"Weekly Editor's Picks" is a "functional" column of Odaily. On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Therefore, every Saturday, our editorial department will select some high-quality articles that are worth spending time reading and collecting from the content published in the past 7 days. You bring new inspiration.

Now, come and read with us:

DeFi

Therefore, every Saturday, our editorial department will select some high-quality articles that are worth spending time reading and collecting from the content published in the past 7 days. You bring new inspiration.

Now, come and read with us:

Under the DEX dilemma, what problems does Uniswap V4 solve?

Because of MEV, no price advantage, gas fees, LPs cannot make money, etc., DEX still cannot directly compete with CEX. The story told by Uni v4 includes customizability (Hook) and extreme cost reduction (The Singleton and bookkeeping), which solves the following problems:

MEV: v4's liquidity provider's internal MEV allocation mechanism will have the opportunity to alleviate the current MEV problem.

Price: The introduction of market makers and price limit trading will alleviate this problem.

LP income: Insufficient LP income comes from three aspects—insufficient transaction volume, gas fees, and impermanent loss—the essential reason for insufficient transaction volume is that DEX is not as good as CEX in terms of product power. V4 is working on solving this problem, and Gas fees Reduction is a problem that v4 mainly solves, and impermanent loss needs to be solved through order book market making-in the future, developers may build a price limit exchange based on Uniswap v4.

Don't ignore the existing competitors on the DEX track, such as Curve, TraderJoe, iZumi, etc.

Uniswap Evolution History: Opportunities and Impacts of V4

Uniswap V4 will also have potential impacts and opportunities on the following tracks: aggregators, customized DEX and similar liquidity customization function protocols, CEX, MEV tracks, oracles.

The V4 code has not yet been finalized and reviewed, so it will take some time before the official public release. This is a window period for many protocols to develop their own liquidity and adjust their development direction.

Binance Research: When liquidity staking meets DeFi

Contributing factors to LSDFi's growth include the growth of staked ETH, and the current low penetration of LSDFi. Currently, the TVL of the LSDFi protocol represents less than 3% of the total accessible market.

While LSDFi presents attractive opportunities for LSD holders, users should be aware of associated risks, including but not limited to slashing risk, LSD price risk, smart contract risk, and third-party risk.

Comparative analysis of lending projects on the RWA chain

The introduction of pure blockchain technology cannot solve the separation of judicial power. The RWA lending business does not currently bring the advantages of no need for trust to traditional finance, but instead allows the default risk of traditional finance to be transmitted to the blockchain. Under the background of not being able to achieve no trust, some projects try to solve the industry's difficulties in the way of multi-party trust. This is a rare business innovation.The article also includes examples of five blockchain lending projects: Centrifuge, Maple, GoldFinch, Credix, TrueFi.》。

NFT, GameFi, and the Metaverse

Readers who are interested in specific project conditions are recommended to read "

Inventory of the most complete projects on the RWA track

Where is the NFT trading market headed? Versatile Aggregation and Multi-Chain Competition

The multi-functional aggregated NFT trading market will become the mainstream, and the future NFT trading market will be a multi-functional aggregated one-stop that integrates diversified spot transactions (pending orders + Pool + rarity transactions), leverage (loan + futures), and LaunchPad. style market.

Multi-chain narratives will evolve into multi-chain wars.

Challenges and Opportunities of User Retention in Web3 Games: Talking from Economic Model and Game Design

Effective token economic design in Web3 games is also key to maximizing retention. The focus is on creating a fun and immersive experience for the player, not just focusing on things like asset value.

New ecology and cross-chain

In order to optimize the game, developers need to take some measures against the bot problem.

DODO Research: The ZK Rollup track is getting crowded, what is the first-mover advantage of zkSync Era?

DAO

Nounish DAO: DAO, Governance and the Diffusion of Cultural Symbols

The biggest selling point of zkSync Era compared to zkSync Lite is that it is compatible with EVM and can execute smart contracts written in Solidity or other high-level languages used in Ethereum development, attracting more developers and users to seamlessly connect to the ecosystem. In addition, the transaction cost is 50 times lower than before, and the speed of 20,000 TPS also makes the user experience a long-term improvement compared with Ethereum itself or zk lite.

From the number of agreements, it can be seen that the most mature development in the zkSync ecosystem is the DEX track. Whether it is the traditional Uni v2 fork, ve(3, 3) solidly fork, or DEX with concentrated liquidity, all have achieved good results. On the contrary, the track of lending, derivatives, NFT, or GameFi currently does not have obvious innovation capabilities. With the emergence of applications that attract users, it can be expected that with the deployment of more infrastructure projects including cross-chain protocols, oracles, and stable coins, more interesting DeFi Lego projects will appear.

Nounish DAO: DAO, Governance and the Diffusion of Cultural Symbols

The more proposals to increase the popularity of Nouns, the more people will know about Nouns and its glasses symbol, which may bring more people who are willing to spend money to shoot Nouns NFT, and the treasury will have more funds, more funds And more proposals can be funded to help spread Nouns. Nouns give everyone a feeling: it has formed a flywheel effect. This positive circular effect is formed because of two key factors: simple hierarchical governance and the proliferation of cultural symbols (memes).

hot spots of the week

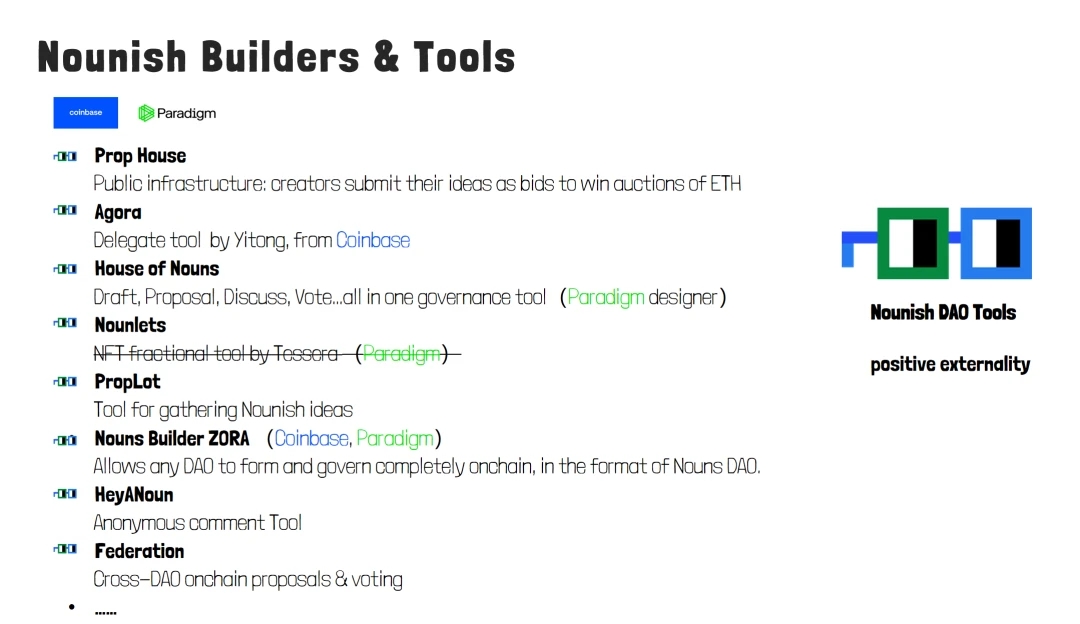

In the past week,Nouns attract a lot of hardcore Builders. The figure below lists some DAO tools developed in the community. Many of the developers have working backgrounds in Coinbase, or their projects are invested by the excellent organization Paradigm.,EDX Marketshot spots of the weekIn the past week,,SEC Approves Volatility Shares' Bitcoin ETF Application, First Leveraged Cryptocurrency ETF,Announced the official launch and completion of a new round of financing, informed sources:,Fidelity May Plan to Acquire Grayscale and Submit a Spot Bitcoin ETF ApplicationBakkt delists ADA, MATIC, SOL on grounds of unclear regulation

In addition, in terms of policies and macro markets,Crypto payments firm Wyre to phase out,, users need to withdraw assets before July 14;In addition, in terms of policies and macro markets,U.S. House Financial Services Committee to Vote on Cryptocurrency, Stablecoin Legislation in July;

Russia could legalize cryptocurrency mining as early as 2024,Informed sources:OpenAI is considering creating an app store for AI softwareIn terms of opinions and voices, Powell:,Coinbase CEO:It would be a mistake to treat stablecoins as a form of money and make the stablecoin issue a weakness for the Fed,Report:Stablecoins, DeFi could be next in SEC crackdown on US crypto,Binance.US:, Hong Kong Financial Secretary Chen Maobo:;

Institutions, large companies and top projects,In the past year, more than 150 Web3-related companies have settled in Cyberport,The problem of USD withdrawal delay has been basically solved, and users are advised to convert USD balances into stable coins,Institutions, large companies and top projects,,Asset Management Firms WisdomTree and Invesco Submit Again for Spot Bitcoin ETF,Bitcoin Miner Core Scientific Files for Chapter 11 Chapter 11,Bloomberg and Other Media Appeal Court Judgment Against FTX,FTX Files Lawsuit Against K 5 Global and Related Entities and Individuals Seeking Recovery of Over $700 Million,OPNX announces oUSD, a credit-based stablecoin, convertible 1:1 with USDT,Bloomberg and Other Media Appeal Court Judgment Against FTX,Wintermute Alleges Wash Trading in Proposed Class Action by Celsius Investors, Denies It,BNB Chain launched opBNB Testnet, a Layer 2 network based on OP Stack,Binance responds to the XIRTAM incident: for the first time, direct claims by victims will be opened,TrueUSD:Binance is integrating the Bitcoin Lightning Network for user deposits and withdrawals,Automatic attestation for TrueUSD has been suspended;

NFT and GameFi fields,TUSD Funds Safe, Unaffected by Prime Trust Deposit Suspension,...well, another week of ups and downs.,Azuki Elementals will be pre-sold on June 28th, Azuki and BEANZ holders will receive a soul-bound token airdrop...well, another week of ups and downs.

With "Editor's Picks of the Week" seriesPortal。

See you next time~