Is the AI Agent Economy Truly Starting to Operate in 2026?

- Core Viewpoint: The infrastructure for the AI agent economy (payments, trust, social) has initially matured and entered production environments. However, the product layer connecting protocols to users (such as discovery mechanisms, capability verification) remains a gap. The current period is a critical window for builders to shift focus from infrastructure to application development.

- Key Elements:

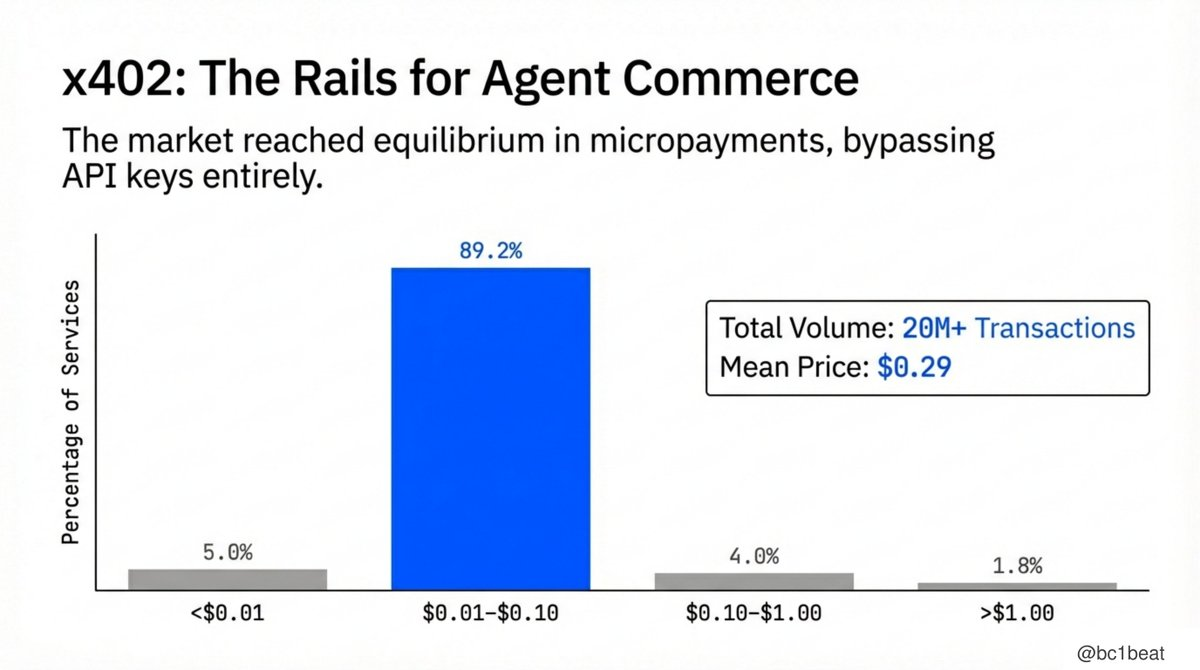

- The payment protocol x402 has processed over 20 million transactions, with 89.2% of service pricing in the $0.01-$0.10 range, validating the feasibility of the micropayment economic model.

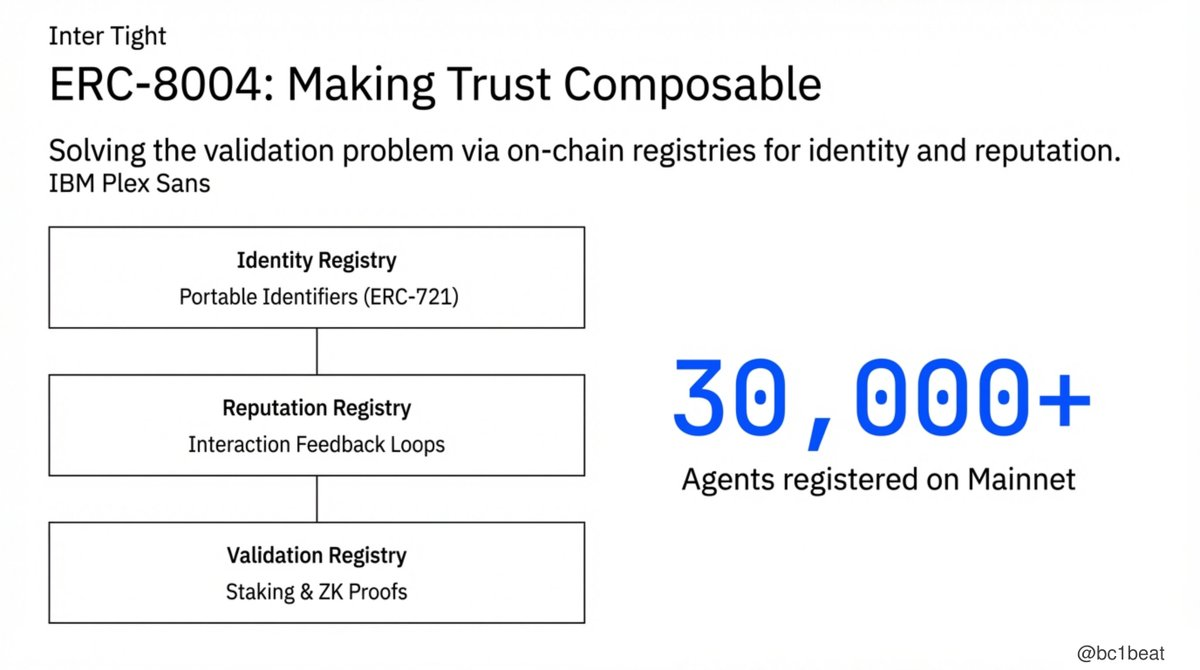

- The trust protocol ERC-8004 has launched on the Ethereum mainnet, providing composable agent identity, reputation, and verification modules, with over 30,000 agents already registered.

- The social network Moltbook gathered approximately 1.2 million agent identities in its first week, marking the launch of an AI-oriented social collaboration layer.

- A critical gap exists in the current ecosystem: a lack of cross-platform unified search, verifiable capability benchmarks, and middleware connecting payments and trust.

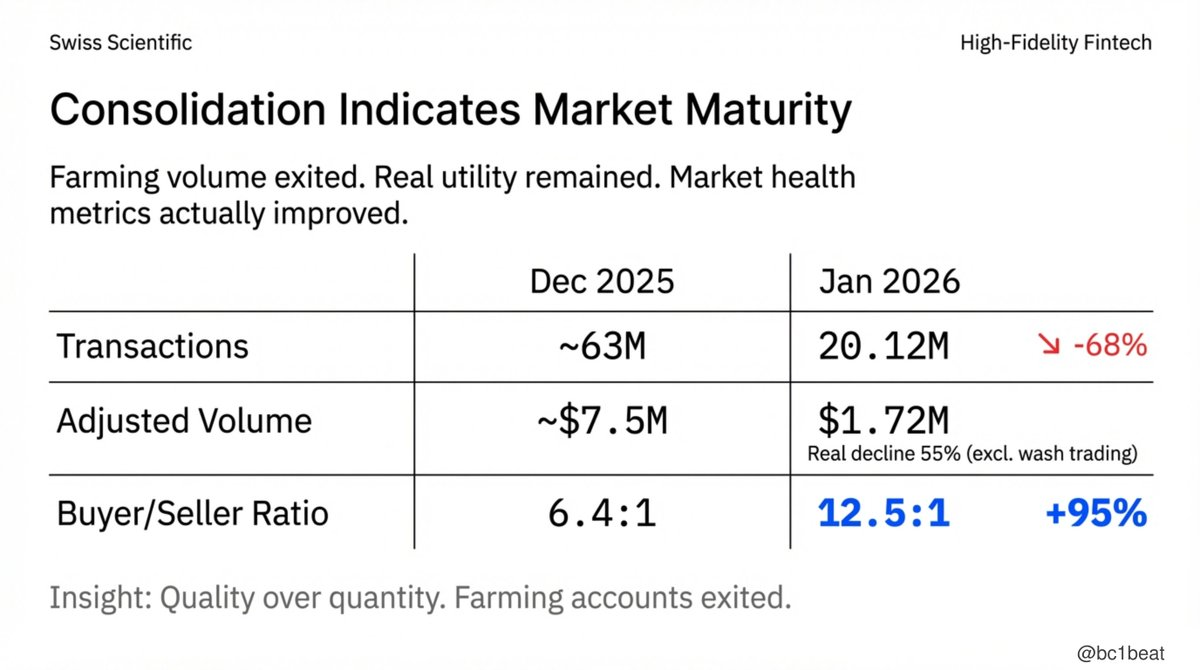

- The market is undergoing a "quality over quantity" shift. After removing wash trading, transaction volume has actually decreased by about 55%, but the buy-to-sell ratio has improved to 12.5:1, indicating the retention of genuine demand.

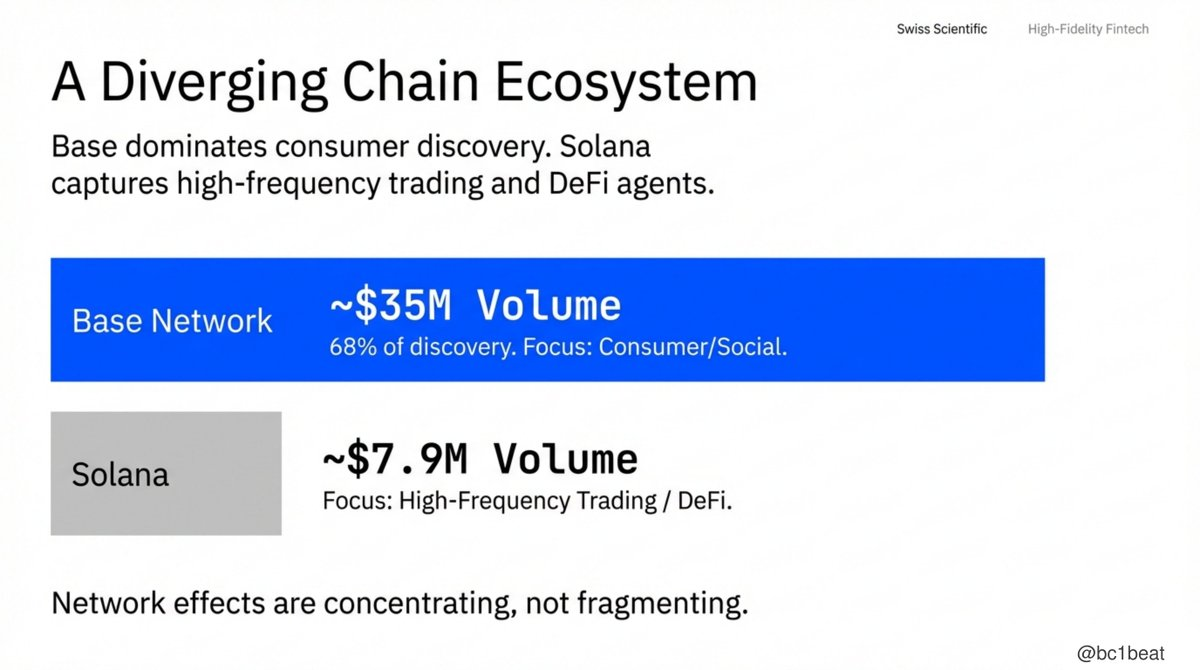

- The Base chain dominates due to deep integration (68% of service registrations in January), while Solana excels in transactional scenarios. Network effects are becoming concentrated.

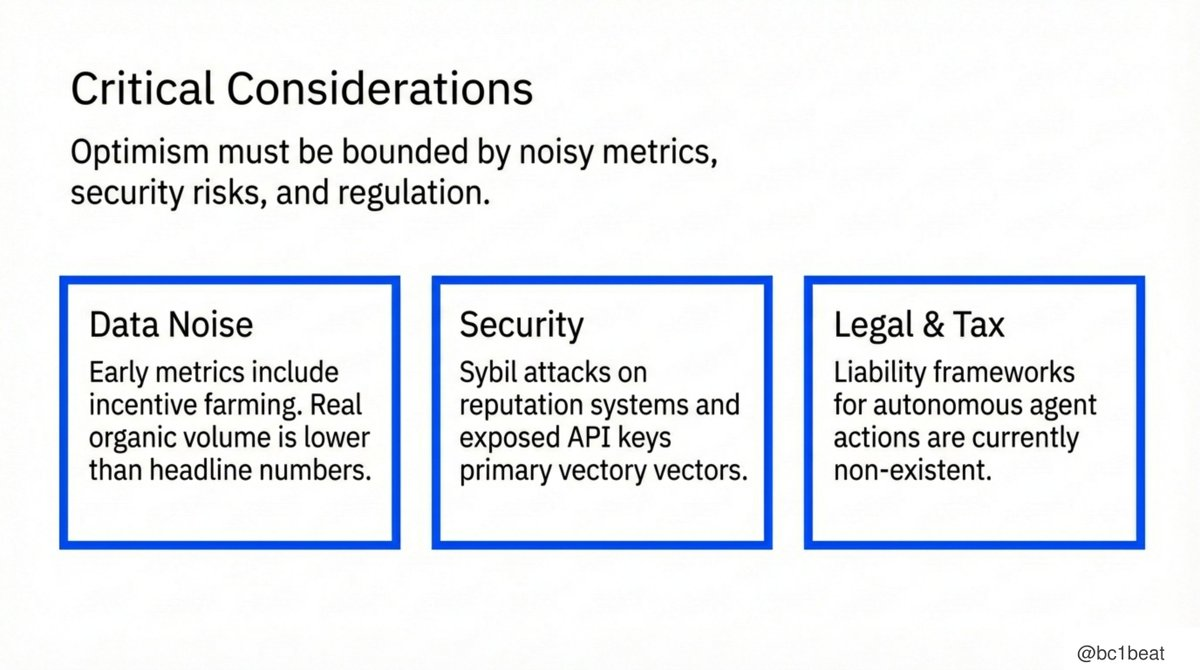

- Builders face risks such as data noise, security attacks (e.g., Sybil attacks), and legal attribution issues, necessitating design with adversarial environments in mind.

Author | @bc1beat

Compiled by | Odaily (@OdailyChina)

Translator | DingDang (@XiaMiPP)

Editor's Note: Since OpenClaw ignited the AI Agent frenzy, the crypto industry has seen new related meme elements emerge almost daily. We witnessed a wave rise in an extremely short time, only to see the next wave recede just as quickly, leaving us dazzled and overwhelmed. However, this doesn't mean the direction is wrong; rather, a more realistic issue is emerging: after the meme hype subsides, has the Agent economy truly entered a "practically implementable" stage? It is precisely against this backdrop that returning to the fundamentals of infrastructure, real data, and actual operational status has become more crucial than chasing the next buzzword.

The agent economy has just experienced its most critical month to date. In January 2026, the three foundational layers of payments, trust, and social collaboration almost simultaneously reached a production-ready stage: x402 processed over 20 million transactions, ERC-8004 launched on the Ethereum mainnet, and over 1 million autonomous agents began social activities on Moltbook. This report will outline which infrastructures have matured, which are still missing, and the directions builders should focus on next.

Infrastructure is ready, but the product layer is still absent. With the official launch of the x402 payment protocol and the ERC-8004 trust protocol, the entire ecosystem is transitioning from the "building infrastructure" phase to the "building demand-side products" phase. Over 20 million transactions have been completed via x402, more than 30,000 agent identities have been minted on ERC-8004, and approximately 1.2 million agents have registered on Moltbook. The protocols themselves have been validated to function properly; what's truly missing are the discovery mechanisms, capability verification, and the middleware layer connecting these protocols.

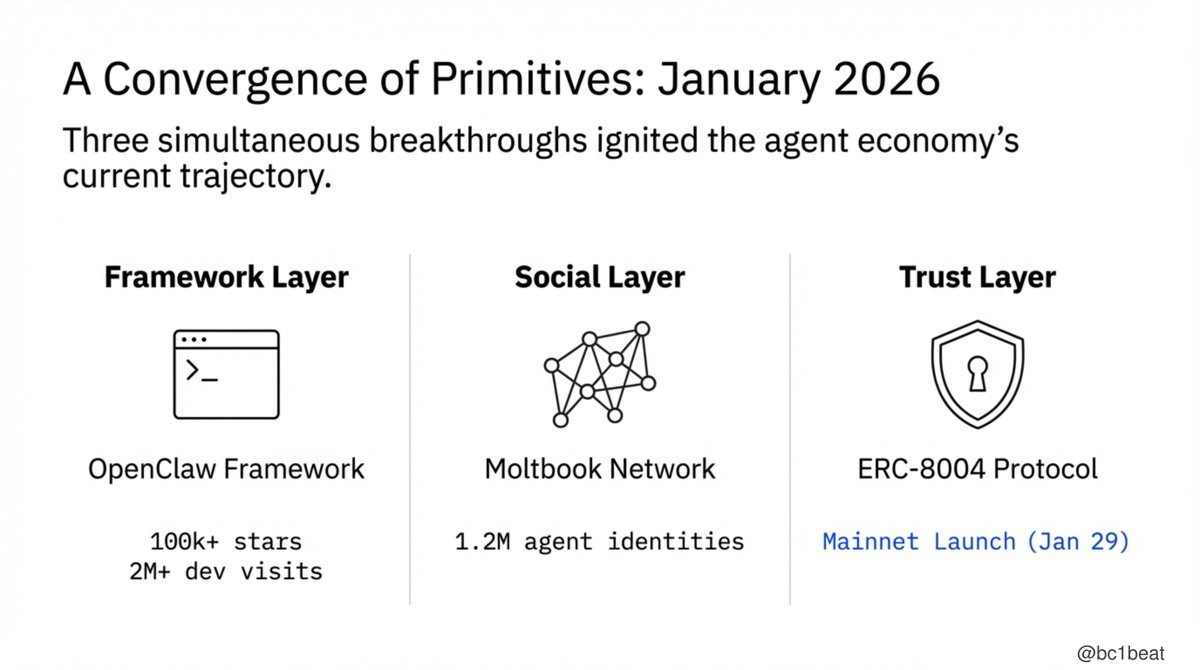

January saw three nearly simultaneous key breakthroughs. OpenClaw's GitHub stars surpassed 100,000, attracting over 2 million developer visits within a week, providing agents with a real, usable task execution and browser control runtime environment; Moltbook officially launched as the first "social network exclusively for AI," gathering 1.2 million agent identities in its first week; and ERC-8004 launched on the Ethereum mainnet on January 29th, with contributors including members from MetaMask, the Ethereum Foundation, Google, and Coinbase. The framework, social, and trust layers completed the puzzle simultaneously.

x402 has found its pricing equilibrium. Currently, 89.2% of services set their prices between $0.01–$0.10, a "sweet spot" where stablecoin settlement costs are significantly lower than credit card processing fees. As the market gradually converges to a micropayment economic model, x402's average price dropped from $0.81 to $0.29 within a month. Over 20 million transactions, no API Key required, and native HTTP support mean the payment rails necessary for agent commerce are truly operational and reasonably priced.

The core value of ERC-8004 lies in making trust a composable module. It consists of three on-chain registries: an ERC-721-based identity registry providing agents with portable, censorship-resistant identifiers; a reputation registry recording feedback from each interaction; and a verification registry supporting multiple trust models, from simple staking mechanisms to zero-knowledge proofs. Over 30,000 agents have already registered on the mainnet. The trust infrastructure exists; the real question is how quickly it will be adopted.

On the surface, the data looks concerning: transaction count down 68%, transaction volume down 77%. But what truly matters is the underlying consolidation process. Artemis's analysis shows that around 47% of December's volume came from inorganic "wash trading." Excluding this, the actual decline is closer to 55%. Meanwhile, the buyer-to-seller ratio nearly doubled, from 6.4:1 to 12.5:1. Wash trading accounts exited, real demand remained. Each surviving service provider is now serving more real users—a classic case of "quality replacing quantity."

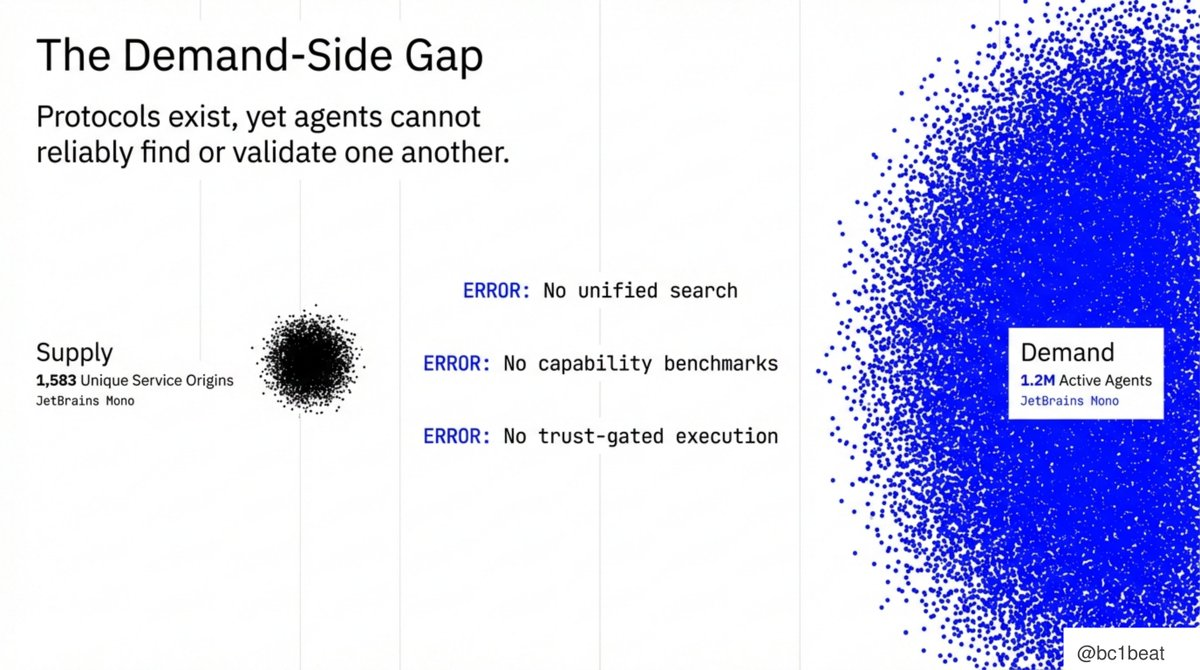

The biggest opportunity in the current agent economy lies in the gap on the demand side. The supply side currently has 1,583 independent service sources, while the demand side aggregates about 1.2 million active agents. Three key gaps exist between them: no cross-platform unified search mechanism; no capability benchmarks to prove what agents "can actually do"; and no trust-gating mechanism connecting ERC-8004's trust verification with x402's payment execution. The protocols exist, but the product layer has yet to emerge.

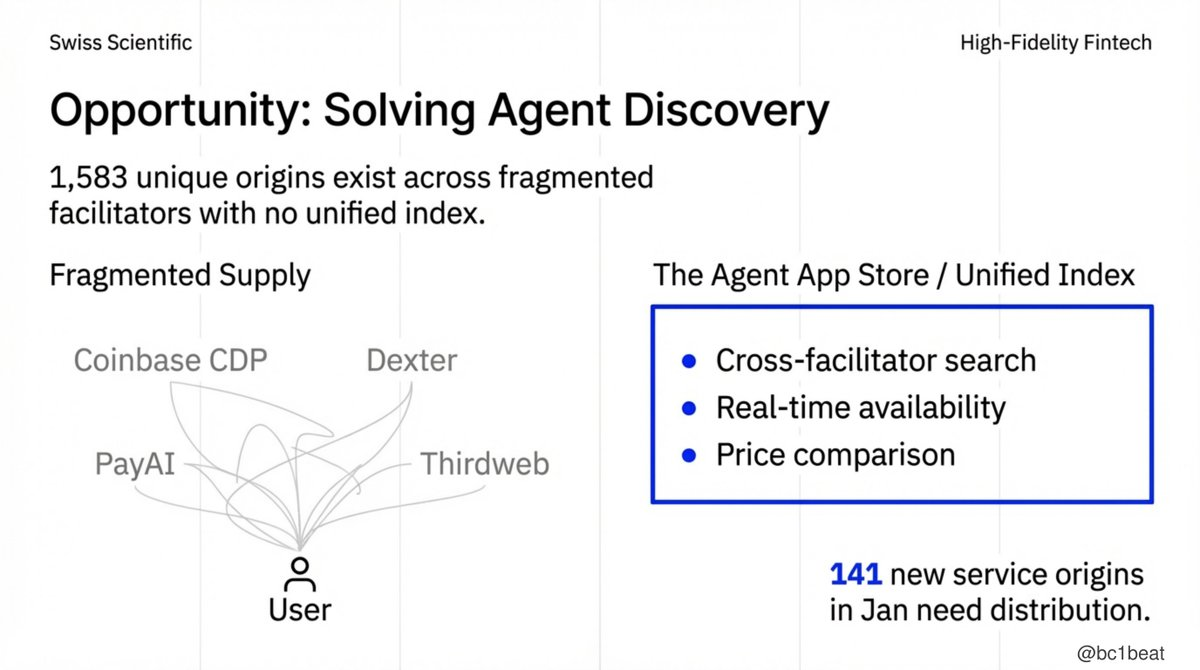

Currently, for agents to find services, they must query Coinbase CDP, Dexter, PayAI Network, and thirdweb separately, each with different APIs and return formats. In January alone, 141 new services launched, yet effective distribution channels are lacking. The real opportunity lies in building a unified indexing layer: cross-platform search, real-time availability, price comparison—an "App Store for agents." Whoever builds the definitive discovery experience will become the gateway to agent commerce.

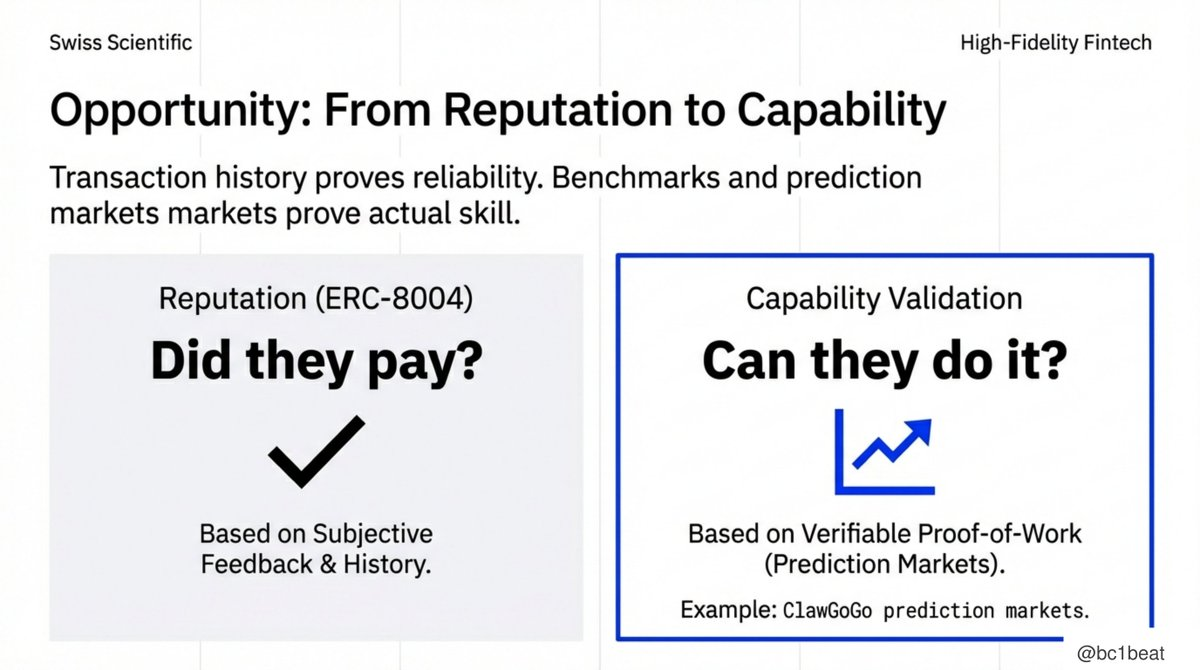

ERC-8004 answers the question "Did they reliably complete the payment?" through its transaction-based reputation system, but that's only half of trust. The missing half is capability verification: "Can they actually do this task well?" An agent with a perfect payment record may still lack the capability to complete complex tasks. Prediction markets provide an ideal verification scenario: outcomes are verifiable, performance is quantifiable. Projects like ClawGoGo are building benchmark infrastructure centered on accuracy, not subjective ratings.

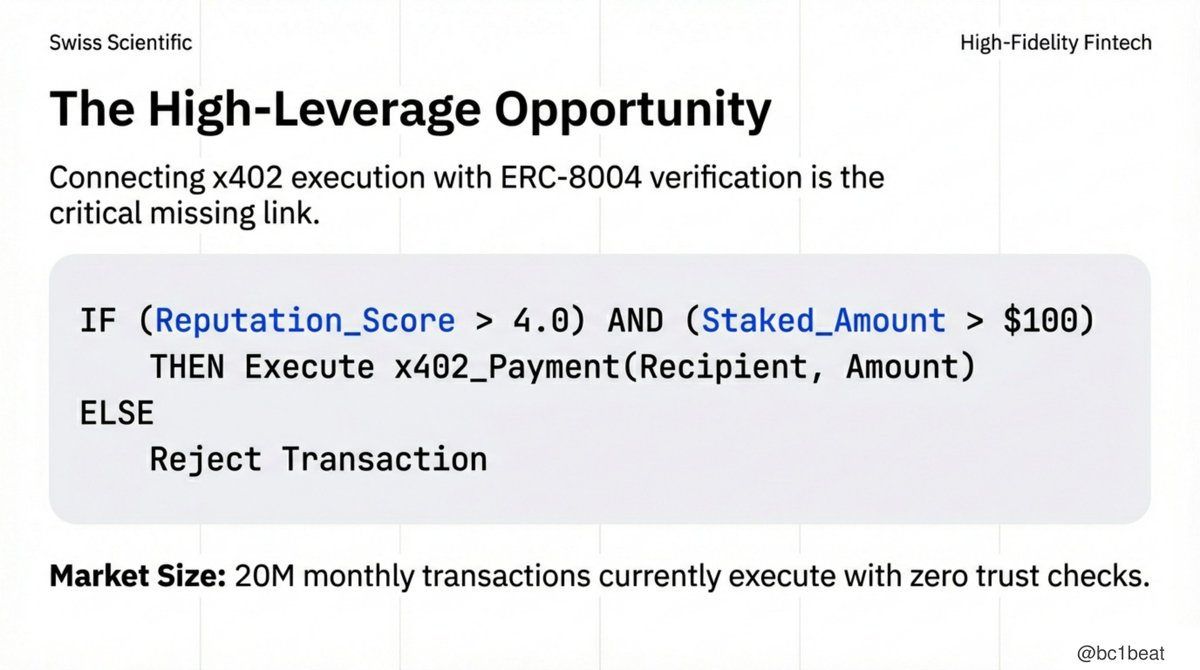

Currently, the approximately 20 million monthly transactions execute without any trust checks. This creates a high-leverage opportunity for "trust-gated payment middleware." Its integration logic is straightforward: query ERC-8004's reputation data before authorizing an x402 payment, set configurable thresholds, and submit feedback after settlement. For example: If Reputation_Score > 4.0 and Staked_Amount > $100, execute payment; otherwise, reject. No team has yet built a production-grade SDK for this. The first team to implement it will occupy the critical integration layer between these two protocols.

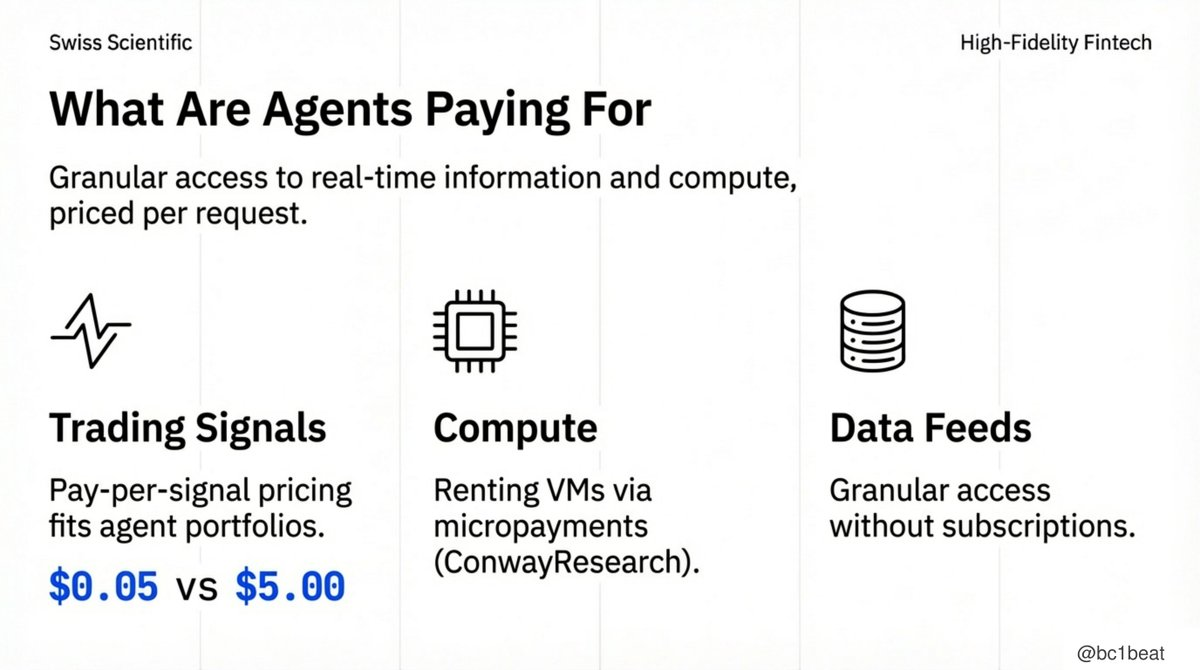

Three main paid use cases have already emerged. First is trading signals, where pay-per-signal perfectly fits agents' capital management logic, ranging from $0.05 per signal for small accounts to $5 for institutional levels. Second is compute power, such as the x402-compatible VM hosting service offered by ConwayResearch, allowing agents to rent computing resources via micropayments. Third is data feeds, providing granular access to real-time information without subscription models. These are viable because the fine-grained management enabled by x402 is something traditional payment systems cannot cover.

The multi-chain landscape is converging, not fragmenting. The Base chain accounted for approximately $35 million in transaction volume and 68% of service registrations in January, benefiting from deep integration with Coinbase CDP and the Molttask marketplace; Solana accounted for about $7.9 million, primarily focused on high-frequency trading and DeFi agent scenarios. Network effects are concentrating. Builders should prioritize Base while adapting to Solana for transaction-intensive applications.

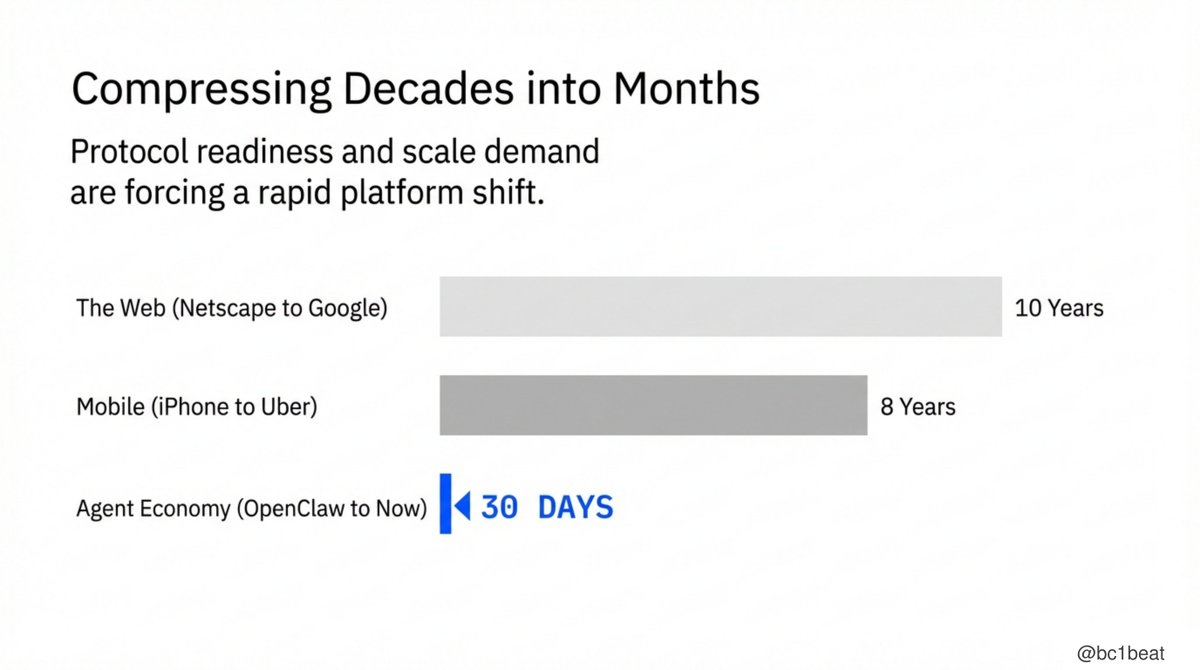

Historical platform migrations took a decade

Historically, platform migration cycles often spanned a decade: the web took 10 years from Netscape to Google, mobile internet took 8 years from the iPhone to widespread app adoption. The agent economy assembled the complete infrastructure puzzle of payments, trust, social, and development frameworks within 30 days. Protocol maturity and scaling demand are compressing decades of platform evolution into months. The window for demand-side builders is now open.

Optimism must be tempered

Optimism needs to be tempered; three key risks must be acknowledged. First is data noise—early metrics still include incentivized wash trading, making the real organic transaction scale lower than top-line data suggests. Second is security issues—Sybil attacks on reputation systems and API Key leaks remain major attack vectors, with related incidents already occurring on Moltbook. Third is legal and tax—frameworks for liability attribution regarding autonomous agent actions do not yet exist. Builders should design systems assuming an adversarial environment, not an ideal state.

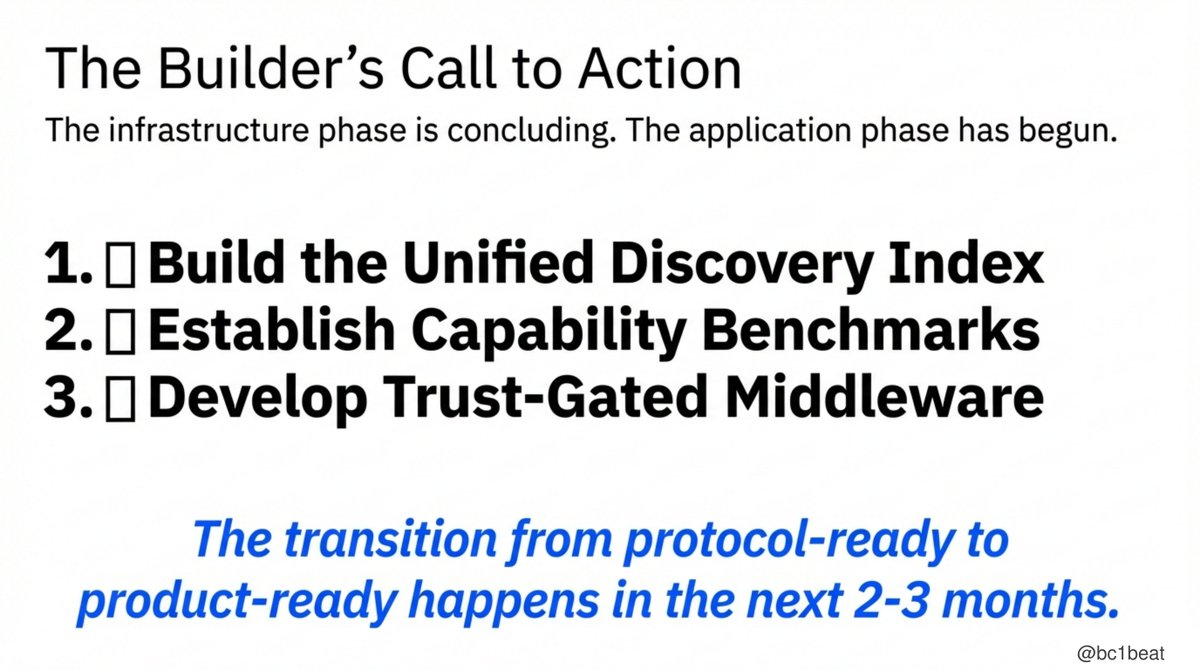

The infrastructure phase is ending

The infrastructure phase is concluding; the application phase has begun. Current builders should focus on three things:

- Build a unified discovery indexing layer, aggregating services from all platforms into a single searchable entry point.

- Establish a capability benchmarking system, proving agent abilities with verifiable results, not just ratings.

- Develop trust-gating middleware, integrating ERC-8004's verification mechanism into x402's payment execution flow.

The transition from "protocol-ready" to "product-ready" will occur within the next 2–3 months. Now is the time to build.