XT Africa AMA Highlights: Is the Crypto Market Becoming Increasingly Difficult to Understand? Trading Blind Spots from a Macro Perspective

- Core Viewpoint: The difficulty in judging the current crypto market trend has increased, primarily because market fluctuations are increasingly and directly shaped by macro factors outside the crypto ecosystem, such as global liquidity, macroeconomic signals, and institutional behavior. Understanding the macro context has become a crucial risk management tool.

- Key Elements:

- The crypto market is still in an evolving stage, with a relatively limited scale, making it highly sensitive to global capital flows. Its volatility is directly influenced by changes in traditional financial markets like bonds, stocks, and monetary policy.

- Market price movements are primarily driven by real liquidity (fund inflows and outflows), rather than mere holding conviction or community narratives. Fiat currency remains the main source of liquidity.

- Not all crypto activities are linked to macro factors. Crypto-native activities, such as testnets and short-term hype narratives, need to be distinguished from macro-driven liquidity changes.

- The purpose of XT Exchange launching the TradFi zone is to provide crypto traders with visual references to global markets (e.g., commodities, stock indices) to supplement the macro context, not to change their trading methods or provide investment advice.

- Experienced traders use macro information to adjust positions in advance and assess risks, preparing for volatility rather than directly predicting price direction, which helps reduce cognitive blind spots.

If you've recently found it harder to judge crypto market trends, it's not a coincidence.

In an XT Africa X Space AMA, multiple guests discussed global liquidity, macroeconomic signals, and institutional behavior, pointing out that these factors are increasingly shaping the volatility structure of the crypto market directly. Senior crypto market educator Tola Joseph Fadugbagbe emphasized that the crypto market is still in an evolving stage and is highly sensitive to global capital flows. In response to this change, the XT TradFi Zone is positioned as a "macro-context tool" designed to help traders understand the macro backdrop more clearly within a crypto-native environment, without altering their existing trading methods.

The ultimate takeaway from this AMA was not a specific conclusion, but a cognitive reminder:

In today's market environment, understanding the world comes before understanding the market.

TL;DR Quick Summary

- The core reason crypto trends are becoming harder to judge is that market pressures are increasingly originating from outside the crypto ecosystem.

- Global liquidity, interest rate changes, inflation data, and institutional behavior are directly shaping the volatility structure of the crypto market.

- Senior educator Tola Joseph Fadugbagbe pointed out that the crypto market is still evolving and highly sensitive to global capital flows.

- Market movements are driven by liquidity, not just belief or narratives; macro awareness has become a practical risk management tool.

- The XT TradFi Zone is positioned as "macro-context infrastructure" to help traders understand *why* the market moves before price fluctuations occur.

The Gap Between Price Volatility and Understanding is Widening

Many crypto traders share a familiar frustration: market volatility strikes fast and hard, yet common technical indicators, market narratives, and on-chain signals often fail to fully explain *why it moved*. Often, before traders can form a clear judgment, the volatility has already happened.

In the opening segment of the Space, Rachel Ong (@1r033r0) highlighted this shift. Crypto trading is no longer driven solely by internal market signals. Increasingly, pressures are building up *outside* the crypto market beforehand—interest rate decisions, inflation data, commodity trends, and changes in global risk appetite all influence crypto trends at different stages.

"Crypto trading is no longer just about reading charts. More and more traders are starting to pay attention to what's happening outside of crypto, because that's often where the real market pressure begins."

This disconnect creates a structural problem: traders often react passively *after* volatility appears, rather than understanding the forces driving the change beforehand. The issue isn't a lack of data, but a lack of sufficient macro context.

This reality formed the starting point for the entire discussion.

The Crypto Market's Blind Spot: Why Global Liquidity Cannot Be Ignored

Drawing on over a decade of experience in crypto market education, Tola Joseph Fadugbagbe (@connectwithtola) offered a straightforward and realistic reminder during the discussion: the crypto market remains a relatively small, continuously evolving market, making it particularly sensitive to the global financial environment.

"The crypto market is still in an evolving stage, and its scale is very small. Changes happening in the global market will impact the crypto market."

To illustrate this relationship more clearly, Tola used an analogy that resonated with many listeners:

"You can think of it as the relationship between a child and a father. The child's behavior is strongly influenced by the family environment. Similarly, the crypto market is influenced by the global market environment."

This impact is not just theoretical. The crypto market is no longer isolated from the global financial system. Changes in bonds, stocks, monetary policy, and commodities are increasingly directly influencing the inflow and outflow of capital into digital assets.

"The crypto market is no longer an isolated market; it has entered the entire financial system."

For traders, ignoring the global liquidity environment means leaving a cognitive blind spot in market judgment that cannot be compensated for by charts alone.

Belief Alone Cannot Move the Market

One of the most direct cognitive corrections in this AMA came from distinguishing between "belief" and "liquidity."

Based on his own experience, Tola pointed out that a common misconception in crypto trading is thinking that long-term holding or strong belief itself can drive market direction. In reality, whether prices can move sustainably depends on whether real capital is flowing into or out of the market, not on whether participants "believe."

"Holding does not equal liquidity. The market moves because liquidity is flowing in, not because people believe in it."

He further noted that many traders mistake price increases in their wallets for real market depth.

"Many people see the numbers in their wallets going up and think that represents value, without realizing it's not the same as real liquidity."

This distinction is particularly crucial during periods of market stress or increased volatility. Liquidity is not generated solely within the crypto market; it circulates through fiat trading pairs, stablecoins, institutional allocations, and macro-level decisions.

Tola also discussed the long-term role of fiat currency in this system:

"Cryptocurrency cannot replace fiat currency. Fiat will always be the source of liquidity, which is why you see trading pairs like BTC/USD, ETH/USD everywhere."

For traders, this understanding helps reframe the nature of volatility. Instead of asking "what's the current popular narrative?", a more valuable question is: Where is the liquidity coming from, and why is it changing now?

When Macro Explains Crypto, and When It Doesn't

During the discussion, the guests deliberately avoided a common pitfall: simply attributing all crypto market changes to macro factors.

Tola pointed out that while global markets are increasingly influencing crypto market volatility and correlation, not all crypto price action is highly aligned with the macro environment.

"Within this ecosystem, there are still activities that don't follow global market patterns, such as testnets, points farming, short-term hype narratives—they are not part of the macro reality."

These activities do play a role within the crypto community but often don't reflect broader capital flows or long-term market trends. Mistaking them for macro signals can distort risk assessment.

At the same time, Tola cautioned traders against swinging to the other extreme and completely ignoring macro factors:

"There is indeed a portion of the crypto market that is highly correlated with global markets, and this cannot be ignored."

The final conclusion points towards a balanced perspective. The macro environment helps explain liquidity cycles and systemic risks, but crypto-native operating logic still exists. The truly valuable skill lies in distinguishing which signals come from the macro level and which belong to the crypto ecosystem itself.

Why XT Launched the TradFi Zone: Providing Context, Not Changing Traders

From the perspective of XT Africa, MR KEN (@MRCGK01) gave a clear positioning for the XT TradFi Zone: it is not meant to change a trader's identity or trading style, but rather a response to traders' existing behavior.

"In the simplest terms, the purpose of the XT TradFi Zone is to provide more context for crypto traders, not to change who they are or how they trade."

The TradFi Zone does not replace on-chain analysis or crypto-native trading strategies. Instead, it surfaces global market changes that often begin influencing risk sentiment *before* they appear on price charts.

"What the TradFi Zone adds is visibility into global markets, which often influence overall risk sentiment before they affect crypto trends."

Commodities, stock indices, and forex markets have long been key references for professional traders to gauge inflation pressures, economic growth, and changes in risk appetite. The TradFi Zone brings this information into the crypto-native environment, lowering the barrier for traders to access macro context.

This is particularly important for traders in Africa.

"Many African traders can already feel the impact of interest rate decisions and macro events on crypto prices, but this connection isn't always so intuitive."

This positioning is not accidental. The core goal of the TradFi Zone is to enhance awareness and understanding, not to give operational instructions.

How to Access the XT TradFi Zone

Desktop (Web)

Go to Futures Trading → USDⓈ-M Futures → USDⓈ-M Perpetual, select a trading pair, then open the TradFi Zone from the category menu.

Go to Futures Trading → USDⓈ-M Futures → USDⓈ-M Perpetual, select a trading pair, then open the TradFi Zone from the category menu.

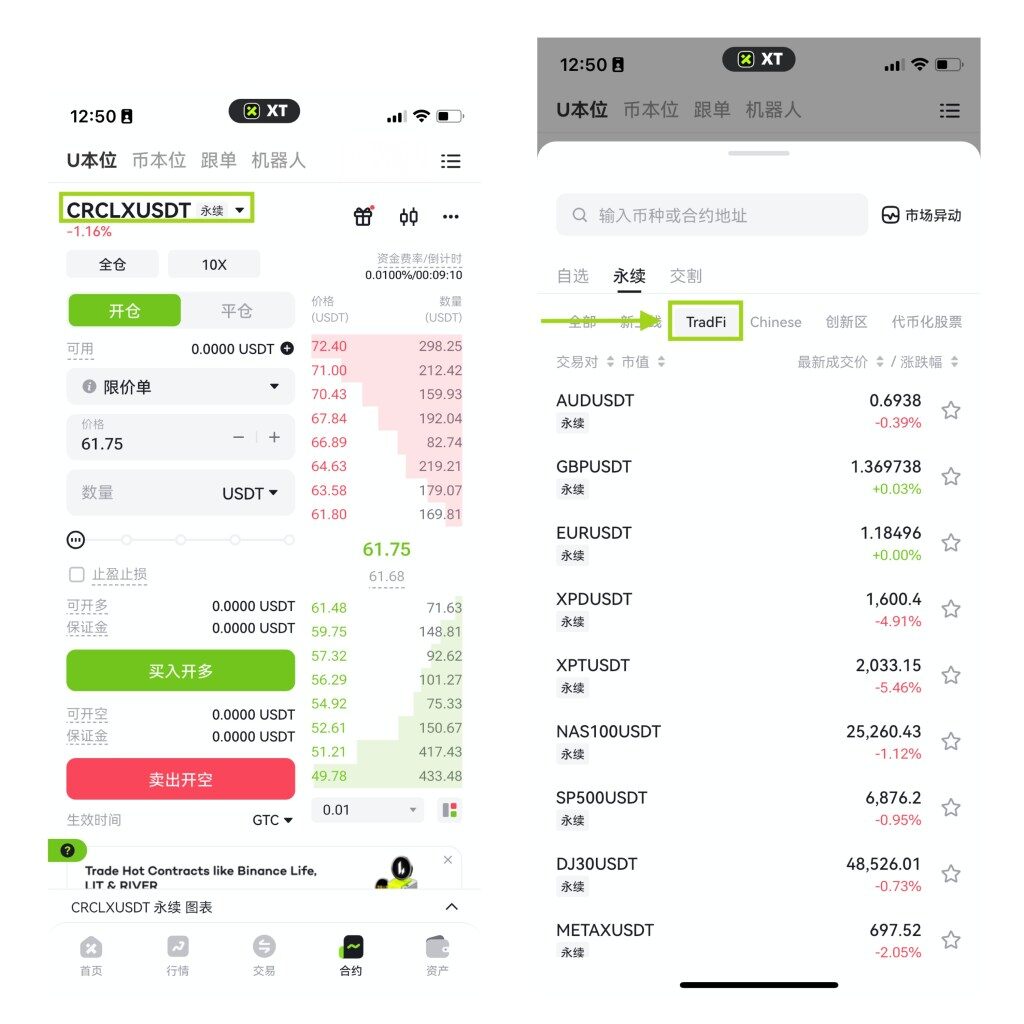

Mobile (XT App)

In the Futures Trading interface of the XT App, tap the current trading pair, then select TradFi from the category menu to enter the TradFi Zone.

In the Futures Trading interface of the XT App, tap the current trading pair, then select TradFi from the category menu to enter the TradFi Zone.

From Awareness to Preparation: How Traders Can Use Macro Context

As the discussion shifted from theory to practical behavior, a clear pattern emerged.

Experienced traders often use macro context for preparation, not for directly predicting market direction. This preparation manifests in various ways, such as adjusting positions before major events, reassessing leverage levels during liquidity tightening cycles, and avoiding overreactions to short-term volatility.

Based on his observations, Tola noted:

"Those who have traded in the crypto market for many years often combine their trading philosophy and psychology with the global market environment."

In contrast, less experienced traders are more prone to using macro news as signals to chase rallies or sell-offs, which can actually amplify risk.

It's important to emphasize that macro context cannot replace execution discipline, but it helps calibrate expectations and assists traders in distinguishing between structural changes and short-term noise.

Common Risk Misconceptions Traders Repeatedly Make

When macro context enters trading decisions, both opportunities and risks are often magnified.

Tola pointed out some recurring typical errors. Traders tend to overestimate opportunities during liquidity expansion phases and underestimate risks when conditions tighten. Many mistakenly believe that simply holding long-term can compensate for shortcomings in risk management.

"Many traders overlook key factors in the global market, thinking holding is enough, but forget that what truly moves the market is liquidity."

Another common misconception is treating volatility itself as an opportunity without understanding the liquidity conditions behind it. In a market shaped by institutional capital and macro policies, feedback is faster, and drawdowns can be more severe.

"ETFs and institutional capital drive liquidity on a larger scale, which changes the speed of market reactions."

This is not a pessimistic judgment but a necessary correction. As the crypto market matures, the importance of risk management is not decreasing but continues to rise.

From Prediction to Preparation: A Deeper Shift

Towards the end of the discussion, Rachel brought the perspective back to a more macro level. As inter-market linkages strengthen, labels like "crypto" and "traditional finance" are becoming less important than how traders understand risk, grasp timing, and adjust their behavior.

"The connections between markets have far surpassed those of the past. What's truly important is how traders manage risk and prepare for volatility."

This shift is not a short-term phenomenon but a structural change. Trading advantage is gradually shifting from "predicting the market" to "preparing in advance." Understanding signals at the global level doesn't guarantee profits but can significantly reduce cognitive blind spots.

In this context, the XT TradFi Zone is seen as "contextual infrastructure." It doesn't make decisions for traders but helps them see more clearly. For a crypto market entering a mature stage, this clarity is no longer optional but is gradually becoming a core competency.

XT TradFi Zone Frequently Asked Questions

1. What is the XT TradFi Zone?

The XT TradFi Zone provides traders with visual references to global markets, including commodities, stock indices, and forex, within a crypto-native trading environment. It is used to supplement market context, not replace crypto analysis itself.

2. Is the XT TradFi Zone designed for traditional finance traders?

No. It is primarily aimed at crypto-native traders, helping them understand more clearly the global factors already influencing the crypto market.

3. How do global markets affect crypto prices?

Primarily through liquidity and risk sentiment transmission. Changes in interest rates, inflation data, and institutional capital flows often impact the crypto market before they are reflected in price action.

4. Can macro factors explain all crypto price action?

No. Some crypto activities, such as testnets or short-term narratives, may fluctuate independently of global markets. Distinguishing the source of different signals is particularly important.

5. How can traders utilize macro information without frequent trading?

Use macro context for advance preparation rather than direct market prediction, such as adjusting risk exposure before major events to avoid emotional reactions.

6. Does the XT TradFi Zone provide trading signals or investment advice?

No. The XT TradFi Zone provides market background information, not trading advice or investment guidance.

About XT.COM

Founded in 2018, XT.COM is a leading global digital asset trading platform with over 12 million registered users, serving more than 200 countries and regions, and an ecosystem traffic exceeding 40 million. The XT.COM cryptocurrency trading platform supports 1300+ high-quality tokens and 1300+ trading pairs, offering diverse trading services including spot trading, margin trading, and futures trading, along with a secure and reliable RWA (Real World Asset) trading market. Upholding the philosophy of "Explore Crypto, Trust Trading," we are committed to providing global users with a safe, efficient, and professional one-stop digital asset trading experience.