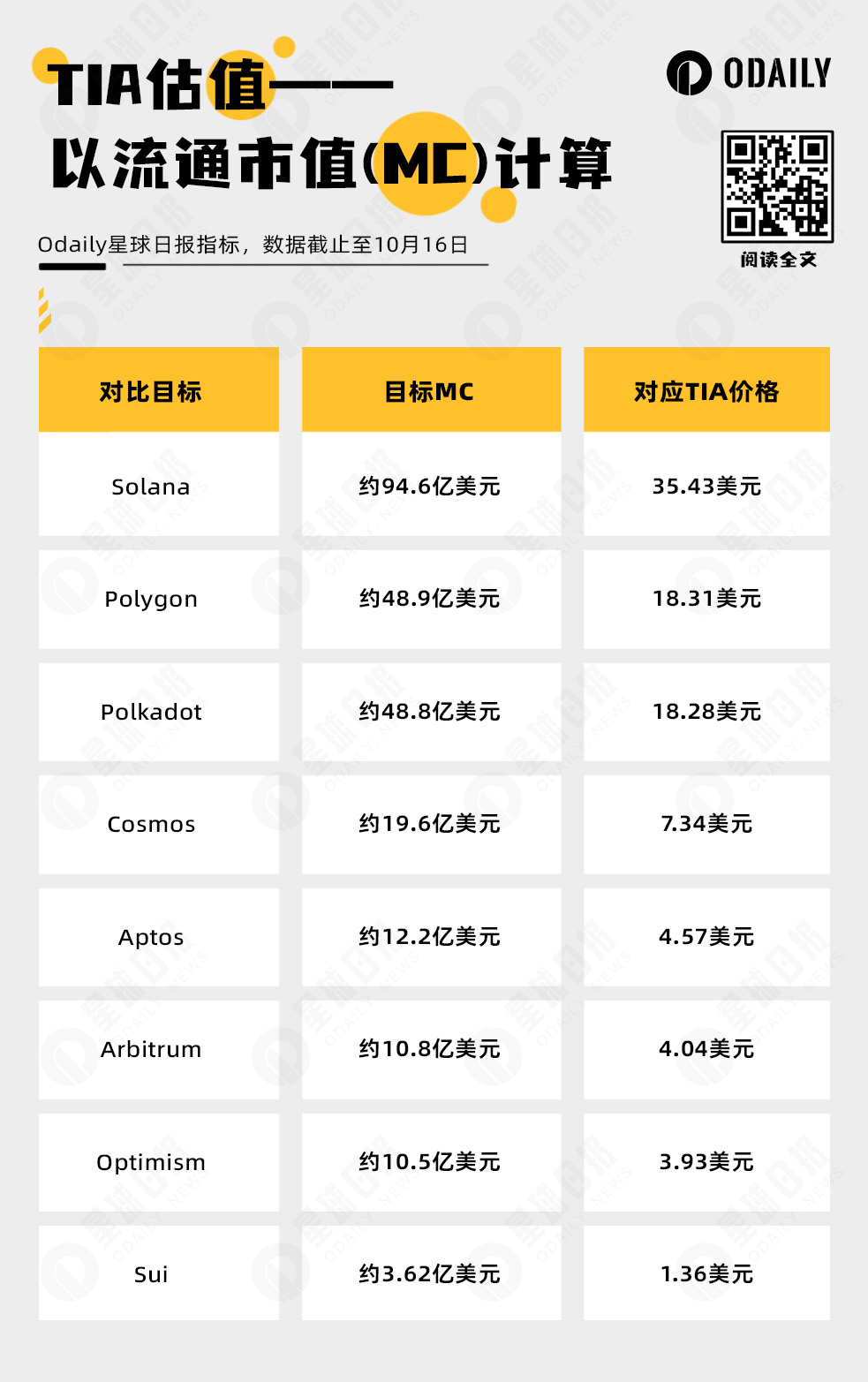

ต่อไป เราจะเปรียบเทียบเครือข่าย L1/L2 หลักแปดเครือข่าย เช่น Solana, Polygon, Polkadot, Cosmos, Aptos, Optimism, Arbitrum และ Sui โดยอิงตามวิธีการคำนวณสองวิธี: มูลค่าตลาดหมุนเวียน (MC) และการประเมินมูลค่าที่ปลดล็อคโดยสมบูรณ์ (FDV) เพียงเก็งกำไรราคาเฉพาะของ TIA หลังจากที่มีการหมุนเวียน

คำนวณเป็น MC

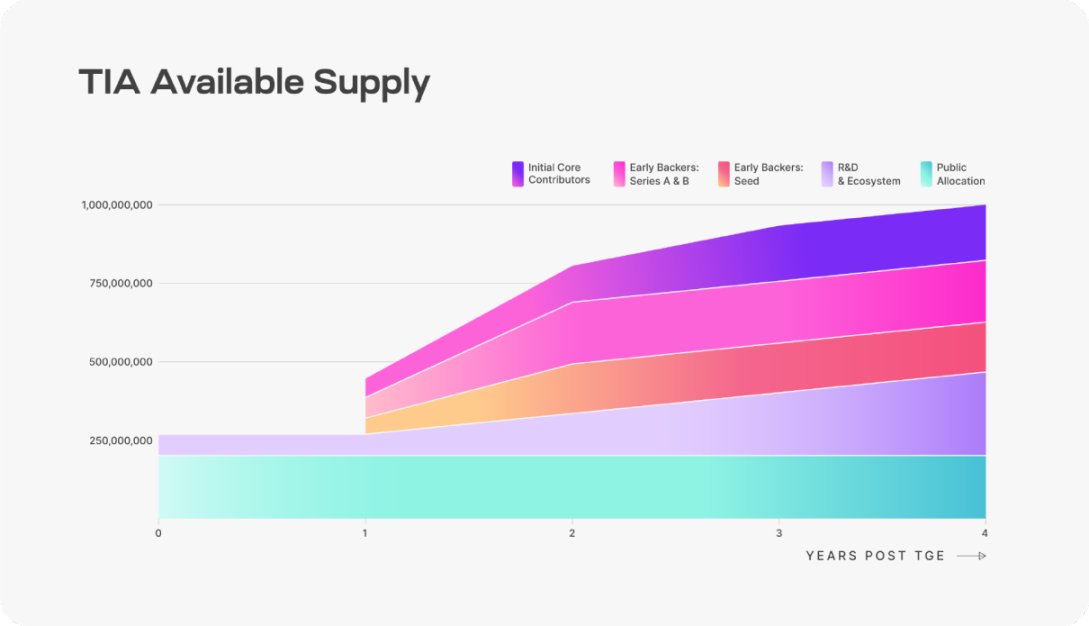

ตามแบบจำลองทางเศรษฐกิจโทเค็นของ TIA ในช่วงแรก ๆ ของ TGE อุปทานหมุนเวียนของ TIA อยู่ที่ประมาณ 267 ล้านเหรียญ (26.7% ของอุปทานทั้งหมด) ประกอบด้วย 20% ของส่วนแบ่ง สาธารณะ โดยเฉพาะและส่วนเล็ก ๆ ของ RD และระบบนิเวศ มีองค์ประกอบร่วมกัน

เมื่อคำนวณจากข้อมูลนี้ การคาดการณ์ราคาของ TIA ที่ได้รับหลังจากเปรียบเทียบ MC ของเครือข่ายหลักทั้ง 8 เครือข่ายจะเป็นดังนี้:

คำนวณเป็น FDV

ในทำนองเดียวกัน เราสามารถคำนวณแยกกันตามการประเมินมูลค่าที่ปลดล็อคทั้งหมด (FDV) อุปทานรวมของ TIA คือ 1 พันล้าน และการคาดการณ์ราคาของ TIA ได้มาจากการเปรียบเทียบ FDV ของเครือข่ายหลักทั้งเจ็ด (Cosmos มีการหมุนเวียนอย่างสมบูรณ์ ข้อมูลจะเหมือนเดิม) ดังนี้

สรุป

เมื่อนำมารวมกัน โดยการเปรียบเทียบผลการคำนวณที่แตกต่างกันของ MC และ FDV จะเห็นได้ว่าการประมาณการราคาของ TIA กลับไปอยู่ที่ช่วง 4-6 US$ ภายใต้สถานการณ์ต่างๆ อย่างไรก็ตาม ควรเน้นย้ำว่าเนื้อหาข้างต้นเป็นเพียงการประมาณการคร่าวๆ ของราคา TIA ที่จัดทำโดย Odaily ตามโครงการที่มีการวางตำแหน่งที่คล้ายคลึงกัน และไม่เกี่ยวข้องกับคำแนะนำในการซื้อขายใดๆ

เนื่องจากแนวคิดแบบโมดูลาร์ที่ Celestia นำเสนอนั้นค่อนข้างใหม่ และการจำหน่ายชิปโทเค็นในช่วงแรกของการจำหน่ายนั้นค่อนข้างพิเศษ จึงไม่มีใครสามารถตัดสินประสิทธิภาพเฉพาะของ TIA ได้อย่างแม่นยำหลังจากการเข้าจดทะเบียน

สิ่งสุดท้ายที่ฉันอยากจะเพิ่มคือไม่นานก่อนที่จะเผยแพร่บทความนี้ OKX Ventures ได้ประกาศการมีส่วนร่วมในการจัดหาเงินทุน Series B ของ Celestia Labs ซึ่งอาจหมายความว่า OKX จะเป็นหนึ่งในแพลตฟอร์มสนับสนุนแรกๆ ของ TIA ผู้ใช้ที่สนใจสามารถ เริ่มเตรียมการล่วงหน้า