솔라나가 죽는다?

이 기사는 Bankless이 기사는

, 원저자: Ben Giove, Odaily 번역가 Katie Koo 편집.11월은 암호화폐에게 힘든 달이었습니다. 시장이 하락하고 대출과 투자가 급감하고 있습니다.암호화 산업의 대규모 정리 해고

이 포스트에서는 솔라나 생태계가 겪었던 힘든 시간을 탐구하고, 네트워크가 어떻게 어려움을 겪었는지, 커뮤니티가 회복력을 보여준 부분에 대해 탐구할 것입니다.

보조 제목

솔라나는 살아남을 수 있을까?

Solana를 포함하여 Alameda Research가 보유한 토큰이 특히 큰 타격을 입으면서 많은 토큰이 더 많이 떨어졌습니다. CoinDesk가 공개한 Alameda의 대차대조표 보고서에 따르면 Alameda는 6월 30일 현재 약 12억 달러의 SOL 토큰을 보유하고 있습니다.

이미지 설명

SOL/USDT. 출처: 트레이딩뷰

최근 하락이 Alameda 자체 또는 트레이더 패닉으로 인한 것인지는 확실하지 않지만 SOL은 FTX/Alameda 충돌 후 몇 주 동안 $35에서 $11(-68.5%)로 급락했습니다.

솔라나가 죽었나요? 반등할까요? FTX 낙진의 영향을 살펴보고 Solana의 미래를 내다봅시다.

네트워크 보안 및 안정성에 미치는 영향

72시간 만에 L1 네이티브 토큰의 60% 하락은 엄청난 "스트레스 테스트"였습니다. 이러한 규모의 폭락은 대출 프로토콜에 대한 부실 부채를 생성할 수 있는 대량 청산을 통해 체인의 DeFi 생태계에 위험을 초래할 수 있으며, 또한 다운타임 가능성(과거 솔라나가 어려움을 겪었던 문제)을 증가시킬 수 있습니다. 네트워크 수준 공격 비용, 안정성 및 보안 위험을 가져옵니다.

보조 제목

사이버 보안

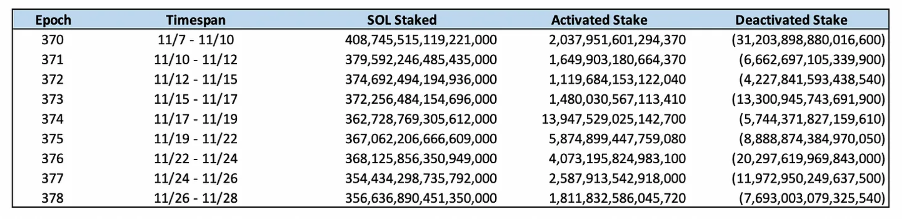

11월 6일 이후 9주기(보통 2~3일 지속)의 순 SOL 가치는 5,460만이며, SOL의 총 미결제약정은 4억 1,120만에서 3억 5,666만으로 13.2% 감소했습니다. 이것은 SOL의 순환 공급량의 약 15%를 나타냅니다.

이미지 설명

주기별 SOL 스테이킹. 출처: 솔라나 나침반

이 중 2,910만 달러(총 순자산의 53%)는 11월 7-10일 사이의 위기 절정기에 스테이킹되지 않았습니다. 결과적으로 네트워크를 보호하는 스테이킹의 달러 가치는 훨씬 더 큰 폭으로 떨어졌습니다. 해당 네트워크를 확보한 SOL의 가치는 147억 달러에서 51억 달러로 65.3% 급감했다.

이러한 유출에도 불구하고(아마도 언스테이킹 잔고가 유동화되는 데 ~3-4일의 지연으로 인해) Solana는 어떠한 보안 문제나 주요 공격도 경험하지 않았습니다. 이 스테이킹 탈출 이후에도 L1은 여전히 스테이킹 보상이 추적하는 PoS 네트워크 중 4번째로 큰 USD 표시 스테이킹을 보유하고 있으며 스테이킹 비율에서 19위를 유지하고 있습니다.

보조 제목

안정

극단적인 시장 상황은 네트워크의 보안과 안정성에 영향을 미칠 수 있습니다. 시장 혼란 기간 동안 체인은 일반적으로 블록 공간에 대한 수요가 급증하기 때문에 사용자와 봇이 미친 듯이 담보를 보충하고 청산을 실행하며 시장 혼란으로 인해 생성된 다른 차익 거래 기회를 포착함에 따라 검증자에게 압력을 가합니다.

Solana는 여러 차례의 성능 저하와 다운타임을 경험하면서 이러한 문제를 처리하기 어렵다는 평판을 얻었습니다. 2021년 9월 이후 네트워크는 총 37시간 11분의 다운타임에 해당하는 4번의 완전한 중단을 경험했습니다.수수료 시장 및 증가된 거래 규모와 같은 다른 업그레이드는 앞으로 몇 달 안에 출시될 것으로 예상됩니다.

이미지 설명

Solana는 위기 기간 동안 다운타임이나 성능 저하를 경험하지 않았기 때문에 이러한 업그레이드는 영향을 미치고 있습니다. 어쨌든 블록체인은 100% 라이브 상태여야 합니다. 그러나 이 기간 동안 솔라나의 성과는 그 역사와 위기의 규모를 감안할 때 주목할 만하며, 이는 네트워크가 더욱 탄력적으로 변하고 있다는 고무적인 신호입니다.

솔라나 DeFi에 대한 시사점

보조 제목

FTX 폭락 이후 솔라나는 심각한 유동성 위기를 겪었습니다.

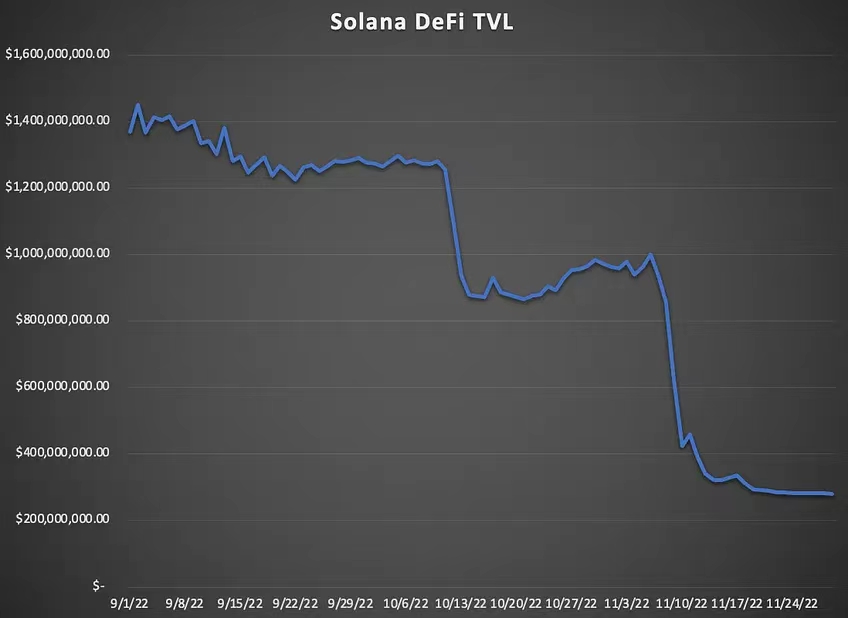

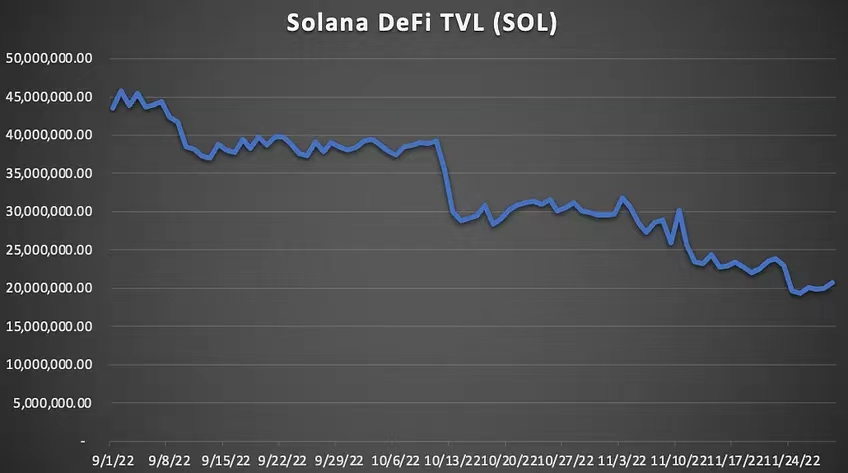

이미지 설명

네트워크의 USD 표시 DeFi TVL은 11월 6일 10억 달러에서 72.1% 하락한 2억 7,830만 달러를 기록했습니다. SOL, ETH 및 BTC와 같은 DeFi 프로토콜에 예치된 많은 자산이 변동성이 있기 때문에 이는 예상됩니다. 따라서 TVL의 하락이 반드시 사용자가 자금을 인출하고 있음을 의미하지는 않습니다.

이미지 설명

솔라나 DeFi TVL. 출처: 아르테미스

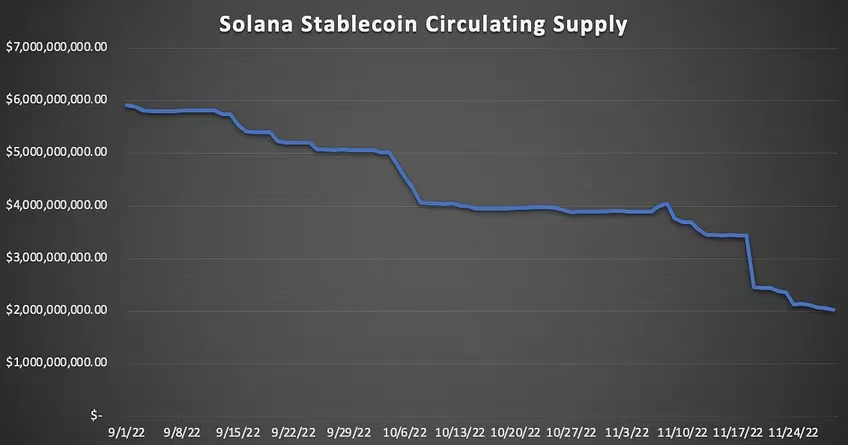

솔라나 플랫폼의 스테이블코인 공급도 최근 몇 주 동안 크게 줄었습니다.

이미지 설명

11월 6일 이후 네트워크의 스테이블코인 시가총액은 39억 달러에서 21억 달러로 46.1% 감소했습니다. 테더의 체인 스왑은 USDT 발행자가 11월 18일에 솔라나에서 이더리움으로 10억 달러의 공급량을 이동시킨 데 따른 것입니다. 이 거래는 위기 이후 전체 스테이블 코인 유출의 55.5%를 나타냅니다.

보조 제목

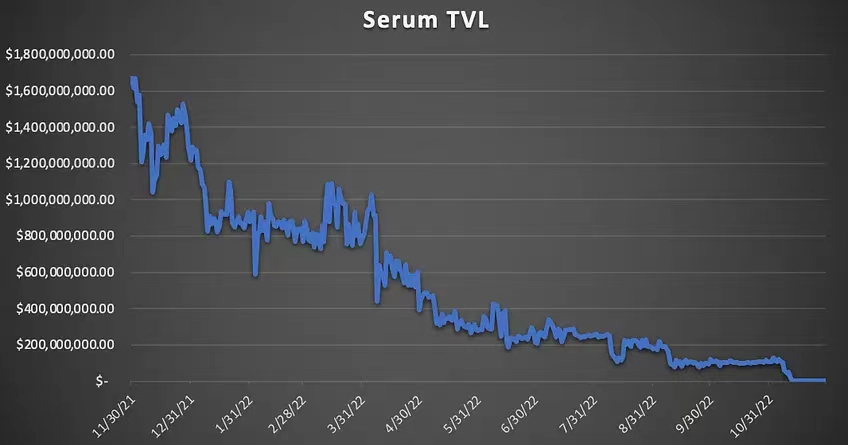

세럼이 치명타를 가한다

많은 DeFi 프로토콜이 FTX의 여파로 심각한 영향을 받았으며 Alameda와 가까운 프로젝트가 가장 큰 타격을 받았습니다. 이들 중 가장 주목할만한 것은 오더북 기반 DEX인 Serum입니다. 그의 거버넌스 토큰인 SRM은 "낮은 플로트, 높은 FDV(완전히 희석된 평가)" 토큰 설계의 포스터 자식이 되어 회사가 부풀려진 가격으로 거래할 수 있도록 합니다. 많은 양의 대출을 얻기 위한 토큰. 지난 3주 반 동안 69.2%의 가격 하락에도 불구하고 SRM은 여전히 FDV에서 24억 달러에 거래되고 있습니다.Serum의 계약은 FTX가 보유한 관리 개인 키에 의해 제어됩니다. 이로 인해 Serum과 Proxy Solana의 생태계가 위험에 처하게 됩니다. Serum의 "딱딱한 양탄자"가 도미노 효과로 이어질 수 있기 때문입니다.

이미지 설명

혈청 USD TVL. 출처: DeFi 라마Solana DeFi 커뮤니티는 또한 세럼 포크(OpenBook)를 배포하여 TVL에서 150만 달러를 유치했습니다. 포크가 살아남을지는 두고 봐야겠지만, "모체 프로토콜 - Serum"보다 위험성이 낮은 유동성 장소로서 Serum 기반 프로젝트에 임시 솔루션을 제공할 수 있습니다.

보조 제목

아래로하지만 밖으로

우리가 본 것처럼 솔라나는 고통을 겪었지만 죽지 않았습니다. SOL의 가격은 SBF 트윗에서 몇 주 전보다 3달러에 가까워졌지만, Solana는 극심한 변동성 이벤트 중에 다운타임이나 성능 저하 없이 네트워크로서 놀라울 정도로 탄력적입니다. 체인은 또한 지금까지 상당 부분의 지분 인출을 견뎌냈습니다. 솔라나의 불안정과 정전의 역사를 감안할 때 이러한 격동의 시기에 원활하게 운영할 수 있다는 것은 네트워크의 미래에 대한 신뢰를 심화하는 데 도움이 될 것입니다.

하지만 솔라나의 미래가 다시 밝다는 말은 아닙니다.

Solana DeFi는 대규모 유동성 유출로 큰 타격을 입었습니다. Serum과 같이 FTX 및 Alameda와 밀접한 관계가 있는 프로젝트가 특히 큰 타격을 받았습니다. 또한 블록체인이 네트워크의 주요 동맹국으로 보는 FTX의 낙진을 떨쳐내는 데 시간이 걸릴 것입니다. 또한 챕터 11 파산 신청을 한 Alameda가 현재 SOL을 얼마나 보유하고 있는지 불분명하며 절차가 진행되는 동안 장부에 남아 있는 자산을 확실히 청산할 것입니다.개발자와 커뮤니티 구성원(이전에 95% 이상의 감소를 경험하지 않았을 수 있음)이 앞으로 몇 달, 몇 년 동안 계속 남아 있을지 생각해 볼 가치가 있습니다.

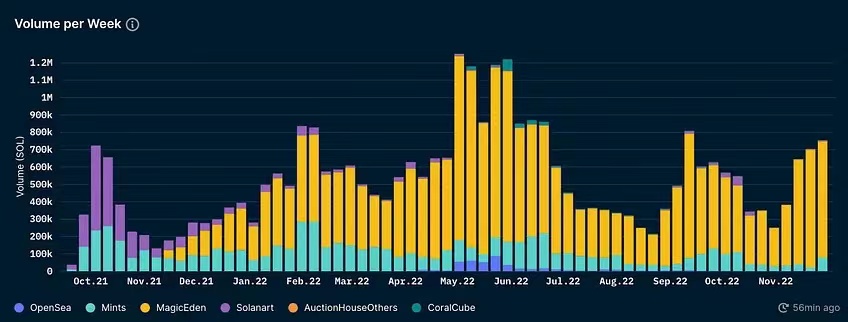

이미지 설명

솔라나 주간 NFT 볼륨. 출처: 난센

즉, Crypto OG는 Solana가 약세장에서도 지속적으로 사용되었기 때문에 SBF의 단순한 "달링" 이상이라는 것을 알고 있습니다. 가장 최근의 블록체인 해커톤에는 750건의 제출이 있었고 SOL로 표시된 NFT 거래는 102% 증가했습니다.장기적으로 솔라나 생태계는 FTX의 약탈적 사업 관행과 자체 토큰 설계에 영향을 받지 않을 것입니다.

따라서 솔라나는 보다 분권화되고 공정한 장소가 될 수 있습니다.