48時間以内に「強気市場」:SECがビットコインETFを延期、それに反応して市場は下落

オリジナル - 毎日

著者 - ルーピー・ルー

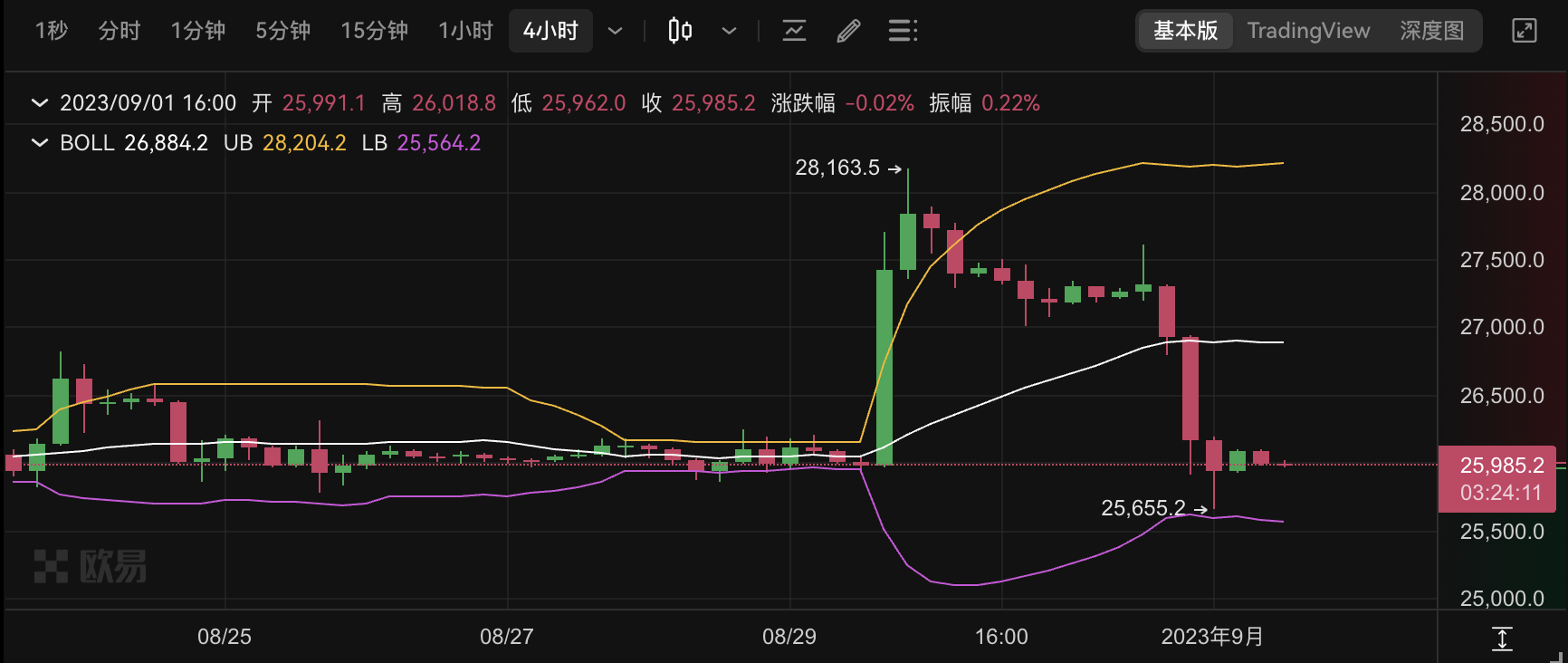

8月30日、グレイスケールはSECに対する訴訟で勝訴した。これに応じて市場は急騰し、ビットコインは一時2万8000ドルを突破した。グレイスケールの司法勝利により、人々は米国でスポットビットコインETFが間もなく承認されることに大きな期待を寄せており、仮想通貨界のこの「野望」は手の届くところにあるようだ。毎日、すぐにレポートと分析がフォローアップされました。「複数の見解: グレースケールが勝訴しますが、ビットコインスポットETFはどのくらい離れていますか?」 》《解釈: グレイスケール社が勝訴したが、SEC は依然として BTC ETF を承認できない》。

しかし、ホイドゥ氏が訴訟に勝ったという朗報から48時間以内に、またも予想外の変化が起きた。

米証券取引委員会は本日、ビットコインのスポットETFの承認を遅らせる必要があると発表し、ウィズダムツリー、ヴァルキリー、インベスコが提案した少なくとも3つのスポットETFの承認を延期した。製品に関する決定は少なくとも10月中旬まで延期される。

明日も明日も明日はたくさんある

SECがビットコインETFの発行を延期したのは最近ではこれが初めてではない。

6月中旬、ブラックロックはビットコインスポットETFを申請し、仮想通貨市場に明らかな強気ムードを引き起こした。 SECは7月下旬、ブラックロックを含むビットコインスポットETF6銘柄の上場申請を承認するか拒否するかの審査を開始した。(注:具体的には、BlackRock iShares Bitcoin Trust、Fidelity Wise Origin Bitcoin Trust、WisdomTree Bitcoin Trust、VanEck Bitcoin Strategy ETF、Invesco Galaxy Bitcoin ETF が含まれます。)

一般に、SEC は問題が連邦公報に掲載されたときに正式に審査を開始します。レビュー期間のデフォルトは 45 日間のみです。ただし、審査期間は延長される場合があります。

したがって、審査結果を遅らせることは、SECが繰り返し試みてきたトリックとなっている。

今年の「ETF波」は「シスター・ウッド」のARKに遡ります。 5 月 15 日、ARK 21 株ビットコイン ETF が連邦官報に掲載されました。 9兆ドル以上を運用するブラックロックは6月にビットコインETFを申請し、業界に興奮の波を引き起こした。 SEC は 7 月 19 日に連邦公報に基金の提案を公表し、委員会がこの商品を裁定するまでの 45 日間のカウントダウンを開始しました。

しかし、これまでのところ、SEC はこれらの ETF について決定を下していません。

8月11日、SECはアーク・インベストメント・マネジメントと21シェアーズのビットコインETF申請の審査時間を再び延長した。 SEC の審査規則に基づき、審査は最大 240 日間延長できます。

もちろん、今日再び延期されたETF申請も同様です。 SECの提出書類には、ウィズダムツリーのETF申請が10月17日まで延期されたことが記載されている。

SECは遅延の具体的な理由を明らかにせず、最終決定を遅らせることに全力を尽くしているようだ。 「欧州委員会は、規則変更案とその中で提起された問題を検討するのに十分な時間を確保するために、規則変更案に対する措置を講じる期間を長く定めることが適切であると考えている。」

価格は下落し、市場の方向性は混乱している

SECが延期を続ける中、市場は再び市場全体に対して悲観的な予測を立てている。

Coinglassのデータによると、過去24時間でビットコインは4,889万ドル、ETHは2,876万ドルが清算されました。

最大 240 日の審査期間内に、45 日、45 日、90 日、60 日という重要な決定を下す必要があるポイントがあります。SECは3回延期した場合、承認か否かの最終決定を下さなければならず、手続き上240日を過ぎると再度決定を延期することができなくなる。

市場の期待の変化により、Kラインのトレンドも完璧な形の「ゲート」を引くことができ、ビットコイン価格は一時2万6000ドルを下回る場面もあった。 ETF問題はいつ決着するのか、人々は疑問を抱かずにはいられない。

この延期のずっと前から、一部のアナリストはこの延期の発生を予測していました。ブルームバーグのアナリスト、ジェームス・セイファート氏は8月15日、9月初旬の審査期限には審査結果が反映されない可能性があるとの見方を示した。同氏は審査が遅れるのは必至だと考えており、最終期限である1月10日のほうを懸念している。

グレイスケールが訴訟に勝ち、クジラが利益を得る

市場動向から判断すると、グレイスケールの勝利は、市場を強く刺激した今回のETF物語の最高点である。

しかし、事実が徐々に明らかになるにつれて、人々はグレイスケールの勝利が本当に BTC の勝利なのかと疑い始めました。グレイスケールは SEC に対して司法上の勝利を収めましたが、グレイスケール GBTC がスポット ETF に転換できることを意味するものではありません。

ブルームバーグTVアナリストのソナリ・バサク氏は、「これはGBTCが自動的かつ即時にETFに転換するという意味ではない。裁判所が述べたように、それは米国SECがなぜグレースケール提案商品ではなくビットコイン先物ETPを承認したのか説明できなかったことを意味するだけだ」と述べた。同氏は、両国が判決を再検討する45日間の上訴期間を含め、まだ長いプロセスが必要であり、SECは完全な審問を要求することもできると付け加えた。 「グレイスケールがGBTCをETFに転換するために申請書を再提出する必要があるかどうかは不明だ。」

簡単に言えば、裁判所はグレースケールを拒否する SEC のプロセスが規則に準拠していないと考えているだけであり、それ以上のことではありません。再度審査プロセスを経た後でも、SECは他の理由を利用してGrayscaleの申請を再度拒否することができる。しかし、このような曖昧なニュースは市場に強い刺激をもたらした。

そして、グレースケールが訴訟に勝つ前に視点を戻すと、訴訟に勝つ前の数日間、巨大なクジラが継続的に展開し、多額の利益を上げていたことを見つけるのは難しくありません。

サンティメントの監視データによると、10~10,000 BTC を保有するウォレットは、Grayscale の勝利のニュースが発表される前日に、BTC の保有額が 4 億ドル近く増加しました。証拠は不足していますが、取引業務に基づいて、クジラのアドレスがグレイスケール社の SEC に対する訴訟の結果を事前に知っていたのではないかという疑いがあります。

グレイスケールの勝利により、巨大クジラが去る機会が生まれたようだ。 Grayscale が訴訟に勝つ前に、市場価格で 8 億 2,200 万ドル相当に相当する 30,000 BTC 近くが CEX に送金されました。

ウー・ジハン氏の仮想通貨金融会社マトリックスポートのリサーチディレクター、マーカス・ティーレン氏は8月29日、「ビットコインをロングし、厳密に損切りをするだろう。米国債の利回りは低下し、米国のハイテク株は上昇すると予想される」と述べた。

“buy the rumor, sell the news”

ニュースに従ってトレードすることは常に危険であり、ニュースが公開された直後に即座にトレード反応を起こすことは困難です。

わずか48時間で市場は再び浮き沈みを経験し、原点に戻った。巨大クジラのグループが利益を上げた可能性がある一方で、別の個人投資家のグループは大規模な清算を経験している。

ブルームバーグの上級ETFアナリスト、エリック・バルチュナス氏は、SECがETF申請を遅らせても驚かないと考えている。同氏は、見直し期間のスケジュールは重要ではないと主張した。 「SECがある時点で撤回する可能性は依然としてあり、最終的にはこれらの申請が承認されることになるだろう。」 同氏は、ビットコインスポットETFが今年発売される確率は75%で、2019年までに発売される可能性は75%であると予測した。遅くとも 2024 年末には 75%、95% に達します。

ETFの効果が一巡し、市場は再び悲観に向かっている。スポットビットコインETFの承認が市場に大きな後押しをもたらす可能性があると多くの人が信じているが、その出来事はまだ遠すぎる。

9月に入ると、市場は再びマイナスに転じます。歴史的に、9月はビットコインにとって最悪の月だった。 2013 年から現在まで、ビットコインが月次利益を達成したのは 9 月の 2 回(2015 年、2016 年)だけで、残りの年は損失でした。

おそらく、長期的には市場の動向に対してまだ忍耐強くなる必要があるでしょう。 9月に予想される大きなポジティブな出来事はありません。10月にイーサリアム先物ETFが承認される可能性は、市場を動かす次の大きな出来事になる可能性がある。