도권은 LUNA 크래시를 어떻게 연출하고 연기했나요?

원본 링크원본 링크

최근 테라리서치포럼의 @FatManTerra 회원은 도권이 UST 언앵커와 LUNA 크래시를 연출하고 연출한 연쇄 데이터를 조사한 결과 이번 폭발의 주범은 사실 도권이 이끄는 테라폼랩스라는 사실을 발견했다.

"인간은 거짓말을 할 수 있지만 블록체인은 거짓말을 할 수 없습니다." - FatMan

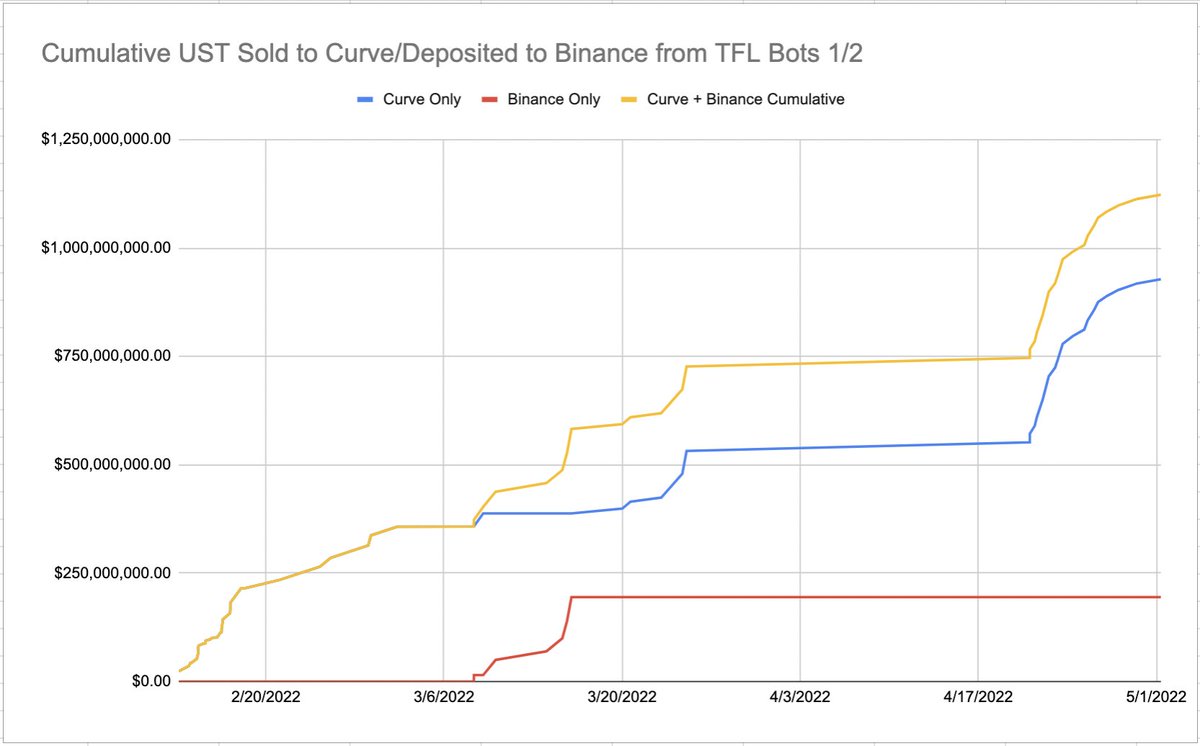

최신 온체인 데이터는 5월 UST 평가절하의 근본 원인을 보여줍니다. depeg 이전 3주 동안 한 기업이 4억 5천만 달러 이상의 UST를 공개 시장에 투매했습니다. 마지막 판매 4일 후 UST는 폭락하기 시작했습니다. 그 엔티티? TFL(Terraform Labs) 외에는 없습니다.

익명의 연구원 @Cycle_22(Hodlnaut의 파산을 발견한 사람)가 수집한 이 방대한 데이터는 TFL이 UST의 분리 이전 기간에 갑자기 총 수억 UST를 판매하기 시작했음을 보여줍니다.

TFL은 UST가"공격"성명. 그러나 이것은 가짜 뉴스입니다. 실제로 TFL 자체가 무책임하게 단기간에 대량의 UST를 매도하여 Curve 풀의 균형을 깨뜨렸습니다. 이는 유동성을 감소시키고 대상의 UST 페그를 심각하게 위태롭게 합니다.

UST 디커플링에 대한 최후의 일격은 누구에게나 전달될 수 있습니다. 얼마나 많은 대형 기관이 UST를 소유하고 있고 TFL의 유동성이 고갈된 것을 본 후 매각을 원할 수 있기 때문입니까? 제네시스, 3AC, Hodlnaut, 점프, 섭씨? 이 목록은 완전하지 않습니다.

$8000만 덤프가 $100억 이상의 생태계를 분리한 방법

요컨대 UST를 상자로 생각하십시오. 실제 달러는 동시에 들어오고 나갈 수 있습니다. 충분한 자금이 남아 있는 한 누구나 즉시 UST 토큰을 실제 달러로 교환할 수 있습니다. 동시에 Anchor의 높은 수익률은 수천 명의 투자자들이 수익률과 "안전"을 위해 자신의 실제 달러를 상자에 넣도록 했습니다.

하지만 실제 달러를 전혀 투자하지 않고 수십억 달러의 UST 토큰을 모은 사람(도권)이 있습니다.그는 LUNA 토큰으로 허공에서 그것들을 인쇄(발행)했습니다. 이 UST는 이제 상자에서 실제 달러를 제거하는 데 사용할 수 있으므로 기본적으로 화폐 인쇄기를 제어합니다.

그런 다음 TFL과 Do Kwon은 생태계에서 최고 속도로 돈을 펌핑하기 시작했습니다. 우리는 이미 27억 달러 이상을 교환한 Degenbox에 대해 논의했습니다. 그러나 앞서 언급한 10억 달러는 그 위에 있습니다! 이것은 UST 디커플링 몇 주 전에 제거되었기 때문에 더욱 심각합니다.

하지만 가장 비열한 부분은 TFL과 도권이 Anchor를 개인 투자자를 위한 저축 상품으로 계속 홍보하고 있다는 것입니다. Terra 백서는 또한 UST가 가격을 안정적으로 유지하고 항상 1달러 상당의 LUNA로 교환할 수 있다고 말합니다(그들이 그것을 버릴 때까지).

그런데 왜 이 모든 일을 합니까?

도권이 마법 상자의 열쇠를 가지고 있기 때문에 그의 목표는 간단합니다.가능한 한 많은 실제 돈을 상자에 넣도록 사람들을 설득하십시오.

그는 권위, 자신감, 안정의 이미지를 투사하며 필요한 수단을 다 동원했지만 조용히 무대 왼쪽을 빠져나갔다.

그렇다면 UST depeg가 시작되면 소매 투자자가 UST 토큰을 투자한 실제 달러로 다시 교환하려고 하면 어떻게 될까요?

즉, 누군가가 달러를 일찍 가져갔기 때문에 돈이 사라지고 상자가 비어 있는 것입니다.

사람들이 돈을 벌기 위해 패닉 매도하면서 UST의 가격은 급락했습니다.

유동성 풀이 고갈되었습니다. 오더북 깊이도 얇습니다. UST는 실제 달러가 시스템에서 인출되었기 때문에 무릎을 꿇고 좀비처럼 얇은 실에 매달려 있습니다.

이 시점에서 필요한 것은 전체 시스템을 다운시키는 동시에 완벽한 희생양이 되는 하나의 대규모 UST 매도 주문입니다.

LFG는 이익의 작은 비율로 가격 페그 방어를 토큰화했지만 UST를 절약하지는 못할 것입니다.

감사 결과 47,000 비트코인이 Jump Crypto로 전송된 것으로 나타났지만 거래 로그/증거는 없습니다.UST 디커플링 이벤트에 대한 Jump의 연결은 더 철저히 조사해야 할 많은 질문을 남겼습니다.

우리는 Do Kwon이 자신의 베이시스 캐시 연결에 대해 대중에게 거짓말을 하고 Terra 스테이블 코인을 더 강력하고 안정적으로 보이도록 온체인을 속였다는 것을 이미 알고 있습니다.

그러나 오늘 우리가 밝혀낸 사실은 그가 저지른 사기와 사기에 새로운 차원을 제시합니다.

2021년 내내 체계적으로 UST를 소매 투자자들에게 "덤핑"하는 동시에 UST 스테이블 코인 내러티브를 홍보하는 것이 중요합니다. 그런데 4월 22일 말에 자진해서 UST에 유동성 경색을 가하고 직접적으로 UST를 분리시킨 다음 다른 사람을 탓하면서 사과하는 척하는 것은 믿을 수 없을 정도로 비열하고 한심합니다.

예, TFL은 소매 투자자를 노렸습니다. 우리는 이것을 알고 있습니다.

그러나 TFL과 도권의 행태는 암호화폐 산업 전체의 시스템적 붕괴로 이어졌고 지금도 우리는 매일같이 통과효과를 느끼고 있다.

그는 기절했고 다른 모든 사람들이 고통받는 동안 회사를 수십억 달러로 채웠습니다.

도권은 여전히 남한 당국으로부터 도주 중이지만 충분한 시간이 주어진다면 국제 조사가 "더 가까워지는" 데 도움이 될 것이라고 굳게 믿습니다.

전 세계는 강력한 메시지를 보내야 합니다. 이 정도 규모의 사기는 처벌을 면할 수 없고 해서는 안 됩니다!

SBF도 마찬가지입니다.

다음은입증하다뛰어난 @Cycle_22 덕분에 이러한 결과에 대한 온체인 증명.

이러한 거래에서 알 수 있듯이 TFL on Curve에서 10억 달러 이상이 판매되었거나 바이낸스로 보내졌습니다.

아, TFL이 모든 UST를 버렸다는 것을 어떻게 알 수 있습니까?

그들은 실수로 자체 감사에서 이것을 인정했습니다.

인간은 거짓말을 할 수 있지만 블록체인은 거짓말을 할 수 없습니다.